When You Become Eligible For Medicare

Lets assume you have a Marketplace plan and are turning 65 sometime this year.

Once youre eligible for Medicare, youll have an Initial Enrollment Period to sign up for Medicare. For most people, the Initial Enrollment Period starts 3 months before their 65th birthday and ends 3 months after their 65th birthday.

In most cases its to your advantage to sign up for Medicare when youre first eligible because:

- Once your Medicare Part A coverage starts, you wont be eligible for a premium tax credit or other savings for a Marketplace plan. If you kept your Marketplace plan, youd have to pay full price.

- If you enroll in Medicare after your Initial Enrollment Period ends, you may have to pay a Part B late enrollment penalty for as long as you have Medicare. In addition, you can enroll in Medicare Part B only during the Medicare general enrollment period . Coverage doesnt start until July of that year. This may create a gap in your coverage.

I Didnt Sign Up For Part B When I First Became Eligible But Want To Sign Up Now I Know There Is A Penalty For Late Enrollment Is There Any Way To Avoid The Penalty

Generally, no. In most cases, if you missed your Part B enrollment window, which runs from the three months before the month of your 65th birthday through the three months after the month of your 65th birthday, you will face a late enrollment penalty once you do enroll, which will be added to your premium costs for the remainder of your enrollment. The penalty equals 10% of the standard monthly premium for each 12-month period that you delayed enrollment.

If you did not enroll for Part B during your initial enrollment period, you may qualify for a Special Enrollment Period to sign up for Part B anytime as long as you or a spouse is working and youre covered by a group health plan through that employment. For people age 65 or over who have coverage through a group health plan, there is also an 8-month SEP which starts the month after the employment ends or the group health plan coverage ends. If you sign up during an SEP, the late enrollment penalty will not apply.

When Can You Enroll In Prescription Drug Coverage

You have a few options as to when you can sign up.

- Your Initial Enrollment Period: This occurs when you first become eligible for Medicare.

- Open Enrollment Period : From October 15 to December 7 each year, you can enroll in a prescription drug plan.

- Medicare Advantage Open Enrollment Period: From January 1 to March 31 each year, if you are already enrolled in a Medicare Advantage plan without drug coverage, you can switch to a plan that includes the coverage.

- Special Enrollment Period: Certain events, like moving or losing your insurance coverage, make you eligible to enroll outside the usual times.

Don’t Miss: Does Medicare Pay For Maintenance Chiropractic Care

Signing Up For Premium

You can sign up for Part A any time after you turn 65. Your Part A coverage starts 6 months back from when you sign up or when you apply for benefits from Social Security . Coverage cant start earlier than the month you turned 65.

After your Initial Enrollment Period ends, you can only sign up for Part B and Premium-Part A during one of the other enrollment periods.

How Can I Delay Medicare Part B

Some people may want to delay Part B coverage but enroll in Part A. If this is your choice, there are a few things to keep in mind as you near your 65th birthday. This will help make sure you delay Part B coverage properly.

If you have been receiving Social Security benefits for four months or longer when you turn 65, then you will be enrolled in both Part A and Part B automatically. If you dont want to enroll in Part B coverage, then contact Social Security as soon as you can and let them know you dont want this coverage. You will find instructions in the package you receive from Medicare a few months before you turn 65.

If you arent receiving Social Security benefits for four months by your 65th birthday, then you will need to directly contact Social Security to enroll for Part A. You can do this through their website, ssa.gov or by calling them directly and notifying them that you want to enroll for Part A only.

Remember, if you are covered under a group plan and delay Part B, you will not have to pay penalty fees when you enroll in Part B later on. You will have 8 months to enroll in Medicare penalty-free after you stop working, or once your employer insurance ceases, whichever comes first.

Recommended Reading: What Are Medicare Part Abcd

Do I Need Medicare Part B

We always advise our clients to contact their employer or union benefits administrator before delaying Part A and Part B to learn more about how their insurance works with Medicare. Employer coverage may require that you enroll in both Part A and Part B to receive full coverage.

Common reasons beneficiaries delay Part B include:

Medicare Faqs And Information To Consider

Automatic Enrollment:

If you are already receiving Social Security benefits, Railroad Retirement benefits, or Federal Retiree benefits, your enrollment in Medicare is automatic. Your Medicare card should arrive in the mail shortly before your 65th birthday. Check the card when you receive it to verify that you are entitled to both Medicare Parts A and B.

Initial Enrollment Period:

If you are not eligible for Automatic Enrollment, contact the Social Security Administration at 800-772-1213 or enroll online at www.socialsecurity.gov, or visit the nearest Social Security office to enroll in Medicare Part A and Medicare Part B. You have a seven month window in which to enroll in Medicare without incurring a penalty. If youre not automatically enrolled in premium-free Part A, you can sign up for it once your Initial Enrollment Period starts. Your Part A coverage will start six months back from the date you apply for Medicare, but no earlier than the first month you were eligible for Medicare. However, you can only sign up for Part B during the times listed below.

General Enrollment Period:

- General Enrollment Period for Medicare Parts A & B

If you have coverage through a current employer, you are not required to enroll in Medicare Part A and B. Below are some things to keep in mind about each part of Medicare.

Recommended Reading: Which Of The Following Is True Regarding Medicare Supplement Policies

Signing Up Late: General Enrollment Period

Part A. If you didn’t sign up for Medicare Part A when you were first eligible, you can sign up for Part A anytime, without penalty.

When coverage begins. Your Part A coverage will go back to six months before the date you signed up .

Part B, C and D. If you didn’t sign up for Medicare Part B when you were first eligible, you can sign up for Part B during a General Enrollment Period, which happens between January 1 through March 31 each year. You will also have from April 1 through June 30 of that year to add a Medicare Advantage plan or Medicare Part D plan.

When coverage begins. When you sign up for Part B, C, or D during a General Enrollment Period, your coverage will start July 1.

Late sign-up penalty. Individuals who did not sign up for Medicare Part B when they turned 65 might face a penalty of higher lifetime premiums when they do sign up. However, most individuals who were covered by a group health plan through an employer are not subject to the penalty. If you didn’t sign up for Part B because you had group health benefits through work, you should be able to sign up during your Special Enrollment Period.

More Answers: Changing From The Marketplace To Medicare

- Can I get help paying for Medicare?

-

If you need help with your Part A and B costs, you can apply for a Medicare Savings Program.

-

You may also qualify for Extra Help to pay for your Medicare prescription drug coverage if you meet certain income and resource limits.

- What if Im eligible for Medicare, but my spouse isnt and wants to stay covered under our current Marketplace plan?

-

If someone gets Medicare but the rest of the people on the application want to keep their Marketplace coverage, you can end coverage for just some people on the Marketplace plan, like a spouse or dependents.

Don’t Miss: When Do Medicare Benefits Kick In

How Medicare Advantage Can Save You Money On Your Part B Premiums

If you don’t qualify for the above programs, you still have options. Consider a Medicare Advantage plan that offers a rebate on your Part B premium. Here’s how that works:

A Medicare Advantage plan provides the same or better coverage than Part A and Part B . To receive this coverage, most enrollees pay a premium for their Medicare Advantage plan in addition to the cost of Part B.

But in some areas, typically large cities, Medicare Advantage providers offer $0 plans to better compete with other insurance companies. A few go even further and offer enrollees a rebate on their Part B premiums. If you enroll in one of these plans, you could pay a lower monthly Part B premiumand have more benefits, such as prescription drug, dental, vision, and hearing coverage.

These plans aren’t available in all areas, but even the average Medicare Advantage plan could help save you money. With most plans, you won’t have to pay an extra premium for prescription drug coverage or dental insurance, for example, which could free up some cash to cover the Part B premium.

To find out if a Medicare Advantage plan could save you money, give us a call.

When Does Medicare Coverage Start If You Sign Up For A Medicare Advantage Plan

If you sign up during your Medicare Initial Enrollment Period, your Medicare Advantage coverage usually starts at the same time your Original Medicare coverage would start, as described above. For example, if you enroll in Medicare Advantage during the three-month period before you turn 65, your plan would start coverage the first day of your birthday month.

If you sign up for a Medicare Advantage plan during the Annual Election Period , your plan coverage usually starts January 1 of the next year. The same is true if you change plans.

If you switch from one Medicare Advantage plan to another during the Medicare Advantage Open Enrollment Period , generally your new coverage starts the first of the month after the plan gets your request.

Don’t Miss: Does Medicare Cover Laser Therapy

B Triggers Medigap Medicare Advantage And Part D Enrollment Window

After you have enrolled in Part B, you should seriously consider getting a Medigap Plan, Medicare Advantage and Part D drug plan, as your Medicare Part A and Part B will only cover you so far. Since you are coming off your work coverage, you will be allowed a 63 day special enrollment period to get extra coverage. Should you miss this window you may be subject to penalties, waiting periods or medical underwriting.

Have You Or Your Spouse Worked For At Least 10 Years At Jobs Where You Paid Medicare Taxes

Generally, youre first eligible to sign up for Part A and Part B starting 3 months before you turn 65 and ending 3 months after the month you turn 65.

Avoid the penalty If you dont sign up when youre first eligible, youll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up. How much is the Part B late enrollment penalty?

Read Also: Does Medicare Require A Referral For A Colonoscopy

Canceling Your Marketplace Plan When You Become Eligible For Medicare

In most cases, if you have a Marketplace plan when you become eligible for Medicare, youll want to end your Marketplace coverage.

IMPORTANT

Don’t end your Marketplace plan until you know for sure when your new coverage starts. Once you end Marketplace coverage, you cant re-enroll until the next annual Open Enrollment Period .

Your Medicare coverage start date depends on your situation.

The Cost Of Medicare Part B

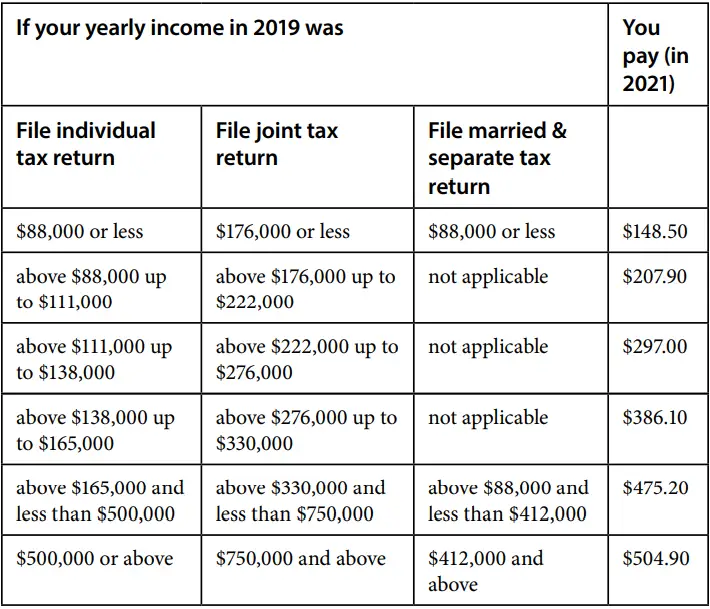

Unlike Medicare Part A, Medicare Part B requires a premium from everyone. The standard premium for Medicare Part B in 2020 is $144.60 a month, which applies to most people, including new enrollees. That premium changes each year, usually increasing. In 2021, the Part B premium is $148.50 a month.

Youll also have an annual deductible of $203 in 2021 .

There are penalty fees for not signing up during your Initial Enrollment Period , but well discuss those in a separate section.

While most people pay the standard amounts for premiums and deductibles, some people will pay more, depending on their income. The more you make, the higher your likelihood will be for paying more than the standard amount. The extra fee per month is called the Income Related Monthly Adjustment Amount . How much more can you expect to pay if you fall outside of the standard range? The Medicare website offers a handy chart on the rates for those with higher incomes, which is updated each year. These are the rates for 2020, based on the income reported on your 2018 tax return:

These amounts reflect individual incomes only. Married couples will pay the same rates, but for different, higher thresholds. For example, a couple that earns over $174,000 per year and files a joint tax return will pay $202.40 per month for Medicare Part B premiums.

Also Check: Can You Sign Up For Medicare Part B Anytime

Delaying Medicare Due To Work: Special Enrollment Period

If you didn’t enroll in Medicare because you were still working, and you were covered under a group health plan based on employment, you have a Special Enrollment Period during which you can sign up for Part A and/or Part B. While you or your spouse are still working and you’re still covered under a group health plan, you can sign up anytime.

After your or your spouse’s employment ends, your Special Enrollment Period lasts eight months, starting the month after the employment or group health plan ends . However, you have only two months after the employment or group health plan ends to sign up for a Medicare Advantage plan or Part D prescription drug plan . You can enroll in a Medicare Advantage plan starting three months before your Medicare Part B enrollment is due to take effect up to the day before your Part B coverage startsbut again, enrollment must take place within two months of your employment or group health plan ending.

Example:

Judy’s last day of work is July 1 and her group health plan ends July 31. She has eight months, until April 30, to sign up for Part B without a penalty. But if she wants to join a Medicare Advantage plan, she needs to do so by September 30 . Instead, on June 15, Judy signs up for Part B coverage to begin on August 1, so that she won’t have a gap in coverage. She has only until July 31 to add a Medicare Advantage plan . Her Medicare Advantage plan will start August 1.

How Do I Sign Up For Medicare Part B If I Already Have Part A

If you are already enrolled in Medicare Part A and you would like to enroll in Part B under the Special Enrollment Period , you can apply online at Apply for Medicare Part B Online during a Special Enrollment Period. You can upload your application and documents that verify your group health plan coverage through your employer.

You can also fax or mail your completed CMS-40B, Application for Enrollment in Medicare Part B and the CMS-L564, Request for Employment Information enrollment forms and evidence of employment to your local Social Security office. If you have questions, please contact Social Security at 1-800-772-1213 .

Note: When completing the forms CMS-40B and CMS-L564:

- State I want Part B coverage to begin in the remarks section of the CMS-40B form or online application.

- If your employer is unable to complete Section B, please complete that portion as best as you can on behalf of your employer without your employer’s signature.

- Also submit one of the following forms of secondary evidence:

- Income tax returns that show health insurance premiums paid.

- W-2s reflecting pre-tax medical contributions.

- Pay stubs that reflect health insurance premium deductions.

- Health insurance cards with a policy effective date.

- Explanations of benefits paid by the GHP or LGHP.

- Statements or receipts that reflect payment of health insurance premiums.

Recommended Reading: Does Medicare Cover Rides To Medical Appointments