Need Help Affording Medicare

Medicares out-of-pocket costs premiums, deductibles, copays and coinsurance can easily result in a large tab each year. If youre struggling to meet those expenses, you might be eligible for federal and state assistance.

If you qualify for Medicaid, the federal-state health insurance program for people with low incomes and individuals with disabilities, it will pay some or all of your out-of-pocket expenses. Individuals on both Medicare and Medicaid are known as dual eligibles.

Other programs are designed for beneficiaries with incomes that are too high to qualify for Medicaid but who still have trouble paying their health care bills. Each program has specific income and asset limits and eligibility requirements that are adjusted annually.

- The Qualified Medicare Beneficiary program helps pay for Part A and Part B premiums as well as deductibles, coinsurance and copays. If you qualify for this program, you automatically qualify for the Extra Help prescription drug program to help you with the out-of-pocket costs of your medicines. This program has the lowest income threshold of the four.

Coronavirus testing

Medicare will pay for beneficiaries to get tested for COVID-19 with no out-of-pocket expenses. During the coronavirus, deductibles and copays for people on Original Medicare and those who have Medicare Advantage plans also will be waived for medical services related to testing, such as going to the doctor or hospital emergency room to see if they need to be tested.

Who Is Eligible For Medicare Part C

Anyone who is already enrolled in Original Medicare is eligible for Medicare Part C.

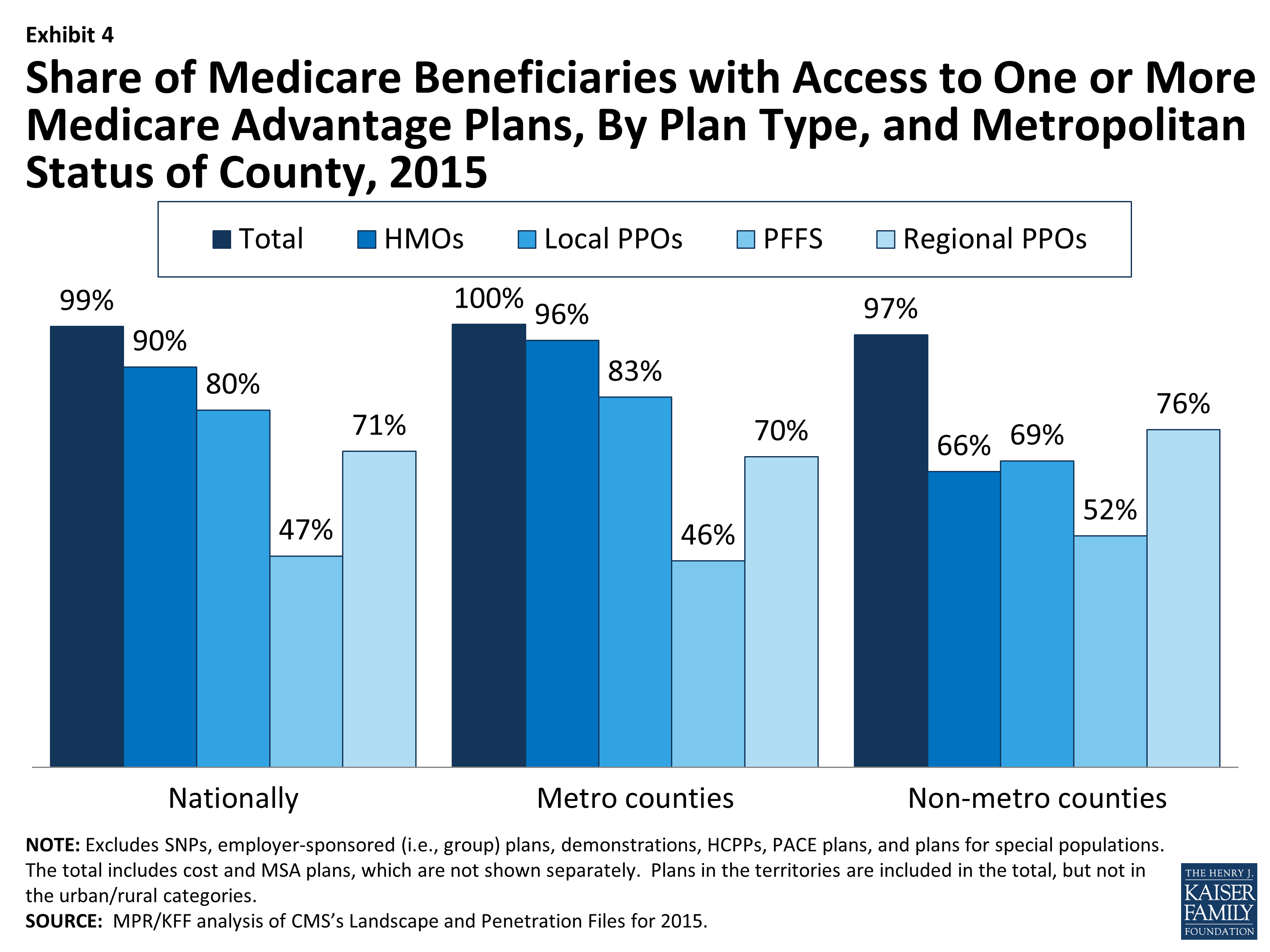

To qualify, you must live in the plans service area and be a U.S. citizen, U.S. national or lawfully present in the U.S. In 2021, the average Medicare beneficiary has access to 33 Medicare Advantage plans, according to the Kaiser Family Foundation.

How Much Do Medicare Advantage Plans Cost

Most of the 24.1 million Americans enrolled in a Medicare Advantage plan in 2020 paid no premiums for their plan itself. But to enroll in an Advantage plan, they still had to pay the monthly premium for Medicare Part B .

There were more than 3,100 different Medicare Advantage plans sold by private insurance companies that contract with Medicare in 2020. The plans are required to provide all the same coverage offered by Original Medicare Part A and Part B.

Medicare Advantage plans can offer additional benefits and that can increase their costs. So, monthly premiums for Medicare Advantage plans vary based on the terms of the plan, the benefits offered and other circumstances.

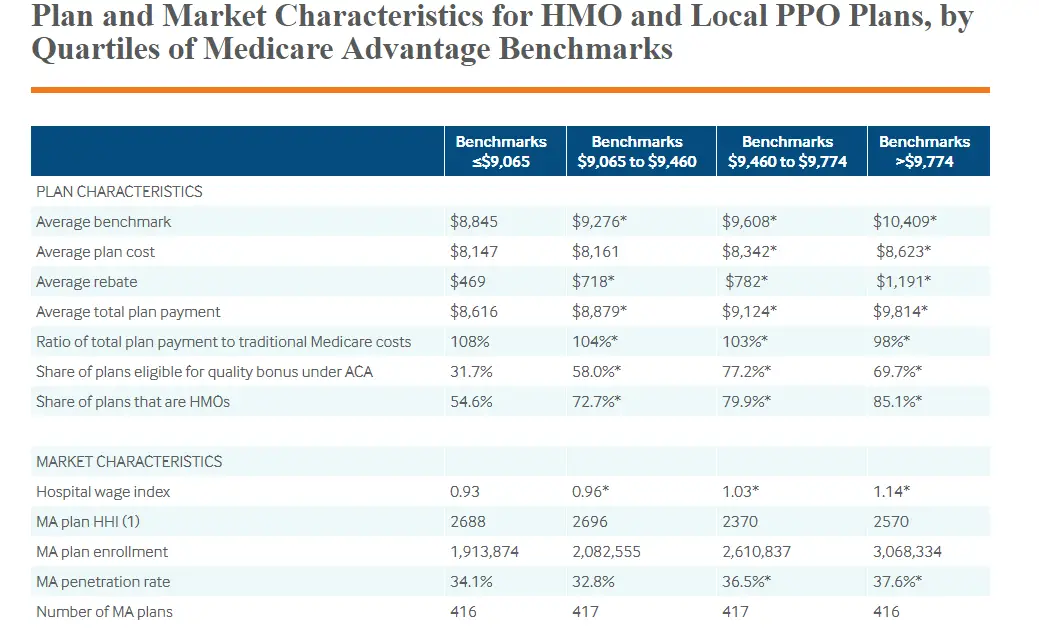

Overall, the average monthly premiums for Medicare Advantage plans have decreased 34 percent between 2015 and 2020, according to the Kaiser Family Foundation. This has been driven largely by steep declines in premiums for local PPO plans.

But regional PPO plans have bucked the trend, increasing by more than 30 percent over the same period.

Read Also: Does Medicare Cover Laser Therapy

Disadvantages Of Medicare Advantage Plans

In general, Medicare Advantage Plans do not offer the same level of choice as a Medicare plus Medigap combination. Most plans require you to go to their network of doctors and health providers. Since Medicare Advantage Plans cant pick their customers , they discourage people who are sick by the way they structure their copays and deductibles.

Although Mom saw her MA premiums increase significantly over the years, she didnt have any real motivation to disenroll until after she broke her hip and required skilled care in a nursing facility. After a few days, the nursing home administrator told her that if she stayed there, she would have to pay for everything out of her own pocket. Why? Because a utilization review nurse at her MA plan, who had never seen or examined her, decided that the care she was receiving was no longer medically necessary.

Because there are no commonly used criteria as to what constitutes medical necessity, insurers have wide discretion in determining what they will pay for and when they will stop paying for services like skilled nursing care by decreeing it custodial.

Consider Medicare Advantage Plan Costs

Choosing the right plan requires a careful comparison of costs and how often you expect to need the benefits. For example, plans with low or no monthly premiums may have higher cost-sharing when you do use a service.

What are the costs of Medicare Advantage plans to consider? Heres a breakdown of typical out-of-pocket expenses you may need to pay.

- Monthly Plan B premiums must still be paid to Medicare, even if youre enrolled in a Medicare Advantage plan.

- Additional monthly premiums may be payable to your private insurer. Some plans have no monthly premiums.

- Deductibles are the costs youre required to pay before the plan pays. There may be an annual deductible and additional deductibles for certain services.

- Coinsurance is the percentage of a claim you must pay.

- Copayments are the fixed amounts you pay per service or treatment.

All Medicare Advantage plans are required to have an annual limit on out-of-pocket costs. Once youve reached this limit, you cant be charged any additional costs.

You May Like: Does Medicare Cover Ct Scans

Costs In The Coverage Gap

Most Medicare drug plans have a coverage gap . This means there’s a temporary limit on what the drug plan will cover for drugs.

Not everyone will enter the coverage gap. The coverage gap begins after you and your drug plan have spent a certain amount for covered drugs. Once you and your plan have spent $4,430 on covered drugs in 2022 , you’re in the coverage gap. This amount may change each year. Also, people with Medicare who get Extra Help paying Part D costs wont enter the coverage gap.

Why Do So Many People Feel Medicare Advantage Is Bad

In our experience, the question comes up because people ask their friends, neighbors, and healthcare providers about Medicare plans, and that brings up the horror stories and a litany of reasons why people dislike their plan.

But, is it true?

Over the years, weve heard from many people, healthcare providers in particular, that they dislike Medicare Advantage plans, but that does not mean they are bad.

These are the 7 most common reasons weve documented that make people feel Medicare Advantage plans are terrible:

Read Also: Does Medicare Cover Varicose Vein Treatment

How Are Medicare Advantage Plans Priced

Its important to look beyond just the monthly premium when shopping for a Medicare Advantage plan. You need to consider your total Medicare costs. These include deductibles, copayments, coinsurance and maximum out-of-pocket costs.

Since Medicare Advantage plans are sold by private insurers, the companies can make several decisions that affect the price of each plan.

Business Decisions That Affect Medicare Advantage Plan Pricing

- Which plans a company chooses to offer

- How the company calculates the price and profit margin for premiums and cost-sharing

- Additional benefits the company offers

Unlike Medigap, which has 10 standardized plans across all companies, there are no standardized Medicare Advantage plans.

You will need to compare Medicare Advantage plans to find the right benefits and prices for your health care needs and personal finances.

Comparing The Costs Of Medicare Advantage Plans

A monthly $0 Medicare Advantage premium may sound enticing, but the plan may come with bare bones coverage. When comparing the costs of Medicare Advantage plans, be sure to consider the benefits you are receiving.

A low premium may not be a good bargain if you end up paying hefty copayments on prescription drugs or have to pay the full costs of benefits you passed up for the lower monthly payment.

Six Costs to Consider When Comparing Medicare Advantage Plans

- Monthly premium

- Maximum out-of-pocket costs

- Additional benefits

Consider how much youll likely pay per year for various health care services, then compare that to the premiums youd pay over the course of the year.

Find More Cost Details from Your Medicare Advantage Plan

- Evidence of Coverage

- Your insurer will send you an EOC document each fall. It will give you updated information about what your plan covers, your costs and other important information.

- Annual Notice of Change

- Your ANOC will alert you to changes in your costs, coverage and services that take effect on Jan. 1 of the coming year. This document also arrives from your insurer in the fall.

Read Also: Does Medicare Cover Cpap Masks

What Is A Medicare Cost Plan

Medicare Cost Plans are Medicare health plans that are available in certain parts of the country. The availability of Medicare Cost Plans depends on the insurance companies offering them, not on Medicare. Medicare Cost Plans may offer coverage for prescription drugs and other benefits, such as hearing and vision coverage not usually provided by Original Medicare.

Medicare beneficiaries with end-stage renal disease usually cannot enroll in a Medicare Cost Plan.

Learn more about Medicare Cost plans here.

Why Missouri Medicare Advantage Plans Are Bad

First things first. Medicare Advantage plans are not bad. More than 20% of all Medicare beneficiaries choose enrollment in a Medicare Advantage plan. But, it’s not for everyone. Before you enroll, learn the disadvantages of these plans if you are a senior in Missouri.

A good way to figure out which coverage is best for you is to look at your health and your finances. If you have one or more chronic conditions and you can afford a supplement, traditional MedicareOriginal Medicare is private fee-for-service health insurance for people on Medicare. It has two parts. Part A is hospital coverage. Part B is medical coverage…. is likely the best option because you have the ability to choose your doctors. Conversely, if you are super healthy, or you are unable to afford a Medicare supplement, then Medicare Advantage is a viable option.

Here’s the fundamental truth. Medicare plus a Medigap plan works best for people with chronic health conditions. It’s also the best coverage for people who can afford a higher monthly premiumA premium is an amount that an insurance policyholder must pay for coverage. Premiums are typically paid on a monthly basis. In the federal Medicare program, there are four different types of premiums. …, even if they rarely see a doctor.

You can learn more about what Medicare supplements are available to you on our Missouri Medigap Plan Finder page.

You May Like: Does Medicare Pay For Entyvio

Medicare Advantage Plans Have An Out

When you enroll in a Medicare Advantage plan, you can ask about your specific policys out-of-pocket spending limit.

Original Medicare does not include an out-of-pocket spending limit. While its not common, you could potentially be responsible for thousands of dollars in out-of-pocket costs if you only have Original Medicare coverage and require extensive medical care throughout the year.

What Are The Worst Medicare Advantage Plans

The Centers for Medicare & Medicaid Services does an excellent job of weeding out bad Medicare Advantage plans. Sub-par plans are given a year to clean up their act and CMS sanctions them.

So, what is a bad plan?

Generally, plans get sanctioned for bad customer service, poor performance managing chronic health conditions, a bad track record keeping members healthy , and a poor member experience with the drug plan . All of these measures are graded by CMS annually, and more. You can check each of the ten grades a health plan receives on our plan pages.

Beyond the 5-star grades, you must look at how a plan will cover you. By this, we mean the out-of-pocket costs you will be charged by the plan when you use health care services. A 4- or 5-star plan can be fantastic for one member and the worst of the bunch for another. It all depends on your total costs.

You must do the research and run numbers based on how you expect to use a plans benefits. Only then will you know if the plan you are choosing is a winner or a loser.

You May Like: Does Medicare Cover Outside Usa

How Do Medicare Cost Plans Work

Medicare cost plans are offered through private insurance companies that are approved by Medicare. These plans work along with original Medicare but also include some additional benefits.

Medicare cost plans appeal to many people because they provide a blend of benefits from both original Medicare and Medicare Advantage .

Medicare cost plans are only available in certain areas of the country. Additionally, changes in federal laws have led to the discontinuation of Medicare cost plans in many areas.

When you enroll in a Medicare cost plan, you gain access to the plans network of healthcare providers. You can either choose a provider within this network or an out-of-network provider. When you go out of network, its covered by original Medicare.

Additionally, some Medicare cost plans come bundled with Part D prescription drug coverage. If your plan doesnt include Part D, you can enroll in a separate Part D plan that best suits your needs.

Theres also additional flexibility in switching plans. If youre not happy with your Medicare cost plan, you can switch back to original Medicare at any time without waiting for the open enrollment period.

Average Cost Of Medicare Advantage Plans In Each State

| State |

Disclaimer: By clicking the button above, you consent to receive emails, text messages and/or phone calls via automated telephone dialing system or by artificial/pre-recorded message from representatives or licensed insurance agents of Elite Insurance Partners LLC, its affiliates or third-party partners at the email address and telephone number provided, including your wireless number , regarding Medicare Supplement Insurance, Medicare Advantage, Medicare Part D and/or other insurance plans. Your consent is not a condition of purchase and you may revoke your consent at any time. This program is subject to our Privacy Policy and Terms of Use. This website is not connected with the federal government or the federal Medicare program.

You May Like: Does Medicare Pay For Physical Therapy After Knee Surgery

The Cost Structure Of Medicare Advantage Plans

Medicare Advantage plans offer great value and typically cost less than Medicare Supplement plans. MA plans, unlike most Supplement plans, come with copaysallowing you to pay only for the health care services you need. Our client advisors are here to make copays simple.

We want to offer knowledge and guidance so that you can make the best decisions for your health care needs. See below for more information about the cost structure of MA plans.

Choosing A Medicare Part C Plan

Now that you know how much Medicare Part C costs per month, you can start planning for the Medicare enrollment period and shop for a Medicare Advantage plan. If youre not sure what plan is right for you, use the Medicare Plan Finder tool to view coverage options, see what plans cover your medications, and compare costs.

Also Check: Is Tresiba Covered By Medicare

Reason : They Make You Get A Referral

In the case of HMO plans and some PPO plans, this is true. According to the Kaiser Family Foundation, nearly all Medicare Advantage plan enrollees are in plans that require prior authorizationPrior authorization is a process used by health plans to control healthcare costs. Most HMO plans and some PPO plans require authorization before receiving certain treatments, medical services, or prescription drugs…. for some services. Health plans are in the business of making money and this is one of the primary ways they have to control costs.

By the way, Congress implemented a similar cost-saving measure with Medicare supplement insuranceMedicare Supplements are additional insurance policies that Medicare beneficiaries can purchase to cover the gaps in their Original Medicare health insurance coverage….. As of 1 January 2020, new Medicare beneficiaries cannot buy a Medigap plan that covers the Part B deductible. The hope is that this change will reduce unnecessary doctor visits.

Learn More About Medicare Advantage Plans With Healthmarkets

With HealthMarkets FitScore®, you can search, compare, and apply for Medicare Part C plans available in your area from leading health insurance companies. You can even add prescription drugs to compare Medicare Advantage premiums for plans that include Part D coverage. After answering a few questions, youll have a personalized list of top Medicare Advantage plan recommendations available in your area. Also, well continuously compare plans and notify you if a better option for your needs comes available. Its fast, simple, and comes at no extra cost. Find a Medicare Advantage plan today!

46585-HM-1020

Don’t Miss: Is Everyone Eligible For Medicare

When Can You Enroll

You can only join, switch, or drop a Medicare Advantage plan during specific enrollment periods.

Medicare Advantage Enrollment Periods

- Initial Enrollment

- You can enroll in a Medicare Advantage plan when you first become eligible for Medicare around your 65th birthday. Initial enrollment is a seven-month window that begins three months before your birthday and extends three months after your birth month.

- Open Enrollment

- Each year, from Oct. 15 to Dec. 7, anyone enrolled in Medicare can join, switch or drop a Medicare Advantage plan. New coverage will begin Jan. 1.

- General Enrollment

- If you didnt sign up for Medicare when you first became eligible, you can do so from Jan. 1 to March 31 each year. After signing up for Medicare Parts A and B during this time, you may then enroll in a Medicare Advantage plan from April through June.

What If I Need Help Paying Medicare Costs

If you have limited income and assets, you may qualify for help with your Medicare costs, including those that you pay for care you receive. There are several programs that help pay Medicare costs. Many people who could qualify never sign up, so be sure to apply if you think you might qualify. Dont hesitate to apply. Income and resource limits vary by program.

You May Like: When Do I Apply For Medicare Part B