What Will Medicare Part B Cost 2020

4.2/5how muchllMedicare Part B2020premium will2020deductiblePart B will

People also ask, what will Part B cost in 2020?

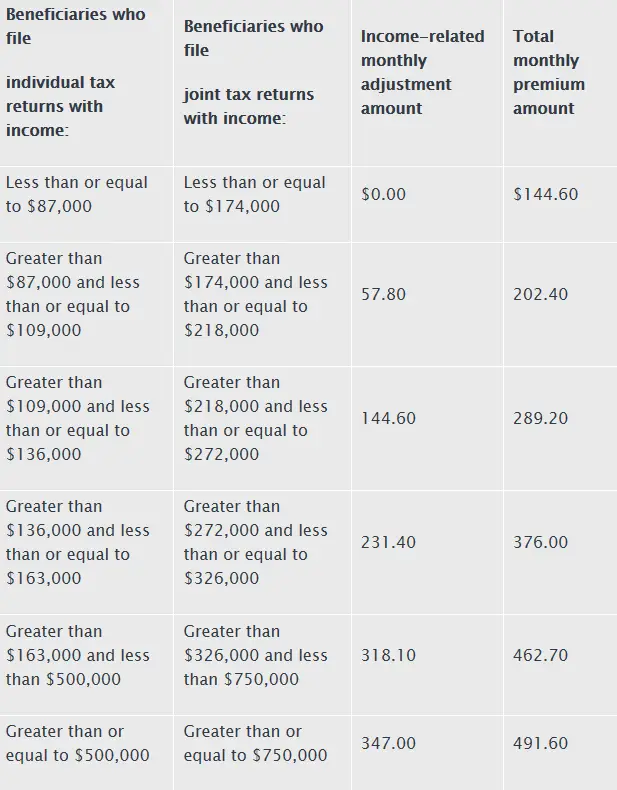

Standard Part B premiums are $144.60/month in 2020. The Social Security COLA was large enough to cover the full cost of the Part B increase for almost all enrollees. The high-income threshold increased to $87,000 for a single person.

Beside above, what is the income limit for extra help in 2020? To qualify for extra help with Medicare prescription drug plan costs in 2020, your annual income must be limited to $19,140 for an individual .

Accordingly, what will Medicare cost in 2020?

The Centers for Medicare and Medicaid Services announced the new 2020 rates Friday. For about 70% of Medicare beneficiaries, the premiums will rise nearly 7% to $144.60 a month, up from $135.50 in 2019.

What happens when the donut hole ends in 2020?

In 2020, youâll pay no more than 25 percent of the price for brand name drugs and generic drugs while youâre in the donut hole. You remain in this Part D donut hole coverage gap until you have paid $6,350 in out-of-pocket costs for covered drugs in 2020. You then enter the catastrophic coverage phase.

Donât Miss: How Much Medicare Is Taken Out Of Social Security Check

Medicare Deductible: Part A

Medicare Part A benefits include inpatient hospital care, skilled nursing facility care, home health services, and hospice.

For a hospital stay, you usually have to pay the Part A hospital inpatient deductible, which is $1,484 in 2021 for each benefit period. You may have other costs for the specific health-care services you receive while in the hospital. On the 61st day of a hospital stay, you would also start to have coinsurance costs. Your coinsurance costs depend on the length of your stay:

- Days 61 to 90: Daily coinsurance of $371 in 2021 for each benefit period

- Days 91 and over: Daily coinsurance of $742 in 2021 for each lifetime reserve day in each benefit period

- After lifetime reserve days are used up: You pay all costs

For home health-care services, all costs are covered under Medicare Part A for a limited time under certain conditions. However, if your doctor orders durable medical equipment and supplies it as part of your care, youll pay 20% of the Medicare-approved amount for the equipment.

For hospice care, all costs are covered. Some exceptions include:

- If you take prescription medications or similar items for pain relief or symptom control while on hospice. You may be responsible for a copayment of no greater than $5 per prescription drug.

- If you need inpatient respite services. You may need to pay 5% of the Medicare-approved amount for that care.

- If you get hospice care in a nursing home. You typically pay for room and board costs.

Are There Changes To Part A

Yes, there are also changes to Medicare Part A. If you have a Medicare Supplement Plan, depending on which Letter plan you have, your supplement will continue to pick up these costs.

If you have a Medicare Advantage Plan, your plans benefits will still apply to you instead of the Original Medicare benefit structure. 2020 plans have already been released, so you will not be affected by these changes.

However, if you have Original Medicare only, you will want to take a look at the Part A changes that affect you here.

Also Check: When Do Medicare Benefits Start

Key Points To Remember About Medicare Part A Costs:

- With Original Medicare, you pay a Medicare Part A deductible for each benefit period.

- A benefit period begins when you enter the hospital and ends when you are out for 60 days in a row.

- One benefit period may include more than one hospitalization.

- Medicare Advantage plans may or may not charge deductibles for hospital stays.

Medicare Part D Costs In 2022

Medicare Part D may be worth considering if youre taking prescription medication on a regular basis when you reach retirement age.

You can choose from two options to get prescription medication coverage. You can either sign up with a private insurance company that you can compare on the Medicare website, or you can get prescription drug coverage through your Part C program.

Like Part C, each plan has different coverage, deductible, and copayment options. Part D is generally included in your plan premium, but unmarried individuals with reported incomes of more than $91,000 will pay an additional amount in 2022. This threshold increases to $182,000 for married filers of joint tax returns in 2022. The average Part D premium is expected to be $33 per month in 2022, up from $31.47 in 2021.

Make sure that it covers the drugs you take in one of the lower tiers before you sign up with a company. It will help keep your costs under control.

Other types of benefits, insurance, and social services can sometimes influence Part D benefits.

You must have Medicare Part A and/or Part B or Part C to enroll in Part D.

Read Also: What Is Difference Between Medicare And Medical

Part A Costs If You Have Original Medicare

Home health care

- 20% of the Medicare-approved amount for durable medical equipment

Hospice care

- $0 for hospice care

- You may need to pay a copayment of no more than $5 for each prescription drug and other similar products for pain relief and symptom control while youre at home. In the rare case your drug isnt covered by the hospice benefit, your hospice provider should contact your Medicare drug plan to see if its covered under Part D.

- You may need to pay 5% of the Medicare-approved amount for inpatient respite care.

- Medicare doesnt cover room and board when you get hospice care in your home or another facility where you live .

Hospital inpatient stay

- Beyond lifetime reserve days: all costs

- 20% of the Medicare-approved amount for mental health services you get from doctors and other providers while youre a hospital inpatient

Note

Theres no limit to the number of benefit periods you can have when you get mental health care in a general hospital. You can also have multiple benefit periods when you get care in a psychiatric hospital. Remember, theres a lifetime limit of 190 days.

Skilled nursing facility stay

- Days 120: $0 for each benefit period

- Days 21100: $185.50 coinsurance per day of each benefit period

- Days 101 and beyond: all costs

Medicare Part A : Out

Most people don’t need to pay monthly premiums for Part A. You won’t pay a premium if you or your spouse paid Medicare taxes for at least 10 years while working.

However, you will need to help cover the cost of some fees when you receive care. These expenses come in the form of deductibles and copayments.

If you are admitted to the hospital, you should expect to pay the following:

A deductible is the amount you pay before your insurance pays.

For Part A , the deductible is $1,556 per benefit period.1

Recommended Reading: What Is Aarp Medicare Supplement

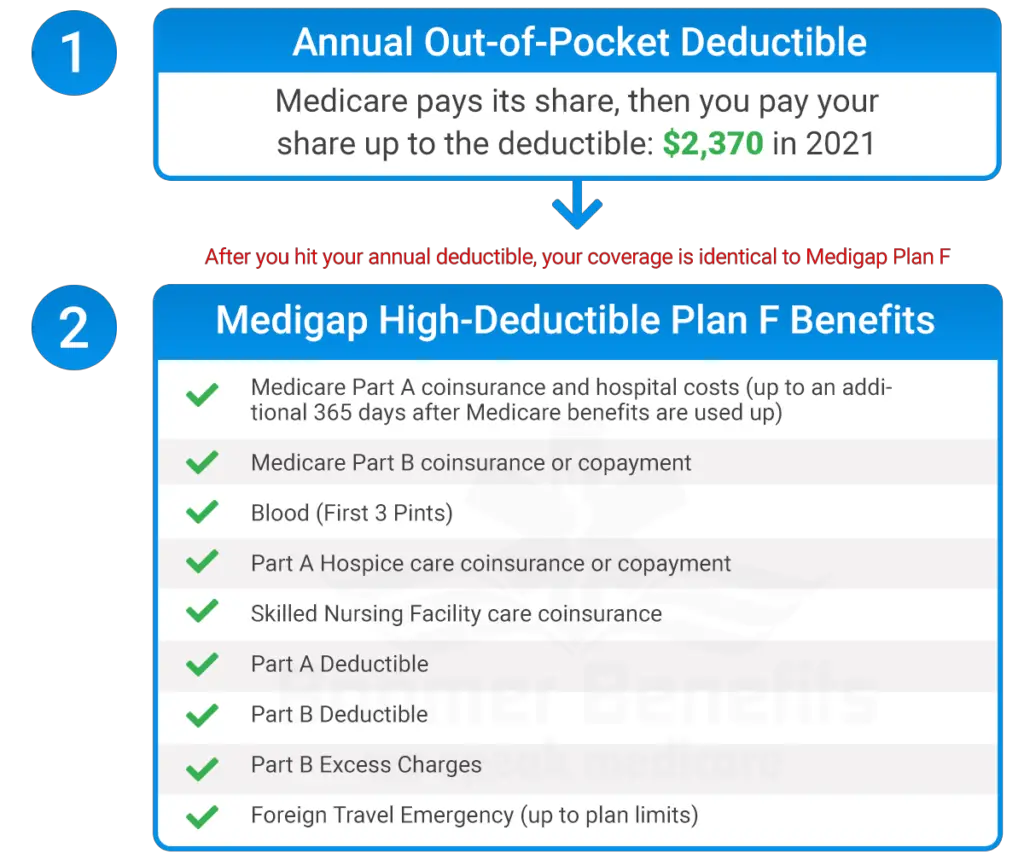

What Changes Are Coming To Medigap In 2021

- Supplemental Medicare or Medigap insurance covers a portion of your Medicare premiums. Supplements to Medicare can help pay the cost of premiums and deductibles.

- Companies that sell plans have varying costs.

- Medicare pays a portion of the costs under Plan G, and you pay the remainder until you reach a $2,370 deductible. Plan G will cover the remaining expenses.

Read Also: What Is Medicare Part G

Medicare Part B : Out

Part B is your doctor’s office insurance under Original Medicare. It covers necessary medical treatments and preventive healthcare services. You pay a monthly premium for this coverage, which can be automatically taken out of your Social Security benefits.

Most people pay a standard monthly premium, which is set each year. In 2022, the standard monthly Part B premium amount is $170.10 . If you earn over $88,000 a year, you will pay a higher premium. If the premium is deducted from your Social Security benefits, you will pay a lower premium.

Your total annual costs for Medicare Part B premium can be up to $6,939.60.

Recommended Reading: How To Get Motorized Wheelchair Through Medicare

Can I Still Buy Medigap Plans C And F

As a result of the Medicare Access and CHIP Reauthorization Act of 2015 , Medigap plans C and F are no longer available for purchase by people who become newly-eligible for Medicare on or after January 1, 2020. People who became Medicare-eligible prior to 2020 can keep Plan C or F if they already have it, or apply for those plans at a later date, including for 2022 coverage.

Medigap Plans C and F cover the Part B deductible in full. But other Medigap plans require enrollees to pay the Part B deductible themselves. The idea behind the change is to discourage overutilization of services by ensuring that enrollees have to pay at least something when they receive outpatient care, as opposed to having all costs covered by a combination of Medicare Part B and a Medigap plan.

Because the high-deductible Plan F was discontinued for newly-eligible enrollees as of 2020, there is a high-deductible Plan G available instead.

When Will I Meet My Part D Deductible

When you meet your Part D deductible depends on:

- How much your deductible is

- What prescription drugs you take and how much they cost

- How many prescription drugs you take

The amount you pay towards your Medicare Part D deductible is for every calendar year and resets January 1.

Suppose your Part D deductible is the maximum allowed in 2021 .

Scenario 1:

Once you meet your deductible, you may not be covered 100%. You may still be responsible for copayments and coinsurance every time you fill a prescription.

Do you have any questions about your Medicare Part D deductibles? Feel free to enter your zip code on this page to start browsing Medicare Part D plans. Or, if you prefer to get personalized assistance, contact eHealth to speak with a licensed insurance agent. We can help you find Medicare plan options that address your Medicare needs.

* Medicare Index Report: Annual Enrollment Period for 2020 Coverage

New To Medicare?

Becoming eligible for Medicare can be daunting. But dont worry, were here to help you understand Medicare in 15 minutes or less.

Read Also: Does Medicare Pay For Entyvio

What Is The Medicare Part D Coverage Gap

Your costs during the deductible phase of your Medicare Part D coverage, as well as your costs and the insurance companys costs during the initial coverage phase, are added together to determine whether you will move into the coverage gap and catastrophic coverage phase.

In 2020, you enter the coverage gap once you and your insurance company spend $4,020 on prescription drugs in a year. In the coverage gap, you no longer pay your tiered copayment when you buy prescription drugs. You pay up to 25% of the cost of your medications until total prescription drug spending reaches $6,350 in 2020. In the catastrophic phase, you pay a small copayment or coinsurance amount of no more than 5% of the cost of your covered medications or $8.95, whichever is greater, for the rest of the year.

Is The Medicare Part A Deductible Increasing For 2022

Part A has a deductible that applies to each benefit period . The deductible generally increases each year, and is $1,556 in 2022, up from $1,484 in 2021. The deductible increase applies to all enrollees, although many enrollees have supplemental coverage that pays all or part of the Part A deductible.

Read Also: Does Medicare Cover Mental Health Visits

Heres What Medicare Plan G Covers

Medicare pays first, then Medicare Plan G steps in and pays the rest after the annual deductible has been satisfied.

Plan G offersthe same comprehensive coverage as Medicare Plan F, except for Plan B deductible. Thats it! It is Plan F with one item removed. Here is a comprehensive list of what Plan G covers.

- Medicare Part A deductible, coinsurance, & hospital costs

- Medicare Part B Coinsurance, co-payment, & excess charges

- Foreign Travel Emergency

- Preventative Care Part B Coinsurance

- Skilled nursing facility coinsurance

- This is inclusive of most doctor services when you are a hospital inpatient and also outpatient therapy

- Durable medical equipment , blood transfusions, lab work, X-rays, surgeries, ambulance rides, and much more

In short, apart from one feature Plan G is the second most comprehensive plan behind Plan F. The only difference is the Medicare Part B deductible is not covered by the plan, meaning it will be covered by you.

It is worth noting some states have slightly different Medicare supplement insurance benefits. If you or your loved one lives in Minnesota, Wisconsin, or Massachusetts, click here to learn more about the specifics of benefits in these states.

Recommended Reading: Why Is My First Medicare Bill So High

Will The Changes Affect Part C Or Part D Costs

No, these deductible and premium increases will not affect Part D Drug Plans or Part C Medicare Advantage Plans. The premium costs and the deductibles have already been set for the coming year. As a result, they are not affected.

According to the CMS press release,

As previously announced, as a result of CMS actions to drive competition, on average for 2020, Medicare Advantage premiums are expected to decline by 23 percent from 2018, and will be the lowest in the last thirteen years while plan choices, benefits and enrollment continue to increase. Premiums and deductibles for Medicare Advantage and Medicare Part D Prescription Drug plans are already finalized and are unaffected by this announcement.

That is extra good news for those on Medicare Advantage Plans that have their deductibles satisfied with their plan. Some Medicare Advantage plans have a zero dollar deductible for their whole plan. These plans bundle Parts A & B and have the option of including the Part B Original Medicare deductible or covering it themselves.

Don’t Miss: How Do I Apply For Medicare In Missouri

Medicare Parts A B & C

As a reminder, there are four parts of Medicare: A, B, C and D. Medicare Part A covers inpatient services, which includes hospital services that you receive as part of an overnight stay. Part B covers outpatient services, such as preventive care, doctor visits, and other medically necessary services.

Part A and Part B make up Original Medicare. Everyone is required to enroll in both parts, and even if you get a more comprehensive private plan, you will still need to pay for Parts A and B.

Medicare Part C, also called Medicare Advantage, is optional and itâs a private health insurance offered through Medicare. It works much like regular health insurance, but itâs generally less expensive because itâs part of Medicare.

Medicare Part C includes Original Medicare benefits plus some extras, usually including prescription drug coverage, known as a Medicare Advantage Prescription Drug plan. You usually donât need Medicare Part D if you have a Medicare Advantage plan.

V Waiver Of Proposed Rulemaking

The annual updated amounts for the Part B monthly actuarial rates for aged and disabled beneficiaries, the Part B premium, and Part B deductible set forth in this notice do not establish or change a substantive legal standard regarding the matters enumerated by the statute or constitute a substantive rule that would be subject to the notice requirements in section 553 of the APA. However, to the extent that an opportunity for public notice and comment could be construed as required for this notice, we find good cause to waive this requirement.

Also Check: Does Medicare Cover Accu Chek Test Strips

Outpatient Hospital Services Deductible

Medicare Part B covers medically necessary outpatient hospital care you receive when you have not been formally admitted to the hospital as an inpatient.

- You usually pay 20% of the Medicare-approved amount for the doctor or other health care providers services.

- In addition, youll usually pay a copayment for each service you receive in a hospital outpatient setting, except for certain preventive services.

How Do Lifetime Reserve Days Work With Medicare

Part A covers inpatient hospital care, skilled long-term facility, and more, for up to 90 days. But if you ever need to extend your hospital stay, Medicare will cover 60 additional days, called lifetime reserve days.

For instance, if your hospital stay lasts over 120 days, you will have used 30 lifetime reserve days. Please note that youll pay a coinsurance of $742 for each lifetime reserve day you use. You can only use your lifetime reserve days once.

Also Check: Can You Use Medicare In Any State

How Does Original Medicare Work

Original Medicare is a federal health care program made up of both Medicare Part A and Part B . Its a fee-for-service plan, which means you can go to any doctor, hospital, or other facility thats enrolled in and accepts Medicare, and is taking new patients.

Medicare was set up to help people 65 and older. In 1972, Medicare became available to people with disabilities and End-Stage Renal Disease/kidney failure.

You May Like: What Age Qualifies You For Medicare

Whats The Difference Between A Deductible Vs Copay

A copay is a set amount that you have to pay for certain services even once youve paid your deductible. For instance, even after youve met your deductible and your coverage is active, you may have to pay $20 each time you see your doctor. The money you spend paying for copays may or may not be counted towards you meeting your deductible.

Recommended Reading: Does Medicare Supplemental Insurance Cover Pre Existing Conditions