Does Medicare Cover Mental Health

There are of course other Medicare benefits outside of the traditional items covered under Part A, B, and D. Medicare covers a wide range of wellness services as well as mental health, home health care, hospice, and long term care. Medicare now covers inpatient and outpatient mental health services provided by psychiatrists, psychologists, …

Can I Keep My Pebb Medical Plan When I Turn Age 65

Yes, unless you have a consumer-directed health plan. Employees and dependents becoming eligible for Medicare can choose to keep PEBB medical as primary coverage, with Medicare coverage as secondary, if they enroll in Medicare.

I have a consumer-directed health plan. What should I do?

Enrolling in Medicare creates a special open enrollment that allows you to change medical plans. If you are enrolled in a consumer-directed health plan with a health savings account , you should consider a plan change when you, the employee, enroll in Medicare. Employees cannot contribute to an HSA while enrolled in Medicare. If you do, you will face tax consequences.

If you are eligible for premium-free Medicare Part A but don’t enroll when first eligible, your Part A will be enrolled retroactively six months before the month you apply for Medicare, but no earlier than the month you turn age 65. If you keep your CDHP past your Initial Enrollment for Medicare, plan carefully when to stop contributing to the HSA to avoid a tax penalty.

If your dependent enrolls in Medicare, however, you can still contribute to an HSA. Contact HealthEquity, Inc. UMP members call 1-844-351-6853 Kaiser Permanente members call 1-877-873-8823 for more information about how Medicare enrollment affects your HSA.

Health Insurance Coverage For People Who Need It

Medicare is the single largest health insurance program in the U.S., providing hospital insurance and medical insurance coverage to more than 60 million Americans.

If Medicare didnt exist, tens of millions of seniors and people with disabilities would have to rely on some form of private health insurance in order to have suitable coverage, something that might not be affordable for many people.

Don’t Miss: Is Inogen One Covered By Medicare

How Do You Enroll In A Medicare Advantage Plan

If you want to enroll in a Medicare Advantage plan, you must:

- Be eligible for Medicare

- Be enrolled in both Medicare Part A and Medicare Part B

- Live within the plans service area

- Not have end-stage renal disease

Want more information about enrollment? Visit Medicare Part C Eligibility and Enrollment Information

What Are My Medicare Part A Benefits

Summary:

Medicare Part A covers most hospital care and inpatient care youâll receive after hospitalization, including skilled nursing facilities. If you end up in the hospital after a fall, heart attack, stroke, or pneumonia, youâre probably hoping you have good coverage under Medicare. Medicare Part A covers most hospital care and inpatient care youâll receive after hospitalization. This article explores your Medicare Part A costs, benefits, and types of coverage.

Recommended Reading: Does Medicare Cover Ob Gyn

Can You Switch Between Original Medicare And Medicare Advantage

As a final note, no matter which option you decide is right for you, you can switch from Original Medicare to Medicare Advantage or vice versa. The two main times you can switch are the Medicare Annual Enrollment Period and the Medicare Special Enrollment Period for qualifying life events, if you qualify.

Footnote

What Are The Benefits Of Having Medicare

Advantages

| Part A coinsurance and hospital coverage | |

| Part B coinsurance or copayment | 50% |

| Part A hospice care coinsurance or copay … | 50% |

| First 3 pints of blood | 50% |

Some of the pros of Medicare include:

- Health Insurance Coverage for People Who Need It. …

- Wide-Ranging Coverage. …

- Mix of Public and Private Coverage. …

- Straightforward Eligibility Requirements. …

Also Check: How To Get A Medicare Card In Pa

Why Choose Medicare Advantage

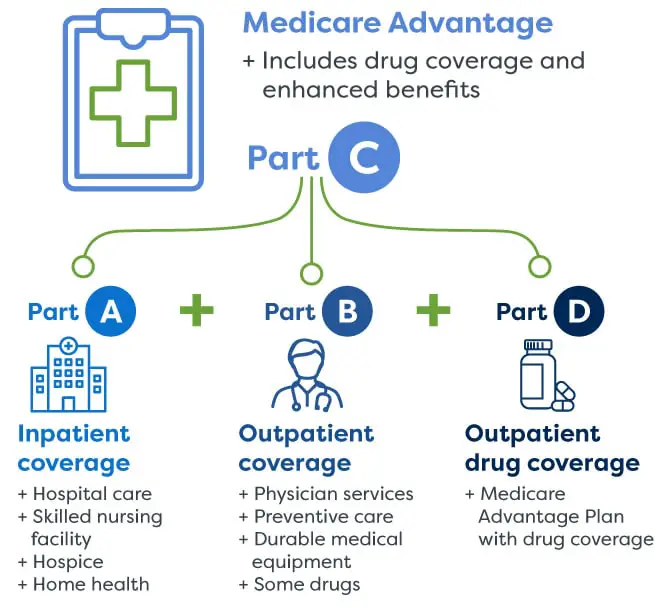

Now that youve learned about the 4 parts of Medicare and when to enroll, its time to consider which plan best fits your needs Original Medicare or a Medicare Advantage plan.

Good health is essential, so finding a plan that supports your health, lifestyle, and budget is important. Consider your care needs and what your life may be like after you turn 65. You might want a plan that includes affordable prescription drug coverage and limits how much you spend out of pocket. From added benefits to more predictable costs, Medicare Advantage offers more than Original Medicare alone.

Medicare Advantage combines everything you get in Original Medicare with other benefits, like prescription drug coverage. Medicare Advantage plans also have predictable costs with set copays, which can make it easier to plan your expenses.

Youll need to enroll in Original Medicare with the federal government before you sign up for Medicare Advantage from a private health care provider. Then the private provider will become your primary insurer.

Get care designed to make your life easier choose a Kaiser Permanente Medicare Advantage plan

With Kaiser Permanente, your doctor, specialists, and health plan all work together to make it easier for you to get care. And when you move your coverage to a Kaiser Permanente Medicare Advantage plan, youll get comprehensive care at a great value.

You can count on:

Value and affordability

Ease and convenience

Quality and service

Get more information

Original Medicare Vs Medicare Advantage

It’s important to learn about the differences in coverage, cost and care provider rules because these will impact how you decide which option is best for you. Read below to learn about each in detail below.

Comparison between Original Medicare and Medicare Advantage| Original Medicare | |

|---|---|

| Includes hospital coverage + medical coverage | Combines hospital coverage + medical coverage + additional health benefits under one plan |

| Does not provide prescription drug coverage | Often includes prescription drug coverage |

| Does not provide additional health benefits | Can include additional health benefits – dental, vision, hearing, fitness |

| Provided by the federal government | Provided by private insurance companies with varying benefits, costs and coverage options based on location and provider |

Read Also: Does Everyone Go On Medicare At 65

Consider How Often You Leave Home

Original Medicare covers care you receive from any provider who accepts Medicare throughout the country. With most Medicare Advantage plans, you need to see providers who are in the plan network in order to avoid added costs. Network providers agree to the plans negotiated prices so you get to take advantage of the cost savings. If you travel a lot, consider how your Medicare coverage may work with this.

Mistake #: Ignoring The Impact Social Security Could Have On Your Taxes Medicare Premiums And Other Benefits

Most people are solely focused on how to get the biggest benefits check. But there’s more to it than that. Your decision could trigger an avalanche of taxes, double your Medicare premiums, and cause you to forfeit other benefits. It’s critical you don’t base your decision on just the amount of your benefits.

For example, B.O.S.S. Retirement Solutions once worked with a nice couple from Salt Lake City that could have lost hundreds of thousands of dollars from filing at the wrong time. A customized analysis revealed that their strategy would trigger a massive tax bill of $137,251 on their lifetime benefits.

We outlined a different strategy that could eliminate these taxes, so they could keep this $137,251 in their pocket. That kind of money could go a long way in retirement.

Read Also: Are Hearing Aids Covered By Medicare Australia

Procedures Covered Under Medicare Advantage

Some procedures that aren’t typically covered by Original Medicare may sometimes be covered by certain Medicare Advantage plans.

These procedures may include but are not limited to the following:

All Medicare Advantage plans are required by law to provide all of the benefits covered by Original Medicare.

Many Medicare Advantage plans also offer prescription drug coverage, and some plans offer benefits like dental, vision, hearing, gym and wellness program memberships and more, all of which aren’t typically covered by Original Medicare.

People Who Have Both Medicare & Medicaid

People who have both Medicare and full Medicaid coverage are dually eligible. Medicare pays first when youre a dual eligible and you get Medicare-covered services. Medicaid pays last, after Medicare and any other health insurance you have.

You can still pick how you want to get your Medicare coverage: Original Medicare or Medicare Advantage . Check your Medicare coverage options.

If you choose to join a Medicare Advantage Plan, there are special plans for dual eligibles that make it easier for you to get the services you need, include Medicare coverage , and may also cost less, like:

- Special Needs Plans

- Medicare-Medicaid Plans

- Program of All-Inclusive Care for the Elderly plans can help certain people get care outside of a nursing home

Also Check: How Much Does Ss Deduct For Medicare

The Pros Of Medicare: Is Medicare A Good Thing

Original Medicare is administered by the federal government under the authority of the Center for Medicare & Medicaid Services , which is part of the Department of Health & Human Services. In 2021, federal spending on Medicare will account for just over 15% of all federal spending for the year.1

Some of the pros of Medicare include:

How Can I Get Help With My Costs Under Medicare Part A

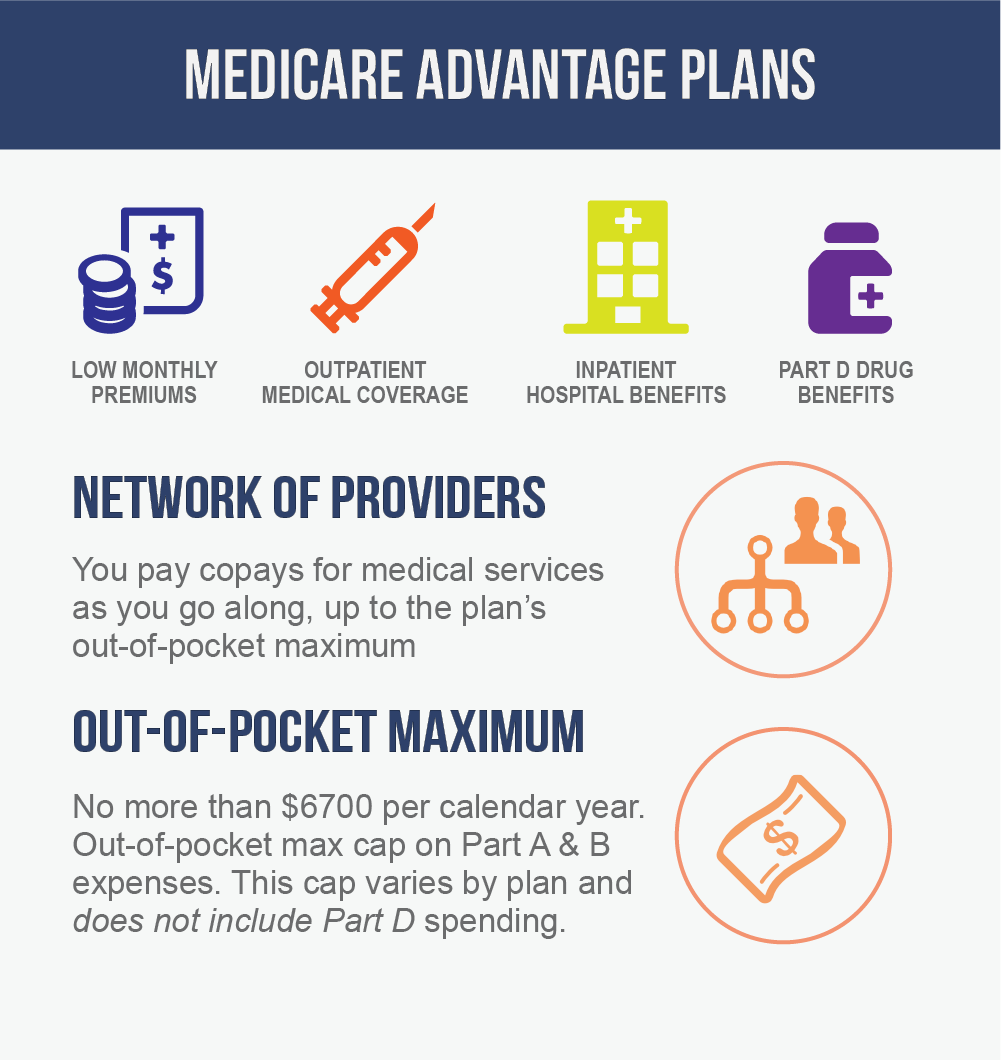

There are two options for limiting your out-of-pocket costs under Medicare Part A. The first is to choose a Medicare Advantage plan instead of Original Medicare. You donât lose any benefits by enrolling in Medicare Advantage, and you get a cap on your out-of-pocket costs. Since these plans are offered by private insurance companies that have contracts with Medicare, you should check the benefits brochure for any plans you are interested in to find out your costs and out-of-pocket cap.

The second option is to purchase a Medicare Supplement insurance Plan. These are private plans that cover some or all of your out-of-pocket costs under Medicare Part A and Part B. You pay a separate monthly premium for the coverage, but the plan picks up your share of covered Medicare expenses. If you think you want coverage with a Medicare Supplement insurance Plan, you should buy one when you are first eligible and have guaranteed issue rights. If you wait, you may have to pass medical underwriting and the insurer may refuse to sell you a plan.

Please note: Medicare Supplement plans donât work with Medicare Advantage plans, so you canât have both options.

To find a Medicare Advantage or Medicare Supplement insurance plan in your area, enter your ZIP code on this page.

Read Also: How Much Can I Make On Medicare

B Covers 2 Types Of Services

- Medically necessary services: Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice.

- Preventive services: Health care to prevent illness or detect it at an early stage, when treatment is most likely to work best.

You pay nothing for most preventive services if you get the services from a health care provider who accepts

Think About What Your Total Costs Could Be

Your total costs will vary based on the coverage you choose and the health services you use. But consider the below specifically when comparing which option fits your financial situation best.

- You get built-in financial protection with Medicare Advantage. The annual out-of-pocket limit provided can help keep your costs under control.

- Your premiums may be higher with Original Medicare. You could have higher monthly premium payments with Original Medicare than with Medicare Advantage, because you might want to add a Part D prescription drug plan or other additional coverage.

- You may pay more copays with Medicare Advantage than with Original Medicare. Depending on the health care services and providers you use, your copays could be more with a Medicare Advantage plan if costs vary in-network versus out-of-network.

- Medicare Advantage provides financial protection with an annual out-of-pocket limit. You can add protection to Original Medicare by buying a Medicare supplement plan.

- You could have higher monthly premium payments with Original Medicare than with Medicare Advantage, because you might want to add a Part D prescription drug plan and/or a Medicare supplement plan.

You May Like: Does Medicare Supplement Cover Dental Implants

The Medicare Advantage Enrollment Period

During the Medicare Advantage Enrollment Period, which runs from January 1 to March 31 each year, you can switch to a different MA plan or to Original Medicare. However, you can only switch once during this period.

* Average time of receiving a Medicare plan recommendation is less than 15 minutes from start of conversation, 2019 2021.** Total number of Medicare Advantage, Part D Prescription Drug Plans, and Medicare Supplement policies submitted 2019 2021 recorded by Assurance.

Assurance IQ is a licensed representative of Medicare Advantage HMO, PPO and PPFS organizations and prescription drug plans with a Medicare contract. Enrollment in any plan depends on contract renewal. For a complete list of available plans please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

The purpose of this site is the solicitation of insurance. Medicare supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and in some states to those under age 65 eligible for Medicare due to disability or End Stage Renal disease. Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program.

Invitations for applications for insurance on assurance.com are made through Assurance IQ, LLC, only where licensed and appointed. Assurances license information can be found here.

Assurance IQ, LLC is a wholly owned subsidiary of Prudential Financial, Inc.

What Cal Mediconnect Plans Are Available In Orange Riverside And San Bernardino Counties

The CMC plan for Orange County residents is OneCare Connect, offered by Cal Optima. In Riverside and San Bernardino County, Molina Dual Options and IEHP DualChoice health plans are offered as Cal MediConnect.

These plans combine your Medicare and Medi-Cal services into one plan with additional benefits, including transportation, vision, dental, and care coordination.

With all your health and home care services coordinated together, members have one card to present at medical appointments and one phone number to call with any questions.

Recommended Reading: What Is Centers For Medicare And Medicaid Services

Why Medicare Advantage Plans Can Fall Short

For many older Americans, Medicare Advantage plans can work well. A JAMA study found that Advantage enrollees often receive more preventive care than those in traditional Medicare. Advantage plans are competing not just on cost but on delivering quality care, says Kenton Johnston, PhD, associate professor of health management and policy at Saint Louis University, co- author of the study.

But if you have chronic conditions or severe health needs, you may want to think twice about Medicare Advantage because of the requirements for pre-authorization and staying in-network, says Melinda Caughill, co-founder of 65 Incorporated, a firm that provides Medicare enrollment guidance to financial advisers and individuals.

If you need to see multiple specialists, and you have to get referrals for each appointment or fight to overturn denials, it can be really challenging, Caughill says.

Steven Feld, 65, a retiree in South Pasadena, Fla., struggled to get coverage for an injection to treat his arthritic knee. The treatment, a prefilled injection administered in a doctors office, is deemed a medical device by the FDA, so the plan twice denied the coverage. When I was on my employers group plan, there was no problem getting the injection covered, says Feld, who joined his Medicare Advantage plan in May.

Does Medicare Cover Vision

Medicare Part B, for example, typically covers 80% of your medical costs, but you may be responsible for covering the remaining 20%. No vision, dental or hearing benefits. If you receive a routine hearing test, or if you visit an eye doctor or a dentist, Original Medicare generally will not cover the cost.

Don’t Miss: How To Sign Up For Medicare In Michigan

Who Is Eligible For Medicare

To become eligible for Medicare, you must be age 65 or older or have a qualifying disability. If you are below 65, you must collect Social Security Disability benefits for at least 24 months before you can apply for Medicare benefits. Though, some people below 65 can get covered without enduring the waiting period. People with amyotrophic lateral sclerosis or End-Stage Renal Disease can qualify for Medicare soon after their initial diagnosis.

What Is Medicare Part B Medical Insurance

Medicare Part B provides outpatient/medical coverage. The list below provides a summary of Part B-covered services and coverage rules:

This list includes commonly covered services and items, but it is not a complete list. Keep in mind that Medicare does not usually pay the full cost of your care, and you will likely be responsible for some portion of the cost-sharing for Medicare-covered services.

The 2022 Part-B premium is $170.10 per month

Recommended Reading: Does Medicare Pay For Anesthesia

What Are My Costs Under Medicare Part A

Most people qualify for premium-free Medicare Part A, so unlike Medicare Part B, you wonât have a monthly premium if you have a qualifying work history. If you or your spouse worked for at least 10 years and paid Medicare taxes, you typically wonât owe a Part A premium.

There is a Medicare Part A deductible, which applies for each benefit period as opposed to the calendar year. This is different from the Part B deductible, which is paid once each calendar year. A benefit period begins the first day of a qualified inpatient hospital or skilled nursing facility stay and ends after you have not received Medicare-covered inpatient care for 60 consecutive days. You may have several benefit periods in a calendar year, and owe the Medicare Part A deductible more than once. In 2022, the Part A deductible is $1,556.

You also have daily coinsurance amounts on inpatient stays of 61 or more days. In 2022, the daily coinsurance amount for days 61 through 90 is $389. You pay a $778 daily coinsurance amount on lifetime reserve days and 100% of your charges once your reserve days are exhausted.