How Much Does Medigap Cost

It is important to know how much a Medicare Supplement plan costs now and consider what it could cost you in the future. Plan prices vary by state so where you live plays a role in how much you pay.

A quick search on medicare.gov revealed plan premiums from $34 a month in Los Angeles, California to $353 a month in West Palm Beach, Florida.

The premium is not only determined by the area where you live but also the plan that you choose. The cheapest plan will not cover as many of your medical expenses as the most expensive .

Depending on the plan you choose, there may be other costs besides the premium. You may pay copays or coinsurance of the cost of services. There could also be a deductible you pay before the insurance begins to cover your medical expenses.

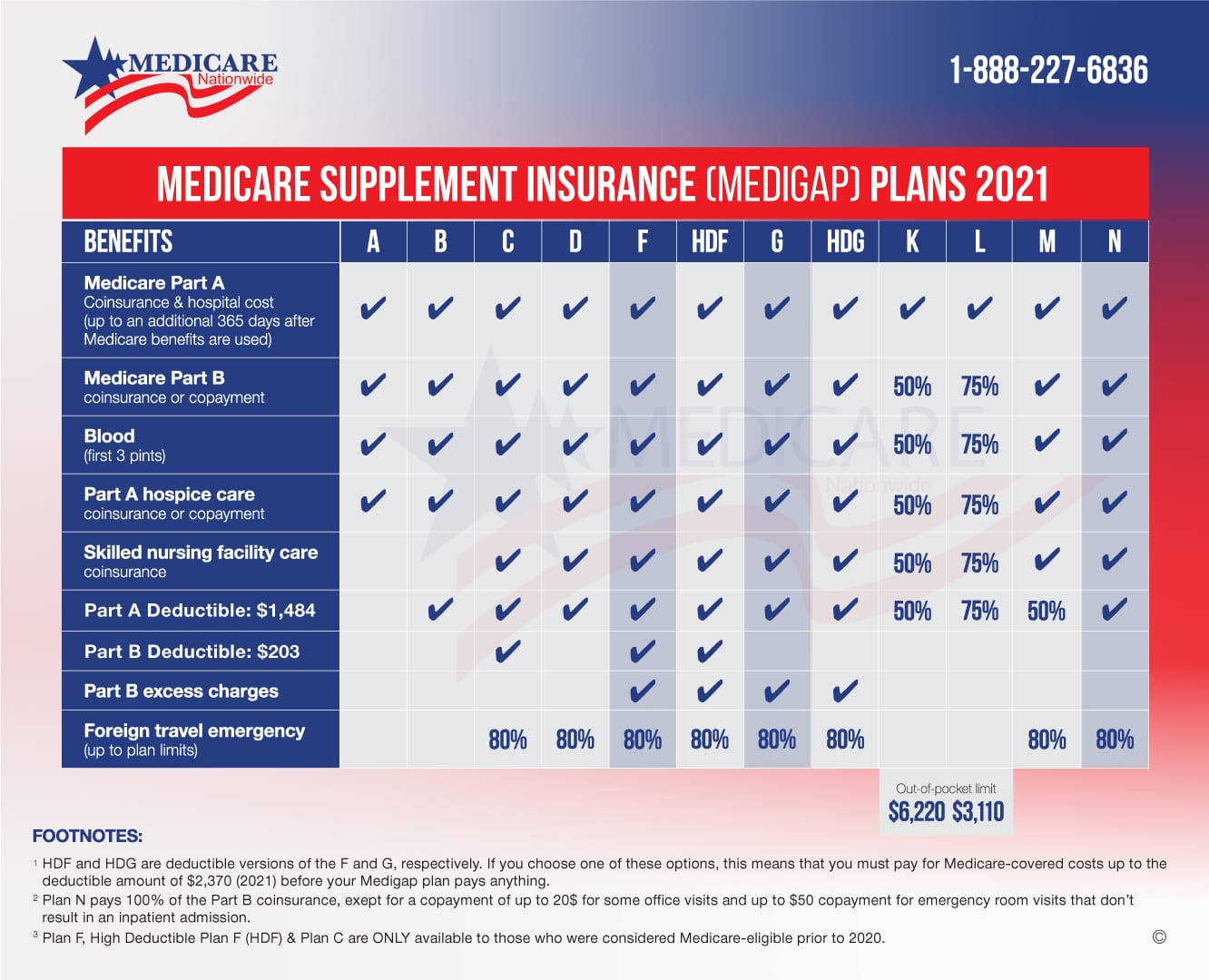

Lets look at your plan options. In most of the United States, plan designs are standardized. However, Minnesota, Wisconsin, and Massachusetts have their own method of standardization. For detailed information on the options in these states, go to Medicare.gov and search Medigap in to learn more.

A Skilled Nursing Care Coinsurance

Medicare Part A covers some skilled nursing facility services. But after 20 days of inpatient skilled nursing facility care, you need to start paying daily coinsurance to keep your coverage going.

For days 21 through 100 in a skilled nursing facility, the daily c-insurance is $194.50 per day in 2022.

Medicare Supplement plans will cover this cost unless you have Plan A or Plan B. If you have any other plan, it will be covered at least partially.

Note: Plan K covers only 50% of the coinsurance and Plan L only covers 75% of it.

How Does Medigap Serve Or Help Me

Medicare coverage lasts for the rest of your life. As you age, doctor visits and hospitalizations may increase. But, it is impossible to project your future healthcare needs.

Medigap policies work hand-in-hand with Original Medicare to limit your exposure to unexpected out-of-pocket medical costs. You decide how much you want to be covered and what premium you want to pay.

Also Check: Does Medicare Part B Cover Durable Medical Equipment

Is There A Best Time To Purchase A Medigap Policy

The best window of time in which to buy a Medigap policy begins on the first day of the month in which youre at least 65 and enrolled in Medicare A and B . This is the start of your initial enrollment period, and it lasts for six months. Under federal rules, Medigap coverage in every state is guaranteed during this window.

If youre eligible for Medicare because of a disability, the majority of the states offer at least some sort of guaranteed issue enrollment periods for those under 65. So it pays to research your states health care regulations. .

If you wait to buy a policy until after your initial enrollment period, your carrier generally has the option of denying the application or charging a higher premium based on the companys underwriting requirements, as there is no federal requirement that Medigap plans be guaranteed-issue outside of the initial enrollment window and very limited special enrollment periods. But states can set their own regulations for Medigap plans:

Check with your state SHIP or your states Department of Insurance for more information about state-based regulations regarding Medigap.

Subd 1sprescription Drug Coverage

Subject to subdivisions 1k, 1m, 1n, and 1p, a Medicare supplement policy with benefits for outpatient prescription drugs, in existence prior to January 1, 2006, must be renewed, at the option of the policyholder, for current policyholders who do not enroll in Medicare Part D.

A Medicare supplement policy with benefits for outpatient prescription drugs must not be issued after December 31, 2005.

After December 31, 2005, a Medicare supplement policy with benefits for outpatient prescription drugs must not be renewed after the policyholder enrolls in Medicare Part D unless:

the policy is modified to eliminate outpatient prescription drug coverage for expenses of outpatient prescription drugs incurred on or after the effective date of the individual’s coverage under Medicare Part D and

premiums are adjusted to reflect the elimination of outpatient prescription drug coverage at the time of Medicare Part D enrollment, accounting for any claims paid, if applicable.

An issuer of a Medicare supplement policy or certificate must comply with the federal Medicare Prescription Drug, Improvement, and Modernization Act of 2003, as amended, including any federal regulations, as amended, adopted under that act. This paragraph does not require compliance with any provision of that act until the date upon which that act requires compliance with that provision. The commissioner has authority to enforce this paragraph.

Recommended Reading: Does Medicare Pay For Ambulance Calls

Disadvantages Of Medigap Plan F

On the downside of this plan option, its large amount of coverage can be costly and have high monthly premiums. Also, if youre newly eligible for Medicare as of January 1, 2020, or later, you will not be eligible to buy this plan, as it is being phased out for new enrollees.

Tips for shopping for a Medigap plan

Follow the tips below while shopping for a Medicare supplement plan:

- Pick a plan. There are several Medicare supplement plans to choose from. The extent of coverage can vary by plan. Review your health-related needs to decide on one thats right for you.

- Compare policies. Once youve decided on a plan, compare the policies offered by different companies, as costs can vary. Medicares website has a helpful tool to compare the policies offered in your area.

- Consider premiums. Providers can set their premiums in different ways. Some premiums are the same for everyone, while others may increase based on your age.

- Remember high deductible options. Some plans have a high deductible option. These plans often have lower premiums and may be a good choice for someone who doesnt anticipate a lot of medical expenses.

Hypothetical Medicare Supplement Premium

- Premium for Plan G: $95.00 per month

- + Medicare Part B premium base rate: $170.10 per month

- + Medicare Part B annual deductible: $233

Total: $3,414.20 per year.2

Plan G covers all of your medical expenses at 100%, except the Part B deductible. So you can expect this to be your total annual cost.

Example 2: Plan G High-Deductible

- Premium for Plan G high-deductible: $20.00 per month

- + Medicare Part B premium base rate: $170.10 per month

- + Medicare Part B deductible: $233

Total: $2,514.20 per year.3

This is your best case scenario, which means you only pay the monthly premium assuming no other out-of-pocket medical expenses if you do not utilize medical services.

Your worst case scenario:

- $2,514.50 premium and Part B deductible

- + $2,490 annual high deductible

Total: $5,004.20 per year.

Comparison: Example 2 costs $1,590more over the course of a year if you meet the deductible. However, Example 1 will cost you $924.20 more in premium if you dont use any services or your medical needs are minimal.

In this example, you might want to consider taking the Plan G high-deductible option if you are healthy.

Why? Because you could save just over $900 a year if you have a good year. Over multiple good years, the savings could add up.

But the math flips if your health changes for the worse. In that case, you could find yourself paying the high deductible for multiple years. And in some states, you wont be able to change plans because you may not pass medical underwriting.

Read Also: Does Medicare Cover Rides To The Doctor

Where Can You Buy Medigap Coverage

Medigap policies are available in every state, from private health insurance carriers. Americas Health Insurance Plans reported in 2021 that total Medigap enrollment in late 2021 stood at 14.5 million people up from 11.6 million in 2014 .

All Medigap insurers must abide by strict state and federal laws. In most states, Medigap carriers must offer standardized policies that are identified by the letters A through N. There are a total of ten different plan designs: A, B, C, D, F, G, K, L, M, and N , and although the price varies from one carrier to another, the plan benefits are the same from one state to another and from one carrier to another, within each letter. So all plan Ks, for example, offer the same benefits regardless of where you live or what insurance carrier you use.

In some states, not all types of Medigap coverage will be available. In other states, you may be able to purchase Medicare SELECT a Medigap policy that requires plan holders to use specific hospitals and, in some cases, specific doctors. Any of the ten Medigap plan designs can be offered as a Medicare SELECT plan, and they tend to be less expensive than typical Medigap policies due to the restricted network. If you choose a Medicare SELECT plan and use a provider thats not in the network, your Medigap plan wont pick up your Medicare out-of-pocket costs unless its an emergency.

Whats The Purpose Of Medigap

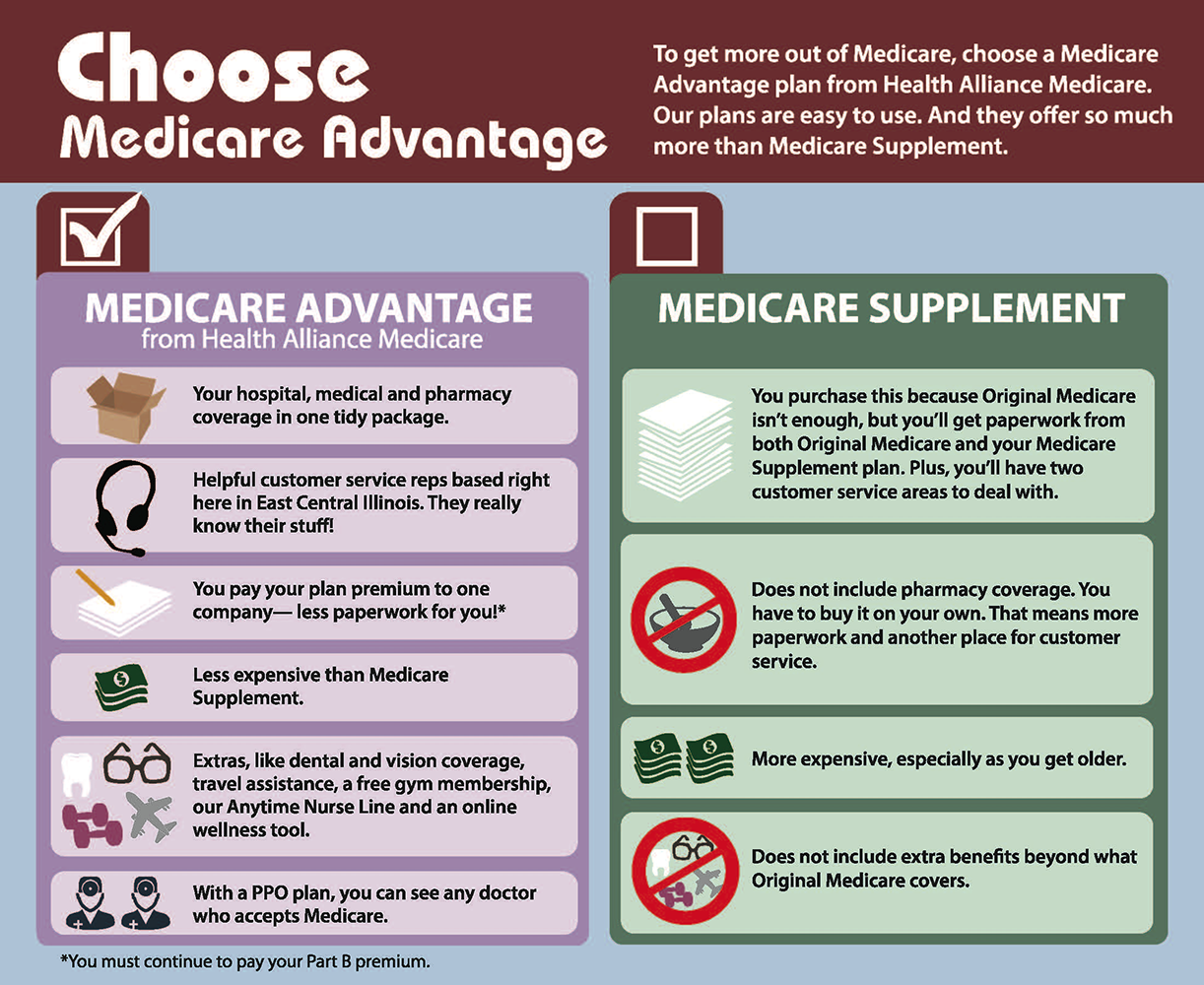

With Original Medicare, you pay the deductibles, copays, and 20% for services you receive from doctors. Medicare Supplement plans can pay some or all of these costs for you. They supplement or fill the gaps in Original Medicare. If Medicare doesnt cover the service, then generally your Medicare Supplement plan doesnt cover the costs either and you would pay for those services yourself.

Medicare Supplement or Medigap policies are designed to pay your costs related to Original Medicare. Depending on the plan you choose, they could pay the Part A hospital deductible, the Part B deductible, and the 20% coinsurance that you are responsible for, as well as other out-of-pocket costs.

In general, Medicare plans are individual plans and only cover one person per policy. This is a great advantage since a husband and wife with different needs can have different plans. They are able to pick the plan that is right for them.

You May Like: Can You Get Medicare If You Live Outside The Us

How Do I Choose A Qualified Long

Here are some important things to determine about your prospective agent.

A qualified long-term care insurance agent should be able to help you sort through the company and benefit choices. Much of the decision making process revolves around your age, health conditions and financial suitability. In order to assist the agent in finding the best long-term care insurance policy for your needs, you need to find a long term care insurance agent you can trust and have a candid conversation with him or her regarding all of these matters.

A good long term care insurance agent will not just sell you a policy but will be there to help you when you have questions, need to make changes or have a claim. Make sure that the agent you are working with has a good history and track record in providing on-going services to his or her clients. Don’t be shy about asking for references. You can also check out a long term care insurance agent by selecting the “Check License Status” link at the top of this page.

Required Health Care Benefits

The following 4 benefits are included, at least in part, in every Medigap policy:

- Part A hospital care coinsurance

- Part A hospice care coinsurance or copayment

- Part B coinsurance or copayment

- First 3 pints of blood

No matter which Medigap plan option you choose, these costs will be covered.

The following explains each of the benefits in detail.

Recommended Reading: Can I Have Medicare Part B Without Part A

How Much Do Medigap Plans Cost

Although Medigap plans are standardized the same way in nearly every state meaning that the benefits they provide are the same, regardless of which insurance company offers the plan the prices vary considerably from one insurer to another. And of course, the prices also vary from one plan level to another, as each plan level provides different benefits .

You can see Medigap plan costs in your area by entering your zip code, age, gender, and tobacco status into Medicares plan finder tool. But just to give you an idea, Medigap Plan A for a 65-year-old non-smoker tends to range from around $70 or $80 per month to as much as $300/month or more. But in New York, where Medigap premiums dont vary based on age, Plan A pricing starts at around $150. However, the same premiums would apply to an 85-year-old in New York, whereas an 85-year-old in most states would pay more than a 65-year-old.

Plan G, which is the most comprehensive Medigap policy available to newly-eligible Medicare beneficiaries, tends to have premiums that start around $110 to $130 per month, and range well above $300 per month, depending on the insurance company thats offering the plan.

Medicare Supplement Insurance Plans

Do you have fairly frequent doctor or hospital visits? If so, you may already know that Medicare Part A and Part B come with out-of-pocket costs you have to pay. You might be able to save money with a Medicare Supplement insurance plan. Medicare Supplement, or Medigap, insurance plans fill gaps in costs left behind by Original Medicare , such as deductibles, coinsurance, and copayments.

In 47 states, there are up to 10 standardized Medicare Supplement insurance plans that are denoted by the letters A through N . The private insurance companies offering these plans do not have to offer every Medicare Supplement plan, but they must offer at least Plan A.

Please note that although the names may sound similar, the parts of Medicare, such as Part A and Part B, are not the same as Medigap Plan A, Plan B, etc.

Don’t Miss: How Much Does Medicare Cover For Home Health Care

Are There Gaps In Medigap Coverage

Yes. Medigap plans are designed to cover some or all of the out-of-pocket expenses for services that Medicare covers. But with limited exceptions for care received outside the U.S., they do not cover care thats not covered at all by Medicare. The list of expenses that Medigap policies dont cover includes long-term care in a nursing home, vision and dental care, hearing aids, eyeglasses, private-duty nursing care, or prescription drugs.

Also, Medigap policies arent compatible with the following types of coverage:

- employer or union plans veterans benefits

- Indian health services

- Medicaid .

Finally, Medigap policies are for individuals only not for couples or families. So if you and your spouse are both eligible for Medicare, youll each need to select an individual Medigap plan.

Will I Have To Wait For My Medigap Policy To Take Effect

An insurer cant make you wait for your coverage to start, but it can make you wait for coverage of a pre-existing condition and may also refuse to cover your out-of-pocket costs for that pre-existing condition for up to six months during a pre-existing conditionwaiting period. That said, if you recently had creditable coverage or if you have guaranteed issue Medigap protection you may be able to shorten or avoid entirely the waiting period.

For more information about Medigap, read Choosing a Medigap Policy: A Guide to Health Insurance for People with Medicare.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health exchange updates are regularly cited by media who cover health reform and by other health insurance experts.

You May Like: Is Wellcare The Same As Medicare

Subd 1ntermination Of Coverage

Termination by an issuer of a Medicare supplement policy or certificate shall be without prejudice to any continuous loss that began while the policy or certificate was in force, but the extension of benefits beyond the period during which the policy or certificate was in force may be conditioned on the continuous total disability of the insured, limited to the duration of the policy or certificate benefit period, if any, or payment of the maximum benefits. The extension of benefits does not apply when the termination is based on fraud, misrepresentation, or nonpayment of premium. Receipt of Medicare Part D benefits is not considered in determining a continuous loss.

the issuer provides an actuarial memorandum, in a form and manner prescribed by the commissioner, describing the manner in which the revised rating methodology and resulting rates differ from the existing rating methodology and resulting rates and

the issuer does not subsequently put into effect a change of rates or rating factors that would cause the percentage differential between the discontinued and subsequent rates as described in the actuarial memorandum to change. The commissioner may approve a change to the differential that is in the public interest.

Subd 1mmedicare Cost Sharing Coverage Changes

A Medicare supplement policy or certificate shall provide that benefits designed to cover cost sharing amounts under Medicare will be changed automatically to coincide with any changes in the applicable Medicare deductible amount and co-payment percentage factors. Premiums may be modified to correspond with the changes.

As soon as practicable, but no later than 30 days prior to the annual effective date of any Medicare benefit changes, an issuer shall notify its policyholders and certificate holders of modifications it has made to Medicare supplement insurance policies or certificates in a format acceptable to the commissioner. Such notice shall:

include a description of revisions to the Medicare program and a description of each modification made to the coverage provided under the Medicare supplement policy or certificate and

inform each policyholder or certificate holder as to when any premium adjustment is to be made, due to changes in Medicare.

The notice of benefit modifications and any premium adjustments must be in outline form and in clear and simple terms so as to facilitate comprehension.

The notices must not contain or be accompanied by any solicitation.

Read Also: Does Medicare Pay For Revitive