Medicare Extra Help 2022 Income Limits

Medicare Extra Help annual income limits for 2022 are $20,385 for an individual or $27,465 for a married couple living together. There also are limits on your other financial resources: Your combined savings, investments and real estate can’t be worth more than $15,510 if you’re single or $30,950 if you are married and live with your spouse. You must meet each of these requirements to qualify for Extra Help.

| 2022 income limit |

|---|

|

Limits are slightly higher in Alaska and Hawaii. If you have income from working, you may qualify for benefits even if your income is higher than the limits listed.

The Medicare Extra Help program assists with monthly Part D costs including monthly premiums, annual drug deductibles and prescription copayments. In 2022, youâll pay a maximum of $3.95 for each generic or $9.85 for each brand-name prescription. Extra Help is estimated to save enrollees about $425 every month.

You can apply for Medicare Extra Help online, at your local Social Security office or over the phone by calling 800-772-1213 .

Extra Help is only available if you’re on Original Medicare and a separate Part D prescription plan. You can’t use Extra Help to reduce drug costs on a Medicare Advantage plan.

Does Roth Conversion Affect Irmaa

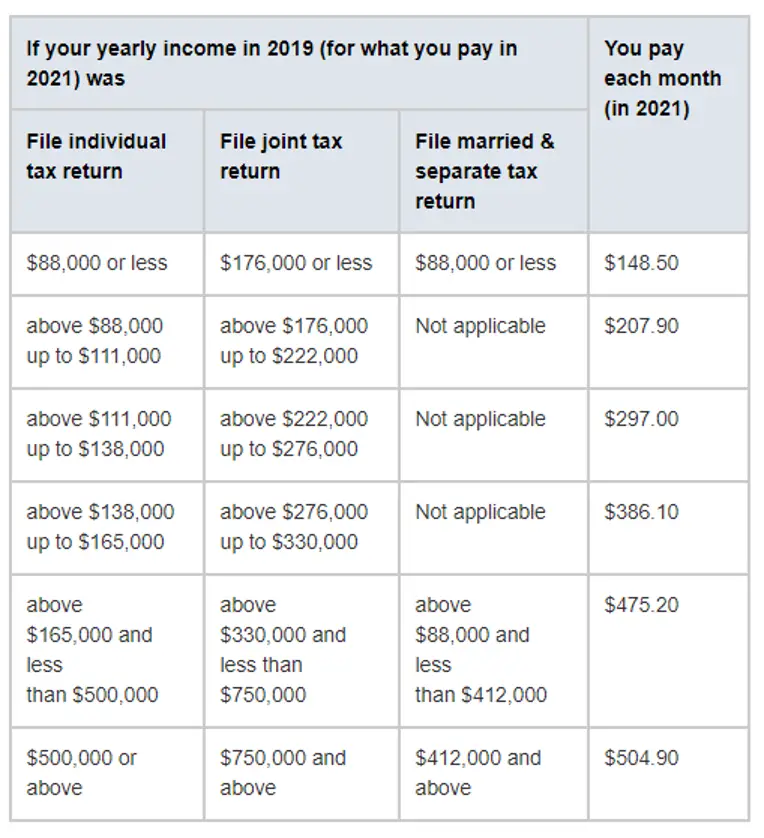

If your income is on the threshold of qualifying for IRMAA treatment, a Roth Conversion could force you to start paying premiums as a percentage of your higher income. There is a two-year look-back that determines IRMAA. So, even if you perform a Roth Conversion in 2019, you may not see the impact until 2021.

How Do You Qualify For Magi

To qualify for Medi-Cal, you must live in the state of California and meet certain rules. You must give income and tax filing status information for everyone who is in your family and is on your tax return. You also may need to give information about your property. You do not have to file taxes to qualify for Medi-Cal.

Recommended Reading: Can You Be On Medicare And Medicaid

Medicare Premiums And Surcharges

There is no premium or surcharge for Part A. Each year, the Centers for Medicare & Medicaid Services sets the following years Part B premium. As noted previously, the 2019 base Part B premium is $135.50 per month per beneficiary. Most people pay that amount. A small number of people pay a premium that is lower than the base premium because they are protected by the hold harmless rule. The hold-harmless provision protects people from having their previous years Social Security benefit level reduced by an increase in the Part B premium.

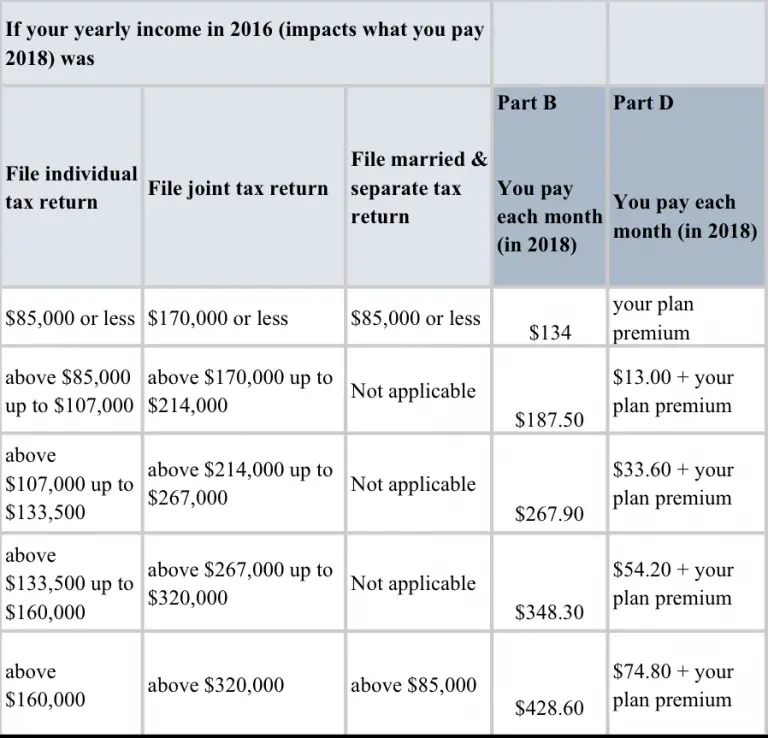

Part D coverage is provided via the individual private plan selected by the beneficiary, and base premiums depend upon the plan chosen. Wealthier taxpayers may also pay Medicare surcharges on Parts B and D in addition to the base premium for traditional Medicare or a Medicare Advantage plan. Higher-income individuals paying surcharges are not shielded by the hold-harmless provision. The table Medicare Parts B and D Premiums for 2019 shows the amounts charged for Part B and Part D at the various income thresholds for individuals and joint filers based upon MAGI from two years prior. In other words, the premiums for 2019 are based upon the reported income tax data from 2017.

Medicare Parts B and D premiums for 2019

Recommended Reading: Are Resident Aliens Eligible For Medicare

How Do I Flag An Individual To Identify That They Have Incorrectly Attested To Their Income Citizenship Or Immigration Status

When an individual has been found to have incorrectly attested to their income, citizenship or immigration status, workers with Unit Type 76 can update the Prevent WAH/MAGI Approval flag in ACES.online by taking the following steps:

On the Welcome back page, complete the following fields in the Quick Navigation section:

- Select a Type of ID drop down box – Select Client.

- Enter an ID field – Enter the .

- Select a Page drop down box – Select Demographics.

- Click the Go button and the Summary page displays.

Note:Yes

See ACES Screens and Online pagesfor an example of pages or screens used in this chapter.

You May Like: How Do I Get A Medicare Explanation Of Benefits

What Line Is Magi On 1040

If the SSA determines that you owe a higher Medicare Part B premium based on your MAGI, they will notify you of your new amount by mail. However, if you think the income information Social Security used to determine your Income Related Monthly Adjustment Amount was incorrect or outdated, you can request an appeal for Medicare to revisit the decision.

In this case, you may need to contact the IRS and correct any wrong information before you file the appeal. Fixing the issue may be as simple as filing an amended tax return.

A new initial determination is a revised decision that the SSA makes regarding your Income Related Monthly Adjustment Amount. If you have experienced a life-changing event that caused a decrease in income, you can request that the SSA revisit its decision.

Situations Social Security Considers Life-Changing Events:

- You or your spouse stop working or reduce the number of working hours

- Involuntary loss of income-producing property due to a natural disaster, disease, fraud, or other circumstances

- Receipt of the settlement payment from a current or former employer due to the employerâs closure or bankruptcy

You can request a new initial determination by submitting a Medicare IRMAA Life-Changing Event form. You can also schedule an appointment with Social Security. Documentation will be required with proof of the life-changing event that caused your income to go down.

Does Modified Adjusted Gross Income Include 401k

If you’re like most taxpayers, you want to take advantage of every tax deduction and tax credit on your income taxes. … Most tax deductions are based on either your adjusted gross income or your modified AGI. Your 401 contributions are deducted from your pay before taxes, so they are not included in your modified AGI.

Recommended Reading: How To Sign Up For Medicare Gov

The High Cost Of Medicare Part B And Part D

Medicare is made up of several parts. Most have monthly premiums, which is the amount you pay each month for coverage.

Part B has a standard premium amount that most people pay each month. That amount changes from year to year, but it’s generally consistent for most Medicare enrollees.

However, the premiums for Part B and Part D can vary between individuals based on their income level.

If your income is above a specific limit, the federal government adds an extra charge to your monthly premium. This charge is known as the Income-Related Monthly Adjustment Amount . Think of IRMAA as a surcharge or a Medicare surtax, as some refer to it.

To determine IRMAA, Social Security looks at the modified adjusted gross income amount reported on your IRS tax return from 2 years ago to determine whether you’ll pay IRMAA. This charge may be applied to your Part B and Part D monthly premiums.

The following chart shows how Medicare calculates IRMAA based on income level:

Unlike Medicare Part B, which the federal government provides, Part D prescription drug plans are provided by private health insurance companies that Medicare approves. Part D monthly premiums can vary a great deal from one health insurance company to another.

To determine how much Part D plans may cost in your area, visit Medicare.gov to get the latest monthly premium costs for Part D plans. If you’re a high-income earner, your Part D IRMAA charge is added to the premiums you’ll see quoted on Medicare.gov.

How Does Medicare Part B Work

Before getting into the weeds of Medicare Part B premiums, lets do a quick review of Medicare Part B and its role in federal retirement health insurance.

Once you turn 65, you become eligible to enroll in Medicare, with its maddening mix of different programs, including Part A, Part B, Part C and Part D. Some of these programs charge you premiums, and some dont.

First the good news: Most Medicare enrollees arent required to pay a premium for Medicare Part A, which covers costs for inpatient hospital care, home nursing care and hospice care. That said, there are typically deductibles and copays for some Medicare Part A expenses.

Medicare Part B covers doctor appointments, outpatient tests and exams as well as medical equipment. Unless your income is very low, youll be charged a monthly premium for Medicare Part B, regardless of whether you are enrolled in Original Medicare or Medicare Advantage, the two options for receiving your Medicare benefits.

If you opt for Original Medicare, the government will cover 80% of your Part B expenses after you meet your deductible. You can purchase a separate supplemental Medigap policy from a private insurer to cover the additional 20% youre on the hook for.

Recommended Reading: Does Medicare Help Cover Assisted Living

You May Like: Is It Medicaid Or Medicare

How Does Modified Agi Work

Modified AGI includes Adjusted Gross Income on your federal income tax return plus any excluded foreign income, nontaxable Social Security benefits , Supplemental Security Income , and tax-exempt interest received or accrued during the taxable year.

You wont find MAGI on your 1040, but you will find Modified AGI on Form 8962, Premium Tax Credit , the form you use for reporting Marketplace cost assistance. If you are looking at past tax returns, look at Adjusted Gross Income and take it from there. In most cases, its a similar amount.

MAGI, in most cases is simply your Adjusted Gross Income plus taxable interest found on lines 37 and 8b of your IRS from 1040. Take a look at the form. Youll see big sections on Income and Adjusted Gross Income. If you dont think your income will change, you can base everything on that information. See the full How to Calculate Modified Adjusted Gross Income video.

We cover MAGI on our subsidy calculator page, but since its so important to the ACA, we will do a detailed breakdown of MAGI and the other income types below.

FACT: When you apply for the Marketplace, all of your calculations will be done for you in regards to receiving cost assistance. That being said, knowing how all of this works will allow you to be certain that your cost assistance is right and will help you if you are filing your taxes by hand. By learning how to take advantage of tax deductions, you can save money both at tax season and when buying health insurance.

What Income Is Subject To Additional Medicare Tax

What Is the Additional Medicare Tax? The Additional Medicare Tax has been in effect since 2013. Taxpayers who make over $200,000 as individuals or $250,000 for married couples are subject to an additional 0.9 percent tax on Medicare. The Additional Medicare Tax goes toward funding features of the Affordable Care Act.

Read Also: How Old To Get Medicare And Medicaid

Does Modified Adjusted Gross Income Include Dividends

Wages, salaries, tips, tax-exempt interest, qualified dividends, IRAs, pensions, annuities, and Social Security benefits are all examples of items you have to include in your AGI. … The deductions you can factor in include IRA contributions, as well as self-employment tax, business expenses, and others.

Can Irmaa Impact My Medicare Part B Premium

Your income and tax-filing status from two years ago determine your IRMAA eligibility. If your income exceeds a pre-determined amount, IRMAA can impact your Medicare Part B premium. Keep in mind, each year the IRMAA amounts change. Thus, qualifying for IRMAA any year does not qualify you for life.

Depending on income, you may not have to pay the additional fee each year. Also, if you have a special situation and believe IRMAA should not apply to you, you can request a redetermination or IRMAA appeal.

You May Like: Does Medicare Pay For Foot Care

What Is Magi In Oregon

Modified Adjusted Gross Income MAGI helps low-income people in Oregon with health insurance. MAGI medical benefits can cover working families, children, pregnant women, single adults, and more. People on MAGI can get long-term care services if they qualify. MAGI is run by the Oregon Health Authority .

The Magi Population Groups

The MAGI population groups include the following:

- Pregnant women

- Dependent children under the age of 19

- Parents/caretaker relatives of children under 19

- Applicants 65 and over, as well as applicants with Medicare, are typically budgeted as non-MAGI.

- However, if such an applicant is a parent/caretaker relative with children under 19, they may choose to be classified as MAGI and MAGI budgeting rules and application and renewal procedures would apply.

Read Also: Do I Need To Register For Medicare At 65

How Do I Calculate My Modified Adjusted Gross Income

Calculating your MAGI is an important step in determining if you qualify for a premium tax credit and other deductions.

Here’s a quick overview of how to calculate your modified adjusted gross income:

- Step 1: Calculate your gross income

- Step 2: Calculate your adjusted gross income

- Step 3: Calculate your modified adjusted gross income

Lets go over each step in more detail.

Who Has To Pay The Medicare Surcharge

Higher-income beneficiaries face the IRMAA surcharge. In this case, “high earner” refers to anyone who claimed an income greater than $91,000 per year or $182,000 per year .

There is no premium surcharge for Medicare Part A even if you do not qualify for premium-free Part A. If the Social Security Administration determines you owe the adjusted amount, the surcharge is added to your Part B and Part D premiums.

Recommended Reading: What States Have Medicare Advantage Plans

The Secure Act And Irmaa

Further complications have been introduced as a result of the SECURE Act , which was enacted in late 2019. The SECURE Act has a number of different features such as allowing IRA contributions after age 70½ if youre still earning an income and it extends the minimum age that one must receive RMDs from 70½ to 72.

The reason this may be important is that it is possible that delaying receiving RMDs may also reduce IRMAA if your Modified Adjusted Gross Income is close to the limits stated in the tables above.

When people withdraw from qualified funds such as a 401, IRA, or 403, these funds are taxable once they are transferred to your individual checking, savings or brokerage account . The amount distributed is added to your taxable income, so exercise caution when youre receiving distributions from qualified funds. This additional income will increase your Modified Adjusted Gross Income, and may subject you to higher Medicare Part B and Medicare Part D premiums.

Further, non-qualified funds must also be tracked because of the way that mutual funds capital gains and dividend distributions are made. At the end of every year, many mutual funds distribute capital gains or dividends to those with mutual fund holdings. As a result, people can unknowingly earn more income as a result of investments, and the result can be higher Medicare premiums.

What Income Is Used To Determine Medicare Premiums

Your modified adjusted gross income as reported 2 years ago on your IRS tax returns are what is used to determine your Medicare Part B premium. You also may see modified adjusted gross income as MAGI.

Your MAGI is determined after taking certain allowable deductions and tax penalties into account. For many taxpayers, your MAGI and your adjusted gross income are the same.

Your MAGI includes any income you earned during the year including

Also Check: Does Medicare Cover Eye Surgery

Who Pays The 38 Investment Tax

The net investment income tax is a 3.8% tax on investment income such as capital gains, dividends, and rental property income. This tax only applies to high-income taxpayers, such as single filers who make more than $200,000 and married couples who make more than $250,000, as well as certain estates and trusts.

Applying For Magi Medicaid

Most MAGI applicants apply online at the NY State of Health Insurance Marketplace. However, there are few exceptions. Local counties and HRA in NYC will continue to handle the following type of cases for MAGI applicants/recipients:

- Medicaid spenddown participants

- Managed Long-Term Care Plan participants

- Assisted living participants

- All Medicaid consumers who need long-term nursing home care, institutional Medicaid

- Adults or children in need of waiver services

- Consumers residing in a congregate care facility.

For more information, see below, Applying for MAGI Medicaid.

Recommended Reading: Does Medicare Cover Stair Chairs

Medicaid And The Affordable Care Act

There were significant changes/expansions in the Medicaid program under the Affordable Care Act for specific population groups, who the ACA labeled as the MAGI populations, Changes include:

- Increased income eligibility thresholds

- Implementing new income budgeting methodology

- Elimination of resource limits

- Implementing new application and renewal procedures

- Expansion of the Medicaid benefit to cover non-disabled adults ages 19 through 64 who do not have dependent children

- Please note that NYS had covered this population prior to the implementation of the ACA through a waiver from the federal government.

The non-MAGI populations were not included in the ACAs Medicaid expansion and continue to operate under the eligibility guidelines, application and renewal procedures in place prior to the implementation of the ACA.

Medicare Part D Premiums

Unlike Medicare Part B, Medicare Part D rates are set by individual insurance providers and can vary by plan. If you have Part D, you pay a monthly amount to your insurance company for your coverage. But if you’re charged a separate amount based on your income, you pay that fee directly to Medicare.

The income limits for Medicare Part D are the same as the Part B amounts. So, if your adjusted gross income for 2020 was more than $91,000 or $182,000 â depending on filing status â you’ll pay extra for Medicare Part D. For example, if you earned $120,000 in 2020 and filed an individual return, you would pay an extra $32.10 per month for Part D in 2022.

Based on the nationwide average Part D premium of $33, your extra Part D premium is comparable to Part B rate increases.

Recommended Reading: Does Medicare Pay For Skilled Nursing Home Care