Medicare Prescription Drug Coverage

Medicare Prescription Drug Plans are sold by private insurance companies approved by Medicare. All people new to Medicare have a seven-month window to enroll in a PDP three months before, the month of and three months after their Medicare becomes effective. The month you enroll affects the PDPs effective date. All people with Medicare are eligible to enroll in a PDP however, unless you are new to Medicare or are entitled to a Special Enrollment Period, you must enroll or change plans during the Open Enrollment Period for Medicare Advantage and Medicare Part D, Oct. 15 through Dec. 7. There is a monthly premium for these plans. If you have limited income and assets/resources, assistance is available to help pay premiums, deductibles and co-payments. You may be entitled to Extra Help through the Social Security Administration. To apply for this benefit contact SHIIP at 1-855-408-1212 or the Social Security Administration at 800-772-1213 or www.socialsecurity.gov.

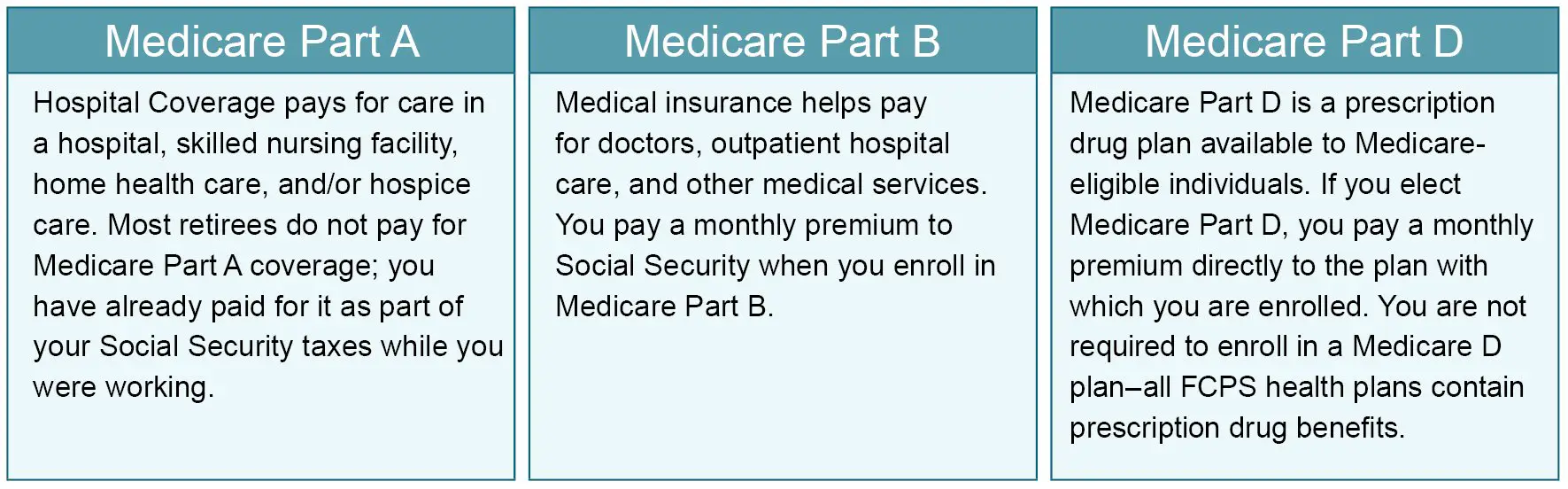

How Much Of My Bill Will Medicare Part B Pay

When all of your medical bills are added up, you will see that Medicare pays, on average, only about half the total. There are three major reasons why it pays so little.

First, Medicare does not cover a number of major medical expenses, such as glasses, hearing aids, dental work, dentures, and a number of other costly medical services.

Second, Medicare pays only a portion of what it decides is the proper amountcalled the approved chargesfor medical services. When Medicare decides that a particular service is covered, it determines the approved charges for it. Part B medical insurance then usually pays only 80% of those approved charges you are responsible for the remaining 20%.

Third, the approved amount may seem reasonable to Medicare, but it is often considerably less than what doctors actually charge. If your doctor or other medical provider does not accept assignment of the Medicare charges, you are personally responsible for the difference, up to a certain maximum.

Note that there are now several types of treatments and medical providers for which Medicare Part B pays 100% of the approved charges rather than the usual 80%. These categories of care include home health care, clinical laboratory services, and flu and pneumonia vaccines.

For details, see our article on what Medicare Part B will pay.

I Dont Have To Pay A Part A Monthly Premium

If youre in this camp, then you can sign up for Part A at any time.

- If you sign up during your Initial Enrollment Period or within six months after you turn 65, you will be covered by Part A beginning on the first day of the month you turn 65.

- If you sign up later than that, your coverage will be retroactive to six months before you enrolled.

Don’t Miss: Is Medicare Part B Necessary

Open Enrollment For Part A

Your eligibility for Part A isnt limited to when you first sign up for Medicare. If you switch from Original Medicare to a Medicare Advantage plan, you may want to go back to Original Medicare at some point. Medicares Open Enrollment Period is one of your chances to do so. Held each year from October 15 to December 7, this enrollment window is often used by Medicare Advantage beneficiaries to change their Part C plans for the upcoming calendar year. But if you have Part C and want to go back to Original Medicare, youre eligible to enroll in Medicare Parts A and B again, and you can also join a Part D plan. This coverage will go into effect January 1 of the following year.

Can You Cancel Your Medicare Part A Plan

Some people may choose to cancel their Part A Medicare plan. In this situation, individuals must fill out CMS form 1763, known as the Request for Termination of Premium Hospital and Medical Insurance form.

After filling out CMS 1763, you need to email it directly to your Social Security Administration office. If you opt-out of the Part A plan after the age of 65, you will need to pay back all the money received from Social Security and Medicare benefits paid on your behalf. To enroll back in the Part A plan, you need to call 1-800-772-1213 or visit your local Social Security Administration office.

Don’t Miss: Which Of The Following Consumers Would Be Eligible For Medicare

C: Medicare Advantage Plans

With the passage of the Balanced Budget Act of 1997, Medicare beneficiaries were formally given the option to receive their Original Medicare benefits through capitated health insurance Part C health plans, instead of through the Original fee for service Medicare payment system. Many had previously had that option via a series of demonstration projects that dated back to the early 1970s. These Part C plans were initially known in 1997 as “Medicare+Choice”. As of the Medicare Modernization Act of 2003, most “Medicare+Choice” plans were re-branded as “Medicare Advantage” plans . Other plan types, such as 1876 Cost plans, are also available in limited areas of the country. Cost plans are not Medicare Advantage plans and are not capitated. Instead, beneficiaries keep their Original Medicare benefits while their sponsor administers their Part A and Part B benefits. The sponsor of a Part C plan could be an integrated health delivery system or spin-out, a union, a religious organization, an insurance company or other type of organization.

The intention of both the 1997 and 2003 law was that the differences between fee for service and capitated fee beneficiaries would reach parity over time and that has mostly been achieved, given that it can never literally be achieved without a major reform of Medicare because the Part C capitated fee in one year is based on the fee for service spending the previous year.

Is It Possible To Be Eligible For Part A Before Age 65

There are a few specific situations where you have Medicare Part A eligibility regardless of age:

- If you have collected Social Security disability benefits for 24 months, you are eligible. If you are approved for Social Security disability because youve been diagnosed with Amyotrophic Lateral Sclerosis , you can enroll in Part A the first month you are approved for Social Security disability.

- If you have end-stage renal disease, you can enroll in Part A on the first day of your fourth month of dialysis.

Read Also: Should I Apply For Medicare If Still Working

Who Is Eligible For Medicare Part D

Before you can take advantage of a Part D plan, you must first be eligible to sign up. There are specific criteria you need to meet in order to qualify for the program.

To be eligible for Part D, you must first be eligible for Medicare at large. The rules for Medicare eligibility are straightforward. Beyond that, there are other specific rules for enrolling in Part D that you need to know.

Important Information Regarding If You Are Currently Enrolled In Other Medical Coverage:

The Medicare Advantage Plan offered to Oklahoma City retirees incorporate Medicare prescription coverage . Medicare regulations only allow an individual to be enrolled in one Medicare Part D prescription plan.

If you are enrolled in another medical plan that incorporates a Medicare Part D prescription benefit, you will need to make a decision of which plan you wish to maintain coverage and terminate coverage with the other plan. When deciding which plan is best for you, below are some considerations to take into account:

-

Premium Cost

-

Eligibility for survivor benefits for spouse

Also Check: What Are Medicare Parts A B C D

What Is Medicare Part A

Part A is the hospital insurance portion of Medicare. Most people become eligible for Medicare once they turn 65, and they may be automatically enrolled if they receive Social Security benefits. Otherwise, you have a limited window of time during which to sign up for Part A without having to pay a penalty. This is referred to as the initial enrollment period. It lasts for a total of seven months .

You won’t pay a premium for Part A if you already receive Social Security retirement benefits or you’re eligible for them.

You could have a coverage gap if you wait to sign up for Medicare until the month you turn 65 or later.

How Much Of My Bill Will Medicare Part A Pay

All rules about how much Medicare Part A pays depend on how many days of inpatient care you have during what is called a “benefit period,” or spell of illness. The benefit period begins the day you enter the hospital or skilled nursing facility as an inpatient and continues until you have been out for 60 consecutive days. If you are in and out of the hospital or nursing facility several times but have not stayed out completely for 60 consecutive days, all of your inpatient bills for that time will be figured as part of the same benefit period.

Medicare Part A pays only certain amounts of a hospital bill for any one benefit periodand the rules are slightly different depending on whether the care facility is a hospital, psychiatric hospital, or skilled nursing facility, or whether care is received at home or through a hospice.

All people covered by Medicare Part A must pay an initial amount before Medicare will pay anything. This is called the hospital insurance deductible. The deductible is increased every January 1.

You can get all the details in our article on Part A medical coverage.

For gaps in what Medicare Part A covers, including deductibles and co-insurance amounts, see Nolo’s article Medigap: Covering the Gaps in Medicare.

For 2020 Part A premiums and deductibles, see Nolo’s 2020 Medicare cost update.

Don’t Miss: How To Replace A Medicare Health Insurance Card

Proposals For Reforming Medicare

As legislators continue to seek new ways to control the cost of Medicare, a number of new proposals to reform Medicare have been introduced in recent years.

Premium support

Since the mid-1990s, there have been a number of proposals to change Medicare from a publicly run social insurance program with a defined benefit, for which there is no limit to the government’s expenses, into a publicly run health plan program that offers “premium support” for enrollees. The basic concept behind the proposals is that the government would make a defined contribution, that is a premium support, to the health plan of a Medicare enrollee’s choice. Sponsors would compete to provide Medicare benefits and this competition would set the level of fixed contribution. Additionally, enrollees would be able to purchase greater coverage by paying more in addition to the fixed government contribution. Conversely, enrollees could choose lower cost coverage and keep the difference between their coverage costs and the fixed government contribution. The goal of premium Medicare plans is for greater cost-effectiveness if such a proposal worked as planned, the financial incentive would be greatest for Medicare plans that offer the best care at the lowest cost.

Currently, public Part C Medicare health plans avoid this issue with an indexed risk formula that provides lower per capita payments to sponsors for relatively healthy plan members and higher per capita payments for less healthy members.

- Senate

When Are The Medicare Part A Enrollment Deadlines

For the most part, signing up for Medicare Part A depends on when you turn age 65.

You have a 7-month time period during which you can enroll. You can enroll as early as 3 months before your birth month, during your birth month, and up to 3 months after your 65th birthday.

If you dont enroll during this time period, you could face financial penalties that result in you having to pay more for your healthcare coverage. This also delays how fast your Medicare benefits begin.

You can sign up for Medicare Part A during the general enrollment period from January 1 to March 31, but you may face penalty fees.

Recommended Reading: What Age Do You Qualify For Medicare

Comparison With Private Insurance

Medicare differs from private insurance available to working Americans in that it is a social insurance program. Social insurance programs provide statutorily guaranteed benefits to the entire population . These benefits are financed in significant part through universal taxes. In effect, Medicare is a mechanism by which the state takes a portion of its citizens’ resources to provide health and financial security to its citizens in old age or in case of disability, helping them cope with the enormous, unpredictable cost of health care. In its universality, Medicare differs substantially from private insurers, which must decide whom to cover and what benefits to offer to manage their risk pools and ensure that their costs do not exceed premiums.

Medicare also has an important role in driving changes in the entire health care system. Because Medicare pays for a huge share of health care in every region of the country, it has a great deal of power to set delivery and payment policies. For example, Medicare promoted the adaptation of prospective payments based on DRG’s, which prevents unscrupulous providers from setting their own exorbitant prices. Meanwhile, the Patient Protection and Affordable Care Act has given Medicare the mandate to promote cost-containment throughout the health care system, for example, by promoting the creation of accountable care organizations or by replacing fee-for-service payments with bundled payments.

When Can I Sign Up And When Will Coverage Start

People who are turning age 65 have an initial enrollment period that lasts until three months after their 65th birthday. If you don’t sign up during that period, you’ll have to wait for a general enrollment period or a special enrollment period . Coverage start dates depend on what type of period you signed up in. Find out more in Nolo’s article on Medicare enrollment periods and coverage start dates.

Recommended Reading: Does Medicare Cover Toenail Removal

B Has A Premium Part A May Not

Generally, Medicare Part B eligibility either comes with age or disability status. In 2021, Medicare set the Part B premium to $148.50

Part A can be premium-free for those with 40 covered quarters of work experience. Social Security measures taxed work history to determine if someone has to pay for Part A, with 40 quarters amounting to about 10 years of work.

In the majority of cases, Part B requires payment of a premium to start it and to keep it going, regardless of work history.

In general, if someone enrolls in Part B on time, high income can affect Part B premium cost.

If an individuals annual income exceeds $88,000, or $176,ooo for married couples, they can expect to pay a higher Part B premium. This also affects the monthly premium for Part D drug coverage.

Known as IRMAA, Income Related Monthly Adjustment Amount, these figures come from the IRS reported modified adjusted gross income from the prior year.

Social Security beneficiaries can get the Part B premium deducted from their normal income benefit.

Those not receiving Social Security benefits must maintain regular payment of monthly Part B premiums. Medicare accepts payments set up directly through a bank or credit union, or with a physical bill in the mail.

Medicare Part A Eligibility And Initial Enrollment

For most people, the trigger for Medicare Part A eligibility is simple: When you turn 65 years old, you become eligible.

But being eligible and being enrolled are two different things.

If you have been receiving Social Security benefits for at least four months leading up to your 65th birthday, you will be automatically enrolled in Medicare Part A . Its becoming less common for people to be automatically enrolled as legislation has pushed the age for receiving full Social Security benefits beyond 65.

So, if you want to be enrolled in Medicare Part A at age 65 which makes financial sense for the large majority of people then you may have to take a little initiative. You can enroll in Medicare Part A by:

- Applying online with the Social Security Administration.

- Visiting a local Social Security office.

You May Like: Can I Buy Into Medicare

Do You Have Medicare Part A Eligibility

Your search for affordable Health, Medicare and Life insurance starts here.

Call us 24/7 at or Find an Agent near you.

When you have Medicare Part A eligibility, youre covered by one of the largest federal programs in the country. Medicare Part A will cover the inpatient hospital care portion of your healthcare.

But how do you know if you qualify for Medicare? And what do you need to know about signing up for Medicare? Learning about your Medicare Part A eligibility is the first step toward choosing a plan that best works for your needs.

What Doesnt Medicare Part A Cover

No part of Medicare covers long-term care, or 24 hour-a-day custodial care. Custodial care is given at home or in a nursing home, such as a memory unit, and provides assistance with the six activities of daily living: eating, bathing, dressing, toileting, transferring, and continence.

Medicare also does not cover dental care, dentures, eye exams for glasses, hearing aids, acupuncture, cosmetic surgery, or routine foot care.

Part A additionally doesnt cover prescription drugs , physician fees, diagnostic services, or preventive services.

Also Check: Is There Any Dental Coverage With Medicare

Retiree Health Plan Part B Reimbursement Options

If you’re retired and have Medicare and retiree group health plan coverage from a former employer, Medicare typically pays first for your medical bills and your retiree plan would pay the remaining amount.

Some of these retiree plans offer a Part B reimbursement to eligible enrollees. Each retiree plan has different eligibility requirements, so check with your plan to understand your options. However, for most plans you must be a retired employee or already enrolled in the health plan and be enrolled in Medicare Part B.

You may be reimbursed the full premium amount, or it may only be a partial amount. In most cases, you must complete a Part B reimbursement program application and include a copy of your Medicare card or Part B premium information.