Can You Switch Yes But Theres A Catch

Its logical to consider enjoying the cost savings of a Medicare Advantage plan while youre relatively healthy, and then switching back to regular Medicare if you develop a condition you want to be treated at an out-of-town facility. In fact, switching between the two forms of Medicare is an option for everyone during the open enrollment period. This Annual Election Period runs from October 15 to December 7 each year.

Heres the catch. If you switch back to regular Medicare , you may not be able to sign up for a Medigap insurance policy. When you first sign up for Medicare Part A and Part B, Medigap insurance companies are generally obligated to sell you a policy, regardless of your medical condition. But in subsequent years they may have the right to charge you extra due to your age and preexisting conditions, or not to sell you a policy at all if you have serious medical problems.

Some states have enacted laws to address this. In New York and Connecticut, for example, Medigap insurance plans are guaranteed-issue year-round, while California, Massachusetts, Maine, Missouri, and Oregon have all set aside annual periods in which switching is allowed. If you live in a state that doesn’t have this protection, planning to switch between the systems depending on your health condition is a risky business.

Medicare Supplement Plan N Explained

Medicare Supplement Plan N works with Original Medicare to cover the cost gaps. Also known as Medigap Plan N, this plan covers all of the major gaps that traditional MedicareOriginal Medicare is private fee-for-service health insurance for people on Medicare. It has two parts. Part A is hospital coverage. Part B is medical coverage. does not cover, but costs less than more comprehensive plans because you share some of the costs when you see your doctor. This is why the plan is gaining popularity.

To best understand Plan N, and all of its benefits, you first need to get a complete picture of the gaps in Original Medicare. Although Medicare helps cover all of your major medical expenses, it only pays about 80% of the total cost. Without a Medigap insurance policy, you are left to pay the remainder out-of-pocket, including:

What Medigap Plan N Does Not Cover

Plan N covers everything that Part F and G cover except for: Part B deductible, Part B excess charges, and co-payments of $20 per doctor visit and $50 per emergency room visit. Doctors rarely charge excess charges, and you can ask your primary physician if they charge or not. Aside from the Part B deductible and co-pays, Plan N can potentially save you up to 25% on your monthly premiums.

Also Check: Does Medicare Cover Iovera Treatment

How Much Is The Copays For Medicare Plan N

In exchange for lower monthly premiums, youre responsible for a small copay of $50 when visiting the emergency room and a $20 copay at the doctors office. Yet, if you visit an Urgent Care center, there is NO copay.

Thus, if you cant get an appointment with your primary care physician, instead of going to the emergency room over something minor, you can go to urgent care and avoid copays. Remember that these copays will NOT count towards the Part B deductible.

Medicare Supplement Plan N What It Covers

Medicare Plan N is one of the most comprehensive plans available and is a great fit for Medicare enrollees who prefer to pay as little out-of-pocket as possible.

Medicare Supplement Plan N covers the following:

- Covers Part A hospital coinsurance and hospital costs for up to 365 days after your Original Medicare benefits are exhausted.

- Covers the Part A hospice care copayment or coinsurance charges.

- Plan N pays the annual Original Medicare Part A deductible

- Covers the Part B coinsurance charges (excluding doctor office visits and ER visits.

- Pays the coinsurance costs for Part B preventive care.

- Covers the cost of the first three pints of blood used in a medical procedure.

- Covers the coinsurance charges for Skilled Nursing Facilities

Don’t Miss: What Is A Medicare Wellness Visit

Medicare Supplement Plan N In 2022

Since the introduction of Medigap Plan N, enrollment increases each year. This popularity is not surprising, because the policy offers a decent amount of coverage at a reasonable price.

Plan N offers extra coverage to supplement your Medicare benefits without breaking the bank. The small copays this plan involves keeping the monthly premium lower.

You may have heard this plan referred to as Part N. Part N, Medigap Plan N, and Medicare Plan N are all the same thing, but the correct term is Plan N. Remember that Parts refer to Original Medicare, and Plans refer to Medigap.

What Is The Rate Increase History For Cigna Medicare Supplement N

It is likely that insurance rate increases will be related to age unless the company uses the Community model for their rates. In general, insurance rate increases are approximately 3% -5%.

Inflation, rising healthcare costs, and other economic factors can drive rate increases.

Among the factors that determine a companys rate increase are the number of claims it receives in a year and the amount of premiums it receives from clients. With Medigap N, Cigna has a history of rate increases lower than most other plans. Historically Plan N has lower rate increases than Plan G and Plan F.

Also Check: What Is My Medicare Number Provider

What Does Medicare Supplement Plan N Not Cover

Medigap Plan N does not cover the Medicare Part B deductible or excess charges, which are the difference in cost between what a health provider charges for a medical service and the Medicare-approved amount. Medicare Plan N will not cover the copay or coinsurance for doctors office and emergency room visits.

How Much Does Medigap Plan N Cost In 2022

The average cost of Plan N is around $120-$180 per month. However, in some states, it can be as much as $200 and in others, it can be as low as $80.

Your premium rates depend on your personal information as well as the plan letter you choose. Factors such as your state of residence, gender, age, and tobacco use affect your premium rates.

Recommended Reading: How To Pick The Best Medicare Plan

What Plan N Does Not Cover

Although Plan N is very comprehensive in terms of filling gaps found in Original Medicare Part A and Part B, some gaps are excluded:

- Plan N will not cover your Medicare Part B Deductible of $203 for 2021.

- Does not cover Part B excess charges

- Does not pay the copayment of up to $20 charges for some office visits

- Does not pay the copayment of up to $50 for ER visits

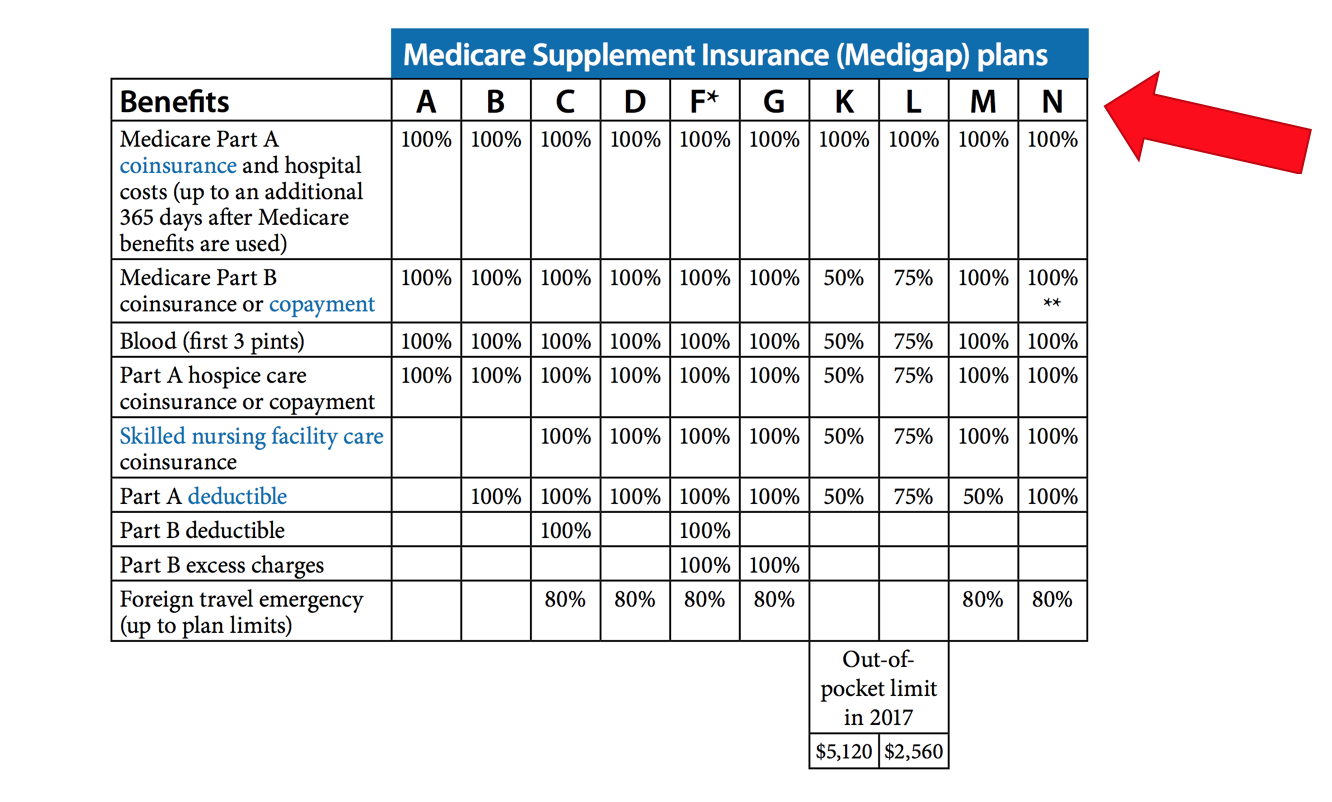

Here is a reference chart for Medicare Supplement Plan N:

How Does Medicare Supplement Plan N Work

Medicare Supplement plans, which can also be called Medigap plans, enhance Original Medicare benefits that have certain limitations. Although Original Medicare helps cover many medical expenses, there are out-of-pocket costs that can add up. To protect themselves from potentially stressful out-of-pocket expenses, many Medicare recipients choose to buy supplemental insurance, such as a Medigap plan.

Understanding Medicare Supplement Plans

Original Medicare provides coverage in two parts. The first, Part A, is hospital insurance and the second, Part B, is medical insurance. Most people do not pay a monthly premium to receive Part A coverage, but they are obligated to pay the Part A deductible and any copayments or coinsurance charges that arise during care. Part B does charge a monthly premium in addition to a deductible, copayments and coinsurances.

Some Medicare recipients may want to enhance the benefits provided by Original Medicare, or reduce their potential out-of-pocket expenses. Medicare Supplement Plans can help reduce a recipients cost-sharing obligations when it comes to certain services, deductibles, copays and coinsurance charges. In order to help those eligible for Medicare choose a plan that meets their needs and their budget, private insurers can offer a range of Medicare Supplement plans with varying degrees of coverage.

Medicare Supplement Plan N Benefits

Related articles:

Don’t Miss: Do I Need Medicare Part C

A Brief Review Of Medicare Supplement Plans

When you turn 65, youre eligible to enroll in Medicare, a federally facilitated health insurance program. Original Medicare will cover some, but not all, of your medical expenses. The portion not covered is often referred to as a gap. Medicare Supplement plans, also called Medigap plans, are policies sold by private insurance companies to help pay for the expenses Medicare does not cover.

A Quick Overview Of Medicare Supplement Plans

When a senior turns 65-years-old, he or she becomes eligible to enroll in Original Medicare, and start getting affordable health insurance that most have paid into over their lifetime.

Original Medicare Part A and Part B will cover the majority of your healthcare costs but there are some gaps in the coverage that you will need to either pay out-of-pocket or transfer to an insurance company that sells Medicare Supplement insurance.

These Medicare Supplement plans are sold by private insurance companies that have been approved by the folks at Medicare and the plans are standardized, meaning every company must offer the same coverage in each of the plans they offer.

The difference between the various companies is the pricing of the plans and any additional services they offer.

Currently, there are ten different plans available to purchase, Plan A,Plan B,Plan C, Plan D, Plan F , Plan G, Plan K,Plan L, Plan M, and Plan N. Plan F and Plan G are also available as a high deductible plan.

Don’t Miss: How To Find Out If I Have Medicare

What To Know Before Enrolling In Medicare Supplement Plan N

If you are interested in enrolling in Medicare Supplement Plan N, or any Medigap plan, there are five things you should know beforehand:

47333-HM-1121

How Does Plan N Compare To Other Popular Medigap Plans

Beyond the Part A hospitalization coverage that all Medigap policies provide, the kind and amount of additional coverage depend on which plan you choose.

According to Medicare.gov, Plan N is one of five Medigap plans that cover 80% of the foreign travel exchange. It’s one of six plans that cover 100% of skilled nursing care coinsurance, one of six covering 100% of the Medicare Part A deductible and one of eight that pays 100% of hospice care co-insurance. Plan N requires more cost sharing than some of the other medicare supplement plans with its co-payments for office and emergency room visits. Like most of the other Medigap plans, Plan N does not set an annual limit for your out-of-pocket expenses.

With 10% of all Medigap policyholders in 2019, according to the American’s Health Insurance Plans , Plan N was the third most popular option, behind Plan F and Plan G . For years, Plan F has been the favorite Medigap policy because it pays the maximum allowed for each of the nine benefits Medicare supplement insurance can cover. However, as of January 1, 2020, Plan F is no longer available to buyers of new Medigap policies. Those who already own one Plan F can keep it.

Apart from not paying for your Part B deductible and excess charges and charging a co-pay for some doctor and emergency room visits, Medigap Plan N provides the same coverage as Plan F.

Recommended Reading: What Is The Advantage Of Medicare Advantage

What Does Plan N Not Cover

Medicare supplement Plan N does not cover the following costs:

- Medicare Part B deductible. This is the amount you must pay out of pocket for outpatient medical services before your Medicare benefits kick in.

- Part B excess charge. Health care providers opting not to participate in Medicare can levy excess charges of up to 15% above Medicare’s allowable amounts for Part B medical services.

As with all other Medigap Policies, Plan N also doesn’t pay for vision, dental, prescription drugs or long-term care.

A Guide To What Medicare Plans Offer Vision Coverage

Vision coverage through original Medicare is limited.

Routine eye exams for glasses or contact lenses are not covered.

Medicare Part A does cover medical emergencies related to vision if you are admitted to the hospital. An example is if you have an eye injury and visit the emergency room.

Medicare Part B will cover preventive treatments and screenings related to diseases affecting the eye. This includes an annual glaucoma test for at-risk individuals. At-risk individuals are those with diabetes, African-Americans and Hispanics age 65 and older, or if you have a family history of glaucoma.

Annual exams that test for diabetic retinopathy are covered under Part B. Other tests such as screenings for macular degeneration and cataract surgery are covered. One pair of post-surgery eyeglasses and contacts will be covered. The supplier must be enrolled in Medicare for the cost to be covered. For each of these services, you are still responsible for the out-of-pocket cost, which is 20% of the Medicare-approved amount along with the Part B deductible.

Medicare Part D offers prescription drug coverage. If you are signed up for Part D, some products such as eye drops or other vision medication may be covered if prescribed by a doctor.

Medicare Supplement plans do not cover vision outside of what is given by original Medicare. Whether you purchase Plan N or one of the more comprehensive plans, there is limited coverage.

Also Check: Can I Use Medicare For Dental

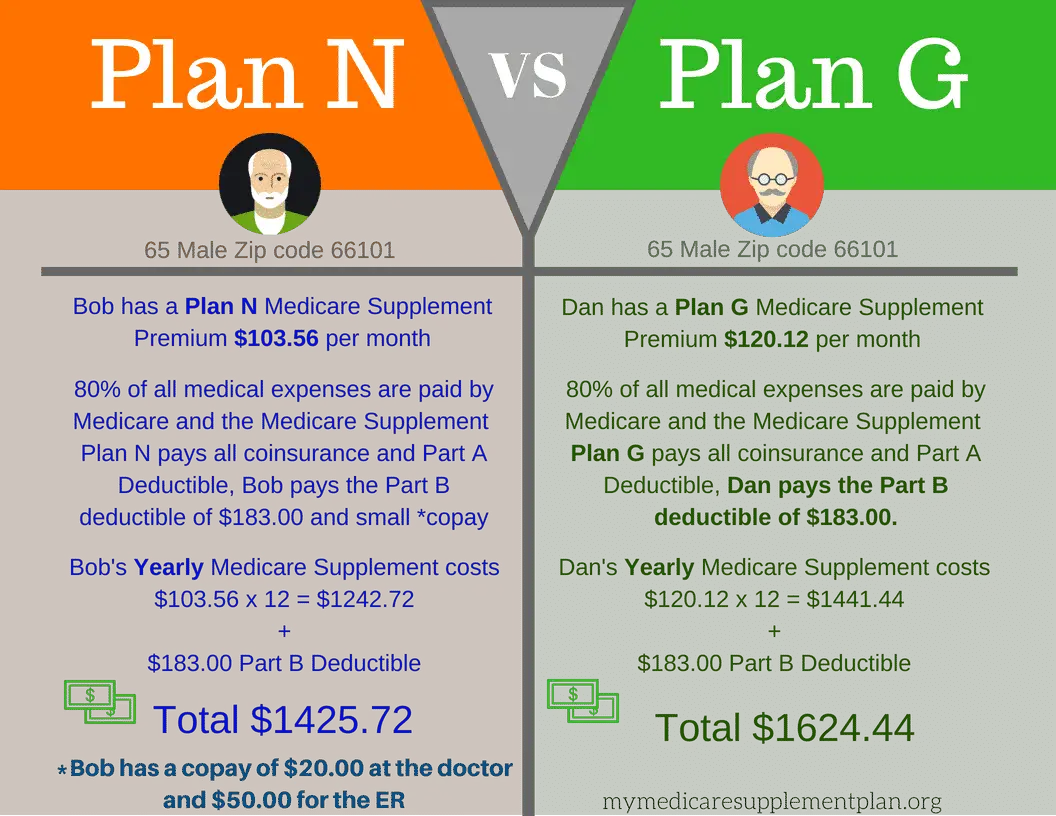

Medigap Plan N Vs Plan G

Plan N and Plan G are frequently compared to one another. We recommend Plan N if you want lower monthly costs and are willing to have some expenses for medical care like doctor appointments. However, Plan G is a better option if you’re willing to pay more each month for a plan that provides the most comprehensive coverage for new enrollees. Note that neither plan covers the Medicare Part B deductible.

| Coverage differences |

|---|

| Medicare Part B excess charges |

The cost structures may determine which plan is better for you.

The standard Medicare Supplement Plan G has higher monthly premiums than Plan N, making Plan N a budget-friendly choice. Plan G, however, does not impose copays for physician office visits or trips to the ER that do not result in hospitalization, a major difference from Plan N, thus appealing to beneficiaries who do not like shelling out copays for these services. Conversely, other beneficiaries may not mind paying more in copays, especially if they do not make frequent trips to physician offices or ERs.

With Plan N, low-end users of health services may come out ahead. High-end users of health care services will have a different experience.

Similarly, if that same beneficiary visits the ER and the visit does not result in a hospitalization, the beneficiary will pay a $50 copay, resulting in the same total cost that month for Plan N as they would pay for Plan G.

Our Review Of Medicare Supplement Plan N

Medigap Plan N has seen a rising enrollment rate in recent years, and for good reason. Plan N offers suitable coverage and will typically be found at a more affordable price than other Medigap plans.

Plan N does not provide coverage of the Medicare Part B deductible. However, the Part B deductible is only $203 per year, which is a relatively small requirement when compared to other Medicare cost requirements. And only beneficiaries who became eligible for Medicare before 2020 can get coverage of the Part B deductible, anyway.

Plan N also does not provide coverage of Medicare Part B excess charges. However, excess charges can be easily avoided simply by confirming whether or not a health care provider accepts Medicare assignment prior to receiving service.

Members of Plan N may encounter copayments for their Medicare Part B coverage, but only in limited circumstances, and the copayment requirements are quite low.

All things considered, Medicare Supplement Plan N is a smart choice for anyone looking for premium coverage without a premium price.

Also Check: Is Imvexxy Covered By Medicare

How Much Does Medicare Supplement Plan N Cost

The premiums associated with Medicare Supplement plans differ by location and insurance company. As a general reference, in 2021, a non-smoking 65-year-old woman living in Floridas 32162 ZIP code would pay between $124 and $182 for Medicare Supplement Plan N monthly premiums.1

But how do companies set these prices? They use one of three price rating systems to set premiums:

There can be a wide variance in cost. Differences may exist based on whether or not the insurance company selling the policy offers discounts or uses medical underwriting.

Pro Tip: When shopping for a Medicare Supplement policy, always compare apples to apples. You want to be make certain you are comparing a Medigap Plan N from one company to a Medicare Plan N from another company. You dont want to compare Plan N at one company to Plan B at another because you wont get a clear comparison between the prices and benefits.

Want an easy way to shop for Medicare Plan N prices? Start comparing Medigap plans with HealthMarkets!