Paying A Premium For Medicare Part C

A premium is an amount you pay each month to purchase your coverage . Some Medicare Part C plans have premiums, while others do not.

People with Medicare Part C still have to pay the monthly premium for Medicare Part B since the Part C plan provides the benefits of Medicare Part A and Part B combined into one private plan.

For most Medicare beneficiaries, Medicare Part A does not have monthly premiums. But for those who don’t have enough work history to qualify for premium-free Medicare Part A, there will be a premium for Part A as well as Part B.

In 2022, the Part B premium for most Medicare beneficiaries is $170.10/month . So most people with Medicare Part C have to pay at least that amount for their coverage.

As of 2022, 59% of Medicare Part C plans have no additional premium other than the premium for Part B, and these are the plans that tend to be favored by Part C enrollees. The majority of these plans also include Part D coverage in addition to the Part A and Part B benefits, but the beneficiaries only pay the premium for Part B.

Some of these plans even have a “giveback” rebate that pays a portion of the Part B premium on the enrollee’s behalf. So in some areas, it’s possible to have Medicare coverage under a Part C plan and pay less than the standard Part B premium each month.

The other 41% of Part C plans have a premium that has to be paid in addition to the Part B premium. These premiums vary from one plan to another.

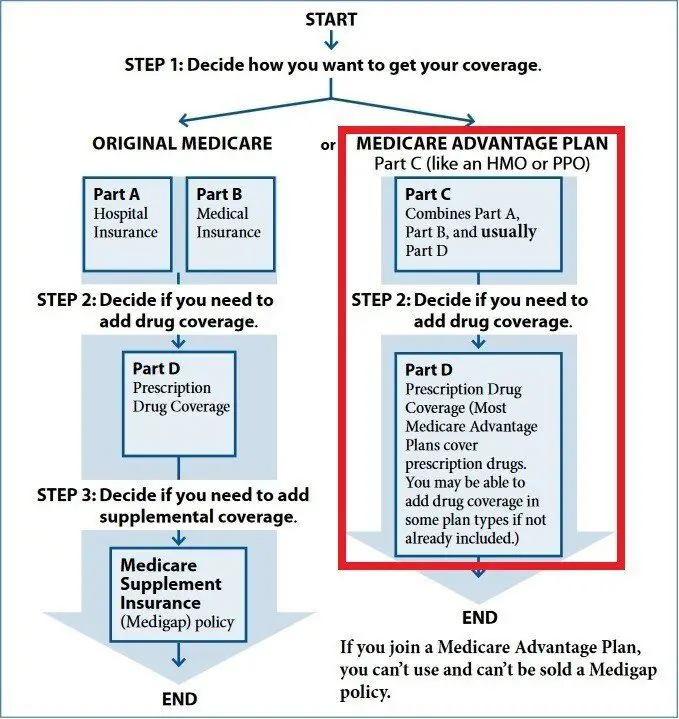

Medicare Advantage : How It Works

Medicare Advantage plans have recently become one of the more popular options among Medicare beneficiaries, accounting for about one third of Medicare coverage in 2019. Over the last ten years, the number of Medicare Advantage beneficiaries has nearly doubled. But what makes Medicare Advantage so appealing and, more importantly, should you take the leap?

Is Medicare Part C Being Discontinued

No, Medicare Part C is not being discontinued. However, there are other types of plans that may be sold by private insurance companies to help fill gaps in Original Medicare called Medicare Supplements or Medigap plans. As of January 1, 2020, Medigap Plan C is not available to those who are new to Medicare.

Recommended Reading: Does Medicare Cover Nerve Blocks

How Much Does A Medicare Part C Advantage Plan Cost

Each Medicare Advantage plan under Part C has a different cost structure. Below are the components that make up this structure.

- Premiums. To enroll in Medicare Part C, you must be enrolled in Parts A and B. Each part has a premium associated with it. This premium is a monthly fee. Under Medicare Part C, you will pay the Medicare Part B premium and the premium associated with Part C.

- Copays. This is a flat fee you pay for each health visit.

- Deductible. This is the amount youll pay for covered services out-of-pocket before your insurance plan kicks in and pays any expense.

- Coinsurance. Once you reach your deductible, you will split the cost with your insurance company. This is known as coinsurance. The percentage split varies by plan.

- Out-of-pocket limit. Once you spend a certain dollar amount in a calendar year on your health, the insurance company will assume responsibility and cover 100% of all out-of-pocket costs. This threshold is known as the out-of-pocket limit. The limit varies by plan because each insurer can set their own limit within the federal maximum limits. For in-network providers, the maximum is $6,700, and for out-of-network providers, it is $10,000.

Medicare Advantage Enrollment Dates

| Initial enrollment period | When you first become eligible for Medicare | Your initial Medicare enrollment period lasts for seven months, starting three months before you turn 65 and ending three months after the month you turn 65. |

| Medicare annual enrollment period | You can join, switch, or drop a plan. This includes Medicare Advantage and Medicare Part D plans. | |

| Medicare Advantage open enrollment period | If you’re enrolled in a Medicare Advantage plan, you can switch to a different Medicare Advantage plan or to Original Medicare . You can only switch once during each open enrollment period. | |

| Special enrollment periods | During certain special circumstances and changes in your life4 | Examples include moving to a skilled nursing facility or long-term care hospital.Rules about when you can make changes are different for each SEP. |

From the pros: Avoid costly late enrollment penalties by following our valuable Medicare enrollment guide!

Also Check: Do I Need To Apply For Medicare Every Year

Do You Need Medicare Part B

The short answer is yes, especially if youll need the covered services mentioned above. However, if you have health insurance through a current job or are on your spouses active plan, you can delay your Medicare Part B enrollment without penalty. Once the spouse with employer coverage stops working whether its you or your partner you have eight months to sign up for Part B. Also, you need to be enrolled in Medicare Part B if you want to sign up for a Medicare Advantage plan.

Changes To Medicare Advantage Under Obamacare

In 2014, the Affordable Care Act changed the healthcare system in America and also changed small parts of Medicare. The only real change that most people noticed is that now Medicare and Medicare Advantage plans must include preventive care and cannot reject anyone for pre-existing conditions.

There was also an initial drop in the number of Medicare Advantage plans being offered. An Avalere Health analysis found a 5 percent drop in the availability of Medicare Advantage plans. In addition, the variety of plan types also dropped, with more Medicare Advantage providers offering only HMO policies instead of PPO, PFFS and Special Needs Plans.

For the 2020 enrollment season, Medicare Advantage customers saw an increase in plan options nationwide, with a total of over 5,000 Advantage plans on the market according to state data that we analyzed from the Centers for Medicare and Medicaid Services.

The donut hole, which is a coverage gap in Medicare, has also been eliminated thanks to measures put into place under the Affordable Care Act. Now, once you reach your drug plans initial coverage limit , youll pay 25 percent of the cost of your medications until you reach the catastrophic limit on the other side.

Recommended Reading: How To Apply For Medicare In Michigan Online

What Is Medicare Advantage

Medicare Advantage, or Medicare Part C, is a type of Medicare plan that uses private health insurance to cover all the services youâd receive under Medicare Parts A and B. Anyone who is eligible for original Medicare Parts A and B is eligible for the Medicare Advantage programs in their area.

People who choose Medicare Advantage plans may enjoyâ¦

-

One stop shopping: Dental care, prescription drugs, vision care, and other important benefits may all be included in your Medicare Advantage Plan.

-

Potential savings: Medicare Advantage Plans have out-of-pocket limits on costs associated with your care, while original Medicare does not.

-

Long-term care services: While original Medicare doesnât cover long-term care like meal delivery and specialized home care, many Medicare Advantage plans do.

There are four main types of Medicare Advantage plans, which you can choose based on your needs: Health Maintenance Organization Plans , Preferred Provider Organization Plans , Private Fee-for-Service Plans , Special Needs Plans . Home Point of Service Plans , and Medicare Medical Savings Account Plans are also less-common types of Medicare Advantage plans.

Though often confused with Medicare Supplement plans, Medicare Advantage plans are run by private insurers and function like traditional health insurance. You cannot have both Medigap and Medicare Advantage at the same time, so itâs up to you to figure out which type of plan works best for your needs.

How Flexible Are Medicare Advantage Plans

Most private health insurance companies that offer Medicare Part C do their best to give members multiple choices when it comes to plans, but certain plans are only available in specific service areas. This means that not all plan types may be available throughout the country, especially in rural areas. In these cases, you may want to go with Original Medicare if you cant find the plan that you want. Most companies will offer different types of plans, including:

- Medicare HMO Health Maintenance Organization

- Medicare PPO Preferred Provider Organization

- Medicare PFFS Pay-Fee-For-Service

- Medicare SNP Special Needs Plans

The most flexible of these plans is likely the PPO, which does not require you to pick a primary care provider or stay within network. In general, PPOs charge a higher fee when you go out of network and may have a higher monthly cost than an HMO. These plans do allow you to go out of network, which is beneficial if you have a chronic health condition or need to see a special doctor. If you already have a primary care doctor you like, a PPO may also be the best option.

An HMO is not a flexible option. For one, you have to pick a primary care provider, and you cant see doctors or facilities outside of the network. You also need a referral to see a specialist. If you have to get urgent care, you need to make sure that your facility is in your network or else you will pay out of pocket.

Recommended Reading: Do Doctors Have To Accept Medicare Advantage Plans

What Is Medicare Part A

Medicare Part A is a basic insurance plan that covers medical services related to inpatient hospitalization and skilled nursing care. It is offered at low or no cost to Americans who are 65 years old and have contributed toward Social Security, as well as other qualified individuals.

What Medicare Part A Covers:

The Future Of Medicare Advantage

If you depend on Medicare for your healthcare, then you must compare plans each year before the open enrollment period begins on October 15. Researching your options well in advance ensures that youll get the best value for your budget and needs. As HMO plans are on the rise with Medicare Advantage, you also may think about switching back to original Medicare if you prefer a wider selection of doctors.

Overall, Medicare Advantage continues to be the lower-cost option, with more value for those who need to cover basic and more serious healthcare needs.

There are a few other types of plans that youll find sponsored by the government under Medicare Part C. Its best to choose a plan based on your specific needs and always look for the plan that offers the most services for the premium that you pay. If your budget isnt that big, you may want to stick to basic services or choose a PFFS plan.

Enrolling in Medicare Part C can only be done at certain times of the year or when you first become eligible for Medicare. Please visit HealthNetwork.com to compare Medicare Advantage plans and get connected with a licensed sales agent that can provide you more information on your Medicare options.

Read Also: How Can Medicare Advantage Be Free

What Are The Additional Benefits Of Medicare Part C Coverage

Part C plans can offer additional benefits beyond what Original Medicare offers. Medicare Advantage Plans can use rebate dollars paid by Medicare to cover the costs of these benefits . The scope and breadth of these benefits vary depending on your plan, but over 90% of Medicare Advantage Plans in 2022 include some coverage for:

- Eye exams and/or corrective lenses

Other less common additional benefits include:

- In-home support

To access any of these additional benefits, you must follow your plans rules, including using network providers and obtaining referrals and prior authorizations. Copays may apply. Beyond routine eye, dental, and hearing exams, most Medicare Advantage Plans provide an allowance for some benefits. For instance, you may receive $150 toward the purchase of eyeglasses if you use an in-network provider. Your benefits and how much you pay are detailed in your plans Evidence of Coverage document.

These additional benefits are not covered by Medicare but are offered as non-covered services by your Medicare Advantage Plan. Your out-of-pocket costs, such as copays, do not apply toward your maximum out-of-pocket spending limit.

How Do I Choose The Right Medicare Advantage Plan

Before the open enrollment season, check out as many Part C plans as you can to determine which options work for your budget and health needs. Each year, from October 15 to December 7, open enrollment allows you to change, switch or initially enroll in a Medicare Advantage plan. The right choice may save you thousands of dollars every year and make it easier to get the help you need when you need it the most.

A Medicare Advantage plan must cover the same services as traditional Medicare plans. These plans also should take care of some costs that would normally come out-of-pocket, without supplemental coverage. Medicare Part C plans usually require that you use healthcare facilities, doctors, physicians and other professionals already existing in the health insurance plans network.

However, most plans offer you either HMO or PPO options. If you choose an HMO Medicare Advantage plan, you will have to choose a primary care physician and receive care within the network. If you go with a PPO, then you may have more of a choice with out-of-network doctors and still receive coverage. Regardless of what you choose, youll most likely have out-of-pocket costs in the form of copayments and coinsurance, which depend on carrier and plan type.

Read Also: Does Medicare Part F Cover Hearing Aids

Medicare Advantage Zero Dollar Premium Plans

Medicare Advantage plans can choose to pass on savings on healthcare costs to members, resulting in a $0 monthly premium. A plan can also be designed to not have a monthly premium, as is the case with a Medicare MSA. In understanding Medicare Part C and its costs, you should be aware that zero-premium Medicare Advantage plans are not freeyou still pay your Part B premium as well as other Medicare out-of-pocket costs, such as deductibles.

The Kaiser Family Foundation reports that 65% of MA-PD enrollees have a zero dollar premium plan, with exception to their Part B premiums.1

Pros Of Medicare Advantage Plans

With Medicare Advantage plans, you can get personalized, coordinated medical care at a lower cost, depending on your plan. There are many advantages of enrolling in a Medicare Advantage plan. You can get:

- All of your coverage bundled together in 1 convenient plan.

- Costs that may be lower than Original Medicare.

- Extra benefits such as coverage for vision, hearing, dental, wellness programs, and discounts on health-related items.

- Prescription drug coverage .

- All the rights and protections offered through the Medicare program.

- Help paying for premiums , if you qualify.

- All the benefits of Medicare Part A and Part B plans, without buying supplemental insurance.

Don’t Miss: Is Repatha Covered By Medicare Part D

What Is Medicare Part C Special Enrollment Period

Certain life events trigger special enrollment periods when you can switch from one Part C plan to another or sign up for Medicare Part C coverage for the first time. There are several life events that count as SEPs for Medicare Advantage. Many of these SEPs also apply to Medicare Part D prescription drug plans. Some of these SEPs include:

- Plan not renewing or reducing its service area: You can enroll in another MA plan starting December 8 and ending the last day of February.

- Medicare ending the plans contract: You can switch to another MA plan starting the 2 months before the contract terminates and ending 1 full month after the contract terminates.

- Losing eligibility for Medicaid: If you receive a notice that you will no longer be eligible for Medicaid benefits for the current plan year, you will have 2 full months after receiving the notice to join an MA plan. If you will not be eligible for Medicaid the following year, you can enroll in an MA plan between January 1 and March 31 .

- Living in a Part C or Part D service area with an overall 5-star quality rating: You can join an MA plan with an overall 5-star quality rating one time between December 8 and November 30.

Enrollment Period For Medicare Part D

Like Medicare Part C, you are eligible to enroll in Medicare Part D during the seven-month period around your 65th birthdaybeginning three months before the month of your 65th birthday, including the month of your birthday, and up to three months after the end of your birthday month. You must enroll directly through an insurance company.

Also Check: Does Medicare Plan F Cover International Travel

Do You Need Medicare Part C

These plans are optional, but if you need more than just basic hospital and medical insurance, Medicare Part C might be a good option for you.

If youre happy with your current Medicare coverage and are only interested in receiving prescription drug coverage, a stand-alone Medicare Part D plan may be the best option.

If you have Medicare coverage but only need additional help with costs, a Medicare supplemental insurance policy might work for you.

For some people, Medicare Part C is an additional cost that they just cant afford in this case, shopping around for Part D and Medigap coverage may help save money.

Important Facts About Medicare Advantage

Dont Leave Your Hard-Earned Benefits Behind. Call to get connected with a licensed agent.

Don’t Miss: How Does United Medicare Advisors Make Money