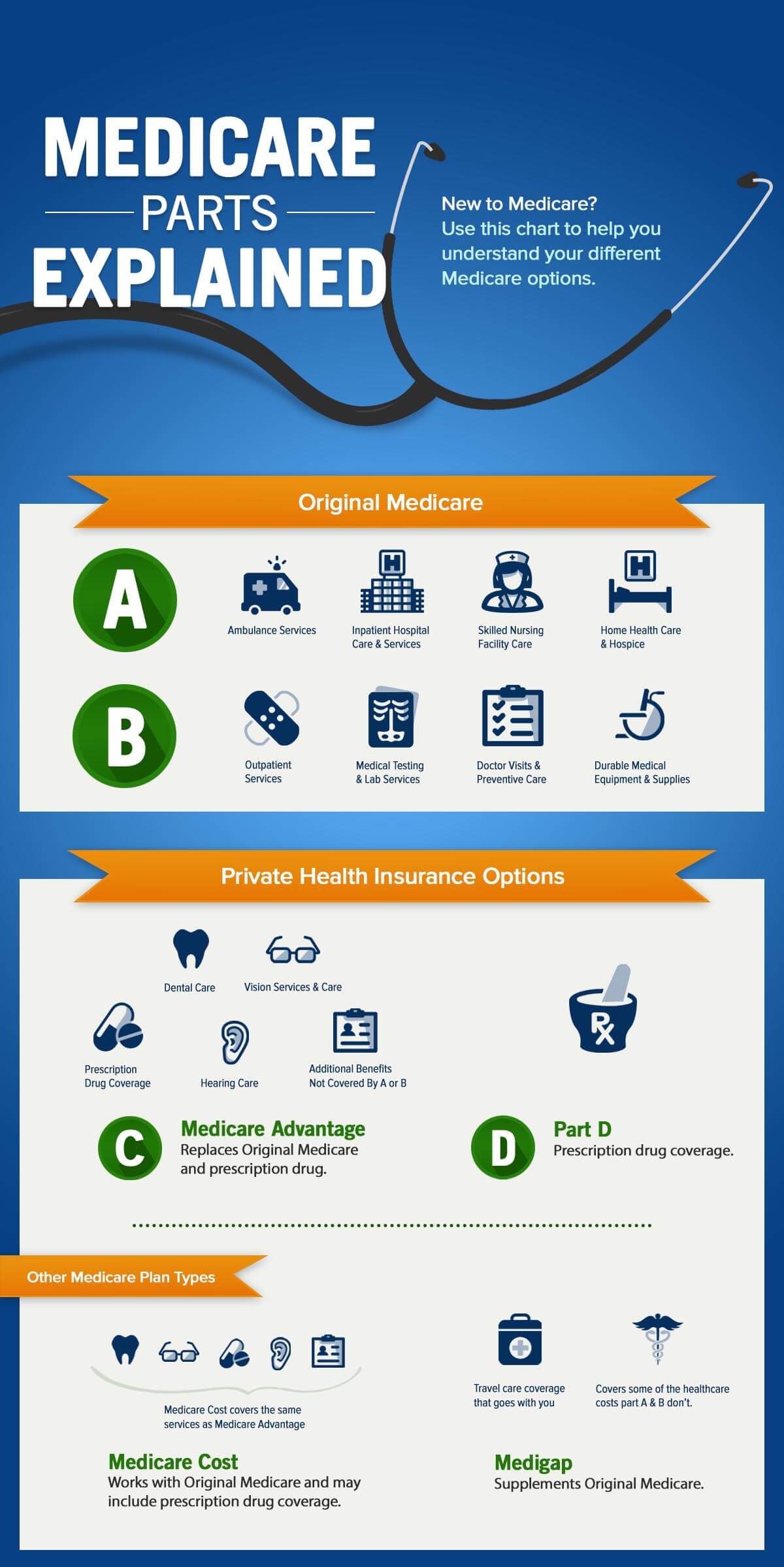

Medicare Part C: Medicare Advantage Plans

Companies, including Blue Shield, offer Medicare Advantage Plans. Only Medicare-approved private companies can offer these plans.

Medicare Advantage Plans provide all the Part A and Part B benefits plus more. Some include vision, hearing, and dental coverage plus wellness programs.

Most Medicare Advantage Plans include coverage for Prescription Drugs . These plans are known as Medicare Advantage Prescription Drug Plans.

For MAPD plans, the amount you pay toward services differs depending on the plan you select. Generally, you will need to see doctors who are in the plan network.

Not Covered Under Medicare Parts A And B

While Medicare Parts A and B cover an extensive list of hospital and doctor services, the coverage is not all-encompassing. Generally, Original Medicare will not cover you for the following healthcare services and medical devices:

-

Long-term care

-

Non-medical care and non-skilled personal care assistance

-

Most dental care

-

Eye exams related to prescribing glasses

-

Dentures

-

Hearing aids and exams for fitting them

-

Routine foot care

-

Concierge care

Medicare Advantage, or Medicare Part C, may cover some of the above services, like vision, hearing and dental . This is not always the case and you should confirm with your provider before purchasing your Medicare Advantage plan.

Medicare has an online tool that can help you confirm if a test, item or service is covered. If it is not listed online, ask your doctor.

Medicare Advantage Vs Medigap

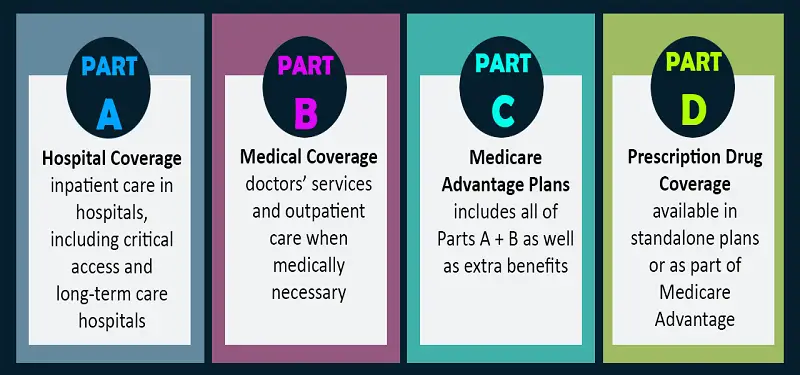

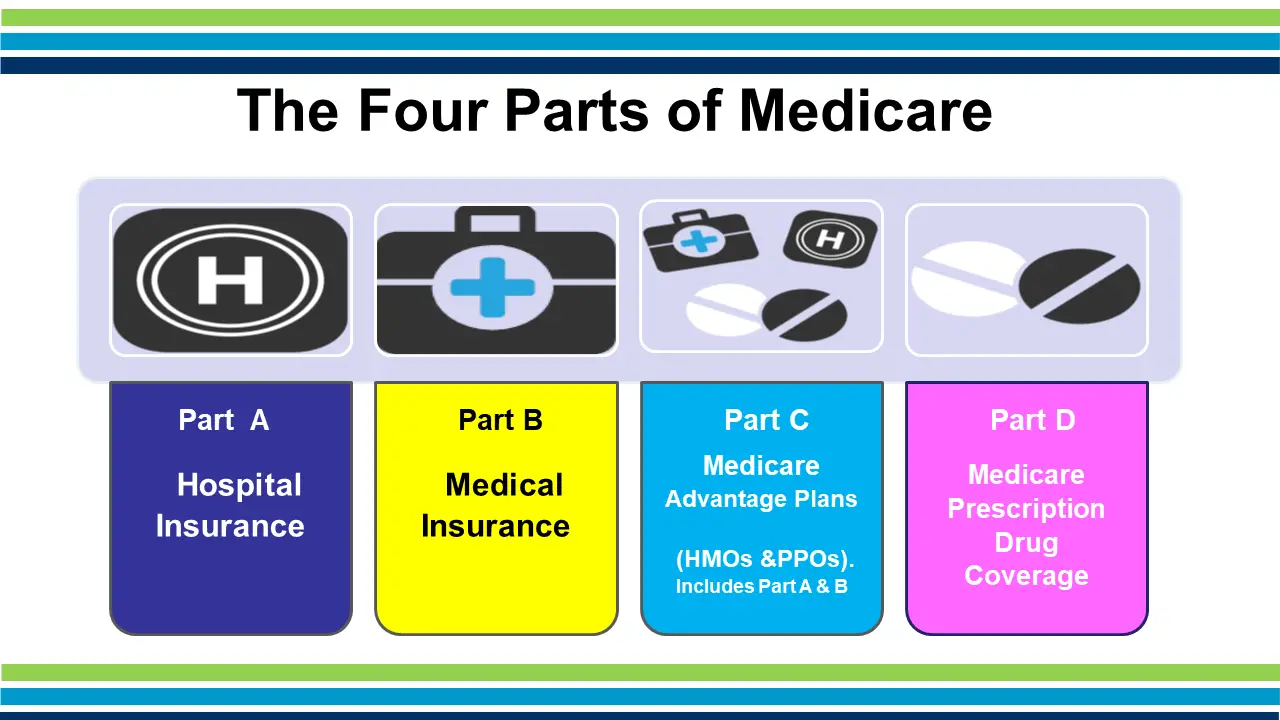

A Medicare Advantage Plan is a full health insurance plan that provides coverage under Medicare Part A , Part B and sometimes Part D . MA plans are sold through private insurers.

Medical Supplement Insurance, Medigap, is supplemental Medicare insurance that plugs some of the “gaps” in Original Medicare coverage. Out-of-pocket costs, like copayments, coinsurance and deductibles would be paid for under a Medigap policy.

Unlike Medicare Advantage, Medigap is a supplemental policy to Original Medicare plans and is not a standalone health insurance policy. However, it is similar to MA plans in that Medigap is also sold through private companies.

|

Medicare Advantage |

|---|

|

Privately sold |

Recommended Reading: Does Medicare Cover All Medical Expenses

Medicare Part D Plans

You are newly eligible for Medicare Part D or you are switching during Annual Enrollment Period from Oct. 15 to Dec. 7.

There are no Medicare Advantage plans in your area.

*Medicare Advantage benefits are based on a January 1, 2022 effective date.**The following counties are only eligible for Medicare Advantage plans starting on January 1, 2022: Chase, Coffey, Dickinson, Franklin, Geary, Linn, Lyon, Marion, McPherson, Miami, Morris, Riley.***Blue Medicare Advantage Choice is a new plan only available on/after January 1, 2022.Certain exceptions apply. Please reference the Evidence of Coverage for additional information.

*Medicare Advantage benefits are based on a January 1, 2022 effective date.**The following counties are only eligible for Medicare Advantage plans starting on January 1, 2022: Chase, Coffey, Dickinson, Franklin, Geary, Linn, Lyon, Marion, McPherson, Miami, Morris, Riley.***Blue Medicare Advantage Choice is a new plan only available on/after January 1, 2022.Certain exceptions apply. Please reference the Evidence of Coverage for additional information.

*Medicare Supplement sample premiums are based on a 65-year-old female, non-tobacco user with household discount eligibility for January 1, 2022 effective date.**For Medicare Supplement Plans sold on or after January 1, 2020, only applicants first eligible for Medicare before 2020 may purchase Plans C and F.

Common Services That Medicare Does And Doesnt Cover

Heres general info about what Medicare does or doesnt cover for common health care needs. Visit medicare.gov/coverage for more detail. Also, check a Medicare health plans Summary of Benefits to learn whats covered.

Medicare has some coverage for acupuncture and it is limited to treatment of chronic low back pain. Some Medicare Advantage plans have benefits that help pay for acupuncture services beyond Medicare such as treatment of chronic pain in other parts of the body, headaches and nausea.

Assisted living is housing where people get help with daily activities like personal care or housekeeping. Medicare doesnt cover costs to live in an assisted living facility or a nursing home.

Medicare Part A may cover care in a skilled nursing facility if it is medically necessary. This is usually short term for recovery from an illness or injury.

The federal Medicaid program can help pay costs for nursing homes or services to help with daily living activities.

Medicare Part B covers outpatient surgery to correct cataracts. It also pays for corrective lenses if an intraocular lens was implanted. Coverage is one pair of standard frame eyeglasses or contact lenses as needed after the surgery.

Medicare Part B covers a chiropractors manual alignment of the spine when one or more bones are out of position. Medicare doesnt cover other chiropractic tests or services like X-rays, massage therapy or acupuncture.

Recommended Reading: What Is A Medicare Discount Card

Medicare Parts C And D

Your search for affordable Health, Medicare and Life insurance starts here.

Call us 24/7 at or Find an Agent near you.

If Medicare Parts A and B are not enough coverage, you may consider learning more about Medicare Parts C and D. These options offer benefits that you may not be getting from your current coverage.

Medicare Part D: Medicare Prescription Drug Plans

Some plans already include Medicare Part D coverage. If you have a Medicare Supplement plan that doesn’t, a standalone Medicare Prescription Drug Plan can help. Blue Shield of California offers these plans to help you cover the costs of your prescription drugs.

You can choose:

- Standalone prescription coverage , which works well with a Medicare Supplement plan

- Medical and prescription coverage combined in a Medicare Advantage Prescription Drug Plan

You May Like: How Much Does Medicare Part B Cost For A Couple

Medicare Prescription Drug Coverage

Medicare Prescription Drug Coverage helps cover your prescription drug costs.

Prescription Drug Plans can be purchased as stand-alone plans from private insurers in addition to Original Medicare or Medicare Advantage plans that dont offer drug coverage.

Many Medicare Advantage plans also include Part D coverage.

If you’re looking for Medicare prescription drug coverage, you can consider enrolling in a Medicare Advantage plan that includes drug coverage, or you can consider enrolling in a Medicare Part D plan.

You can compare Part D plans available where you live and enroll in a Medicare prescription drug plan online in as little as 10 minutes when you visit MyRxPlans.com.1

What To Do If Something You Need Isn’t Covered By Medicare Part C

If you do not have other prescription drug coverage, join an HMO or PPO that includes it. You cannot have a separate drug plan and an HMO or PPO at the same time. You can only purchase a separate drug plan if you are enrolled in a Part C plan that doesnt offer drug coverage, such as a PFFS or MSA.

You may be able to get other coverage under a second insurance plan. For example, if you are still working, you may be able to combine your Medicare Part C coverage with the coverage provided under an employer-sponsored health insurance plan. If you have private insurance, that plan usually pays first if your employer has at least 20 employees. Once the private plan processes the claim, a second claim is submitted to the Medicare Advantage insurer. You are responsible for any charges not covered by either plan.

Don’t Miss: Where Do I Apply For Medicare Benefits

Medicare Part C: Medicare Advantage

Medicare Advantage , or Part C, is an alternative to Original Medicare that bundles Part A, Part B and sometimes Part D into a single health plan. Instead of being a government-funded health plan, MA plans are sold by private insurance companies.

The advantage of an MA plan is that you may find coverage that would otherwise be excluded in Original Medicare, such as vision, hearing and dental coverage. However, you would only be allowed to use doctors within your plan’s network. With Original Medicare, you can use any doctor or hospital that accepts Medicare.

Unlike Original Medicare, there is no standard premium for an MA plan the cost will vary by the provider. Our sample in Orange County, California showed that the Part C premium can range from $170.10 to $567.10 per month in 2022.

How Do I Sign Up For Medicare Part C

To join a Medicare Advantage plan, you must qualify for Original Medicare, which is available to people aged 65 and older, and younger disabled individuals. Medicare Advantage plans are available to U.S. citizens, U.S. nationals, and other people who are lawfully present in the United States. You must also live in the service area covered by the plan. You must be enrolled in Medicare Part A and B to join a Medicare Advantage plan.

For people who meet the eligibility requirements, its important to compare Medicare Advantage plans, since coverage and costs vary. Youll have to enter your ZIP code to find plans in your area. After choosing a plan, its necessary to fill out an enrollment form and pay the required premium to receive coverage under Medicare Part C.

LeRon Moore has guided Medicare beneficiaries and their families as a Medicare professional since 2007. First as a Medicare provider enrollment specialist and now a Medicare account executive, Moore works directly with Medicare beneficiaries to ensure they understand Medicare and Medicare Advantage Plans.

Moore holds a bachelors degree from Southern New Hampshire University and is A+ Certified with a Medical Records Clerk Certification and Medical Terminology Certification from Midlands Technical College.

You May Like: What Does Plan N Medicare Supplement Cover

What Does Medicare Part C Cover For Inpatient Care

Medicare Part C generally provides the same inpatient benefits as Medicare Part A. These include:

- Inpatient hospital care if you have a doctors order and the hospital is in your plans network. Depending on your plans rules about how you obtain inpatient benefits, you may need a referral and prior authorization. Hospital care may be for acute illness or injury, rehabilitation, long-term care, or mental health.

- Cost-sharing is structured differently with a Medicare Advantage Plan. Original Medicare Part A charges a deductible for each benefit period. Medicare Advantage Plans typically charge a copay for the first several days of an inpatient stay. If you stay longer, your copay is $0. A transfer from one type of inpatient facility to another is considered a new admission and initial copays apply.

- Skilled nursing facility care and rehabilitation services provided on a continuous, daily basis in an in-network skilled nursing facility . Services are paid for in accordance with Medicare guidelines.

When you receive services in an inpatient setting, your Medicare Advantage Plan covers medically necessary care in accordance with Medicare guidelines and your plans rules. These services typically include:

- A semi-private room

- Meals

- Physical, occupational, and speech therapy

- Medications

- Blood

Medicare Part B: Medical Services

Purchasing Medicare Part B affords you coverage for several types of medical services, including :

-

Alcohol misuse screenings and counseling: Covers up to four face-to-face counseling sessions each year.

-

Ambulance services: Includes ground ambulance transportation to a hospital or other healthcare facility.

-

Bariatric surgery: Pays for gastric bypass surgery, laparoscopic banding surgery or some other type of procedure related to morbid obesity.

-

Preventative services: Flu shots, glaucoma tests and screenings for HIV and Hepatitis B and C and other types of services that detect early signs of illness are covered.

-

Acupuncture: Covers up to 12 acupuncture visits for eligible chronic low back pain.

-

Chemotherapy: Covers chemotherapy appointments in a doctor’s office, freestanding clinic or hospital outpatient setting.

-

Chiropractic services: Covers treatment to your spine by a chiropractor.

-

Chronic care management: Covers treatment for chronic conditions . This can include a comprehensive care plan, medication and other support.

-

Colorectal cancer screening: Covers tests to identify precancerous growths and other early signs of cancer. Covered screening tests may include colonoscopies, fecal occult blood tests and flexible sigmoidoscopies.

-

Continuous Positive Airway Pressure devices: You may qualify for a three-month trial of CPAP therapy if you’ve been diagnosed with obstructive sleep apnea.

4 Parts Of Medicare – Compare Quotes

Recommended Reading: How To Avoid Medicare Part D Penalty

Is Medicare Part A Free

Typically, most people dont pay for Part A if they have paid Medicare taxes for a certain amount of time while working. However, if you dont qualify for premium-free Part A, it can be purchased for a monthly premium. This amount may vary each year and is based on how long you or your spouse worked and paid Medicare taxes.

Does Medicare Part C Cover Prescription Drugs

According to the Kaiser Family Foundation, 89% of Medicare Advantage Plans include prescription drug coverage in 2022. Most of these plans are Health Maintenance Organizations or Preferred Provider Organizations . In fact, if you join an HMO or PPO, you will not be able to purchase a standalone Medicare Part D prescription drug plan .

Part C plans with prescription drug coverage must follow Medicares rules but may have different formularies and preferred pharmacies. Your out-of-pocket costs for drugs do not apply toward your maximum out-of-pocket limit.

Don’t Miss: How Many Parts Does Medicare Have

Medicare Part B: Doctors And Tests

Medicare Part B covers a long list of medical services including doctor’s visits, medical equipment, outpatient care, outpatient procedures, purchase of blood, mammograms, cardiac rehabilitation, and cancer treatment.

You’re not required to enroll in Part B if you have “” from another source, such as an employer or spouse’s employer. If you don’t enroll and you don’t have creditable coverage from another source, you may have to pay a penalty if you enroll later.

You pay a monthly premium for Part B. In 2022, the standard cost is $170.10, up from $148.50 in 2021. If you’re on Social Security, this may be deducted from your monthly payment.

The annual deductible for Part B is $233 in 2022. Once you meet the deductible, you pay 20% of the Medicare-approved cost of the service, provided your healthcare provider accepts Medicare assignment. But beware: There is no cap on your 20% out-of-pocket expense.

For example, if your medical bills for a certain year were $100,000, you could be responsible for up to $20,000 of those charges, plus the charges incurred under Part A and D umbrellas. There is no lifetime maximum.

Kathryn B. Hauer, MBA, CFP®, EA, a financial advisor with Wilson David Investment Advisors in Aiken, S.C., and author of Financial Advice for Blue Collar America, explains:

On the other hand, you pay nothing for most preventive services, such as diabetes screenings and flu shots, if you receive those services from a provider who accepts Medicare assignment.

Why Do I Need Medicare Part A

If you have not needed hospital or inpatient coverage in the past, you might wonder why you need Medicare Part A. Without proper coverage, hospital stays can be costly. The cost of services and amenities quickly adds up without coverage.

Get A Free Quote

Find the most affordable Medicare Plan in your area

Predicting the future is not possible, so knowing when you will need inpatient coverage is not feasible. If you enroll in Medicare Part A coverage and need hospital and inpatient services in the future, Medicare Part A will provide coverage. Under Medicare Part A, your hospital meals, some hospital rooms, lab tests, x-rays, and more are covered. Additionally, because Medicare Part A coverage does not have a premium for most, it only makes sense to enroll. You have paid into the coverage your entire working life, so it is important to utilize benefits once you qualify.

You May Like: Does Medicare Pay For Penile Pumps

Medicare Part D: Prescription Drugs

Medicare Part D pays for prescription drugs, including generic and brand-name drugs. Part D is completely optional and can be purchased at an additional cost to supplement Original Medicare plans. Medicare Advantage plans may have Part D coverage already bundled into the plan, but not always. You should confirm with your MA plan provider if you require prescription drug coverage. You cannot buy Part D and Part C together.

There is no fixed premium for Part D coverage and the cost will vary by the individual. Our sample in Orange County, California showed that the Part D premium can range from $7.50 to $160.20 in 2022.

Faq: Does Medicare Cover Nursing Homes

This is a common question and one that can be confusing to find a clear answer for.

As a rule, short-term stays in skilled nursing facilities are covered under Part A, but long-term stays arent. The difference is medical necessity.

Medicare only covers stays in skilled nursing facilities under set conditions, including:

- The stay needs to follow a 3-day inpatient hospital stay.

- A doctor needs to order the care youll receive in the skilled nursing facility.

- You must require care such as nursing, physical therapy, or other skilled healthcare services.

Medicare will only pay for this care while its still considered medically necessary for a maximum of 100 days per benefit period.

This is different from a long-term move into a nursing home, assisted living facility, or any other form of what Medicare calls custodial care. Medicare never pays for this type of care.

Don’t Miss: Are You Automatically Enrolled In Medicare At 65

Medicare A B C And D Costs And Coverage

If youre diving into Medicare for the first time, you may be surprised to find that its not one type of plan, but four. Each part of Medicare covers different medical services and has different costs.

Below youll find a quick guide that breaks down each piece of Medicare and the essential facts you need to know.

What Is Medicare Part B Medical Insurance

Medicare Part B provides outpatient/medical coverage. The list below provides a summary of Part B-covered services and coverage rules:

This list includes commonly covered services and items, but it is not a complete list. Keep in mind that Medicare does not usually pay the full cost of your care, and you will likely be responsible for some portion of the cost-sharing for Medicare-covered services.

The 2022 Part-B premium is $170.10 per month

Also Check: Is Medicare Automatically Deducted From Social Security