How Do I Apply For Medicare Part B

Beneficiaries collecting Social Security benefits when they age into Medicare at 65 will automatically enroll. If this is the case for you, you will receive your Medicare card one to three months before your 65th birthday. If you are not collecting Social Security benefits, you will need to enroll yourself. You can apply for Medicare Part B online, over the phone, or in person.

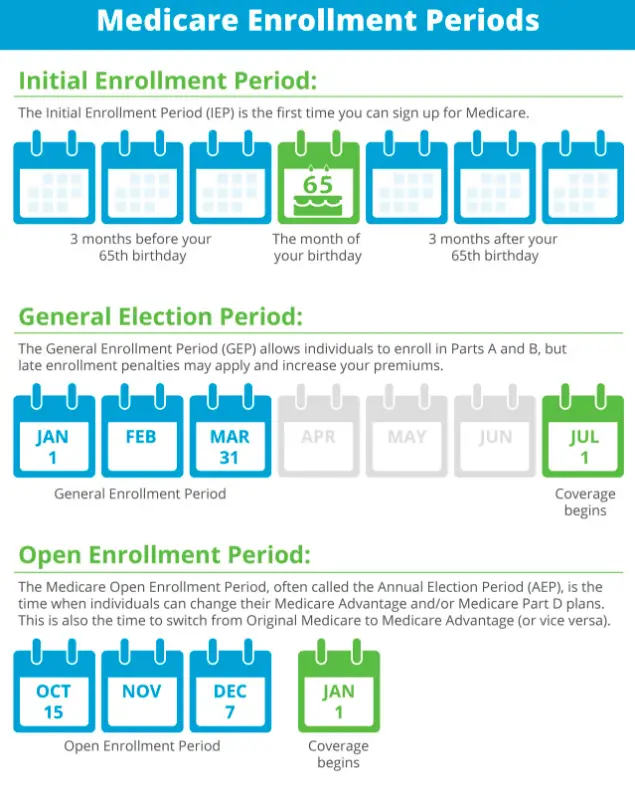

All beneficiaries will have an Initial Enrollment Period for Original Medicare. Your Initial Enrollment Period begins three months before your 65th birth month and ends three months after you turn 65. If you do not enroll during your Initial Enrollment Period and do not have creditable coverage, you could be subject to a penalty when you decide to enroll in the future.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Costs: Part B Vs Part D

The costs for Part B and Part D vary depending on the plan and options.

Part B

A person must pay a monthly premium for Medicare Part B. The premiums usually change each year, but for 2021, the standard premium is $148.50.

In addition, Part B has a 2021 deductible of $203. A 20% coinsurance for most Medicare-approved services will apply after a person has paid the deductible. The coinsurance applies to certain services, including doctors visits and prescription drugs.

Part D

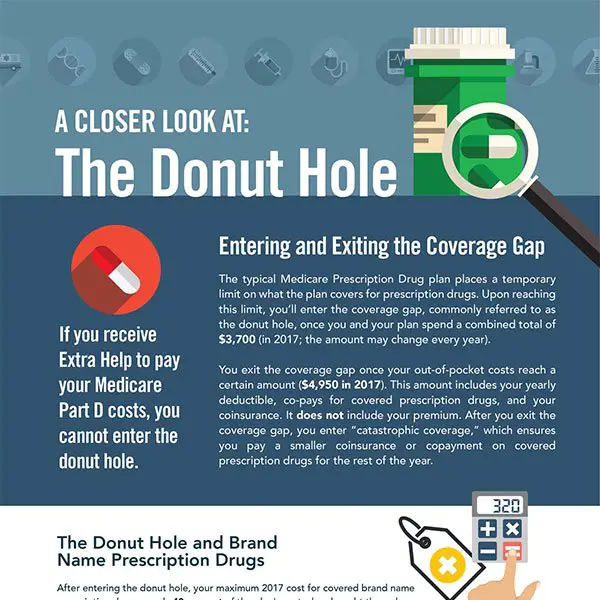

As private insurance companies administer Part D plans, the costs vary by plan and location. Some plans offer comprehensive prescription drug coverage. In 2021, the average Part D monthly premium is $33.06, which is a 1% increase from 2020, according to the Kaiser Family Foundation.

Medicare Advantage and Part D

A person may choose a Part D plan as part of a Medicare Advantage package. Private insurance companies offer Medicare Advantage plans, which results in varying benefits and costs among plans. The costs may include the monthly premium, deductibles, copayments, and coinsurances.

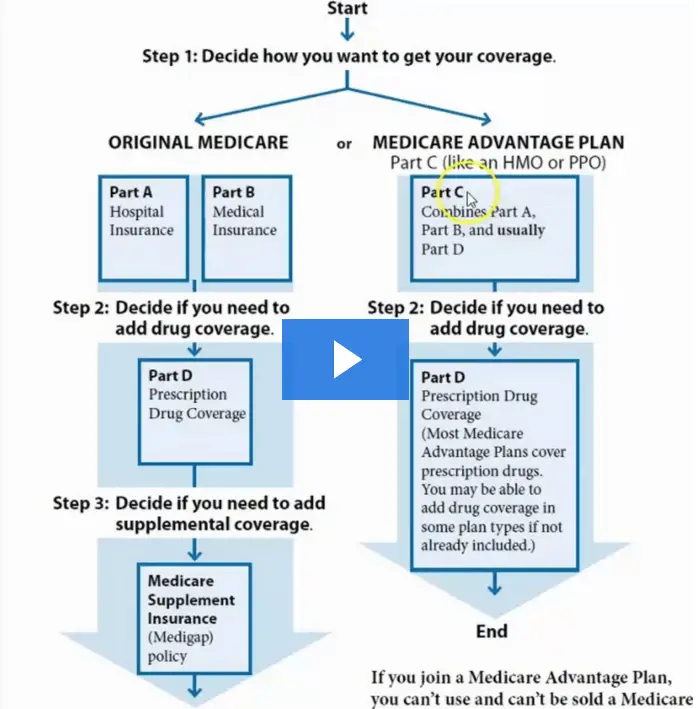

What Is Part C On Social Security

Medicare Part C is not a program that you enroll in at Social Security. Instead, it is the official name for the program we now know as Medicare Advantage. Medicare Part C plans provide you an alternative to traditional Medicare. They are optional, so not everyone will feel like Part C is the best fit for them.

Don’t Miss: Can You Sign Up For Medicare Part B Anytime

Medicare Plus Medigap Supplemental Insurance Policies

About 58% of the 62 million older adults and people with disabilities who receive Medicare benefits choose Original Medicare, Parts A and B, which cover hospitals, doctors, and medical procedures. About 81% of these beneficiaries supplement their insurance with Medigap , Medicaid, or employer-sponsored insurance, and 48 million also pay for a stand-alone Medicare Part D prescription drug policy.

Medicare Supplement Insurance, or Medigap plans, are not connected with or endorsed by the U.S. government or the federal Medicare program.

While this may be the more expensive option, it has a few advantages. Both Medicare and Medigap insurance plans cover you for any hospital or doctor in the U.S. that accepts Medicare, and the great majority do. There is no need for prior authorization or a referral from a primary care doctor. Coverage includes the entire U.S., which may be important for anyone who travels frequently or spends part of the year in a different locale. This option is also attractive to those who have particular physicians and hospitals they want to use.

Medicare Part Ahospital Insurance

Medicare Part A is designed to cover the parts of your major medical care that involve being in the hospital or its aftermath.

If you need to be hospitalized and the hospital you choose accepts Medicare, Medicare Part A will usually cover these aspects:

Medicare Part A also covers other important services:

- Home health care

- Nursing home care

Most people who qualify for Medicare Part A will not pay a premium for their care. If you or your spouse are over 65 and qualify for Social Security benefits, currently receive benefits from Social Security or the Railroad Retirement Board, or had Medicare-covered government employment, you will likely not pay a premium for Medicare Part A. Some younger people with disabilities or life-threatening diseases, such as End-Stage Renal Failure , may also qualify for premium-free Medicare Part A.

You likely will pay certain out-of-pocket expenses, such as coinsurance and deductibles, with Medicare Part A. But whats the difference between Medicare A and B?

Don’t Miss: How Many Quarters Do You Need To Qualify For Medicare

What Does Medicare Part A Cost

Many are eligible for premium-free Part A, which is exactly what it sounds likequalified Medicare beneficiaries arent required to pay a premium for Medicare Part A coverage. To be eligible for Medicare Part A for free, you must be over age 65 and meet one of the following requirements:

- You or your spouse paid Medicare taxes while employed with the government.

- You are eligible for Social Security or Railroad Retirement Board benefits but havent started collecting them yet.

- You currently receive retirement benefits from Social Security or the Railroad Retirement Board.

If you are under age 65, you might still be eligible for premium-free benefits if you meet one of two requirements:

- You have received Social Security or Railroad Retirement Board benefits for two years.

- You have End-Stage Renal Disease .

If you dont meet any of the five requirements above, youll have to pay a premium for Part A. For 2020, the monthly premium is $458 .1 Additional costs with Part A include coinsurance in specific situations and a deductible of $1,408 in 2020 to cover hospital inpatient care.2

Medicare Part A B C And D: Whats The Difference

Selecting a Medicare plan can be overwhelming. Understand which plans cover which services so you can make the best choice for you.

Open enrollment happens every year from the middle of October to the middle of December. It is the period of time when you can make changes to your Medicare coverage. You can enroll in a new Medicare prescription drug plan, switch from Original Medicare to a Medicare Advantage plan or change Medicare Advantage plans.

When youâre first selecting a Medicare plan, you may be faced with an overwhelming number of choices. One of the most challenging parts of understanding Medicare is how the different parts fit together.

This article describes the differences between Original Medicare and Medicare Advantage . It also explains how Part D fits into the different plans. Youâll also learn what else to keep in mind as you are picking a plan.

Also Check: What Is A Medicare Advantage Plan Part C

Original Medicare Vs Medicare Advantage

It’s important to learn about the differences in coverage, cost and care provider rules because these will impact how you decide which option is best for you. Read below to learn about each in detail below.

| Original Medicare | |

|---|---|

| Includes hospital coverage + medical coverage | Combines hospital coverage + medical coverage + additional health benefits under one plan |

| Does not provide prescription drug coverage | Often includes prescription drug coverage |

| Does not provide additional health benefits | Can include additional health benefits – dental, vision, hearing, fitness |

| Provided by the federal government | Provided by private insurance companies with varying benefits, costs and coverage options based on location and provider |

Which Is Better Ppo Or Hmo

The biggest advantage that PPO plans offer over HMO plans is flexibility. PPOs offer participants much more choice for choosing when and where they seek health care. The most significant disadvantage for a PPO plan, compared to an HMO, is the price. PPO plans generally come with a higher monthly premium than HMOs.

Recommended Reading: Does Medicare Cover Eye Exams For Glaucoma

Is Medicare Part A Free

Typically, most people dont pay for Part A if they have paid Medicare taxes for a certain amount of time while working. However, if you dont qualify for premium-free Part A, it can be purchased for a monthly premium. This amount may vary each year and is based on how long you or your spouse worked and paid Medicare taxes.

Enrollment Period For Medicare Part D

Like Medicare Part C, you are eligible to enroll in Medicare Part D during the seven-month period around your 65th birthdaybeginning three months before the month of your 65th birthday, including the month of your birthday, and up to three months after the end of your birthday month. You must enroll directly through an insurance company.

Also Check: Where Can I Sign Up For Medicare

What Medicare Coverage Does Blue Shield Offer

If you’re eligible for Medicare, you can get health coverage through Original Medicare alone. To help pay for additional services and benefits, you may be interested in enhancing your coverage with a Medicare Supplement plan .

You may also like the convenience and coverage of a Medicare Advantage Plan that provides rich benefits without large plan premiums. In fact, some of these plans, like most of the Medicare Advantage Plans offered by Blue Shield of California, don’t have any additional plan premium at all.

Blue Shield also offers standalone Medicare Prescription Drug Plans.

Complete coverage = Medicare, Parts A and B plus Blue Shield Medicare plans: Medicare Supplement + Prescription Drug Plans or Complete coverage = Medicare Advantage-Prescription Drug Plans which include Part C + Part D

What Is The Difference Between Original Medicare And Medicare Advantage

Definitions:

- Premium: The monthly fee you pay to have Medicare or your health plan.

- Deductible: What you must pay before Medicare or your health plan starts paying for your care.

- Copayment/coinsurance: Your share of the cost you pay for each service.

- Part A: Medicare hospital insurance for inpatient care.

- Part B: Medicare medical insurance for outpatient care.

- Part D: Medicare drug coverage.

- Medigap: Supplemental insurance that helps pay your out-of-pocket cost in Original Medicare.

You May Like: How Do You Qualify For Medicare In Texas

When To Sign Up For Medicare

As you approach age 65, its important to know which enrollment deadlines apply to your circumstances. Begin by checking on your eligibility. To avoid costly penalties and gaps in coverage, most people should for Medicare Part A and Part B in the seven-month window that starts three months before the month you turn 65 and runs for another three months following your 65th birthday.

If you currently get Social Security, you will be automatically enrolled if not, you need to sign up either online or at your Social Security office.

What Prescription Drugs Are Covered By Medicare Part B

Medicare Part B only covers certain medications for some health conditions, while Part D offers a wider range of prescription coverage. Part B drugs are often administered by a health care provider , or through medical equipment at home. Examples of drugs covered under Medicare Part B include:

- Injections for osteoporosis

- End-stage renal disease medications

- Flu, pneumonia, and Hepatitis B shots

Medicare Part D may cover medications that arent covered under Part B, and vice versa. When you choose a Medicare plan, make sure it will cover your current medications.

Read Also: Can You Register For Medicare Online

What Is Medicare Part B Medical Insurance

Medicare Part B provides outpatient/medical coverage. The list below provides a summary of Part B-covered services and coverage rules:

This list includes commonly covered services and items, but it is not a complete list. Keep in mind that Medicare does not usually pay the full cost of your care, and you will likely be responsible for some portion of the cost-sharing for Medicare-covered services.

The 2022 Part-B premium is $170.10 per month

Medicare Part C = Medicare Advantage Plans

- Once you have Parts A and B, you can enroll in a Medicare Advantage plan

- When Medicare Advantage plans include Part D prescription drug coverage, they’re called MAPD plans

- MAPD plans are usually the lowest cost way to get Parts A, B and D together

- You’ll continue to pay your Part B premium to the federal government

- Usually, you’ll pay an additional monthly premium to your private insurance company, too

- Medicare Advantage plans may also include extras like dental and vision coverage

- You won’t be denied due to a pre-existing condition

Also Check: Does Medicare Part D Cover Dental

Medicare Part B: Medical Insurance

Examples of services that Medicare Part B helps cover include:

-

Doctors office visits

-

Ambulance services

-

Durable medical equipment

The standard premium amount for Medicare Part B is 2022 is $170.10 per month .

In addition to your monthly premium, you pay $233 per year for your Part B deductible in 2022.

Once your deductible is met, you usually pay a coinsuranceof 20% of the Medicare-approved amount for medically necessary care and services.

What Is Part D In Medicare Explained

Medicare Part D, the prescription drug benefit, is the part of Medicare that covers most outpatient prescription drugs. Part D is offered through private companies either as a stand-alone plan, for those enrolled in Original Medicare, or as a set of benefits included with your Medicare Advantage Plan.

Read Also: How Can I Get A Medicare Card

Choosing Traditional Medicare Plus A Medigap Plan

As noted above, Original Medicare comprises Part A and Part B . You can supplement this coverage with a stand-alone Medicare Part D prescription drug plan and a Medigap supplemental insurance plan. While signing up for Medicare gets you into Parts A and B, you have to take action on your own to buy these supplemental policies.

Medicare Parts A B C And D

by Christian Worstell | Published January 20, 2022 | Reviewed by John Krahnert

Medicare is made up of four parts: Medicare Part A, Part B, Part C and Part D. Each part provides different benefits, and some even work together.

Learn more about the 4 parts of Medicare and the benefits they offer below.

Don’t Miss: Does Medicare Cover Total Knee Replacement

How Much Does Medicare Part B Cost

When you enroll in this part of Medicare, you are responsible for its costs such as premium. In 2022, the standard Medicare Part B premium is $170.10 each month.

However, those in a higher income bracket will pay a higher monthly premium.This higher monthly premium is due to the Income Related Monthly Adjustment Amount . IRMAA is calculated by looking at your annual income and using a sliding scale to determine your premium.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

| 2020 annual income: Individual | |

|---|---|

| $587.30 | Plan Premium + $77.90 |

For most beneficiaries, the premium is automatically deducted from their monthly Social Security benefits check. If you do not receive Social Security benefits, you will get a quarterly bill from Medicare.

Medicare offers an online payment option called Easy Pay, which you can access with a MyMedicare account. Additionally, you may pay your quarterly premium by mail instead.

Alongside the premium, your Medicare Part B coverage includes an annual deductible and 20% coinsurance, for which you are responsible for paying out-of-pocket. In 2022, the Medicare Part B deductible is $233.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

If you are a lower-income beneficiary and are dual-eligible for both Medicare and Medicaid, you may qualify for a Medicare Savings Program.

What Does Medicare Part B Cost

Medicare Part B, on the other hand, requires a monthly premium. The standard premium is $144.60 in 2020 and increases with income.3 You can choose to have this premium deducted automatically from your Social Security benefits, which can make things easier.

The annual deductible for Part B is $198 in 2020 .4 Once this is paid, youll only pay your coinsurance payments, which are 20% of covered expenses.

Some low-income and disabled people may be eligible for help paying Part B premiums through their state’s Medicare Savings Program . Those eligible for free Medicare Part B may qualify for free or lowered deductibles and coinsurance as well.

If you con’t qualify for an MSP, consider purchasing a Medicare Supplement plan to help cover the costs of both Parts A and B.

Learn more about Medicare costs.

You May Like: Do You Have Dental With Medicare

What Is Covered By Medicare Part B

Medicare Part B offers comprehensive coverage for outpatient services, durable medical equipment, and doctor visits. The two main types of coverage this part of Medicare includes are medically necessary and preventive.

The medically necessary coverage encompasses a variety of tests, procedures, and care options. A medical service or supply must be a requirement for treating or diagnosing a medical condition for Medicare to consider them medically necessary. Each situation is different, so a medical supply or service that is medically necessary for one person may not be for another.

It is easy to keep up with your general health needs through Medicares outpatient insurance by utilizing annual wellness visits.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Medicare Part B covers the following preventive care services:

- Mental Health Counseling

You can receive many preventive services and more at your annual wellness visit.

Alongside preventive care services, Medicare Part B covers certain outpatient services you receive in the hospital. These include:

If you are administered drugs while at the hospital, Medicare Part B will also provide coverage for these services.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

What Does Medicare Part A Cover

Medicare Part A essentially covers inpatient medical care:

- Home health services, including nursing care, physical therapy, and occupational therapy

- Hospice, which is care aimed at making terminally ill individuals as comfortable as possible after they decide they no longer want to pursue treatment for their illness

- Hospital care, including long-term care facilities and inpatient rehab

- Nursing home care, but only if the beneficiary requires more than custodial care

- Skilled nursing facility care, including meals, supplies, and nurse-administered injections

How much Part A covers for these services depends on which type of facility you stay in, whether you’ve met the deductible , and how long your stay lasts.

Don’t Miss: Is Medicare Good Or Bad