I Am Turning 65 Next Year When Can I Sign Up For Medicare

If you are eligible for Medicare, your initial enrollment period for Part A and Part B begins three months before the month of your 65th birthday and ends three months after it. For example, if your 65th birthday is in June, your enrollment period will extend from March 1 through September 30. If you join during one of the 3 months before you turn 65, coverage will begin the first day of the month you turn 65. If you join during the month you turn 65, your coverage will begin the first day of the month after you turn 65. If you join in the month after you turn 65, coverage will begin 2 months later, and if you join 2 or 3 months after you turn 65, coverage will begin 3 months later. A recent change in law limits these gaps in coverage. Starting in 2023, if you enroll in Medicare during the first 3 months after your turn 65, coverage will begin the first day of the month following the month you enroll.

Once you have Part A and Part B, you are then also eligible to enroll in a Medicare Advantage plan and/or a Part D plan. If you are already receiving Social Security benefits when you turn 65, you will automatically be enrolled in Part A and Part B. If you are not already receiving Social Security benefits and you want to enroll in Medicare, you should contact Social Security.

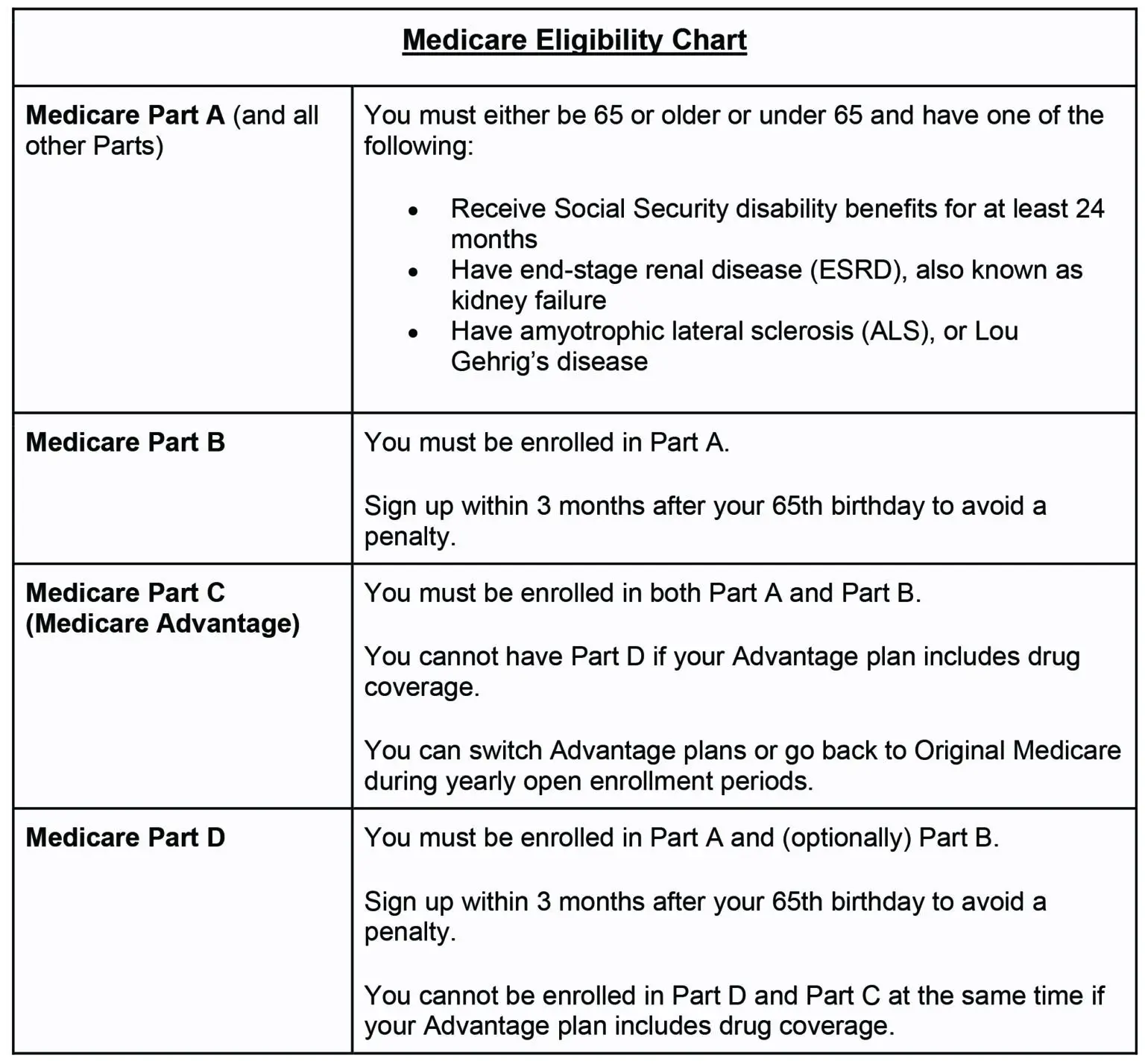

Medicare Eligibility Age Chart

Most older adults are familiar with Medicare and its eligibility age of 65. You can qualify for Medicare Part A and Medicare Part B by:

- Being age 65 or older

- Living with a qualifying disability

- Living with certain health conditions, like end-stage renal disease or amyotrophic lateral sclerosis

Individuals under 65 and already receiving Social Security or Railroad Retirement Board benefits for 24 months are eligible for Medicare. Still, most beneficiaries enroll at 65 when they become eligible for Medicare.

What Can I Do Next

Generally, youre first eligible to sign up for Part A and Part B starting 3 months before you turn 65 and ending 3 months after the month you turn 65.

Because the company has less than 20 employees, your job-based coverage might not pay for health services if you dont have both Part A and Part B.

Don’t Miss: Where Do I File For Medicare

Can I Buy A Medigap Policy If I Lose My Health Coverage

You may have a guaranteed issue right to buy a Medigap policy. Make sure you keep these items:

-

A copy of any letters, notices, emails, and/or claim denials that have your name on them as proof of your coverage being terminated

- The postmarked envelope these papers come in as proof of when it was mailed

You may need to send a copy of some or all of these papers with your Medigap application to prove you have a guaranteed issue right.

If you have a Medicare Advantage Plan but youre planning to return to Original Medicare, you can apply for a Medigap policy before your coverage ends. The Medigap insurer can sell it to you as long as youre leaving the plan. Ask that the new policy take effect no later than when your Medicare Advantage enrollment ends, so youll have continuous coverage.

| Note |

|---|

|

The guaranteed issue rights in this section are from federal law. These rights are for both Medigap and Medicare SELECT policies. Many states provide additional Medigap rights. |

Understanding Medicare Part A Eligibility

Like many American citizens, you may be automatically enrolled in Medicare coverage if one of the following applies to you:2

- Youre 65 and already receive benefits from Social Security.

- Youre 65 and already receive benefits from the Railroad Retirement Board .

- Youre under 65, have a disability, and are receiving disability benefits.

- You have ALS or ESRD .

If any of the above Medicare Part A eligibility qualifications apply to you, then youre considered Medicare eligible. Your Medicare card will be mailed to you three months before your 65th birthday or on your 25th month of disability.

If you arent getting benefits from Social Security at least four months before you turn 65, youll need to sign up with Social Security directly.2

Don’t Miss: How Old Before I Can Get Medicare

Turning 65 In Wi Learn About The 2 Parts Of Medicare

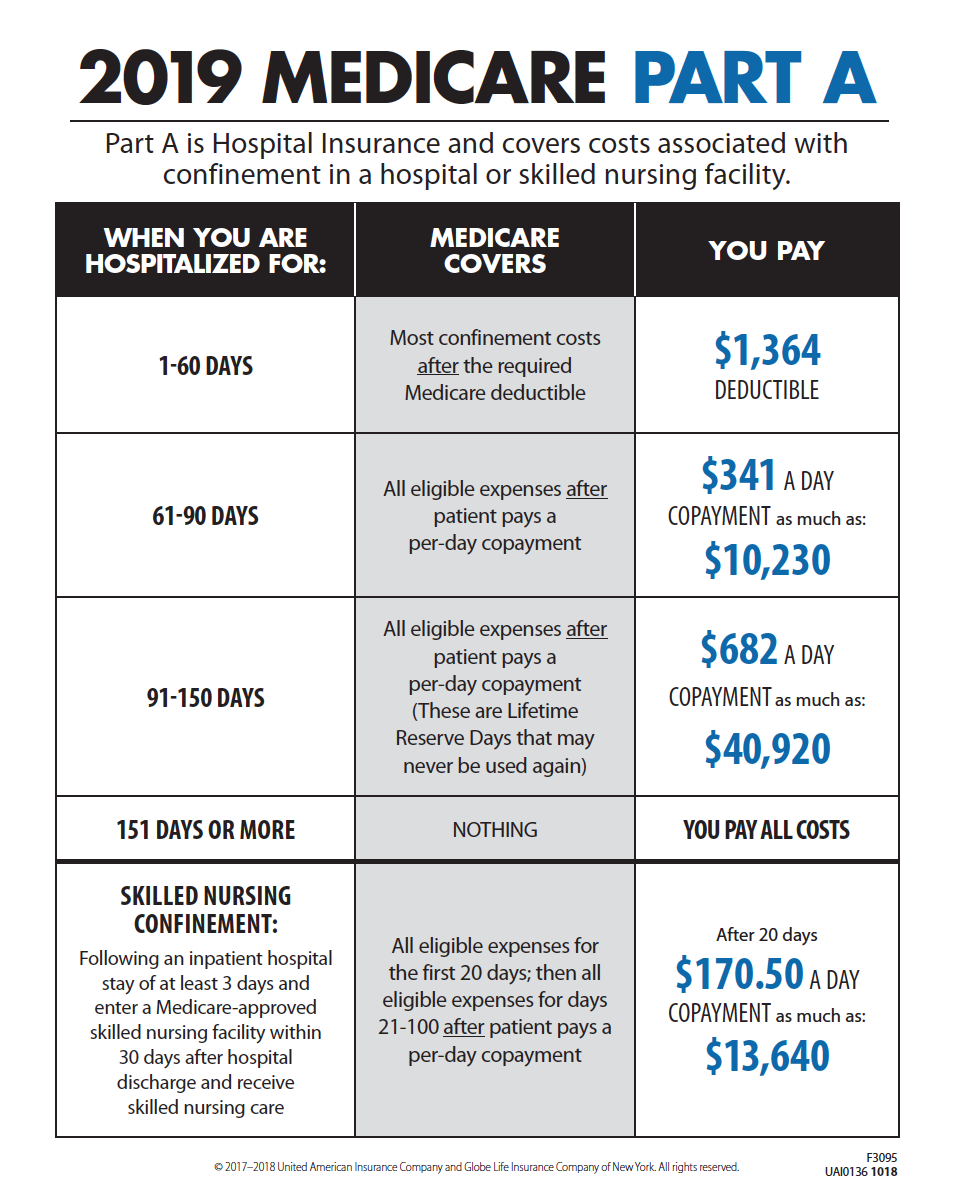

Medicare is broken down into two different parts, Part A and Part B. Part A is hospital insurance. It covers inpatient hospital stays, skilled nursing facilities, hospice care, and some home health care. Part B is medical insurance. It covers services such as office visits to doctors and other health care providers, outpatient care, home health care, durable medical equipment like wheelchairs and walkers, and many preventative services. To enroll in Part A and Part B, you can do so through the Social Security Office.

Medicaid Or Medicare Savings Programs

Medicare beneficiaries with limited income or very high medical costs may be eligible to receive assistance from the Medicaid program. There are also Medicare Savings Programs for other limited-income beneficiaries that may help pay for Medicare premiums, deductibles, and coinsurance. There are specified income and resources limits for both programs. Contact your local county Department of Social Services or SHIIP to apply for one of these programs.

You May Like: Is The Urolift Procedure Covered By Medicare

Reimbursement For Part A Services

For institutional care, such as hospital and nursing home care, Medicare uses prospective payment systems. In a prospective payment system, the health care institution receives a set amount of money for each episode of care provided to a patient, regardless of the actual amount of care. The actual allotment of funds is based on a list of diagnosis-related groups . The actual amount depends on the primary diagnosis that is actually made at the hospital. There are some issues surrounding Medicare’s use of DRGs because if the patient uses less care, the hospital gets to keep the remainder. This, in theory, should balance the costs for the hospital. However, if the patient uses more care, then the hospital has to cover its own losses. This results in the issue of “upcoding”, when a physician makes a more severe diagnosis to hedge against accidental costs.

How To Get Premium

The system of eligibility for Medicare measures the working years in which the individual paid the Federal Insurance Contributions Act tax, or FICA tax.

With the exceptions of self-employment and certain government positions, most people have this included in the payroll taxes deducted from each paycheck.

These working years accrue what is known as Quarters of Coverage.

Quarters of Coverage each represent a three-month period of work while paying the FICA tax about 4 Quarters of Coverage are earned in a single year.

The Quarters of Coverage are units of measuring eligibility for Medicare coverage and Social Security benefits. This measurement determines both the level of monthly Social Security income benefits and whether Part A is premium-free.

To get Part A premium-free, one typically must have earned 40 quarters of coverage, or about 10 years of employment while paying payroll taxes. The 40 total Quarters of Coverage do not have to be earned over 10 consecutive years.

These quarters of coverage can be earned through ones own work history or the work history of a spouse, parent, or child.

Those who have not quite accrued 40 Quarters of Coverage can still join Medicare Part A at age 65, but it will require paying a premium.

Earning 30-39 credits sets the monthly premium for Part A in 2021 at $259, and having earned less than 30 credits sets the Part A premium at $471.

You May Like: The Government Wants To Make Medicare Benefits Available

Don’t Miss: How Do I Become A Medicare Provider

How Much Is The Part A Late Enrollment Penalty

If you have to pay a Part A monthly premium because of your work history and you dont have a reason for delaying enrollment in Part A that creates a Special Enrollment Period, then you may have to pay a late enrollment penalty if you wait until after age 65 to first enroll in Part A.

- For every year you didnt enroll, you will have a 10% penalty added to your Part A premium for two years.

- So, if you delayed enrollment for three years for example, youll have a 30% penalty added to your Part A premium for six years.

Sign Up: Within 8 Months After Your Family Member Stops Working

- If you have Medicare due to a disability or ALS , youll already have Part A .

- Youll pay a monthly premium for Part B , so you may want to wait to sign up for Part B.

Avoid the penalty & gap in coverageIf you miss this 8-month Special Enrollment Period, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty until you turn 65. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

You May Like: What Is Part C Under Medicare

Should I Take Medicare Part B

You should take Medicare Part A when you are eligible. However, some people may not want to apply for Medicare Part B when they become eligible.

You can delay enrollment in Medicare Part B without penalty if you fit one of the following categories.

Employer group health plans may cover items normally not covered by Medicare Part B. If so, and you meet one of the categories above or below, then you may not need to enroll in Medicare Part B and pay the monthly premium.

If you are:

- a spouse of an active worker

- a disabled, active worker

- a disabled spouse of an active worker

and choose coverage under the employer group health plan, you can refuse Medicare Part B during the automatic or initial enrollment period. You wait to sign up for Medicare Part B during the special enrollment period, an eight month period that begins the month the group health coverage ends or the month employment ends, whichever comes first.

You will not be enrolling late, so you will not have any penalty.

If you choose coverage under the employer group health plan and are still working, Medicare will be the “secondary payer,” which means the employer plan pays first.

If the employer group health plan does not pay all the patient’s expenses, Medicare may pay the entire balance, a portion, or nothing. An employer group health plan must be primary or nothing.

Who Qualifies For Medicare Part C

Medicare Part C is an alternative way to get your Medicare Part A and Part B benefits. Medicare Advantage plans are available through Medicare-approved private insurance companies. To be eligible for Medicare Part C, you must already be enrolled in Medicare Part A and Part B, and you must reside within the service area of the Medicare Advantage plan you want. You can get more information about and enroll in a Medicare Advantage plan by contacting a licensed health insurance agent or broker, such as eHealth.

The Medicare Advantage plan Initial Coverage Election Period is generally the same as the Initial Enrollment Period for Medicare Part A and Part B . Or, you can sign up during the Annual Election Period from October 15 to December 7 for coverage effective January 1 of the following year. You can also enroll during a Special Election Period , if you qualify.

Please note: If you have end-stage renal disease , hereâs a change you may want to know about. Starting in 2021, you may qualify for a Medicare Advantage plan if you have end-stage renal disease and meet the usual requirements listed below.

Medicare Part C is optional, and there is no penalty for not signing up. But you must have Medicare Part A and Part B to get Part C, and live in the service area of a Medicare Advantage plan.

Don’t Miss: Does Medicare Cover Chronic Pain Management

What Is The Texas Health Information Counseling And Advocacy Program

If you are eligible for Medicare, the Texas Health Information, Counseling and Advocacy Program can help you enroll, find information and provide counseling about your options. This partnership between the Texas Health and Human Services system, Texas Legal Services Center and the Area Agencies on Aging trains and oversees certified benefits counselors across the state.

Will I Be Automatically Enrolled In Part A

Many individuals find that they are automatically enrolled in Medicare Part A. To receive automatic enrollment in Medicare Part A, you must: Already be receiving Social Security retirement benefits, Receive benefits from the Railroad Retirement Board , or Already be receiving disability benefits from Social Security for 24 months

If you are automatically enrolled in Medicare Part A, your benefits will begin on the first day of the month you turn 65 or have a qualifying disability. If you have worked in the U.S. for at least 10 years or 40 quarters, you will likely be eligible for premium-free Part A, meaning you will not need to pay a monthly premium to receive your Part A benefits.

You May Like: What Scooters Are Covered By Medicare

Confused By Medicare Terms

* Insured by Cigna Health and Life Insurance Company, American Retirement Life Insurance Company, Loyal American Life Insurance Company or Cigna National Health Insurance Company. In North Carolina, these plans are insured by Cigna National Health Insurance Company. In Kansas and Pennsylvania, Medicare Supplement insurance policies are insured by Cigna National Health Insurance Company. American Retirement Life Insurance Company, Loyal American Life Insurance Company and Cigna Health and Life Insurance Company plans are not available to residents of Kansas or Pennsylvania.

Notice for persons eligible for Medicare because of disability:

In the following states, all Medicare Supplement plans are available to persons eligible for Medicare because of disability: California, Colorado, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Kansas, Kentucky, Louisiana, Maine, Minnesota, Mississippi, Missouri, Montana, New Hampshire, Oregon, Pennsylvania, South Dakota, Tennessee, Vermont, and Wisconsin.

Tennessee Medicare Supplement Policy Forms

Plan A: CNHIC-MS-AA-A-TN Plan F: CNHIC-MS-AA-F-TN Plan G: CNHIC-MS-AA-G-TN Plan N: CNHIC-MS-AA-N-TN.

Dont Miss: What Are Common Employee Benefits

Who Qualifies For Medicare

Medicare eligibility is simple. Typically, you must be at least 65 years old, and a U.S. citizen or have legal residency in the U.S. for at least five years.

Those younger than 65 and collecting Social Security Disability Income benefits for at least 24 months are also eligible. Lastly, those diagnosed with end-stage renal disease who require a kidney transplant or dialysis and those with an amyotrophic lateral sclerosis diagnosis also meet the requirements for Medicare eligibility.

Also Check: What Age Am I Medicare Eligible

What Are My Rights As A Medicare Beneficiary

As a Medicare beneficiary, you have certain guaranteed rights. These rights protect you when you get health care, they assure you access to needed health care services, and protect you against unethical practices.

You have these rights whether you are in Original Medicare or another Medicare health plan.

Your rights include, but are not limited to:

The Right to Receive Emergency Care

If you have severe pain, an injury, or a sudden illness that you believe may cause your health serious danger without immediate care, you have the right to receive emergency care. You never need prior approval for emergency care, and you may receive emergency care anywhere in the United States.

The Right to Appeal Decisions About Payments or Services for Medical Care

If you are enrolled in Original Medicare, you have the right to appeal denial of a payment for a service you have been provided. If you are enrolled in another Medicare health plan, you have the right to appeal the plan’s denial for a service to be provided.

The Right to Information About All Treatment Options

You have the right to know about all your health care treatment options from your health care provider. Medicare forbids its health plans from making any rules that would stop a doctor from telling you everything you need to know about your health care. If you think your Medicare health plan may have kept a provider from telling you everything you need to know about your health care options, then you have the right to appeal.

When Am I Eligible For Medicare If I Have End

If you are eligible for Medicare because you have end stage renal disease and youâre on dialysis, your Medicare coverage usually will begin on the first day of the fourth month of your dialysis treatment. Your Medicare coverage may start on the first month of dialysis under certain conditions.

When you become eligible for Medicare because of ESRD you also usually can sign up for Medicare Part D prescription drug coverage. However, you may not be eligible for Medicare Advantage or Medicare Supplement . Medicare Advantage plans generally exclude people with ESRD and Medicare Supplement plans generally exclude people under 65. If you miss your Medicare Initial Enrollment Period, you can usually sign up for Medicare Part D in the Medicare Open Enrollment Period, which is October 15-December 7 each year.

You May Like: How Do You Get A Medicare Part B Penalty Waiver

When Should You Enroll For Medicare

Just because you qualify for something doesnt mean you need to sign up, right? Not always. In the case of Medicare, its actually better to sign up sooner rather than later. While its true that Medicare isnt mandatory, there are fees for signing up outside of your initial eligibility window. Also known as the initial enrollment period , this 7-month window gives you some flexibility in enrolling in Medicare once you qualify.

If you dont get automatic enrollment , then you must sign up for Medicare yourself, and you have seven full months to enroll. The IEP starts three months before the month you turn 65 and ends three months after the month you turn 65.

|

Initial Enrollment Period |

Coverage start dates vary based on when you sign up. If you sign up during the first three months of your IEP , then your health insurance will take effect on the first day of your birthday month. If your birthday falls on the first of the month already, then your coverage will start on the first of the previous month. The longer you wait to sign up, the later your coverage will start, which is why its a good idea to check your eligibility and enroll as soon as youre able.

This initial signup period applies to people who dont get automatically enrolled. People who are already enrolled in Social Security and those with disabilities will be automatically enrolled into original Medicare depending on their situation.