What Is Part D Coinsurance

There are four payment stages or Part D policyholders.

- Your annual deductible: For 2022, it can be up to $480 per year. You pay this entirely out of pocket.

- Initial coverage, where youll pay your share of copay or coinsurance until the total amount spent on drugs reaches $4,430.

- The coverage gap , where you pay 25% of all costs until youve paid $7,050 out of pocket.

- Catastrophic coverage: For the rest of the year, youll owe 5% coinsurance or $3.95 for generic drugs and $9.85 for brand drugs, whichever is greater.

How Much Does Medicare Part B Cost In 2021

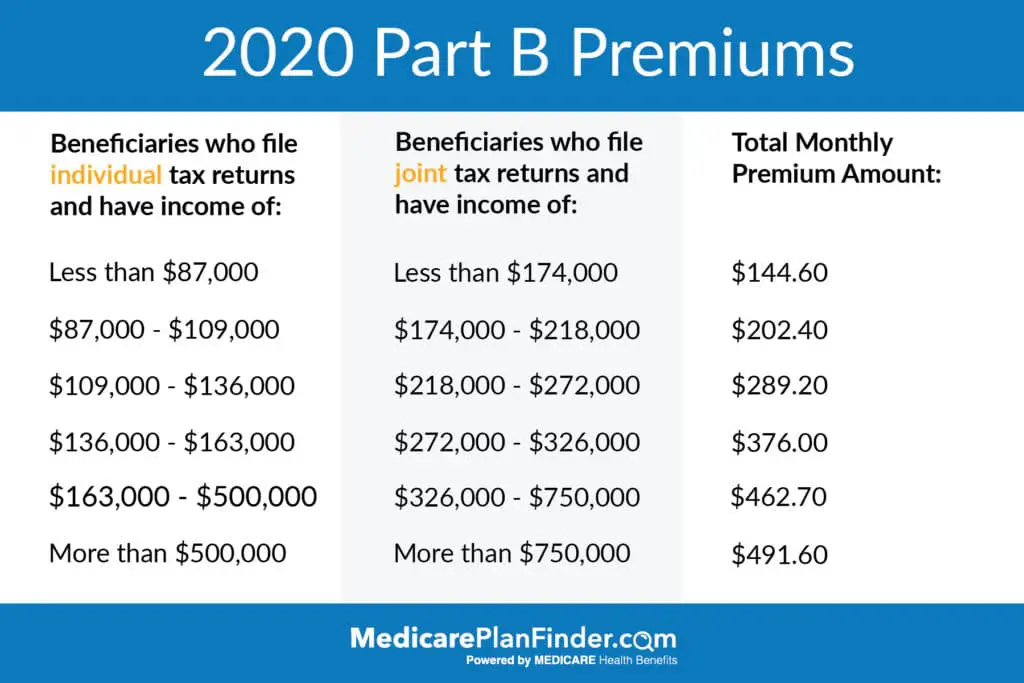

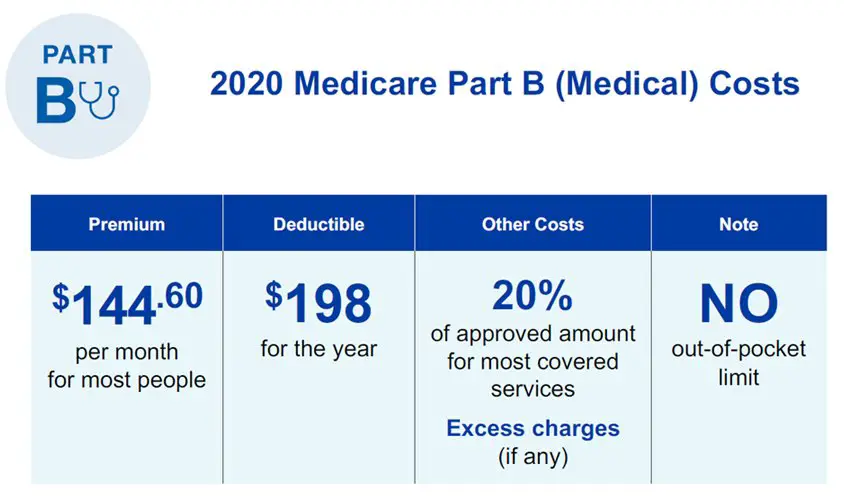

The premium for Medicare Part B in 2021 is $148.50 per month. You may pay less if youâre receiving Social Security benefits. You also may pay more â up to $504.90 â depending on your income. The higher your income, the higher your premium.

The deductible for Medicare Part B is $203 per year.

The Medicare Part B coinsurance amount is 20% for covered supplies and services.

Learn more about Medicare Part B, including Part B premiums prices based on income level.

What Is The Medicare Part B Late Enrollment Penalty

If you dont sign up Part B when youre first eligible, you may be required to pay a late enrollment penalty when you do choose to enroll. Additionally, youll need to wait until the general enrollment period .

With the late enrollment penalty, your monthly premium may go up 10 percent of the standard premium for each 12-month period that you were eligible but didnt enroll. Youll continue to pay this penalty for as long as youre enrolled in Part B.

For example, lets say that you waited 2 years to enroll in Part B. In this case, youd pay your monthly premium plus 20 percent of the standard premium.

You May Like: Is A Psa Test Covered By Medicare

Medicare Part B Premium

If you have Part B, youll need to pay a monthly premium. The standard monthly premium for 2021 is $148.50.

However, the amount of this premium can increase based on your income. People with a higher income typically pay whats known as an income-related monthly adjustment amount . For 2021, your income amount is calculated from your 2019 tax return.

The following individuals can enroll in original Medicare :

- people age 65 and older

- individuals with a qualifying disability

Eligibility for Part B depends on whether or not youre eligible for premium-free Part A. Most people get premium-free Part A because theyve paid Medicare taxes while working.

What Is The Average Cost Of Medicare Supplement Insurance

The average premium paid for a Medicare Supplement Insurance plan in 2019 was $125.93 per month.3

Its important to note that each type of Medigap plan offers a different combination of standardized benefits. Plans with fewer benefits may offer lower premiums.

Other factors such as age, gender, smoking status, health and where you live can also affect Medigap plan rates.

Medicare Supplement Insurance plans help pay for some of the out-of-pocket expenses youll face when you use Medicare Part A and Part B benefits. Medigap plans are sold by private insurance companies.

These costs can include certain Medicare deductibles, coinsurance, copayments and other charges.

There are 10 different Medigap plans available in most states. You can use the chart below to compare the costs that each type of Medigap plan may cover.

Medigap plans and Medicare Advantage plans are not the same thing. You cannot have a Medigap plan and Medicare Advantage plan at the same time.

| 80% | 80% |

Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

Read Also: How To Sign Up For Medicare And Tricare For Life

How Do You Qualify For $144 Back From Medicare

How do I qualify for the refund?

- Be a Medicare beneficiary enrolled in Part A and Part B,

- be responsible for paying the Part B premium, and.

- Live in a service area of a plan that has chosen to participate in this program.

What is the Medicare Give Back Program? The refund benefit is another term for Part B premium reduction. This is when a Medicare Advantage plan reduces the amount you pay for your monthly Part B premium.

Why Are Medicare Costs Increasing

These increases can be attributed to a handful of factors.

Across the healthcare industry, there are rising prices and more utilization.

This drives higher premiums while accounting for anticipated increases due to the intensity of provided care.

Congress also acted to lower the expected 2021 Part B premium increase.

As a result, there is a small $3 per beneficiary, per month increase in the Part B premium through 2025.

There are also contingency reserves needed because of the new Alzheimer’s disease drug, Aduhelm.

Due to the drug’s newness, having gained FDA approval over the summer, it is still unclear how and if it will be covered by Medicare beneficiaries in 2022.

As a result, the program is planning for “higher expenditures” to offset the potential costs of new treatments, according to the CMS.

Read Also: Will Medicare Cover Walk In Tubs

A Hospital Deductible Up To $1556

The Part A hospitalization deductible will increase from $1,484 to $1,556. The deductible covers a 60-day benefit period. The daily copayment or coinsurance for extended hospital stays or skilled nursing facility admission will also increase in 2022.

There is no income related adjustment on Part A as most people qualify for $0 cost Part A by virtue of working for 40 quarters and paying the Medicare tax. There is an income related adjustment to the Part D prescription drug plans, similar to Part B.

Medicare Advantage, Supplements, Part D Plan Shopping

There are a couple different ways to structure Medicare coverage. In the absence of any extra help from Medicaid or Social Security for Part D prescription drug coverage, the average Medicare beneficiary will realize the $170.10 for Part B and approximately $35 for a Part D plan. If the beneficiary adds a Medicare Supplement to cover most of the deductibles, copayments, and coinsurance of Original Medicare, there could be an additional cost of approximately $150 That brings the monthly insurance costs up to $355.

Does My Health Play Any Role In My Costs

No. If youre enrolled in Original Medicare , your health wont play a role in how much you pay for your Medicare coverage. Part A is determined by how long you paid Medicare taxes. For Part B, all enrollees pay the same deductible while premiums are calculated using income and whether you signed up on time.

Recommended Reading: Is Obamacare Medicare Or Medicaid

B Premiums And Medicare Advantage

You can elect to have Original Medicare or a Medicare Advantage plan . Medicare Advantage plans are offered by private insurance companies and will cover everything that Original Medicare offers and more.

Even if you decide on a Medicare Advantage plan and pay premiums to the insurance company, you still have to pay Part B premiums to the government. You must take that added cost into consideration.

The Basics On Medicare

The first thing you need to know is that Medicare is not a welfare program. It is a national program that is available for everyone 65 and older. Your income and your assets will not be taken into consideration when it comes to determining the eligibility or benefit payment.

Medicare covers some of the cost of medical care. In this way, its similar to what private insurance companies offer. Those with Medicare are required to pay deductibles and coinsurance.

Recommended Reading: Where To Send Medicare Payments

How Social Security Determines You Have A Higher Premium

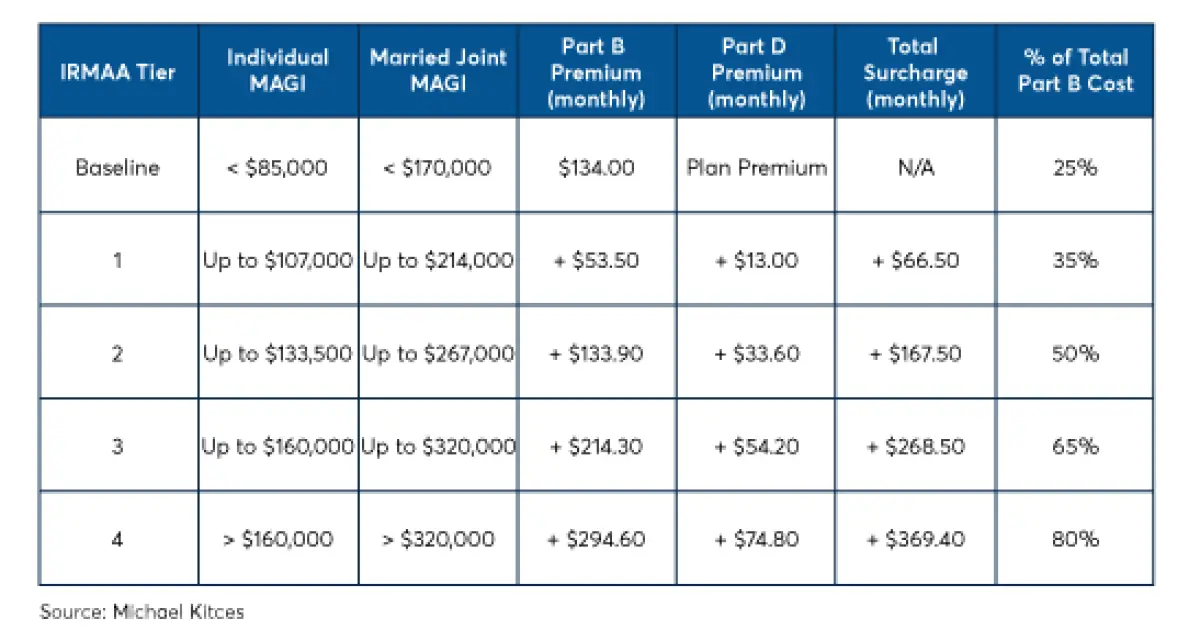

Social Security uses the most recent federal tax return the IRS provides to us. If you must pay higher premiums, we use a sliding scale to calculate the adjustments, based on your modified adjusted gross income . Your MAGI is your total adjusted gross income and tax-exempt interest income.

If you file your taxes as married, filing jointly and your MAGI is greater than $176,000, youll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $88,000, youll pay higher premiums , for an idea of what you can expect to pay).

If you must pay higher premiums, well send you a letter with your premium amount and the reason for our determination. If you have both Medicare Part B and Medicare prescription drug coverage, youll pay higher premiums for each. If you have only one Medicare Part B or Medicare prescription drug coverage youll pay an income-related monthly adjustment amount only on the benefit you have. If you decide to enroll in the other program later in the same year, and you already are paying an income-related monthly adjustment amount, well apply an adjustment automatically to the other program when you enroll. In this case, we wont send you another letter explaining how we made this determination.

Remember, if your income isnt greater than the limits described above, this law does not apply to you.

What Is The Difference Between Fehb And Medicare

your FEHB plan is the primary payer of the cost of health benefits and Medicare is the secondary payer if you are employed by the federal service Medicare is the primary payer and FEHB is the secondary payer if you are not employed by the federal service.

Can Federal Employees Have Both FEHB and Medicare? The answer: yes! FEHB coverage is similar to Medicare coverage. Federal employee plans often include prescription drug benefits, although drug coverage may vary. As with any prescription drug plan, check for specific medications on the plans formulary.

Also Check: When Does Medicare Part D Start

Why 2022 Medicare Part B Premiums Soared

The surprisingly big jump in Medicare Part B premiums for 2022 reflects the sky-high cost of a controversial Alzheimers disease drug. The premium hike will put more than a dent in the newly increased Social Security cost-of-living allowance, which worked out to $92 a month for the average retired worker. If youre wondering how to pay for healthcare after retirement, consider working with a financial advisor.

How We Got Here

In June 2021 the Food and Drug Administration, using its accelerated approval pathway, greenlit the use of Aduhelm, a $56,000-per-year Alzeimers disease medication produced by Swiss pharmaceutical company Biogen. Alzeimers, a progressive brain disorder, affects some 50 million worldwide. No medical treatment has been found to actually cure the ailment.

The move went down well on Wall Street as Biogen share prices popped 31% on the news. But the move didnt go down as well with many in the medical and public health community who dispute Aduhelms efficacy. Three FDA advisors resigned in protest.

The FDAs move is likely to be extremely costly for Medicare. The Kaiser Family Foundation in July said it conservatively estimates the cost to Medicare of Aduhelm at $29 billion in one year, based on 500,000 Medicare patients getting the new drug. For perspective, the total Medicare spending for all physician-administered drugs in 2019 was $37 billion.

The Reason for the Sticker Shock

The Upshot

Bottom Line

Healthcare Tips

Medicare Part D Donut Hole Coverage Gap Costs

Medicare Part D prescription drug plans and some Medicare Advantage plans have what is known as a donut hole or coverage gap, which is a temporary limit on how much a Prescription Drug Plan will pay for prescription drug costs.

As of 2020, Part D beneficiaries pay 25 percent of the cost of brand name and generic drugs during the coverage gap until reaching catastrophic coverage spending limit.

Recommended Reading: Does Medicare Have A Limit

Am I Eligible For Medicare Part B

Anyone who is eligible for premium-free Medicare Part A is eligible for Medicare Part B by enrolling and paying a monthly premium. If you are not eligible for premium-free Medicare Part A, you can qualify for Medicare Part B by meeting the following requirements:

- You must be 65 years or older.

- You must be a U.S. citizen, or a permanent resident lawfully residing in the U.S for at least five continuous years.

You may also qualify for automatic Medicare Part B enrollment through disability. If you are under 65 and receiving Social Security or Railroad Retirement Board disability benefits, you will automatically be enrolled in Medicare Part A and Part B after 24 months of disability benefits. You may also be eligible for Medicare Part B enrollment before 65 if you have end-stage renal disease or amyotrophic lateral sclerosis .

NEW TO MEDICARE?

If Your Income Has Gone Down

If your income has gone down due to any of the following situations, and the change makes a difference in the income level we consider, contact us to explain that you have new information and may need a new decision about your income-related monthly adjustment amount:

- You married, divorced, or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property because of a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employers pension plan.

- You or your spouse received a settlement from an employer or former employer because of the employers closure, bankruptcy, or reorganization.

If any of the above applies to you, we need to see documentation verifying the event and the reduction in your income. The documentation you provide should relate to the event and may include a death certificate, a letter from your employer about your retirement, or something similar. If you filed a federal income tax return for the year in question, you need to show us your signed copy of the return. Use Form Medicare Income-Related Monthly Adjustment Amount Life-Changing Event to report a major life-changing event. If your income has gone down, you may also use Form SSA-44 to request a reduction in your income-related monthly adjustment amount.

Read Also: Does Medicare Cover Varicose Vein Treatment

How Long Can I Keep Fehb In Retirement

Most employees are aware of this five-year rule however, theyre not clear on what that five-year rule really means. It does not mean that the employee had to be in the same FEHB subscription for five years. Employees are allowed to change carrier, plan, and type of coverage within that five-year period.

How does FEHB work after retirement?

Once employees retire and have chosen to keep their FEHB coverage after retirement, they start paying the premium with after-tax cash. While they work, they pay the FEHB premium with pre-tax money, but when they retire, they pay it with after-tax money.

Do federal employees get medical benefits when they retire?

After retirement, federal employees enjoy a monthly annuity and medical coverage. To qualify for coverage, you must meet minimum service requirements, which include being covered as a federal employee for at least five years. Your spouse will receive coverage without the five-year plan.

What Do Medicare Part A And Part B Premiums Cover

Medicare has different parts and plans, but the most common is Original Medicare . Parts A and B are available to all Americans 65 years of age and older and individuals under 65 with certain disabilitiesA disability is a restriction or lack of ability to perform an activity in the manner or within the range considered normal for a human being. The Social Security Administration judges disability and whether you qualify for financial assistance based on whether you can work..

Keep in mind, Parts A and B provide different coverage:

| And more | And more |

You need to know, like coverage, they also are different in cost. If you are new to Medicare, we have answers to help you make the right choice for your health and budget.

Don’t Miss: Does Cigna Have A Medicare Supplement Plan

What Is A Deductable

The deductable refers to the amount a member is expected to pay before their coverage kicks in.

The deductible will increase from $203 to $230 in 2022. After the deductible has been reached, members will be required to pay twenty percent of the costs for various services including, most doctor services, outpatient therapy, and medical equipment.

What is causing the increase in costs?

The CMM provided a series of reasons as to why the price is increasing.

The first is that each year based on the continuous increase in the costs of providing health care. Each year, the premium increases a small amount to reflect this market-wide trend. However, from 2020 to 2021, the price only increased two percent, whereas from 2021 to 2022 it will be more than fifteen percent.

Another reason relates to Congressional action to lower the cost of premiums in 2021, “which resulted in the $3.00 per beneficiary per month increase in the Medicare Part B premium being continued through 2025.”

Medicare Part A Deductible

Most Part A costs come from the inpatientInpatient refers to medical care that requires admission to the hospital, usually overnight. hospital deductible. Inpatient care provided at a hospital or skilled nursing facilitySkilled nursing facilities provide in-patient extended care with trained medical professionals to recover from injury or illness and activities of daily living. These facilities provide physical and occupational therapists, speech pathologists and medical professionals assist with medications, tube feedings and wound care. Skilled nursing stays are usually covered under Medicare Part A. will require you to pay the annual deductible.

For the year 2021, the Plan A deductible increased from 2020:

- Medicare Part A deductible 2020: $1,408

- Medicare Part A deductible 2021: $1,484

Read Also: How To Get Medicare For Free