How To Switch Part D Plans

Finding the right Medicare Part D prescription drug plan isnt easy. So after you settle on one, switching plansand going through the process all over againmight seem life a pain. But there are plenty of reasons to switch.

- Your doctor changed your medications or dosages

- Your insurance company changed up your plan

- Your current plan isnt available in your area anymore

No matter what your reason for switching Part D plans, you can make the process faster and easier by knowing the ins and outs before you get started.

When Can You Disenroll From A Medicare Advantage Plan

Like switching Medicare Advantage Plans, you can only disenroll from a Medicare Advantage Plan during certain times of the year.

You can disenroll from your plan during the annual election period, special election periods or during the annual Medicare Advantage Open Enrollment Period, Dworetsky says. Medicare will automatically disenroll you from your old plan if you switch to a different Medicare Advantage plan during any of these periods.

What Is The Annual Election Period

The Medicare AEP is sometimes also called by several other names, such as the Annual Election Period or the Open Enrollment Period for Medicare Advantage and Medicare prescription drug coverage. It is also sometimes called the Medicare Fall Open Enrollment Period.

Its understandable why there can be some confusion between these two enrollment periods.

Our helpful Medicare Enrollment Guide can help walk you through the enrollment process.

Recommended Reading: How To Apply For Medicare In Colorado

When To Switch Plans

You can switch to a new Medicare prescription drug plan simply by joining another drug plan during Medicare’s yearly Open Enrollment Period, Oct. 15 – Dec 7.

To find out which plans cover your drugs, go to the Medicare.gov Plan Finder . Enter your ZIP code and your prescription drugs.

There are other times of the year Medicare may allow you to switch plans. For example, if you move to a new area, or you lose or gain other health insurance. Contact us to find out if you might qualify for a Special Enrollment Period to change plans without having to wait for the Open Enrollment Period.

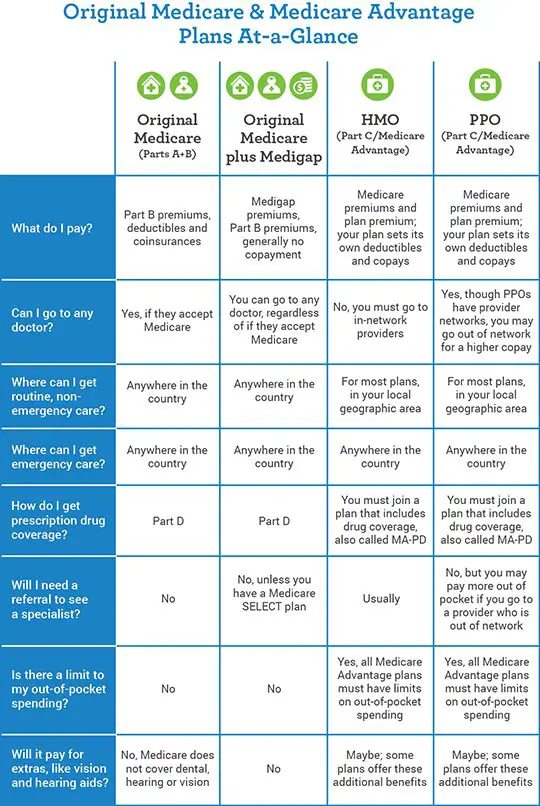

Do You Want Coverage In One Plan

If you dont mind having restrictions on what health care providers you can visit, or what medical facilities and suppliers you can use, enrolling in a Medicare Advantage plan that includes prescription drug coverage may be a good solution.Most Medicare Part C plans include additional prescription drug coverage and extra benefits bundled together with the basic benefits of Medicare Parts A and B. Compare plans online to find the one that is right for you.

Read Also: Does Medicare Pay For Insulin

Ready To Change Coverage Youre Not Alone

Youve done your homework, carefully compared Medicare coverage options, and youve become one of more than 63 million Americans enrolled in some kind of Medicare plan.

And now whats this? Youre ready to change your Medicare plan or your coverage?

Youre not alone. Hundreds of thousands of Medicare enrollees take a hard look at their Medicare coverage and decide to switch each year . Many beneficiaries are looking for improvement in their access to providers or specific medications, while others complain that they chose coverage based on inaccurate information theyd received. Others cite claims denials for medical services they expected would be covered.

But while there are a variety of reasons a consumer might want to make a leap to new coverage, the options for coverage switches are limited. With that in mind, weve put together a summary of your options for changing your coverage.

When To Change Medicare Part D Plans

Its a good idea to review your prescription drug coverage each year to ensure youre still in the right plan for your needs, but there are limits to when you can change plans. Most people switch Part D plans during annual open enrollment , which occurs October 15 through December 7 each year.

If youre switching from Medicare Advantage back to Original Medicare and want to add Part D coverage at the same time, you can do so during annual open enrollment or the Medicare Advantage Open Enrolment Period January 1 through March 31.

If you want to switch plans outside these two enrollment periods, you may do so if you qualify for a special enrollment period . There are many kinds of SEPs, and you could be eligible for one if you:

- Move out of your plans service area

- Lose coverage because your insurer withdraws coverage fromform your current area

- Can prove the plan failed to provide promised coverage

- Leave Medicare Advantage to return to Original Medicare

- Move into a nursing home or other institution

- Join Programs of All-Inclusive Care for the Elderly

- Lose or gain Extra Help

Finally, you can switch from any Part D plan to a 5-star plan at any time during the year .

Learn more about Medicare enrollment periods.

You May Like: What Age Can You Start To Collect Medicare

Changing Your Medicare Supplement

Why would you want to change your Medicare Supplement plan? In talking with customers, we find a handful of basic reasons customers might consider switching.

Switching Medicare Supplement plans is easy. However, make sure you are not losing benefits or coverages when switching companies or to a different plane.

You dont have to wait for a special enrollment period to make the switch. In most states, you will have to answer medical questions and could be turned down based on pre-existing conditions. Theres a wide range of questions and responses between insurance carriers. Some make the process simple with few questions. Others have more detailed questionnaires.

If you are considering switching, an experienced agent with access to multiple carriers can direct you to the simplest and most competitive options.

Rules around switching plans can vary based on the state you live in. These states allow you to switch without medical questions:

California and Oregon have the Medicare Supplement birthday rule. For these states, you can change each year during your birth month with no medical questions.

Connecticut and New York allow for guaranteed issuance when switching policies at any time.

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Don’t Miss: Should I Get Medicare Part C

Medicare Part D Costs

The national average monthly bid amount for Medicare Part D is $38.18 for 2022. Thats down from $43.07 in 2021.

But a Kaiser Family Foundation study found actual premiums paid by Part D recipients in 2022 vary widely across the country, from a low of $5.50 in Colorado to a high of $207.20 in South Carolina.

High-income households pay even more. This income-related monthly adjustment amount is added to the standard Part D premium.

You may also have a deductible or copay cost.

When youre looking for the right prescription drug plan, keep this in mind:

When Can I Join A Medicare Part D Prescription Drug Plan

En español | You can get Medicare prescription drug coverage in one of two ways: through a stand-alone Part D drug plan or through a Medicare Advantage managed care plan which includes Part D drug coverage in its benefits package. Both types of plan are offered by private insurance companies that are regulated by Medicare.

Whether you choose a stand-alone Part D drug plan or a Medicare Advantage plan, you must enroll during a designated enrollment period:

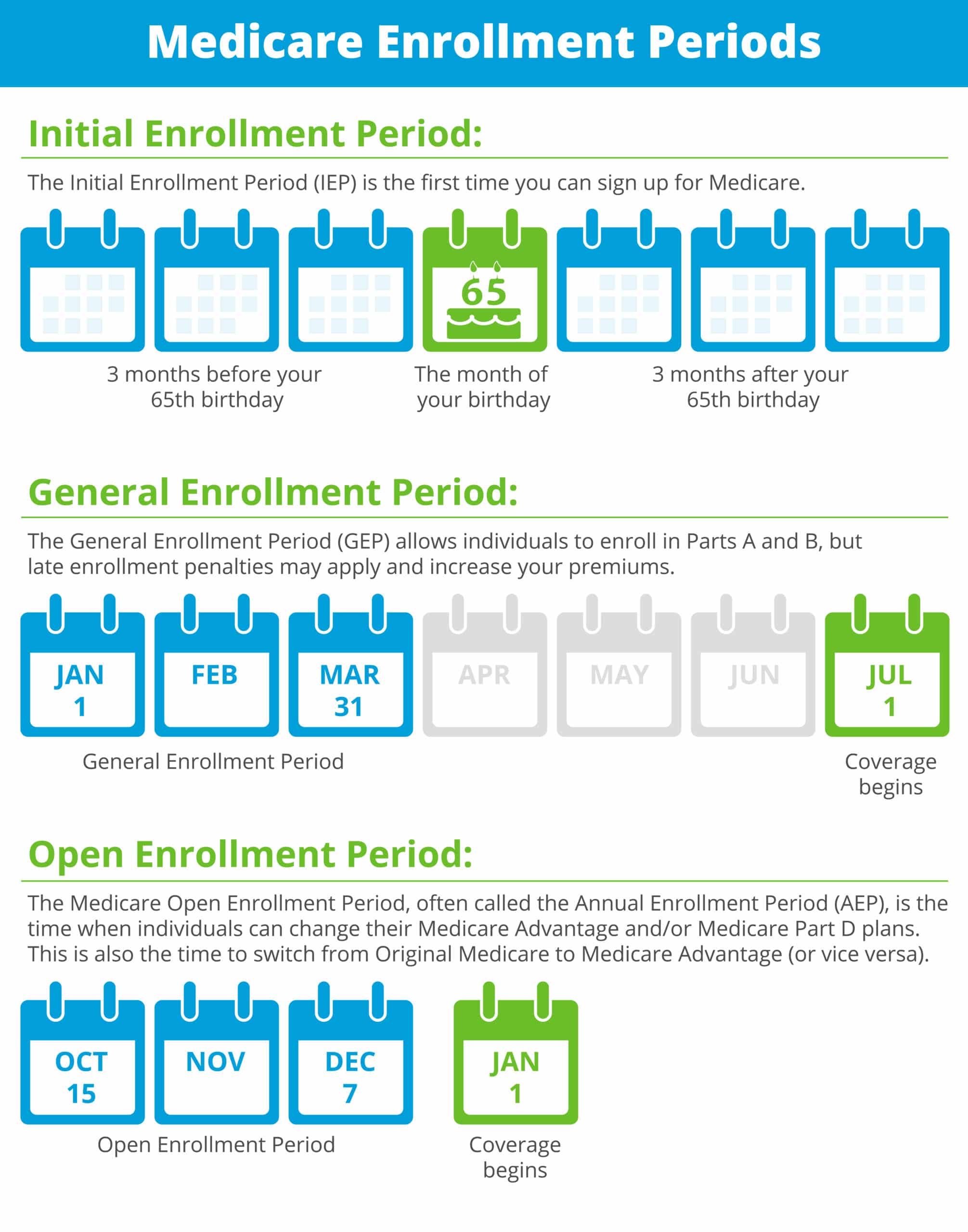

- Your initial enrollment period , which runs for seven months, of which the fourth is the month of your 65th birthday.

- A special enrollment period , which youre entitled to in certain circumstances:

If you qualify for Extra Help or enter or leave a nursing home, you can join a Part D drug plan or switch to another at any time of the year.

If you lose creditable drug coverage from elsewhere such as an employer, union, retiree benefits, COBRA, Medicaid, or the Veterans Affairs health care program you can sign up with a drug plan within two months of this coverage ending.

If you move outside of your current drug plans service area , you can sign up with a new plan, either before or within two months of the move.

If your current Part D plan withdraws service from your area, you can switch to another plan before or when your current coverage ends.

If a plan violates its contract with you, you can ask Medicare to investigate if Medicare agrees, you can switch to another plan at that time.

Read Also: Does Medicare Pay For Vascepa

What Is The Coverage Gap Or Donut Hole

Until your total drug costs hit $4,430, you pay the cost sharing designated in your policy in 2022.

- When you reach the initial coverage limit of $4,430 , you enter the coverage gap, also known as the donut hole.

- You then pay 25% of costs for the costs of brand and generic drugs until your total out-of-pocket Part D spending reaches $7,050

- At that point, the catastrophic limit kicks in and beneficiaries pay the greater of 5% or $3.95 for generic medications and $9.85 for brand-name drugs for the rest of the year.13

When You First Get Medicare

- I’m newly eligible for Medicare because I turned 65.

-

What can I do?

Sign up for a Medicare Advantage Plan and/or a Medicare drug plan.

When?

During the 7-month period that:

- Starts 3 months before the month you turn 65

- Includes the month you turn 65

- Ends 3 months after the month you turn 65

If you join

Also Check: What’s Better Medicare Or Medicare Advantage

Evaluate Your Current Coverage And Needs

As with finding a plan for the first time, start by making a list of your current medications. Include the exact name, dosage, and frequency as written on the bottle.

Next, gather any documents from your current plan, including your Evidence of Coverage and any receipts or bills that show your prescription costs. Add up what youve paid in premiums and in drug costs throughout the year to estimate your annual prescription drug costs.

Next, input your zip code, medications, and other information into the Medicare Plan Finder, just as you would if enrolling in Part D for the first time.

When your search results pop up, select up to three plans at a time to compare side by side. If you find your current plan, include it in your comparison to see if it still might be the best option for you.

As you browse plans, look beyond premiums to other Part D costs, such as the deductible, copayments, and estimated annual cost. Typically, a low-premium plan will have higher out-of-pocket costs than a higher-premium plan. A higher-premium plan could save you money over the course of the year if you regularly take several expensive prescriptions.

Im Signed Up For Medicare Parts A & B Can I Sign Up For Part C

If you want to enroll in a Medicare Part C plan, you can only do so during specific times:

- You are new to Medicare Initial Enrollment Period : This is the 7-month period when you are first eligible for Medicare. After you enroll in Parts A & B, you can choose to enroll in a Medicare Advantage plan.

- You have enrolled in Medicare Parts A & B already The Annual Election/Open Enrollment Period : Each year between October 15 and December 7, you can switch from Original Medicare to a Medicare Advantage plan or vice versa.

Be aware that if you have Original Medicare with a Medigap/supple-mental policy and you switch to Medicare Advantage, you most likely will not be able to get a Medigap policy again if you switch back.

The date your coverage starts depends on the period in which you enroll. Remember not to drop your existing coverage, if any, until your coverage with your Medicare Advantage plan has started.

Don’t Miss: What Is The Best Medicare Advantage Plan In Arizona

Additional Special Enrollment Periods

Some Medicare special enrollment periods apply on a one-time basis and are triggered by specific events, while others apply year-round for specific populations. Some apply to Medigap, while others apply to Medicare Advantage and Part D Prescription Drug Plans.

For Medicare beneficiaries who qualify for a Low-Income Subsidy , and for those who are in a nursing home or other institutional facility, enrollment in Medicare Advantage plans and Part D prescription drug coverage is not limited to the annual open enrollment period. Enrollees who qualify for Extra Help can make changes to their Medicare Advantage or Part D coverage up to once per calendar quarter. And enrollees who are institutionalized can make changes to their Medicare Advantage or Part coverage year-round, with coverage effective the first of the month following their enrollment.

. Visit this page to review our guides to Medicaid benefits available to Medicare enrollees in each state.)

Medicare beneficiaries who qualify for a State Pharmaceutical Assistance Program also have the option to join a Medicare Advantage or Part D plan at any point during the year, but only once per year.

How Can I Switch Part D Outside Of Open Enrollment

There are a few Special Enrollment qualifying events that allow you to switch a Medicare prescription drug plan outside of Medicares Open Enrollment:

- Your Part D or Medicare Advantage company goes out of business

- Your Part D or Medicare Advantage plan misled you

- If you find a Medicare 5-star rated plan, you can change your Part D at anytime of the year to the 5-star plan*

*While 5-star drug plans are available in some areas, as this is the highest rating Medicare gives, they are not always available in all areas.

Also Check: How To Change Primary Doctor On Medicare

When Can I Join Switch Or Drop A Medicare Drug Plan

- When you first become eligible for Medicare, you can join during your Initial Enrollment Period.

- If you get Part B for the first time during the General Enrollment Period, you can also join a Medicare drug plan from April 1 through June 30 and your coverage will start on July 1.

- You can join, switch, or drop a Medicare drug plan between October 15 through December 7 each year and your changes will take effect on January 1 of the following year, as long as the plan gets your request before December 7.

- If you’re enrolled in a Medicare Advantage Plan, you can join, switch, or drop a plan during the Medicare Advantage Open Enrollment Period between January 1 through March 31 each year.

- If you qualify for a Special Enrollment Period.

Change Medicare Plans During Medicare Advantage Open Enrollment Period

If youre enrolled in Medicare Advantage and want to switch back to Original Medicare, Part A and Part B, you can do so during the Medicare Advantage Open Enrollment Period , which runs from January 1-March 31 each year. You will also have until March 31 to join a stand-alone Medicare Prescription Drug Plan , and your coverage will go into effect the first day of the month after your new plan gets your enrollment form.

Also Check: How To Sign Up For Medicare And Tricare For Life

Can I Change Medicare Advantage Plans Anytime

Updated: September 16, 2021Expert reviewed by: Kelly Blackwell, Certified Senior Advisor®Medicare Advantage Plans, also called Medicare Part C, are an alternative to Original Medicare. They provide the same coverage as Medicare Part A and Part B, and sometimes offer additional benefits not included in Original Medicare, like drug, dental and vision coverage.

Kelly Blackwell

Kelly Blackwell is a Certified Senior Advisor ®. She has been a healthcare professional for over 30 years, with experience working as a bedside nurse and as a Clinical Manager. She has a passion for educating, assisting and advising seniors throughout the healthcare process.

Special Enrollment Available For 5

Medicare utilizes a star rating system for Medicare Advantage and Part D Prescription Drug Plans. Each Medicare contract is assigned a rating of one to five stars, with the best contracts receiving five stars. If you live in an area where a 5-star Part D or Advantage plan is available, you can join or switch to the 5-star plan up to once per year, between December 8 and November 30.

In 2021, there are a total of 28 Medicare contracts nationwide that have a 5-star rating. Two are Medicare cost plans, five are stand-alone Part D plans, and the rest are Medicare Advantage plans.

Most plans do not receive five stars, and in most years, most areas of the country do not have 5-star plans available. For 2021, however, theres a UnitedHealthcare contract with a five-star rating, available in most of the US.

You May Like: Does Medicare Offer Dental And Vision