How Using Multiple Years Could Change The Risk Adjustment Model

It is possible that physicians and other health care providers do not consistently code conditions on claims from year to year. For example, a physician may indicate on a medical record that a patient has diabetes when initially diagnosed, but might not indicate it on a follow-up visit in the next year if the diabetes is well-controlled. Depending on the extent of the inconsistency in coding conditions over time, there can be instability in the risk scores and payments to plans.

Furthermore, an analysis by the Medicare Payment and Advisory Commission also showed that the occurrence of having a chronic condition coded in one year and not in the subsequent year occurred more often for FFS beneficiaries than MA enrollees. This aligns with the notion that there are stronger incentives for complete coding in the MA environment since payments are directly tied to diagnosis coding. These differential coding rates between MA and the Medicare FFS program can cause Medicare payments to MA plans to be larger than the amount Medicare would have spent if the MA enrollees were enrolled in FFS Medicare. Using two or more years of diagnostic data could reduce the effects from the difference in coding patterns between MA and FFS Medicare, as more enrollees would be identified with chronic conditions in the FFS data.

Proposals For Reforming Medicare

As legislators continue to seek new ways to control the cost of Medicare, a number of new proposals to reform Medicare have been introduced in recent years.

Premium support

Since the mid-1990s, there have been a number of proposals to change Medicare from a publicly run social insurance program with a defined benefit, for which there is no limit to the government’s expenses, into a publicly run health plan program that offers “premium support” for enrollees. The basic concept behind the proposals is that the government would make a defined contribution, that is a premium support, to the health plan of a Medicare enrollee’s choice. Sponsors would compete to provide Medicare benefits and this competition would set the level of fixed contribution. Additionally, enrollees would be able to purchase greater coverage by paying more in addition to the fixed government contribution. Conversely, enrollees could choose lower cost coverage and keep the difference between their coverage costs and the fixed government contribution. The goal of premium Medicare plans is for greater cost-effectiveness if such a proposal worked as planned, the financial incentive would be greatest for Medicare plans that offer the best care at the lowest cost.

Currently, public Part C Medicare health plans avoid this issue with an indexed risk formula that provides lower per capita payments to sponsors for relatively healthy plan members and higher per capita payments for less healthy members.

- Senate

Using Diagnosis Data To Control For Health Status

In Part 1 of this series, we provided an overview of how the MA risk adjustment model works and why it is needed. For purposes of understanding the issue of expanding the data available for risk adjustment, it is important to know that Medicare payments to MA plans are enrollee specific i.e., a specific payment is calculated for each enrollee which includes an adjustment for health status known as a risk adjustment. The adjustment is conducted by applying a risk score that, relative to an average payment amount, increases payments for enrollees expected to need higher than average medical resources , and decreases payments for enrollees expected to need less than average resources .

Currently, CMS estimates the size of the risk adjustment factors with spending and diagnostic data from traditional Medicare fee-for-service claims. This is because FFS claims are the only available data source with complete spending and diagnostic data for Medicare enrollees. In order to calculate risk scores for MA enrollees, CMS applies the risk adjustment factors estimated with Medicare FFS data to demographic and diagnostic information for MA enrollees. Therefore, the relative completeness and accuracy of diagnostic data in both FFS Medicare and MA affect the accuracy of risk scores and payments to MA plans.

You May Like: How To Apply For Medicare Advantage

What Does Part B Cost

With Medicare Part B, you pay a standard monthly premium thats based on your income. In some cases, your monthly premium may be higher if you didnt sign up for Part B when you became eligible.

You may also need to meet an annual deductible before Medicare kicks in and starts paying. Once youve met your deductible, you will pay a 20 percent copay for approved Medicare Part B services.

You can always buy a Medicare Supplement Plan that pays your Part B deductible, as well as other out-of-pocket costs such as copays and coinsurance.

How Do You Enroll In Original Medicare

To enroll in Original Medicare , you must be 65 and dont necessarily have to be retired. Initial enrollment period packages are sent to people 3 months before they turn 65 or during their 25th month of disability benefits.

If youve received Social Security disability benefits for 24 months, you are automatically enrolled in Part A and Part B.

Don’t Miss: Does Medicare Cover Cpap Masks

The Solvency Of The Medicare Hi Trust Fund

This measure involves only Part A. The trust fund is considered insolvent when available revenue plus any existing balances will not cover 100 percent of annual projected costs. According to the latest estimate by the Medicare trustees , the trust fund is expected to become insolvent in 8 years , at which time available revenue will cover around 85 percent of annual projected costs for Part A services. Since Medicare began, this solvency projection has ranged from two to 28 years, with an average of 11.3 years. This and other projections in Medicare Trustees reports are based on what its actuaries call intermediate scenario but the reports also include worst-case and best-case projections that are quite different .

Medicare Doesn’t Cover Prescription Drugs

Medicare doesnt provide coverage for outpatient prescription drugs, but you can buy a separate Part D prescription-drug policy that does, or a Medicare Advantage plan that covers both medical and drug costs. You can sign up for Part D or Medicare Advantage coverage when you enroll in Medicare or when you lose other drug coverage. And you can change policies during open enrollment season each fall. Compare costs and coverage for your specific medications under either a Part D or Medicare Advantage plan by using the Medicare Plan Finder.

Don’t Miss: Does Medicare Pay For Private Duty Nursing

Medicare Doesn’t Cover Deductibles And Co

Medicare Part A covers hospital stays, and Part B covers doctors services and outpatient care. But youre responsible for deductibles and co-payments. In 2021, youll have to pay a Part A deductible of $1,484 before coverage kicks in, and youll also have to pay a portion of the cost of long hospital stays — $371 per day for days 61-90 in the hospital and $742 per day after that. Be aware: Over your lifetime, Medicare will only help pay for a total of 60 days beyond the 90-day limit, called lifetime reserve days, and thereafter youll pay the full hospital cost.

Part B typically covers 80% of doctors services, lab tests and x-rays, but youll have to pay 20% of the costs after a $203 deductible in 2021. A medigap policy or Medicare Advantage plan can fill in the gaps if you dont have the supplemental coverage from a retiree health insurance policy. Medigap policies are sold by private insurers and come in 10 standardized versions that pick up where Medicare leaves off. If you buy a medigap policy within six months of signing up for Medicare Part B, then insurers cant reject you or charge more because of preexisting conditions. See Choosing a Medigap Policy at Medicare.gov for more information. Medicare Advantage plans provide both medical and drug coverage through a private insurer, and they may also provide additional coverage, such as vision and dental care. You can switch Medicare Advantage plans every year during open enrollment season.

Dental Care Eye Care And Other Services

Dental care is not required to be covered by the government insurance plans. In Quebec, children under the age of 10 receive almost full coverage, and many oral surgeries are covered for everyone. Canadians rely on their employers or individual private insurance, pay cash themselves for dental treatments, or receive no care. In some jurisdictions, public health units have been involved in providing targeted programs to address the need of the young, the elderly or those who are on welfare. The Canadian Association of Public Health Dentistry tracks programs, and has been advocating for extending coverage to those currently unable to receive dental care.

The range of services for vision care coverage also varies widely among the provinces. Generally, “medically required” vision care is covered if provided by physicians . Similarly, the standard vision test may or may not be covered. Some provinces allow a limited number of tests . Others, including Ontario, Alberta, Saskatchewan, and British Columbia, do not, although different provisions may apply to particular sub-groups .

You May Like: Should I Get Medicare Part C

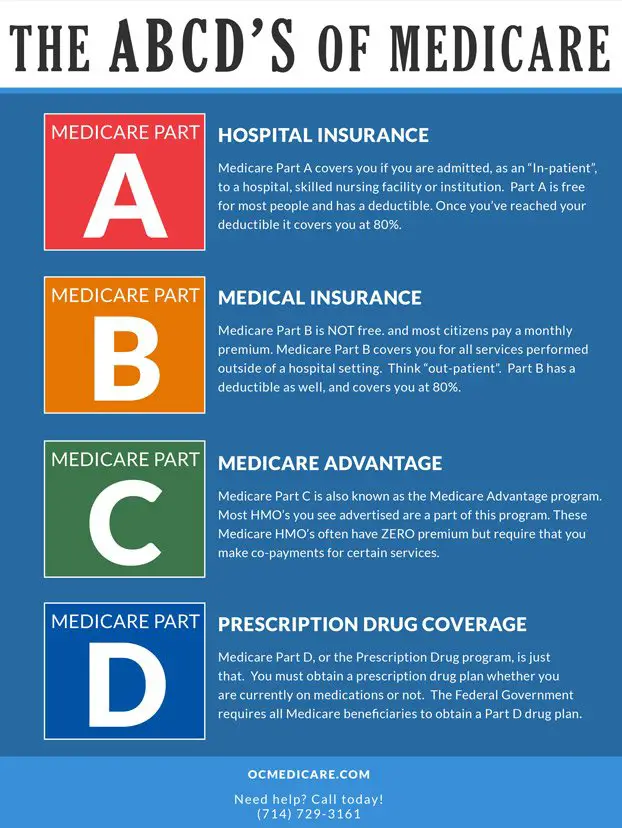

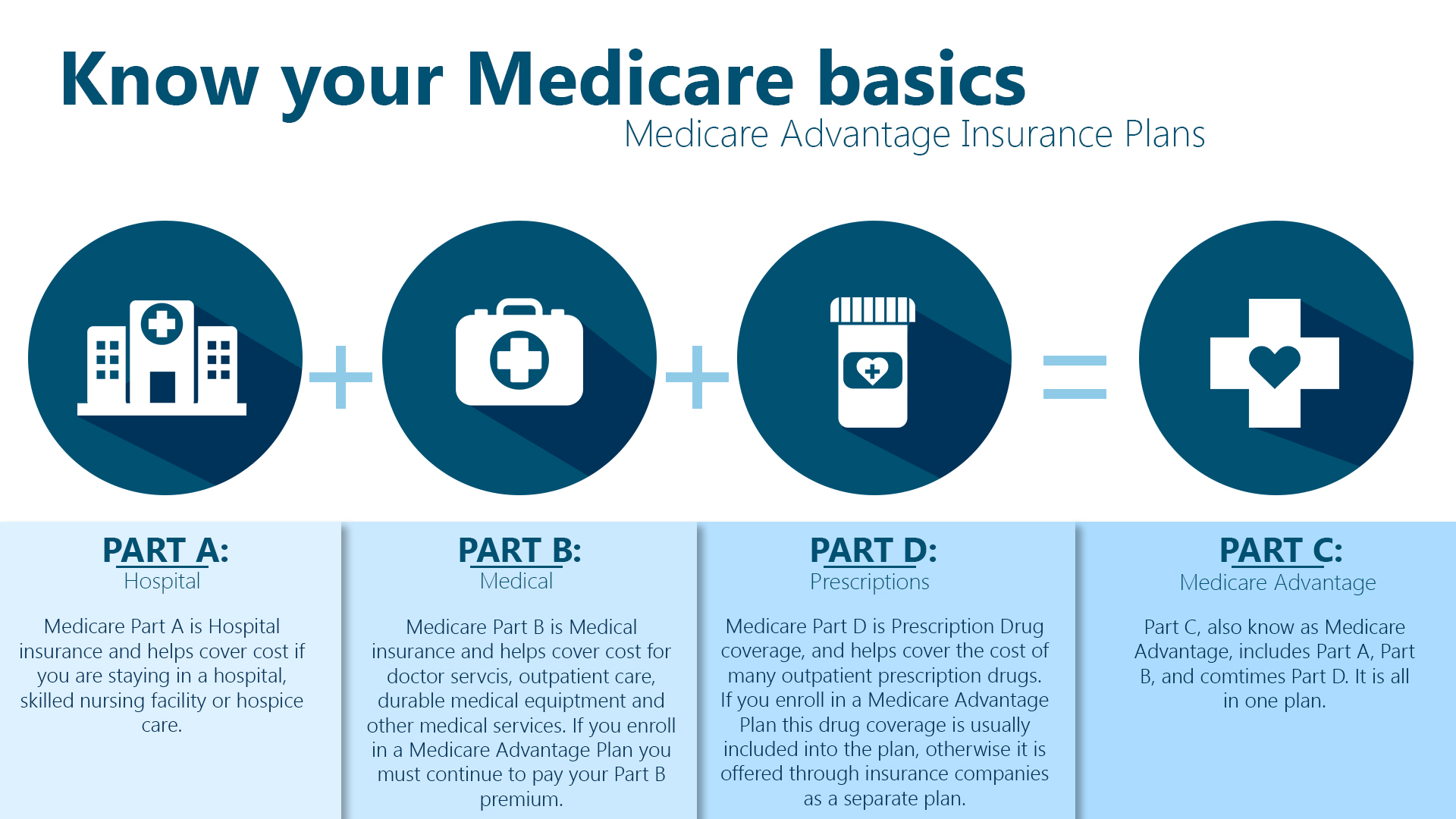

Medicare Part A: Hospital Insurance

Medicare Part A covers the costs of hospitalization. When you enroll in Medicare, you receive Part A automatically. For most people, there is no monthly cost, but there is a $1,484 deductible in 2021.

Services covered under Part A may include surgeries, inpatient care in hospitals, skilled nursing facilities, hospice care, home healthcare services, and inpatient care in a religious non-medical healthcare institution.

This sounds straightforward, but it’s not. For example, Part A covers in-home hospice care but does not cover a stay in a hospice facility.

Additionally, if you’re hospitalized, a deductible applies, and if you stay for more than 60 days, you have to pay a portion of each day’s expenses. If you’re admitted to the hospital multiple times during the year, you may need to pay a deductible each time.

B Doctor And Outpatient Services

This part of Medicare covers doctor visits, lab tests, diagnostic screenings, medical equipment, ambulance transportation and other outpatient services.

Unlike Part A, Part B involves more costs, and you may want to defer signing up for it if you are still working and have insurance through your job or are covered by your spouses health plan. But if you dont have other insurance and dont sign up for Part B when you first enroll in Medicare, youll likely have to pay a higher monthly premium for as long as youre in the program.

The federal government sets the Part B monthly premium, which is $148.50 for 2021. It may be higher if your income is more than $88,000.

Youll also be subject to an annual deductible, set at $203 for 2021. And youll have to pay 20 percent of the bills for doctor visits and other outpatient services. If you are collecting Social Security, the monthly premium will be deducted from your monthly benefit.

Read Also: Does Medicare Cover The Cost Of A Shingles Shot

What About Prescription Medicines

Medicare Part D covers prescription medications. If you have Part C, you might automatically get Part D. On the other hand, people who have Part A and/or B can opt to enroll in Part D as well.

There are other supplementary plans that can help you get the coverage you want for your personal health needs. For example, Medigap is a program that can help you afford your out-of-pocket costs.

To learn more about your optionsand whats best for youvisit Medicare.gov or speak to an insurance representative.

Reviewed by: Review date:

How Much Does Part A Cost

Most Medicare beneficiaries can get Part A benefits without paying a monthly premium, provided they have reached age 65 and paid into the Social Security system for at least 40 quarters, or 10 years, before becoming eligible for Medicare.

If you didnt work long enough to qualify for premium-free Part A, your Part A premium could be $252 or $458 per month, depending on how long you worked and paid Medicare taxes.

While Part A does not charge a monthly premium for most of its beneficiaries, there are many costs left uncovered by the plan. Part A beneficiaries generally carry a deductible for each benefit period that in 2020 costs $1,408.

The Part A deductible is not annual, and you could potentially face more than one benefit period in a calendar year. The benefit period that the Part A deductible applies to starts when you are admitted for inpatient care, and it ends once you have been discharged and stopped receiving inpatient care for 60 consecutive days.

For example, consider you are admitted for inpatient hospital care on June 1 and are released on June 8, and you are then readmitted for inpatient care again on June 15. Because you are still in the same benefit period, you wouldnt need to hit your Part A deductible again before your benefits kick in.

In addition to the deductible, Part A benefits carry a coinsurance requirement.

To the fullest extent possible, try to discuss prescribed treatments with your doctor to make sure your benefits cover the likely cost.

Recommended Reading: Does Medicare Cover Hiv Medication

What Is The Donut Hole

The donut hole is a coverage gap that begins after you pass the initial coverage limit of your Part D plan. Your deductibles and copayments count toward this coverage limit, as does what Medicare pays. In 2021, the initial coverage limit is $4,130.

The federal government has been working to eliminate this gap and, according to Medicare, youll only pay 25 percent of the cost of covered medications when youre in the coverage gap in 2021.

Theres also a 70 percent discount on brand-name medications while youre in the donut hole to help offset costs.

Once your out-of-pocket expenses reached a certain amount, $6,550 in 2021, you qualify for catastrophic coverage. After this, you will only pay a 5 percent copay for your prescription medications for the rest of the year.

Here are a few points to remember when choosing a plan:

What Is Medicare Part A Hospital Insurance

Medicare Part A covers the following services:

- Inpatient hospital care: This is care received after you are formally admitted into a hospital by a physician. You are covered for up to 90 days each benefit period in a general hospital, plus 60 lifetime reserve days. Medicare also covers up to 190 lifetime days in a Medicare-certified psychiatric hospital.

- Skilled nursing facility care: Medicare covers room, board, and a range of services provided in a SNF, including administration of medications, tube feedings, and wound care. You are covered for up to 100 days each benefit period if you qualify for coverage. To qualify, you must have spent at least three consecutive days as a hospital inpatient within 30 days of admission to the SNF, and need skilled nursing or therapy services.

- Home health care: Medicare covers services in your home if you are homebound and need skilled care. You are covered for up to 100 days of daily care or an unlimited amount of intermittent care. To qualify for Part A coverage, you must have spent at least three consecutive days as a hospital inpatient within 14 days of receiving home health care.

- Hospice care: This is care you may elect to receive if a provider determines you are terminally ill. You are covered for as long as your provider certifies you need care.

Keep in mind that Medicare does not usually pay the full cost of your care, and you will likely be responsible for some portion of the cost-sharing for Medicare-covered services.

Read Also: Does Medicare Have Life Insurance

Additional Considerations From Using Two Or More Years Of Diagnosis Data

CMS has so far not decided to increase the number of years of FFS and MA diagnostic data available to estimate the CMS-HCC model and calculate MA risk scores. Even if it did, there are still some issues to be determined regarding how to implement the provision. For example, because two years of diagnosis data would not be available for MA enrollees in their first or second year of Medicare eligibility, an alternative approach would be needed for them. It may be possible to estimate a risk score only using demographic information, which is currently done for enrollees in their first year . It may also be possible to use one year of diagnostic data for enrollees in their second year of Medicare eligibility.

Ways To Find Out If Medicare Covers What You Need

Also Check: What Is The Difference Between Medicare Supplemental And Advantage Plans

Medicare Doesn’t Cover Medical Care Overseas

Medicare usually doesnt cover care you receive while traveling outside of the U.S., except for very limited circumstances . But medigap plans C through G, M and N cover 80% of the cost of emergency care abroad, with a lifetime limit of $50,000. Some Medicare Advantage plans cover emergency care abroad. Or you could buy a travel insurance policy that covers some medical expenses while youre outside of the U.S. and may even cover emergency medical evacuation, which can otherwise cost tens of thousands of dollars to transport you aboard a medical plane or helicopter.

Medicare Part A Hospital Deductible

Medicare Part A also has a deductible. The Part A deductible is set at $1,556 in 2022. You will be responsible for paying the deductible each benefit period until Medicare starts to pay for your hospital expenses.

The Medicare Part A deductible resets each benefit period. How this works is that 60 days after being discharged from the hospital, your benefit period resets. If you are admitted to the hospital after those 60 days have passed, you will once again be responsible for covering your Part A deductible.

As you can see, having lots of unexpected hospital admissions in a year can cost you thousands of dollars out-of-pocket. However, there are certain Medicare Supplement Insurance plans that can help to cover your Part A deductible, which is something that you may want to consider.

You May Like: Will Medicare Pay For A Patient Lift