California Association Of Area Agencies On Aging

California Association of Area Agencies on Aging can connect you with one of its regional agencies, all of which provide a comprehensive selection of services for the regions older adults. The agencies have programs designed to help seniors 60 and older maintain their health and independence, including resources to guide you through the Medicare enrollment process, and the counselors will help you understand the available benefits fully.

Contact information: Website | 443-2800

Estate Recovery And Medi

If a beneficiary dies and still owes money for Medi-Cal services that were provided, the amount owed can be recovered from the beneficiarys estate. The exception to this is that they will not put a lien on the beneficiarys house if a living spouse or dependent children still live in the home. Survivors can submit a hardship waiver to try and avoid estate recovery.

Medicare In California: By The Numbers

California, the state with the highest population, also has the most Medicare beneficiaries. To learn more about Medicare in California, here are some statistics:

- Number of Medicare beneficiaries in California in 2021: more than 6.4 million

- More than 2.7 Million beneficiaries enrolled in a Medicare Advantage plan in 2020

- Almost 190 thousand California beneficiaries enrolled in a Medicare Advantage Special Needs plan in 2018

Private Insurance companies that offer Medicare Advantage and Medicare prescription drug plans must have a contract with Medicare.

Not all plans are available in every service area in the state. Contracts renew each year. In some cases, this can mean changes in the availability of plans within the state.

Don’t Miss: Does Medicare Pay For Inogen Oxygen Concentrator

I Am Considering Medicare Services Through An Hmo What Should I Know

- The two kinds of HMOs

- Joining an HMO

- Possible benefits of belonging to an HMO

- Possible disadvantages of belonging to an HMO

- Payment of Medicare and the HMO and

- Getting out of an HMO.

The two kinds of HMOs: Most HMOs are risk HMOs. They require you to use only physicians and other medical providers they have approved. They are paid a fixed amount by Medicare for your membership regardless of the cost of your care. If you use medical providers who do not work for the HMO, or are not approved by the HMO, you will be responsible for the bill: Medicare nor your HMO will pay it.

The other kind of HMO is called a cost HMO. You can use health care providers outside the plan and the bill will be sent to Medicare. When you use cost HMO services, Medicare pays for the cost of services provided to you.

Joining an HMO: Many HMOs have contracts with the Health Care Financing Administration to serve Medicare beneficiaries. The requirements for your enrollment in these HMOs are:

- You must be enrolled in Medicare Part B

- You cannot have elected care from a Medicare-certified hospice

- You cannot be medically determined to have end stage renal disease .

- However, if you are already a member of an HMO when you become eligible for Medicare, and that HMO has a contract with Medicare, you can remain in your HMO even if you have ESRD and

- You must live within the service providing area for which the HMO has a Medicare contract.

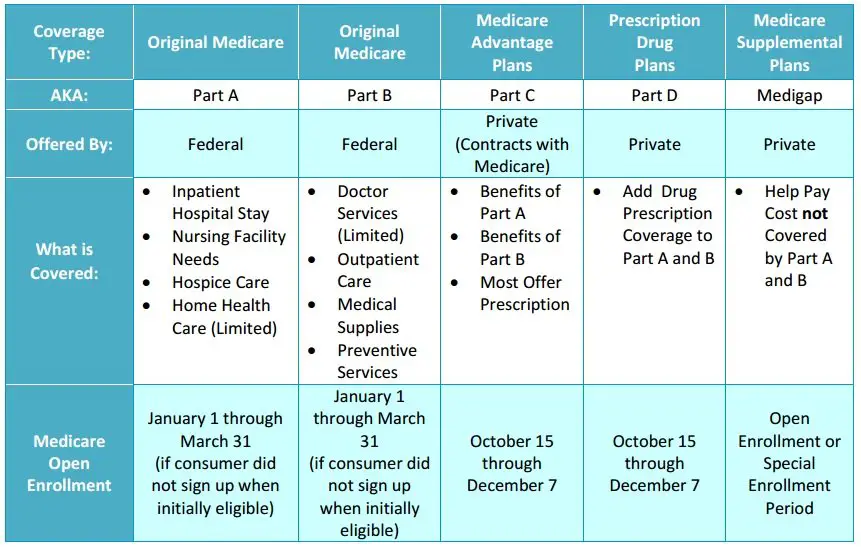

What Exactly Is Medicare And What Are Its Components

Medicare is the federal health insurance program for people 65 and over, and it plays an important role in covering your health care costs as you age. Medicare also covers some people under 65 who have received disability benefits.

Medicare has four parts: A, B, C and D. You must pay the federal government a premium for Medicare Part B, and possibly other parts of Medicare the amount depends on your income. These premiums are separate from the premiums you pay to UC. See below and medicare.gov/your-medicare-costs for more information.

Part A covers hospital care, skilled nursing and hospice care and home health services. Most people dont pay a premium for Part A because you or your spouse or ex-spouse have worked full-time for 10 years and paid for it through Medicare taxes.

Part B covers outpatient medical services. Everyone enrolled in Medicare must pay a monthly premium to the federal government for Part B. For those with higher incomes, this premium is indexed to your modified adjusted gross income.

Part C is another term for Medicare Advantage, a type of Medicare-approved plan offered by private insurance companies that combines Medicare Parts A, B and D benefits. If you enroll in a Medicare Advantage plan, Medicare pays your insurance company a set amount and the company approves and pays for your care.

You May Like: Does Medicare Part B Cover Hearing Aids

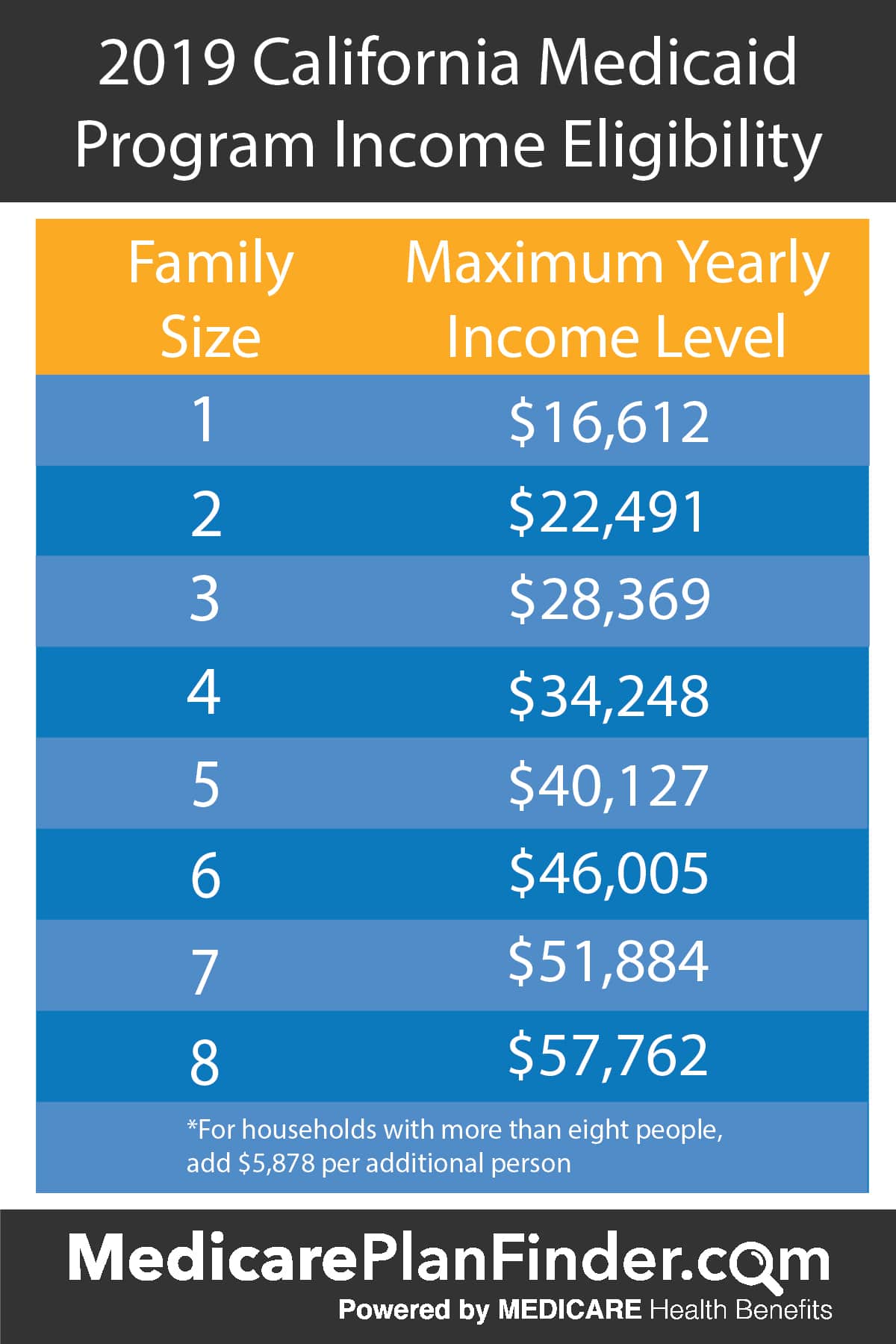

Federal Poverty Level Eligibility For Medi

Medi-Cal programs offer multiple levels. Depending on income, you may qualify for Medi-Cal that is free to you, or you may qualify for Medi-Cal that is requires you to share in the cost. This means you would be required to pay for a portion of your medical services.

In determining income eligibility for Medi-Cal, your monthly income will be considered. The table below shows the FPL by family size.

| Family Size |

|---|

|

$91,825 |

How To Apply For Medicare

For an insurance agent who specializes in Medicare Applying for Medicare does not feel like an overwhelming issue. This is because we live and breath everything Medicare on a daily basis.

But for you, we understand that you dont know all of the ins and outs of Medicare. There is a reason many people dont sign up for Medicare correctly and make assumptions that they have selected the right Medicare Part and plan, only to find out they left something out and now face lifetime penalties.

We walk thousands of people through this very process of how to sign up for Medicare every year, so we encourage you to continue reading and learn everything you need to know about how to apply for Medicare.

The Social Security office handles Medicare applications for Parts A and Part B of Original Medicare ONLY. You have several different ways to enroll into Medicare. Depending on your preferred method of communication you should be able to easily enrolled without having any issues. You can apply either online, by phone, or in person. If you are about to turn 65, you can apply for Medicare as early as 3 months prior to the month of your 65th birthday.

We recommend for you to begin the enrollment process as early as possible, as this will reduce most of the stress people experience because they waited to enroll until the last minute.

As your Medicare Insurance Agent, I am unable to help you obtain these plans until you are fully enrolled into both Part A and Part B.

Read Also: Why Is Medicare Advantage Bad

Medicare Resources In California

Many California residents take advantage of Medicare resources that provide unbiased information about Medicare in California. Here is a general overview of the Medicare options you have:

Medicare Part A : Helps cover inpatient care in hospitals, skilled nursing facility care, hospice care, and home health care.

Medicare Part B : Helps cover services from doctors and other health care providers. Additionally, Part B helps cover outpatient care, home health care, durable medical equipment , and many preventive services

Medicare Supplement Insurance : Insurance from a private company that helps with Original Medicare costs. In most states, these plans are named by letters, like Plan G or Plan K. The benefits in each lettered plan are the same, no matter which insurance company sells it.

Get more information about Medicare Supplement insurance plans in California

Medicare Part D : Helps cover the cost of prescription drugs .

You can also get prescription drug coverage if you stay with Original Medicare. You can enroll in a Medicare Part D stand-alone prescription drug plan if you have Medicare Part A or Part B.

Find out about stand-alone Medicare Part D prescription drug plans in California

Medicare Advantage

Many Medicare Advantage plans include prescription drug coverage. Known as Medicare Advantage prescription drug plans, they combine health and prescription drug coverage into a single plan.

Read more about Medicare Advantage plans in California

How Does Original Medicare Work

You don’t automatically get Medicare when you become eligible. You must enroll in Medicare.

You can enroll in Medicare during the Initial Enrollment Period that begins three months before the month you turn 65 and ends three months after the month you turn 65. Most people will be automatically enrolled in Part A, but there are certain situations where you may need to manually enroll in Medicare Part A and/or Part B during your IEP. In order to avoid paying late fees, it is important that you sign up before you turn 65. This applies if you retire at age 65 or if you are enrolled in a Covered California plan.

If youre enrolled in a Covered California plan, you could save almost $1,250 per month in plan premiums by switching to a Blue Shield Medicare Advantage Plan. Thats nearly $15,000 per year.*

To apply, call or visit your local Social Security office or call Social Security at between 7 a.m. to 7 p.m., Monday through Friday. TTY users should call

If you have health insurance through your employer or your spouse’s employer, look at your options before signing up for Part B. Please note that Part B has a monthly premium. Ask your benefits administrator or human resources representative for help in choosing the right option for you. Or call Blue Shield of California at 203-3874. Were here to help.

Also Check: Do You Automatically Get Medicare When You Turn 65

Who Is Eligible For Medicare

You are eligible for Medicare if you are a citizen of the United States or have been a legal resident for at least 5 years and:

- You are age 65 or older and you or your spouse has worked for at least 10 years in Medicare-covered employment.

- You are age 65 or older and you or your spouse has worked 30-39 quarters in Medicare-covered employment.

- You are age 65 or older and you or your spouse has worked 0-29 quarters in Medicare-covered employment. You must enroll as a voluntary enrollee and pay the full Part A monthly premium. Note:Low-income programs can help you pay these premiums if you meet the income and asset levels.

My Spouse And I Are Thinking Of Moving Out Of California Can We Keep Our Uc Plan

Theres a lot to think about if youre considering a move including what it might mean for your health insurance coverage. Its a good idea to talk to someone before you move.

If you and everyone you cover with UC insurance are in Medicare and you move to another U.S. state, youll transition to the Medicare Coordinator Program, administered by Via Benefits. You wont have the option to stay in your UC Medicare plan. Through the Medicare Coordinator Program, licensed Via Benefits advisors work with eligible UC retirees to find the Medicare medical and prescription drug plans available where they live that work best for them. These plans are not affiliated with UC.

Your enrollment in an individual medical plan through Via Benefits is paired with a Health Reimbursement Account , with a maximum annual contribution from UC of $3,000 per person. In many cases, the HRA funds provided by UC will cover the cost of the premiums as well as some additional out-of-pocket health care costs . Any costs above $3,000 are the enrollees responsibility and subject to the plans out-of-pocket limits.

Retirees must enroll through Via Benefits if all conditions below apply:

- You have a non-California home address on file

- You are eligible for UC retiree health insurance and receive a monthly retirement benefit

- All family members you cover by UC health insurance are at least 65 years old and eligible for Medicare.

Don’t Miss: Who Is Entitled To Medicare Part A

This Year I Am Being Billed By Medicare For A Higher Part B Premium Than Last Year Why

It is possible that the Part B premium increased, and/or that the modified adjusted gross income you reported on your 2019 tax return was higher than the previous year. The same is true for Part D monthly premiums. The premium amounts are set by Medicare, not UC, and they increase depending on your income. There are appeal procedures that can be directed to Medicare.

Who Is Eligible For Medi

There are three ways you can qualify for Medi-Cal:

First, you can qualify if you meet the income limits.

To see if you qualify based on income, look at the chart below. Income numbers are based on your annual or yearly earnings.

Second, you can also get Medi-Cal if you are:

- 65 or older

- Transportation costs for children with disabilities

Read Also: Why Do Doctors Hate Medicare Advantage Plans

Medicare Spending In California

In 2018, Original Medicares average per-beneficiary spending in California was $9,868, based on data standardized to eliminate regional differences in payment rates .

Nationwide, average per beneficiary Original Medicare spending was $10,096 per enrollee, so Medicare spending in California was about 2 percent below the national average. Per-beneficiary Original Medicare spending was highest in Louisiana, at $11,932, and lowest in Hawaii, at just $6,971.

Why Should I Choose A Uc Medicare Plan Instead Of One Of The Other Medicare Plans I See Advertised

You may already be receiving ads for commercial health plans and you can probably just recycle them. If youre eligible for UC retiree health benefits, a UC Medicare plan is likely to be your best option.

Because UC values its retirees and their service, it is projected to contribute over $300 million to health plans for retirees and their family members in 2021. UC has also negotiated with insurance companies on your behalf to ensure these plans offer as much protection as possible, with an upper limit on your out-of-pocket costs and help with appeals if you need it.

Medicare Part D for prescription drugs is folded into your UC Medicare plan . If you enroll in these commercial Medicare health and/or Medicare Part D prescription plans, your UC Medicare plan will be terminated automatically.

Don’t Miss: Does Medicare Cover Ambulance Fees

What Are The Different Benefits Categories For Medi

Medi-Cal Benefits are broken down into 14 categories. Medi-Cal benefits are a comprehensive set of health benefits that may be utilized when necessary. Beneficiaries may receive free coverage, partial pay coverage, or coverage for specific services. Depending on your medical needs, coverage may be short term or ongoing.

Ambulatory Patient Services

- Home and community based care

Property Eligibility And Medi

Property is defined as the things you own such as a car, house, and bank account. Property is considered when determining Medi-Cal eligibility. Different Medi-Cal programs have different property limits that can exclude you from eligibility. The home the family lives in is not counted towards the property limit.

The number of vehicles is counted differently based on the program. In some programs, they count the number of vehicles regardless of value, while in other programs they take into consideration the equity value and fair market value of the vehicle.

A handful of Medi-Cal programs do not consider property when determining eligibility. They are:

- Childrens Percent Program

- Programs for adoption assistance and former foster care children

The 250% Working Disabled Program exempts IRAs and 401 accounts from property counts.

You May Like: Will Medicare Pay For Breast Implant Removal

Can I Get Medi

To get Medi-Cal as a disabled person, you must have severe physical and/or mental problem which will:

- Last at least 12 months in a row and,

- Stop you from working during those 12 months, OR

- Possibly result in death.

Additionally, you must prove your disabling physical and/or mental problem with medical records, tests, and other medical findings.

How To Apply For Medicare In Person

For something as important as health insurance you might think that apply for Medicare in person at your local Social Security office is the only way to go. This can be a convenient option if you are very close to turning 65 and need to get your application processed quickly.

We recommend that you visit the social security website to search for the office nearest you. We also recommend that you call before hand and confirm what documents they will need to process your enrollment into Medicare Part A and Part B. This will ensure you come prepared. For your convenience we have created a quick link below to their website search function which will hep you find your local office.

Documentation is key when it comes to almost everything that is important. When it comes to Medicare insurance this is no exception to the rule. Once you have finished enrolling into Medicare Part A and Part B at your local Social Security office, ask for proof of coverage being activated. This print out should include the following information: Part A and Part B effective dates and your Medicare ID number. By doing this, it should speed up the process for us to help you take the next steps of enroll into a Medicare Advantage plan or a Medicare Supplement plan.

Don’t Miss: A Medicare Supplement Policy Must Not Contain Benefits Which

Enrolling Through A Spouse Under 65

If you’re currently ineligible for Medicare Part A without cost in your own right, you may be or become eligible through a current, former, or deceased spouse’s work history. If you’re eligible through a spouse, you may apply when your spouse is first eligible to receive Social Security benefits, generally at age 62. Contact the Social Security Administration at 325-0778 or TTY 325-0778 to clarify your Medicare eligibility through a spouse.

Can I Get Medicaid Can I Register For Medi

Any California resident can register for Medicaid through Medi-Cal and other Medi-Cal programs. Since Medi-Cal has more than 90 eligibility categories, applying can help you understand if you fall under one of them. The people who qualify for Medi-Cal can include:

- Low-income adults

For more information on Medi-Cal registration in your area, contact your countys social services office.

Read Also: Does Medicare Pay For Tummy Tuck