Medicare Advantage Plans Do Not Travel With You

For many of us, retirement is a time to travel, explore, enjoy the good life, and do the things we were unable to do with the responsibilities of family and career. But, what if you have a chronic health condition that necessitates regular doctor visits? This is the issue many snowbirds face. Your primary residence is in Idaho where the summers are mild, but you like to winter over in Arizona where the sunshine warms your bones.

Unfortunately, Medicare Advantage simply isnt suitable for a travel lifestyle. Sure, youre completely covered in an emergency situation, but regular care isnt. MA plans are regional , and you must get your regular care within the plans network or pay out-of-pocket. For travelers among us, the best coverage is a Medigap plan and traditional MedicareOriginal Medicare is private fee-for-service health insurance for people on Medicare. It has two parts. Part A is hospital coverage. Part B is medical coverage…..

So Are Medicare Advantage Plans Good Or Bad

In this article, we have done our level best to remove any personal bias we may have for or against Medicare Advantage plans to get to the simple truth. Medicare Advantage plans work for tens of millions of Americans and are an option to Part A and Part B coverage.

So we pose these two questions. If a plan keeps your costs to a minimum while giving you added benefits, how can it be seen as anything but good? But if your costs skyrocket and your access to a preferred doctor or specialist is limited by network providers and referrals, how can this be anything but bad? Both situations exist in relatively equal numbers.

And heres another potential issue. Although most Medicare Advantage plans have low monthly premiums, their copayments when you use health services can be quite high. In fact, more than half of all 2021 Medicare Advantage plans will charge you more than Original Medicare for a 7-day stay in the hospital. Can you afford out-of-pocket expenses that are higher than Medicare Part A without supplemental coverage? Most people cant.

So, is Medicare Advantage the right option for you? The only way to know for sure is to do the math, weigh your risks, add up the benefits, and make an honest assessment of your personal health and financial needs.

If you qualify for Medicare and don’t know where to start

Medicare Advantage And Part D

Federal guidelines call for an annual open enrollment period for Medicare Advantage and Medicare Part D coverage in every state. Theres also a Medicare Advantage open enrollment period that allows people who already have Medicare Advantage to switch to a different Advantage plan or switch to Original Medicare. But while these provisions apply nationwide, plan availability and prices are different from one state to another.

Medicare uses a star rating system for Medicare Advantage and Part D plans, and the availability of high-quality plans is not the same in every state.

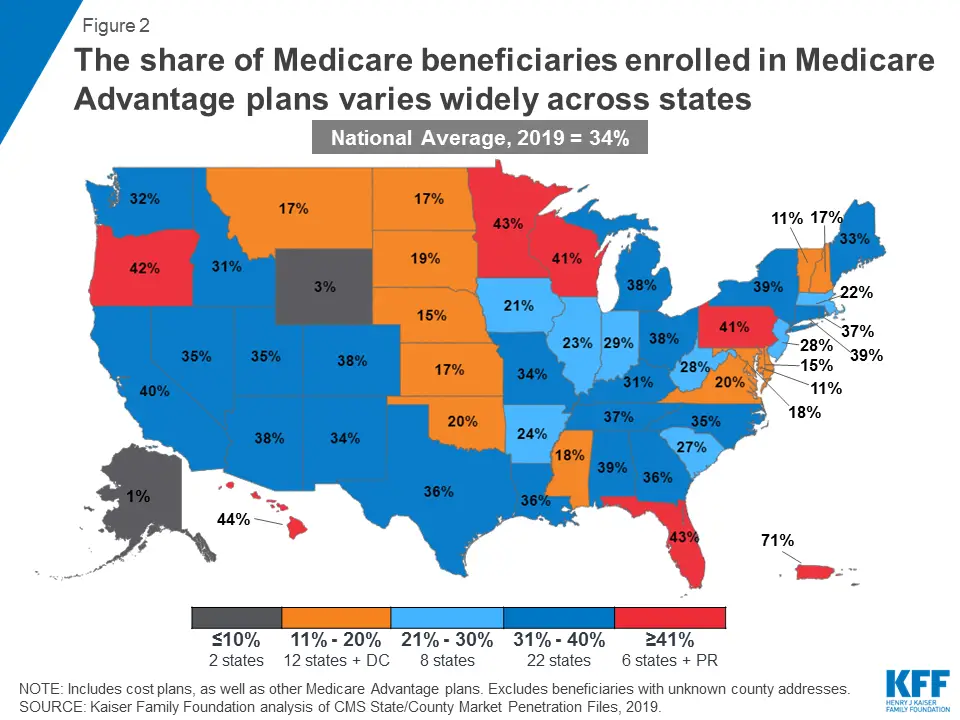

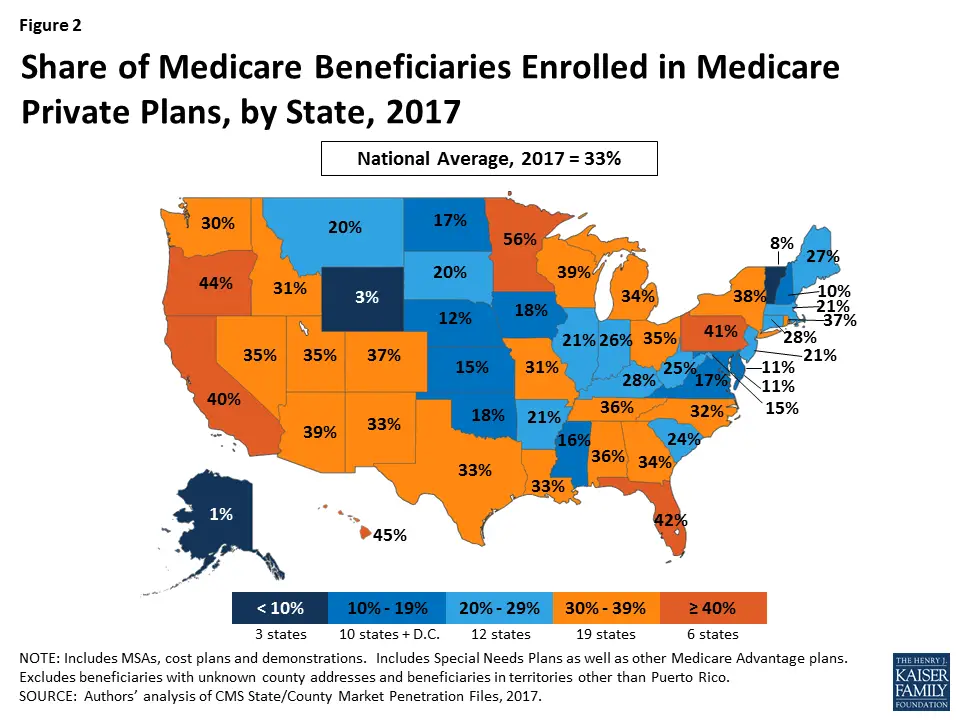

Not surprisingly, the popularity of Medicare Advantage plans varies significantly from one state to another, with only one percent of the Medicare population enrolled in Advantage plans in Alaska. Contrast that with 52% enrollment in Minnesota.

Part D prescription drug plan availability differs from state to state as well, with the number of plans for sale in 2021 varying from 25 to 35, depending on the region. The number of available premium-free prescription plans for low-income enrollees varies from five to ten, depending on the state.

You May Like: How Many Parts Medicare Has

Switching Back To Original Medicare

While you can save money with a Medicare Advantage Plan when you are healthy, if you get sick in the middle of the year, you are stuck with whatever costs you incur until you can switch plans during the next open season for Medicare. At that time, you can switch to an Original Medicare plan with Medigap. If you do, keep in mind that Medigap may charge you a higher rate than if you had enrolled in a Medigap policy when you first qualified for Medicare.

Most Medigap policies are issue-age rated policies or attained-age rated policies. This means that when you sign up later in life, you will pay more per month than if you had started with the Medigap policy at age 65. You may be able to find a policy that has no age rating, but those are rare.

Original Medicare & Medicare Supplement Plans

Regardless of where you are within the United States, Original Medicare and/or Medicare Supplement Plans will provide all of your Medicare benefits, as long as you visit a doctor or hospital that accepts assignment. For more comprehensive coverage nationwide, consider pairing one of the 10 standard Medigap plans with your Original Medicare coverage. Additionally, some Medigap plans may offer coverage for health care services or supplies when traveling outside of the country.

You May Like: Does Humana Offer A Medicare Supplement Plan

Medicare Advantage Plans Are A Pay

One of the biggest misconceptions of Medicare Advantage is that it saves you money. This is completely false.

As we will discuss in the next section, MA plans will protect you with an annual cap, but the cap can be very high. The Medicare coverage provided by an MA plan must offer all of the same basic benefits as Original Medicare, but plans do not have to cover the benefits in the same way.

The cost-saving misunderstanding is rooted in the zero-dollar premium feature of many plans. A zero-dollar premium simply means that the entire cost of the plan is covered by what Medicare pays the plan and the monthly Medicare Part B premium paid by the beneficiaryA person who has health care insurance through the Medicare or Medicaid programs…..

Unfortunately, many people see the $0 monthly price tag, and mistakenly think that all or most costs are covered. Or they dont take into account their personal health situation and how that will translate into copays when they use health services.

Is pay-as-you-go healthcare a good thing or a bad thing? It all depends on the state of your health. For healthy, younger seniors who are accustomed to using HMO-style employer group plans, Medicare Advantage is a great way to save money.

Medicare Advantage In : Enrollment Update And Key Trends

Over the last decade, the role of Medicare Advantage, the private plan alternative to traditional Medicare, has grown. In 2021, more than 26 million people are enrolled in a Medicare Advantage plan, accounting for 42 percent of the total Medicare population, and $343 billion of total federal Medicare spending . The average Medicare beneficiary in 2021 has access to 33 Medicare Advantage plans, the largest number of options available in the last decade.

To better understand trends in the growth of the program, this brief provides current information about Medicare Advantage enrollment, including the types of plans in which Medicare beneficiaries are enrolled, and how enrollment varies across geographic areas. A second, companion analysis describes Medicare Advantage premiums, out-of-pocket limits, cost sharing, extra benefits offered, and prior authorization requirements in 2021. A third analysis compares Medicare Advantage plans star ratings and federal spending under the quality bonus program.

Read Also: Should I Enroll In Medicare If I Have Employer Insurance

How We Chose The Best Medicare Advantage Plan Insurance Companies

We reviewed 10 of the most commonly used insurance companies in the United States and selected companies that serve the majority to provide the best selection for most consumers. We also considered the companys financial and public relations reputation, the price, AM Best ranking, accessibility of the website or mobile app, availability of international coverage, whether or not local, in-person agents are available, availability in at least 40 states, and how easy it is to get estimates and apply for coverage. We also considered whether companies offer extra bonuses for enrollees, such as membership in health plans or automatic withdrawal from your Social Security for premiums.

ARTICLE SOURCES

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

The Real Disadvantage Of Medicare Advantage Plans

In Understanding Medicare in 4 Easy Steps, we outline how to determine if Medicare Advantage or Original Medicare and a Medigap plan is the best option for you. To paraphrase, we suggest that theres a single fundamental difference that helps most people make the right choice. In fact, the bulk of the pros and cons of Medicare Advantage plans take a back seat to this one issue.

The difference is this. With Original Medicare and supplemental Medicare insurance, you pay the bulk of your major medical costs upfront through monthly insurance premiums. Doing so lets you budget your health care costs.

When you have Medicare Advantage, you pay most of your health care costs when you use services. For this reason, it is very difficult to budget your health care costs. And this is the primary disadvantage of Medicare Advantage plans. If you fit into one of the five categories above, this wont be much of a disadvantage. If not, it could put you in a world of hurt.

Don’t Miss: Does Medicare Cover Bladder Control Pads

Enrollment In Medicare Advantage Has More Than Doubled Over The Past Decade

In 2021, more than four in ten Medicare beneficiaries 26.4 million people out of 62.7 million Medicare beneficiaries overall are enrolled in Medicare Advantage plans this share has steadily increased over time since the early 2000s. Between 2020 and 2021, total Medicare Advantage enrollment grew by about 2.4 million beneficiaries, or 10 percent nearly the same growth rate as the prior year. The Congressional Budget Office projects that the share of all Medicare beneficiaries enrolled in Medicare Advantage plans will rise to about 51 percent by 2030

For Medicare Advantage Enrollees The Average Out

Figure 8: Average Medicare Advantage Plan Out-of-Pocket Limits, Weighted by Plan Enrollment, 2020

In 2020, Medicare Advantage enrollees average out-of-pocket limit for in-network services is $4,925 and $8,828 for out-of-network services . For HMO enrollees, the average out-of-pocket limit is $4,486 these plans do not cover services received from out-of-network providers. For local and regional PPO enrollees, the average out-of-pocket limit for both in-network and out-of-network services are $8,795, and $9,010, respectively. These out-of-pocket limits apply to Part A and B services only, and do not apply to Part D spending.

HMOs generally only cover services provided by in-network providers, whereas PPOs also cover services delivered by out-of-network providers but charge enrollees higher cost-sharing for this care. The size of Medicare Advantage provider networks for physicians and hospitals vary greatly both across counties and across plans in the same county.

Average overall out-of-pocket limits for in-network services has trended down from 2017 with the largest decrease for HMOs . Out-of-network limits for PPOs have also decreased since 2017 .

Read Also: Does Medicare Cover Skin Removal

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

What Are The Worst Medicare Advantage Plans

The Centers for Medicare & Medicaid Services does an excellent job of weeding out bad Medicare Advantage plans. Sub-par plans are given a year to clean up their act and CMS sanctions them.

So, what is a bad plan?

Generally, plans get sanctioned for bad customer service, poor performance managing chronic health conditions, a bad track record keeping members healthy , and a poor member experience with the drug plan . All of these measures are graded by CMS annually, and more. You can check each of the ten grades a health plan receives on our plan pages.

Beyond the 5-star grades, you must look at how a plan will cover you. By this, we mean the out-of-pocket costs you will be charged by the plan when you use health care services. A 4- or 5-star plan can be fantastic for one member and the worst of the bunch for another. It all depends on your total costs.

You must do the research and run numbers based on how you expect to use a plans benefits. Only then will you know if the plan you are choosing is a winner or a loser.

Also Check: How To Compare Medicare Supplement Plans

Which Path You Take Will Determine How You Get Your Medical Care And How Much It Costs

by Dena Bunis, AARP, Updated October 12, 2021

Getty/AARP

En español | As you think about how Medicare will cover your health care needs, your first major decision should be whether you want to enroll in federally run original Medicare or select a Medicare Advantage plan, the private insurance alternative.

Think of it as choosing between ordering the prix fixe meal at a restaurant, where the courses are already selected for you, or going to the buffet , where you must decide for yourself what you want.

If you elect to go with original Medicare, your buffet will include Part A , Part B and Part D . If you decide to go with Part C, a Medicare Advantage plan, it will be more like a set menu, since a private insurer has already bundled together parts A and B and almost always D into one comprehensive plan.

Some aspects of your care will be constant whichever plan you choose. Under both choices, any preexisting conditions you have will be covered and you’ll also be able to get coverage for prescription drugs.

But there are significant differences in the way you’ll use Medicare depending on whether you pick original or Advantage. Here’s a comparison of how each works.

Medicare Advantage Plans Cant Turn You Down

When President G. W. Bush signed Medicare Advantage into law in 2003, he started the pre-existing conditionA pre-existing condition is any health problem that occurred before enrolling in a health plan. The Affordable Care Act law made it illegal for health plans to or charge more due to a pre-existing condition…. coverage revolution that went into The Affordable Care Act. Unlike Medicare supplement insuranceMedicare Supplements are additional insurance policies that Medicare beneficiaries can purchase to cover the gaps in their Original Medicare health insurance coverage…., which only has one guaranteed-issue period, people with Medicare Advantage medical insurance can change plans every year without having to answer questions about their health.

Only those with ESRD , also known as kidney failure, is a condition that causes you to need dialysis or a kidney transplant. People with ESRD are eligible for Medicare coverage regardless of age….) and a few rare health conditions can be turned down. For these people, Medicare offers special coverage directly.

This is a significant benefit of the Medicare Advantage program that cannot be overstated. Millions of Americans, who would otherwise be bankrupted by healthcare costs in traditional Medicare, are able to get quality care through an MA plan.

Recommended Reading: Does Medicare Cover Full Body Scans

Medicare Advantage Resources In Washington

It is so important that seniors have access to healthcare resources that are suited to their needs and deliver a high standard of care. Medicare Advantage offers the perfect solution for seniors looking for extensive and comprehensive health insurance coverage. Washingtons Medicare Advantage program provides a wide range of plans and options throughout the state. However, such a broad range of plans and options can often confuse first-time applicants and those looking to switch plans to find the right coverage. To ensure seniors have access to the answers they need to make these decisions, Washington offers a number of resources at local and state levels that provide free Medicare counseling services to qualifying seniors.

Top Rated Assisted Living Communities By City

Original Medicare can be used in all 50 states, as well as in the District of Columbia, American Samoa, Guam, the Northern Mariana Islands, Puerto Rico and the Virgin Islands. The same isnt true for Medicare Advantage plans. These plans have defined service areas and may not cover out-of-state care, with the exception of emergency and urgent care situations.

Don’t Miss: Will Medicare Pay For Handicap Bathroom

What States Do Not Allow Medicare Excess Charges

If youre looking at purchasing a Medigap policy, you may find that some of the plans cover excess charges. When a doctor doesnt accept Medicare, excess charges may occur doctors can only charge 15% above the threshold.

States that DONT ALLOW excess charges:

- Connecticut

Disclaimer: By clicking the button above, you consent to receive emails, text messages and/or phone calls via automated telephone dialing system or by artificial/pre-recorded message from representatives or licensed insurance agents of Elite Insurance Partners LLC, its affiliates or third-party partners at the email address and telephone number provided, including your wireless number , regarding Medicare Supplement Insurance, Medicare Advantage, Medicare Part D and/or other insurance plans. Your consent is not a condition of purchase and you may revoke your consent at any time. This program is subject to our Privacy Policy and Terms of Use. This website is not connected with the federal government or the federal Medicare program.