What’s The Difference Between Medicare Advantage And Medigap Coverage

The differences between Medicare Advantage and Medigap coverage can get confusing for people very quickly, says Ryan Cicchelli, founder of Generations Insurance & Financial Services in Cadillac, Michigan. While both provide protections Original Medicare does not, he says the two couldnt be more separate from one another.

| Plan type | |

| If you want coverage for out-of-pocket expenses | If you want more extensive coverage but can pay out-of-pocket expenses |

Original Medicare Vs Medicare Advantage Vs Medicare Supplement

by Christian Worstell | Published April 22, 2021 | Reviewed by John Krahnert

Original Medicare is Part A and Part B .

But beneficiaries also have other Medicare coverage options, including Medicare Advantage plans and Medicare Supplement Insurance plans .

Learn more about how these options compare to find out which one might be right for your needs.

Read Also: Why Sign Up For Medicare At 65

Having Medicaid Or A Medicare Savings Program

Medicare covers many services, but it doesnt cover long-term care benefits and can leave its enrollees with large cost-sharing expenses. Medicaid pays for some services that Medicare doesnt cover for enrollees whose incomes and assets make them eligible. If you have Medicaid or a Medicare Savings Program a program where Medicaid pays for Medicare premiums and cost-sharing then your enrollment options are different than if you only had Medicare.

Some Medicare Advantage plans specialize in covering low-income Medicare beneficiaries. These are known as Dual Eligible Special Needs Plans , and are available in every state. If you have Medicare and Medicaid, you should have few out-of-pocket expenses if you see providers enrolled in both programs regardless of whether you enroll in a D-SNP. Receiving coverage through a D-SNP requires you to see only providers who participate with the D-SNP insurer.

Some D-SNPs offer additional services, such as home care, dental or vision benefits. D-SNPs can also help coordinate all of the health services you receive. But low-income Medicare beneficiaries are better off with Original Medicare paired with regular Medicaid as secondary coverage if their providers accept those programs, but not D-SNP plans. In many states, the fee-for-service Medicaid benefit also covers dental or vision care.

Here is more information about programs available to Medicare beneficiaries with limited incomes and assets.

Also Check: Can I Enroll In Medicare Online

If You Lose Your Medicaid Eligibility:

If youre covered by both Medicare and Medicaid and then you lose eligibility for Medicaid, you can switch from Medicare Advantage to Original Medicare up to three months from the date you lose Medicaid eligibility, or the date youre notified, whichever is later.

- If youre told in advance that youll lose your Medicaid coverage for the following year, you can switch to Original Medicare between January 1March 31.

How Do I Choose Between Medicare Advantage Or Original Medicare

The best way to decide which plan is right for you is to try our Medicare Insurance recommendation tool. It will ask you some questions and come back with a recommendation.

Note: We rarely recommend that Medicare-eligible individuals enroll in Original Medicare without a Medigap or Medicare Advantage plan helping to address out-of-pocket costs. If you cannot afford to supplement Original Medicare with a Medigap plan, Medicare Advantages out-of-pocket protections can often save you money over Original Medicare alone. Plus many MA plans have nice additional benefits not found in Original Medicare such as smaller deductibles/co-insurance, prescription drugs, vision, hearing, and drugs.

If the Medicare Advantage plans in your area are limited to small regional networks, Original Medicares large and flexible network may be a better fit. Just be aware that you could be subject to greater out-of-pocket costs than those who purchase a Medicare Advantage plan.

Read Also: Does Medicare Cover Hospital Bed For Home Use

You Can’t Have Both So You Must Choose Wisely

Consumer ReportsOncology TimesMEDICAThe New York Times MagazinePsychology TodaySports Illustrated

We recommend the best products through an independent review process, and advertisers do not influence our picks. We may receive compensation if you visit partners we recommend. Read our advertiser disclosure for more info.

Anyone who’s ready to sign up for Medicare has a lot of decisions to make. But one decision is especially importantshould you choose Medicare Advantage or use Medigap to supplement your Original Medicare plan?

The Drawbacks Of Medicare Advantage Plans Can Become Apparent When Serious Illness Or Injury Strikes

Medicare Advantage plans are attracting seniors with their appealing price tags and promise of comprehensive health coverage in one convenient package. But are these plans actually a disadvantage for people with serious health problems?

Thats the question raised by a string of recent studies. A 2017 review by the U.S. Government Accountability Office, for example, found that in some Advantage plans, enrollees in poor health were substantially more likely to dump the plan than those in good health. A recent study by Brown University researchers found that Medicare Advantage enrollees are more likely to enter lower-quality nursing homes compared with people on original Medicare. Earlier studies have also found that people using high-cost services such as nursing-home care disproportionately switch from Medicare Advantage to original Medicare.

Medicare Advantage tends to work for people when they are relatively well, says Judith Stein, executive director of the Center for Medicare Advocacy. But if they become ill or injured and really need a significant length of care, theyre not as well served.

Theres a reason enrollment in MA plans continues to increase year over year: It works, says Cathryn Donaldson, spokesperson for Americas Health Insurance Plans, which represents insurers offering Advantage plans. Advantage enrollees, she says, are receiving better care, better service and better value.

Don’t Miss: Can Medicare Be Used Internationally

Medicare Advantage Vs Medicare Supplement

Medicare Advantage and Medicare Supplement plans are both provided through private insurance companies.

Medicare Advantage is a stand-alone plan that bundles your coverage. On the other hand, Medicare supplemental policies are add-on plans that are only available to beneficiaries in the Original Medicare program. Medicare Parts A and B pay for about 80% of Medicare costs under Original Medicare, creating gaps in coverage filled by supplemental policies.

| Medicare Advantage | |

|---|---|

| Plans do not cover foreign travel health expenses. | Some of the plans cover foreign travel health expenses. |

How Medicare Advantage Plans Work

First, it will help to review a few basics. Medicare comes in four parts, with Part A covering inpatient hospital care, and skilled nursing. Theres no premium if you or your spouse have earned at least 40 Social Security credits.

Part B covers doctor services and outpatient hospital care. You have to pay a monthly premium for this coverage, which is $170.10 in 2022, with a deductible of $233. High earners pay more.

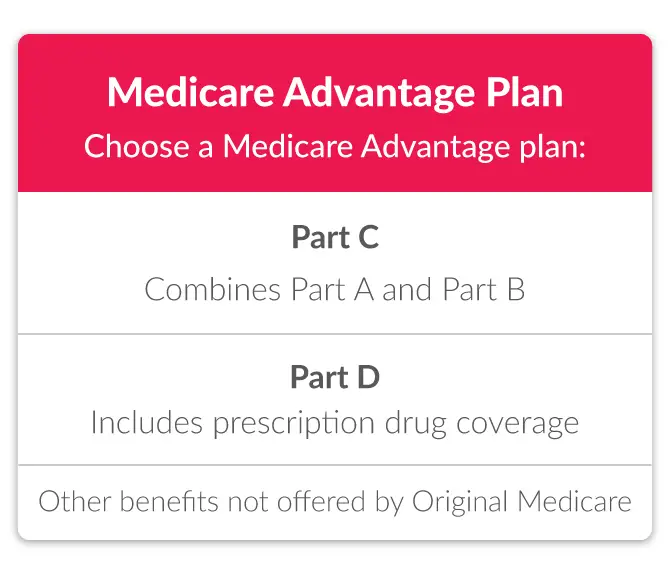

The other parts of MedicarePart C, aka Medicare Advantage, and Part D, prescription drug coverageare optional and offered by private insurers.

Medicare Advantage is an all-in-one managed care plan, typically an HMO or PPO. Advantage plans provide the benefits of Part A and B, and most also include Part D, or prescription drug coverage. Some offer extra benefits not available through Original Medicare, such as fitness classes or vision and dental care.

If you opt for Medicare Advantage, you typically continue to pay your Part B premium as usual, but you will pay little or no additional premiums for your coverage. You generally have copays or coinsurance, but once you reach your out-of-pocket limit, the plan will pay 100 percent of your medical costs covered under Medicare for the rest of the year. The out-of-pocket limit does not apply to prescription drugs or extra benefits.

With Medigap, youll pay more in monthly premiums compared with Advantage plans . Youll also have a bit more work choosing your Part D plan.

Read Also: Is Husky A Medicare Or Medicaid

Original Medicare Vs Medicare Advantage Plan: Comparing Your Options

Making a choice between Original Medicare vs. Medicare Advantage plans is dependent on your own health needs and budget. There is no one coverage option that is right for everyone.

When deciding between Original Medicare vs Medicare Advantage plans, keep the following in mind:

- Cost and coverage: These vary by plan.Check the available Medicare Advantage plans in your area to see if any of them include benefits that are important to you and that arenât included in Original Medicare Part A and Part B coverage, like routine vision and dental.

- Network: Are there doctors and hospitals that you would prefer to keep seeing?You may want to check with each Medicare Advantage plan youâre considering to see if your favorite physicians are in the planâs provider network.Under Original Medicare, you can visit any doctor or hospital that accepts Medicare assignment.

Prescription drugs: Most Medicare Advantage plans combine health benefits and prescription drug coverage into a single plan.If you choose to receive your Medicare benefits through Original Medicare, then you may sign up for a stand-alone Medicare Part D Prescription Drug Plan to receive prescription drug coverage since Original Medicare offers little coverage.

Original Medicare Coverage Alone Doesn’t Cut It Here Are Ten Factors To Help You Decide Which Private Insurance Options You Might Need

You can opt for Original Medicare and supplement it with a Medigap plan and/or a Part D prescription plan, or you can choose a Medicare Advantage plan.

Reviewed by our health policy panel.

Once youve decided that you want more coverage than Original Medicare alone, the next step is figuring out which of the many private insurance options will best fit your needs and budget.

Recommended Reading: How Old You Have To Be To Get On Medicare

How Many Seniors Choose Medicare Advantage Over Original Medicare

Roughly 22 million Americans are enrolled in Medicare Advantage. Part C is a more recent offering and still falls behind Original Medicare, which accounts for about two-thirds of all Medicare beneficiaries. Enrollment in Medicare Advantage has doubled since 2010, however, and government officials expect it to equal Original Medicares enrollment numbers by 2029.

Get real Medicare answers and guidance — no strings attached.

Added Benefits In Medicare Advantage Plans For 2023

For seniors considering switching to a Medicare Advantage plan during the current Medicare open enrollment period which runs through Dec. 7 choosing a plan might be tougher than ever.

The number of Medicare Advantage plans for 2023 is greater than ever, according to a new analysis by the nonprofit Kaiser Family Foundation . Nationwide, there are 3,998 such plans, a 6% increase from 2022.

That doesnt mean seniors will have that many plans to choose from, though. Medicare Advantage plans are offered by private health insurance companies, so plan availability can vary widely from county to county.

On average, seniors in any given location will have access to 43 Medicare Advantage plans for 2023, according to the KFF analysis. That is more than double the average for 2018.

Besides the plan availability in their area, another factor that will help seniors narrow their Medicare Advantage options are any extra benefits that come with a plan.

Medicare Advantage plans must provide all the same benefits as traditional Medicare. But Medicare Advantage plans can offer additional benefits that arent covered by traditional Medicare and many do.

For example, the following extra benefits are offered by individual Medicare Advantage plans for 2023, according to KFF:

Also Check: What Is A Coverage Gap In Medicare

Pros Of Original Medicare

More than 59 million people were on Medicare in 2018. Forty million of those beneficiaries chose Original Medicare for their healthcare needs.

Access to a broader network of providers: Original Medicare has a nationwide network of providers. Best of all, that network is not restricted based on where you live like it is with Medicare Advantage. All you need to do is pick a healthcare provider that takes Medicare. If you find a healthcare provider that accepts assignment too, meaning they also agree to the Medicare Fee Schedule that is released every year, even better. That means they can offer you preventive services for free and cannot charge you more than what Medicare recommends.

Keep in mind there will be healthcare providers that take Medicare but that do not accept assignment. They can charge you a limiting charge for certain services up to 15% more than Medicare recommends. To find a Medicare provider in your area, you can check Physician Compare, a search engine provided by the Centers for Medicare and Medicaid Services.

Ability to supplement with a Medigap plan: While most people get Part A premiums for free , everyone is charged a Part B premium based on their annual income. There are also deductibles, coinsurance, and copays to consider. For each hospitalization, Part A charges a coinsurance and for non-hospital care, Part B only pays 80% for each service, leaving you to pay 20% out of pocket.

Whats Included In Medicare Advantage Plans

Plans are sold by private companies approved by Medicare. Plans include Part A, Part B and typically, Part D or prescription drug coverage. However, some companies choose to sell this coverage separately.

While it may seem that Original Medicare is cheaper, the costs may be more advantageous in Medicare Advantage if you want to pay a little extra for additional flexibility and services. Vision, dental, hearing and wellness programs may be provided in Medicare Advantage but are not typically available in Original Medicare.

You May Like: When Can A Disabled Patient Enroll In Medicare Part D

Whats The Difference Between Original Medicare And Medicare Advantage

Original Medicare and Medicare Advantage are the two main types of Medicare.

Original Medicare is the traditional Medicare program offered directly by the federal government. Medicare Advantage plans are an all-in-one alternative offered by private insurance companies.

Choosing between these two options is perhaps the biggest decision Medicare enrollees face. They must make it when they first enroll in Medicare, and they have an opportunity to switch from one type of Medicare to the other during open enrollment periods.

Original Medicare is currently the more popular of the two main options. As of 2021, 43% of all Medicare enrollees chose a Medicare Advantage plan, according to the latest annual report from the Medicare boards of trustees.

Medicare Advantage plans have been growing in popularity, though. In 2004, only 12.8% of all Medicare enrollees chose a Medicare Advantage plan.

Plan B Vs Medicare Advantage

People with Original Medicare may choose to buy a Medigap Plan B policy to supplement their coverage, or they may decide to switch to a Medicare Advantage plan. When deciding which option is right for you, consider a few important factors:

- Healthcare budget: Compare healthcare costs for Plan B compared to Medicare Advantage. Medicare Advantage plans typically have additional benefits that Original Medicare and Medigap do not provide, such as Part D drug coverage, vision, and dental coverage. However, Medicare Advantage plans also tend to have more out-of-pocket costs.

- Health forecast: Consider your current health and family medical history to determine what health needs you may have in the future. Compare this to the coverages that Original Medicare and Medicare Advantage plans provide.

- Doctors and hospitals: Original Medicare and Plan B can be used at any provider that accepts Medicare nationwide, while Medicare Advantage plans limit care to a network of participating providers. If you travel often or your preferred doctors and hospitals are not on a Medicare Advantage plans network, Original Medicare may be a better choice.

Also Check: When Do I Apply For Medicare Benefits

How Do They Differ On Cost

Having Medicare Part A and Part B without any supplemental coverage can be costly because there is no cap for cost-sharing or no limit on out-of-pocket expenses.

If you dont need much medical care and dont have many prescriptions, you might find Original Medicare to be cost-efficient. Original Medicare has copayments for Part A services and a 20% coinsurance for most Part B services. While a Medicare beneficiary has the option to enroll solely in Original Medicare, they should be informed about the penalty if they dont enroll in a Part D plan when eligible, and then decide much later to enroll in a Part D plan.

With Medicare Advantage, enrollees pay copayments, though annual out-of-pocket costs are capped at $6,700. That can be helpful for those with complicated conditions who get regular, expensive medical care. Premiums for Medicare Advantage plans range from $0 to more than $100. Plans with no or low premium can have higher copayments and/or deductibles than plans with higher premiums.

Read Also: Must I Take Medicare At 65

How Original Medicare And Medicare Advantage Differ

Since the 1990s, Medicare recipients have been able to choose private health plans as an alternative to original Medicare. These health plans, once called Medicare Part C, are now known as Medicare Advantage.

Most Medicare recipients still choose the original program, but in 2019, 34% of Medicare beneficiaries opted to enroll in Medicare advantage. In 2016, 29% of new Medicare beneficiaries chose an Advantage plan during the first year of enrollment. The two programs offer similar benefits, but there are some important distinctions.

Don’t Miss: Does Medicare Pay For Sleep Apnea

Why Choose Medicare Advantage

Medicare Advantage plans must offer benefits comparable to original Medicare. The government regulates these plans, ensuring that they meet certain basic care requirements. The costs and copays for various services, however, may be different. For some people, Medicare Advantage is a better choice. You might choose Medicare advantage because:

- There are more options. In 2018, the average Medicare beneficiary could choose from 21 plans, though some regions offered even more choices.

- Premiums may be lower on some plans. Some even offer $0 premiums, though this usually means you’ll pay higher copays.

- There is usually prescription drug coverage. Original Medicare does not cover prescription drugs unless you enroll in Part D. In 2019, 90% of Medicare Advantage policies offered prescription drug coverage.

- You may pay less for expensive services. Medicare Advantage plans are legally required to limit your out-of-pocket maximum costs. With original Medicare, you keep paying costs no matter how much you spend. In 2020, the out-of-pocket maximum for most Medicare Advantage costs was $6,700.

- There is often coverage for services original Medicare will not fund. Each plan is different, so it is important to compare and review plan documents. However, many Medicare Advantage plans offer dental or vision coverage. Original Medicare, by contrast, covers only medical and hospital care.