How To Apply For Medicare Extra Help

To take advantage of Medicare Extra Help benefits you must be enrolled in a Medicare Part D prescription drug program. You could technically apply for Extra Help if youre not enrolled in Part D coverage yet. But if approved, your benefits wouldnt kick in until you have prescription drug coverage in place.

You can apply for Extra Help online if you:

- Are enrolled in Medicare Part or Medicare Part B

- Live in one of the 50 states or the District of Columbia

- Have combined financial resources of $15,510 or less if youre not married or dont live with your spouse and $30,950 if you are married and live with your spouse

You dont need to fill out the online application if you have Medicare and Medicaid or have Medicare and receive SSI benefits. In that case, you should receive a letter explaining that youre automatically approved for Medicare Extra Help.

If youre not able to submit an application for Extra Help online, you can apply over the phone by calling Social Security at 1-800-772-1213. You also have the option to submit a paper application by mail or visit your local Social Security office to apply, though you may need to have an appointment for that.

Here are the documents Social Security suggests collecting before you apply:

- Social Security card

- Statements for IRAs and other investment accounts

- Your most recent Social Security benefits award letter or statements for Railroad Retirement benefits, Veterans benefits, pensions and annuities

Find Medicare Advantage Plans Where You Live

If you have any questions about the Medicare Advantage plans that are available near you and the network coverage they offer, you can call to speak with a licensed insurance agent.

A licensed agent can help you find out if your doctor is part of plan networks available near you, and they can also help you see if your prescriptions drugs are covered by any available plans.

How Much Can You Expect To Pay For Medicare Coverage

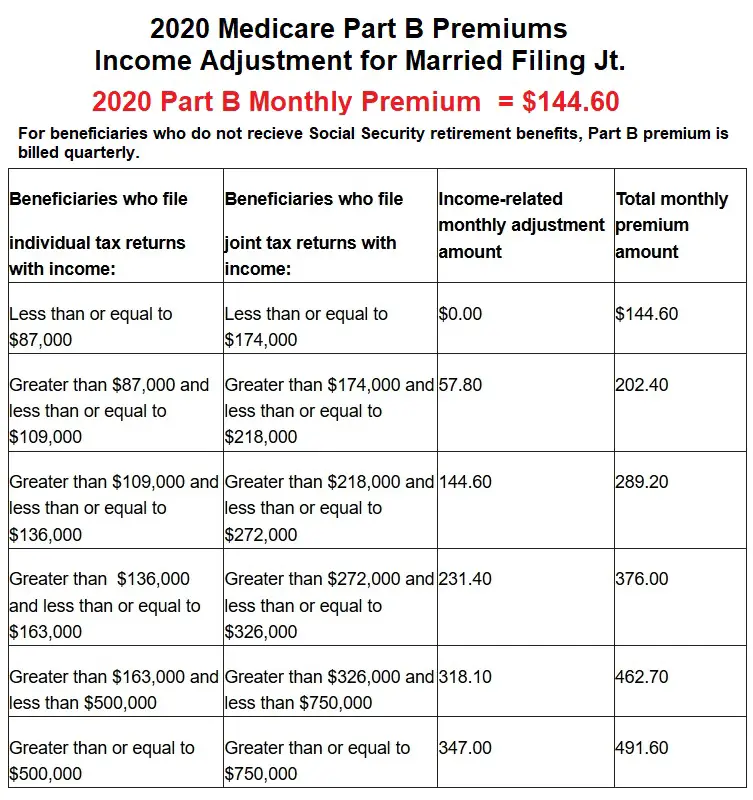

Individuals making $88,000 or less and married couples who file a joint tax return and make $176,000 or less will pay the standard amount, i.e. their monthly payment will be $148.50. This is for Medicare part B. Individuals making between $88,000 and $111,000 and couples making between $176,000 to $222,000 will pay $207.90 a month, and the rates increase from there. A full breakdown of Medicares income limits and the corresponding IRMAA surcharges can be seen on pages 2 and 3 of this PDF, which is published by the official government website for Medicare.

Related: Do You Qualify For A Medicare Special Enrollment Period?

Part D prescription drug coverage is also affected by the aforementioned income limits. The additional amount you will pay for prescription coverage or Medicare part D ranges from $12.30 to $77.10, with the same income thresholds applied. Thats on top of any premium you pay, whether through a standalone plan or via the Advantage Plan, which typically includes drug coverage.

As for Medicare part A, most people do not pay for this coverage because they paid Medicare taxes while working. In order to receive free part A coverage you must have workedand paid Medicare taxesfor 10 years or more. If you dont get premium-free Part A, you may pay up to $471 each month.

You May Like: How Much Does Medicare Cost Annually

Also Check: Why Is My First Medicare Bill For 5 Months

How Medicare Determines Irmaa

Medicare premiums are based on the adjusted gross income you reported to the IRS two years ago. You will receive the IRMAA notification from Social Security if your MAGI exceeds the amounts listed above.

Since the Income Related Monthly Adjustment Amount is based on your tax return from two years ago, it’s possible your income is no longer that high particularly if you retired. You may file an appeal if you believe the IRMAA is unwarranted. However, you have to prove that there has been a permanent reduction in income, typically due to a life-changing event .

Find full details at Medicare.gov by clicking here.

Monthly Medicare Premiums For 2022

The standard Part B premium for 2022 is $170.10. If youre single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

| Modified Adjusted Gross Income | Part B monthly premium amount | Prescription drug coverage monthly premium amount |

|---|---|---|

| Individuals with a MAGI of less than or equal to $91,000 Married couples with a MAGI of $182,000 or less | 2022 standard premium = $170.10 |

| Your plan premium + $77.90 |

Recommended Reading: Does Medicare Cover Skin Removal

Medicare Part D Premium

Medicare Part D is optional prescription drug coverage, available as a stand-alone Medicare Prescription Drug Plan that you enroll into to augment your Original Medicare coverage or through a Medicare Advantage Prescription Drug plan.

Although Medicare Part D is offered by private Medicare-contracted insurance companies, the government still sets an income-related monthly adjustment amount. Heres a breakdown of the Medicare Part D payment adjustments . Please note that you typically pay your Part D premium regardless of income level the amount in the far right column is the income adjustment payment.

| Your income if you filed an individual tax return | Your income if married and you filed a joint tax return | Your income if married and you filed a separate tax return | You pay your Medicare Part D premium, plus this amount |

| $85,000 or less | |||

| $72.90 |

Your Medicare Part D income adjustment payment is typically deducted from your monthly Social Security benefit it isnt added to the premium bill you get from the Part D Prescription Drug Plan. If you have to make an adjustment payment, youll get a notice from Social Security.

If youre charged the income adjustment payment outlined above for Medicare Part B but your income has dropped, you can contact the Social Security information and apply to reduce your adjustment amount.

Governor Hochul Announces Expanded Assistance For Income

Access to Newly Expanded Medicare Savings Program Benefits to Save Beneficiaries an Estimated Average of $7,000 Annually Starting In 2023

Objective Statewide Health Insurance Counseling Program Available toHelp and Screen Beneficiaries During Medicare’s Open Enrollment Between Now and December 7

Governor Kathy Hochul today announced that more New Yorkers will be eligible for additional financial assistance in 2023 through the newly expanded Medicare Savings Program. Adopted through the FY 2023 State Budget, the increased income-eligibility limits will help older adults and individuals with disabilities pay for health care costs, which is estimated to save them an average of $7,000 annually.

“We have an obligation to help older adults and individuals with disabilities to age within their community with dignity,” Governor Hochul said. “By expanding eligibility for the Medicare Savings Program, we can ensure that a greater number of these New Yorkers aren’t burdened by the cost of healthcare. I encourage all eligible beneficiaries to apply for this program so they can save money and improve their health care coverage.”

A local counselor can be reached by calling the statewide helpline at 1-800-701-0501. Information about applying for this program can also be found online.

Recommended Reading: Does Medicaid Cover More Than Medicare

Medicare Benefits And Mippa

The Medicare Improvements for Patients and Providers Act of 2008 provides federal funding for State Health Insurance Assistance Programs , among others. This funding allows SHIIP to help low-income Medicare beneficiaries apply for programs that make Medicare affordable. Click the link below for a printable version of the information on this page.

Finding Out If You Qualify

With so many different programs providing assistance for so many different types of costs, its easy to get confused. Fortunately, there is help available to find out if you qualify for financial assistance for Medicare.

A good place to start is with BenefitsCheckup.org, a free online tool from the National Council on Aging that connects people with benefits they may qualify for. Insurance brokers and state-area offices on aging are also excellent resources.

Dont be afraid to reach out for help in finding out if you qualify for assistance paying for your Medicare coverage. After all, youve earned it.

Also Check: How Do You Become Eligible For Medicare

What Are The Coverage Limits During The Medicare Part D Donut Hole

Medicare Part D prescription drug plans feature a temporary coverage gap, or donut hole. During the Part D donut hole, your drug plan limits how much it will pay for your prescription drug costs.

- Once you and your plan combine to spend $4,430 on covered drugs in 2022, you will enter the donut hole.

- Once you enter the donut hole in 2022, you will pay no more than 25 percent of the costs for brand name drugs and generic drugs until you reach the catastrophic coverage phase.

- After you spend $7,050 out-of-pocket on covered drugs in 2022, you leave the donut hole coverage gap and enter the catastrophic coverage stage. Once you reach this stage, you only pay a small coinsurance or copayment for your covered drugs for the rest of the year.

Do Medicare Premiums Change Yearly Based On Income

Yes, your Medicare Part B premium will change based on your MAGI.

You can expect to pay more for your Medicare Part B premiums if your MAGI is over a certain amount of money. For 2023, the threshold for these income-related monthly adjustments will kick in for those individuals with a MAGI of $88,000 and for married couples filing jointly with a MAGI of $176,000.

Finding the Medicare plan thatâs right for your life and budget doesnât have to be overwhelming â eHealth is here to help. Get started now.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealthâs Medicare related content is compliant with CMS regulations, you can rest assured youâre getting accurate information so you can make the right decisions for your coverage.Read more to learn about our Compliance Program.

Read Also: Is Medicare Or Medicaid For Old People

What Are My Medicare Costs In 2023

Most people will pay the standard Medicare Part B rate in 2023. For Part D, you pay the rate for the plan you select and may pay an additional amount to Medicare, depending on your income.

| Individual 2021 income | |

|---|---|

| 240% | $76.40 |

Part B and Part D premiums are deducted automatically from your Social Security or Railroad Retirement Board benefit payments. If you don’t get a monthly payment, Medicare will send you a bill.

How Does Your Income Impact Your Medicare Premium

Part B coverage will cost you a yearly payment. Most people will pay the usual premium amount. The average monthly premium in 2022 is $170.10. However, if your income exceeds the established restrictions, you will be required to pay a higher premium.

The additional payment is known as an income-related monthly adjustment amount based on income. The Social Security Administration calculates your IRMAA by looking at the gross income on your tax return. Medicare makes use of your tax return from two years ago.

The IRS will give Medicare your income from your 2020 tax return when you apply for Medicare coverage in 2022. Your income may force you to pay more.

People earning more than $91,000 per year will have to pay extra for their premiums in 2022, and the amount will rise from there. If the SSA determines that you must pay a higher premium, you will receive an IRMAA letter.

Prescription medications are covered under Medicare Part D. Part D plans are not all the same price. The nationwide base beneficiary premium for Medicare Part D in 2022 is $33.37, but costs can vary.

Your Part D premium will vary depending on the plan you select. As with Part B, if your income exceeds a certain amount, you will pay more for your coverage.

Starting in 2022, if you earn more than $91,000 per year, you will be required to pay an IRMAA of $12.40 per month in addition to your Part D premium. IRMAA levels increase as income increases.

You May Like: Does Medicare Part A Cover Doctors In Hospital

Medicare Part B Costs

Part B Monthly Premium

The average Part B monthly premium is $170.10 in 2022. Social Security will inform you of your 2022 Part B premium.

First-time Part B enrollees in 2022 pay the standard premium if:

- You don’t get SSI.

Medicare Part B Costs 2022

If your 2-year-old modified adjusted gross income is above a specific threshold, you’ll pay the usual Part B premium and an income-related monthly adjustment. The Part B deductible is $233 per year.

If your 2020 yearly income was:

- $91,000 or less for individuals: $170.10

- $182,000 or less for joint tax return: $170.10

- $91,000 or less for married filing separate tax return: $170.10

- $91,001 to $114,000 for individuals: $238.10

- $182,001 to $228,000 for joint tax return: $238.10

- $114,001 to $142,000 for individuals: $340.20

- $228,001 to $284,000 for joint tax return: $340.20

- $142,001 to $170,000 for individuals: $442.30

- $284,001 to $340,000 for joint tax return: $442.30

- $170,001 to $500,000 for individuals: $544.30

- $340,001 to $750,000 for joint tax return: $544.30

- $500,000 or above for individuals: $578.30

- $750,000 or above for joint tax return: $578.30

What Salary Is Considered Middle Class In Ny

In New York state, a two-person family would be considered middle class if the households income range is between $46,597 and $139,098. A three-person middle-class familys income would range from $55,155 to $164,644, and a four-person family in the middle tier would have income between $67,252.59 to $200,754.

Also Check: Who Is Entitled To Medicare Part A

Read Also: Is There A Charge For Medicare Part B

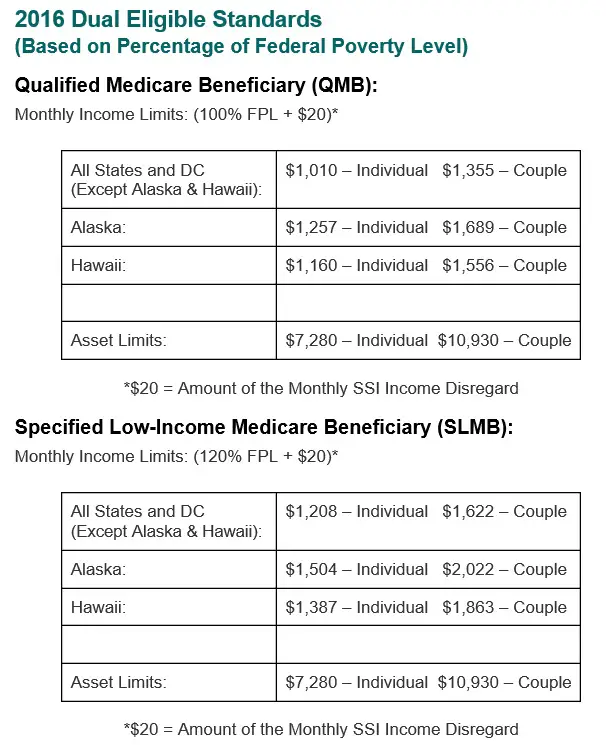

Medicaid And Medicare Dual Eligibility

If you qualify for both Medicare and Medicaid, you are considered dual eligible. In this case, you may qualify for a certain type of Medicare Advantage plan called a Dual Eligible Special Needs Plan . D-SNPs are designed to meet the specific needs of people who have Medicaid and Medicare.

You can compare plans online to find out if D-SNPs are available where you live, or you can call to speak with a licensed insurance agent for information about eligibility and enrollment.

Medicare Part D Premiums

Unlike Medicare Part B rates, Medicare Part D rates are set by individual insurance providers and can vary by plan. If you have Part D, you pay a monthly amount to your insurance company for your coverage. But if you’re charged more based on income, you pay the extra amount directly to Medicare.

For 2023, the extra Part D premium is based on the nationwide average amount of $32.74.

The income limits for Medicare Part D are the same as the Part B amounts. So, if your modified adjusted gross income for 2021 was more than $97,000 or $194,000 â depending on filing status â you’ll pay extra for Medicare Part D. For example, if you earned $124,000 in 2021 and filed an individual return, you would pay an extra $31.50 per month for Part D in 2023.

Read Also: Am I Required To Sign Up For Medicare At 65

Income Limits Per Medicare

There is no income limit for Medicare. But there is a threshold where you might have to pay more for your Medicare coverage.

In 2022, Medicare beneficiaries with a modified adjusted gross income above $91,000 may have an income-related monthly adjustment added to their Medicare Part B premiums.

For couples who file a joint tax return, that threshold is $182,000 per year.

Note: that the government looks at your income for two years before determining the IRMAA amount.

An IRMAA is a surcharge for those Medicare beneficiaries with a higher gross income.

Medicare Part B Premium

Beneficiaries typically pay a monthly Medicare Part B premium, although if you have a low income, you may qualify for help paying it. This premium amount may vary, depending on your situation. Here are a few different scenarios:

- If you enrolled in Part B before 2016, your premium will generally be $104.90 per month.

- Youll generally pay $121.80 for your monthly premium if any of the following situations applies to you:

- You enroll in Part B for the first time in 2016.

- You arent receiving Social Security benefits yet.*

- You are billed directly for your Part B premium.

- You have both Medicare and Medicaid coverage , and Medicaid pays for your premiums.

*If you worked for a railroad, contact the Railroad Retirement Board to learn more about your Part B premium costs. You can contact the RRB at 1-877-772-5772, Monday through Friday, from 9AM to 3:30PM, to speak to an RRB representative. TTY users call 1-312-751-4701.

In some situations, your Part B premium may be higher than the above amounts. The government looks at your income as reported on your tax return from two years ago to set your Medicare Part B premium. This table refers to your 2014 income and your 2016 Medicare Part B monthly premium.

| More than $129,000 | $389.80 |

Your Medicare Part B premium payment is typically deducted from your monthly Social Security benefit. If you have to pay an income-related monthly adjustment amount, youll get a notice from Social Security.

Recommended Reading: Is Original Medicare Better Than An Advantage Plan

Qualified Medicare Beneficiary Program

Helps pay for: Part A premiums Part B premiums, deductibles, coinsurance, and copayments .

Monthly income and resource limits for 2022:

| Your situation: |

|---|

* Limits slightly higher in Alaska and Hawaii

If you qualify for the QMB program:

- Medicare providers arent allowed to bill you for services and items Medicare covers, including deductibles, coinsurance, and copayments. What to do if you get a bill

- You may get a bill for a small Medicaid copayment, if one applies.

- You’ll also get Extra Help paying for your prescription drugs. Youll pay no more than $4 in 2022 for each drug covered by your Medicare drug plan.