What Medicare Part D Drug Plans Cover

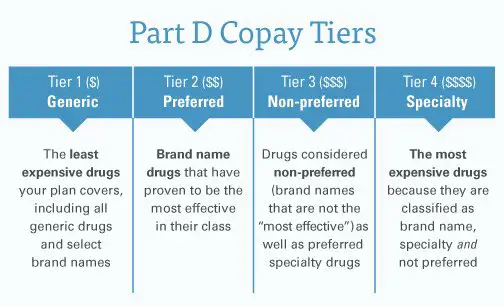

All plans must cover a wide range of prescription drugs that people with Medicare take, including most drugs in certain protected classes, like drugs to treat cancer or HIV/AIDS. A plans list of covered drugs is called a formulary, and each plan has its own formulary. Many plans place drugs into different levels, called tiers, on their formularies. Drugs in each tier have a different cost. For example, a drug in a lower tier will generally cost you less than a drug in a higher tier.

What Are The Benefits Of Extra Help And Epic

Those approved for full Extra Help, a Medicare Savings Program or a Medicaid Spenddown do not have to pay any EPIC fees. EPIC will continue to pay Medicare Part D plan premiums for LIS members, and those with Full LIS in enhanced plans or Medicare Advantage plans up to the basic amount after Medicare premium subsidization.

Drug Utilization Rules That Affect Your Part D Coverage

Medicare allows drug plan carriers to apply certain rules for safety reasons and also for cost containment. The most common utilization rules that you may run into are:

Your overall Medicare prescription costs can be affected by these restrictions. Always check your medications in the plan formulary to see if restrictions apply to any of your important medications.

Related Article: Why Medicare Part D Will Drive You Nuts

Read Also: What Weight Loss Programs Are Covered By Medicare

What Is The Medicare Part D Deductible

Medicare Part D is prescription drug coverage. You dont get it automatically when you sign up for a Medicare prescription drug plan.

Medicare prescription drug plans are offered by private, Medicare-approved insurance companies that may charge premiums and deductibles for your coverage. Plans usually also charge coinsurance or copayment amounts for each covered medication.

There are two types of Medicare prescription drug plans. Each type might have a deductible.

- Medicare Advantage prescription drug plans include your Medicare Part A, Part B, and Part D coverage in a single plan. Not every Medicare Advantage plan includes prescription drug coverage.

How Do Medicare Part D Plans Work

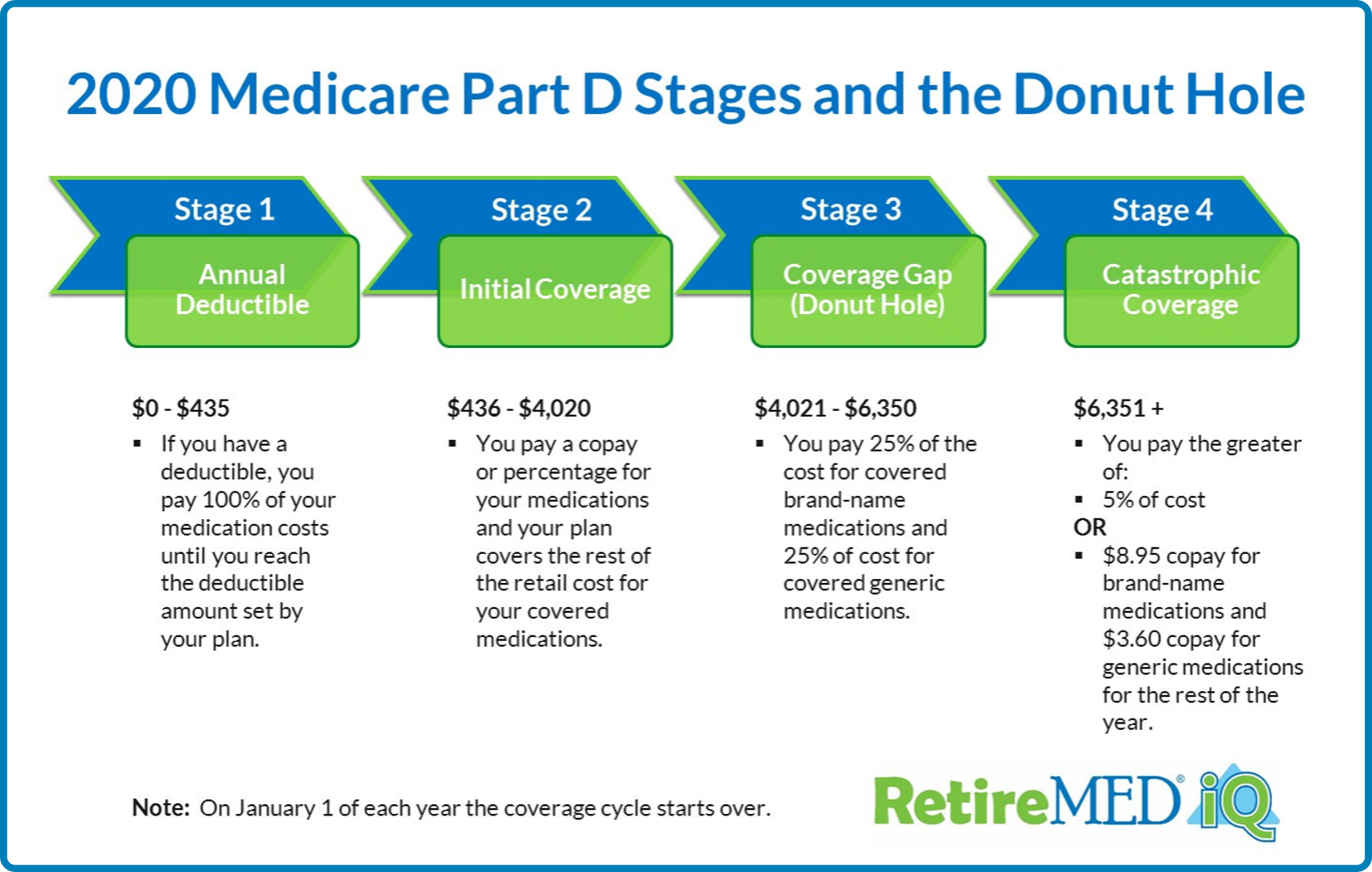

A typical Part D plan has 3 phases and works like this:

- Deductible and Initial Coverage: The typical plan has an annual deductible. After you have paid costs equal to the deductible amount, then you have Initial Coverage. In this phase, you will only pay a copay or coinsurance on covered prescription drugs until you reach the Initial Coverage Limit, which starts the Coverage Gap.

- Coverage Gap: Also known as the donut hole. Here you pay a discounted amount for brand and generic drugs. Once your combined drug costs reach the upper level of the Coverage Gap, you move to Catastrophic Coverage.

- Catastrophic Coverage: You will pay a small amount for medications, typically not more than 5% of the cost. The plan pays most of the cost.

You May Like: What Age Does A Person Qualify For Medicare

Costs In The Coverage Gap

Most Medicare drug plans have a coverage gap . This means there’s a temporary limit on what the drug plan will cover for drugs.

Not everyone will enter the coverage gap. The coverage gap begins after you and your drug plan have spent a certain amount for covered drugs. Once you and your plan have spent $4,430 on covered drugs in 2022 , you’re in the coverage gap. This amount may change each year. Also, people with Medicare who get Extra Help paying Part D costs wont enter the coverage gap.

Are Copayments Likely To Change

Medicare usually reviews all charges yearly, meaning that the costs for premiums, deductibles, and copayments may change every year.

Private companies may also change the amounts of their out-of-pocket expenses each year, but Medicare usually limits these expenses.

A person can contact their plan provider to ask about the history of copayment charges. They may also find out whether the company plans to raise the out-of-pocket costs in the future.

A person may be eligible for help paying their healthcare costs, and there are several options available.

Also Check: What Do You Need To Sign Up For Medicare

D Plan Premiums And Benefits In 2022

Premiums

The 2022 Part D base beneficiary premium â which is based on bids submitted by both PDPs and MA-PDs and is not weighted by enrollment â is $33.37, a modest increase from 2021. But actual premiums paid by Part D enrollees vary considerably. For 2022, PDP monthly premiums range from a low of $5.50 for a PDP in Colorado to a high of $207.20 for a PDP in South Carolina . Even within a state, PDP premiums can vary for example, in Florida, monthly premiums range from $7.70 to $174.30. In addition to the monthly premium, Part D enrollees with higher incomes pay an income-related premium surcharge, ranging from $12.30 to $77.10 per month in 2021 .

Benefits

The Part D defined standard benefit has several phases, including a deductible, an initial coverage phase, a coverage gap phase, and catastrophic coverage, although it does not have a hard cap on out-of-pocket spending. Between 2021 and 2022, the parameters of the standard benefit are rising, which means Part D enrollees will face higher out-of-pocket costs for the deductible and in the initial coverage phase, as they have in prior years, and will have to pay more out-of-pocket before qualifying for catastrophic coverage .

- The standard deductible is increasing from $445 in 2021 to $480 in 2022

- The initial coverage limit is increasing from $4,130 to $4,430, and

- The out-of-pocket spending threshold is increasing from $6,550 to $7,050 .

Figure 6: Medicare Part D Standard Benefit Parameters Will Increase in 2022â

How Do Medicare Copays And Deductibles Work

by Christian Worstell | Published April 22, 2021 | Reviewed by John Krahnert

A copay is your share of a medical bill after the insurance provider has contributed its financial portion. Medicare copays most often come in the form of a flat-fee and typically kick in after a deductible is met.

A deductible is the amount you must pay out of pocket before the benefits of the health insurance policy begin to pay.

Also Check: What Is The Best Medicare Supplement Plan In Arizona

When Can I Enroll In A Medicare Prescription Drug Plan

You can enroll in a plan at any time during your Medicare Initial Enrollment Period, which starts three months before your 65th birthday month, includes your birthday month, and extends for three additional months. If you get Medicare because of a disability, you can generally enroll in Medicare Part D after you are on Social Security disability for 24 months.

You can make changes to your prescription drug coverage each year during the Fall Open Enrollment Period . If you get Medicare Part D as part of your Medicare Advantage plan, you can also make changes during the Medicare Advantage Open Enrollment Period which runs from January 1st through March 31st.

Its important to enroll in a plan when you are first eligible if you want to avoid a late enrollment penalty with your monthly premium. If you go without creditable prescription drug coverage and you dont enroll in Part D when you are first able, youll pay a penalty of 1% of the national base premium for each month you go without coverage. You pay this penalty for as long as you have Medicare Part D coverage.

New To Medicare?

Becoming eligible for Medicare can be daunting. But don’t worry, we’re here to help you understand Medicare in 15 minutes or less.

Is There An Out

No. Medicare Part D has never capped out-of-pocket costs. Even when you reach catastrophic coverage, your 5% coinsurance lasts the rest of the year.

Medicares lack of an out-of-pocket maximum for prescription drugs is drawing the attention of lawmakers again, though, who have proposed several reform options.

Read Also: How To Prevent Medicare Fraud

How Are Part D Copays Determined

Since Medicare Part D plans are sold by private insurance companies, they can choose how much to charge for a copayment. Medicare Part D copays can vary between plans, which is why it is important to compare plans before enrolling in prescription drug coverage.

Generally, Part D plans organize their covered prescription drugs into different tiers. The tiers determine how much a copay will cost for a specific drug. Each plan can determine how to organize its tiers, which means different plans can have a different tier structure. Here is an example of a Medicare Part D drug plan tier according to Medicare.gov:

- Tier 1lowest copayment: most generic drugs

- Tier 2medium copayment: preferred, brand-name drugs

- Tier 3higher copayment: non-preferred, brand-name drugs

- Specialty tierhighest copayment: very high-cost prescription drugs

It is important to note, once you enter the last two parts of the four coverage stages of Medicare Part D you will no longer pay your plans set copay amount. Instead, in the coverage gap or donut hole phase, you will be responsible for 25% of the cost of your medications. After you exit the donut hole phase and enter the catastrophic coverage phase, your prescription drug costs will dramatically decrease and youll only be responsible for around 5% of the cost of your medications.

The Medicare Donut Hole And Catastrophic Coverage

In addition to the premium, the deductible, copays, the formulary, and the different drug tiers, you should consider the coverage gap to understand how Part D plans work and how much yours will cost. The donut hole indicates when there is a temporary limit on the coverage offered by your Part D plan.

In 2021, it starts when you and the drug plan have spent $4,130 total on covered prescriptions, and ends once youve spent $6,550 out of pocket. In 2022, the Medicare donut hole starts when you and the plan have spent $4,430 total on covered prescriptions, and ends once youve spent $7,050 out of pocket . During this time, youll generally pay no more than 25% toward the cost of prescription drugs.

Once youve left the coverage gap, you enter another level of Part D called Catastrophic Coverage. At that level, you will be charged a small coinsurance amount or copayment, such as the greater of 5% or a small copay for the remainder of the coverage year.

Also Check: Does Medicare Cover Dexcom G6 Cgm

Find A Medicare Drug Plan In Your Area

Use the online Medicare Plan Finder tool for a list of the stand-along Part D plans and Medicare Advantage plans with drug insurance available in your ZIPcode.16 The comparison tool shows the drugs covered by each plan, cost-sharing amounts, and whether you need prior authorization and preferred pharmacies.

Does Medicare Part D Have A Copay

There are several costs to be aware of when it comes to prescription drug coverage. One such cost is a Medicare Part D copay. Understanding how the Medicare Part D copay works can help you determine if a Medicare Part D plan is right for you. Keep reading to learn more about Medicare Part D copay amounts.

Recommended Reading: Is My Spouse Covered Under My Medicare

What Do Medicare Part D Plans Cover

Medicare Part D plans can vary greatly in what they cover, so you will need to check a planâs individual details. You can tell what prescriptions a plan will pay for by viewing its formulary. Each plan has its own formulary that lists all of the drugs it will cover.

Most plans break their covered drugs into tiers so that itâs easier to understand how much they will cost you. The prices you pay are based on a drugâs tier, with higher tiers requiring a higher copay. Tiers are generally divided into generic drugs, preferred brand-name drugs, non-preferred brand-name drugs, and drugs that are very expensive.

Hereâs an example of the tiers for a Medicare Part D plan:

-

Tier 1: lowest copay and includes most generic prescription drugs

-

Tier 2: medium copay and includes preferred, brand-name prescription drugs

-

Tier 3: higher copay and includes non-preferred, brand-name prescription drugs

-

Specialty tier: highest copay and includes very high cost prescription drugs

Each state has a preferred drug list , which is a list of drugs and medications that Part D will reimburse without the need for prior authorization, usually generic versions of brand-name drugs. These medications are selected because of their combination of effectiveness and affordability. Getting a prescription medication that isnât in the PDL will come with a higher cost and your doctor will need to get approval for Medicare to cover its cost.

How Do I Choose A Medicare Part D Plan

According to the Kaiser Family Foundation, the average Medicare beneficiary has 30 stand-alone Medicare Part D prescription drug plans to choose from in 2021. Its important to comparison shop to find the one thats right for you. In addition to monthly premiums and deductibles, you should definitely compare plan formularies, especially if you take daily medications.

Some plans use a pharmacy network. If you have a pharmacy you really like, make sure its part of the plans network. Look for other benefits, such as mail-order pharmacies, that can help save money out-of-pocket.

Also Check: Where Can I Get Medicare Information

What Is Extra Help And Who Is Eligible

You may be eligible for lower premiums, deductibles and coinsurance through Medicares Extra Help program. In 2022, those enrolled in the program pay $3.95 for each generic and $9.85 for each brand name drug.

In 2021, you may qualify if your income is up to $19,320 for an individual and $26,130 for a couple and you have a limited amount of resources such as savings, stocks and bonds. If your income or resources change, you can apply for Extra Help at any time.14

Choose The Right Prescription Drug Plan For You

Here are some tips for finding a plan that meets your budget, needs and preferences.17

- Check the prices. The monthly premium is an important consideration but look too at cost-sharing, such as deductibles, coinsurance and copays. A low premium may cost you more in the long run.

- If you prefer one-stop shopping and are willing to choose a plan that limits you to a network of providers, you may have lower premium costs with a Medicare Advantage plan with prescription drug coverage.

- If you take no or very few medications, you may want to opt for a low-premium plan. It will still cover most of the drugs that people on Medicare need.

- If you are taking specific long-term medications, check their availability and costs in various plans. If the drugs you take are generics, look for plans that charge you little or nothing for these.

- If you expect large medication expenses, it may pay to look for a plan that extends additional coverage if you reach high spending levels.

- When selecting a plan, check to see if they have a convenient preferred pharmacy, where you can often get added savings on prescription drugs.

Read Also: How Much Is Medicare B Cost

Prescription Drugs Not Covered By Medicare Part D

Over-the-counter medications generally arent covered by Part D plans, which includes:

- vitamins

- cosmetic and weight loss medications

Prescription drugs not covered by Medicare Part D include:

- your plan doesnt offer Part D services

- you want to switch to a plan with a higher star rating

You can also change plans during open enrollment each year.

What Can You Do To Manage Your Part D Costs

Check available pharmacies. Sometimes just changing pharmacies to a preferred one in your insurers network can lower a drugs price. Use GoodRX to compare prices and look for coupons that could save you money on your medications. Sometimes checking competitors or switching to a mail-order pharmacy can make a big difference.

Check your insurers formulary. It is good to not only check the plan during Medicares annual open enrollment from October 15 to December 7 when you are able to change plans for the next year but also throughout the year, to see if there have been changes.

Contact the State Health Insurance Assistance Program. Its a nonprofit network of trained, unbiased benefits counselors who provide free guidance on Medicare issues. A SHIP counselor can help you with Part D questions.

See if you qualify for Medicare Extra Help. Medicare provides financial help to people with lower income who are struggling to pay Part D costs. See if you qualify.

Do you qualify for Medicaid? Medicaid is a joint federal-state health insurance program for people with low income. Learn about its benefits in each state and whether you qualify. It is possible to be eligible for Medicare and Medicaid at the same time. You can start the Medicaid application process at Healthcare.gov.

State assistance and Medicare wraparound programs

Read Also: Does Medicare Cover Family Counseling

Two Ways To Get Medicare Drug Coverage

Drug Plan with Original Medicare

If you choose Original Medicare, you can purchase a stand-alone Medicare Part D prescription drug plan through a private insurance company. For example, UnitedHealth Group, Humana, and CVS Health together insure about 56 percent of Medicare Part D enrollees. In 2021, half of Part D enrollees chose a stand-alone plan.3

Drug Plan with Medicare Advantage

If you enroll in a Medicare Advantage plan, most policies include prescription drug insurance. Half of Part D enrollees chose Medicare Advantage prescription drug plans .4 Aetna, Humana, and Blue Cross Blue Shield are some of the many insurance companies that offer Medicare Advantage plans with prescription drug coverage.

What Is The Cost Of Medicare Part D For 2021

You can buy Medicare Part D coverage through a standalone plan if you have original Medicare or a Medicare Advantage plan that doesnt offer prescription drug coverage.

First, you will be charged a Medicare Part D premium. Thats the amount you pay monthly to a Medicare-approved private insurance plan to have prescription drug coverage, whether or not you fill any prescriptions. The government says the average monthly amount is $33.06, or $396.72 annually. In practice, premiums vary a lot from plan to plan.

Medicare can help you find a plan that costs the least based on the drugs you take and the pharmacies available to you. You enter the names of the drugs and how much of each drug you take on the Medicare Plan Finder tool, and it will calculate which Part D plan is likely to be the cheapest for you in your area.

Part D prescription plan prices are reset annually. You begin paying the new rates in January. In addition to the premium, there are four stages of pricing. Heres how the four stages are expected to break down in 2022:

All these prices seem reasonable at first glance, but, for many people, the costs are higher and harder to understand than they appear here.

You May Like: Does Medicare Pay For Prep