Verify The Providers Reputation

A companyâs reputation may help you choose between insurers with similarly priced plans.

- Financial strength: Working with a financially stable company ensures that it will be able to pay for services long into the future, even if costs rise substantially or a disaster requires the company to pay for care for hundreds or thousands of policyholders. AM Best, Moodyâs, Fitch, and Standard & Poorâs are independent agencies that rate insurance companiesâ financial stability. You can visit these agenciesâ websites to see how they rate the financial stability of a specific company. Although many insurance companies list ratings on their websites, you can see the most reliable and recent rating on the independent agenciesâ websites.

- Years in business: The amount of time a company has been in business can indicate that they have reliable business practices and good customer service. You may also wish to compare how long a company has offered Medicare supplement insurance.

- Recommendations: Ask friends and family members to tell you about their experiences with different insurance companies. Read online reviews to determine how the company deals with customers.

Best Cheap Medicare Supplement Plan: Plan K

If you are interested in the cheapest Medigap policy that still provides some coverage on top of Original Medicare, you may want to look into Plan K.

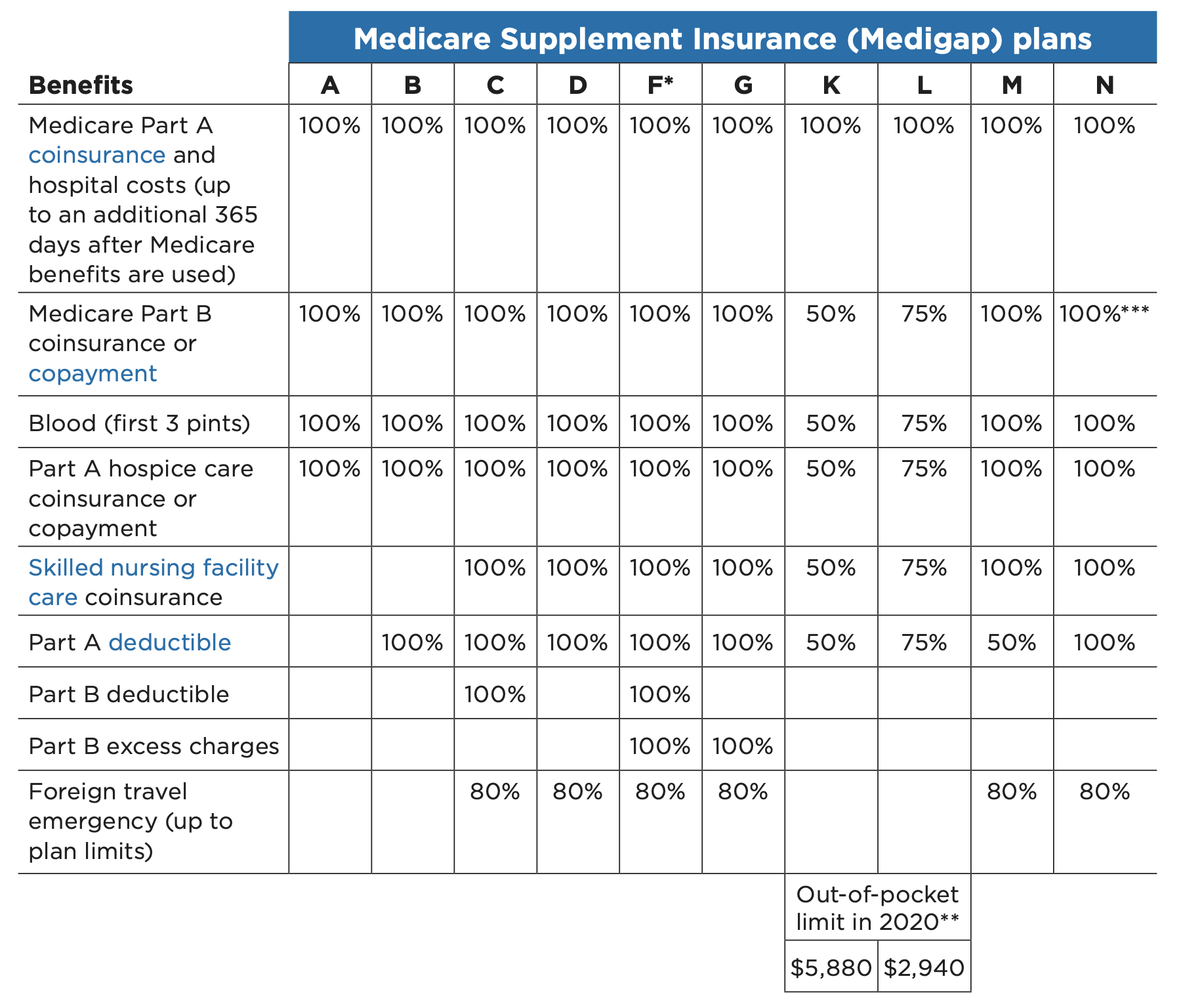

Plan K is significantly different from many other Medigap policies since it provides only 50% coverage for Medicare Part B coinsurance, blood, Part A hospice, skilled nursing and the Part A deductible. Many other Medigap plans, such as Plan G, provide full reimbursements for these types of health care.

This is crucial to consider if you need health insurance coverage for skilled nursing. In this case, if you were to get Plan K, only 50% of such costs would be covered.

On the other hand, your monthly premiums with Plan K will be much cheaper. Policyholders can expect to pay about $77 per month, making it the best Medicare Supplement plan for low-income seniors.

Standard Medicare Supplement Coverage

To make it easier for you to compare one Medicare Supplement policy to another, Indiana allows 8 standard plans to be sold. The plans are labeled with a letter, A through N. Plans H, I, and J are no longer offered, and Plans C and F are only available to people who were eligible for Medicare before January, 2020. There are high deductible versions of Plans F and G..

These 8 plans are standardized, which means that benefits will be the same no matter which company sells the policy to you. Plan A is the basic benefit package. Plan A from one company is the same as Plan A from another company. Since Medicare Supplement policies are standardized, you are free to shop for the company with the best price and customer service. To see what benefits are offered with each plan,.

Generally, Medicare Supplement policies pay most, if not all, Medicare copayment amounts, and policies may pay Medicare deductible amounts except for the Part B deductible. Although the benefits are the same for each standard plan, the premiums may vary greatly. Before purchasing a supplement policy, determine how the company calculates its premiums.

An insurance company can calculate premiums one of three ways.

- Issue Age: If you were 65 when you bought the policy, you will pay the same premium the company charges people who are 65 regardless of your age.

- Attained Age: The premium is based on your current age and will increase as you grow older.

- No Age Rating: Everyone pays the same premium regardless of age.

Also Check: Does Medicare Cover One Touch Test Strips

Best Medicare Supplement Insurance Companies In 2022

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here’s how we make money.

Medicare Supplement Insurance, or Medigap, covers gaps in Original Medicare coverage, such as certain out-of-pocket expenses like copays, coinsurance and deductibles.

Medigap plans are sold by private insurance companies, but the plans Medicare coverage is regulated by the government. So, for example, Medigap Plan G has the same Medicare benefits regardless of which insurance company you choose.

In most states, there are 10 standardized Medigap plan types. The insurance companies are responsible for which plan types they sell, what they charge and whether to include extra perks, as well as providing customer service. Each company has different strengths and weaknesses.

Blue Cross Blue Shield

BlueCross Blue Shield is one of the biggest names in insurance. They have a website specifically dedicated to Medicare Supplement Plans, so you don’t have to worry about sorting through health insurance information that doesn’t apply to you.

Information-filled, but confusing layout

If you’re looking for an online quote, you may have a hard time spotting where to start. The BCBS site for Medigap coverage is full of information you may or may not need: terms to know, enrollment periods, and so on. To get a quote, look on the right side of the page where it says Enter Zip Code and Find Coverage.

Finding the online quotes

From there, it’ll take you to another page that asks you to fill in your information to talk to a Medicare Health Benefit Advisor or to call them directly . However, if you look carefully, you’ll spot links that say Browse or Find a Plan that let you get an initial idea of pricing online before you reach out to BlueCross Blue Shield.

Help Me feature

On that page, you can either choose to View All Plans or select Help Me Find a Plan. If you already know which Medicare Supplement Plan interests you, choose the first option. If you need some guidance and are willing to answer a few questions, the second choice will walk you through which available plans are a good fit.

Simple process

Discounts available

Middle of the road premiums

Start your application online

BBB ratings vary by state

Highly regarded by the experts

Overall good choice

Also Check: Is Medicare Part B Necessary

Buyers Guide: How To Choose Medicare Supplement Insurance

Finding the right Medicare Supplement Insurance provider can be an overwhelming task. There are many different companies offering a wide selection of supplement plans, along with other additional policies. In this buyers guide, well walk you through a few simple steps that can help you determine if you need Medicare Supplement Insurance and help you find the company thats right for you.

Step 1: Determine your Eligibility and if Medicare Supplement Insurance is Right for You

To be eligible for a Medicare Supplement plan, youll need to have Original Medicare, which is Parts A and B. If you have Medicare Advantage you cannot purchase these plans unless you are switching to Original Medicare.

A supplemental insurance plan may be right for you if you wish to add additional coverage that can protect you from unexpected medical expenses in the future. While this means youll need to budget for an additional monthly premium, it also means expenses like copayments and deductibles will be covered. Since medical expenses can put a significant strain on your budget, especially if they arent planned for, this coverage can provide peace of mind over all of the gaps in Medicare coverage.

Step 2: Understand Your Needs

Once you know that Medicare Supplement Insurance is for you, your next step is to understand your coverage needs. This will depend on several factors, including your current health and financial situation.

Step 3: Consider Additional Services and Benefits

How Medicare Supplement Insurance Plans Work

When you purchase a Medicare Supplement Insurance plan, your Medigap supplement plan will serve as a secondary source of insurance. Medicare will be used first to pay for any Medicare-approved costs for health care supplies and services, then your Medigap policy will be charged.

In most cases, there is nothing additional you need to do to submit a claim to your Medigap supplement plan as most doctors and health care facilities will bill for you automatically.

Medigap policies are guaranteed renewable. That is, as long as you pay your premiums on time, your policy will remain in effect.

You May Like: Is There A Copay With Medicare Part D

Best For Perks: Humana

Why we chose it: Offers a variety of plan types, including its innovative Healthy Living plan, and discounts, including one for enrolling online.

-

Offers Healthy Living plan with extra perks

-

Offers household and online discounts

-

Available in all states and the District of Columbia

-

No high-deductible Plan G

-

Healthy Living plan can make premiums higher

Humana has been in operation since 1961 and has an AM Best rating of A- . It earned high marks from us thanks to its plan offerings. Specifically, Humana offers Plans A, B, C, F, high-deductible F, G, K, L, and N in many states. The only option we did not see offered was a high-deductible Plan G.

In addition to these Medigap plans, Humana offers a Healthy Living supplement to some plans. This offers extra services, much in the way Medicare Advantage does, including vision and dental services, such as 100% coverage for two dental exams and cleanings annually. The Healthy Living plan also offers fitness, hearing, and prescription discounts as well as a 24-hour nurse advice line.

Humana also offers a discount for enrolling online and a 5% household discount, as well, if another person in your household signs up for Humana. You can compare pricing and the plans themselves with the Add to Compare option, which allows you to view three plans side-by-side.

What Are Medigap Plans

Medigap plans are Medicare Supplement Insurance offered by Medicare-approved private insurance companies to help cover cost sharing requirements of Original Medicare Parts A and B.

While Medicare pays for a large percentage of the health care services and supplies you may need, you are still responsible for a portion of the costs in the form of deductibles, copays, and coinsurance. Medigap policies help with these costs and sometimes offer more coverage for excess charges and foreign travel health emergencies.

Medigap plans are standardized by Medicare and regulated by state laws and insurance commissioners. You pay a monthly premium for Medigap. Costs and availability of Medigap plans vary depending on several factors including your age and gender, the insurer, and your state of residence. Learn about Medigap in South Carolina so you can determine which plan best meets your needs.

- In 2019, there were over 280,000 Medicare Supplement enrollees in South Carolina.

- Plans F and G are the most popular and comprehensive Medigap plan types in South Carolina. Plan F is no longer available to people who are eligible for Medicare after December 31, 2019.

- Monthly premiums for Plan G for a 65 year old female who doesnt use tobacco range from $84 to $361.

- South Carolina does not require Medigap insurers to offer plans to disabled Medicare beneficiaries under age 65, however one South Carolina agency, United American Insurance, does offer plans to people under the age of 65.

Read Also: Can I View My Medicare Eob Online

Plan F: Best Medicare Supplement Plan For Coverage

As you can see by the chart above, there is one Medicare Supplement plan that stands above the rest when it comes to the benefits offered.

Plan F is the only Medigap plan to offer coverage in each of the nine benefit areas offered by this type of insurance. Members of Plan F enjoy little to no out-of-pocket expenses because their Medigap plan picks up nearly all health care costs not paid for by Original Medicare . Roughly half of all Medigap beneficiaries are enrolled in Plan F.

However, Plan F does come with one downside. Federal legislation has made Plan F off-limits to anyone who first became eligible for Medicare on or after January 1, 2020. Only those who became eligible for Medicare before that date may enroll in Plan F. Because of that rule, we can expect to see Plan F enrollment decrease every year until it eventually no longer exists.

Medigap Plan C is the only other type of Medigap plan that is subject to the same enrollment rule as Plan F. If you were eligible for Medicare before 2020, you may still be able to enroll in Plan F or Plan C if either plan is available where you live.

How Do You Select A Medicare Supplement Insurance Company That Works For You

After youve researched and compared companies, you will select a supplemental insurance company that works best for you. You will want to consider things like the reputation and reviews of the insurance company as well as how easy it is to navigate their website and apply for coverage. Additional factors to consider include types of plans available, pricing, and deductibles. You may also want to select a company that has an app so you can manage your policy on the go.

Don’t Miss: Does Medicare Pay For Prep

Best Medicare Supplement Companies

Unlike with traditional health insurance, where policies differ among providers, Medicare Supplement plans are standardized so that the benefits for each plan letter are the same for each company. This means that Medicare Supplement Plan G from UnitedHealthcare will be identical in coverage to the Plan G offered through Aetna.

However, rates will change from company to company since each provider will choose a different pricing structure for its Medicare Supplement plans. It’s important that you take this into account along with each providerâs financial strength and history of rate increases. Some companies may offer cheap rates but will increase your rates more quickly as you age.

- Medigap plans offered: A, F, G, N and high-deductible F

- Average cost of Plan G: $179

Cigna, like UHC and Aetna, currently has an AM Best rating of A, meaning that it has the financial strength to continue to pay health insurance claims in the future. Cigna plans are widely available, and Cigna stands out for its high-deductible Plan F, which is an affordable way to protect yourself if you need expensive medical care. Cigna’s Medicare Supplement plans are generally priced higher than plans from some other companies, but using the company’s household premium discount can help you to get a better deal. The discount is available in most states when multiple family members in the same household enroll in the same Cigna Medigap plan.

What Do Medicare Supplement Plans Cover

All 10 Medicare Supplement plans offer the following core set of benefits:

- 100 percent of Your Part A Coinsurance There is also an additional 365 days of coverage after your Part A benefits are exhausted.

- Part B Coinsurance Plan K pays 50 percent, Plan L pays 75 percent, all other plans pay 100 percent.

- Your First Three Pints of Blood Each Year Plan K pays 50 percent, Plan L pays 75 percent, all other plans pay 100 percent.

- Part A Hospice Coinsurance Plan K pays 50 percent, Plan L pays 75 percent, all other plans pay 100 percent.

Some plans build on these baseline benefits and cover other out-of-pocket costs, such as your Part A and Part B deductibles, Part A skilled nursing facility coinsurance, and Part B excess charges. A few plans even offer a foreign travel emergency benefit that helps cover medical costs if you need care while traveling outside the United States.

Also Check: What Is The Yearly Deductible For Medicare

Compare Medicare Supplement Insurance Plans

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

Medicare Supplement Insurance, or Medigap, is insurance that pays for some costs that arent covered in Original Medicare. A Medicare Supplement Plan might cover copayments, coinsurance or deductibles you owe under Original Medicare.

Medicare Supplement Plans operate as additional not primary insurance coverage. You must have Medicare Part A and Part B to buy a Medigap plan. These policies are sold by private companies, and the plans are standardized, so Medicare Supplement Plan G in New York will offer the same coverage as Medicare Supplement Plan G in Ohio .

See Which Medicare Supplement Plans Are Available In Your State

Compare the difference in cost between the plans as insurance plan costs differ from state to state. Narrow down the insurance companies you are considering and contact each one for an individualized rate quote to compare prices. Be sure you are comparing the same type of Medicare Supplement plan. For example, compare the price of plan A from one company with other companies plan A costs.

Recommended Reading: Is Oral Surgery Covered By Medicare

Find Balance In Premium And Copays With Plan G

With Plan G, youll get the same benefits as Plan N plus coverage for any excess charges. Also, you wont have to pay those small copays that Plan N requires you to pay. In exchange for not having to pay a small copay every time you visit the doctor or hospital, you agree to pay a slightly higher monthly premium. For many years, Plan G has been the runner-up plan to Plan F.

Plan G replicates Plan F. The only difference is that it does not cover the Part B deductible.

This plan is a wise choice for those who:

- Dont want surprise out-of-pocket hospital costs

- Want rate increases that dont catch them by surprise

- Like to travel outside of the United States

- Live in a state that allows excess charges