How Has Health Reform Impacted Medicare Advantage

The Patient Protection and Affordable Care Act has restructured payments to Medicare Advantage plans in an effort to reduce budget spending on Medicare, but for the last few years, the payment changes have either been delayed or offset by payment increases. When the law was first passed, many people including the CBO projected that Medicare Advantage enrollment would drop considerably over the coming years as payment reductions forced plans to offer fewer benefits, higher out-of-pocket costs, and narrower networks.

But that has not been the case at all. Medicare Advantage enrollment continues to grow each year. There were nearly 28 million Advantage enrollees in 2021, which accounts for more than 43% of all Medicare beneficiaries Thats up from just 13% in 2004, and 24% in 2010, the year the ACA was enacted.

The number of Medicare Advantage plans available has increased for 2022 to the highest in the last decade, with a total of 3,834 plans available nationwide. The majority of beneficiaries still have at least one zero-premium plan available to them, and the average enrollee can select from among 39 plans in 2022.

How Much Does Medicare Part C Cost

If you enroll in a Medicare Advantage plan, you may have to pay some or all of the following expenses:

Some Medicare Advantage plans feature $0 premiums, though $0 premium plans aren’t available in all locations.

54 percent of all Medicare Advantage plans that include prescription drug coverage feature a $0 premium, and 98 percent of Medicare Advantage beneficiaries who have a plan that includes drug coverage are enrolled in a $0 premium plan.1

In the video below, Medicare expert John Barkett explains that Medicare Advantage premiums dropped by around 14 percent in 2020.

Who Offers Medicare Part C Plans

Medicare Part C plans are offered by traditional health insurance companies. Just a few examples include Aetna, Blue Cross Blue Shield, Cigna, Kaiser Permanente, United Healthcare, and others. You may want to ask a health insurance agent to guide you through each plan to decide which one is the best for your needs.

All Part C Plans all involve a network of healthcare providers through either a Health Maintenance Organization or a Preferred Provider Organization . You must live within the geographical area required by the plan you choose.

You May Like: How Can I Sign Up For Medicare Part B

Are You Eligible For Medicare Part C

You qualify for Medicare Part C if you already have Medicare parts A and B, and if you live in the service area of the Medicare Part C provider you are considering.

Due to law passed by Congress that went into effect in 2021, people with end stage renal disease are eligible to enroll in a broader range of Medicare Advantage plans. Before this law, most plans would not accept you or limit you to a Special Needs Plan if you had a diagnosis of ESRD.

what you need to know about enrolling in medicare

- Enrollment into Medicare is time-sensitive and should be started roughly 3 months before you turn age 65. You can also apply for Medicare on the month you turn 65 and the 3 months following your 65th birthday although your coverage will be delayed.

- If you miss the initial enrollment period, open enrollment runs from October 15 through December 7 every year.

- You can sign up for original Medicare online through the Social Security Administration website.

- You can compare and shop for Medicare Part C plans online through Medicares plan finder tool.

There are two main types of Medicare Advantage plans offered, which well go over in detail next.

What Are Medicare Advantage Plans

A Medicare Advantage Plan is another way to get your Medicare coverage. Medicare Advantage Plans, sometimes called Part C or MA Plans, are offered by Medicare-approved private companies that must follow rules set by Medicare. If you join a Medicare Advantage Plan, youll still have Medicare but youll get most of your Medicare Part A and Medicare Part B coverage from the Medicare Advantage Plan, not Original Medicare. Most plans include Medicare prescription drug coverage . In most cases, youll need to use health care providers who participate in the plans network. However, many plans offer out-of-network coverage, but sometimes at a higher cost. Remember, you must use the card from your Medicare Advantage Plan to get your Medicare-covered services. Keep your red, white, and blue Medicare card in a safe place because youll need it if you ever switch back to Original Medicare.

Medicare Advantage Plans cover almost all Medicare Part A and Part B benefits

In all types of Medicare Advantage Plans, youre always covered for emergency and urgent care. Medicare Advantage Plans must cover almost all of the medically necessary services that Original Medicare covers. However, if youre in a Medicare Advantage Plan, Original Medicare will still cover the cost for hospice care, some new Medicare benefits, and some costs for clinical research studies.

Plans can offer extra benefits

Medicare Advantage Plans must follow Medicare’s rules

Don’t Miss: Does Medicare Cover Total Knee Replacement

Already Enrolled In Medicare

If you have Medicare, you can get information and services online. Find out how to .

If you are enrolled in Medicare Part A and you want to enroll in Part B, please complete form CMS-40B, Application for Enrollment in Medicare Part B . If you are applying for Medicare Part B due to a loss of employment or group health coverage, you will also need to complete form CMS-L564, Request for Employment Information.

You can use one of the following options to submit your enrollment request under the Special Enrollment Period:

Note: When completing the forms CMS-40B and CMS-L564

- State I want Part B coverage to begin in the remarks section of the CMS-40B form or online application.

- If possible, your employer should complete Section B.

- If your employer is unable to complete Section B, please complete that portion as best as you can on behalf of your employer without your employers signature and submit one of the following forms of secondary evidence:

- Income tax form that shows health insurance premiums paid.

- W-2s reflecting pre-tax medical contributions.

- Pay stubs that reflect health insurance premium deductions.

- Health insurance cards with a policy effective date.

- Explanations of benefits paid by the GHP or LGHP.

- Statements or receipts that reflect payment of health insurance premiums.

Some people with limited resources and income may also be able to get .

Pitfalls Of Medicare Advantage Plans

We publish unbiased product reviews our opinions are our own and are not influenced by payment we receive from our advertising partners. Learn more about how we review products and read our advertiser disclosure for how we make money.

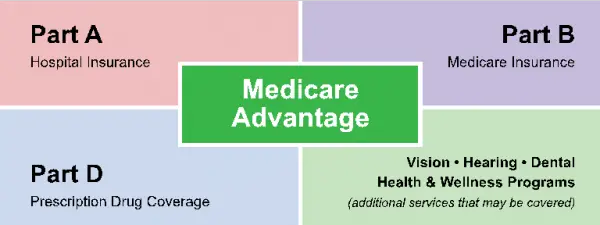

A Medicare Advantage Plan, also called a Part C or an MA Plan, may sound enticing. It combines Medicare Part A , Medicare Part B , and usually Medicare Part D into one plan. These plans cover all Medicare services, and some offer extra coverage for vision, hearing, and dental. They are offered by private companies approved by Medicare.

Still, while many offer low premiumssometimes as low as $0 per monththe devil is in the details. You will find that many plans unexpectedly won’t cover certain expenses when you get sickresulting in unforeseen out-of-pocket costs for youand what they pay can differ depending upon your overall health. Here’s a look at some of the disadvantages of Medicare Advantage Plans.

Recommended Reading: What Does Medicare Part E Cover

Pros And Cons To Medicare Advantage Part C Plans

Pros:

- These are typically cheaper compared to Medicare Supplement plans.

- These normally include Rx drug coverage.

- They can be switched once per year .

- SOME plans include dental and vision coverage.

Cons:

- Because they are cheaper, the benefits are often lacking compared to Medigap plans.

- One must deal with networks of hospitals and doctors .

- Plan benefits and premiums usually change once per annum . While this isnt inherently a bad thing, we have observed that costs tend to rise and benefits decrease.

There is a lot more information to be covered regarding these plans. In order to make sure that youre choosing the best MAPD healthcare plan for your needs, do not hesitate to give us a call, and our highly trained Medicare agents will be available to assist you. We can answer any questions you may have regarding the MAPD disenrollment period and healthcare.

Get the Cheapest Medicare Advantage Plan Part CRates!

If you’ve been asking, What is Medicare Advantage Part C? Speak to one of our licensed Medicare agents to get the best rates today!

- Medicare Advantage Plan Part C

Con: Plans Vary From State To State

Regular Medicare is universal across the United States. However, since Medicare Advantage plans are private plans, they vary depending on your state. For example, the above chart is specific to a plan in Florida.

As we mentioned earlier, Medicare Advantage plans vary depending on your ZIP. If you live in a rural area, you may not have the best network included in your plan. If you move to another state or even a different area, your Medicare Advantage plan may be unavailable. You can switch your plan outside of open enrollment, but the process can be quite tedious in many cases.

If you travel often, you may not receive coverage everywhere you visit. This is extremely challenging if you get hurt out of your home state.

Don’t Miss: Is A Walk In Tub Covered By Medicare

Con: Additional Coverage Costs

Similar to an all-in-one shampoo and conditioner, Medicare Advantage may not cover a lot of specifics despite covering everything. Users often find a lot of additional fees for things such as drug deductibles and copays for specialist visits.

Before committing to a Medicare Advantage plan, carefully review the copay and deductible summary. On average, here are some expected copays you could see on your Advantage plan.

| Service | |

| Outpatient surgery | $100 |

If you get sick or have an accident, your out-of-pocket costs can quickly add up. Despite the $0 monthly premium, beware of the out-of-pocket expenses.

Also Read:How Your Income Affects Your Medicare

What Is The Network Like

Medicare Advantage plans have a network of doctors to choose from. It may be an HMO, PPO, or POS network. Supplement plans, on the other hand, do not have a network.

PPO Advantage Plans may restrict members to receiving care only in their county. This can be an issue if you live close to the county line and wish to see doctors in a neighboring county.

Also Check: Will Medicare Cover Walk In Tubs

Rules For Medicare Advantage Plans

Medicare pays a fixed amount for your care each month to the companies offering Medicare Advantage Plans. These companies must follow rules set by Medicare.

Each Medicare Advantage Plan can charge different

. They can also have different rules for how you get services, like:

- Whether you need areferralto see a specialist

- If you have to go to doctors, facilities, or suppliers that belong to the plan for non-emergency or non-urgent care

These rules can change each year.

What Is The Advantage Of A Medicare Part C Plan

Federal law requires Medicare Part C plans to provide, at a minimum, all the same services provided by Original Medicare Parts A and B. Examples of these services are:

- Inpatient hospital stays and treatments.

- A limited number of days in a skilled nursing facility.

- Inpatient rehabilitation.

- A limited number of days of home health care.

- Outpatient doctors visits.

- Laboratory tests, including blood tests and X-rays.

- Limited mental health services.

- Emergency care, including ambulance transportation.

- Preventive care.

Also Check: Does Medicare Part D Cover Dental

Signing Up For Original Medicare

Some people qualify for automatic enrollment, and others have to enroll.

- If youre already receiving Social Security or railroad retirement benefits youll be enrolled in Part A and Part B automatically on your 65th birthday. If youre under 65, its the 25th month you receive disability benefits.

- ALS patients are automatically enrolled in Medicare coverage when their Social Security disability benefits begin, regardless of age. If you have end-stage renal disease , you must manually enroll.

If youre eligible for Medicare but dont qualify for automatic enrollment, you can apply online, over the phone or in person at your local Social Security office.

If you worked for a railroad, youll need to contact the Railroad Retirement Board for information on enrollment.

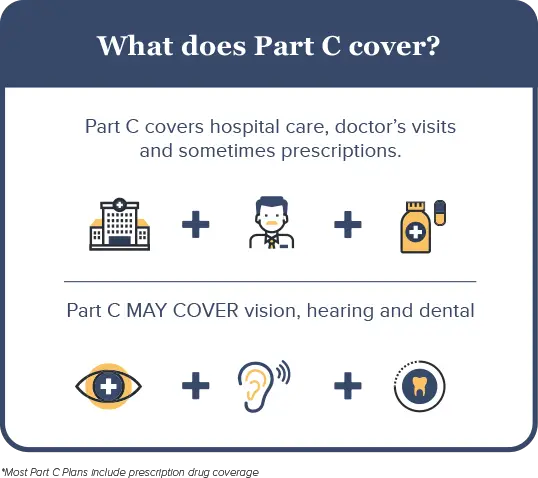

What Is Medicare Part C Coverage For Extra Benefits

Unlike Original Medicare, Medicare Part C generally offers coverage for prescription drugs you take at home. The exact prescription drugs that are covered are listed in the planâs formulary. Formularies may vary from plan to plan.

Other extra benefits that Medicare Part C may cover include:

- Routine dental care including cleanings, x-rays, and dentures

- Routine vision care including contacts and eyeglasses

- Routine hearing care including hearing aids

- Fitness benefits including exercise classes

Not all Medicare Part C plans cover extra benefits in the same way. For example, some Medicare Part C plans may only cover âMedicare-covered dental benefitsâ which generally only means dental care in the event of an accident or disease of the jaw. If your Medicare Part C covers dental benefits more extensively, you may have a higher monthly premium for that coverage.

Also Check: Can You Be Denied Medicare Coverage

How To Choose The Best Medicare Advantage Plan

Comparing Medicare Advantage plans requires you to understand your health care needs and think about what each type of plan offers. If you have a chronic health condition and want to be able to keep using a specific doctor or facility, youll want health coverage that they accept. If you take prescription drugs, some plans may offer lower out-of-pocket costs than others.

Here are some questions to ask as you evaluate Medicare Advantage plans:

-

Do you have to get a referral to see specialists?

-

What benefits does each plan include?

-

Are all of your prescription drugs covered, and how much will they cost?

-

Are your doctors covered?

-

Whats the plan’s Medicare star rating?

The Parts Of Medicare

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

Most people age 65 or older are eligible for free Medical hospital insurance if they have worked and paid Medicare taxes long enough. You can enroll in Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

Recommended Reading: Is It Better To Have Medicare Or Medicaid

How Much Do Medicare Advantage Plans Cost

Even though Advantage enrollees have rights and protections under Medicare guidelines, the services offered and the fees charged by private insurers vary widely. A thorough understanding of how these plans work is key to the successful management of your personal health.

Advantage plans can charge monthly premiums in addition to the Part B premium, although 59% of 2022 Medicare Advantage plans with integrated Part D coverage are zero premium plans. This means that beneficiaries only pay the Part B premium .

But across all Medicare Advantage plans, the average premium is about $19/month for 2022. This average includes zero-premium plans and Medicare Advantage plans that dont include Part D coverage if we only look at plans that do have premiums and that do include Part D coverage, the average premium is higher.

Some Advantage plans have deductibles, others do not. But all Medicare Advantage plans must currently limit in-network maximum out-of-pocket to no more than $7,550. The out-of-pocket maximum had previously been $6,700 each year from 2011 through 2020, but it increased as of 2021, under new methodology that was finalized in 2018. CMS will continue to gradually change it over time, although its still $7,550 for 2022.

Copayments for doctors visits differ dramatically, as do the actual health care services and how often enrollees receive those services. Close attention to the details is necessary when assessing these plans.

How Medicare Advantage Plans Work

Medicare Advantage plans also known as Medicare Part C are required to provide the same benefits as Medicare Part A, which covers hospitalization, and Medicare Part B, which covers doctors visits. Medicare Advantage plans also typically include Medicare Part D prescription drug coverage and may include benefits not covered by Medicare, providing some savings on routine dental care, eye exams and glasses, and hearing aids.

You May Like: Which Glucometer Is Covered By Medicare

How To Choose The Right Medicare Advantage Plan

In many cases, despite some of the downsides, $0 monthly premiums are hard to say no to. When choosing your Medicare plan, ask yourself:

- How much did you spend on both fixed and out-of-pocket healthcare costs?

- Which prescriptions do you need and how expensive they are?

- What additional coverage do you need?

- Will a chronic condition affect your plan, how often do you seek care for your condition?

- Do you have long-term medical needs or concerns?

- Does your current doctor fall under the same network?

- How important is it to receive your current physicians continued care?

- How often do you seek care out-of-network?

Most importantly, when looking for Medicare Advantage plans, you should check CMS quality star rating. The CMS star rating measures things like managing chronic conditions, available care, customer experience, and drug pricing.

If youre ever confused about which plan is best suited for you, you can use an unbiased tool like Quote Purple to get a free quote and talk directly with a partner when you call today.