Medicare Costs: Parts A/b/c/d

For the last fifty years, one undeniable healthcare success story has been Medicare. This federal health insurance program, established in 1965, provides healthcare coverage and security for men and women age 65 and older. This coverage includes hospital and medical care, preventive and other health services and prescription drugs.But Medicare actually serves a much wider audience, including some people under age 65 with disabilities. And, since 1972, this program has provided essential coverage to patients with end-stage renal disease . To qualify for Medicare, an individual must meet one of three categories: age, disability or ESRD. By far, age being 65 or older is the leading eligibility factor. As of 2010, Medicare covered more than 47 million Americans. In 2010, the number of Medicare customers broke down as follows:

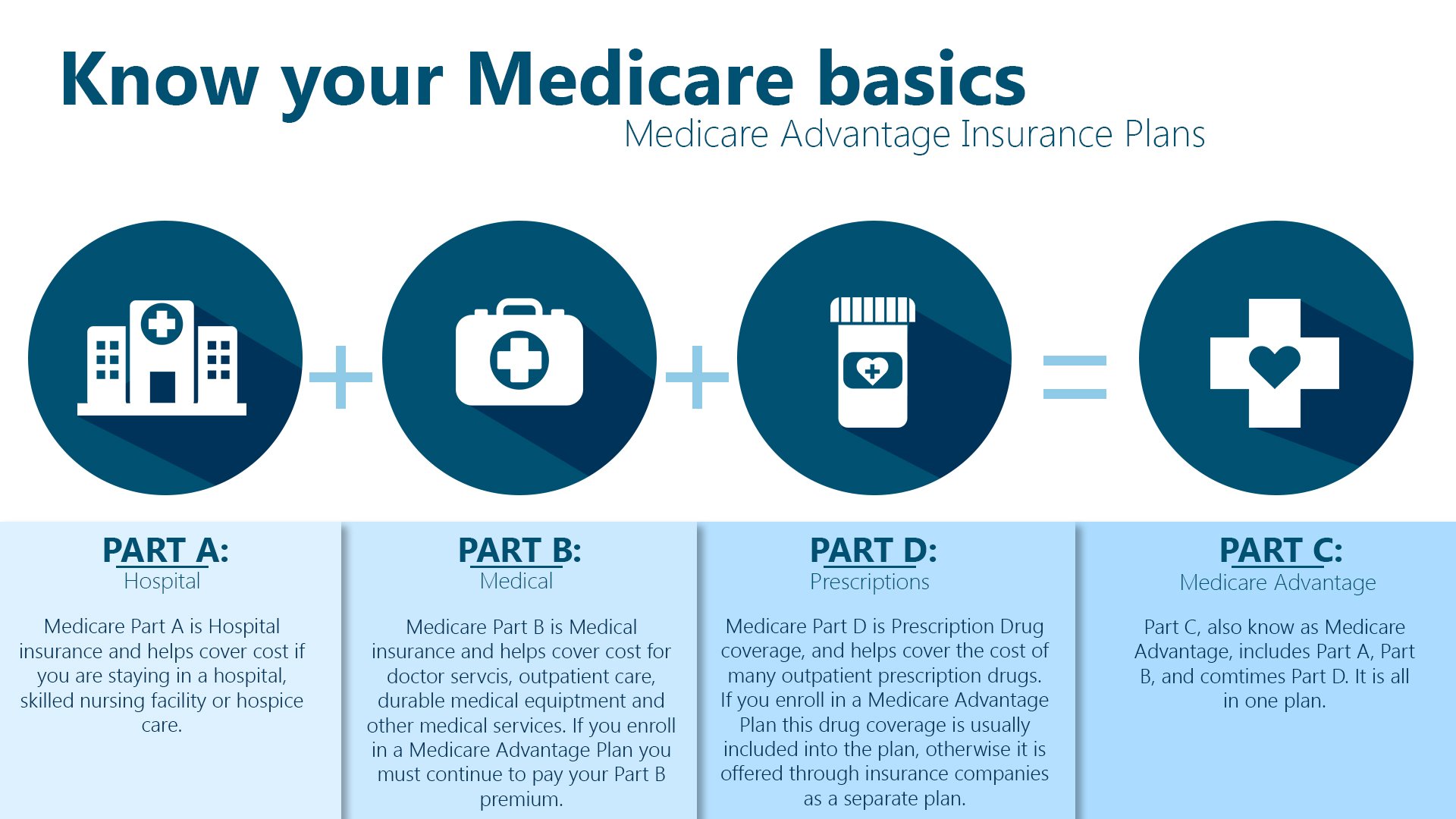

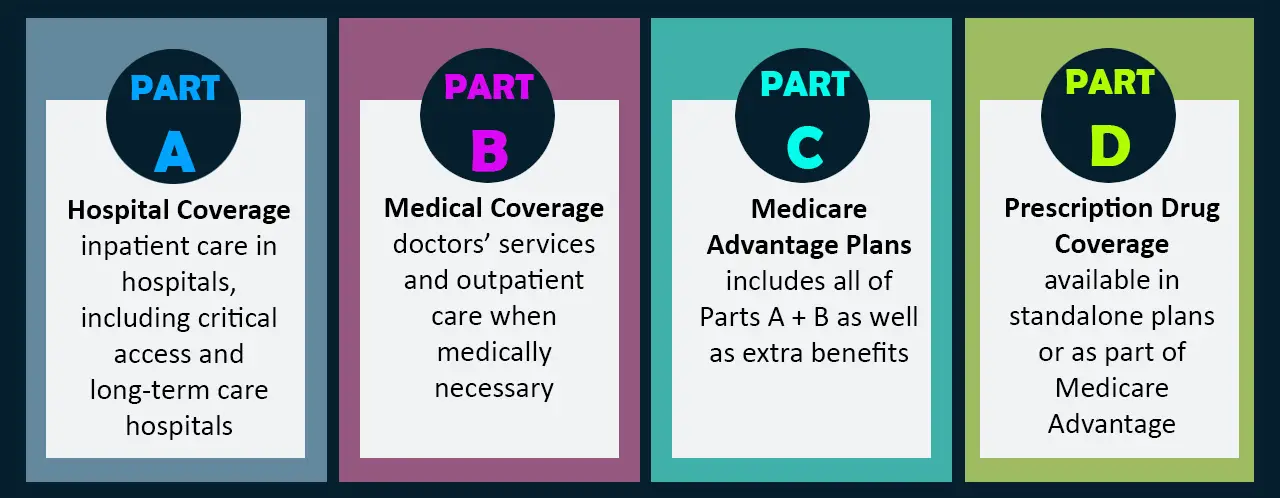

The Medicare program is comprised of four parts. Weve provided an overview of each part, including expected 2015 costs.

- Part A this refers to Hospital Insurance. Parts A and B together make up the government health plan known as Original Medicare.

- Part B supplementary medical insurance

- Part C the Medicare Advantage program, in which enrollees receive benefits through private plans

- Part D the voluntary outpatient prescription drug benefit initiative. Established in 2006, Part D is delivered by private plans

In 2010, Medicare spent nearly $523 billion on benefits and administration, including:

3.) Medicare pays its share of the approved amount.

Medicare Part B: Doctors And Tests

Medicare Part B covers a long list of medical services including doctor’s visits, medical equipment, outpatient care, outpatient procedures, purchase of blood, mammograms, cardiac rehabilitation, and cancer treatment.

You’re not required to enroll in Part B if you have “” from another source, such as an employer or spouse’s employer. If you don’t enroll and you don’t have creditable coverage from another source, you may have to pay a penalty if you enroll later.

You pay a monthly premium for Part B. In 2021, the cost is $148.50, up from $144.60 in 2020. If you’re on Social Security, this may be deducted from your monthly payment.

The annual deductible for Part B is $198 in 2020 and rises to $203 in 2021. Once you meet the deductible, you pay 20% of the Medicare-approved cost of the service, provided your healthcare provider accepts Medicare assignment. But beware: There is no cap on your 20% out-of-pocket expense.

For example, if your medical bills for a certain year were $100,000, you could be responsible for up to $20,000 of those charges, plus the charges incurred under Part A and D umbrellas. There is no lifetime maximum.

Kathryn B. Hauer, MBA, CFP®, EA, a financial advisor with Wilson David Investment Advisors in Aiken, S.C., and author of Financial Advice for Blue Collar America, explains:

Skilled Nursing Facility Benefits And Costs

You must meet all the following conditions:

- Require daily skilled services

- In order for Medicare to cover your SNF, you MUST have been hospitalized for at least 3 consecutive inpatient overnights prior to SNF admission

- Admitted to SNF within 30 days after leaving hospital

- Receive care in the SNF for the condition treated in the hospital.

- The SNF must be a Medicare participating SNF.

SNF Costs for 2019

- Days 1 to 20 covered in full

- Days 21 to 100 beneficiary is responsible for $170.50 per day

- No custodial or intermediate nursing home care provided

Also Check: Is Medicare A Federal Program

How Much Does Medicare Part A Cost

If you or your spouse have worked at least 40 calendar quarters in any job where you paid Social Security taxes, you do not have to pay a premium for Part A.

- Premium: $0 per month

- 2020 Deductible: $1,408 for each benefit period

The 2020 Medicare Part A premium for those who do not qualify for $0 premiums is either $252 or $458 per month, depending on how long you worked and paid Medicare taxes.

Reimbursement For Part A Services

For institutional care, such as hospital and nursing home care, Medicare uses prospective payment systems. In a prospective payment system, the health care institution receives a set amount of money for each episode of care provided to a patient, regardless of the actual amount of care. The actual allotment of funds is based on a list of diagnosis-related groups . The actual amount depends on the primary diagnosis that is actually made at the hospital. There are some issues surrounding Medicare’s use of DRGs because if the patient uses less care, the hospital gets to keep the remainder. This, in theory, should balance the costs for the hospital. However, if the patient uses more care, then the hospital has to cover its own losses. This results in the issue of “upcoding”, when a physician makes a more severe diagnosis to hedge against accidental costs.

Don’t Miss: When Do Medicare Benefits Kick In

Medicare Advantage Plans Have An Out

When you enroll in a Medicare Advantage plan, you can ask about your specific policys out-of-pocket spending limit.

Original Medicare does not include an out-of-pocket spending limit. While its not common, you could potentially be responsible for thousands of dollars in out-of-pocket costs if you only have Original Medicare coverage and require extensive medical care throughout the year.

Quality Of Beneficiary Services

A 2001 study by the Government Accountability Office evaluated the quality of responses given by Medicare contractor customer service representatives to provider questions. The evaluators assembled a list of questions, which they asked during a random sampling of calls to Medicare contractors. The rate of complete, accurate information provided by Medicare customer service representatives was 15%. Since then, steps have been taken to improve the quality of customer service given by Medicare contractors, specifically the 1-800-MEDICARE contractor. As a result, 1-800-MEDICARE customer service representatives have seen an increase in training, quality assurance monitoring has significantly increased, and a customer satisfaction survey is offered to random callers.

Don’t Miss: Can You Change Medicare Plans After Open Enrollment

What You Need To Know About Medicare Parts A B C And D

We publish unbiased product reviews our opinions are our own and are not influenced by payment we receive from our advertising partners. Learn more about how we review products and read our advertiser disclosure for how we make money.

There are four parts of Medicare: Part A, Part B, Part C, and Part D. In general, the four Medicare parts cover different services, so it’s essential that you understand the options so you can pick your Medicare coverage carefully.

Medigap Plans Work Alongside Original Medicare

Medicare Supplement Insurance plans help cover certain Medicare out-of-pocket costs, such as deductibles, coinsurance, copays and other fees.

There are 10 standardized Medigap plans in most states, and each provides its own level of coverage. A licensed insurance agent can help you find Medigap plans in your area and get you enrolled in one that works for you.

Recommended Reading: What Is Medicare Ffs Program

Medicare Part C Combining Your Coverage

Medicare Part C is also known as Medicare Advantage. It’s made up of plans approved by Medicare that are offered through private insurance companies. Before enrolling in a Medicare Advantage plan, you will still need to sign up for both Part A and Part B, and then choose a Medicare Advantage plan that is right for you. This means that to get a Medicare Advantage plan, you will have to sign up directly with the private insurer that offers the plan you want after youve enrolled in Part A and B.

- Dental, vision or hearing services

- Prescription drug coverage

- Fitness club memberships

Medicare Advantage plans can offer additional benefits because the plans are made up of networks of health care providers. Networks can be more efficient in delivering care. As a result, they reduce overall health care costs. Some Medicare Advantage plans require you to use their network of providers. Others allow you to go out-of-network, usually for a higher cost.

What Happens If I Delay Signing Up For Part B

If you delay enrollment into Part B, you may need to pay a monthly late enrollment penalty. This penalty is not based on your actual premium amount but rather, on the standard Part B premium. It is important not to wait to sign up for Part B because the Part B late enrollment penalty lasts a lifetime.

You May Like: Do I Need Health Insurance With Medicare

Do You Have To Pay A Part A Premium

You may be wondering does Medicare Part A cover 100 percent? And while this is not the case, there are provisions in place to make Medicare affordable to beneficiaries.

Many people dont pay a monthly premium for Medicare Part A. For example, if you worked at least ten years while paying taxes, you dont pay a premium for Part A. If you worked for fewer than 30 quarters, you generally pay $471 per month in 2021. If you worked more than 30 but fewer than 40 quarters, your premium is $259 per month in 2021

Can I Delay Enrolling In Medicare Part B

Some people may get Medicare Part A premium-free, but most people have to pay a monthly premium for Medicare Part B. Because Medicare Part B comes with a monthly premium, some people may choose not to sign up during their initial enrollment period if they are currently covered under an employer group plan .

If you are still working, you should check with your health benefits administrator to see how your insurance would work with Medicare. If you delay enrollment in Medicare Part B because you already have current employer health coverage, you can sign up later during a Special Enrollment Period without paying a late penalty. You can enroll in Medicare Part B at any time that you are still covered by a group plan based on current employment. After your employer health coverage ends or your employment ends , you have an eight-month special enrollment period to sign up for Part B without a late penalty.

Keep in mind that retiree coverage and COBRA are not considered health coverage based on current employment and would not qualify you for a special enrollment period. If you have COBRA after your employer coverage ends, you should not wait until your COBRA coverage ends to sign up for Medicare Part B. Your eight-month Part B special enrollment period begins immediately after your current employment or group plan ends . This is regardless of whether you get COBRA.

Read Also: Does Medicare Offer Dental Plans

Costs And Funding Challenges

Over the long-term, Medicare faces significant financial challenges because of rising overall health care costs, increasing enrollment as the population ages, and a decreasing ratio of workers to enrollees. Total Medicare spending is projected to increase from $523 billion in 2010 to around $900 billion by 2020. From 2010 to 2030, Medicare enrollment is projected to increase dramatically, from 47 million to 79 million, and the ratio of workers to enrollees is expected to decrease from 3.7 to 2.4. However, the ratio of workers to retirees has declined steadily for decades, and social insurance systems have remained sustainable due to rising worker productivity. There is some evidence that productivity gains will continue to offset demographic trends in the near future.

The Congressional Budget Office wrote in 2008 that “future growth in spending per beneficiary for Medicare and Medicaidthe federal government’s major health care programswill be the most important determinant of long-term trends in federal spending. Changing those programs in ways that reduce the growth of costswhich will be difficult, in part because of the complexity of health policy choicesis ultimately the nation’s central long-term challenge in setting federal fiscal policy.”

B Doctor And Outpatient Services

This part of Medicare covers doctor visits, lab tests, diagnostic screenings, medical equipment, ambulance transportation and other outpatient services.

Unlike Part A, Part B involves more costs, and you may want to defer signing up for it if you are still working and have insurance through your job or are covered by your spouses health plan. But if you dont have other insurance and dont sign up for Part B when you first enroll in Medicare, youll likely have to pay a higher monthly premium for as long as youre in the program.

The federal government sets the Part B monthly premium, which is $148.50 for 2021. It may be higher if your income is more than $88,000.

Youll also be subject to an annual deductible, set at $203 for 2021. And youll have to pay 20 percent of the bills for doctor visits and other outpatient services. If you are collecting Social Security, the monthly premium will be deducted from your monthly benefit.

Recommended Reading: When Is Open Enrollment For Medicare

What Is Medicare Part B

Medicare Part B is medical insurance. It generally covers services and items such as:

- Doctor office visits

- Preventive services, such as certain tests and screenings

- Flu shots

- Diabetes screenings, supplies, and self-management therapy

- Durable medical equipment, such as wheelchairs

This is not a complete list. Part B may cover many different services and items, but certain coverage rules apply. For example, providers must accept Medicare assignment , and certain items and services must be medically necessary.

Under Part B, in most cases you will pay 20% of the Medicare-approved amount for each item or service. A deductible may also apply.

What Do Medicare Parts A B C And D Mean

Who is this for?

If you’re new to Medicare, this information will help you understand the different parts and what they do.

There are four parts of Medicare. Each one helps pay for different health care costs.

Part A helps pay for hospital and facility costs. This includes things like a shared hospital room, meals and nurse care. It can also help cover the cost of hospice, home health care and skilled nursing facilities.

Part B helps pay for medical costs. This is care that happens outside of a hospital. It includes things like doctor visits and outpatient procedures. It also covers some preventive care, like flu shots.

Parts A and B together are called Original Medicare. These two parts are run by the federal government. Find out more about what Original Medicare covers in our Help Center.

Part C helps pay for hospital and medical costs, plus more. Part C plans are only available through private health insurance companies. Theyre called Medicare Advantage plans. They cover everything Parts A and B cover, plus more. They usually cover more of the costs youd have to pay for out of pocket with Medicare Parts A and B. Part C plans put a limit on what you pay out of pocket in a given year, too. Some of these plans cover preventive dental, vision and hearing costs. Original Medicare doesnt.

You can see a list of the Medicare Advantage plans we offer and what they cover.

Also Check: What Does Medicare Part B Include

Who Is Automatically Enrolled

Groups that are automatically enrolled in original Medicare are:

- those who are turning age 65 and already getting retirement benefits from the Social Security Administration or the Railroad Retirement Board

- people under age 65 with a disability who have been receiving disability benefits from the SSA or RRB for 24 months

- individuals with amyotrophic lateral sclerosis who are getting disability benefits

Its important to note thateven though youll be automatically enrolled, Part B is voluntary. You canchoose to delay Part B if you wish. One situation where this may occur is ifyoure already covered by another plan through work or a spouse.

How To Decipher The Abcds Of Medicare: Part E

| Editors Note: Click HERE and discuss how BHM services reach your goals. |

Summary: What is Medicare Part E? What does it cover? What are the costs?

Medicare is defined according to Medicare.gov as the federal health insurance program for people who are age 65 or older, certain younger people with disabilities, and people with End-Stage Renal Failure .

This article is part of a series of articles:

What does Medicare Part E cover?

You might be aware of now decade old proposal for a Medicare Part E. Nothing ever become of the proposal, but with the current political climate revisiting Medicare for All you may want to read this Brookings report on the subject.

In lieu of an official Part E of Medicare, there is an additional aspect of Medicare deserving consideration. The missing link is called Medigap insurance or maybe referred to as a Medicare supplement. This type of insurance is used to fill in the gaps and provide coverage for some of the things Medicare doesnt cover such as: coinsurance, co-payments, and deductibles.

For more information on Medicare Supplemental Insurance, visit AARP.

Here is a good article on how does Medicare Advantage, Medicare Supplemental Insurance differ.

8 facts specific to Medicare Supplements

Recommended Reading: What Is Medicare Part G

S Abcd Of Medicare Plans

CPA, MBA President & Chief Executive Officer

Contact Steve today for more info.

Medicare was launched in 1965 to provide health insurance coverage for Americas seniors. It has become a very popular program with seniors and insurance companies. Like most government programs, it has grown and become far more expensive than ever envisioned. Roughly 60 million people are insured under Medicare.

In this article I will walk you though the ABCD of Medicare plans. That is, an explanation of parts A, B, C and D that make up Medicare.