Medicare Faqs And Information To Consider

Automatic Enrollment:

If you are already receiving Social Security benefits, Railroad Retirement benefits, or Federal Retiree benefits, your enrollment in Medicare is automatic. Your Medicare card should arrive in the mail shortly before your 65th birthday. Check the card when you receive it to verify that you are entitled to both Medicare Parts A and B.

Initial Enrollment Period:

If you are not eligible for Automatic Enrollment, contact the Social Security Administration at 800-772-1213 or enroll online at www.socialsecurity.gov, or visit the nearest Social Security office to enroll in Medicare Part A and Medicare Part B. You have a seven month window in which to enroll in Medicare without incurring a penalty. If youre not automatically enrolled in premium-free Part A, you can sign up for it once your Initial Enrollment Period starts. Your Part A coverage will start six months back from the date you apply for Medicare, but no earlier than the first month you were eligible for Medicare. However, you can only sign up for Part B during the times listed below.

General Enrollment Period:

- General Enrollment Period for Medicare Parts A & B

If you have coverage through a current employer, you are not required to enroll in Medicare Part A and B. Below are some things to keep in mind about each part of Medicare.

How Do I Enroll In Medicare

Administration at 1-800-772-1213 to enroll in Medicare or to ask questions about whether you are eligible. You can also visit their web site at www.socialsecurity.gov.

The Medicare.gov Web site also has a tool to help you determine if you are eligibile for Medicare and when you can enroll. It is called the Medicare Eligibility Tool.

Medicare Advantage Open Enrollment Period

Medicare Advantage Open Enrollment happens every year from Jan. 1 to March 31. If youre enrolled in a Medicare Advantage plan and want to make changes, you can do one of these:

- Switch to a different Medicare Advantage plan with or without drug coverage

- Go back to Original Medicare and, if needed, also join a Medicare prescription drug plan

Your new coverage begins on the first day of the month following the month you make a change and will be in effect for the rest of the year.

Don’t Miss: Will Medicare Pay For Alcohol Rehab

Determine Whether You Need To Sign Up For Medicare

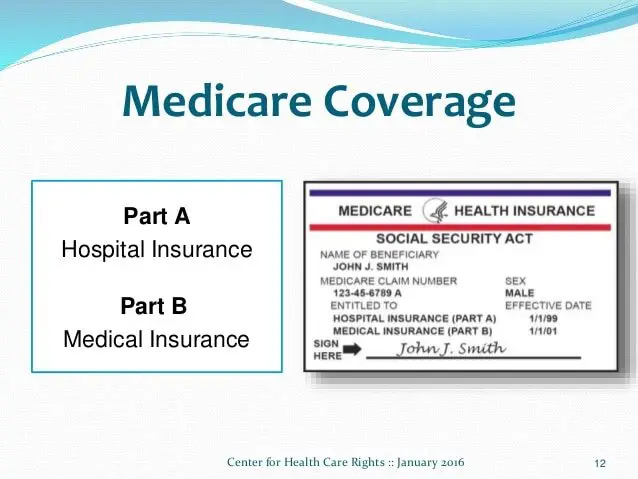

Some people are automatically enrolled in Medicare Part A hospital insurance and Medicare Part B medical insurance.

You are automatically enrolled in Medicare Part A and Part B if:

If you already collect Social Security retirement benefits, you are automatically enrolled in Medicare Part A and Part B. No further action is required.

Your coverage will begin the first day of the month you turn 65.

Even if you are automatically enrolled, you may also decide to:

- Sign up for a Medicare Part D drug plan.

- Buy a Medigap supplement insurance policy.

- Switch to a Medicare Advantage plan.

Applying For Medicare With Employer Coverage

Can you still enroll in Medicare coverage, even if youre not yet seeking retirement? The answer is yes! Medicare coverage can coincide with your group coverage through your employer. If your employer has more than 20 employees, your group coverage will work as your primary insurance, and Medicare will be your secondary insurance.

You can choose to apply for Part B, or you can wait until leaving your employer group coverage. For more information on the benefits of obtaining Medicare while receiving group coverage through work, give our team a call, and we can review the pros and cons.

Sometimes beneficiaries dont want to apply for Part B when they initially become eligible because of employer health coverage. Should you lose your health insurance through your employer, or if you prefer to switch over to Medicare, you can apply any time while receiving coverage through your employer.

Read Also: How To Win A Medicare Appeal

Why Do I Need Medicare Prescription Coverage

In brief, Medicare prescription drug coverage reduces the costs of medicines. Especially for patients with long-term courses of prescriptions, this can amount to significant savings.

Some prescription drug plans come with zero deductibles. Many more offer achievable yearly deductibles.

Once subscribers pass the deductible amount for the year, the insurance benefits start. The insurer pays the agreed amount for a prescribed drug, and the consumer typically pays a copay.

All Part D plans must cover commonly prescribed drugs taken by the Medicare population, as well as most drugs in protected classes, like those for cancer or HIV/AIDS.

Although every plan that offers Part D coverage includes a wide array of prescription medications, some drugs are not covered while other drugs may have a high cost.

Pharmaceutical companies develop and manufacture a wide range of prescription drugs. The plans rank drugs in tiers based upon cost.

Drug tiers rank one through five, or six. Typically, the lower tiers have low prices and have many generic drugs. In contrast, upper tiers have higher prices and fewer generic equivalents.

The higher tier drugs cost more and get more limitations from the insurers. The insurers urge the use of effective lower cost generic drugs to reduce costs on all sides.

Consequences Of Canceling Part B

If you have a gap in coverage, the Medicare program could tack late-enrollment penalties onto your Part B premiums if you re-enroll in coverage again later. Avoid this pitfall by working with your human resources department to ensure that your companys insurance is indeed creditable . You may need to provide documentation of creditable coverage during your Part B cancellation interview.

A gap in coverage could also adversely affect your health if you avoid seeing the doctor because you dont have health insurance. And you may have to go without other forms of coverage too. Without Part B, you cant enroll in other parts of Medicare, such as Part D prescription drug coverage, Medicare Supplement , or Medicare Advantage. These gaps will remain until you re-enroll in Part B again later.

Read Also: What Does Original Medicare Mean

What Is Part D Medicare

Part D Medicare is coverage for some of your prescription drugs. This plan must be purchased through a private insurer.

These plans usually have out-of-pocket costs, premiums, flat co-pay options, or a percentage of prescription costs. Make sure to look at the plan you are considering in detail. Ask questions when you do not understand something.

It is important to confirm that the plan will meet your budget and medical needs.

This plan has limits, if your total prescription drug costs for the year reach $4,130, you must pay 25% of your prescription costs for the rest of the year.

Visit medicare.gov to see whether the plan you are looking at will cover the medicines you need.

What Is The Medicare Advantage Plan Initial Coverage Election Period

Most beneficiaries are first eligible to enroll in a Medicare Advantage plan during the Initial Coverage Election Period. Unless you delay Medicare Part B enrollment, this enrollment period takes place at the same time as your Initial Enrollment Period , starting three months before you have both Medicare Part A and Medicare Part B and ending on whichever of the following dates falls later:

- The last day of the month before you have both Medicare Part A and Part B, or

- The last day of your Medicare Part B Initial Enrollment Period.

If youre under 65 and eligible for Medicare due to disability, your IEP will vary depending on when your disability benefits started.

Recommended Reading: Does Medicare Pay For Medical Alert Bracelets

Do I Need To Get Medicare Drug Coverage

As long as you have , you can wait to join a Medicare drug plan or a Medicare Advantage Plan with drug coverage. If youre not sure, ask your drug plan if its creditable drug coverage.

Each year your plan must tell you if your non-Medicare drug coverage is creditable coverage. Keep this information you may need it when youre ready to join a Medicare drug plan.

You can join a plan anytime while you have job-based health insurance, and up to 2 months after you lose that insurance.

andbefore

Even if you have a Special Enrollment Period to join a plan after you first get Medicare, you might have to pay the Part D late enrollment penalty. To avoid the Part D late enrollment penalty, dont go 63 days or more in a row without Medicare drug coverage or other creditable drug coverage.

When Do I Sign Up For Medicare Part D

The initial enrollment is the best time to sign up for every part of Medicare. It is the ideal time to get prescription coverage without penalty.

Applicants that do not add either a Part D or a Part C MAPD plan during their initial signup may face a penalty when adding one later. In either form, you can apply for Medicare Part D coverage by secure phone call with our licensed insurance specialists.

Even for those not currently taking any prescription medications when beginning Medicare, Part D coverage is recommended.

There are limited periods of the year in which to apply for Medicare Part C and Medicare Part D Prescription Drug coverage.

- Initial enrollment period: during the 7 months when first becoming eligible.

- Annual open enrollment season: every October 15th through December 7th.

- Medicare Advantage Disenrollment period: from January 1st through February 14th, if you have an MAPD plan you can drop it and get a stand-alone Part D policy, also returning you to Original Medicare.

- General Enrollment Period: from January 1st through March 31st if you have a Medicare Advantage plan, you can switch to another plan, whether or not your current or new plan has built-in Part D coverage.

- Special enrollment periods: based on exceptional life events and circumstances that prevented you from enrolling.

You May Like: Can You Sign Up For Medicare Part A Only

If You Already Receive Benefits From Social Security:

If you already get benefits from Social Security or the Railroad Retirement Board, you are automatically entitled to Medicare Part A and Part B starting the first day of the month you turn age 65. You will not need to do anything to enroll. Your Medicare card will be mailed to you about 3 months before your 65th birthday. If your 65th birthday is February 20, 2010, your Medicare effective date would be February 1, 2010.

Medicare Prescription Drug Coverage

Medicare Prescription Drug Plans are sold by private insurance companies approved by Medicare. All people new to Medicare have a seven-month window to enroll in a PDP three months before, the month of and three months after their Medicare becomes effective. The month you enroll affects the PDPs effective date. All people with Medicare are eligible to enroll in a PDP however, unless you are new to Medicare or are entitled to a Special Enrollment Period, you must enroll or change plans during the Open Enrollment Period for Medicare Advantage and Medicare Part D, Oct. 15 through Dec. 7. There is a monthly premium for these plans. If you have limited income and assets/resources, assistance is available to help pay premiums, deductibles and co-payments. You may be entitled to Extra Help through the Social Security Administration. To apply for this benefit contact SHIIP at 1-855-408-1212 or the Social Security Administration at 800-772-1213 or www.socialsecurity.gov.

You May Like: Can Medicare Take My Settlement

Applying For Medicare Online

Applying for Medicare online is a quick and easy process on the Social Security website, taking approximately ten minutes. After you have applied for Medicare online, you can check the status of your application and/or appeal, request a replacement card, and print a benefit verification letter.

You can easily apply online for Medicare and Social Security retirement benefits or just Medicare.

Once you apply for Part B, give us a call so we can help you choose a supplement plan to cover what Medicare doesnt.

If youre not comfortable applying for Medicare online, you can do so over the phone.

To Qualify For Medicare You Need To Get Disability Benefits From:

- Social Security

- Railroad Retirement Board

Youll automatically get Part A and Part B after you get disability benefits for 24 months. Well mail you a welcome package with your Medicare card.

If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.

If you live in Puerto Rico or outside the U.S.

Also Check: Does Medicare Pay For Catheters

How Do I Check On My Online Medicare Application

You can check on the status of your Medicare application at any time using your My Social Security account. You can use the confirmation number you received when you submitted your application.

Youll be able to see when your application has been received, is processing, and is approved. You can also call Social Security at 800-722-1213 to check on your status.

Youll receive a decision letter in the mail when Social Security is done processing your application.

Youll also receive your Medicare card in the mail, as long as your application was approved. It generally takes less than a month from the time you apply to the time you receive your card in the mail.

When Can I Enroll In Medicare If I Am Not Receiving Retirement Benefits

If you are not yet receiving retirement benefits and are close to turning 65, you can sign up for Medicare Part A and/or Part B during your IEP. If you decide to delay your Social Security retirement benefits or Railroad Retirement Benefits beyond age 65, there is an option to enroll in just Medicare and apply for retirement benefits at a later time.

Don’t Miss: How Do I Become A Medicare Provider

How To Enroll In The Various Medicare Plans

There are three types of Medicare plans that all have different ways of signing up. Each of these plans also has different enrollment periods. Delaying your Medicare Enrollment could result in various penalties and fees. Its helpful to set reminders for these important dates, especially when signing up for Medicare for the first time.

| Plan | |||

|---|---|---|---|

| Original Medicare |

|

Automatic or three months before the month you turn 65 and extends three months after. | 10 percent of the monthly premium |

| Medicare Advantage Plans |

|

None | |

|

|

Six months after the month youre 65 and enrolled in Medicare Part B. | None | |

|

|

It depends on how long you went without Part D |

When Is The Earliest You Can Sign Up

Youre first eligible for Medicare starting three months before you turn 65. That kicks off whats known as your Initial Enrollment Period.

The Initial Enrollment Period covers seven months: the three months before your 65th birth month, the month of your 65th birthday and the three months following your 65th birth month. For example, lets say your birthday is sometime in May. The three months before are February, March and April, and the three months following are June, July and August.

Keep in mind that the date you apply for Medicare will affect the start date of your coverage. To receive Medicare Part A and Medicare Part B beginning the first day of the month you turn 65, you must sign up during the three months before your 65th birth month. If you wait to sign up during your birth month or the next three months, your start date will be delayed by one, two or three months.

If your birthday is on the first day of your birth month, Part A and Part B will start the first day of the prior month. So, if, say, your birthday is September 1, your benefits will begin on August 1.

Recommended Reading: Does Medicare Cover Disposable Briefs

Recommended Reading: Does Medicare Pay For Licensed Professional Counselors

How Often Do You Have To Enroll In Medicare

In general, once youre enrolled in Medicare, you dont need to take action to renew your coverage every year. This is true whether you are in Original Medicare, a Medicare Advantage plan, or a Medicare prescription drug plan. As long as you continue to pay any necessary premiums, your Medicare coverage should automatically renew every year with a few exceptions as described below.

What Is The Medicare Part B Late

If you do not sign up for Medicare Part B when you are first eligible, you may need to pay a late enrollment penalty for as long as you have Medicare. Your monthly Part B premium could be 10% higher for every full 12-month period that you were eligible for Part B, but didnt take it. This higher premium could be in effect for as long as you are enrolled in Medicare. For those who are not automatically enrolled, there are various Medicare enrollment periods during which you can apply for Medicare. Be aware that, with certain exceptions, there are late-enrollment penalties for not signing up for Medicare when you are first eligible.

One exception is if you have health coverage through an employer health plan or through your spouses employer plan, you can delay Medicare Part B enrollment without paying a late-enrollment penalty. This health coverage must be based on current employment, meaning that COBRA or retiree benefits arent considered current employer health coverage.

Read Also: How Much Is Medicare Copay For A Doctor’s Visit