What Does Medicare Cover

Medicare can cover a variety of treatments, services, tests, and prescriptions. Medicare is broken down into different parts. Each part covers specific services, tests, and supplies.

Part A is hospital insurance and Part B covers doctors visits and other outpatient services. Part C is called Medicare Advantage, it is another health insurance plan some individuals choose. Part D is a plan that covers prescription drugs.

What Factors Can Affect My Medicare Part B Premium

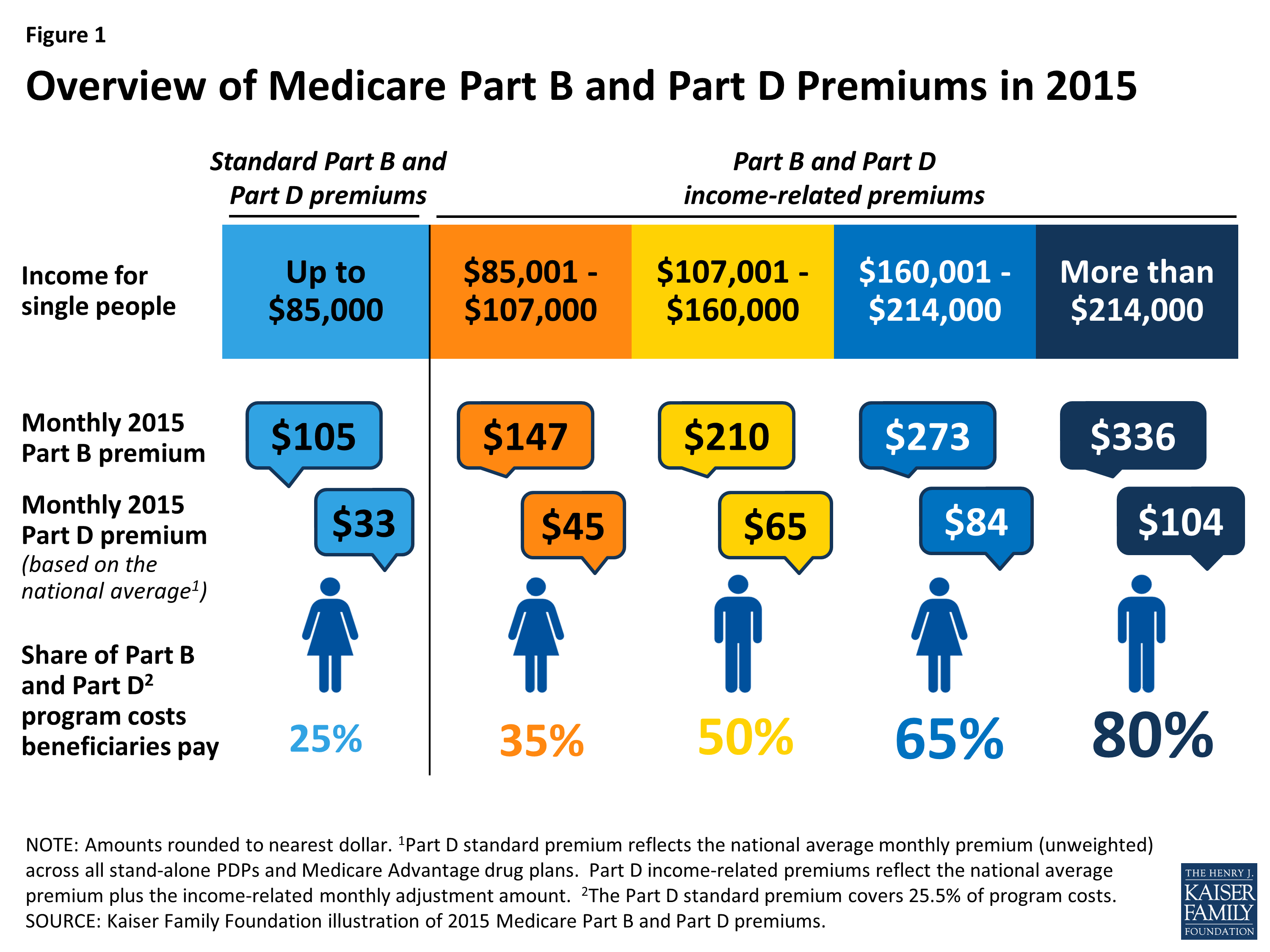

Most people actually pay less than the standard Medicare Part B premium amount, which is determined by the federal government each year. In 2021, the standard Medicare Part B premium is $148.50. You might pay more if you have a high income. See details below.

The standard premium also may apply to you if get both Medicare and Medicaid benefits, but your state may pay the standard Medicare Part B premium if you qualify.

If you delayed enrollment in Part B, you might have to pay a late-enrollment penalty along with your monthly premium- see below.

If your income is above a certain amount, you may be subject to the Income Related Monthly Adjustment Amount . See the table below.

What Does Medicare Part B Cover

Medicare Part B covers doctor visits and most routine and emergency medical services. It also covers some preventive care, like flu shots.

What is covered by Medicare Part B

- Doctor visits, including when you are in the hospital

- An annual wellness visit and preventive services, like flu shots and mammograms

- Clinical laboratory services, like blood and urine tests

- X-rays, MRIs, CT scans, EKGs and some other diagnostic tests

- Some health programs, like smoking cessation, obesity counseling and cardiac rehab

- Physical therapy, occupational therapy and speech-language pathology services

- Diabetes screenings, diabetes education and certain diabetes supplies

- Mental health care

- You enroll for the first time in 2021.

- You aren’t receiving Social Security benefits.

- Your premiums are billed directly to you.

- You have Medicare and Medicaid, and Medicaid pays your premiums.

Your Part B premium may be less than the standard amount if you enrolled in Part B in 2020 or earlier and your premium payments are deducted from your Social Security check.

Your premium may be more than the standard amount based on your income. You will pay an incomerelated monthly adjustment amount if your reported income from 2019 was above $88,000 for individuals or $176,000 for couples. Visit Medicare.gov to learn more about IRMAA.

And while Medicare will share your Part B health care costs with you, there is something called “Medicare assignment” that’s important to understand.

Don’t Miss: How To Qualify For Extra Help With Medicare Part D

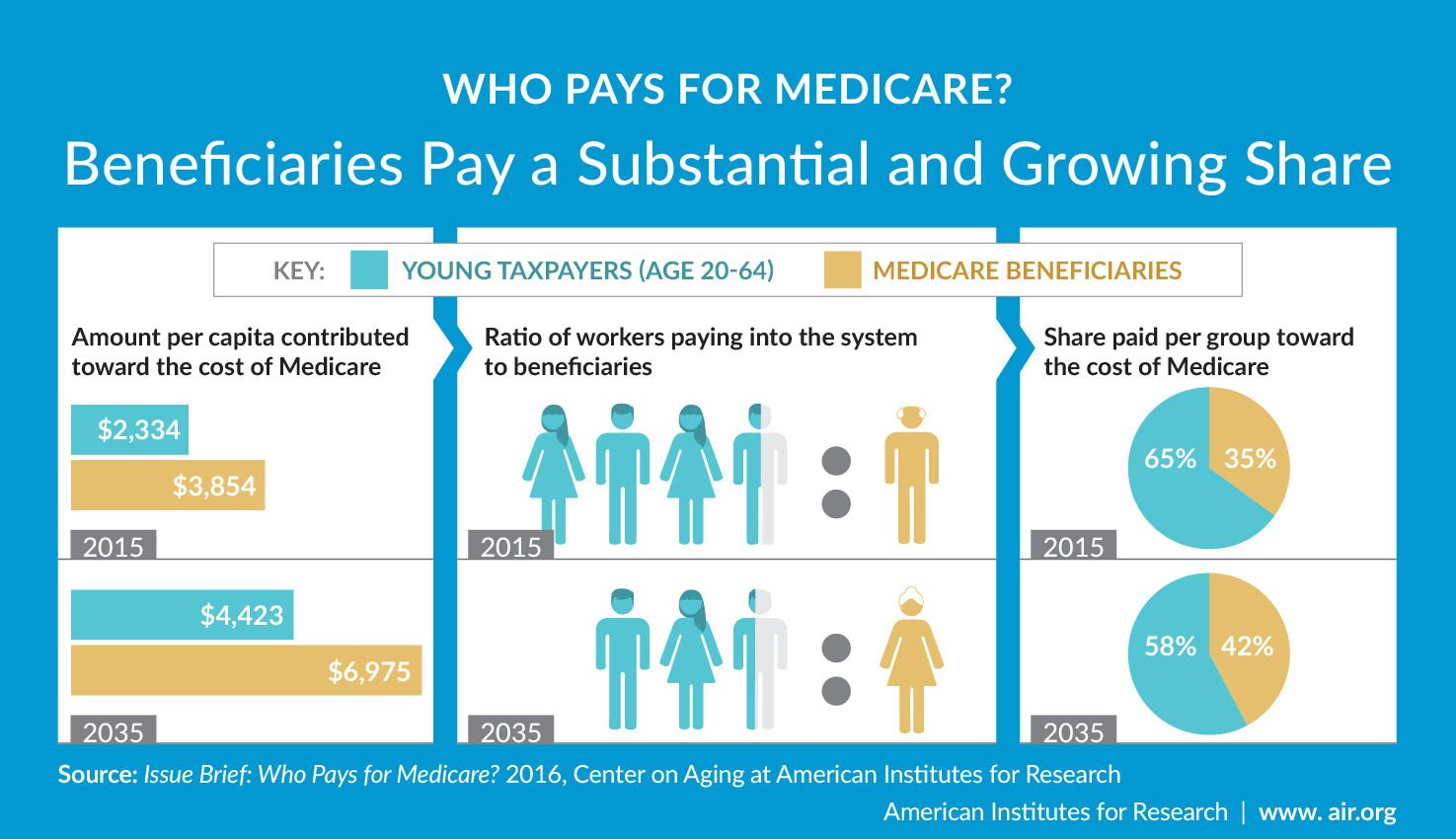

How Is Medicare Funded

The Centers for Medicare & Medicaid Services is the federal agency that runs the Medicare Program. CMS is a branch of the

. CMS also monitors

programs offered by each state.

In 2017, Medicare covered over 58 million people. Total expenditures in 2017 were $705.9 billion. This money comes from the Medicare Trust Funds.

What If My Premium Payment Is Late

If your First Bill payment is late, you’ll get a Second Bill. Your Second Bill will include both past amounts and next month’s premium. If you dont pay the total amount due by the 25th of the month, you’ll get a Delinquent Bill. If you get a Delinquent Bill and you dont pay your total amount due by the 25th of the month, youll lose your Medicare coverage.

Read Also: Is Medicare A Social Security Benefit

Who Won Ballon D’or : Medicare Part D Or Medicare Drug Coverage Is A Prescription Drug Policy That Can Help You Pay For A Variety Of Medications

Medicare part d is a prescription drug program offered by private insurance plans. We reviewed and compared the best directors and officers insurance based on policies, costs, customer reviews, and more. Medicare part d coverage can be complicated. Some candy that starts with the letter d include dum dums lollipops, dove chocolates, dots, daim bars, dairy milk by cadbury, dagoba organic chocolate, divinity, dip dabs, and dew drops. This is a notably generous boost of d3 at a super affordable price.

When Can I Enroll In Medicare Part B

If you are receiving retirement benefits before age 65 or qualify for Medicare through disability, generally youre automatically enrolled in Medicare Part A and Part B as soon as you become eligible.

If you do not enroll during your initial enrollment period and do not qualify for a special enrollment period, you can also sign up during the annual General Enrollment Period, which runs from January 1 to March 31, with coverage starting July 1. You may have to pay a late enrollment penalty for not signing up when you were first eligible.

If youre not automatically enrolled, you can apply for Medicare through Social Security, either in person at a local Social Security office, through the Social Security website, or by calling 1-800-772-1213 from 8AM to 7PM, Monday through Friday, all U.S. time zones.

Keep in mind that once you are both 65 years or older and have Medicare Part B, your six-month Medigap Open Enrollment Period begins. This is the best time to purchase a Medicare Supplement insurance plan because during open enrollment, you have a guaranteed-issue right to buy any Medigap plan without medical underwriting or paying a higher premium due to a pre-existing condition*. Once you are enrolled in Medicare Part B, be careful not to miss this one-time initial guaranteed-issue enrollment period for Medigap.

Don’t Miss: What Medicare Plans Do I Need

What Is The Special Enrollment Period

The Special Enrollment Period allows you to enroll for Part B later if you have an insurance plan under your or your spouses employment. You may qualify for the Special Enrollment Period under two conditions.

They are:

Who Qualifies For Premium

Most people dont have to pay a monthly premium for their Medicare Part A coverage. If youve worked for a total of 40 quarters or more during your lifetime, youve already paid for your Medicare Part A coverage through those income taxes.

Outside of qualifying for premium-free Part A based on your work history, there are a few other situations when you may receive coverage without a monthly premium:

- Youre 65 years old and receive retirement benefits from Social Security or the Railroad Retirement Board .

- Youre 65 years old and you or your spouse had Medicare-covered health benefits from a government job.

- Youre under age 65 and have received Social Security or RRB disability benefits for 24 months.

Also Check: Are Medicare Advantage Premiums Deducted From Social Security

Medicare Part D Prescription Drug Coverage

What it covers:

- Medicare Part D covers prescriptions drugs.

- Plan premiums, the drugs that are covered, deductibles, coinsurance and copays will vary by plan, so you should check and compare plans each year based on your needs, the prescription drugs you take, etc.

What it costs:

- Like Medicare Advantage , prescription drug plans are offered by private insurance companies contracted by the federal government.

- Plans vary in cost, coverage, deductibles and copays.

This material is provided for informational use only and should not be construed as medical advice or used in place of consulting a licensed medical professional. You should consult your doctor to determine what is right for you.

Some links on this page may take you to Humana non-Medicare product or service pages or to a different website.

Y0040_GNHKHNSEN

Should I Apply For Medicare Part B

When applying online, you can apply for Part A and Part B at the same time. You must pay a premium to receive Part B coverage. You have the option to turn down Part B.

If you turn down applying for Part B, if you want it later, your coverage may be delayed for a while. You may also have a higher premium.

The premium you would pay for delayed Part B coverage goes up by 10% every 12 month period where you are eligible for Part B but choose not to have it.

However, if you qualify for the Special Enrollment Period your premium may not be increased if you initially opt out of Part B.

Don’t Miss: How Do I Get A Second Opinion With Medicare

Ask The Medicare Maven

Medicare rules and private insurance plans can affect people differently depending on where they live. To make sure the answers here are as accurate as possible, Phil is working with the State Health Insurance Assistance Program . It is funded by the government but is otherwise independent and trains volunteers to provide consumer Medicare counseling in state and local offices around the country. The non-profit Medicare Rights Center is also providing on-going help.

Moeller is a research fellow at the Center on Aging & Work at Boston College and co-author of How to Live to 100. Follow him on Twitter or e-mail him at .

The Entitlement Wars are coming. Make no mistake. The attacks may be about Social Security, Medicare, Medicaid, or the Affordable Care Act the newest member of what some conservatives see as the Four Horseman of the Financial Apocalypse. Or they could emerge from the growing skirmishes over whether income inequality is getting worse. The tax code could enter the picture. So might the national impasse over what to do about immigration.

Any or all of these roads could lead to a reckoning about how much deficit spending the nation can continue to afford, and whos going to pay the price for a belt-tightening that is decades overdue. Heres a primer to help better understand some of the issues, including a little tough love about the role that Medicare beneficiaries play in the nations expanding entitlement deficits.

Each Year That You Work And Pay Into Social Security Or Medicare You Receive Quarters Or Credits If You Work 10 Years You Would Have 40 Quarters

If you have 30-39 quarters you would pay a premium of $226.00 for Part A. And if you have less than 30 quarters, the premium you pay would be $411.00

If you signed up for Part B before 2016 your premium should be around $104.90 each month.

If you enrolled in Part B in 2016, your deductible would be $121.80. If you arent receiving Social Security payments yet or are billed directly for your Plan B coverage, your premium would generally be $121.80.

If you worked for the railroad, you need to contact the Railroad Retirement Board to understand more about your Plan B premium costs.

The premium can be higher if you make more than $88,000 annually. The government will review your tax returns and calculate your premium.

The table below shows how your premium may be calculated:

Read Also: How Can I Get My Medicare Card Number

Some Basics Of Medicare Supplemental Insurance Plans

Supplemental plans fill the gap in medical expenses that Original Medicare does not fully cover.

For example, if you need care for a medical condition, Medicare Part B only covers 80 percent of those costs, and you are on the hook for the remaining 20 percent.

Using a supplemental plan, you can significantly reduce the out-of-pocket costs that can add up from medical care, including copayments, deductibles and coinsurance.

Private insurance companies offer supplemental plans, also known as Medigap.

If you cannot afford the out-of-pocket expenses you incur from Part B, then a supplemental policy may help you curb those costs.

You must pay a monthly premium for a supplemental plan, so it is imperative that you shop by comparison when you are searching for one.

Just like traditional health care, you should never decide on the first insurance company that you see.

This is especially true here, because Medigap plans are standardized into types, and plans of the same type offer the exact same coverage, no matter the private carrier.

In other words, the only difference between Medicare supplements plans of the same type is the monthly premium charged by the carrier.

There are several Medicare-approved private insurance companies that offer quality supplemental plans.

The cost of your monthly premium and the portion of your medical expenses a supplemental plan will cover are at stake, so thoroughly comparison shop private insurance companies offering supplemental plans.

B Doctor And Outpatient Services

This part of Medicare covers doctor visits, lab tests, diagnostic screenings, medical equipment, ambulance transportation and other outpatient services.

Unlike Part A, Part B involves more costs, and you may want to defer signing up for it if you are still working and have insurance through your job or are covered by your spouses health plan. But if you dont have other insurance and dont sign up for Part B when you first enroll in Medicare, youll likely have to pay a higher monthly premium for as long as youre in the program.

The federal government sets the Part B monthly premium, which is $148.50 for 2021. It may be higher if your income is more than $88,000.

Youll also be subject to an annual deductible, set at $203 for 2021. And youll have to pay 20 percent of the bills for doctor visits and other outpatient services. If you are collecting Social Security, the monthly premium will be deducted from your monthly benefit.

Read Also: Why Is My Medicare So Expensive

How Will I Know When I Am Approved And Recieve Coverage

Once your application is processed, reviewed, and approved you should receive an acceptance letter 45 to 90 days after you submitted your application.

This letter will come with a Welcome To Medicare packet that gives more information and details on how to use your plan. The package should include your Medicare card.

You may also receive a reminder letter 1 month before your Medicare coverage becomes active.

View a sample here.

Need More Information On Medicare Advantage Plans

I am happy to answer your questions about Medicare Advantage. If you prefer, you can schedule a phone call or request an email by clicking on the buttons below. You can also find out about plan options in your area by clicking the Compare Plans button.

New To Medicare?

Becoming eligible for Medicare can be daunting. But don’t worry, we’re here to help you understand Medicare in 15 minutes or less.

Also Check: How To Get A Lift Chair From Medicare

Ways To Pay Your Medicare Bill:

If you pay by credit/debit card, enter the account information and expiration date as it appears on your card. Be sure to sign the coupon.

Mail your Medicare payment coupon and payment to:

Medicare Premium Collection Center

The Lowdown On The Best And Most Cost

We publish unbiased product reviews our opinions are our own and are not influenced by payment we receive from our advertising partners. Learn more about how we review products and read our advertiser disclosure for how we make money.

Planning for retirement includes obtaining appropriate and affordable healthcare coverage. In that respect, for Americans 65 and older, any conversation about healthcare must include Medicare. Eligibility at age 65 means that health insurance becomes more affordable.

When you retire, its important to understand how Medicare works and how you can get the best and most cost-effective coverage. Many retirees wonder how to determine whether they need all four parts of Medicare. Questions about Medicare costs, supplemental insurances, and enrollment periods often arise as well.

Recommended Reading: How Does Geha Work With Medicare

How To Make Premium Payments

Your Part B Medicare premiums are billed directly through Medicare, while your Part C premiums are billed through the private insurance company associated with your Medicare Advantage plan. Heres how you pay Medicare and your private insurance company.

- Premium Payments to Medicare: If you receive Social Security, Office of Personnel Management, or Railroad Retirement Board benefits, Medicare will automatically deduct your Part B premiums from your benefits check. If you dont receive these benefits, you will receive a bill called Notice of Medicare Premium Payment Due. You can then pay by mailing a check, use your banks online billing to make payments every month, or sign-up for Medicares bill pay to have the premium come out of your bank account automatically.

- Part C Premium Payments to Private Insurance Companies: If your insurance company charges a premium for your Medicare Part C plan, you can set your payments to come from your Social Security benefits. But this is not an automatic action. You must submit a request to Social Security, and they have to approve your request before your Part C premium payments will be deducted. If you dont get Social Security, you can mail in a check or have your premium automatically drafted from your bank account.