Best For Discounts: Blue Cross Blue Shield

Blue Cross Blue Shield

-

Also offers dental, hearing, vision, and Part D plans

-

Few states with High-Deductible Plan F

-

Rates increase based on age

Founded in 1929, Blue Cross Blue Shield was the first insurance company to manage Medicare claims in 1966. BCBS is the umbrella company for Anthem, CareFirst, Highmark, and The Regence Group. Altogether, BCBS offers Plan F in 43 states, excluding Alabama, Arkansas, Hawaii, Massachusetts, Minnesota, North Carolina, and Wisconsin. High-Deductible Plan F is available in 14 states: Alaska, Delaware, Illinois, Maryland, Michigan, Montana, New Mexico, New York, North Dakota, Oklahoma, Pennsylvania, South Carolina, Texas, and West Virginia.

Because several independent companies work under the BCBS name, there is no go-to contact number to call to enroll in Medicare Supplement Plan F. When you enter your ZIP code on its website, BCBS directs you to the appropriate company in your state.

What makes BCBS stand out is its breadth of insurance options. Not only does it offer Plan F, but it also offers dental, hearing, and vision coverage, in addition to 4- to 5-Star Medicare Part D prescription drug plans that can maximize your coverage options under Original Medicare. Like most companies, its pricing for Medigap is based on an attained-age model in which rates increase based on your age.

How Does Medicare Part F Compare To Other Medsup Plans

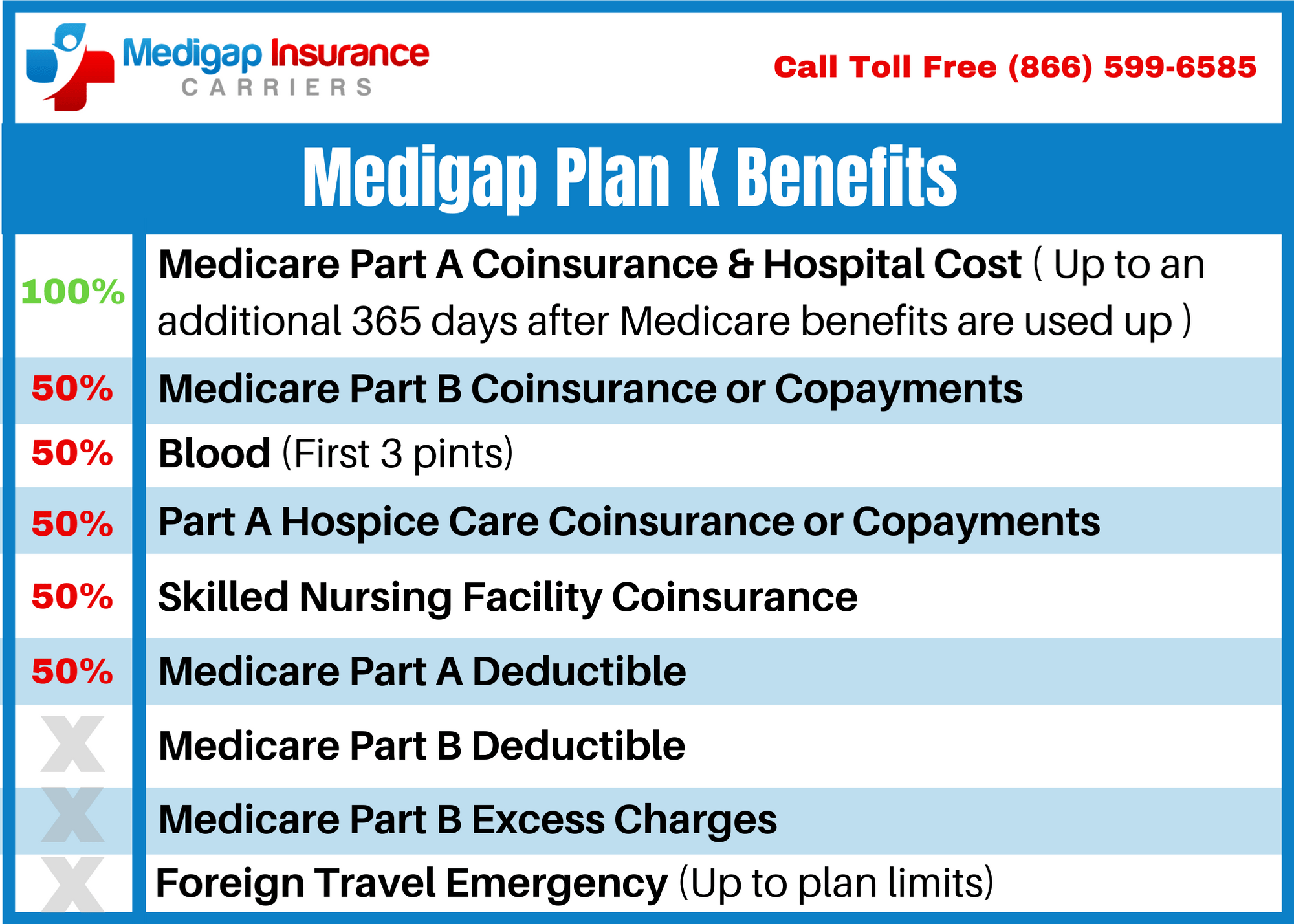

Going into detail about how Medicare Part F compares to the nine other available MedSup plans might be a bit overwhelming. So, lets focus on how it compares to another popular Medicare Supplement policy, which some call Medicare Part G.

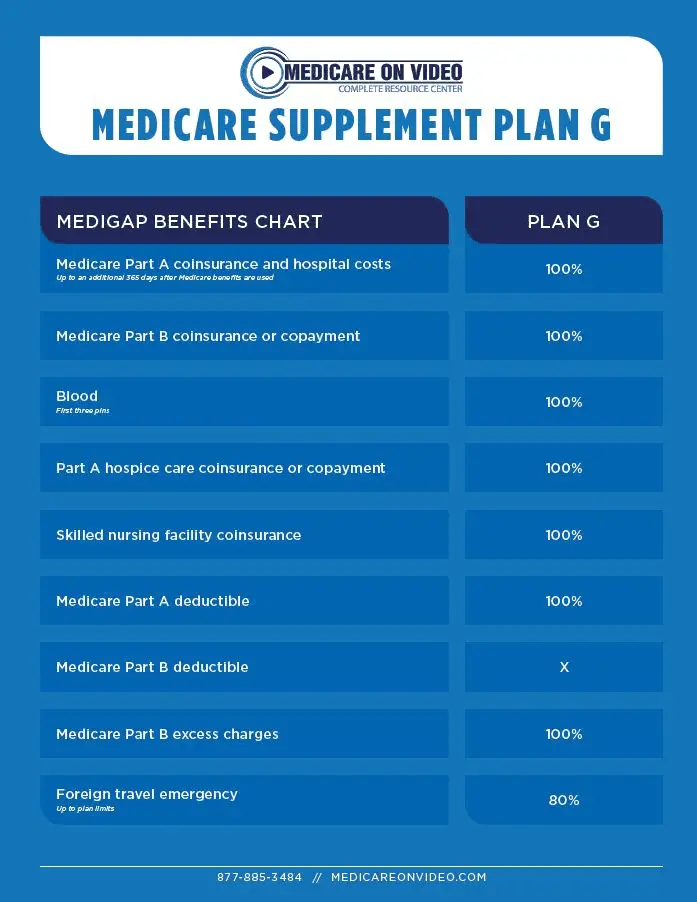

The only way MedSup Plan F differs from Plan G is that Plan F pays your Medicare Part B deductible while Plan G does not. All other benefits are the same between these two MedSup plans.

Both Plan F and Plan G cover Medicare Part B excess charges, by the way. Theyre the only two Medicare Supplement policies that pay these fees. If having low out-of-pocket expenses is important to you, you might want to pick MedSup Plan F or G over the eight other plans insurers sell.

Keep the similarities between MedSup Plan F and G in mind if you only recently signed up for Medicare. People who became eligible for Medicare on or after Jan. 1, 2020, can no longer enroll in MedSup Plan F. If youre one of those people, MedSup Plan G might be a good alternative for you.

Best For User Experience: Cigna

Cigna

-

Household discounts

-

User-friendly website and mobile apps

-

Also offers Part D plans

-

Rates increase based on age

-

Rates not available without a quote

Founded in 1792 as an insurance company, Cigna ventured into health care in 1912 and remains a leader in the industry. It offers Plan F in 46 states, excluding Massachusetts, Minnesota, New York, and Wisconsin, and offers High-Deductible Plan F in 30 states, excluding the aforementioned states as well as Alaska, Arkansas, Delaware, Hawaii, Indiana, Maine, Montana, Nebraska, North Dakota, Oregon, Pennsylvania, Rhode Island, South Carolina, Washington, West Virginia, and Wyoming.

To request a quote or enroll in Cigna Plan F, call the company or fill out the form on its website that requires basic personal information, including your start dates of Medicare Parts A and B. Plans vary based on your age, gender, medical conditions, and address.

The plans are based on an attained-age model in most states it services. Under this format, prices increase regularly based on your age. Cigna has several plans to meet your needs if you are also looking for a Medicare Part D plan to round out your Medicare coverage.

Cost-wise, Cigna is competitive. In all states except for Hawaii, Idaho, Minnesota, and Vermont, it offers further savings with a 7% household discount on monthly premiums when two or more enrollees live together. In Washington, the discount only applies to spouses.

Don’t Miss: Do You Have To Start Medicare At 65

Who Can Enroll In Plan F

Any Medicare beneficiary who was Medicare-eligible prior to January 1, 2020, can enroll in Plan F. If you are within the first six months of having enrolled in Medicare Part B, you are able to enroll in Plan F under the guarantee issue period.

If your 6-month period has ended and you dont qualify for a Special Enrollment Period you can apply to enroll in Plan F by completing an application that asks about your health history. The insurance company can decline your application and/or request medical records to determine whether it will accept you.

Why Should I Enroll In A High

High-deductible Plan F policies usually have lower premiums than standard Plan F policies. As a result, if you need or want to keep your monthly payments to a minimum, this might be your best option as far as Medicare Supplement policies are concerned.

Just know that youll have to deal with higher out-of-pocket costs if you get sick or otherwise need medical care. Given that, people who are fairly healthy are the best candidates for high-deductible Medigap Plan F coverage.

Also Check: What Is A Medicare Physical Exam

Best For Cost And Overall Price Transparency: Aetna

Aetna

-

Highest household discounts

-

Also offers dental, vision, and Part D drug plans

-

Rates available online

-

Cannot enroll online

-

Rates increase based on age

Founded in 1853 as a life insurance company, Aetna entered the healthcare market in 1899. Now a subsidiary of CVS Health Corporation, these two reputable companies work together to bring you a well-rounded healthcare experience. Aetna offers Plan F in 35 states, excluding Alaska, Connecticut, Hawaii, Maine, Massachusetts, New York, Washington, Washington D.C., and Wisconsin.

High-Deductible Plan F is also available in 35 states: Alabama, Arizona, Arkansas, California, Delaware, Georgia, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maryland, Michigan, Mississippi, Montana, Nebraska, Nevada, New Jersey, New Mexico, North Carolina, North Dakota, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, and Wyoming.

Enrolling in Medicare Supplement Plan F is easy, and if you also need to plan for the prescription drug plan, it offers many that rate four stars or higher on the Medicare 5-Star Rating System. To enroll, you must reach out to a representative by phone. Its rate for Plan F was the lowest we found, starting at $142 per month for a 66-year-old man. Rates may vary based on age, preexisting medical conditions, and where you live.

How Can I Lower The Costs Associated With My Medicare Part F Plan

One way to lower what you pay for Medicare Supplement Part F is to move to an area where this kind of coverage costs less than it does where you live now.

Not many people are going to go to such lengths to save a few dollars a month, though, so here are a handful of other options for cutting your MedSup Plan F costs:

- Shop around. Different insurers charge different amounts for the same MedSup plan, so you could save some money by getting quotes from several companies.

- Ask the insurance companies that serve your area if they offer any discounts on these plans.

- Quit smoking.

Read Also: Do Medicare Advantage Plans Include Part B

Is Medicare Plan F Going Away What You Need To Know

Medicare Plan F is the most comprehensive Medicare Supplement plan, but starting in 2020 the plan will not be available to everyone enrolled in Original Medicare.

Everyday Health may earn a portion of revenue from purchases of featured products.Shutterstock

Comparing Medicare Supplement plans to find the right fit for you? If youre enrolled in Original Medicare Part A and Part B, you might have considered purchasing the common Medicare Supplement insurance plan, Medicare Plan F.

According to AARP, Medicare Supplement Plan F provides the most coverage, and as a result, its the most popular plan among those eligible for Medicare. But with recent changes, Plan F is no longer available to everyone as of January 1, 2020.

What Is The Average Cost Of Medicare Supplement Insurance Plan F

by Christian Worstell | Published December 16, 2020 | Reviewed by John Krahnert

Medicare Supplement Insurance Plan F offers the most benefits of any of the 10 standardized Medigap plans available in most states.

Some Medicare beneficiaries might assume that Plan F is also the most expensive, but an examination of the average cost of Medigap plans reveals otherwise.

Don’t Miss: Can You Sign Up For Medicare Part B Anytime

Do Medigap Plans Cover Pre

The best time to buy a Medicare Supplement Insurance plan is during your Medigap open enrollment period. During your open enrollment period, insurance companies cannot consider any pre-existing conditions when deciding whether or not to offer you a policy. They also cannot charge you more for a Medigap plan based on pre-existing conditions.

Your Medigap open enrollment period only lasts for six months. It begins as soon as you are at least 65 years old and enrolled to receive Medicare Part B benefits.

If you need help understanding the basic benefits for any policy, there are state specific agencies that offer free assistance to help answer your questions.

Once you compare the basic benefits available through Medicare Supplement Insurance plans, connect with a licensed agent to get a free quote for plans in your area.

When Can I Enroll In Medicare Plan F

You can sign up for a Medicare Supplement plan at any time, as long as you are eligible. Although, the best time to sign up for Plan F is during your one-time Medigap Open Enrollment Period. If you apply outside of this window or do not have guaranteed issue rights, youll need to answer underwriting eligibility questions and wait for application approval.

Don’t Miss: How Much Is Medicare Gap Insurance

Best Discounts For People New To Medicare: Aarp By Unitedhealthcare

AARP by UnitedHealthcare

-

Rates do not increase based on age

-

Also offers Part D drug plans

-

No High-Deductible Plan F

-

Requires dues for AARP membership

UnitedHealth Group was founded in 1977, and its insurance arm, UnitedHealthcare, has been in partnership with AARP since 1997. Combining quality healthcare offerings with one of America’s largest advocacy groups for people over 50, AARP by UnitedHealthcare Medicare Supplement Plans are highly ranked. It offers Plan F, but not High-Deductible Plan F, in all states except for Massachusetts, Minnesota, and Wisconsin.

Enrollment in Medicare Supplement Plan F requires AARP membership, which is $16 unless signing up for automatic renewal, making it $12. Membership comes with added perks, including financial planning services, shopping discounts, and more. Once you are a member, you can reach out to UnitedHealthcare to sign up for Plan F and, if you’re interested, one of the company’s highly-rated Medicare Part D plans for prescription drug coverage.

Reach out to a representative seven days a week, or chat with an agent online at its website. The site is easy to use and provides a wealth of information about Medicare and Medicare Supplement Plans. The company did not provide a quote to us over the phone because we were not applying for a plan.

UnitedHealthcare offers several discounts, so be sure to ask for available discounts when you sign up to save even more on Plan F.

Explore Your Medicare Supplement Options With Healthmarkets

The Medicare Plan F vs. Plan G decision doesnt have to be complicated. HealthMarkets can help you get the right Medicare Supplement plan for your needs. Best of all, this service comes at no cost to you. Compare plans online today or call to speak with a licensed insurance agent.

48182-HM-1121

* The cost of Plan G premiums will vary by state, age, sex, and tobacco use.

1.How to compare Medigap policies. Medicare.gov. Retrieved from https://www.medicare.gov/supplements-other-insurance/how-to-compare-medigap-policies. Accessed on November 10, 2021. | 2.Medicare costs at a glance. Medicare.gov. Retrieved from https://www.medicare.gov/your-medicare-costs/medicare-costs-at-a-glance. Accessed on November 10, 2021. | 3.Supplement Insurance plans in Florida. Medicare.gov. Retrieved from https://www.medicare.gov/medigap-supplemental-insurance-plans/#/m/plans?fips=12083& zip=32162& year=2022& lang=en. Accessed on November 10, 2021.

Don’t Miss: Who Can Get Medicare Insurance

How We Chose The Best Medicare Supplement Plan F Companies

When we began assembling the best Medicare Supplement Plan F companies and providers, the very first thing we looked at was the geographic range of service areas. The plans here are available in at least 40 states. From there, we compared prices, website ease of use, availability of information and assistance, and the overall level of coverage that comes with the plan.

Where Can You Buy Medicare Supplement Plan F

Private insurance companies sell Medigap policies. You can use Medicares search tool to find out which plans are offered in your area. Youll need to enter your ZIP code and select your county to see available plans. Each plan will be listed with a monthly premium range, other potential costs, and what is and isnt covered.

You can also look at the companies that offer each plan and how they set their monthly premiums. Because the cost of a Medigap policy can vary by company, its very important to compare several Medigap policies before selecting one.

Don’t Miss: How Do I Apply For Medicare Part A

Disadvantages Of Medigap Plan F

On the downside of this plan option, its large amount of coverage can be costly and have high monthly premiums. Also, if youre newly eligible for Medicare as of January 1, 2020, or later, you will not be eligible to buy this plan, as it is being phased out for new enrollees.

Tips for shopping for a Medigap plan

Follow the tips below while shopping for a Medicare supplement plan:

- Pick a plan. There are several Medicare supplement plans to choose from. The extent of coverage can vary by plan. Review your health-related needs to decide on one thats right for you.

- Compare policies. Once youve decided on a plan, compare the policies offered by different companies, as costs can vary. Medicares website has a helpful tool to compare the policies offered in your area.

- Consider premiums. Providers can set their premiums in different ways. Some premiums are the same for everyone, while others may increase based on your age.

- Remember high deductible options. Some plans have a high deductible option. These plans often have lower premiums and may be a good choice for someone who doesnt anticipate a lot of medical expenses.

Is Medicare Plan F Going Away

Starting in January 2020, new enrollees will not be able to purchase Medigap Plan F. However, if you were eligible for Original Medicare before 2020 then you would still be allowed to enroll and keep your current Plan F policy. Furthermore, Plan F is still one of the best Medicare Supplement plans available on the market. The change is due to legislation in Congress focused on giving doctor better pay when they provide services to a Medicare patient.

Don’t Miss: How To Apply For Medicare In San Diego

What Are The Costs For The High

Costs for the high-deductible Plan F may also include monthly premiums, which are usually lower than the premiums for the standard plan because of the higher deductible amount. If you choose this option, youll need to pay for all out-of-pocket Original Medicare costs until you reach a designated amount , before your policy pays anything.

You may be able to find other Medigap plans with lower premiums than Plan F. But if you see your doctor frequently, need many health-care services, or face high out-of-pocket costs, Plan F generally gives you the most help with Original Medicare costs.

Medicare Supplement insurance pricing can vary by company, and you may wish to consider all the available options in your area to find the right price point. A good time to enroll is during the Medicare Supplement Open Enrollment Period, which is a six-month period that starts automatically when you are 65 or older and have Part B. During this period, Medigap insurance companies cant turn you down for coverage even if you have pre-existing conditions or health problems. After this period is over, it may be harder for you to enroll in a Medicare Supplement plan or switch plans if you have health problems.

Remember that Plan F will be gradually discontinued see the note above. You may still be able to buy it and keep it if you qualify for Medicare before January 1, 2020.

New To Medicare?

Is There A Lower Premium Option For Plan F

Are you interested in enrolling in Plan F but find that the premium rates are more than you want to spend? High Deductible Plan F is a potential option for you to consider. If you are comfortable with reaching the higher deductible prior to receiving full coverage for this plan, the lower premium could be worth it.

Recommended Reading: When Is The Last Day To Change Medicare Plans

Who Can Keep Medicare Supplement Plan F

If you were eligible for Medicare before January 1, 2020 and bought a Medicare Supplement Plan F, youll likely be able to keep your plan. Even if you didnt purchase a Medicare Supplement Plan F before January 1, 2020, you might be able to buy Plan F or change insurance companies after this date. However, you may have to meet medical underwriting qualifications to purchase a Medicare Supplement Plan F.

Medicare Supplement Plan F: What Will The Change Mean To You

Obviously if you werent eligible for Medicare prior to January 1, 2020, Medicare Supplement Plan F wont be a plan option. Still, you may have choices in Medicare Supplement insurance plans. Make the best coverage decision for yourself. If you have a Medicare Supplement Plan F, you dont have to take any action because your coverage is still active.

Do you want to shop Medicare Supplement Plan F and other Medicare Supplement insurance plan choices available to you? Simply type your zip code and press the Browse Plans button on this page.

The product and service descriptions, if any, provided on these Medicare.com Web pages are not intended to constitute offers to sell or solicitations in connection with any product or service. All products are not available in all areas and are subject to applicable laws, rules, and regulations.

New To Medicare?

Becoming eligible for Medicare can be daunting. But don’t worry, we’re here to help you understand Medicare in 15 minutes or less.

Recommended Reading: How To Pick The Best Medicare Plan