How Does The Medicare Part D Donut Hole Work

After the deductible, youll enter the Initial Coverage phase. During the Initial Coverage phase, you pay copays for your prescriptions until the total cost of your medications reaches the threshold that puts you in the donut hole.

To get out of the donut hole, youll pay a certain percentage of your prescriptions until the total cost reaches the threshold that puts you in the Catastrophic Coverage phase through the end of the year.

Find A Medicare Plan Based On Your Needs And Preferences

Even if you have Medicare Advantage, Original Medicare will still be the go-to insurer for coverage of hospice care and some costs for clinical research studies if you need these services.

Its important to remember that Medicare Advantages extra benefits typically come with different rules and restrictions. In most cases, you must visit a healthcare provider in your plans designated network or, if this option is available, face higher costs to see an out-of-network provider. You also commonly need a referral to see a specialist.

How Does It Work

Here is an example of process of how a Medicare user crosses the donut hole and reaches catastrophic coverage in 2020.

An individual and their insurance company have spent $4,020 on medications since the start of their plan. That person is now in the donut hole. The person pays 25% of their medication costs. For example, if they have a medicine that costs $100, they will pay $25. The pharmaceutical company then discounts the medication by $70, and the insurance company pays the remaining $5. The person continues paying 25% out of their own money until they have spent $6,350. When this occurs, they are out of the donut hole. A person is now in the catastrophic coverage portion of their coverage. They will pay either a minimum copay or 5% of the drugs cost.

According to the most recent statistics from the Kaiser Family Foundation, an estimated 4.9 million Medicare Part D enrollees reached the catastrophic coverage portion of Medicare Part D in 2017.

Recommended Reading: Does Medicare Pay For Dental Visits

What Happens When Youre In The Donut Hole

When you reach the coverage gap what you pay will differ for the brand-name drugs and generic drugs covered by your Medicare plan.1

For brand-name drugs:

- Youll pay no more than 25% of the cost of the drug and 25% of the dispensing fee.

- Youll pay a discounted rate if you buy your medications at a pharmacy or through the mail.

- What you pay and what the drug manufacturer pays will count towards out-of-pocket spending that helps you eventually get out of the donut hole.

For generic drugs:

- Youll pay 25% of the price. Medicare pays 75% of the price.

- Only the amount you pay will count towards getting you out of the donut hole.

NOTE: Some plans may have coverage in the gap, so if this is true for you, you will get a discount after the plans coverage has been applied to the drugs price.

Medicare Advantage Plan Types

Private insurers offering Medicare Advantage plans can offer many different types of plans. These plan types include:

- Health Maintenance Organization Plans: With HMO plans, you usually must get your care from in-network providers, except for temporary out-of-network dialysis, out-of-network urgent care, and emergency care. You will probably also need a referral to see a specialist if you have an HMO.

- Preferred Provider Organization Plans: PPO plans are popular with people who like flexibility. Usually, people will pay less to see their in-network providers and specialists and may pay a little more to see out-of-network providers that accept Medicare. In a PPO, most people do not need prior authorization or a referral to see a specialist. PPO plan premiums are often higher than HMO plan premiums.

- Private Fee for Service Plans

- Special Needs Plans

- HMO Point of Service and Medicare Medical Savings Account Plans

Plan types vary depending on how you access your healthcare providers and how much you pay in copayments, coinsurance, and premiums.

You May Like: What Do Medicare Advantage Plans Cover

Did The Donut Hole Close In 2019

The Medicare Part D donut hole has been closing in recent years due to provisions in the Affordable Care Act , also known as Obamacare.

The donut hole was set to disappear in 2020, but it closed faster for brand name drugs in 2019. This is because of the Bipartisan Budget Act of 2018, signed into law by President Donald Trump.

Are you looking for Medicare Part D prescription drug coverage?

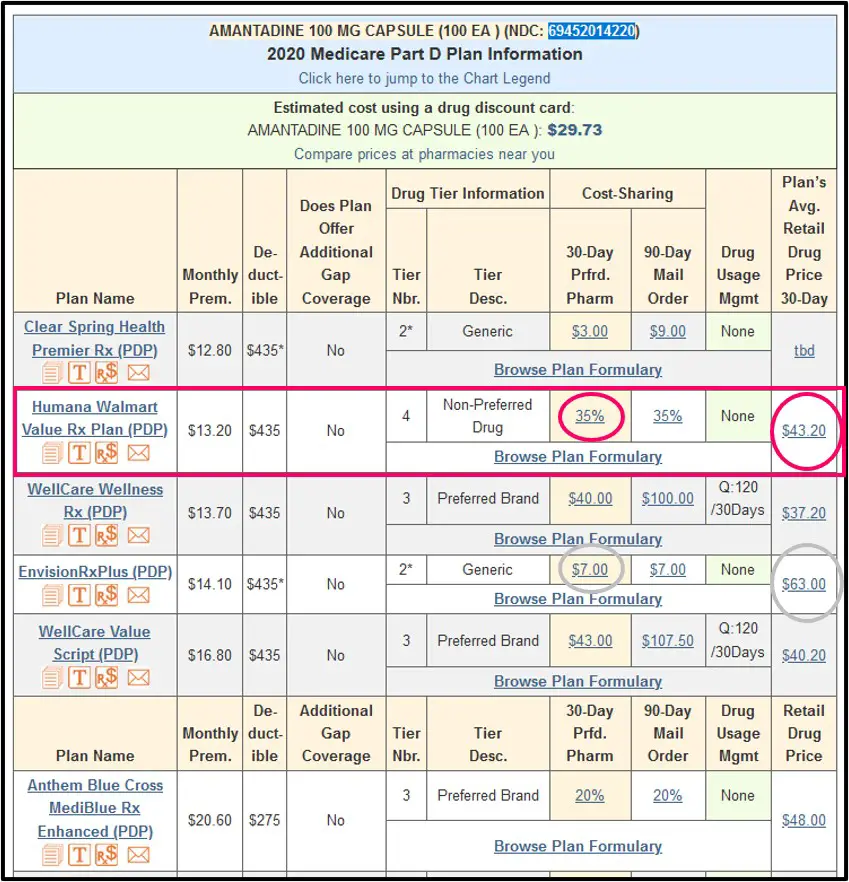

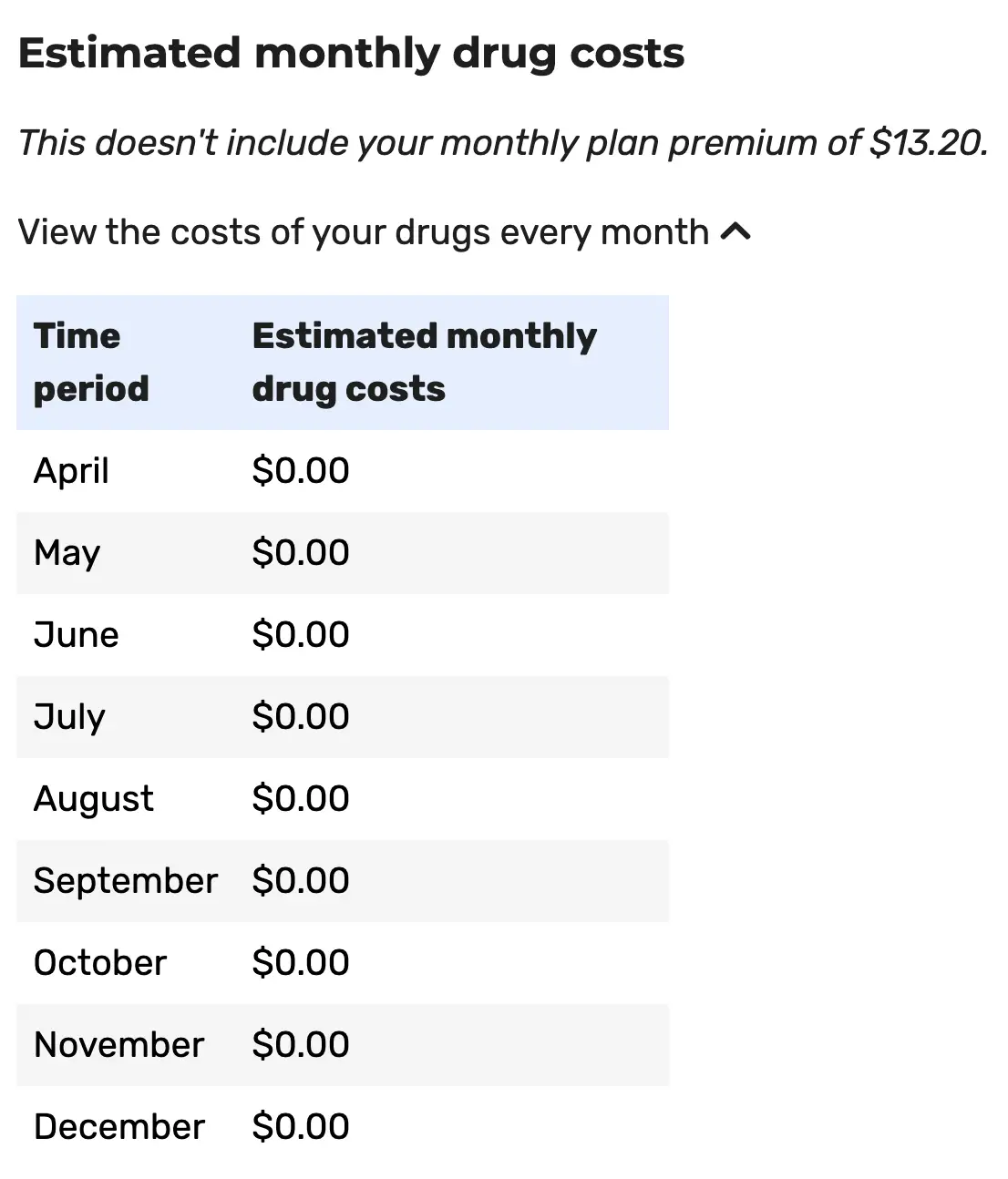

You can compare Part D plans available where you live and enroll in a Medicare prescription drug plan online when you visit MyRxPlans.com.

What Is The Donut Hole Gap In 2020

In 2011, the government took several actions that started to close the donut hole. These included:

- 2011: The Affordable Care Act required pharmaceutical manufacturers to introduce discounts of up to 50% for brand name drugs and up to 14% for generic drugs, making it easier for people to buy medications once in the donut hole.

- 20122018: The discounts continued to increase.

- 2018: The Bipartisan Budget Act sped up changes to prescription drug discounts when a person was in the donut hole. Examples included manufacturer discounts and decreasing a persons costs on brand name drugs once they enter the donut gap.

The aim of these changes was to make drugs more affordable once a person reached the donut hole, which would encourage people to continue taking their medications and reduce the risk of a break in treatment. As of 2020, prescription drug coverage takes the following shape:

Ideally, these changes will allow a person to have long-term access to the medications their doctor prescribes.

Recommended Reading: What Is My Medicare Group Number

What Drugs Are Covered By Medicare Part D

Part D plans help pay for medications you take regularly to manage chronic conditions, for example, heart disease, high cholesterol, or asthma. It also pays for medications you take for a short period of time, such as antibiotics. There are also some medications covered by your Original Medicare Part B plan and not covered by Part D.

Read more about Part B vs. Part D

What Happens When I Exit The Medicare Donut Hole

After you get out of the donut hole, you will be eligible for catastrophic coverage. This means youll be required to pay whatever is higher for the rest of the year: 5% of the prescriptions cost or a small copay.

The minimum copay for 2022 has increased over the years from 2021:

- Generic drugs: the minimum copay is $3.95, slightly higher compared to $3.70 in 2021.

- Brand-name drugs have a minimum copay of $9.85, up from $9.20 in 2021.

Also Check: What Is Trump’s Plan For Medicare

Medicare Donut Hole And The Inflation Reduction Act

The Inflation Reduction Act will bring some significant changes to Medicare that could affect coverage gaps for those with Medicare Part D. Specifically, the law is set to:

- Require the federal government to negotiate prices for certain prescription drugs covered under Medicare Part B and Part D

- Require drug companies to pay rebates to Medicare when drug prices rise faster than inflation

- Cap out-of-pocket expenses for individuals who receive Medicare Part D

- Expand eligibility for full benefits under Medicare Part Ds Low-Income Subsidy Program

Additionally, Medicare Part D recipients wont pay anything out of pocket during the catastrophic phase of coverage. That provision eliminates the current rule dictating that beneficiaries pay 5% co-insurance after reaching the $7,050 out-of-pocket threshold. That part of the Inflation Reduction Act will take effect in 2024.

The Part D Donut Hole What Is It

If Medicare Part D prescription drug coverage is new to you, or you havenât used many prescription drugs under your Part D coverage, you may wonder what the Medicare donut hole is. Put simply, the Medicare donut hole refers to the third of four progressive payment stages in Medicare Part D prescription drug coverage. These four payment stages are:

You may have had Medicare Part D coverage for many years and never experienced some of these stages and their related out-of-pocket expenses. For example, you may select a Medicare plan with prescription drug coverage that doesnât have a deductible. In that case, you skip the deductible stage and go immediately to the initial coverage stage. Or you may take generic prescription drugs. If so, the cost you and your Medicare Part D plan pay for your medications may never reach amounts that put you in the Medicare donut hole or catastrophic coverage stages.

But if you do have high prescription drug costs, you could still enter the âcoverage gapâ phase once you and the Medicare Part D plan have spent a certain amount .

Youâll pay no more than 25% of the cost of your covered medications during this phase.

Then, if your spending on covered medications reaches $7,050 , youâll enter the catastrophic coverage stage. Your Medicare prescription drug plan will pay most of the cost of your covered medications for the balance of the year.

Don’t Miss: What Is The Cost Of Medicare B

What Are The 4 Phases Of Medicare Part D

The four phases of Medicare Part D are:

- Deductible Phase

- Coverage Gap Phase

- Catastrophic Coverage Phase

During the deductible phase, you are responsible for 100 percent of your prescription drug costs until you meet your Part D plans annual deductible. The insurance companies that provide Part D plans set their own costs, including deductibles and premiums. However, they must work within guidelines established by the Centers for Medicare & Medicaid Services . In 2022, the maximum Part D deductible is $480.

Also Check: How Do I Get A Medicare Explanation Of Benefits

What Costs Dont Count Towards Getting Out Of The Coverage Gap

Not all out-of-pocket costs count towards reaching catastrophic coverage. The following costs dont count towards getting you out of the coverage gap:

- The monthly premium for your Medicare Prescription Drug Plan or Medicare Advantage Prescription Drug plan

- The costs you pay for prescription drugs that arent covered by your Medicare plan

You May Like: How Do I Qualify For Medicare Low Income Subsidy

How Can You Get Help Paying For Prescription Drug Coverage

If you qualify, Medicare and Social Security offer a program called Extra Help that lowers your drug costs to $3.95 for each generic covered drug and $9.85 for each brand-name covered drug.5

You may also be able to get help through state pharmaceutical assistance programs, through assistance programs from pharmaceutical companies themselves, or by choosing a Medicare drug plan that offers additional coverage during the gap.6

A Reminder

If you dont sign up for Medicare Part D when youre first eligible, you may have to pay a late enrollment penalty.

What Is The Medicare Part D Donut Hole Or Coverage Gap

Find Cheap Medicare Plans in Your Area

The Medicare Part D donut hole is an interim phase in all Medicare prescription drug plans when you pay a higher share of your prescription drug costs. You reach the donut hole stage when you and your plan have paid $4,660 in drug costs.

During the coverage gap, or donut hole, you pay 25% of the cost of your prescription medications until your total expenses reach $7,400.

Don’t Miss: How Do I Find A Medicare Advocate

When Can I Sign Up For Medicare Part D

Generally, youre eligible to enroll in Medicare beginning in the year when you turn 65 years old. If you are already enrolled in Medicare and would like to join, switch, or drop a drug plan, you can do so during the annual Medicare open enrollment period. For 2022, Medicare open enrollment extends from Oct. 15 to Dec. 7. If youre enrolled in a Medicare Advantage Plan, you can switch to a different plan or move to Original Medicare during a second open enrollment period that extends from Jan. 1 to March 31 each year.

What Is The Initial Coverage Period

During theinitial coverage period, you will pay the stated copayment or coinsurance fees for either brand-name or generic drugs. The exact amounts of these costs are based on your specific plan details and vary depending on your unique plan coverage.

Many Medicare recipients will stay in this period for the entire plan year it all depends on the cost of your prescriptions and the types of medications you take.

Recommended Reading: How To Sign Up For Medicare At Age 65

Tips For Navigating The Part D Coverage Gap

Its best to avoid the coverage gap all together if you can. People who reach the coverage gap need to get through it wisely so they can get the most from their Part D coverage.

Drug costs can take a bite out of your budget. Here are some ideas to help turn that bite into a nibble, even if you are unlikely to reach the coverage gap.

Did The Medicare Donut Hole Go Away In 2020

No. The Medicare donut hole still exists. However, starting in 2020, instead of being responsible for 37% of the cost of generic prescription drugs and 25% of the cost of brand name prescription drugs while in the donut hole , Medicare beneficiaries only pay 25% for both brand name and generic drugs.

Previously, when Medicare Part D was first rolled out in 2007 and prior to the Affordable Care Act, beneficiaries paid 100% of drug costs while in the donut hole.

Don’t Miss: How To Become Medicare And Medicaid Certified

How Does The Inflation Reduction Act Affect Part D Coverage For 2023

The Inflation Reduction Act includes numerous provisions that will improve Medicare beneficiaries access to affordable prescriptions, with provisions phasing in over the next several years. Starting in 2023, Part D plans will have to offer all of their covered insulin products with monthly costs of no more than $35. And they will also have to cover recommended vaccines without any copays, deductible, or coinsurance, meaning theyll be free for the enrollee .

Also starting in 2023, the Inflation Reduction Act requires drug manufacturers to start paying rebates to Medicare if the cost of their drugs increases faster than inflation. This is an effort to slow the increase in drug prices and keep them more affordable over time.

Five Ways To Avoid The Medicare Part D Coverage Gap

If you use one or more prescription medications, you know how important drug coverage through a Medicare Part D prescription drug plan can be. Whether you have a stand-alone Medicare Part D prescription drug plan or a Medicare Advantage prescription drug plan, this benefit can help pay for important medications throughout the year. However, at a certain point when you and the plan have spent up to a certain dollar amount, you reach a coverage gap, also called the âdonut hole.â This is a temporary limit on what the Medicare Part D prescription drug plan will pay for your prescriptions.

The main way to not hit the coverage gap is to keep your prescription drug costs low so you donât reach the annual Medicare coverage gap threshold. This is also called the initial coverage limit. And even if you do reach the gap, lower drug costs and forms of assistance may help you pay for prescriptions you still need, even if they arenât covered at the time. Here are some ideas:

Also Check: Does Medicare Cover Home Health Care Costs

The Phases Of Part D Prescription Coverage

In addition to your premium, you likely will pay a fixed dollar amount, called a copayment, for each of your prescriptions after you meet any deductible. Or you may pay coinsurance, a percentage of the costs your plan charges for a medication. What you pay out of pocket can vary depending on how much youve already paid during a year.

| Annual deductible | |||

| You pay for your medicines until reaching your plans deductible. | You pay your plans copays or coinsurance for brand-name and generic drugs. | You pay no more than 25 percent of the cost of brand-name and generic drugs. | You pay a small copay amount or small insurance percentage. |

| If your plan has no deductible, initial coverage starts with your first prescription. | You stay in this stage until your total drug costs reach $4,430 in 2022. | You stay in this stage until your out-of-pocket costs reach $7,050 in 2022 | You stay in this stage for the rest of the year. |

What Are The Pros And Cons Of Part D Prescription Drug Plans

Advantages of Medicare Part D Prescription Drug plans include:

- Cost protection: Part D plans help protect against high-cost prescription drugs by offering various levels of cost coverage for different tiers of drugs.

- Low premiums help make these plans affordable.

- Flexible plan options: Part D plans offer you choices in cost and benefit levels depending on your needs and other coverage you may have.

- Works with Medicare Part A and Part B , or may be included in a Medicare Advantage plan .

Disadvantages of Medicare Part D Prescription Drug plans include:

- Need to anticipate your prescription drug needs for the year: Part D plans differ in the types of drugs they cover. Knowing your medical situation can help you select a plan that is right for you and covers the prescription drugs you expect to need.

- Plans differ from insurer to insurer: Part D plans must offer a minimum amount of coverage per Medicare, but otherwise plans can differ. This means you need to shop around and educate yourself on what each plan covers.

- Not all drugs are covered: Each plan has its own drug list , level of cost coverage, and monthly premium.

- Late Enrollment Penalty : Fail to enroll in a Part D plan when you are eligible and you may end up paying a late enrollment penalty. For every month you delay enrolling, Medicare will charge you a small fee, which is added to your monthly premium.

Learn more about Medicare Part D Enrollment and the LEP

Don’t Miss: Can I Apply For Medicare After Age 65