Traveling Internationally With Medigap

If you have Original Medicare and you plan to travel abroad regularly, consider adding a Medigap plan to your coverage. You could have foreign travel coverage for emergencies.

There are 10 Medigap plans available, but not all of them cover international travel. Plans C, D, F, G, M, and N cover 80% of these expenses. If you already have Plan E, H, I, or J , you could receive coverage while traveling internationally.

Other Medigap plans won’t add any international coverage to Original Medicare.

All services must be medically necessary, and you may need to meet any applicable Medicare deductibles first . Because this coverage applies only to emergency care, it’s not for things like medical equipment or preventative care.

Medigap coverage may not be the most reliable health insurance option for long-term travelers. For one thing, you must begin care within 60 days of leaving the US. After that, you’re on your own. Also, this coverage has a maximum lifetime benefit of just $50,000. If you plan to circumnavigate the globe or live abroad, you may need to look elsewhere for coverage, such as travel health insurance.

Medicare For Australian Citizens Overseas Clearing Up The Confusion

For any Australian expat who is confused about the Medicare for Australian citizens overseas, take a look below.

An Australian resident , living and working overseas as an expat will remain liable for a 2% Medicare Levy , if their taxable income exceeds $27,475 and $46,361 plus $4,257 for each dependent child for 2017-18.

In addition to the Medicare Levy, if the income of an Australian tax resident exceeds $90,000 or $180,000 a further Medicare Levy Surcharge of between 1 2% applies if they do not maintain private health cover for all their dependents, even when they are not living in Australia.

Note that the Australian Taxation Office uses a special definition of income called Income for Medicare Levy Surcharge purposes in determining who is required to pay the surcharge. For the purposes of this email I wont run through every element of income that is included in that definition as too much detail is required, but you might be surprised to learn that tax losses are added back in as income, as are any tax exempt income that you may have earned .

So what are the implications if I am an Australian tax resident whilst living and working overseas?

In short, if youre working overseas, youll remain liable for the Medicare Levy. And since you are liable for the levy, it also means that you remain eligible to use Medicare as and when you need it, whenever you are present in Australia.

What about the Medicare Levy Surcharge? Do I have to pay that too?

Traveling Internationally With Medicare Advantage

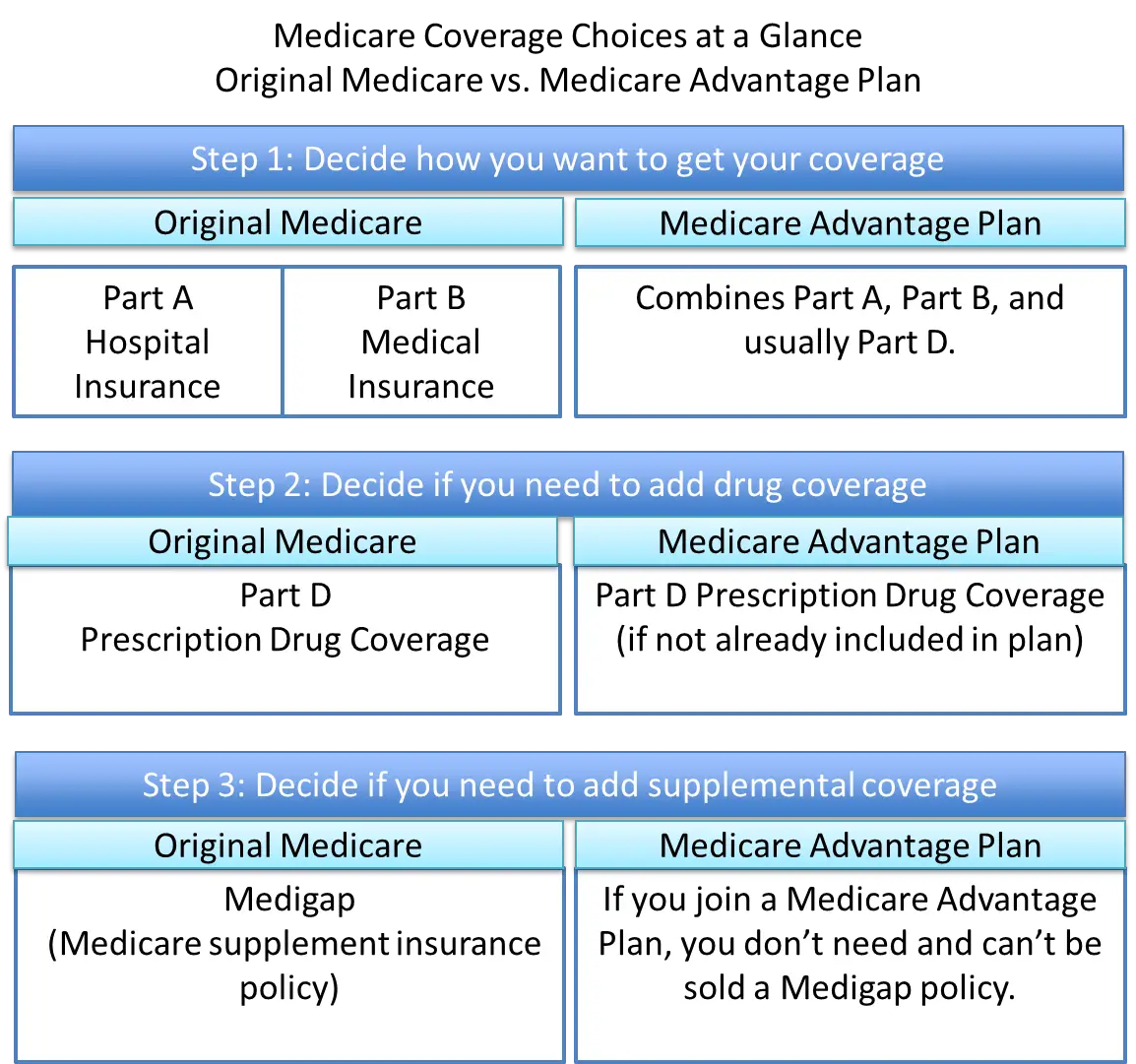

Medicare Advantage is an optional plan that allows enrollees to receive their Medicare benefits in a way that’s more like employer-sponsored coverage. Advantage plans cover everything Original Medicare covers . But Medicare Advantage plans can also include extras such as prescription drugs, vision, dental, hearing, and fitness.

Some Medicare Advantage plans cover enrollees while traveling internationally in more situations than Original Medicare will. Each policy varies, so contact your insurance company to learn more. If your plan wont cover much travel or you dont have Medicare Advantage, speak with a licensed Medicare agent to go over your options.

Don’t Miss: What Is The Maximum Income For Medicare

I Plan To Be A Roving Retiree And Spend A Few Years Traveling In Retirement Before Returning To The Us At Which Point I Might Spend Part Of The Year Away And Part Of It Stateside What Should I Do About Medicare

Balancing the cost of maintaining Medicare coverage while living and traveling outside of the U.S. is based on individual circumstances and therefore the decision is personal to each of us. However, certain principles apply to most situations.

It is important that the roving retiree maintains Parts A and B and continues payment of their Part B premium.

While Advantage Plans wont cover full-time overseas livingbecause they require continued residence in their plan areathey do have an extended coverage period of up to six months or a year when traveling out-of-country. This means that part-time expats and frequent travelers can use it as emergency coverage while theyre abroad. Many come with $0 or low-cost premiums.

Roving retirees can keep their Supplement Plan in force even while living overseas. The advantages include access to worldwide emergency traveler coverage for the first 60 days of any trip out of the U.S., being fully covered in the event of an emergency return to the U.S., and no health underwriting for a Supplement Plan upon return to the U.S. The disadvantage is in the cost of continuing to pay the Part B and Supplement premiums while out of the country. If you discontinue Part B, the Supplement would be terminated, and you would face the same delays for coverage and monetary penalties seen in Example 2 of Janice Smith living in Thailand.

People With Disabilities Who Have Medicaid Or Medicare Are Not Covered While They Are Outside The United States

If you are a Medicaid recipient, you may be dropped from enrollment in the medical plans if you do not keep a U.S. state residence or address or if you lose your SSI eligibility . Loss of enrollment creates a gap of coverage upon return home from traveling abroad, especially if the travel health insurance does not cover you in your home country.

Individuals who are entitled to Medicare and leave the United States are still enrolled in the Medicare program The issue is that Medicare will not make payments for services given or supplies sent outside the United States.*

If you are a U.S. citizen or permanent resident on Medicare, consider purchasing a Medicare supplement plan from a local insurance agent instead of getting separate international coverage. This supplement will cover you for the first 60 days of a trip outside of the United States. There is a $250 deductible. After meeting the deductible, the insurance will cover 80% of all billed charges up to a lifetime maximum of $50,000. This Foreign Travel Emergency benefit is just one of the many benefits included in the supplement package. The premium will likely be between $100 and $150 depending on your age, and if you already have a Medicare supplement, you may only need to add as little as $9.00 for overseas coverage.**

Contact the Social Security Administration and the Medicaid/Medicare office for more information .

** Information from: Good Neighbor Insurance, subject to change

You May Like: What Age Can You Join Medicare

What Countries Accept Us Medicare

Your Original Medicare coverage will not apply in any other country than the US unless you meet the specific requirements in the previous section. Within the US, your Medicare policy is good in all 50 states. In addition, your policy will also work in US territories. These territories include:

If you are traveling in any of these territories, medical facilities will accept your Medicare policy.

What Other Foreign Travel Emergency Coverage Is Available

Other policies provide some coverage for foreign travel emergencies:

Medicare Advantage. Some private Medicare Advantage plans cover foreign travel emergency care, but the coverage limits and details vary. Find out more about the Medicare Advantage plans available in your area by using the Medicare Plan Finder.

Travel insurance. While some travel insurance policies cover trip cancellations, others also cover emergency medical care in a foreign country and medical evacuation to a nearby medical facility or back to the United States for care. However, some travel insurance policies exclude preexisting conditions, so find out about exclusions, coverage limits and other details before choosing a policy.

Tricare for Life. If youre a military retiree, you may have foreign-country health care coverage through Tricare for Life after you enroll in Medicare. Tricare for Life typically covers Medicares deductibles, copayments and coinsurance, but it also provides some additional benefits, such as health care outside of the United States. It provides the same foreign travel coverage under Tricare that military retirees and dependents have before enrolling in Medicare. You pay any deductibles and copayments for that coverage.

Keep in mind

You May Like: Is New Shingles Vaccine Covered By Medicare

Enrolling In Medicare While Working Abroad

You can delay enrollment in Medicare Part B and avoid its premiums without a late enrollment penalty if you have health care coverage from any of the following:

- An employer for which you or your spouse actively work and that provides group health insurance for you or both of you.

- The public national health system of the country where you live, regardless of whether you or your spouse works for an employer or is self-employed. This delay applies only if either of you is still working, not if you have retired.

- The sponsoring organization of voluntary service you provide abroad for example, the Peace Corps.

When you or your spouse stops working or loses your coverage, youll be eligible for an eight-month special enrollment period to sign up for Medicare without having to pay a late enrollment penalty. But if youre volunteering, the special enrollment period is only six months long.

If you stop working or volunteering but dont return to the United States within that time, youll have the same dilemma that non-working people abroad face: Either sign up for Part B and pay premiums for coverage you cant use or delay enrollment until your return to the U.S. and then become liable for permanent late penalties.

Getting Medicare While Traveling Or Living Overseas

Many retirees look forward to traveling in their retirement, and more and more are actually retiring overseas, in part as a way to stretch savings. But what happens to retirees’ federal benefits while they are out of the country? The short answer is that although Social Security benefits are available to retirees in other countries, Medicare generally is not. In this installment we look at Medicare.

Traditional Medicare does not provide coverage for hospital or medical costs outside the United States . In rare cases, Medicare may pay for inpatient hospital services in Canada or Mexico.

Local Elder Law Attorneys in Your City

City, State

Some Medicare Advantage plans may provide coverage benefits for health care needs when enrollees travel outside the United States. But those retiring overseas — or travelers enrolled in the traditional Medicare program or whose Medicare Advantage plan does not cover foreign travel — will need to purchase health insurance from another source.

Whatever option retirees choose while abroad, if they return to the United States they will still be covered by Medicare Part A. Medicare Part A covers institutional care in hospitals and skilled nursing facilities, as well as certain care given by home health agencies and care provided in hospices. There are no premiums for this part of the Medicare program and anyone who is 65 or older and is eligible for Social Security automatically qualifies.

For more about the Medicare program, .

Also Check: When To Sign Up For Medicare For First Time

Traveling With Medicare Advantage Plans

If you receive your Medicare coverage through a Medicare Advantage plan, instead of Original Medicare, the rules for out-of-state coverage are different and will depend on the type of Medicare Advantage plan youâre enrolled in. Certain types of Medicare Advantage plans, such as HMOs, have provider networks that you must use to be covered for routine care. You generally need to get health-care services from doctors and hospitals in the plan network, although youâll still be covered if you need emergency medical care, out-of-area urgent care, or out-of-area kidney dialysis.

Other Medicare Advantage plans, such as PPO plans, are more flexible and may let you see health-care providers outside of your planâs preferred provider network. Depending on the rules of your plan, however, you could have to pay a higher copayment or coinsurance to receive non-emergency care from an out-of-network provider. If you will be traveling out of state, contact your Medicare Advantage plan for more information on coverage while out of your planâs service area.

If you are traveling overseas, Medicare Advantage plans must provide at least the same level of coverage as Original Medicare, so youâll be covered in the same limited situations described above. However, some Medicare Advantage plans may provide additional coverage when you are traveling outside of the United States. Check with your Medicare Advantage plan for more information.

Can Original Medicare Cover Medical Costs Overseas

If your only form of health insurance is Original Medicare Part A and Part B then you will likely have a tough time getting any medical expenses incurred outside of the United States or its territories covered. This is because Original Medicare generally does not cover any medical costs outside of the United States.

Only in certain instances will Original Medicare pay for healthcare services that you receive in a foreign country. The instances in which Original Medicare may cover healthcare services that you receive in a foreign country include:

- Youre in the United States when the emergency occurs, and a foreign hospital is closer to you than the nearest U.S.-based hospital that can treat you.

- Youre traveling through Canada by the most direct route between Alaska and another U.S. state when a medical emergency occurs, and a Canadian hospital is closer to you than the nearest U.S.-based hospital that can treat you.

- You live in the U.S. and a foreign hospital is closer to your home than the nearest U.S. hospital that can treat you, regardless of whether or not an emergency exists.

In any other case, you will typically be required to pay 100 percent of the medical costs that you incur under Original Medicare. There may be some instances in which Medicare Part B will cover necessary healthcare services that you receive if youre on a cruise ship, but again, there are limitations, such as:

Recommended Reading: Is Visiting Nurse Covered By Medicare

Traveling Internationally With Original Medicare

Made up of Part A and Part B , Original Medicare is the backbone of most retirees health-care coverage. But, for the most part, it doesnt cover you unless both your feet are firmly planted on US soil. The good news is that US soil includes popular destination territories such as Puerto Rico, the Northern Mariana Islands, Guam, American Samoa, and the US Virgin Islands.

There are a few exceptions. You could receive coverage in the following situations:

- You live in a border town in the US, but the closest hospital is in another country.

- You need emergency dialysis .

- Youre on a cruise ship within six hours of a US port with a US-approved doctor.

- Youre traveling to or from Alaska via Canada, and an emergency occurs. To receive coverage, you must be on a direct route and travel without delay.

If you receive coverage in one of these situations, be prepared to file your own insurance claims. Foreign hospitals arent required to file Medicare claims for you like US hospitals are.

A Medigap Supplement Plan Can Also Help

While Original Medicare and most Medicare Advantage plans provide little to no Medicare coverage in foreign countries, one often overlooked plan type may be a major help to you. In many cases, Medigap policies will cover you if you have a medical emergency in a foreign country.

More specifically, Medigap policies C through J offer travel emergency coverage. This benefit typically applies only during the first two months of any trip, but if you plan on being out of the country for less than 60 days, this should not be an issue. The Medigap travel emergency benefit covers 80 percent of emergency care you receive outside of the country.

To receive a Medigap policy with travel emergency coverage, a $250 deductible and $50,000 lifetime maximum apply. If you dont plan on traveling often and just want a helpful option in case of an emergency overseas, Medigap policies C through J may be just what you need.

You May Like: How To Apply For Medicare In Hawaii

Does Medicare Advantage Cover Travel

Medicare Advantage plans must cover the same limited foreign emergency care expenses as Original Medicare.

Some Medicare Advantage plans may offer additional coverage as well. Certain rules and restrictions may apply.

For example, your Medicare Advantage plan may require you to pay your expenses upfront and get reimbursed by the insurance company later. Other plans might cap overseas travel benefits.

Its important to check the details of your specific plan for more information. Make sure to contact your plan provider to ask about costs and coverage rules.

International Travel Insurance For Us Citizens Enrolled In Medicare

When you are on a ship and need coverage, Medicare will not pay for health care services when the ship is more than 6 hours away from the US port. The Medicare prescription drugs plan don’t offer coverage for the drugs purchased outside the United States. All the 50 US states, the District of Columbia, Puerto Rico, the U.S. Virgin Islands, Guam, the Northern Mariana Islands, and American Samoa are considered part of the U.S and accept US Medicare.

As Medicare offers limited coverage for travel outside the US, It is advisable to buy adequate international travel health insurance to get proper medical coverage while outside the US borders. All of the popular international travel destinations for US citizens like Canada, Mexico, the Caribbean islands, Latin and South American nations, Europe, Australia and Asia are not covered by regular Medicare coverage.

You May Like: Can I Get Glasses With Medicare

Do Medicare Supplement Policies Cover Foreign Travel

If you buy a private Medicare supplement policy, better known as Medigap, you may have some coverage for foreign travel emergencies. Medigap Plans C, D, F, G, M and N cover emergency health care while you travel outside of the United States. Plans C and F are no longer available to new Medicare beneficiaries. Only people eligible for Medicare before 2020 can enroll in those two plans.

These Medigap plans cover foreign travel emergency care that begins in the first 60 days of your trip. They pay 80 percent of the billed charges for certain medically necessary emergency care outside the United States, but first you pay a $250 deductible for the year. The Medigap foreign travel emergency coverage has a lifetime limit of $50,000.