What Youll Pay For Medicare Part A

Most people dont pay a premium for Medicare Part A. Youll get premium-free Part A if you or your spouse worked and paid Medicare taxes for 10 years. If you have to pay a premium, youll pay as much as $499 per month, depending on how long you or your spouse worked and paid Medicare taxes.

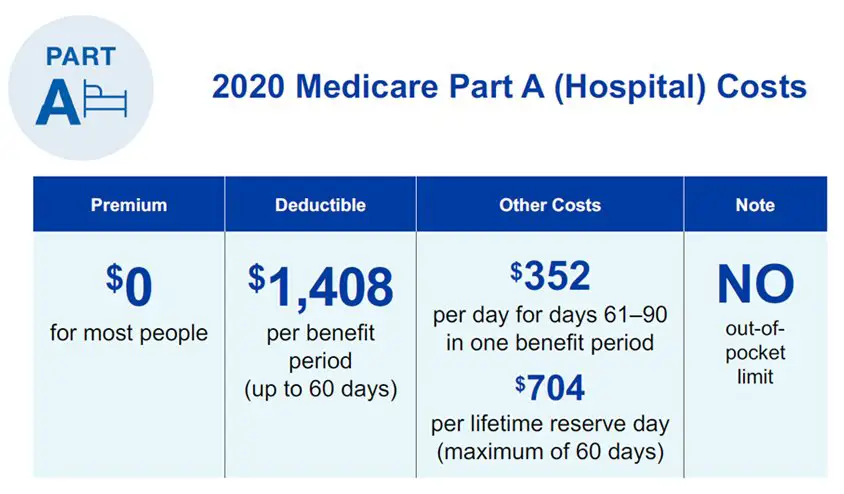

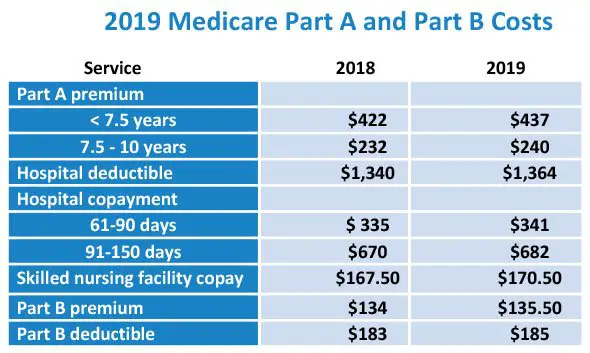

Medicare Part A also has a deductible, or amount you must pay before your insurance starts paying its share. In 2022, it’s $1,556 for each benefit period. Depending on the length of your hospital stay, you may also be responsible for paying coinsurance.

What Is The Average Cost Of Medicare Part D Prescription Drug Plans

In 2022, the average monthly premium for a Medicare Part D plan is $47.59 per month.1

Medicare Part D plan provide coverage solely for prescription medications. Part D plan costs may vary based on your plan and your location.

Learn about the average cost of Part D plans in your state.

You can also compare Part D plans available where you live and enroll in a Medicare prescription drug plan online in as little as 10 minutes when you visit MyRxPlans.com.2

Depending on your income, you may be required to pay a higher Part D premium. As with Medicare Part B premiums, this adjusted amount is called the IRMAA .

If you are required to pay a higher Part D premium, it will be based on your reported income from two years ago .

Medicare Part D IRMAA|

More than or equal to $500,000 |

More than or equal to $750,000 |

More than or equal to $409,000 |

$77.90 + your plan premium |

Medicare Part B Coinsurance

Coinsurance is a cost-sharing term that means insurance pays a percentage and you pay a percentage. With Medicare Part B, you pay 20 percent of the cost for the services you use. So if your doctor charges $100 for a visit, then you are responsible for paying $20 and Part B pays $80.

There is no limit on Part B coinsurance costs, which could add up if you have a lot of doctor visits or need other services.

With a Medicare Advantage plan, your costs will be different and may include copays for doctor visits or other services. However, your out-of-pocket costs are limited to the annual plan maximum. Once youve paid that amount, the plan pays 100 percent for Medicare-covered services through the end of the year.

If Medicare costs are a concern, you may want to take advantage of financial protection and other benefits offered by Medicare Advantage plans.

Footnote

Also Check: How Long Does It Take To Get Medicare After Applying

How Much Do Medicare Part A And Part B Cost In 2022

Part A and Part B of Medicare have standardized costs that are the same across every state.

- Most people qualify for premium-free Part A. To qualify for premium-free Part A, you or your spouse must have worked and paid Medicare taxes for the equivalent of 10 years . Those 40 quarters do not have to be consecutive.

- If you pay a premium for Part A, your premium could be up to $499 per month in 2022.If you paid Medicare taxes for only 30-39 quarters, your 2022 Part A premium will be $274 per month. If you paid Medicare taxes for fewer than 30 quarters, your premium will be $499 per month.

- The standard Part B premium is $170.10 per month in 2022.Some beneficiaries may pay higher premiums for their Part B coverage, based on their income. This change in cost is called the IRMAA .

Find out whether you are required to pay a Medicare IRMAA in 2022.

Read additional medicare costs guides to learn more about Medicare costs and how they will affect you.

Can You Change How You Pay For Medicare

If you have Social Security benefits, your Part B premiums will be automatically deducted from them. If you dont qualify for Social Security benefits, youll get a bill from Medicare that youll need to pay via:

- Your online Medicare account

- Medicare Easy Pay, a tool that lets you automatically transfer monthly payments

- Online bill pay through your bank account

- Check, money order, or credit card payment

If you are having trouble paying your bill, you can contact someone at Medicare for help.

Medicare Advantage and Part D premiums arent automatically deducted from your Social Security benefits, so youll typically receive a bill and pay the insurer directly. If youd prefer to have your premiums for these plans deducted from your benefits check, you can contact your insurer to request this change.

Recommended Reading: Are Grab Bars Covered By Medicare

B Premiums And Medicare Advantage

You can elect to have Original Medicare or a Medicare Advantage plan. Medicare Advantage plans are offered by private insurance companies and will cover everything that Original Medicare offers and more.

Even if you decide on a Medicare Advantage plan and pay premiums to the insurance company, you still have to pay Part B premiums to the government. You must take that added cost into consideration.

How Much Will Medicare Cost In 2022

Find Cheap Medicare Plans in Your Area

For all Medicare plans, costs will vary depending on what plans you decide to purchase, the company you purchase your plan from, your income and sometimes your age. For this reason, you should carefully balance your coverage needs and the costs of the plans when choosing the right mix of Medicare policies.

Recommended Reading: How Do I Find Medicare Number

Medicare Part D Prescription Drug Coverage

What it helps cover:

- Medicare Part D helps cover prescriptions drugs.

- Plan premiums, the drugs that are covered, deductibles, coinsurance and copays will vary by plan, so you should check and compare plans each year based on your needs, the prescription drugs you take, etc.

What it costs:

- Like Medicare Advantage , prescription drug plans are offered by private insurance companies contracted by the federal government.

- Plans vary in cost, coverage, deductibles and copays.

Original Medicare Part B Medical Coverage

What it helps cover:

What it costs:

- Most 2021 Medicare members must pay a monthly premium of $148.50.

- If you don’t enroll in Medicare Part B as soon as you are eligible, you could be assessed a late enrollment penalty when you do enroll.

- The penalty could be as high as a 10% increase in your premium for each 12-month period that you were eligible but not enrolled.

Other Part B costs:

- There is a $203 annual deductible for Medicare Part B in 2021. After the deductible, youll pay a 20% copay for most doctor services while hospitalized, as well as for DME and outpatient therapy.

- There is a 20% copay of the Medicare-approved amount for doctor visits to diagnose a mental health condition after the deductible.

- If you receive these services at a hospital outpatient department or clinic, additional copays or coinsurance amounts may apply.

Recommended Reading: What Is The Medicare Out Of Pocket Maximum

How Much Does Entresto Cost With Medicare

In 2022, the manufacturer of Entresto states that around 80% of individuals with Medicare Part D prescription drug plans pay less than $50 per month in out-of-pocket costs for Entresto, and over 50% of people with Medicare Part D pay $10 or less for their Entresto prescription each month. Thats a significant saving compared to uninsured individuals who pay the full list price of $623.69 for Entresto, as stated on the manufacturers website.

The amount an individual pays for Entresto with prescription insurance coverage depends on various factors such as:

- the type of Medicare coverage

- the formulary tier

- whether the individual has reached their annual deductible amount

- coinsurance or copayments

How Does Medicaid Expansion Affect State Budgets

Expansion has produced net savings for many states, according to the Center on Budget and Policy Priorities. Thats because the federal government pays the vast majority of the cost of expansion coverage, while expansion generates offsetting savings and, in many states, raises more revenue from the taxes that some states impose on health plans and providers.

Also Check: How Do I Lookup My Medicare Provider Number

Premiums Paid By Medicare Advantage Enrollees Have Declined Since 2015

In 2022, the average enrollment weighted MA-PD premium, including among those who do not pay a premium, is $18 per month. However, average MA-PD premiums vary by plan type, ranging from $16 per month for HMOs to $20 per month for local PPOs and $49 per month for regional PPOs. Nearly 6 in 10 Medicare Advantage enrollees are in HMOs , 38% are in local PPOs, and 3% are in regional PPOs in 2022. Regional PPOs were established to provide rural beneficiaries with greater access to Medicare Advantage plans.

Average MA-PD premiums have declined from $36 per month in 2015 to $18 per month in 2022. The reduction is driven in part by the decline in premiums for local PPOs and HMOs, that account for a rising share of enrollment over this time period. Since 2015, a rising share of plans are bidding below the benchmark, which enables them to offer coverage without charging an additional premium. More plans are bidding below the benchmark partly because Medicare Advantage benchmarks relative to traditional Medicare have increased over time, and when benchmarks increase, plans are able to keep more for Part A and B services as well as for extra benefits. Further, rebates paid to plans have increased over time, and plans are allocating some of those rebate dollars to lower the part D portion of the MA-PD premium. Together, these trends contribute to greater availability of zero-premium plans, which brings down average premiums.

What Affects Medicare Part D Costs Each Year

Several factors can play into determining the cost of a Medicare Part D plan, such as:

- Drug formularyEach Medicare Part D plan contains a formulary, which is a list of drugs covered by the plan. Covered drugs are divided up into different tiers. Generic drugs are typically on lower tiers and cost less, while brand name drugs and specialty drugs are typically on higher tiers and cost more.

- Local competitionMedicare Part D plans are sold by private insurance companies. These insurance companies are generally free to set their own premiums for the plans they sell. Medicare Part D plan costs in any particular area may depend partly on the cost of other plans being sold in the same area by competing carriers.

- Cost-sharingSome Medicare Part D plans have deductibles and copayments or coinsurance. The cost of your Part D premium may depend on the amounts of coinsurance or copayments you pay with your plan, as well as whether or not your plan has a deductible.

Your Part D deductible is the amount that you must spend out of your own pocket for covered drugs in a calendar year before the plan kicks in and begins providing coverage.

Copayments and coinsurance are the amounts that you must pay once your plans coverage does begin.

A copayment is usually a fixed dollar amount while coinsurance is most often a percentage of the cost . Plans might have different copayment or coinsurance amounts for each tier of drugs.

Recommended Reading: Who Provides Medicare Advantage Plans

How Much Does Medicare Cost In 2022

- Part A: Most people can get Medicare Part A for a zero-dollar premium.

- Part B: Medicare Part B has a standard monthly premium of $170.10 in 2022.1

- Part C: Medicare Part C has an average monthly premium of $19 in 2022.2

- Part D: Medicare Part D stand-alone plans are projected to have an average monthly premium of $33.3

There are four different parts of Medicare labeled A and B , C , and D . Each comes with its own set of expenses.

Lets take a closer look with a detailed breakdown of the costs associated with each part of Medicare.

How Much Do Prescriptions Cost With Medicare

Its no secret that prescription payments are a common worry today. Naturally, those worries will linger when it comes to enrolling in Medicare and completing monthly payments. This is where Medicare Part D comes in handy.

Part D provides two options, given that youre already enrolled in Parts A and B. One is a prescription drug plan that can come through private insurance plans like Priority Health Medicare Advantage plans. The other is a stand-alone prescription drug plan . While the exact price of monthly premiums for these plans vary by provider, most will provide a formulary list that can tell you what specific drugs might be covered, which is another great way to get clear-cut answers for your health plan. If youre a Priority Health member, you can also use the Cost Estimator tool to help estimate potential costs for prescriptions and other specific services.

Also Check: Does Medicare Part A And Part B Cover Prescriptions

When Do You Have To Pay For Medicare

If you dont qualify for premium-free Part A coverage, youll need to pay a monthly premium. Youll also have to pay a premium if you sign up for Part B, which is optional.

If you receive Social Security benefits, youll have these premiums automatically deducted from your checks. Medicare will bill you directly if you arent collecting Social Security.

If you sign up for Parts C and D, youll also need to pay premiums for those plans. If you receive Social Security benefits, you can request that the premiums be deducted from your checks, but this wont happen automatically. If you dont receive benefits, youll get a bill from Medicare for Part D and from the insurer for Part C.

B Premiums And Social Security

You cannot be expected to pay more for Medicare if there is not also a proportionate rise in Social Security benefits. The hold harmless provision of the Social Security Act protects recipients from paying higher Medicare Part B premiums if those premiums will cause their Social Security benefits to be lower than they were the year before.

Simply put, increases in Part B premiums cannot exceed the annual cost-of-living adjustment for Social Security.

In those cases, the Medicare Part B premium will be decreased to maintain the same Social Security benefit amount. However, keep in mind that the hold harmless provision does not apply to Medicare Part D. If the Medicare Part D Income-Related Monthly Adjustment Amount increases, a beneficiary may still see a decrease in their overall Social Security benefits.

Not everyone is eligible for the hold harmless provision. Only people in the lowest income category who have already been on Medicare Part B and have had their premiums directly deducted from their Social Security checks for at least two months in the past year are considered. Beneficiaries new to Medicare and people on Medicaid will be subjected to the current premium rate.

The Social Security cost-of-living adjustment for 2022 is 5.9%. This is estimated to be an additional $92 per month for the average recipient. This amount would be able to cover the rise in Medicare premiums in the new year.

For those who are dual eligible, Medicaid will pay their Medicare premiums.

Recommended Reading: When Can You Get Medicare At What Age

Costs For Medicare Part A

For many, Medicare Part A has a $0 monthly premium. However, depending on how many quarters you paid Medicare tax in the U.S. you may pay a premium of $274 each month or $499 each month. The price you pay is based on the number of years you pay Medicare tax.

Get A Free Quote

| 0-29 | $499 |

In addition to the monthly premium, you will also pay the Medicare Part A deductible for each new benefit period you use Medicare Part A benefits. The Medicare Part A deductible in 2022 is $1,556.

Is Medicare Supplement Plan G Worth It

Plan F is the most inclusive of the different Medigap plans. However, who can enroll has changed beginning in 2020. These changes are because Medigap plans sold to those new to Medicare can no longer cover the Medicare Part B deductible, which is included in Plan F.

Those who already have Plan F or were new to Medicare prior to January 1, 2020 may still have a Plan F policy.

Plan G may be a good option if you are new to Medicare and cant enroll in Plan F. The only difference in coverage between the two is that Plan G doesnt cover the Medicare Part B deductible.

You can first buy a Medigap policy during Medigap open enrollment. This is a 6-month period that starts the month youre age 65 or older and have enrolled in Medicare Part B.

Other enrollment guidelinesassociated with Medigap include:

- Medigap policies only cover one person, so your spouse will need to buy their own policy.

- Federal law doesnt require that companies sell Medigap policies to those under age 65. If youre under age 65 and eligible for Medicare, you may not be able to purchase the Medigap policy that you want.

- You cannot have both a Medigap policy and a Medicare Part C policy. If you want to purchase a Medigap policy, youll have to switch back to original Medicare .

- Medigap policies cannot cover prescription drugs. If youd like prescription drug coverage, youll need to enroll in a Medicare Part D plan.

Also Check: How Much Does Medicare Cost At Age 62