If Your Income Has Gone Down

If your income has gone down due to any of the following situations, and the change makes a difference in the income level we consider, contact us to explain that you have new information and may need a new decision about your income-related monthly adjustment amount:

- You married, divorced, or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property because of a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employers pension plan.

- You or your spouse received a settlement from an employer or former employer because of the employers closure, bankruptcy, or reorganization.

If any of the above applies to you, we need to see documentation verifying the event and the reduction in your income. The documentation you provide should relate to the event and may include a death certificate, a letter from your employer about your retirement, or something similar. If you filed a federal income tax return for the year in question, you need to show us your signed copy of the return. Use Form Medicare Income-Related Monthly Adjustment Amount Life-Changing Event to report a major life-changing event. If your income has gone down, you may also use Form SSA-44 to request a reduction in your income-related monthly adjustment amount.

My Income Has Changed: What Can I Do

The SSA states that if life-changing events altered your income in a way that would impact your IRMAA surcharge, you can complete form SSA-44 . After entering your name and social security number, follow these step-by-step directions on how to complete the form:

Step 1 Type of “Life Changing Event”

- Retirement is a life-changing event therefore, you would select work stoppage. Or, if the familys main income earner has passed, then choose death of a spouse.

- Other acceptable events are work reduction, marriage, divorce, loss of income via property or pensions, and employer settlement payment.

Step 2 Reduction in Income

- Enter the tax year, AGI, and tax-exempt interest for the year your income situation changed. For example, if you retired in 2020 and the SSA uses tax information from 2019 , you will use your 2020 tax return and reference form 1040 to complete the section.

- If you retired in 2021 and the SSA uses tax information from 2019, you will want to estimate your AGI and tax-exempt interest for 2021 and enter the applicable information.

- Dont forget to indicate your appropriate tax filing status for the tax year you are reporting, not your current filing status, if different.

Step 3 Modified Adjusted Gross Income

Step 4 Documentation

Step 5 Signature

- Finally, sign the form and provide your phone number and address.

Once you have completed the form, you can either mail it to a local SSA office or take it in personally to meet with a representative.

How Much Does Medicare Cost For A Married Couple

Medicare has no family plans, meaning that you and your spouse must enroll for Medicare benefits separately. This also means husbands, wives, spouses and partners pay separate Medicare premiums.

You may need to enroll at different times, depending on your age and health. While Medicare considers you individually as beneficiaries, your marital status can influence some of your Medicare costs.

Recommended Reading: Does Medicare Cover Bladder Control Pads

How Does Social Security Determine Whether You Pay Extra

The Social Security Administration bases the IRMAA determination on federal tax return information received from the IRS. The adjustment is calculated using your modified adjusted gross income from two years ago. In 2022, that means the income tax return that you filed in 2021 for tax year 2020.

If Social Security determines you have to pay higher premiums, they send you a letter detailing what your premium will be and how they arrived at their decision. If you have both Part B and Part D, you’ll pay a higher premium for each. But if you only have one, you’ll only owe the adjusted amount on the “part” you have. If later in the year you sign up for whichever part you don’t currently have, the adjusted amount is automatically added and you will not receive a second notification.

Again, less than 5 percent of Medicare beneficiaries owe the IRMAA surcharge.

Are My Medicare Benefits The Same As My Spouses

Are you trying to figure out how to get your Medicare benefits? Many people are covered under a spouses health insurance plan while theyre working. But Medicare benefits dont usually cover your spouse. Medicare is individual coverage there is no such thing as Medicare family coverage.

Lets examine how Medicare benefits work if you are married.

Don’t Miss: Does Medicare Cover Prolia Injections

More Resources For Low

If youre disabled or have a low income, you might qualify for financial help through Medicaid, an assistance program run jointly through the federal government and individual states. You might qualify for other financial assistance programs.

Some Medicare policies that are offered by Medicare-approved private insurance companies may save you money, depending on your situation. If you have questions about Medicare plan options, you can contact eHealth to speak with a licensed insurance agent and learn more about your coverage options.

To learn about Medicare plans you may be eligible for, you can:

- Contact the Medicare plan directly.

- Contact a licensed insurance agency such as Medicare Consumer Guides parent company, eHealth.

- Or enter your zip code where requested on this page to see quote.

Planning For Medicare Taxes Premiums And Surcharges

A little foresight can reduce costs.

Medicare and budgeting for future medical expenses are important elements of personal financial planning. Sometimes, controlling Medicare premium costs is overlooked and estimating future medical out-of-pocket expenses is understated. Accordingly, this article focuses on Medicare planning issues that CPA financial planners should consider when advising clients. These issues include an overview of Medicare taxes, the determination of premium surcharges, projected future health care costs, and strategies to mitigate the impact of the escalating Medicare charges paid by many higher-income clients.

Also Check: Does Medicare Pay For Teeth Implants

Top Rated Assisted Living Communities By City

While income doesnt directly play a part in Medicare Advantage premiums, it can be a factor in the total amount owed for Medicare. As Medicare Part B premiums are income-driven, any Medicare Advantage plan that doesnt cover Part B premiums in full will have payments that relate in some part to the amount of money seniors earn.

What You Need To Know For Open Enrollment

Interview by: Heidi Frankel |

fyi50+: Fall is the time of year when the leaves and seasons change. It is also the time of year when people over the age of 65 start considering, comparing, and changing what type of Medicare plan they want to use in 2022. Understanding the details about Medicare is a challenging task.

I asked David Freitag to list a few items about Medicare that are confusing and often overlooked.

How the Cost of Medicare Premiums Is Determined

David Freitag: The big question is always the cost of premiums, and that varies based on your income. In 2021, if you are married and have a joint income less than $176,000, traditional Medicare Part B coverage is just $148.50 a month per person. Expect Medicare premiums to increase in 2022. Additionally, Part B coverage does not include prescription drugs, so people also buy Part D coverage for prescription drugs, which is a separate premium.

Again, if your income is less than $176,000, the cost varies depending on the type of drugs you need but is generally very affordable. With traditional Medicare, people often also buy a supplement policy that covers the deductibles in Medicare Part A and B.

One big misunderstanding about the cost of Medicare premiums is that it is means-tested. A married couple with an income more than $176,000 is subject to IRMAA . IRMAA can be a huge deal.

Which Years Income Is Used to Determine Medicare Pricing

Medicare and Health Savings Accounts

Help With Choosing the Right Health Insurance

You May Like: Does Costco Pharmacy Accept Medicare Part D

Medicare And Taxes: How Your 2023 Medicare Premiums Are Affected By Your 2021 Tax Filing

The 60+ million Americans who are enrolled in Medicare will be paying significantly more in premiums this year than in 2021. But how about 2023 premiums? Did you know that what your Form 1040 includes this year will impact your premiums for next year? And did you also know that if you are a profitably self-employed individual, you can deduct your Medicare premiums and potentially save a bunch of money?

As you begin the process of filing 2021 taxes, you should be aware that what goes on a completed Form 1040 will have an impact on what premiums you will be paying in 2023.

Heres what you need to know:

Self-employed people are allowed to deduct their health insurance premiums on Schedule 1 of the 1040 form as an above the line deduction . The IRS considers you to be self-employed if you own a business as either a sole proprietor , partner , limited liability company member, or S corporation shareholder with at least 2% of company stock.

You can deduct Medicare premiums if youre not self-employed by itemizing deductions using Schedule A. If you are planning to itemize, you can include out-of-pocket medical expenses that exceed 7.5% of your AGI.

Medicare Part B covers medical visits, including services that are deemed necessary or preventive and are part of Original Medicare . This means you are automatically eligible for Part B coverage once you are within three months of your 65th birthday.

More From GOBankingRates

How Much Does Medicare Part B Cost

Q: How much does Medicare Part B cost the insured?A: In 2022, most people earning no more than $91,000 will pay $170.10/month for Part B. And in most cases, Part B premiums are just deducted from beneficiaries Social Security checks.

The standard Part B premium increase for 2022 amounts to nearly $22/month, and is higher than the premium that had been projected in the Medicare Trustees Report.

CMS noted that the higher Part B premiums are due to a variety of factors, including costs associated with the COVID pandemic, the 2020 legislation that kept 2021 Part B premiums lower than they would otherwise have been , and potential costs related to new drugs that might be covered under Part B in the near future .

As described below, the Social Security cost-of-living adjustment can sometimes limit the increase in Part B premiums, but thats not the case for 2022. Although the premium increase is significant, the Social Security COLA was historically large for 2022, and adequate to cover the additional Part B premiums.

You May Like: Can I Get Glasses With Medicare

Medicare Advantage: What About My Spouse

Medicare Advantage plans dont cover both you and your spouse together under one policy. Just as Medicare Part A and Part B cover each Medicare beneficiary separately, you cant share a Medicare Advantage plan with your spouse.

Certainly, theres nothing to prevent you from signing up for the same Medicare Advantage plan as your spouse, in the sense of enrolling in a plan of the same type from the same insurance company.

For example, suppose your wife qualifies for Medicare before you do. Lets say she enrolls in Medicare Advantage Plan X from XYZ Health Insurance Company. If your wife is happy with this plan, you might be interested in signing up for Plan X when youre eligible for Medicare. But you wont have the same policy. When your wife signs up, for example, her plan cant include you. In this way, its different from the way group health insurance often works.

Recommended Reading: Must I Take Medicare At 65

Understanding Modified Adjusted Gross Income

MAGI can be defined as your households adjusted gross income after any tax-exempt interest income, and certain deductions are factored in.

The Internal Revenue Service uses MAGI to establish whether you qualify for certain tax benefits. Most notably, MAGI determines:

- Whether your income does not exceed the level that qualifies you to contribute to a Roth IRA

- Whether you can deduct your traditional individual retirement account contributions if you and/or your spouse have retirement plans, such as a 401 at work

- Whether youre eligible for the premium tax credit which lowers your health insurance costs if you buy a plan through a state or federal Health Insurance Marketplace

For example, you can contribute to a traditional IRA no matter how much money you earn. Typically, you can deduct the IRA contribution amount, reducing your taxable income for that tax year. However, you cant deduct those contributions when you file your tax return if your MAGI exceeds limits set by the IRS and you and/or your spouse have a retirement plan at work.

Recommended Reading: Why Is Medicare Advantage Free

You May Like: What Is The Window To Sign Up For Medicare

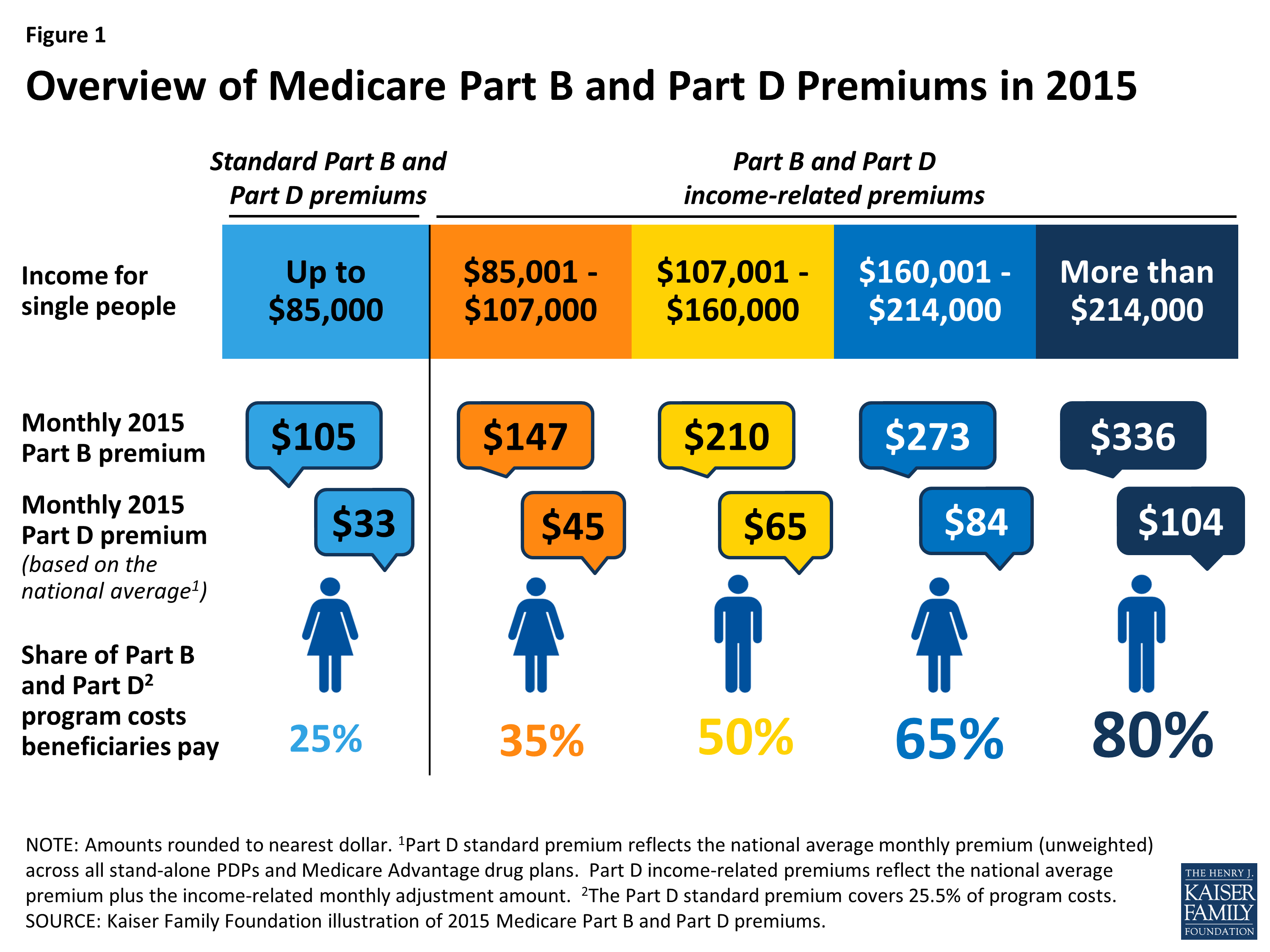

The Medicare Part B Premium

Medicare Part B covers inpatient services like doctor visits and lab work. The standard monthly Part B premium in 2022 is $170.10. This accounts for around 25 percent of the monthly cost for Part B, with the government paying the remaining 75 percent. The percentage paid by high-income beneficiaries ranges between 35 and 85 percent, depending on their income as reported to the IRS.

Paying For Medicare Premiums Tips: Your Hsa And Employer Health Plan

From the above, you can see you may face higher costs for Medicare than you originally thought. Thats why you should consider two things a health savings account plan and if you have employer health coverage.

If you have an HSA and must get Medicare at age 65, the good news is that you can use your HSA funds to pay for Medicare costs including Part B and Part D premiums. Your HSA also can help with other costs, and you can learn more about how Medicare and HSAs work here.

Also Check: Can You Be Dropped From Medicare

How To Calculate Medicare Premiums

By: Mathew J. Ryan, MBA, CFP®, EA

As you hit the retirement milestone, one of the items youll likely need to address is enrolling in Medicare. Medicare has many complexities and the calculation of premiums that you will pay is one of them. The questions and confusion can be endless.

Just a quick, high-level review. Medicare is available for those attaining age 65. Although, you can postpone enrolling if you choose to continue to work and have qualified employer coverage.

Medicare Part A is typically free to all beneficiaries. In contrast, Part B and Part D require premium payments. Thus, collectively speaking, the government covers approximately 75% of the programs overall costs while the premium payments from enrollees account for the remaining 25%. So, how much will you pay?

Read Also: Do You Have To Get Medicare When You Turn 65

Is There Help For Me If I Cant Afford Medicares Premiums

Medicare Savings Programs can pay Medicare Part A and Medicare Part B premiums, deductibles, copays, and coinsurance for enrollees with limited income and limited assets.

Reviewed by our health policy panel.

Q: Is there help for me if I cant afford Medicares premiums?

A: Yes. Medicare Savings Programs can help with premiums and out-of-pocket costs.

Also Check: Does Medicare Have Long Term Care Insurance

How Much Will I Pay For Premiums In 2022

Most people will pay the standard amount for their Medicare Part B premium. However, youll owe an IRMAA if you make more than $91,000 in a given year.

For Part D, youll pay the premium for the plan you select. Depending on your income, youll also pay an additional amount to Medicare.

The following table shows the income brackets and IRMAA amount youll pay for Part B and Part D in 2022:

| Yearly income in 2020: single | Yearly income in 2020: married, joint filing | 2022 Medicare Part B monthly premium | 2022 Medicare Part D monthly premium |

|---|---|---|---|

| $91,000 | |||

| $578.30 | your plans premium + $77.90 |

There are different brackets for married couples who file taxes separately. If this is your filing situation, youll pay the following amounts for Part B:

- $170.10 per month if you make $91,000 or less

- $544.30 per month if you make more than $91,000 and less than $409,000

- $578.30 per month if you make $409,000 or more

Your Part B premium costs will be deducted directly from your Social Security or Railroad Retirement Board benefits. If you dont receive either benefit, youll get a bill from Medicare every 3 months.

Just like with Part B, there are different brackets for married couples who file separately. In this case, youll pay the following premiums for Part D:

- only the plan premium if you make $91,000 or less

- your plan premium plus $71.30 if you make more than $91,000 and less than $409,000

- your plan premium plus $77.90 if you make $409,000 or more

You can request an appeal if:

Medicare Part D Premium

Medicare Part D is optional prescription drug coverage, available as a stand-alone Medicare Prescription Drug Plan that you enroll into to augment your Original Medicare coverage or through a Medicare Advantage Prescription Drug plan.

Although Medicare Part D is offered by private Medicare-contracted insurance companies, the government still sets an income-related monthly adjustment amount. Heres a breakdown of the Medicare Part D payment adjustments . Please note that you typically pay your Part D premium regardless of income level the amount in the far right column is the income adjustment payment.

| Your income if you filed an individual tax return | Your income if married and you filed a joint tax return | Your income if married and you filed a separate tax return | You pay your Medicare Part D premium, plus this amount |

| $85,000 or less | |||

| $72.90 |

Your Medicare Part D income adjustment payment is typically deducted from your monthly Social Security benefit it isnt added to the premium bill you get from the Part D Prescription Drug Plan. If you have to make an adjustment payment, youll get a notice from Social Security.

If youre charged the income adjustment payment outlined above for Medicare Part B but your income has dropped, you can contact the Social Security information and apply to reduce your adjustment amount.

Recommended Reading: How Old To Be Covered By Medicare