Medicare Supplement Plans: How To Apply

Medicare can cover a wide range of medical costs, but like anything else, its not perfect. We would all like a bit more coverage than Original Medicare can offer, especially when we know we’ll be in more need of the benefits later in life. Luckily, Medicare Supplement plans provide a solution, helping boost your Medicare coverage and potentially save you thousands.

This guide will cover how to apply for a plan and, most importantly, when to apply so you can ensure valuable federal protections.

What Is A Medicare Supplement Plan

Medicare consists of Part A, which covers hospital, skilled nursing and hospice costs, and Part B, which covers medically necessary services and supplies. Part A and Part B are often referred to as Original Medicare.

A Medicare Supplement plan is sold by private insurance companies and can help you get the coverage you need to fill the gaps in Original Medicare. Plans are lettered A through N and offer a standardized set of benefits, although each is a little different in what and how much they cover.

In 2015, one in four people with Original Medicare had a Medigap supplemental policy to help cover deductibles, cost-sharing and catastrophic expenses, according to a report from the Kaiser Family Foundation Boccuti C, Jacobson G, Orgera K, Neuman T. Medigap Enrollment and Consumer Protections Vary Across States. Kaiser Family Foundation. Accessed 09/22/2021. .

Indeed, Original Medicare coverage often contains large gaps. For example, nearly six million Medicare beneficiaries are currently facing out-of-pocket costs for COVID-19 treatment, because they had no supplemental coverage like Medigap to help pay for some or all of the cost sharingFreed M, Cubanski J, Neuman T. Medicare Beneficiaries Without Supplemental Coverage Are at Risk for Out-of-Pocket Costs Relating to COVID-19 Treatment. Kaiser Family Foundation. Accessedd 09/22/2021. .

Should You Change Your Medigap Policy

You may want to consider changing your plan or insurance company to increase your benefits or lower your monthly costs.

If you are happy with your current policy, there is no reason to change plans. But you may be interested in changing policies under certain circumstances:

- Better priceEvery September, insurance companies must send out a Medicare Annual Notice of Change letter to Medicare beneficiaries. This letter tells you of any changes to your rates. If your rates go up, you may want to consider looking for a new policy. You can shop around for a similar plan offered by the same company or a different company for a lower premium.

- More coverageIf you decide you need more coverage, you can switch to a different plan letter to get more benefits.

- Less CoverageLikewise, if you dont need or want to keep paying for benefits you dont use, you might consider switching to a more basic plan if it offers a lower premium.

- Different ProviderIf you are unhappy with your insurance company for any reason, you can purchase a plan from a different insurance underwriter.

Read Also: How Much Is Medicare B Deductible

How Much Do Medicare Supplement Plans Cost

Medicare supplements vary in rate by carrier and plan choice. Not every carrier offers all plans, says Brandy Corujo, partner of Cornerstone Insurance Group in Seattle. Policy prices for Medigap are set by the individual insurance companies selling them. Companies set their premium pricing in one of three ways:

- Community-rated: Premiums are the same regardless of age.

- Issue or entry age-rated: Premiums are cheaper if the policy is purchased at a younger age. Premiums do not increase with age.

- Attained-age-rated: Premiums are based on your age at the time of purchase. As you age, your premium increases.

Some factors that may also influence your rates include your location, gender, marital status and lifestyle .

Medigap plans are purchased through a private insurance company, and you pay a monthly premium for the policy directly to the company. Medigap policies can be purchased from any insurance company licensed to sell one in your state, but available policies and prices will depend on your state. Medigap plans only cover one person, so married couples need to purchase separate policies.

Do I Need Medicare If I Plan To Work Past Age 65

If you plan to work past age 65 and have health insurance through your employer, you may be able to delay enrolling in Medicare without penalty. Your Medicare enrollment options will depend on the size of the employer and if your insurance is considered .

Don’t Miss: Does Md Anderson Take Medicare

How To Cancel Medicare Part B

The Part B cancellation process begins with downloading and printing Form CMS 1763, but dont fill it out yet. Youll need to complete the form during an interview with a representative of the Social Security Administration by phone or in person.

Due to the COVID-19 pandemic, all Social Security Administration offices are currently closed. The SSA is still answering phone calls, and you can access many services on its website. See the latest COVID-19 updates.

You can schedule an in-person or over-the-phone interview by contacting the SSA. If you prefer an in-person interview, use the Social Security Office Locator to find your nearest location. During your interview, fill out Form CMS 1763 as directed by the representative. If youve already received your Medicare card, youll need to return it during your in-person interview or mail it back after your phone interview.

What happens next depends on why youre canceling your Part B coverage.

Medigap Enrollment And Consumer Protections Vary Across States

One in four people in traditional Medicare had private, supplemental health insurance in 2015also known as Medigapto help cover their Medicare deductibles and cost-sharing requirements, as well as protect themselves against catastrophic expenses for Medicare-covered services. This issue brief provides an overview of Medigap enrollment and analyzes consumer protections under federal law and state regulations that can affect beneficiaries access to Medigap. In particular, this brief examines implications for older adults with pre-existing medical conditions who may be unable to purchase a Medigap policy or change their supplemental coverage after their initial open enrollment period.

Read Also: Does Medicare Cover Assisted Living In Michigan

Should I Sign Up For Medical Insurance

With our online application, you can sign up for Medicare Part A and Part B. Because you must pay a premium for Part B coverage, you can turn it down.

If youre eligible at age 65, your Initial Enrollment Period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

Note: Important Upcoming Change Rules for 2023 and later: If you accept the automatic enrollment in Medicare Part B or if you sign up during the first three months of your IEP, your coverage will start the month youre first eligible. Beginning January 1, 2023, if you sign up during the month you turn 65 or during the last three months of your IEP, your coverage starts the first day of the month after you sign up.

The following chart shows when your Medicare Part B becomes effective in 2022:

| In 2022, if you sign up during this month of your IEP | Your Part B Medicare coverage starts |

|---|---|

| One to three months before you reach age 65 | The month you turn age 65. |

| The month you reach age 65 | One month after the month you turn age 65. |

| One month after you reach age 65 | Two months after the month of enrollment. |

| Two or three months after you reach age 65 | Three months after the month of enrollment. |

The following chart shows when your Medicare Part B becomes effective in 2023:

Q: Is There A Best Time To Enroll In A Medicare Supplement Plan

A: Yes. The best time to enroll is during your Medigap open enrollment period, a six-month window of time that begins on the first day of the month that you are at least 65 years old and are enrolled in Medicare Part B.

During this period, a private insurance company that offers Medigap coverage can not:

- refuse to sell you any Medigap policy it offers

- make you wait for your coverage to take effect or

- charge you additional fees for your coverage because of your medical history.

Even if you enroll during your initial enrollment period, a private Medigap insurer may refuse to pay your out-of-pocket expenses if you have a pre-existing health issue. If your pre-existing condition was diagnosed or treated within six months prior to the date your Medigap supplemental coverage was to begin, the insurance company can make you wait six months before covering your out-of-pocket expenses.

But if you had creditable coverage before enrolling in Medigap, without a gap in coverage of more than 63 days, the pre-existing condition waiting period will be reduced by the number of months that you had creditable coverage. So if you had continuous coverage for six or more months before enrolling in Medigap, you wont have a pre-existing condition waiting period. The rules can be confusing, so dont hesitate to talk to a representative of the Medigap insurance company for clarification.

You May Like: Is Any Dental Work Covered By Medicare

When Can You Enroll In A Medicare Supplement Plan Or Medigap Policy

Our content follows strict guidelines for editorial accuracy and integrity. Learn about oureditorial standardsand how we make money.

If youre thinking about joining a Medicare Supplement Plan or Medigap policy, figuring out when to enroll can be difficult.

While you can enroll in a Medicare Supplement Insurance at any time, if you enroll at the wrong time it can sometimes limit your choices, cost you more money, and affect your cover.

This article will discuss when you can enroll in a Medicare Supplement Plan and what you should know before you do.

Medicare Supplements And Pacemakers

A pacemaker is a small device implanted under the skin to help control your heartbeat. This requires a surgical procedure.

Your Medicare plan should cover your pacemaker if it is deemed medically necessary. If you already have a pacemaker, you might be issued a decline because of Medigap underwriting.

However, this isnât an immediately declinable condition. There may be some wiggle room, depending on your lifestyle and the companyâs specific rules.

Many companies have a two-year lookback, so they may ask you something like âIn the past 2 years, have you had a pacemaker installed ?â

A few companies have a 12-month lookback, but two years is fairly common. Donât worry â we can analyze all of your options to make choosing a plan simple.

You May Like: How To Apply For Medicare Through Social Security

Federal Law Provides Limited Consumer Protections For Medigap Policies

In general, Medigap insurance is state regulated, but also subject to certain federal minimum requirements and consumer protections. For example, federal law requires Medigap plans to be standardized to make it easier for consumers to compare benefits and premiums across plans. Federal law also requires Medigap insurers to offer guaranteed issue policies to Medicare beneficiaries age 65 and older during the first six months of their enrollment in Medicare Part B and during other qualifying events . During these defined periods, Medigap insurers cannot deny a Medigap policy to any applicant based on factors such as age, gender, or health status. Further, during these periods, Medigap insurers cannot vary premiums based on an applicants pre-existing medical conditions . However, under federal law, Medigap insurers may impose a waiting period of up to six months to cover services related to pre-existing conditions, only if the applicant did not have at least six months of prior continuous creditable coverage.5 As described later in this brief, states have the flexibility to institute Medigap consumer protections that go further than the minimum federal standards.

Federal law also imposes other consumer protections for Medigap policies. These include guaranteed renewability , minimum medical loss ratios, limits on agent commissions to discourage churning of policies, and rules prohibiting Medigap policies to be sold to applicants with duplicate health coverage.6

What Are Alternatives To Medigap High

Medicare Supplement Plan K and Plan L could be another Medigap option for saving money on monthly premiums. These plans have a cost-sharing benefit and out-of-pocket limits.

If you want more coverage than those two options, a Plan N may be beneficial. Plan N has a slightly lower premium than standard plan G or Plan F in exchange for a few copays.

Another option would be a Medicare Advantage plan since the premiums are low. However, a Part C plan could be more expensive in the long run since there are ongoing out-of-pocket costs through coinsurances and copayments.

Lower-income beneficiaries may be eligible for assistance such as:

Read Also: Will Medicare Cover Cataract Surgery

Key Terms To Remember When Choosing A Medicare Supplement Plan:

Coinsurance – The amount a Medicare beneficiary will have to pay for healthcare services, items, and equipment.

Deductibles – The amount that a Medicare enrollee will have to pay each coverage period towards expenses before their Medicare coverage starts.

Copayments – Set amounts that Medicare beneficiaries pay for medical services and items, such as doctors consultations and blood tests.

Monthly premiums – The amount that Medicare enrollees have to pay each month for Medicare coverage for Part and B expenses.

Out-of-pocket expenses – These are any costs that Medicare doesnt cover, which a beneficiary must pay.

Before you decide on a plan, make sure that youre getting the right cover for your medical costs and that your provider is offering a deal that’s right for your needs.

Below is a table summarizing the different benefits that each plan covers. The percentage indicates how much coverage each Medicare Supplement Plan offers.

Understanding The Part D Coverage Stages

During the year, you may go through different drug coverage stages. There are four stages, and itâs important to understand how each impact your prescription drug costs. You may not go through all the stages. People who take few prescription drugs may remain in the deductible stage or move only to the initial coverage stage. People with many medications may move into the coverage gap and/or catastrophic stage.

The coverage stage cycle starts over at the beginning of each plan year, usually January 1st.

Annual Deductible

You pay for your drugs until you reach your planâs deductible

If your plan doesnât have a deductible, your coverage starts with the first prescription you fill.

Initial Coverage

You pay a small copay or coinsurance amount.

You stay in this stage for the rest of the plan year.

- Total drug costs: the amount you and your plan pay for your covered prescription drugs. Your plan premium payments arenot included in this amount.

- Out-of-pocket costs: The amount you pay for your covered prescription drugs plus the amount of the discount that drug manufacturers provide on brand-name drugs when youre in the third coverage stage â the coverage gap . Your plan premiums are not included in this amount.

*If you get Extra Help from Medicare, the coverage gap doesnât apply to you.

Dont Miss: Does Medicare Pay For Insulin Pumps

Don’t Miss: What Does Medicare Plan F Pay For

What Does Medicare Supplement Insurance Cover

Medicare Supplement Insurance helps cover some costs not paid by Original Medicare Part A and B. These plans help pay copays, coinsurance, and deductibles for your Part A and Part B , as well as additional out-of-pocket costs for things like hospitalization, doctors services, home health care, lab costs, durable medical equipment, and more.

Medicare will pay its share of the Medicare-approved amount for covered health costs. Then, your Medicare Supplement Insurance plan will pay its share of the costs it covers.

There are a wide range of Medicare Supplement plans that differ in coverage and costs, from basic to extensive. Compare Medicare Supplement plans

VIDEO

Do Some People Get A Second Open Enrollment Period For Medigap

There are very few situations where you can get a second Medigap Open Enrollment opportunity. Below is a list of a few.

- If you retire, enroll in Medicare Part B, then go back to work and join your employers group health care coverage, you will get a second Medicare Supplement Open Enrollment Period when you retire again and enroll back into Medicare Part B.

- If you get Medicare due to a disability under 65, youll receive two Medigap Open Enrollment Periods. The first will start with your Medicare Part B effective date before you turn 65. The second will begin when you turn 65.

One reason someone on Medicare due to disability would choose not to enroll during their initial Medicare Supplement Open Enrollment is minimal Medigap plan options available to them. Only some states require Medicare Supplement carriers to offer Medigap options to people under 65.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

In fact, most states only offer Medigap Plan A to those under 65. As a result, someone qualifying due to disability may not have many options when first eligible. Allowing for a second Medicare Supplement Open Enrollment Period gives these beneficiaries access to all plans in their area.

Don’t Miss: Do I Need Supplemental Health Insurance With Medicare

Avoid Medicare Late Enrollment Penalties

The best way to avoid a is to sign up for Medicare during your IEP. If you dont, youll pay a penalty that will be added to your monthly premium.

Here are some details for Medicare late enrollment penalties:

- Part A late enrollment penalty. If you need to buy Part A and you dont buy it during your IEP, your monthly premium may go up by 10%. Also, youll have to pay the penalty for twice the number of years you didnt sign up.

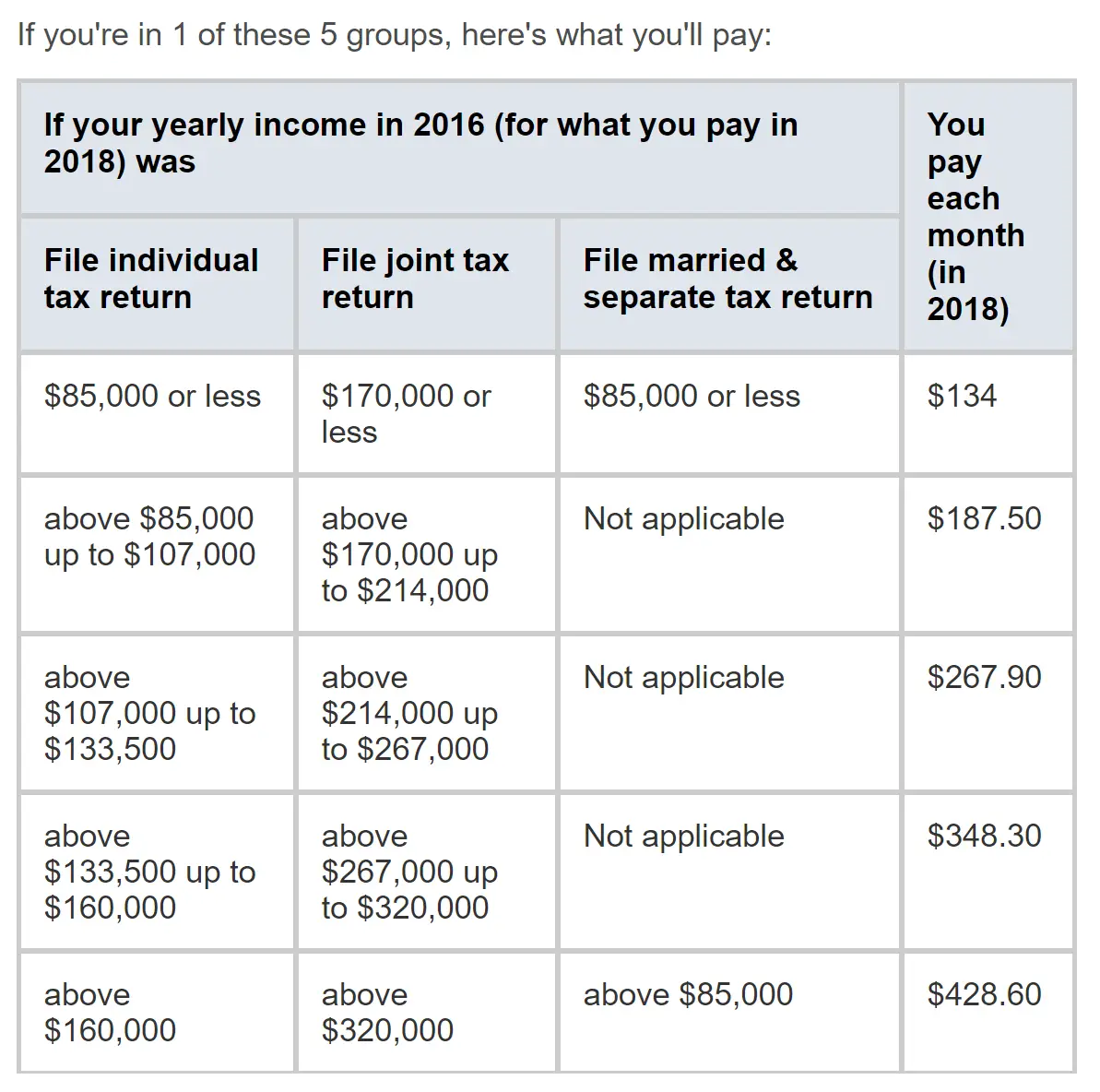

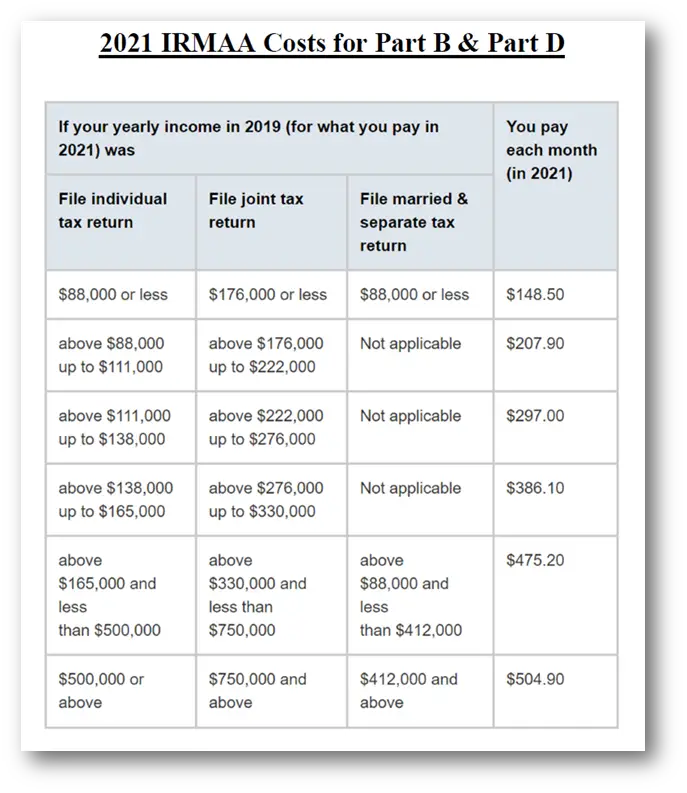

- Part B late enrollment penalty. The penalty for Part B is 10% for each 12-month period you delay enrollment. You may also pay a higher premium depending on your income.

- Part D late enrollment penalty. If you dont join a Medicare drug plan during your IEP or go 63 days or more without creditable drug coverage, youll pay an extra 1% for each month . You may also pay a higher premium depending on your income.

Note: There are some exceptions that eliminate late enrollment penalties.

Another great way to avoid late enrollment penalties is to plan ahead. To learn about types of Medicare plans, costs and more, explore our library of helpful .

Learn about Medicare