Faq About The Nyc Medicare Advantage Plus Plan

Over the past few months, the UFT has worked tirelessly with fellow municipal union leaders on the Municipal Labor Committee to address the rising cost of health care while maintaining members current benefits and quality of care. On July 14, the MLC voted on and approved the NYC Medicare Advantage Plus Plan, which means retirees will continue to benefit from premium-free coverage while maintaining access to all of the same providers and hospitals they currently use. Unlike any other Medicare Advantage program in existence, this new plan not only mirrors and improves on the GHI Senior Care Plan, but also includes aggressive oversight to protect member benefits.

NEW – Read the from the MLC

What is the new NYC Medicare Advantage Plus Plan?The Municipal Labor Committee and the city have been working to negotiate a unique custom-made large group Medicare Advantage plan that would provide the same or ideally increase member benefits currently covered by the GHI Senior Care plan. The NYC Medicare Advantage Plus Plan is a result of the work done by the MLC. The MLC met all its goals by maintaining all of retirees’ current, premium-free benefits while adding additional enhancements. See the MLC’s FAQ on this new plan »

When was this decision made?The MLC voted to adopt the new NYC Medicare Advantage Plus Plan on July 14.

What is the start date for the NYC Medicare Advantage Plus Plan to take effect?The start date is Jan. 1, 2022.

Selecting A Medigap Plan: Recent Changes Limit Choices

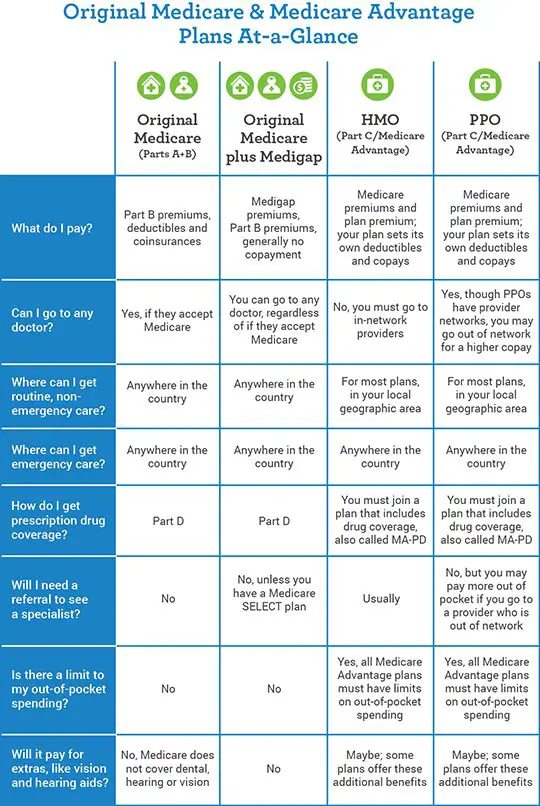

Medigap policies are private plans, available from insurance companies or through brokers, but not on medicare.gov. They are labeled Plans A, B, C, D, F, G, K, L, M, and N, each with a different standardized coverage set. Plans F and G also offer high-deductible versions in some states. Some plans include emergency medical benefits during foreign travel. Since coverage is standard, there are no ratings of Medigap policies. Consumers can confidently compare insurers prices for each letter plan and simply choose the better deal.

As of Jan. 1, 2020, Medigap plans sold to new Medicare beneficiaries aren’t allowed to cover the Part B deductible.

Before 2020, most people who bought Medigap policies chose Plan F, which gave the most comprehensive coverage, including paying for the Medicare Part B deductible . However, in an effort to trim Medicare expenses, Congress suspended Plans C, F, and High Deductible F for people who become Medicare-eligible in 2020 and beyond.

Plan D and Plan G have similar benefits to Plan C and Plan F, except for not covering the Part B deductible. People who signed up or became eligible for Medicare before 2020 can purchase or continue Plans C or F, though prices may rise and it may be a better deal to switch to a plan that doesnt cover the deductible.

How To Choose The Best Medicare Advantage Plan

Comparing Medicare Advantage plans requires you to understand your health care needs and think about what each type of plan offers. If you have a chronic health condition and want to be able to keep using a specific doctor or facility, youll want health coverage that they accept. If you take prescription drugs, some plans may offer lower out-of-pocket costs than others.

Here are some questions to ask as you evaluate Medicare Advantage plans:

-

Do you have to get a referral to see specialists?

-

What benefits does each plan include?

-

Are all of your prescription drugs covered, and how much will they cost?

-

Are your doctors covered?

-

Whats the plan’s Medicare star rating?

Recommended Reading: Am I Qualified For Medicare

Finding Part D Drug Insurance

To get started, find the plans available in your zip code. Once you have created an account at Medicare.gov, you can enter the names of your drugs and use a convenient tool that allows you to compare plan premiums, deductibles, and Medicare star ratings .

If you dont take many prescription drugs, look for a plan with a low monthly premium. All plans must still cover most drugs used by people with Medicare. If, on the other hand, you have high prescription drug costs, check into plans that cover your drugs in the donut hole, the coverage gap period that kicks in after you and the plan have spent $4,430 on covered drugs in 2022.

You Can’t Have Both So You Must Choose Wisely

Consumer ReportsOncology TimesMEDICAThe New York Times MagazinePsychology TodaySports Illustrated

Our editors independently research and recommend the best products and services. You can learn more about our independent review process and partners in our advertiser disclosure. We may receive commissions on purchases made from our chosen links.

Anyone who’s ready to sign up for Medicare has a lot of decisions to make. But one decision is especially importantshould you choose Medicare Advantage or use Medigap to supplement your Original Medicare plan?

Also Check: Can We Apply For Medicare Online

Can You Switch Yes But Theres A Catch

Its logical to consider enjoying the cost savings of a Medicare Advantage plan while youre relatively healthy, and then switching back to regular Medicare if you develop a condition you want to be treated at an out-of-town facility. In fact, switching between the two forms of Medicare is an option for everyone during the open enrollment period. This Annual Election Period runs from October 15 to December 7 each year.

Heres the catch. If you switch back to regular Medicare , you may not be able to sign up for a Medigap insurance policy. When you first sign up for Medicare Part A and Part B, Medigap insurance companies are generally obligated to sell you a policy, regardless of your medical condition. But in subsequent years they may have the right to charge you extra due to your age and preexisting conditions, or not to sell you a policy at all if you have serious medical problems.

Some states have enacted laws to address this. In New York and Connecticut, for example, Medigap insurance plans are guaranteed-issue year-round, while California, Massachusetts, Maine, Missouri, and Oregon have all set aside annual periods in which switching is allowed. If you live in a state that doesn’t have this protection, planning to switch between the systems depending on your health condition is a risky business.

National Medicare And Ma Enrollment Figures

Over 64 million Americans are enrolled in Medicare, and this number will only continue to rise as members of the baby boomer generation continue to join the 65-and-over demographic.1

Medicare Advantage enrollment is also on the rise. In fact, more than 26 million Americans or more than one out of every three people with Medicare are enrolled in a Medicare Advantage plan.2

A Medicare Advantage plan offers the same coverage as Medicare Part A and Part B, and some Medicare Advantage plans may also offer benefits such as vision, hearing and dental coverage. Some plans may also cover prescription drugs.

Medicare Advantage plans are offered by private insurance companies. Plan availability varies from state to state.

Don’t Miss: What Does Part B Cover Under Medicare

Learn More About Medicare

Join our email series to receive your free Medicare guide and the latest information about Medicare and Medicare Advantage.

The Medicare Star Ratings are assigned to Medicare plans based on five aspects of each plan:

- Screening tests and vaccinesThis criterion evaluates the type of access that plan members have to preventive services such as annual physicals, screenings, and vaccines.

- Management of chronic conditionsThis measures how efficiently care is coordinated for plan members with chronic conditions and how often they receive treatment for long-term health issues.

- Member experience with the planPlan members overall satisfaction with the plan is factored into this rating criteria.

- Member complaints and changes in plan performanceThis reflects how often plan members issued complaints about the plan, experienced problems receiving covered services or opted out of the plan entirely. It also measures how the plans performance improved from the previous year.

- Customer serviceMedicare evaluates the quality of service at the plans call center and how efficiently appeals and enrollments were processed.

If a plan receives fewer than three stars for three consecutive years, Medicare determines it to be a low-performing plan and reserves the right to remove it from its coverage. Current members of the plan will be notified and given a Special Enrollment Period to enroll in another Medicare plan.

Choosing A Medicare Advantage Plan

Medicare Advantage Health Plans are similar to private health insurance. Most services, such as office visits, lab work, surgery, and many others, are covered after a small co-pay. Plans might offer an HMO or PPO network and all plans place a yearly limit on total out-of-pocket expenses. Each plan has different benefits and rules. Most provide prescription drug coverage. Some require a referral to see a specialist while others do not. Some may pay a portion of out-of-network care, while others will cover only doctors and facilities that are in the HMO or PPO network. There are also other types of Medicare Advantage plans.

Selecting a plan with a low or no annual premium can be important. But it’s also essential to check on copay and coinsurance costs, especially for expensive hospital stays and procedures, to estimate your possible annual expenses. Since care is often limited to in-network physicians and hospitals, the quality and size of a particular plans network should be an important factor in your choice.

Also Check: Is Entyvio Covered By Medicare Part B

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Medicare Advantage Plan Benefits Include:

Nationwide access to providers and care.

The same benefits in and out of the plan’s network.

EmblemHealth Medicare Part D Pharmacy Coverage

Telehealth through LiveHealth Online and other virtual care options.

Value-added resources like SilverSneakers®.

Access to discounts and special offers from our healthy living partners.

To find an in-person doctor or specialist in your plan’s network prior to enrollment, please visit Find Care.

You May Like: How Many Chiropractic Visits Does Medicare Allow

Medicare Advantage Managed Care Plans: Beneficiary Protections

- The plan cannot charge more than a $50 copayment for visits to the emergency room.

- You or your doctor can appeal a denial of service and the appeal must be handled in a “timely” way. The plan must make an initial determination within 14 days. Reconsideration of a decision must be made within 30 days. Decisions regarding urgent care must be made within 72 hours.

- The plan must have a process for identifying and evaluating persons with complex or serious medical conditions. A treatment plan must be developed within 90 days of your enrollment.

- If your treatment plan includes specialists, you must have direct access to those specialists. You do not need a referral from your primary care physician.

What To Consider When Reviewing Medicare Advantage Plans

When reviewing a Medicare Advantage plan, its helpful to not only read the reviews and ratings of others, but to also to review the plan details yourself. Because each plan can vary so much, the right plan for you may be quite different than the right one for someone else.

When shopping for a Medicare Advantage plan, take time to review the following:

- CostCost is obviously an important thing to consider as you compare Medicare Advantage plans. Plans may come with monthly premiums, deductibles, coinsurance and other costs you will want to consider.

- BenefitsMedicare Advantage plans may offer a variety of benefits that are not covered by Original Medicare, and these additional benefits can differ from one plan to the next. Review your health care requirements and find a plan that covers what you need most.

- Network participantsYou may want to look for a Medicare Advantage plan that includes your preferred doctor or the nearest health care facilities as part of the plan network, if the plan has one. The list of participating providers can differ from plan to plan.

- Type of planThere are several types of Medicare Advantage plans, and it may be wise to review how each type of plan works in general so that you may enroll in the best plan for you.

Recommended Reading: Does Medicare Cover Hospital Bills

When To Sign Up For Medicare

As you approach age 65, its important to know which enrollment deadlines apply to your circumstances. Begin by checking on your eligibility. To avoid costly penalties and gaps in coverage, most people should for Medicare Part A and Part B in the seven-month window that starts three months before the month you turn 65 and runs for another three months following your 65th birthday.

If you currently get Social Security, you will be automatically enrolled if not, you need to sign up either online or at your Social Security office.

What Is A Medicare Advantage Plan

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Medicare Advantage is a bundled alternative to Original Medicare. Private insurers that offer Medicare Advantage plans contract with the federal government to provide health insurance benefits to people who qualify for Medicare.

In 2021, about four in 10 people eligible for Medicare are in Medicare Advantage plans.

Read Also: When Will I Get Medicare

Why Is Medicare Advantage A Bad Choice

Medicare Advantage can become expensive if you’re sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient’s choice. It’s not easy to change to another plan if you decide to switch to Medigap, there often are lifetime penalties.

Medicare Advantage Vs Medicare Supplement Insurance Plans

Are you trying to decide between Medicare Advantage vs. Medicare Supplement insurance? Heres a rundown of the two types of coverage.

While Original Medicare covers many health-care expenses, it doesnt cover everything. Even with covered health-cares services, beneficiaries are still responsible for a number of copayments and deductibles, which can easily add up. In addition, Medicare Part A and Part B also dont cover certain benefits, such as routine vision and dental, prescription drugs, or overseas emergency health coverage. If all you have is Original Medicare, youll need to pay for these costs out-of-pocket.

As a result, many people with Medicare enroll in two types of plans to cover these gaps in coverage. There are two options commonly used to replace or supplement Original Medicare. One option, called Medicare Advantage plans, are an alternative way to get Original Medicare. The other option, Medicare Supplement insurance plans work alongside your Original Medicare coverage. These plans have significant differences when it comes to costs, benefits, and how they work. Its important to understand these differences as you review your Medicare coverage options.

Don’t Miss: Is Stem Cell Treatment Covered By Medicare

What Are The Benefits To Medicare Advantage

Medicare Advantage covers more than Medicare , allowing patients more options and flexibility. Patients can customize their Medicare Advantage to cover specific needs like wheelchair ramps, adult day care, and respite care. Additionally, the 2020 CARES Act expanded Medicare’s network to cover more telehealth services.

Benefits Of Medicare Advantage Plans

Even though you have a Medicare Advantage plan, you are still responsible for paying the premium for Medicare Part B. The insurance company determines the Medicare Advantage plan premium. Most Medicare Advantage plan premiums are $0 a month. Nevertheless, the copayments are less with the Medicare Advantage Plan. As an example, lets say your copayment under Medicare Advantage Plan to see your physician is $20 dollars. Under the original Medicare plan, the cost of the coinsurance is 35 %, which is more than $20. The Medicare Advantage Plan is designed to save thousands of dollars. For example, the Medicare Advantage plan has set limits to the maximum amount of out- of- pocket expenses . Once you have spent that out-of-pocket expense, your covered medical expenses are free for the remainder of the year. The original Medicare is quite different. Under the original Medicare plan, there is no cap on out-of-pocket expenses , which means that your potential expenses could constantly grow. Another essential benefit of Medicare Advantage Plan is that you can select a Primary Care Physician to help manage your health. By having access to a Primary Care Physician, this is not only a great asset to your health, but also a early intervention to any life-threatening ailments.

Read Also: How Much Does Medicare Pay For A Doctors Office Visit

Medicare Advantage Plans Coverage For Some Services And Procedures May Require Doctors Referral And Plan Authorizations

Medicare Advantage plans try to prevent the misuse or overuse of health care through various means. This might include prior authorization for hospital stays, home health care, medical equipment, and certain complicated procedures. Medicare Advantage plans often also require your primary care doctors referral to see specialists before they will pay for services.