Sign Up: Within 8 Months After Your Family Member Stops Working

- If you have Medicare due to a disability or ALS , youll already have Part A .

- Youll pay a monthly premium for Part B , so you may want to wait to sign up for Part B.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty until you turn 65. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

You Automatically Get Medicare

- You should already have Part A and Part B , because you have ALS and youre already getting disability benefits.

- We mailed you a welcome package with your Medicare card.

Sign up for Part B if you live in Puerto Rico or outside the U.S.

- Well mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months after your Part A starts, you might have to wait to sign up and pay a monthly late enrollment penalty.

- Well mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months of turning 65, you might have to wait to sign up and pay a monthly late enrollment penalty.

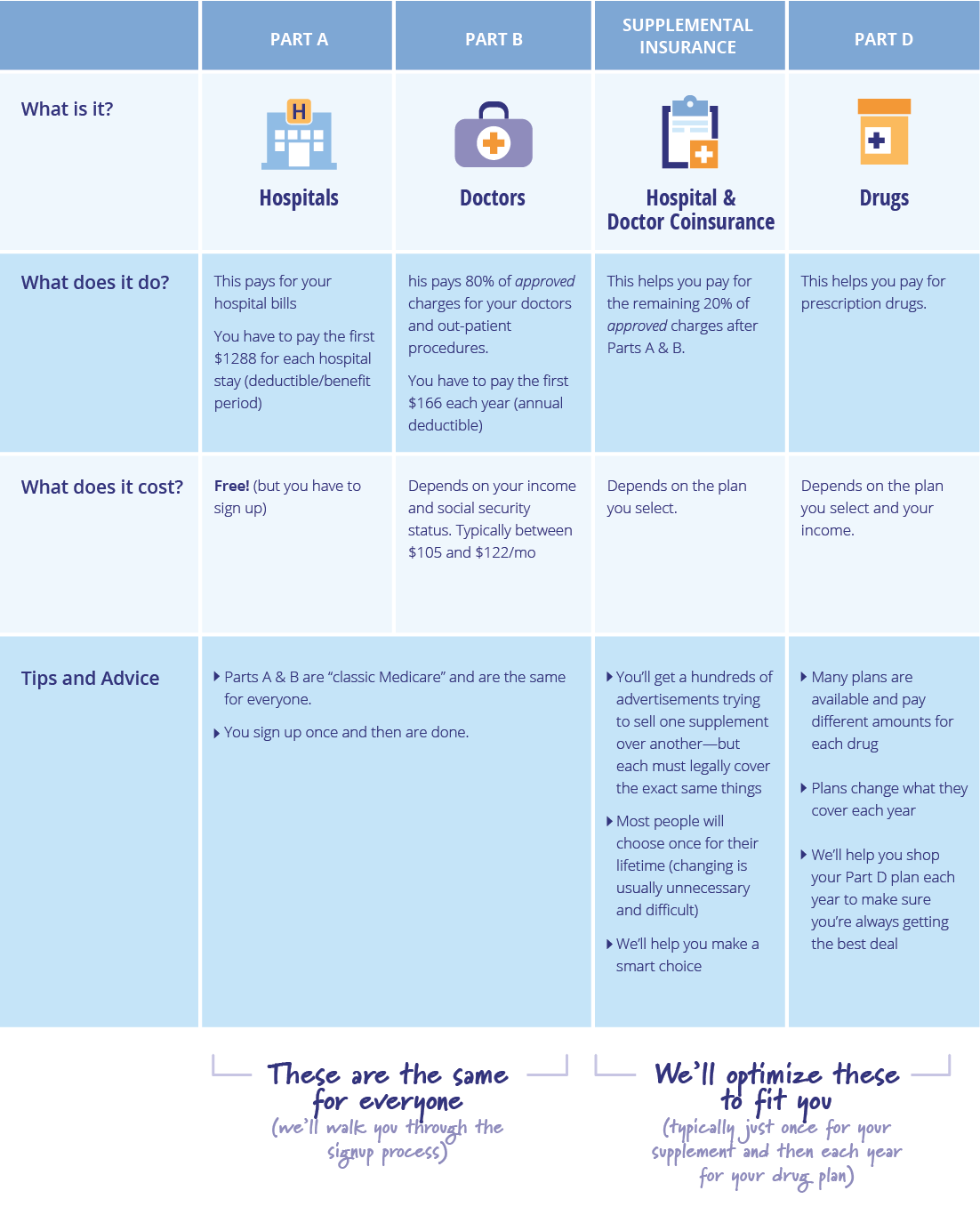

Enrolling In Medicare Part D

Medicare Part D covers prescription drugs. You can add a stand-alone prescription drug plan to augment your Medicare A and B, or you can choose a Medicare Advantage plan that provides all of the benefits of Medicare A and B, plus prescription drugs and often other benefits as well.

Youre first eligible to enroll in Part D when youre first eligible for Medicare. When you apply, you will enroll in a private plan and must enroll during a seven-month period that starts three months prior to the month that you reach age 65. If you dont enroll during this period, you may pay a late-enrollment penalty that will raise your Part D premium when you do decide to purchase coverage .

If youre Medicare-eligible because youre disabled AND youve reached age 65, you can enroll in a Part D plan, switch Part D plans, or drop your Part D plan during this seven-month period.

If youre newly eligible because youre disabled, you can enroll starting 21 months after you began receiving RRB or Social Security benefits and have through the 28th month to enroll . Your Part D coverage will start at the beginning of your 25th month of receiving RRB or Social Security benefits.

And if, later on, you want to change to a different Part D plan, you can do that during Medicares Open Enrollment period that runs from October 15 to December 7 each year.

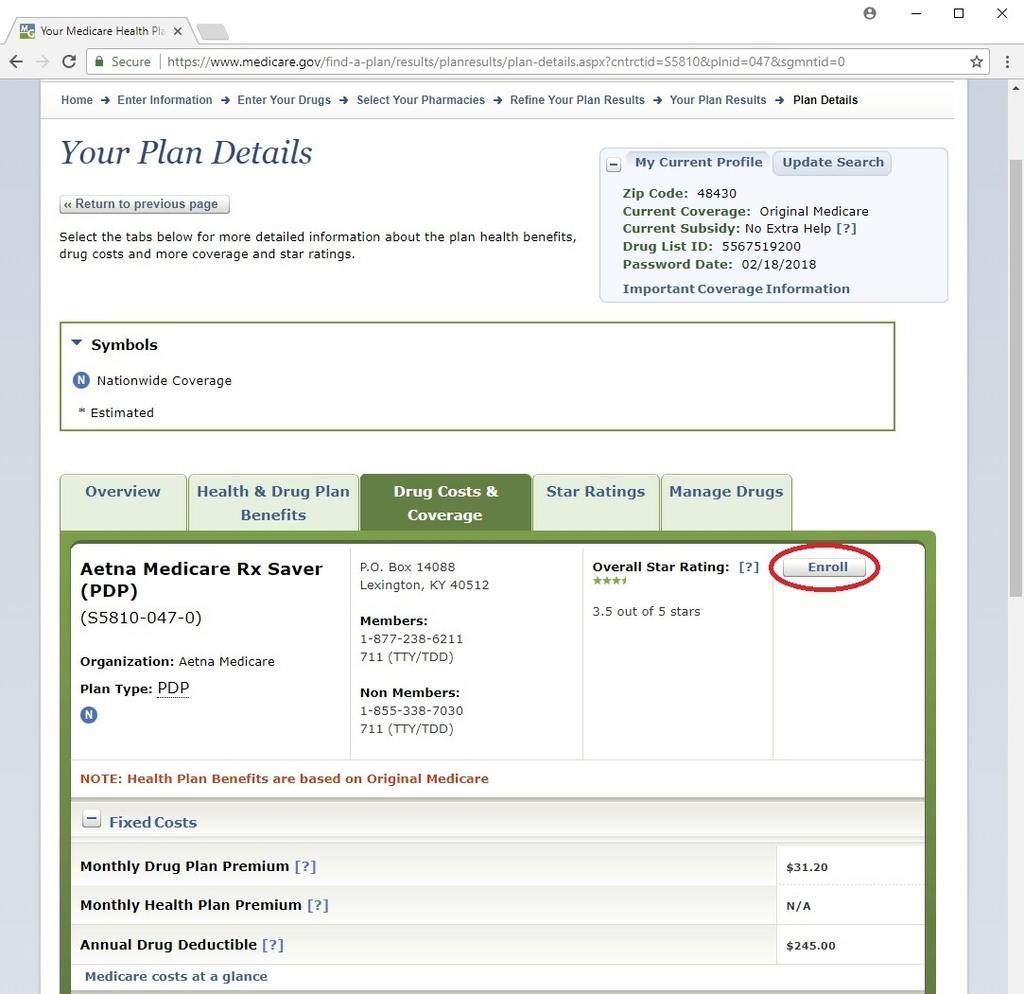

After youve chosen from the various PDP offerings, you can enroll by:

- filling out the paperwork sent by mail from Medicare, or

Don’t Miss: How Much Does Medicare Pay For Diabetic Test Strips

Do I Need To Sign Up For Medicare At 65 If Im Still Working

Q: If Im still working at 65, do I need to enroll in Medicare?

A: Medicare eligibility begins at age 65, and enrolling early might save you money on premiums. However, if youre working at the age of 65, you have a little more leeway.

Your family cannot be added to your Medicare coverage. Once youve enrolled, find out how to make sure they have health insurance.

At the age of 65, you become eligible for Medicare. Your initial enrollment window is a seven-month period that begins three months before and ends three months after your 65th birthday. Seniors are often urged to join up as soon as possible to avoid fines that might be costly in the long run.

If you dont sign up for Medicare in a timely manner, you face a 10% surcharge on your Medicare Part B payments for each year you go without coverage after becoming eligible. If youre still working at 65, though, youll have to follow a new set of restrictions.

Do I Automatically Get Medicare When I Turn 65

Some people automatically get Medicare at age 65, but those numbers have declined as the Medicare and Social Security ages have continued to drift apart.

Most people who automatically get Medicare at age 65 do so because they have been receiving Social Security benefits for at least four months before turning 65. Traditionally, Medicare premiums are deducted from your Social Security check. For the longest time, you could retire with full Social Security benefits at 65 and start on Medicare at the same time.

You are still automatically enrolled in Medicare Part A and Part B at 65 if youre drawing Social Security, but not as many people draw Social Security that early these days because of changes to the eligibility age for full Social Security benefits.

In 2000, the Social Security Amendments of 1983 began pushing back the standard age for full Social Security benefits. The progressive changes are nearing their conclusion: Beginning in 2022, the standard age for full benefits will be 67 for anyone born after 1960.

Besides the Medicare eligibility age of 65, what remains unchanged is that you can opt to begin drawing partial Social Security benefits as early as age 62. So, if you opt for accepting partial Social Security benefits before age 65, you are automatically enrolled in Medicare.

A smaller group of people also automatically get Medicare at age 65: people who receive Railroad Board benefits for at least four months before 65.

Don’t Miss: How Much Can I Make On Medicare

How Does My History Of Receiving Ssdi Affect When Or If I Can Receive Medicare

You typically become eligible for Medicare after 24 months on SSDI. After receiving SSDI for 2 years, you are automatically enrolled in Medicare Part A and Part B. During the 2-year waiting period, you can apply for Medicaid or enroll in a low-cost private health plan through the marketplace at Healthcare.gov. You may be able to keep your Medicaid eligibility once you get Medicare.

Recommended Reading: Is There An Income Limit For Medicare

No Need To Double Up On Coverage

Many seniors are no longer employed by the time they reach 65, so they rush to enroll in Medicare as soon as they can. You dont have to enroll in Medicare right now if youre still working at 65 and have coverage via a group health plan through a business with 20 or more employees. If your company has less than 20 employees, however, you must enroll in Medicare Parts A and B, as this will be your primary insurance. If you dont enroll, your employers health-care plan may pay less or nothing for your care once it learns.

Even if you already have health insurance, its frequently a good idea to enroll in Medicare Part A on time. It will not cost you anything, and Medicare will act as your secondary insurance, covering whatever your primary insurance does not. The only exception is if youre already contributing to a health savings account and want to keep it up. Even if they continue to be covered by an employers HSA-qualified high-deductible health plan, Medicare participants are not permitted to contribute to an HSA.

Don’t Miss: How To Purchase Medicare Insurance

The Cost Equation: Will Medicare Save You Money

If your employer requires you to pay a large portion of the premium on your group health insurance, you may find Medicare cheaper and the coverage adequate. So compare your current coverage and out-of-pocket expenses including premiums, deductibles, copays and coinsurance with your costs and benefits under Medicare, which may also pay some expenses not covered by your group plan.

Do I Need To Enroll At 65 If I Work For A Large Company

As long as you have health insurance from a company that employs 20 or more people where you or your spouse actively works, you can delay enrolling in Medicare until the employment ends or the coverage stops, whichever happens first. Youre entitled to a special enrollment period to sign up for Medicare before or within eight months of losing that job-based coverage to avoid a late-enrollment penalty.

The law. Large employers with at least 20 employees must offer you and your spouse the same benefits they offer younger employees and their spouses. You not the employer can decide whether to:

- Accept the employer health plan and delay Medicare enrollment

- and rely wholly on Medicare

- Have employer coverage and Medicare at the same time

Many people enroll in Medicare Part A at 65, even though they have employer coverage, because its free unless they or their spouse has paid fewer than 40 quarters of Medicare taxes. However, they may decide to wait if they want to continue contributing pretax dollars to a health savings account . More on that later.

Those who have access to employer-based health insurance often delay signing up for Part B while theyre still working. That way, they dont have to pay premiums for both Medicare and the employer coverage.

Be aware. If you choose to enroll in both an employer group plan and Medicare Part B, the employer insurance is always primary when a large company provides it. That means it pays your medical bills first.

Recommended Reading: What Is The Difference Between The Medicare And Medicaid Programs

Medicare Part A: If Its Free Why Not Take It

If by the time you reach 65 youve worked a total of approximately 10 years over your career, youre entitled to premium-free Medicare Part A, which pays for in-patient hospital charges and more.

Why sign up for more hospital insurance when an employer plan already provides good coverage at low cost to you? Because in some cases, Medicare Part A may cover what your employer plan does not.

But as with so many aspects of Medicare, there are caveats, exceptions and potential pitfalls.

If the employer has 20 or more employees: If your or your spouse’s employer has 20 or more employees and a group health plan, you don’t have to sign up for Medicare at 65 if it doesn’t make financial sense.

If the employer has fewer than 20 employees: If your or your spouse’s employer has fewer than 20 employees and the health coverage is not part of a multiemployer group plan, at age 65 you must enroll in Medicare Part A, which will be your primary insurance. Primary means that Medicare pays first, and then the employer insurance kicks in to pay whatever might be covered under that policy but was not covered by Part A.

If you have an HSA and want to keep contributing: If you’re saving to a Health Savings Account and wish to keep doing so, you must delay enrollment in Medicare Part A , because Medicare enrollees can’t contribute to an HSA. In fact, to avoid a tax penalty, you should plan to stop making HSA contributions at least six months prior to signing up for Medicare.

How To Avoid The Late

You might not be getting retirement benefits when you turn 65 because you are still working. In this case, you will have to sign up for Medicare coverage options when you retire and lose your employer health care coverage. When your employer coverage ends, you may have a special enrollment period to sign up for Medicare Part B without receiving a late-enrollment penalty.

Generally your monthly premium for Part B may go up 10% for each full 12-month period that you could have had Part B but didnât sign up for it. Similarly, your Part A monthly premium may go up by 10% if you didnât enroll when you were first eligible. However, most people qualify for premium-free Part A and therefore are also exempt from the Medicare Part A late-enrollment penalty.

You May Like: Does Medicare Cover Inspire Sleep

Already Enrolled In Medicare

If you have Medicare, you can get information and services online. Find out how to .

If you are enrolled in Medicare Part A and you want to sign up for Part B, please complete form CMS-40B, Application for Enrollment in Medicare Part B . If you are applying for Medicare Part B due to a loss of employment or group health coverage, you will also need to complete form CMS-L564, Request for Employment Information.

You can use one of the following options to submit your enrollment request under the Special Enrollment Period:

Note: When completing the forms CMS-40B and CMS-L564:

- State I want Part B coverage to begin in the remarks section of the CMS-40B form or online application.

- If possible, your employer should complete Section B.

- If your employer is unable to complete Section B, please complete that portion as best as you can on their behalf and submit one of the following forms of secondary evidence:

- Income tax form that shows health insurance premiums paid.

- W-2s reflecting pre-tax medical contributions.

- Pay stubs that reflect health insurance premium deductions.

- Health insurance cards with a policy effective date.

- Explanations of benefits paid by the GHP or LGHP.

- Statements or receipts that reflect payment of health insurance premiums.

Some people with limited resources and income may also be able to get .

When Your Coverage Starts

The date your coverage starts depends on which month you sign up during your Initial Enrollment Period. Coverage always starts on the first of the month.

If you qualify for Premium-free Part A: Your Part A coverage starts the month you turn 65.

Part B : Coverage starts based on the month you sign up:

|

If you sign up: |

|

|---|---|

|

1 month after you turn 65 |

In 2022: 2 months after you sign up Starting January 1, 2023: the next month |

|

2 or 3 months after you turn 65 |

In 2022: 3 months after you sign up Starting January 1, 2023: the next month |

Also Check: Does Medicare Pay For Home Care Services

You’re Still Working And Have Access To A Group Health Plan

Just because you’re turning 65 doesn’t mean you’re on the cusp on retirement. You may still have plans to work another few years — or longer.

If you have access to a group health insurance plan through your employer, and you’re happy with that coverage, then enrolling in Medicare doesn’t make sense — especially if it will cost you more than what you currently pay for insurance. As long as your company’s group health plan covers 20 or more people, you won’t face penalties for missing your initial Medicare enrollment window. Rather, you’ll get a special enrollment period that will begin once you no longer have your group health plan.

Now if you still have access to a great health plan but are turning 65, you may want to consider signing up for Medicare Part A, which covers hospital care. Part A, unlike Part B, is generally free for enrollees. And if you put that coverage in place, Part A can be your secondary insurance for hospital care — and potentially pick up costs that your primary insurance doesn’t cover.

The only caveat here is that once you enroll in any part of Medicare — whether it’s coverage you pay for or not — you’ll no longer be eligible to participate in a health savings account . HSAs offer a number of tax breaks, so if you’re currently funding one, you may want to hold off on signing up for Medicare — even Part A.

Can You Get Private Insurance Instead Of Medicare

If you have Medicare Part A or Part B, insurers generally arent allowed to sell you a traditional individual health insurance plan .

You can purchase individual health insurance if youve never enrolled in Medicare because you think the overall costs are too high. If youre in the unusual situation of paying for Part A premiums, you can also switch to individual health insurance.

If you develop a medical condition before turning 65 that would qualify you for Medicare, such as ESRD, you can decline to purchase Medicare.

If you decide to purchase private insurance once youre eligible for Medicare unless youre continuing the employer-sponsored insurance that qualifies you for a Special Enrollment Period then youll have to pay the costly late enrollment penalty once you do apply.

If youre nearing the age of 65, then its important you start considering your Medicare coverage.

Also Check: Does Medicare Have Open Enrollment

Who Can Delay Signing Up For Medicare

So, whose insurance remains the primary payer? In a nutshell, if you have coverage through your or your spouse’s current employment, and the employer has 20 or more employees, your insurance plan remains the primary payer.

If you aren’t sure if your employer meets the “group health coverage” criteria, ask your employer’s benefits manager.

If you do qualify, you can delay signing up for Medicare for as long as you are still working. Once the employment or your employer-based health coverage ends, you’ll have eight months to sign up for Medicare Part B without paying a penalty, which is a permanently higher premium.

It’s also important to note that regardless of whether you’re still working or not, if you’ve already signed up for Social Security benefits, you’ll be automatically enrolled in Medicare Parts A and B when you turn 65. If you don’t want to keep Part B, you’ll need to cancel it .