Choosing Traditional Medicare Plus A Medigap Plan

As noted above, Original Medicare comprises Part A and Part B . You can supplement this coverage with a stand-alone Medicare Part D prescription drug plan and a Medigap supplemental insurance plan. While signing up for Medicare gets you into Parts A and B, you have to take action on your own to buy these supplemental policies.

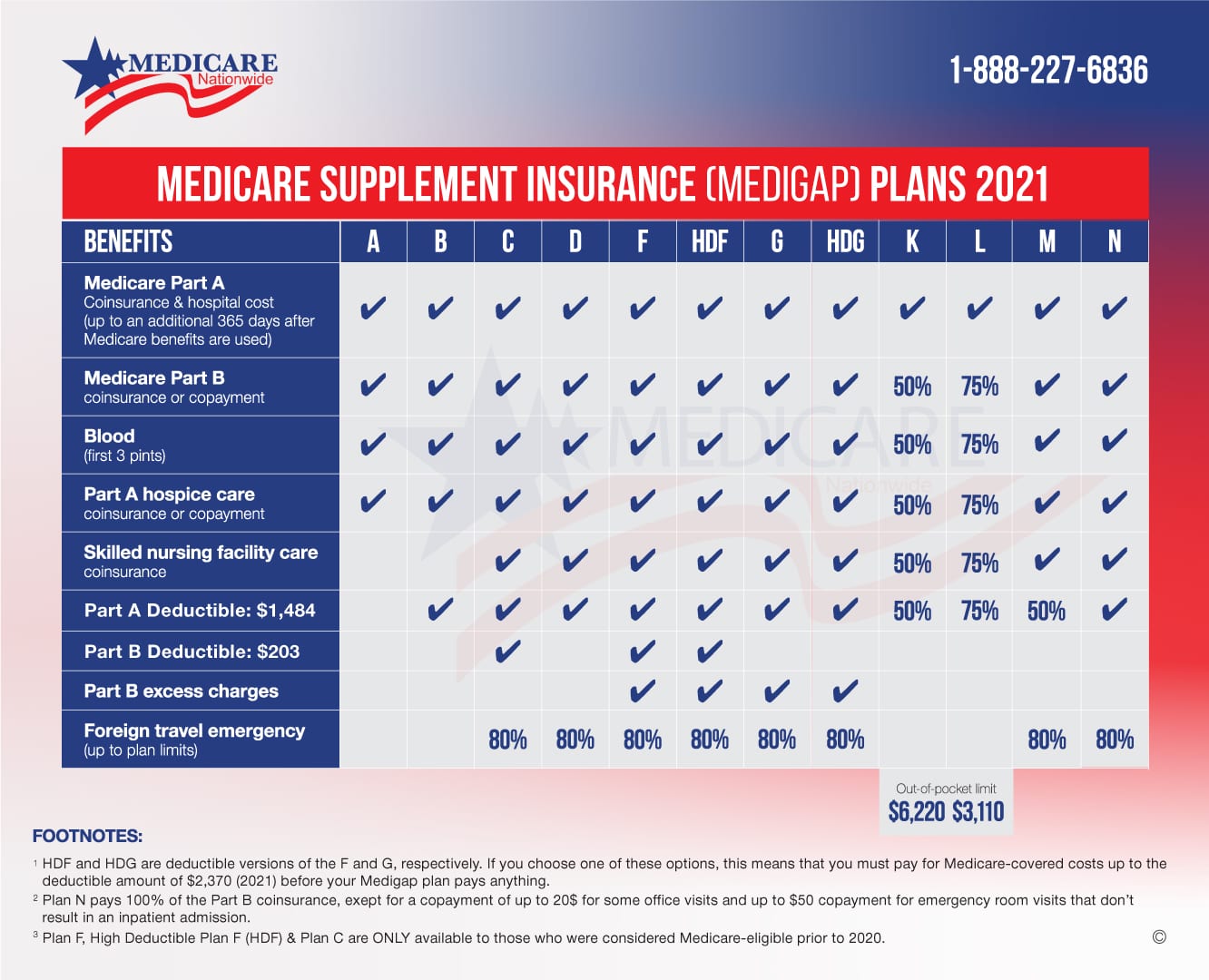

Plan K And Plan L: Best Medicare Supplement Plans For Budgeters

Surprise or unexpected medical bills can ruin anyones budget. But Medigap Plan K and Plan L have annual out-of-pocket limits built into them to give beneficiaries an extra layer of protection.

For 2022, Plan Ls out-of-pocket spending limit is $3,310, and Plan Ks limit is $6,620. Once a plan member spends that amount on covered care, the plan then pays for 100% of all covered services and items for the remainder of the year.

Original Medicare does not include an out-of-pocket limit, which leaves beneficiaries exposed to potentially high medical bills for more serious injuries or illnesses.

Find Balance In Premium And Copays With Plan G

With Plan G, youll get the same benefits as Plan N plus coverage for any excess charges. Also, you wont have to pay those small copays that Plan N requires you to pay. In exchange for not having to pay a small copay every time you visit the doctor or hospital, you agree to pay a slightly higher monthly premium. For many years, Plan G has been the runner-up plan to Plan F.

Plan G replicates Plan F. The only difference is that it does not cover the Part B deductible.

This plan is a wise choice for those who:

- Dont want surprise out-of-pocket hospital costs

- Want rate increases that dont catch them by surprise

- Like to travel outside of the United States

- Live in a state that allows excess charges

Recommended Reading: What Age Can You Get Medicare Part B

Review Any Changes To Your Current Medicare Plan

If you have original Medicare, check the latest Medicare & You handbook for an overview of next years costs and benefits. Page 2 has a list of new and important facts. You can find more detailed information in other Medicare publications or at the Medicare website.

If you have a Medicare Advantage plan or a Part D plan, you should have already received an Annual Notice of Change or Evidence of Coverage by mail or email. It would have arrived by September 30. The ANOC or EOC lists any changes in your plans costs, benefits, and rules for next year.

Such changes could include:

-

New rules about prior authorization or step therapy

With Medicare Advantage, provider networks can change, so make sure you have access to all the providers and medications you need for the coming year,” says Murdoch.

Even if you like your current Medicare Advantage plan, it might not be your best option. The plan could be ending, or its rules might be changing. Or, maybe you can get everything you need from a cheaper plan. Reviewing the details will help clarify your choices. If you decide to make a change but miss the fall open enrollment period, dont panic: You can switch during the special Medicare Advantage open enrollment period that runs from January 1 to March 31.

Best For Variety Of Plans: Humana

Humana

Why we chose it: Humana was selected because of the financial stability of the company coupled with the number of unique benefits and plans it offers. In addition, Humana gets high customer service ratings from J.D. Power and other high customer rating reviews.

-

Gets a 4.5 rating

-

Offers Medicare Advantage plans in 47 states

-

SilverSneakers fitness program

-

Prescription drug coverage and mail delivery pharmacy

-

Routing hearing and dental care

-

HMO plans with $0 premiums in some locations

-

PPO plans allow any Medicare approved doctor

-

Unique Medicare Advantage plans such as PFFS and SNP

-

Offers a wealth of information about Medicare and online resources

-

Emergency coverage is available outside of the United States

-

The website can be difficult to navigate due to the number of services and types of insurance policies offered

-

Plans may differ according to location

-

Some premium rates are higher than many of their competitors

Humana Advantage Care includes some unique plans that are not offered by many other providers such as:

- Humana PFFS plans, private-fee-for-service plans, which allow beneficiaries to select any health care provider that accepts Humana insurance payments

- Special Needs Plan , which is for people with special needs due to a chronic health condition

Some of the unique benefits offered by Humana include:

You can call a licensed Humana agent to learn more about plans in your state.

You May Like: Do Medicare Supplements Cover Pre Existing Conditions

Tip : Drug Formularies Are Your Friends

Medicare plans have a list of covered drugs called a formulary. Each plan creates its own formulary and can change it from year to year. Check each formulary when shopping and reject any plan that doesnt list the prescription drugs you take.

Once you find a few plans that offer the medications you need, then compare costs and other factors for the remaining plans youre interested in. Most plans have pharmacy networks that offer plan pricing to members, so youll want to find one that includes the pharmacy you like to use as well.

You can get prescription drug coverage through a standalone Medicare Part D plan or as part of a Medicare Advantage plan.

Best Price Transparency: Aetna

-

Household discount program

-

Offers dental, vision, and Part D plans for extra coverage

-

Rates available online

-

Rates increase based on age

-

Cannot sign up online

When it comes to price transparency, Aetna is the clear winner. It uses attained-age pricing and is the only company on the list to provide rates for Medicare Supplement Plan G right on its website. From the homepage, select your state in the dropdown box to view Medicare Supplement State Insurance Plans, and with a few more clicks you can easily generate an Outline of Coverage PDF file with rate information for the plan based on age, gender, and ZIP code. Rates vary by location.

While the website is full of useful information, you can also turn to the company’s mobile app, Aetna HealthSM, and its Medicare Nurse Line 24 hours a day, 7 days a week. The one thing you cannot do online is to sign up for a planyou must reach out to an Aetna agent by phone.

Aetna was founded in 1853 and was acquired by CVS Health Corporation in 2018. It offers Medicare Supplement Plan G in 22 states, excluding Alaska, Connecticut, Hawaii, Maine, Massachusetts, Minnesota, New York, Vermont, Washington, and Wisconsin. High-Deductible Plan G is available in Alabama, Arizona, Arkansas, Delaware, Georgia, Indiana, Iowa, Kentucky, Mississippi, Montana, Nebraska, Nevada, New Jersey, North Dakota, Ohio, Oklahoma, Rhode Island, Pennsylvania, South Carolina, South Dakota, West Virginia and Wyoming.

Also Check: How Much Do I Have To Pay For Medicare

What Does A Five Star Medicare Advantage Plan Mean

Medicare Advantage plans are rated from 1 to 5 stars, with five stars being an excellent rating. This means a five-star plan has the highest overall score for how well it offers members access to healthcare and a positive customer service experience.

Heres a look at what each star rating means to help you better understand a five-star rating.

- excellent

What Do Medicare Advantage Plans Not Cover

At the basic level, Medicare Advantage plans do not cover dental or vision, but many plans offer those and other extra benefits, such as gym memberships or wellness programs. Some also offer 24-hour nurse hotlines to answer medical questions. Part of the reason Medicare Advantage plans are popular is that they are comprehensive and all-encompassing.

You May Like: Does Medicare A Have A Deductible

Benefits Available With A Medicare Advantage Plan

Medicare Advantage Plans are required to provide the same benefits as Original Medicare does. These include:

- Part A inpatient hospitalization and skilled nursing facility care and some home care. Hospice care, a Part A benefit, is still primarily provided by Original Medicare, not Medicare Advantage Plans.

- Part B medically necessary outpatient care, supplies, and services, such as doctors visits, lab tests, and durable medical equipment

Medicare Advantage Plans also provide more benefits. These typically include:

- Part D Prescription drug coverage per your plans formulary

- Routine vision exams

| Yes | Emergency and out-of-area dialysis plus other care if in your plans network |

*All plans include deductibles, copays and/or coinsurance for services received. Medicare Advantage Plans have an out-of-pocket max that applies to Medicare-covered benefits. There is no cap on what you spend for Original Medicare services, but if you purchase a Medigap plan , it will cover most of Original Medicares cost sharing requirements.**Check with your plan for out-of-state coverage and service area.

What Are The Benefits To Medicare Advantage

Medicare Advantage covers more than Medicare , allowing patients more options and flexibility. Patients can customize their Medicare Advantage to cover specific needs like wheelchair ramps, adult day care, and respite care. Additionally, the 2020 CARES Act expanded Medicare’s network to cover more telehealth services.

Don’t Miss: How Much Money Is Deducted From Social Security For Medicare

Who Is Eligible For Medicare Part D

If youre wondering whether you are eligible for a Medicare prescription drug plan, this is the criteria you need to meet:

- Be aged 65 years or over

- Have Original Medicare

- Aged younger but have a qualifying disability or condition

- Have end-stage renal disease that requires dialysis or a kidney transplant

If you signed up for Social Security before turning 65, you would have been enrolled in Medicare automatically, though benefits will begin once you turn 65. There can be penalties for not enrolling at age 65, so signing up on time will help you avoid this.

If you have employer sponsored coverage, you might be able to delay Medicare while your EIS is still active. That said, the size of your employer/company will determine whether or not youll pay a penalty for not enrolling by age 65. We suggest looking into this in advance of your 65th birthday to avoid paying a possible penalty.

Is Medicare Advantage Or Medigap Coverage Your Best Choice

Generally, if you are in good health with few medical expenses, Medicare Advantage is a money-saving choice. But if you have serious medical conditions with expensive treatment and care costs, Medigap is generally better.

Speaking with a licensed insurance agent about your particular health situation can help you decide which is best for you. Since you are not allowed to have Medicare Advantage and Medigap at the same time, you have to choose carefully to make sure you have suitable coverage for your specific situation.

Weighing what options are most important to you and talking with a licensed insurance agent about your particular wants and needs can help you make an informed choice between Medicare Advantage and Medigap.

You May Like: What Is The Average Premium For Medicare Advantage Plans

Who Should Get A Medicare Advantage Plan

A Medicare Advantage Plan may be a good choice for you if you:

- Prefer a Medicare insurance plan that bundles together all medical, prescription drug, and other benefits, like dental and vision coverage.

- Are willing to receive your benefits from a network of providers in order to keep your healthcare costs as low as possible.

- Dont want to risk paying uncapped out of pocket costs of Original Medicare or have to purchase a Medigap policy.

What Are The Best Medicare Supplement Plans Available In 2021

Find out how to choose the right Medicare Supplement plan for you.

Everyday Health may earn a portion of revenue from purchases of featured products.

Knowing how much money to set aside for your healthcare expenses can seem daunting without proper preparation and research. Medicare doesnt meet every coverage need for many people, but there are options available to fill those gaps. Depending on your health and budget needs, enrolling in a Medicare Supplement plan could be a viable option.

Recommended Reading: Does Medicare Cover Outside Usa

Use Star Ratings To Find Your Best Medicare Plan

If you think you have to be an insurance expert to compare Medicare Advantage and Part D plans, you might be surprised: Medicare rates plans use a Star Rating System to make it easier to compare plans.

Keep in mind if a plan is new, there may not be enough data available yet for it to have a star rating that doesn’t necessarily mean it’s a bad plan. Here’s how the Medicare Star Rating System works:

Medicare Advantage plans that include prescription drug coverage are rated up to 45 quality measures. Advantage plans that don’t include drug coverage are rated up to 33 quality measures. Standalone Part D plans are rated on up to 14 measures. Those measures fall into a few broad categories:

Medicare Advantage plans:

-

Preventive care

-

Managing chronic conditions

-

Responsiveness and care

-

Problems and complaints

-

Customer service

-

Drug prices and patient safety

-

Overall experience of members

-

Centene Corporation

What Are My Medicare Plan Options

Medicare plans come in all different shapes and sizes. Some plans like Medicare Advantage stand on their own and provide comprehensive coverage. Other plans like Part D and Medigap plans must be used in combination with Original Medicare. Your options for Medicare coverage fall into four broad categories:

Recommended Reading: How Many Days Does Medicare Pay For Nursing Home

Can I Get My Health Care From Any Doctor Other Health Care Provider Or Hospital

- Original Medicare

-

You can go to any doctor or hospital that takes Medicare, anywhere in the U.S.

In most cases, you don’t need a

referral

to see a specialist.

- Medicare Advantage

-

In many cases, youll need to only use doctors and other providers who are in the plans network . Some plans offer non-emergency coverage out of network, but typically at a higher cost.

You may need to get a

referral

-

You can join a separate Medicare drug plan to get Medicare drug coverage.

- Medicare Advantage

-

Medicare drug coverage is included in most plans. In most types of Medicare Advantage Plans, you cant join a separate Medicare drug plan. You can join a separate Medicare drug plan with certain types of plans that:

- Cant offer drug coverage

- Choose not to offer drug coverage

Youll be disenrolled from your Medicare Advantage Plan and returned to Original Medicare if both of these apply:

How To Choose The Best Medicare Supplement Plan

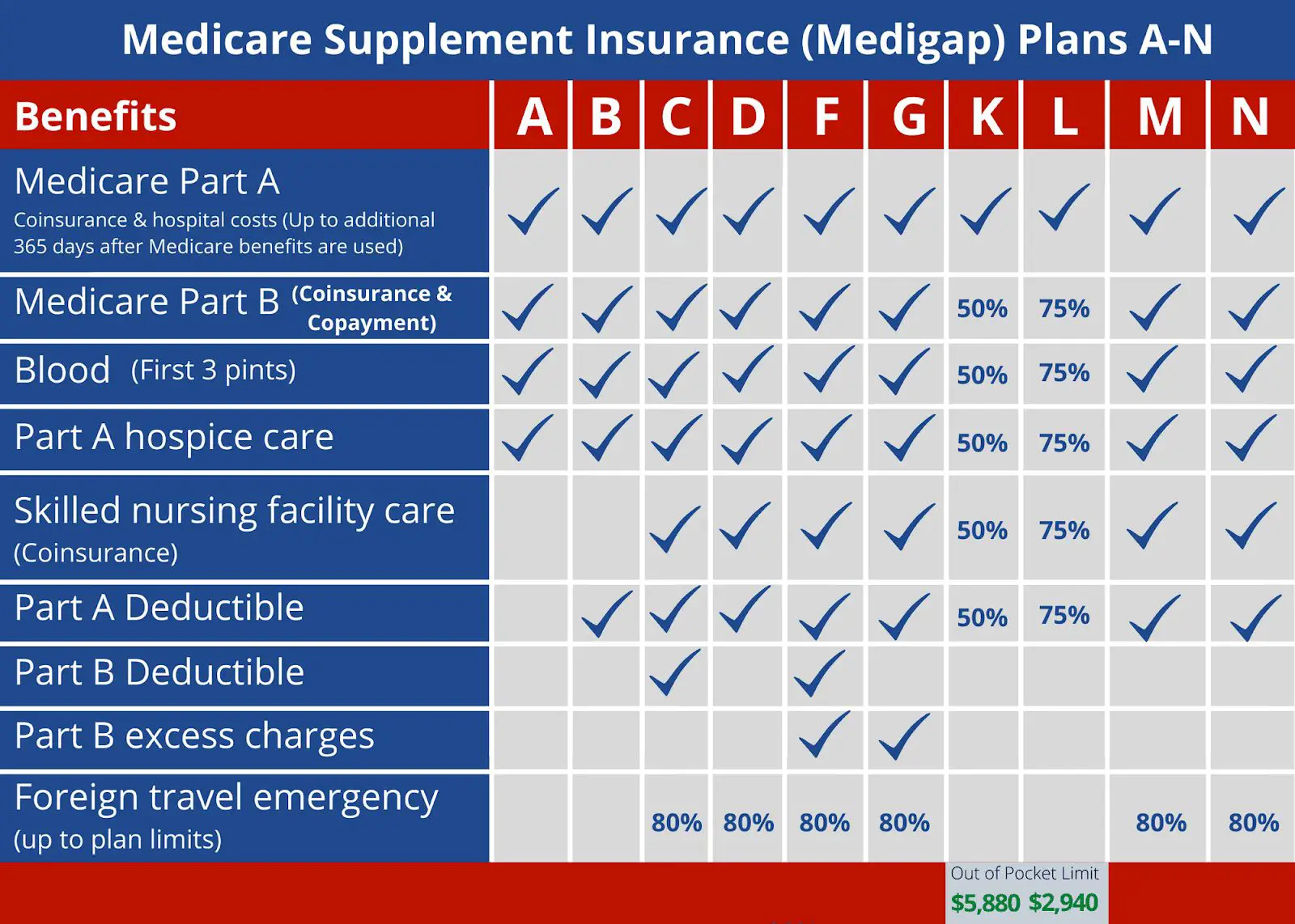

The best Medicare Supplement plan for you will depend on which policy provides the best benefits for your medical needs and fills in the coverage gaps where you expect to spend the most on health care.

For example, if you need skilled nursing coverage or want more protection for foreign travel emergencies, then consider how well each plan covers those categories of care. If you expect to need hospital care, a plan that pays for the Medicare Part A deductible can help protect you from a large hospital bill.

Say you need surgery in the upcoming year. For the 2022 plan year, the Medicare Part A deductible is $1,556. Some Medicare Supplement policies, such as Plan A, provide no coverage for this deductible. Therefore, you would be responsible for paying the entire $1,556 out of pocket before your Original Medicare coverage would kick in.

On the other hand, if you choose Medigap Plan G, the $1,556 deductible would be fully covered by your Supplement policy. This means you would begin having your claims covered immediately, rather than first having out-of-pocket costs for medical care. However, you should also consider the cost of the plan since Plan G can be more expensive than Plan A.

It is for this reason that you should carefully analyze what each Medigap plan covers and costs so that you can choose the best one for your situation. Often, there is an ideal supplemental policy for your health care needs.

Don’t Miss: Is It Too Late To Change Medicare Advantage Plans

Why Are Some Medicare Advantage Plans Free

When a Medicare Advantage plan has a $0 premium, the company can often offer that lower price by saving money on other costs, such as using in-network healthcare providers. They pass those savings on to you by offering a premium at no charge. A $0 premium is also a great way for providers to attract customers. You will, however, still have other monthly costs.

Theres No Right Answer

We work with a broker in Colorado who explains that theres no one-size-fits-all when it comes to Medicare plan options. Two of her clients are siblings who live in the same town one has a zero-premium Medicare Advantage plan, while the other has Original Medicare plus a comprehensive Medigap plan and a Part D prescription plan.

The one with the Medicare Advantage plan would rather save money on premiums, and doesnt mind the higher out-of-pocket exposure and limited provider network. The other sibling, on the other hand, is willing to pay higher premiums in trade for the lower out-of-pocket costs and nationwide provider choice that comes with Original Medicare.

Ultimately, the choice between Medicare Advantage and Original Medicare with supplements is a personal one that reflects each applicants health, risk tolerance, and approach to personal finances.

And there are varying degrees of coverage within each type of plan. Medicare Advantage plans include extra benefits that arent available with Original Medicare + supplemental coverage, and some Medicare Advantage plans have out-of-pocket maximums well below the federally-allowed limit. And while some Medigap plans, like Plans C and D , cover most of an enrollees out-of-pocket costs under Original Medicare, other Medigap plans, like Plan N, for example, are less robust.

Don’t Miss: How Can I Enroll In Medicare Part D