Will You Have To Pay For Anaesthesia

Most people won’t have to pay for anaesthesia. In three quarters of cases, health funds pay for what Medicare doesn’t.

For the minority who dopay a gap fee, the ‘gap’ being the difference between what a doctor charges and what’s covered by health funds and Medicare, the typical out-of-pocket cost is 40% of their entireanaesthesia fee. Their overall bill tends to be higher too, with averagefees twice that of “no gap” bills. That’s because the anaesthetists whocharge a gap are either unwilling or unable to charge the fund-dictatedfees.

Anaesthesia is the service most commonly paid for byprivate health funds, and it’s no mystery why. Anaesthetists are as crucial to operations assurgeons. “Without anaesthesia, surgeries would involve a heck of a lot ofscreaming,” jokes president of the Australian Society of Anaesthetists, David Scott.

How Can I Get Medicare Supplement Plan G Prices

Unfortunately, most insurance companies no longer openly publish their rates online without requiring you to meet with an agent or enter your personal information first. So, although some companies put their Medicare Supplement Plan G prices online, the information will be slanted towards that one company and will not be a full picture of what is available to you.

There are two options for obtaining the prices for a Medicare Supplement Plan G. One, you can contact your state department of insurance to get a list of all the companies offering supplement plans in your state usually around 30-35 companies. From there, you can contact each insurance companys call center and set an appointment to have an agent from each company come to your home so you can meet with them and obtain the rates for their plans. Sounds enjoyable, right?!?!

The much-simpler, more consumer-friendly alternative is to contact a trusted, verified independent Medicare insurance broker. Whether that broker is 65Medicare.org or someone else, using an independent broker gives you the opportunity to compare multiple options in a centralized, unbiased place. The broker works with you based on your needs and is incentivized to put you in a plan that you are happy with and that fits your needs, not one that helps their employers bottom line.

How They Are Priced

One difference in premiums can arise from how they are “rated.” If you know this, it may help you anticipate what may or may not happen to your premium down the road.

Some policies are “community rated,” which means everyone who buys a particular plan pays the same rate regardless of their age.

Others are based on “attained age,” which means the rate you get at purchase is based on your age and will increase as you get older. Still others use “issue age”: The rate won’t change as you age, but it’s based on your age at the time you purchase the policy .

Premiums also may go up from year to year due to other factors, such as inflation and insurer increases.

It’s worth choosing an insurance company that has a good track record, Gavino said.

“Sometimes new carriers come into the market and have really low rates to entice people but then after a year of claims under their belt, they may have to raise rates significantly,” Gavino said. “I’ve seen it a lot.”

You May Like: How Many Parts Medicare Has

What Is Plan G

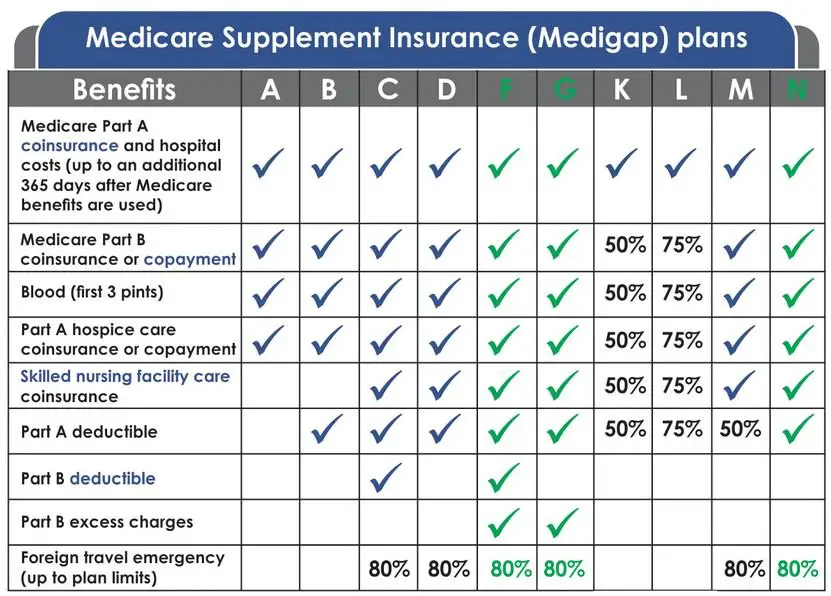

Medicare Plan G is the second most popular Medicare Supplement after Plan F, partly because it covers the most gaps in coverage of any Medigap plan available to new Medicare beneficiaries who first became eligible for Medicare after January 1, 2020.

All Medigap plans help pay for the costs that Parts A and B may not cover, such as deductibles, copayments and coinsurance. But each Medigap plan covers different charges at different amounts.

Medicare Supplement Plan G covers:

- Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits run out

- Part A deductible

- Part A hospice care coinsurance or copayment

- Part B coinsurance or copayment

- Part B excess charges

- Blood

- Skilled nursing facility coinsurance

- Foreign travel emergency care

The only thing that Plan G does not cover that Plan F does is the Part B deductible. However, Plan F is no longer available to those who became eligible for Medicare after Jan. 1, 2020. So for the newly eligible, Plan G may be the best option for the most extensive Medicare Supplement coverage.

Once you meet your Part B deductible, Plan G covers Part B outpatient medical services such as doctor visits, lab work, chronic disease supplies, durable medical equipment, X-rays, ambulance transportation, surgeries and a great deal more.

You Can’t Have Both So You Must Choose Wisely

Consumer ReportsOncology TimesMEDICAThe New York Times MagazinePsychology TodaySports Illustrated

Our editors independently research and recommend the best products and services. You can learn more about our independent review process and partners in our advertiser disclosure. We may receive commissions on purchases made from our chosen links.

Anyone who’s ready to sign up for Medicare has a lot of decisions to make. But one decision is especially importantshould you choose Medicare Advantage or use Medigap to supplement your Original Medicare plan?

Read Also: Does Medicare Part C Cover Dentures

Learn More About Your Medicare Advantage Prescription Drug Coverage Options

The cost of a Medicare Part D plan may vary from one insurance company to the next and from one location to another.

One way to learn about your Medicare prescription drug coverage options is to speak with a licensed insurance agent. You can compare Medicare Advantage plan costs in your area and find a plan that covers the prescription drugs you need.

How Much Does Medicare Part D Cost In 2022

Medicare Part D is prescription drug coverage. It is provided by Medicare-approved private insurers.

Premium costs vary by plan, state and income, but the average basic monthly premium for a Medicare Part D plan in 2020 was about $43, according to data from the CMS compiled by Policygenius. High-income Medicare beneficiaries are subject to an income-related monthly adjustment amount , meaning if you make more, youâll pay more. For 2022 plans, the additional costs will be based on your 2020 income.

Getting Medicare Part D requires enrolling in Original Medicare, so youâll pay any of those premiums, too.

The deductibles vary, but no Medicare Part D plan can have a deductible higher than $480 in 2022, up from $445 in 2021.

Copays and coinsurance vary by plan and tier and whether youâve hit the Medicare Part D coverage gap, or âdonut hole.â After the insurer has covered a certain amount on prescriptions, they will temporarily limit how much your plan will help pay for prescriptions.

Learn more about Medicare Part D plans and the âdonut holeâ here.

Also Check: How To Order Another Medicare Card

Costs For Services Outside Hospital

Out-of-hospital medical services might include:

- GP or specialist appointments

If an out-of-hospital service is on the Medicare Benefits Schedule , Medicare will pay:

- 85% of the MBS fee

- for GP appointments, 100% of the MBS fee

Medicare does not generally pay a benefit for out-of-hospital services that are not on the MBS, like physiotherapy and podiatry.

Your out of pocket costs for services outside hospital that are on the MBS will be the difference between what your doctor charges and any Medicare benefit paid by the government.

Most doctors bill Medicare directly for the Medicare benefit. If the service is not bulk billed, you pay the difference between the Medicare benefit and the total fee .

Private health insurers cant cover out-of-hospital Medicare services. However, they might cover some of the services Medicare doesnt, like physiotherapy and other allied health services not on the MBS.

Learn more about what private health insurance covers.

A Note About Assigned Commissions

Oftentimes, an agent working with an FMO will receive commissions directly from the carrier. In select cases, an FMO may want agents to assign them their commissions . In others, the carrier may require agents to assign their commissions to their FMO . When you assign your commissions to the FMO, this means the carrier will pay the FMO, who will then pay you. Agents signing an Assignment of Commissions contract must be careful, because depending on their contract, their upline could keep their renewals should they choose to leave.

Note: In cases where you must sign an Assignment of Commissions contract with Ritter, it is an immediate vested contract, meaning that any money you make is yours!

â â â

Selling Medicare can be very lucrative, if done right. Hopefully now you have a better idea of how much Medicare agents can make and know that working with an FMO should never hurt your commissions, only help them grow!

You May Like: Can You Have Medicare And Medical At The Same Time

What Do I Need To Know When Comparing Plans

First, there are no provider networks with Medicare Supplement insurance plans. Plans can be used with any doctor or hospital that accepts Medicare. Second, the basic benefits offered by Plans A, B, C, F, G, K, L and N are the same from every insurance company. However, some companieslike Humanaalso offer additional benefits. Take some time to consider the differences is in the companies, the quality of service and the price.

Do I Really Need Supplemental Insurance With Medicare

Lets start our discussion by addressing the elephant in the room. Is a Medicare supplement plan really necessary, and, if so, why?

As you may already be aware, Original Medicare only covers about 80% of your major medical costs. The remaining 20% of all Medicare-approved costs are the beneficiarys responsibility. These costs, which include deductibles, copayments, and coinsurance on the healthcare services you use can be paid in several different ways, including:

These are the most common ways people cover their major medical costs when they have Medicare. If you dont qualify for one of the benefits listed above, then you self-pay out of pocket, or you buy a Medigap plan.

If youre thinking about the self-pay option, think twice. This is a very risky proposition. While you can probably swing the cost of regular doctor visits, the cost of advanced diagnostic or hospitalization due to a critical illness or injury, is enough to send most people to bankruptcy court. Compare how much is Medigap per month vs. self-pay and it wont be difficult to see which costs less.

Think about it. Could you afford to pay 20% of the cost of cancer treatment or a hip replacement? A 2013 cost-effectiveness study reported a total cost of $40,102 for first-line mesothelioma treatment. Thats just the treatment, which does not include your inpatient care. The average cost of a hip replacement in the United States is almost as costly at $32,000.

You May Like: Does Medicare Cover Breast Prosthesis

How Much Does The Average Medicare Supplement Plan Cost In 2021

The table below displays the average cost of Medicare Supplement Insurance Plan G and Plan F by age.1

Based on our analysis, we noted several key takeaways:

-

Medicare Supplement Insurance Plan F premiums in 2021-2022 are lowest for beneficiaries at age 65 and highest for beneficiaries at age 85 .

-

Medigap Plan G premiums in 2021-2022 are lowest for beneficiaries at age 65 and highest for beneficiaries at age 85 .

| Average Monthly Cost of Plan F | Age in Years |

|---|---|

| $235.87 |

The Medicare Part D Donut Hole Coverage Gap

After 2020, Medicare Part D plans have a shrunken coverage gap, or donut hole, which represents a temporary limit on what the plan will cover for prescription drugs.

You enter the Part D donut hole once you and your plan have spent a combined $4,430 on covered drugs in 2022.

Once you reach the coverage gap, you will pay up to 25 percent of the cost of covered brand name and generic drugs until you reach total out-of-pocket spending of $7,050 for the year in 2022.

Once you reach $7,050 in out-of-pocket spending, you are out of the donut hole and enter catastrophic coverage, where you typically only pay a small copayment or coinsurance payment for the rest of the year.

Read Also: Does Medicare Cover Depends For Incontinence

Learn More About Your Costs With The Medical Costs Finder

The Medical Costs Finder is an online tool that lets you find out more about the costs of specialist medical services.

You can use the tool to:

- compare costs you are quoted by your specialists with the typical cost of the medical service in your area

- see how much people have paid out of pocket for the same medical service

How Much Do Medigap Plans Cost

Most Medicare beneficiaries would agree that its tricky enough just to figure out what youll be paying for Medicare Parts A, B and D. Then, just when you think youve got it covered, you learn that Medicare doesnt cover everything, and youll probably need some additional coverage to pay for your deductibles and the 20% of outpatient expenses that you are responsible for.

Shutterstock

Estimating these costs ahead of time is an important part of your retirement planning. The cost for Medigap insurance varies based on a number of factors, so let’s take a look at those.

First, theres the plan itself that you choose.

Fortunately, for all of us, Medicare standardized the Medigap plans back in 1990. This makes it easier to compare costs between carriers. Still, there are 10 different standardized plans and one high deductible option. When looking at costs, the plans with the highest premiums will typically be Medigap Plans F and G. Thats because these two plans have the most coverage, leaving you with little to no out-of-pocket spending.

If you are someone who wants a lower monthly premium and doesnt mind doing some more cost-sharing on medical services as you go along, Plans K and N are options to consider. Both of these plans offer considerably lower premiums because you have fewer benefits. You are responsible for more cost-sharing on the back end.

Next, theres your demographic information.

Fort Worth, Texas

Plan F: $149 – $180/month

Read Also: Who Funds Medicare And Medicaid

Choosing A Medicare Advantage Plan

Medicare Advantage Health Plans are similar to private health insurance. Most services, such as office visits, lab work, surgery, and many others, are covered after a small co-pay. Plans might offer an HMO or PPO network and all plans place a yearly limit on total out-of-pocket expenses. Each plan has different benefits and rules. Most provide prescription drug coverage. Some require a referral to see a specialist while others do not. Some may pay a portion of out-of-network care, while others will cover only doctors and facilities that are in the HMO or PPO network. There are also other types of Medicare Advantage plans.

Selecting a plan with a low or no annual premium can be important. But it’s also essential to check on copay and coinsurance costs, especially for expensive hospital stays and procedures, to estimate your possible annual expenses. Since care is often limited to in-network physicians and hospitals, the quality and size of a particular plans network should be an important factor in your choice.

When Should You Enroll In A Medigap Policy

The best time to purchase your Medicare Supplement plan is during the Medigap Open Enrollment Period, the six-month period that begins on the first day of the month in which you are 65 or older and enrolled in Medicare Part B. During those six months, private insurers cannot deny you an available policy for any reason, and you have more options and lower pricing. You may also have other options for purchasing a Medigap policy later, depending on your situation. For example, a canceled policy, a loss of insurance, an insurance carrier bankruptcy, and other circumstances may qualify.

But outside of open enrollment, insurers can use medical underwriting things like your age, gender, area of the country, and previous health conditions when deciding to sell a policy. That means you may be denied a policy or have to wait for preexisting condition coverage, often for six months after your policy is in effect, pay higher premiums, or have fewer options than when enrolling during the open enrollment period.5

Your state may have additional rules regarding open enrollment so check to be sure.

Don’t Miss: What Is The Window To Sign Up For Medicare

Which Blue Cross Blue Shield Medigap Plan Is Right For Me

Now that you’ve learned a bit about each type of plan, let’s figure out which one is right for you. Our outline below will help you better understand which plan might work best for you or your spouse.

Seniors with limited funds who don’t go to the doctors as often

Do you rarely visit the doctor? Are you active and healthy? Then you may not need as much supplemental coverage as others. Plan N could be a good option for you, given its low premium. Just know that you’ll owe a $20 copay for each office visit and a $50 copay for ER visits.

FYI: If you’re still not sure which plan or provider is right for you, head to our Medigap guide. We cover tips for choosing the right plan, how to enroll, and more.

Seniors with a chronic illness, frequent appointments, or needed surgeries

If you know that you’ll be regularly attending doctor’s appointments, scheduling surgeries, or visiting specialists, a Plan G high-deductible option may be a good fit. In 2021, Plan G has a $2,370 deductible. In other words, after you pay $2,370 in out-of-pocket costs, the plan kicks in to help pay your out-of-pocket Medicare costs.

Pro Tip: Plans A through G have higher premiums with limited out-of-pocket costs. Plans K through N give you similar benefits at lower premiums, but you’ll have higher out-of-pocket costs.

Seniors who love to travel

Seniors who want basic coverage and lower premiums