What Is Medicare Part C

A Medicare Advantage Plan is another Medicare health plan choice you may have as part of Medicare. Medicare Advantage Plans, sometimes called Part C or MA Plans, are offered by private companies approved by Medicare.

If you join a Medicare Advantage Plan, the plan will provide all of your Part A and Part B coverage. Medicare Advantage Plans may offer extra coverage, such as vision, hearing, dental, and/or health and wellness programs. Most include Medicare prescription drug coverage .

Medicare pays a fixed amount for your care every month to the companies offering Medicare Advantage Plans. These companies must follow rules set by Medicare. However, each Medicare Advantage Plan can charge different out-of-pocket costs and have different rules for how you get services . These rules can change each year.

Can I Delay Enrolling In Medicare Part B

Some people may get Medicare Part A premium-free, but most people have to pay a monthly premium for Medicare Part B. Because Medicare Part B comes with a monthly premium, some people may choose not to sign up during their initial enrollment period if they are currently covered under an employer group plan .

If you are still working, you should check with your health benefits administrator to see how your insurance would work with Medicare. If you delay enrollment in Medicare Part B because you already have current employer health coverage, you can sign up later during a Special Enrollment Period without paying a late penalty. You can enroll in Medicare Part B at any time that you are still covered by a group plan based on current employment. After your employer health coverage ends or your employment ends , you have an eight-month special enrollment period to sign up for Part B without a late penalty.

Keep in mind that retiree coverage and COBRA are not considered health coverage based on current employment and would not qualify you for a special enrollment period. If you have COBRA after your employer coverage ends, you should not wait until your COBRA coverage ends to sign up for Medicare Part B. Your eight-month Part B special enrollment period begins immediately after your current employment or group plan ends . This is regardless of whether you get COBRA.

Improve Medicare For All Beneficiaries

Medicare is extremely popular, but it needs attention to ensure all beneficiaries receive comprehensive coverage and equitable treatment. The Medicare program that Americans know and cherish has been allowed to wither. Traditional Medicare, preferred by most beneficiaries, has not been improved in years, yet private Medicare Advantage plans have been repeatedly bolstered. Its time to build a better Medicare for all those who rely on it now, and will in the future.

You May Like: Does Stanford Hospital Accept Medicare

How Do I Sign Up For Medicare Part A

If you need to manually enroll in Medicare Part A, you can do so through Social Security or the Railroad Retirement Board . You can sign up in a few different ways:

- Online: Visit the Social Security website to apply for Medicare Part A and/or Part B.

- : Call Social Security at 1-800-772-1213 . Representatives are available Monday through Friday, from 7AM to 7PM.

- In-person: Visit your local Social Security office to apply.

- If you worked for a railroad, contact the RRB to apply at 1-877-772-5772. . You can call Monday through Friday, 9AM to 3:30PM, to speak to an RRB representative.

You may be subject to a late-enrollment penalty if you do not enroll in Medicare Part A when you are first eligible to do so. If you do not automatically qualify for Medicare Part A, you can do so during your Initial Enrollment Period, which starts three months before you turn 65, includes the month you turn 65, and lasts for three additional months after you turn 65.

If you dont sign up during your Initial Enrollment Period, you may be able to sign up during the General Enrollment Period that takes place every year from January 1 to March 31 your coverage would start on July 1.

Whats The Difference Between Medicare Part A And Medicare Part B

Part A is the hospital services part of Medicare. This benefit covers inpatient care, hospital stays, skilled nursing facility care, hospice care, and medically needed home health care services.

Part B is the medical services part of Medicare. It covers many of the medically necessary services not covered in Part A, such as outpatient and preventive services. This involves things like x-rays, bloodwork, doctors visits, and outpatient care. It will also cover other medical items such as diabetic test strips, nebulizers, and wheelchairs.

Don’t Miss: Does Medicare A Have A Deductible

Original Medicare Vs Medicare Advantage

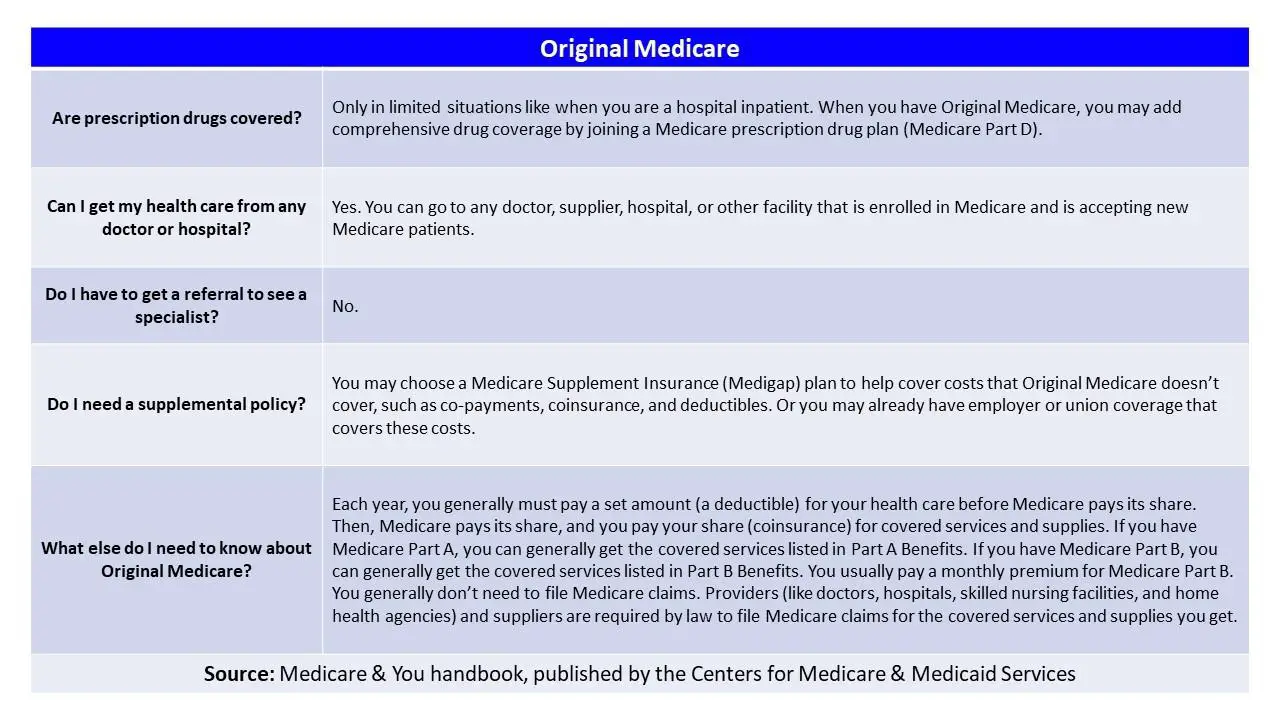

Whether you choose Original Medicare or a Medicare Advantage plan will depend on your healthcare needs, preferences, and financial situation. Original Medicare is a fee-for-service plan that allows you to go to any doctor or hospital that accepts Medicare. It only pays for 80% of services received, which may not be cost effective if you need a lot of healthcare. In this case, you may choose to supplement your Original Medicare with a Medigap plan.

Medicare Advantage on the other hand covers everything Part A and Part B covers, but charges a copayment and coinsurance for in network services. Some plans also include ancillary services like vision, hearing, and dental benefits, which may make Medicare Advantage more cost effective if you need those services and dont need a lot of healthcare.

| Original Medicare |

|---|

Factors That Affect Original Medicare Out

- Whether you have Part A and/or Part B. Most people have both.

- Whether your doctor, other health care provider, or supplier accepts assignment.

- The type of health care you need and how often you need it.

- Whether you choose to get services or supplies Medicare doesn’t cover. If you do, you pay all the costs unless you have other insurance that covers it.

- Whether you have other health insurance that works with Medicare.

- Whether you have Medicaid or get state help paying your Medicare costs.

- Whether you have a Medicare Supplement Insurance policy.

- Whether you and your doctor or other health care provider sign a private contract.

Also Check: Is Blood Pressure Monitor Covered By Medicare

What Are My Medicare Part A Costs

Many people get Medicare Part A without a premium if theyve worked the required amount of time under Medicare-covered employment, generally 10 years or 40 quarters and paid Medicare taxes while working . However, your Part A coverage may still include other costs, even after Medicare has paid its share. This may include deductibles, copayments, and/or coinsurance, which can all change from year to year. Your costs may depend on the type of service youre getting and how often.

Medicare Part A cost-sharing amounts are listed below.

Inpatient hospital care:

- $0 coinsurance for the first 60 days of each benefit period

- $371 a day for the 61st to 90th days of each benefit period

- $742 a day for days 91 and beyond per each lifetime reserve day of each benefit period

- After lifetime reserve days are used up: You pay all costs

Skilled nursing facility care:

- $0 for days 1 to 20 for each benefit period

- $185.50 a day for the 21st to 100th days

- Days 101 and beyond: all costs

Medicare Part B Medical Insurance

While Part A basically covers inpatient services, Medicare Part B is also referred to as medical insurance because it covers medically necessary services including physician and nursing fees, x-rays, diagnostic tests, blood transfusions, chemotherapy, renal dialysis, and some vaccinations and also preventive services. Although most medically necessary services are covered by either Part A or Part B, most outpatient prescription drugs are not . Dental care is also not covered under Original Medicare, and neither is routine vision care.

Enrollees pay a monthly Part B premium . Learn more about how to enroll in Part B.

You May Like: Are Motorized Wheelchairs Covered By Medicare

What Does Medicare Part A And Part B Cover

Original Medicare

- Hospice care

- Some home health care

You can enroll in Part A once you turn 65. If you’re already collecting Social Security disability benefits, you’ll be automatically enrolled in Part A.

Part B

- Some preventive services

Medicare pays 80 percent of approved charges and you pay about 20 percent.

Part B is optional because you have to pay a monthly premium and meet a deductible before Medicare will pay benefits.

Medicare Plan N Vs Plan F

Everything said above about Plan N vs. Plan G holds true for Plan N vs. Plan F except for one thing. Medicare Plan FMedicare Supplement Plan F is the most comprehensive Medicare supplement plan available. This plan covers all Original Medicare deductibles, coinsurance, and copayments, leaving you with no out-of-pocket costs on all Medicare-approved services…. does cover the Part B deductible. A Plan F Medigap policy is the only plan that covers all of the gaps in Original Medicare, and its also the most expensive. Is it the best plan? You bet it is, but you pay for the privilege of first-dollar coverage.

First-dollar coverage means that you pay nothing to see your doctor or to use any other Medicare-approved services. With Medicare Plan F, you never have a bill because Medicare pays first and your Medigap policy pays the rest. This is not true with Medicare Plan N.

With a Plan N policy, you pay your Medicare Part B deductible on your first doctor visit. Thereafter you pay up to $20 to see your doctor and up to $50 if you need to use the emergency room. All other costs, except excess charges, are covered by the Plan N policy, just like they are with Plan F. The big difference is the cost. Plan N policies are often 40% less than Plan F policies, depending on where you live. In high-cost of living areas, the savings are often more.

If you qualify for Medicare and don’t know where to start

Licensed Sales Agent

Trademark Notice

About MedicareWire

You May Like: Does Medicare Pay For Licensed Professional Counselors

Reimbursement For Part A Services

For institutional care, such as hospital and nursing home care, Medicare uses prospective payment systems. In a prospective payment system, the health care institution receives a set amount of money for each episode of care provided to a patient, regardless of the actual amount of care. The actual allotment of funds is based on a list of diagnosis-related groups . The actual amount depends on the primary diagnosis that is actually made at the hospital. There are some issues surrounding Medicare’s use of DRGs because if the patient uses less care, the hospital gets to keep the remainder. This, in theory, should balance the costs for the hospital. However, if the patient uses more care, then the hospital has to cover its own losses. This results in the issue of “upcoding”, when a physician makes a more severe diagnosis to hedge against accidental costs.

The Solvency Of The Medicare Hi Trust Fund

This measure involves only Part A. The trust fund is considered insolvent when available revenue plus any existing balances will not cover 100 percent of annual projected costs. According to the latest estimate by the Medicare trustees , the trust fund is expected to become insolvent in 8 years , at which time available revenue will cover around 85 percent of annual projected costs for Part A services. Since Medicare began, this solvency projection has ranged from two to 28 years, with an average of 11.3 years. This and other projections in Medicare Trustees reports are based on what its actuaries call intermediate scenario but the reports also include worst-case and best-case projections that are quite different .

Also Check: Does Medicare Have Life Insurance

Using Medigap To Pay Medicare Deductibles

Medigap, also known as Medicare Supplement plans, can help pay some of your out-of-pocket costs, including your Medicare Part A deductibles.

These plans are sold through private insurers. There are eight standardized plans across 47 states and the District of Columbia. There are different standardized plans for Minnesota, Massachusetts and Wisconsin.

Each plan has a letter for a name. Some of these plans may cover all or a portion of your Part A deductible.

Medigap Plan Coverage of Part A Deductibles

| A |

|---|

Federal Employee Health Benefits Plan

The FEHB Program offers health coverage for current and retired federal employees. If you are covered under a FEHB plan, you will get information during the open season about your prescription drug coverage and whether it is creditable prescription drug coverage. Read this information carefully. Contact your FEHB insurer before making any changes. It will almost always be to your advantage to keep your current coverage without any changes. For most people, unless you qualify for extra help, it is not cost effective to join a Medicare drug plan. Caution: You cannot drop FEHB drug coverage without also dropping FEHB plan coverage for hospital and medical services, which may mean higher costs for these services.

Read Also: Is Balloon Sinuplasty Covered By Medicare

When Can I Enroll In Medicare Part B

If you are receiving retirement benefits before age 65 or qualify for Medicare through disability, generally youre automatically enrolled in Medicare Part A and Part B as soon as you become eligible.

If you do not enroll during your initial enrollment period and do not qualify for a special enrollment period, you can also sign up during the annual General Enrollment Period, which runs from January 1 to March 31, with coverage starting July 1. You may have to pay a late enrollment penalty for not signing up when you were first eligible.

If youre not automatically enrolled, you can apply for Medicare through Social Security, either in person at a local Social Security office, through the Social Security website, or by calling 1-800-772-1213 from 8AM to 7PM, Monday through Friday, all U.S. time zones.

Keep in mind that once you are both 65 years or older and have Medicare Part B, your six-month Medigap Open Enrollment Period begins. This is the best time to purchase a Medicare Supplement insurance plan because during open enrollment, you have a guaranteed-issue right to buy any Medigap plan without medical underwriting or paying a higher premium due to a pre-existing condition*. Once you are enrolled in Medicare Part B, be careful not to miss this one-time initial guaranteed-issue enrollment period for Medigap.

What Is Not Covered Under Original Medicare

The two parts of original Medicare were designed to cover services needed in hospitals and as an outpatient. You might think these two categories cover every imaginable service, but they do not. For that reason, its always important to check if the services or supplies you need are covered by Medicare.

Some of the things original Medicare does not cover include:

- custodial care, such as nursing homes

- services or supplies that are not considered medically necessary

Although original Medicare doesnt cover the services listed above, many Medicare Advantage plans do. If any of these benefits are important to you, you can search for Medicare Advantage plans in your area that offer the coverage you need.

Also Check: How Do I Join Medicare

Choosing Between Traditional Medicare And Medicare Advantage

If you are eligible for Medicare you can chose between getting Medicare benefits through traditional Medicare or a Medicare Advantage plan. Making this choice is personal and requires individuals to consider their circumstances, including their health, need for flexibility, budget and tolerance for financial risk. Before deciding how to receive Medicare, it is important to understand the different parts of Medicare, how they work together, and the key differences between traditional Medicare and Medicare Advantage. It is also important to ask questions and gather information before deciding whether to enroll in a Medicare Advantage plan.

A. Understanding the Parts of Medicare

Before discussing the differences between traditional Medicare and Medicare Advantage, it is important to understand the different parts of Medicare and how they work together. Medicare has four parts: Part A, Part B, Part C and Part D.

Part C, also known as Medicare Advantage plans, are administered by private insurers that have contracts with the Medicare program. MA is a different way of getting Medicare Part A and Part B coverage and is The plans combine Part A and Part B, and often Part D, into one plan so the entire package of benefits comes from a private insurance company, regulated by the federal government

B. Medigap

C. Key Differences between Traditional Medicare and a Medicare Advantage Plan

- Traditional Medicare

Do I Pay For Medicare Part A

Medicare is a benefit that you pay into during your lifetime through taxes taken out of your paycheck. If you have worked for at least 10 years and paid into the Medicare fund, you likely wont have to pay for Part A once you qualify at retirement age or by way of legal disability. Homemakers or spouses who didnt work can also qualify so long as their spouse worked for 10 years or more. Because you have already paid into this fund, you dont have to worry about paying a premium to receive Part A hospital coverage.

Sometimes, people have not worked the full 10 years to be eligible for Medicare. In this case, you would be required to pay a monthly premium to receive Part A coverage. For 2016, this premium can cost as much as $411 per month.

Recommended Reading: What Is Centers For Medicare And Medicaid Services

Medicare Part B Covering Your Doctor Visits And Beyond

- What Medicare Part B covers: Part B pays for services like:

- Doctor visits

- Outpatient procedures

- Lab services

- other testing