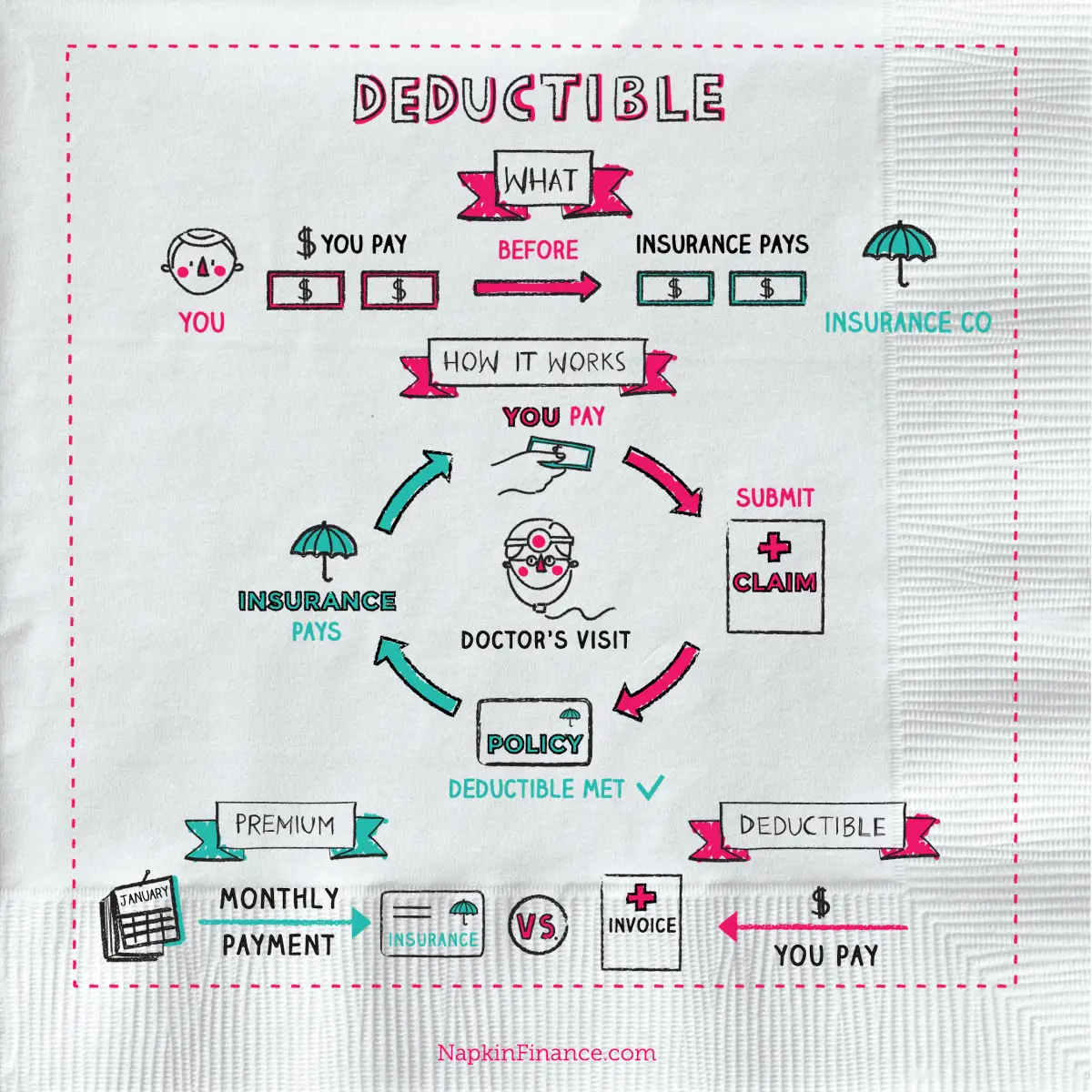

What Is Not Subject To Deductible

Not subject to deductible: In deductible plans, some medical services are covered immediately and therefore are not subject to deductible. This means that from your first day of coverage, you can receive these services for the standard copayment or coinsurance, without having to first satisfy the deductible.

D Prescription Drug Plans

Part D prescription drug plans cover take-home prescription medications.

A person can expect to pay a copayment of no more than $3.70 for generic drugs and $9.20 for brand name drugs in 2021, once they enter the catastrophic coverage stage of their plan.

Also, in 2021, a private insurance company may not charge more than $445 per year for the Part D deductible.

How To Use Medicare Star Ratings

Medicare Star Ratings are meant to be a guide to Medicare plans and you can view the ratings by logging in to your Medicare account. If you don’t have a Medicare account yet because you’re enrolling for the first time, you can still search for plans by zip code on the Medicare website.

You’ll be asked whether you receive any help with health care costs through Medicaid, Supplemental Security Income , Medicare Savings Program, or Extra Help from Social Security. You can either answer “I don’t know” if you’re unsure, or “no” if you don’t receive those types of help. You’ll also have an opportunity to enter information for any prescription drugs you’re currently taking.

Once you’ve entered those details, you’ll be shown a list of available plans in your area ranked in order of star rating. The highest-rated plans will be at the top. At this point, you’ll be able to review information for each plan, including:

- Monthly premiums

You can compare plans against one another to see how they measure up. It’s important to keep in mind, however, that Medicare Star Ratings are not intended to be the only thing you consider when choosing a plan.

It’s also important to consider your individual needs, preferred health care providers, and budget when selecting a Medicare Advantage plan. For example, if you’re debating whether to enroll in a Medicare Health Maintenance Organization or an Preferred Provider Organization , you may want to ask questions like:

Also Check: What Are Some Medicare Advantage Plans

Is 80% Or 100% Coinsurance Better

Response 9: In the case of 100% coinsurance, if a property insurance limit is lower than the value of the insured property, a proportional penalty will be assessed after a loss. A typical 80% coinsurance clause leaves more leeway for undervaluation, and thus a lower chance of a penalty in a claim situation.

Lets Look At An Example Of Copays On Part D:

Every time she gets them filled, she pays a

- $0 copay for her Tier 1 drug

- $19 copay for her Tier 2 drug

- $46 copay for her Tier 3 drug

Her friend Doug takes exactly the same medications she does but is on a different plan. He wanted to get the same plan Janet has but because he lives in a different state, he chose a plan that was available in his area.

When he gets his medications, he will pay:

- $1 copay for his Tier 1 drug

- $8 copay for his Tier 2 drug

- $43 copay for his Tier 3 drug

Notice that the amounts they pay for their drugs are very different because of the plan they are on.

This is something that happens very frequently.

Rember, when buying a drug plan, work with an agent who will look at all the plans in your area. This way youll get the best coverage.

Here is an article that talks about how to pick an agent.

Don’t Miss: Does Medicare Cover A Yearly Physical

What Are The Benefits Of A 5

Generally speaking, a higher Medicare star rating indicates a higher level of satisfaction with the plan among people who are enrolled in it. Choosing a 5-star plan may also afford enhanced benefits if the plan includes a wider range of features or services compared to a 1-star plan. Star ratings do not, however, indicate what you’ll pay for a Medicare Advantage or Medicare Part D plan.

Insurance Factors That Affect Costs

| What is it? |

|---|

What it helps cover:

- Medicare Part D covers prescriptions drugs.

- Plan premiums, the drugs that are covered, deductibles, coinsurance and copays vary by plan, so you should compare plans each year based on your needs, the prescription drugs you take, etc.

What it costs:

- Like Medicare Advantage , prescription drug plans are offered by private insurance companies contracted by the federal government.

- Plans vary in cost, coverage, deductibles and copays.

Read Also: Is Healthfirst Medicaid Or Medicare

What Does Medicare Cover For Elderly

Medicare is a federal health insurance program for the elderly aged over 65. … 2) Medicare Part B, also referred to as Medical Insurance, covers outpatient physician and hospital services, some home health services, and durable medical equipment. For most seniors, Part B costs about $148.50 / month in 2021.

When Are Medicare Premiums Due

All Medicare bills are due on the 25th of the month. In most cases, your premium is due the same month that you get the bill. Example of billing timeline

For your payment to be on time, we must get your payment by the due date on your bill. Submit your payment at least 5 business days before the due date, so we can get it on time.

Also Check: Does Medicare Cover Spinal Fusion Surgery

Medicare Advantage Plan Spending Limits

Medicare Advantage plans have out-of-pocket maximums that limit the amount you pay each year. For example, if you enroll in a Medicare Advantage plan that has a $5,000 maximum-out-of-pocket amount, and you have already spent $5,000 out-of-pocket for in-network eligible medical expenses, you will spend $0 for the rest of the year for covered medical services you receive from providers participating in your Medicare Advantage plan. It is important to note that most annual out-of-pocket spending limits typically apply only to covered medical services provided by providers participating in the planâs network. If you choose to go out-of-network for services, you may either be subject to a higher out-of-network maximum-out-of-pocket limit or your payments may not be figured into your annual expenditures at all.

Remember, also, that the maximum-out-of-pocket limit is only for medical services and reaching your maximum-out-of-pocket limit does not affect your Medicare Advantage planâs prescription drug coverage, if included. Please note that the maximum out-of-pocket amount may vary by plan, so itâs recommended that you check all available Medicare Advantage plans in your area to find the one that best suits your needs.

There is no maximum-out-of-pocket limit with Original Medicare, Part A and Part B.

What If Your Medicare Premium Payment Is Late

If you miss a payment, or if we get your payment late, your next bill will also include a past due amount.

If you get a Medicare premium bill that says Delinquent Bill at the top, pay the total amount due, or youll lose your Medicare coverage. Get a sample of the delinquent bill in English.

Dont risk losing your Medicare coverage

Also Check: Can You Get Medicare Early If You Are Disabled

How Do You Enroll In Medicare

You can enroll in original Medicare directly through the Social Securitys website during your initial enrollment period. This period includes the 3 months before, the month of, and the 3 months after your 65th birthday.

If you miss your initial enrollment period or want to change or enroll in a different Medicare plan, here are the additional enrollment periods:

- General and Medicare Advantage enrollment: from January 1 to March 31

- Open enrollment: from October 15 to December 7

- Special enrollment: a number of months depending on your circumstances

The initial enrollment period is the time in which you can enroll into Medicare parts A and B. Once youre enrolled in original Medicare, though, you may decide that you would rather enroll into a Medicare Advantage plan.

Before you choose an Advantage plan, youll want to shop around to compare the different plans available in your area. Comparing benefits, health perks, and plan costs including copay amounts can help you choose the best Medicare Advantage plan for you.

The Cost Of Medicare Advantage Premiums

Premiums for Medicare Advantage plans vary based on the insurer and county. The average premium for a Medicare Advantage plan in 2023 is $18 per month. Medicare Advantage is an insurance plan purchased from a private insurance company as an alternative to original Medicare. The plans receive payments from the federal government to provide Medicares benefits to enrollees.

Although your premiums may be lower with a Medicare Advantage plan, the network of doctors covered by the plan will likely be smaller. Medicare Advantage plans can also require prior approval before obtaining services or can deny coverage for health care received. However, with a Medicare Advantage plan, you wont need a separate prescription drug plan, and some coverage for dental, hearing and vision care may be included.

You can’t purchase additional Medigap coverage with Medicare Advantage as you can with original Medicare. Unlike original Medicare, Medicare Advantage plans have a cap on how much you can spend out of pocket for Medicare covered hospital and physician services .

Don’t Miss: Are Hearing Aid Batteries Covered By Medicare

Explore Our Plans And Policies

Medicare Advantage Policy Disclaimers

All Cigna products and services are provided exclusively by or through operating subsidiaries of Cigna Corporation. The Cigna name, logos, and other Cigna marks are owned by Cigna Intellectual Property, Inc. All clinical products and services of the LivingWell Health Centers are either provided by or through clinicians contracted with HealthSpring Life & Health Insurance Company, Inc., HealthSpring of Florida, Inc., Bravo Health Mid-Atlantic, Inc., and Bravo Health Pennsylvania, Inc. or employees leased by HS Clinical Services, PC, Bravo Advanced Care Center, PC , Bravo Advanced Care Center, PC and not by Cigna Corporation. The Cigna name, logos, and other Cigna marks are owned by Cigna Intellectual Property, Inc. All pictures are used for illustrative purposes only.

Cigna contracts with Medicare to offer Medicare Advantage HMO and PPO plans and Part D Prescription Drug Plans in select states, and with select State Medicaid programs. Enrollment in Cigna depends on contract renewal.

Medicare Supplement Policy Disclaimers

Medicare Supplement website content not approved for use in: Oregon and Texas.

AN OUTLINE OF COVERAGE IS AVAILABLE UPON REQUEST. We’ll provide an outline of coverage to all persons at the time the application is presented.

American Retirement Life Insurance Company, Cigna National Health Insurance Company and Loyal American Life Insurance Company do not issue policies in New Mexico.

Exclusions and Limitations:

Eliquis Coverage Through Medicare Part D

Medicare Part D is a part of Medicare that covers prescription drugs, and is offered by private insurance companies. Unlike original Medicare, the pricing is only partially set by the government. Medicare Part D will cover your Eliquis prescription, but you may have to pay a deductible, copayment, or coinsurance.

Recommended Reading: What Age Can I Apply For Medicare

Medigap Helps Cover Medicare Copayments

There are 10 standardized Medigap plans available in most of the United States. These plans help you pay out-of-pocket costs associated with Original Medicare.

Most Medigap plans cover some or all of the costs of your Medicare Part A and Medicare Part B deductibles, copayments and coinsurance. Two of the 10 plans cover either 50% or 75% of copayment and coinsurance costs.

You cannot, however, buy a Medigap plan if you have a Medicare Advantage plan.

Medicare Part A Deductible

Original Medicare requires that you pay a deductible for each inpatient hospital benefit period, which means you may have to pay a deductible more than once in a single year.

A benefit period begins the day you’re admitted to a hospital or skilled nursing facility and ends when you haven’t spent the night in one of them for 60 consecutive days. If you’re admitted to a hospital or skilled nursing facility after one benefit period has ended, then a new one begins, and youll have to pay another deductible.

The 2022 Medicare Part A deductible for each benefit period is $1,556.

Read Also: Are Legal Residents Eligible For Medicare

What Are The Different Types Of Medicare Health Plans

Original Medicare

Original Medicare includes Part A Hospital coverage, and Part B Medical coverage. Once you sign up for Medicare, you receive a red, white and blue Medicare card. Once enrolled in Medicare you may be charged a 20 percent copayment for health care services that Original Medicare does not cover. This is why some seniors chose to enroll in a Medicare Advantage Plan for additional health care cost coverage. These additional plans help to cover that 20 percent of health care costs that Original Medicare does not cover. You can view a Medicare Card Frequently Asked Questions document here.

Original Medicare with a drug plan

There are Medicare Part D Drug Plans available to add to Original Medicare. A Part D Drug Plan will help cover the cost of your prescription drugs. There could be a monthly premium to enroll in a Part D plan.

Medicare Advantage Plan without a drug plan

Medicare Advantage Plan with a prescription drug plan

Some Medicare Advantage Plans offer Part D drug coverage in combination with the Part C benefits mentioned above. These plans may have a monthly premium and a copayment for certain health services and your prescriptions. To learn more about Capital Blue Cross Medicare Advantage options, view our Capital Blue Cross Medicare plans.

How To Potentially Reduce Your Deductibles With Medicare Supplement Plans

You can buy private to cover , including the hospital deductible.

However, if youre enrolled in a Medicare Advantage Plan, you can only purchase a if your Medicare Advantage plan coverage is ending. Medicare Supplement plans can not be purchased while you are currently enrolled and planning to remain on a Medicare Advantage plan.

Read Also: Does Medicare Pay For Physical Therapy After Knee Surgery

How Do You Enroll In Original Medicare

To enroll in Original Medicare , you must be 65 and dont necessarily have to be retired. Initial enrollment period packages are sent to people 3 months before they turn 65 or during their 25th month of disability benefits.

If youve received Social Security disability benefits for 24 months, you are automatically enrolled in Part A and Part B.

The Basics Of Medicare

Medicare is broken down into several different parts and depending on what part you are using, youll pay a copay in some form or fashion.

The 4 Parts of Medicare are:

In addition to these 4 major parts, Medicare Supplements also play a role in determining what your copay may be.

Supplement Plans are optional benefits you can purchase to help with some of your out-of-pocket while being on Medicare. You can read more about them here.

People often ask what their copay is to get a general understanding of what is covered while being on Medicare.

Don’t Miss: Does Medicare Cover Wheelchair Repairs

Medicare Supplement And Copays

Medicare Supplement Plans, often referred to as Medigap plans, help cover the additional expenses you would otherwise be paying entirely out-of-pocket if you had only Medicare Part A and Part B.

These plans work with Medicare Part A and Part B, and we will discuss them further in a different post, here.

There are several Supplement Plans to choose from, depending on which one suits your needs.

All these plans cover the Part A hospice copay in full, and most cover any Part B copays in full.

Here are a few exceptions:

- Plan K covers 50% of Part B copays

- Plan L covers 7% of Part B copays

- Plan N requires you to pay 20% of a doctors visit with a maximum of $20, and no more than $50 for emergency room visits. This coinsurance amount is billed in the form of a copay.

Does Medicare Have Copays

Not every part of Medicare has copayments, but every part will usually have some form of out-of-pocket cost, so itâs really all about what works for your needs.

For example, Original Medicare does not have any copays, but you will have to pay for the 20% Part B coinsurance. So, if you have Original Medicare only, you will likely have costs to account for when receiving certain types of care.

Additionally, Medicare Part D prescription drug plans may also have copays, but the amount will depend on your specific plan and which tier your drug is in.

Don’t Miss: What Is My Medicare Number Provider

Medicare Advantage Plans Out

Unlike Original Medicare, all Medicare Advantage plans have out-of-pocket maximums. An out-of-pocket maximum can be a reassuring thing because this means you only have to pay up to known amount before all your covered medical costs are paid for. The Medicare Advantage out-of-pocket maximum can vary from plan to plan, although Medicare determines a yearly upper limit for the out-of-pocket maximum.

For example, if you have a surgery that costs $10,000, but your out-of-pocket maximum is $3,000, you will only have to pay $3,000 or less for the surgery. You may have to pay less if you already paid for other services that also helped count to your out of pocket maximum.