What Is The Part A Late Payment Penalty

If you have to pay Medicare Part A premiums but dont enroll at age 65, your monthly premiums may cost 10% more. And you may be required to pay those higher premiums for twice the number of years you didnt sign up.5

A Word of Advice

While calculating the costs of Medicare can feel overwhelming, figuring out the cost of each part can help you devise a good estimate of your total Medicare costs.

What Else Should I Consider

Original Medicare is most common and has remained popular over the years. There are, however, other options that you may want to consider. For example:

Medicare Advantage: Also called Medicare Advantage Plan Medicare Advantage is health insurance for Americans aged 65 and older that blends Medicare benefits with private health insurance. This typically includes a bundle of Original Medicare and Medicare Prescription Drug Plan ., this is an alternative to Original Medicare that provides additional benefits like dental, vision and prescription drug coverage. These plans are regulated by Medicare but provided through private insurance companies. Its also important to know that Medicare Advantage also has its own Annual Enrollment Period .

Medigap:Medicare Supplement Insurance Medicare Supplement Insurance is designed to provide coverage that Original Medicare does not. Medigap policies are purchased in addition to Original Medicare and have their own monthly premiums you’ll need to pay. fills the holes in your policy that arent covered by Original Medicare. These are purchased in addition to your Medicare coverage and are offered by private insurance companies.

Medicare Advantage Plans Have An Out

When you enroll in a Medicare Advantage plan, you can ask about your specific policys out-of-pocket spending limit.

Original Medicare does not include an out-of-pocket spending limit. While its not common, you could potentially be responsible for thousands of dollars in out-of-pocket costs if you only have Original Medicare coverage and require extensive medical care throughout the year.

Don’t Miss: Who Pays For Part A Medicare

Original Medicare Only Pays 80%

Many people about to retire are shocked to learn that Original MedicareOriginal Medicare is private fee-for-service health insurance for people on Medicare. It has two parts. Part A is hospital coverage. Part B is medical coverage…. only pays about 80% of Medicare-covered costs and that theres no out-of-pocket maximum on the costs that beneficiaries pay . Learning this is when most people become interested in supplemental Medicare insurance.

A Medicare Supplement plan is additional insurance that helps pay some of the deductiblesA deductible is an amount a beneficiary must pay for their health care expenses before the health insurance policy begins to pay its share…., copaymentsA copayment, also known as a copay, is a set dollar amount you are required to pay for a medical service…., and coinsuranceCoinsurance is a percentage of the total you are required to pay for a medical service. … thats baked into Original Medicare. Some supplements have out-of-pocket limits, meaning they will pay all your covered medical expenses once youve paid a certain amount, but most plans cover one or more of the gaps straight across the board.

With Medicare supplements, the cost is a function of the gaps you want to have covered. The more expansive the coverage, the more the plan will cost. For this reason, its important that you know what costs Medicare expects you to pay, and which ones you are most likely to incur, so you can choose the right amount of coverage.

Medicare Part B: Medical Coverage

Medicare Part B covers outpatient services, doctors fees, preventative services, and the cost of using medical equipment. Some people, such as those who are enrolled for Social Security, are automatically enrolled in Part B. Others have to enroll online.

Premiums

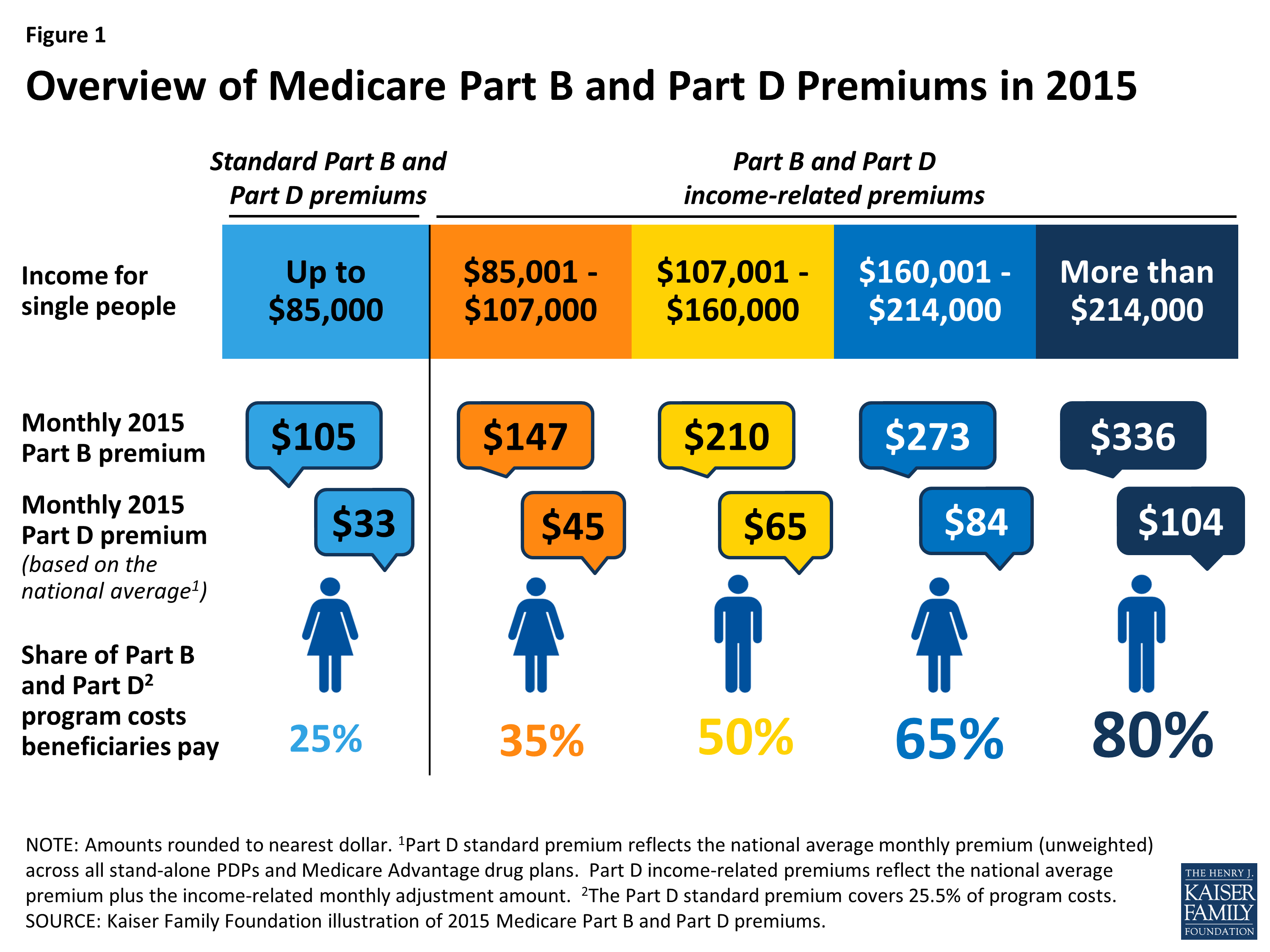

Individuals who earn less than $88,000 per year or couples who file jointly and earn less than $176,000 per year pay the standard premium of $148.50. Those with higher incomes are tiered into different premium levels by their income.

Deductible

For 2021, the standard deductible for Part B costs $203. If you receive benefits through Social Security, the Railroad Retirement Board, or the Office of Personnel Management, your premium is automatically deducted from your benefits.

Copays and Coinsurance

Medicare works with doctors offices to set standardized prices that they will pay for services. After youve paid the deductible, Medicare will cover 80% of these medical expenses, while youll be expected to cover the remaining 20% of the approved amount.

Read Also: Does Medicare Cover Ice Therapy Machines

Do Medicare Supplements Have Deductibles

The term deductible is probably familiar to you in terms of your car insurance. Its the amount you pay before your insurance begins to pay. Some Medigap plans pay the Medicare Part A hospital deductible but make you pay the Medicare Part B medical deductible. Other plans dont cover either deductible.

There are two plans that have substantially lower monthly premiums than other plans. However, these low premiums come with a high deductible. With these plans, you pay a significant amount out of pocket before the Medigap plan pays anything. If you are healthy and have saved for the day when you may need to pay the deductible, one of these plans may work for you, but be sure to discuss it with your insurance agent first.

The plans are:

- High Deductible Medicare Plan FMedicare Supplement Plan F is the most comprehensive Medicare supplement plan available. This plan covers all Original Medicare deductibles, coinsurance, and copayments, leaving you with no out-of-pocket costs on all Medicare-approved services….

- High Deductible Medicare Plan G

Premium Surcharge Is Based On 2020 Tax Return You Can Appeal It If Your Income Has Changed

The government determines whether you have to pay an income-related premium surcharge based on your income tax return from two years ago, since that is the most recent tax return they have on file at the start of the plan year. 2020 tax returns were filed in 2021, so those were the most current returns available when income-related premium adjustments are determined for 2022.

But if a life-change event has subsequently reduced your income, theres an appeals process you can use. In the appeal, you can request that the income-related premium adjustment be changed or eliminated without having to wait for it to reflect on a future tax return.

Read Also: Does Humana Medicare Cover Incontinence Supplies

How Much Does Covid Testing Cost

You pay nothing for a COVID test in a Medicare-approved facility. Medicare Part B normally covers 80 percent of costs for approved services. However, this is not the case with COVID testing services. You do not have to worry about any deductiblesA deductible is an amount a beneficiary must pay for their health care expenses before the health insurance policy begins to pay its share…., copaymentsA copayment, also known as a copay, is a set dollar amount you are required to pay for a medical service…., or coinsurances.Medicare.gov, Coronavirus disease 2019 tests, Accessed October 29, 2021

How Much Does Medicare Cost At Age 65

The United States national health insurance program known as Medicare has been providing people with health care insurance coverage since 1966. Today, Medicare provides this coverage for over 64 million beneficiaries, most of whom are 65 years and older.

The U.S. government has set the age of eligibility for Original Medicare Parts A and B at 65. And, while most people enroll at this age, others continue working and choose to stay on their employers insurance plan until the time they retire.

If your 65th birthday is coming up and you are planning to enroll for your Medicare benefits, you may be wondering what your costs will be. Here is a look at what you pay for Medicare insurance at the age of 65.

What Medicare costs do you have at age 65?The four parts of Medicare have their own premiums, deductibles, copays, and/or coinsurance costs. Here is a look at each part separately to see what your costs may be at age 65.

Part A

If you are not receiving Social Security benefits three months before your 65th birthday, you must sign up for Part A during your initial enrollment period which lasts for a period of seven months based on your 65th birth month.

There is no monthly premium for Part A if you meet the following requirements for premium-free Part A:

You are currently receiving retirement benefits from either the SSA or the RRB.

You have not applied for SS or RRB benefits yet, but you are eligible for them.

Days 1 60: $0 coinsurance per benefit period

Part B

Also Check: What Is Blue Cross Blue Shield Medicare Advantage

Find A $0 Premium Medicare Advantage Plan Today

1 MedicareAdvantage.com’s The Best States for Medicare report.

2 10-minute claim is based solely on the time to complete the e-application if you have your Medicare card and other pertinent information available when you apply. The time to shop for plans, compare rates, and estimate drug costs is not factored into the claim. Application time could be longer. Actual time to enroll will depend on the consumer and their plan comparison needs.

3 TZ Insurance Solutions LLC internal sales data, 2019. This data is based on the Medicare Supplement Insurance policies TZ Insurance Solutions LLC has sold. It is not a comprehensive national average of all available Medicare Supplement Insurance plan premiums.

About the author

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options.

His work has been featured in outlets such as Vox, MSN, and The Washington Post, and he is a frequent contributor to health care and finance blogs.

Christian is a graduate of Shippensburg University with a bachelors degree in journalism. He currently lives in Raleigh, NC.

Where you’ve seen coverage of Christian’s research and reports:

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Compare Medigap Plan Costs In Your Area

Bear in mind that the premium averages listed above are just that averages. There may be plans available in your area that cost less than the average listed above for your age.

Other factors such as gender, smoking status, health and where you live can also affect Medigap plan rates.

A licensed insurance agent can help you compare Medicare Supplement Insurance plan costs in your area so that you can find a plan that fits your coverage needs as well as your budget.

Compare Medigap plan costs in your area.

You May Like: When Can Medicare Plans Be Changed

Medicare If You’re Married

You and your spouse’s Medicare coverage might not start at the same time. Medicare is an individual plan . However, you may be eligible for Medicare based on your spouses work history — even if you are not eligible on your own. You and your spouse’s Medicare coverage might not start at the same time. Since you each must enroll in Medicare separately, one of you may be able to sign up before the other one, depending on your age.

Your premiums may change because of your total income. There are no family plans or special rates for couples in Medicare. You will each pay the same premium amount that individuals pay. Here’s what to know about costs:

Medicare Advantage Special Needs Plans May Have Lower Costs

A Medicare Special Needs Plan is a type of Medicare Advantage plan that is designed specifically for someone with a particular disease or financial circumstance.

Many Medicare SNPs cover most of the qualified health care costs for beneficiaries. All SNPs must include prescription drug coverage.

Some Medicare SNPs are designed for people who are dual-eligible, meaning they are eligible for both Medicare and Medicaid. These plans are commonly called Dual-Eligible Special Needs Plans .

Medicare Advantage Special Needs Plans can also cater more specifically to the needs of people with specific medical conditions, such as:

- Dependence issues with alcohol or other substances

- Autoimmune disorders

- Chronic lung disorders

- Strokes

Some SNPs can also be available to people who live in a long-term care facility such as a nursing home.

Read Also: How Many Days Does Medicare Pay For Nursing Home

Find Cheap Medicare Plans In Your Area

For all Medicare plans, costs will vary depending on what plans you decide to purchase, the company you purchase your plan from, your income and sometimes your age. For this reason, you should carefully balance your coverage needs and the costs of the plans when choosing the right mix of Medicare policies.

How Does Age Affect Medicare Supplement Insurance Premiums

There are three different age-related pricing models that Medicare Supplement Insurance companies use to determine their Medigap plan rates in 2021-2022.

Each type of cost model can affect the average price of a given Medigap plan.

-

Community-rated Medigap plansWith community-rated Medigap plans, every member of the plan pays the same rate, regardless of age.

For example, an 82-year-old who enrolls in a community-rated Plan G will pay the same Medigap premiums as a 68-year-old beneficiary who has the same Plan G in the same market.

-

Issue-age-rated Medigap plansWith issue-age-rated Medigap plans, premiums are based on your age at the time you enrolled in the plan.

You will typically pay less for an issue-age-rated plan if you enroll in the plan when you’re younger. Your premiums also won’t increase based on your age.

-

Attained-age-rate Medigap plansAttained-age-rated Medigap plans set their premiums based on your current age. As you age, your Medigap plan premiums will gradually increase each year.

Medigap premiums can increase over time due to inflation and other factors, regardless of the pricing model your insurance company uses.

Also Check: Is There A Copay With Medicare Part D

How Much Does Supplemental Insurance Cost

One of the most frequent questions we get is, What is the average cost of supplemental health insurance for seniors?

Medigap, also known as Medicare supplement insurance, is a group of standardized plans that help cover the gaps in Original Medicare health insurance. And, unfortunately, stating an average cost of Medicare supplemental insurance wouldnt do much good. Plans average anywhere from $50 to $300 or more per month, depending on where you live and the amount of coverage you need. So, if your question is, how much is Medigap per month?, you will need to get a quote.

Before you ask for rates, lets explore questions about the price of Medicare supplemental insurance in a couple of different ways. Like, how much coverage can I get that I can afford? And, how can I save money on a Medigap plan and still be covered for my major medical costs? And, what is the best Medigap plan for me?

Those are the questions well help answer and offer additional resources.

Medicare Supplement Insurance Plans Can Help Cover Some Of Your Part B Out

A Medicare Supplement Insurance plan could help cover certain Part B out-of-pocket costs.

Medicare Supplement Insurance, or Medigap, is a type of private insurance that is used along with Original Medicare to provide coverage for some of Original Medicare’s out-of-pocket costs.

Medicare Supplement Insurance can provide partial or full coverage of your Part B coinsurance or copayments in 2019. Certain Medigap plans can also help cover the Part B deductible and Part B excess charges.

The chart below shows which benefits are covered by the 10 types of standardized Medigap plans that are offered in most states.

A licensed insurance agent can help you compare Medicare Supplement Insurance plans in your area. You may be able to find a plan that covers some of your Medicare Part B out-of-pocket costs.

Also Check: Does Medicare Pay For Custom Foot Orthotics

Medicare Part Bmedical Coverage

What it helps cover:

What it costs:

- The Part B monthly premium in 2021 is $148.50

- If you don’t enroll in Medicare Part B as soon as you are eligible, you could be assessed a late enrollment penalty when you do enroll.

- The penalty could be as high as a 10% increase in your premium for each 12-month period that you were eligible but not enrolled.

Other Part B costs:

- There is a $203 annual deductible for Medicare Part B in 20201. After the deductible, youll pay a 20% copay for most covered doctor services while hospitalized, for durable medical equipment and for outpatient therapy.

- There is a 20% copay of the Medicare-approved amount for doctor visits to diagnose a mental health condition after the deductible.

- If you receive these services at a hospital outpatient department or clinic, additional copays or coinsurance amounts may apply.

Medigap Plans Dont Include Prescription Drug Coverage

Theres a simple rule to follow with Medicare supplement insurance plans. If Original Medicare doesnt cover it, your supplemental insurance cant cover it either. One of the strengths of Original Medicare is that it covers your major medical, allowing you to choose additional coverage ala carte style. To get a prescription drug plan, you use the Medicare Part D plan option. You can purchase a Part DMedicare Part D plans are an option Medicare beneficiaries can use to get prescription drug coverage. Part D plans provide cost-sharing on covered medications in four different phases: deductible, initial coverage, coverage gap, and catastrophic. Each… plan during your initial enrollment periodThe Initial Enrollment Period is a seven-month period when new beneficiaries can enroll in Medicare without a penalty. Most people enroll in Medicare at age 65…. or the upcoming Medicare Open Enrollment PeriodDuring the Medicare Open Enrollment Period, Medicare Advantage and Part D plan members can change, switch, or drop a plan they chose during the Annual Election Period. OEP starts on January 1 and ends on… from October 15 through December 7 each year

Also Check: What Do You Need To Sign Up For Medicare

Medicare Part A Premiums

Medicare calculates Part A premium costs by how long you or your spouse have paid Medicare taxes.

Here is an explanation of monthly premiums for Plan A in 2021:

If you or your spouse paid Medicare taxes for ten years or more

$259/mo.

If you or your spouse paid Medicare taxes for more than 7.5 years but less than 10

If you paid Medicare taxes for fewer than 7.5 years