When Can You Sign Up If You Missed The Initial Enrollment Period

If you didnt sign up when you were first eligible and you dont have current healthcare coverage elsewhere , youll have to wait for the next General Enrollment Period which runs each year from January 1 through March 31.

Your coverage will then begin in July of that year, and you may have to pay a late enrollment penalty on your Medicare Part B premium for as long as you have Part B coverage. Your premium will go up by 10% for every 12-month period you werent enrolled.

If You Get Ssdi Benefits And Are In A 24

- You may be able to get Medicaid coverage while you wait. You can apply 2 ways:

- Create an account or log in to complete an application. Answer yes when asked if you have a disability. Well forward your application to your state Medicaid agency.

- Apply directly to your state Medicaid agency. Select your state from the menu on this Medicaid page for contact information.

When asked about your income on your Marketplace application, be sure to include your SSDI income.

Step By Step Instructions For Filling Out This Application

Also Check: How Much Will Medicare Pay For Nursing Home Care

If You Already Receive Benefits From Social Security:

If you already get benefits from Social Security or the Railroad Retirement Board, you are automatically entitled to Medicare Part A and Part B starting the first day of the month you turn age 65. You will not need to do anything to enroll. Your Medicare card will be mailed to you about 3 months before your 65th birthday. If your 65th birthday is February 20, 2010, your Medicare effective date would be February 1, 2010.

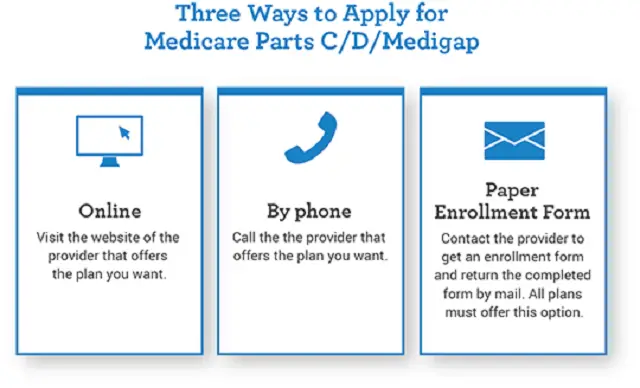

Signing Up For Original Medicare

There are a few different ways to sign up for Medicare Part A and Medicare Part B if you are not automatically enrolled.

Medicare Part A and Part B are also called Original Medicare.

3 Ways to Sign Up for Medicare Part A and Part B

If you worked at a railroad, call the Railroad Retirement Board at 1-877-772-5772 to sign up.

If you are not automatically enrolled, the best time to sign up for Medicare is during your initial enrollment period.

This is a seven-month window that begins three months before the first day of the month of your 65th birthday, includes your birth month and ends three months after your birthday.

Prepare for Medicare Open Enrollment

Also Check: Does Medicare Pay For Stem Cell Knee Replacement

Applying For Medicare Over The Phone

Applying by phone is another good option that works for many. Just follow these simple steps.

If you apply over the phone, you will need to send in documents such as your original birth certificate to verify your identity. If this makes you nervous, applying in person is probably your best bet.

When Can I Enroll In Medicare If I Am Not Receiving Retirement Benefits:

If you are not yet receiving retirement benefits and are close to turning 65, you can sign up for Medicare Part A and/or Part B during your IEP. If you decide to delay your Social Security retirement benefits or Railroad Retirement Benefits beyond age 65, there is an option to enroll in just Medicare and apply for retirement benefits at a later time.

Read Also: Does Medicare Part D Cover Shingrix

When To Enroll In Medicare If I Dont Want Medicare Part B:

If youre automatically enrolled in Medicare Part B, but do not wish to keep it you have a few options to drop the coverage. If your Medicare coverage hasnt started yet and you were sent a red, white, and blue Medicare card, you can follow the instructions that come with your card and send the card back. If you keep the Medicare card, you keep Part B and will need to pay Part B premiums. If you signed up for Medicare through Social Security, then you will need to contact them to drop Part B coverage. If your Medicare coverage has started and you want to drop Part B, contact Social Security for instructions on how to submit a signed request. Your coverage will end the first day of the month after Social Security gets your request.

If you have health coverage through current employment , you may decide to delay Medicare Part B enrollment. You should speak with your employers health benefits administrator so that you understand how your current coverage works with Medicare and what the consequences would be if you drop Medicare Part B.

You Automatically Get Medicare When You Turn 65

- Well mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months of turning 65, you might have to wait to sign up and pay a monthly late enrollment penalty.

Read Also: Can You Have Two Medicare Advantage Plans

Retiree Health Plan Part B Reimbursement Options

If you’re retired and have Medicare and retiree group health plan coverage from a former employer, Medicare typically pays first for your medical bills and your retiree plan would pay the remaining amount.

Some of these retiree plans offer a Part B reimbursement to eligible enrollees. Each retiree plan has different eligibility requirements, so check with your plan to understand your options. However, for most plans you must be a retired employee or already enrolled in the health plan and be enrolled in Medicare Part B.

You may be reimbursed the full premium amount, or it may only be a partial amount. In most cases, you must complete a Part B reimbursement program application and include a copy of your Medicare card or Part B premium information.

Naturalization Certificate Or Certificate Of Citizenship

You can request a copy of your Naturalization Certificate or Certificate of Citizenship from U.S. Citizenship and Immigration Services. You can fill out Form N-565, Application for Replacement Naturalization/Citizenship, either online or by mail, to have a copy of these documents sent to you.

To submit this form, youll need to pay a $555 fee and send in two identical passport-style photos of yourself. Youll also have to send in a sworn statement if your document was lost or a police report if it was stolen.

Recommended Reading: Does Kaiser Permanente Take Medicare

To Qualify For Medicare You Need To Get Disability Benefits From:

- Social Security

- Railroad Retirement Board

Youll automatically get Part A and Part B after you get disability benefits for 24 months. Well mail you a welcome package with your Medicare card.

If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.

If you live in Puerto Rico or outside the U.S.

What Other Times Can You Sign Up

You may also become eligible for Medicare for other reasons. If youre eligible due to a disability, you qualify after youve received Social Security disability or certain Railroad Retirement Board disability benefits for 24 months.

If you have end-stage renal disease , youre eligible in the fourth month of dialysis treatment, possibly earlier.9 And if you have ALS, you qualify the same month your disability benefits begin.10

Recommended Reading: Does Medicare Cover Oxygen At Home

Medicare Annual Enrollment Period

Once you sign up for Original Medicare Part A and Part B, you are covered and dont need to renew it. But every year, during the Medicare Annual Enrollment Period you have an opportunity to change your Medicare health or prescription drug plan. This happens annually from Oct. 15 through Dec. 7. If you make a change during this enrollment period, your new plan benefits are effective Jan. 1 of the following year.

Read more info in our Medicare Annual Enrollment Period Guide.

Applying For Medicare Online

Applying for Medicare online is a quick and easy process on the Social Security website, taking approximately ten minutes. After you have applied for Medicare online, you can check the status of your application and/or appeal, request a replacement card, and print a benefit verification letter.

You can easily apply online for Medicare and Social Security retirement benefits or just Medicare.

Once you apply for Part B, give us a call so we can help you choose a supplement plan to cover what Medicare doesnt.

If youre not comfortable applying for Medicare online, you can do so over the phone.

Also Check: Do You Have To Pay For Part B Medicare

Medicare Special Enrollment Period

Special situations may come up that give you the chance to sign up for or change your Medicare plan outside of your Initial Enrollment Period or the Annual Enrollment Period.

There are several special cases that make you eligible for a Special Enrollment Period.

Here are some common situations:

- You move: If you move to an address outside your plans service area, into a nursing home, or you have different plan options at your new address, youll be able to apply for a new plan.

- You want to switch to a 5-star Medicare plan: Every year, Medicare evaluates plans based on a 5-star rating system. Medicare considers these plans excellent. You can make the switch once to a 5-star plan anytime from Dec. 8 through Nov. 30 if one is available in your area.

- You lose your current coverage: This applies if you or your spouse will retire or change to a job that doesnt offer coverage. It doesnt apply if your insurance company cancels your coverage because you didnt pay your monthly premiums.

- Your plan changes its contract with Medicare: Enrollment in a plan depends on the plans contract with Medicare, and for various reasons these contracts could change.

Your new coverage begins on the first day of the month after you sign up.

Age To Apply For Medicare

If you do not fall into any of these categories, you will have to apply for Medicare when you turn 65. You have six months to get this done 3 months before the month of your 65th birthday till 3 months after the month of your 65 birthday. Your Medicare will not be automatic. You will have to set it up. Do not apply late or you could be fined. Even if you are still working and have a health plan, it is still in your interest to apply as soon as you are eligible.

You May Like: Is Medicare The Same As Ahcccs

Do I Need Medicare Part B

We always advise our clients to contact their employer or union benefits administrator before delaying Part A and Part B to learn more about how their insurance works with Medicare. Employer coverage may require that you enroll in both Part A and Part B to receive full coverage.

Common reasons beneficiaries delay Part B include:

Medicare Part D Premiums

Each year, the Medicare Part D base premium is set at 25.5% of the expected per capita costs for standard prescription drug coverage.49 Beneficiary premiums are based on average bids submitted by participating drug plans for basic benefits each year and are adjusted to reflect the difference between the standardized bid amount of the plan the beneficiary enrolls in and the nationwide average bid. The actual cost of coverage and premiums, however, varies by plan. Medicare Part D enrollees may pay premiums to their plans directly or may have premiums automatically deducted from their Social Security benefits.50

In 2018, the Medicare Part D base premium is $35.02.51 However, as noted, actual premiums vary by plan and the average Medicare Part D premium, weighted for enrollment, is $41.00.52

Also Check: How Do Zero Premium Medicare Plans Work

Medicare Part B Premiums

Beneficiaries enrolled in Medicare Part B must pay premiums .35 By law, individuals receiving Social Security benefits have their Medicare Part B premiums automatically deducted from their benefit checks.36 In 2017, approximately 75% of Medicare Part B enrollees had their Medicare Part B premiums deducted from their monthly Social Security benefit checks.37 Those not receiving Social Security are billed by Medicare,usually on a quarterly basis.38Individuals who are enrolled in Medicare Part B but do not receive Social Security may include individuals who are waiting to reach full retirement age and individuals who spent their careers in employment that was not covered by Social Security, including certain federal, state, and local government workers.

The standard monthly Medicare Part B premium in 2018 is $134.00. This premium applies to individuals with a modified adjusted gross income of $85,000 or less and to couples with a MAGI of $170,000 or less.42 Enrollees earning more than those respective amounts pay higher premiums based on their income, as shown in Table 1.

Table 1. Medicare Part B Premiums, 2018

|

Modified Adjusted Gross Income a |

|

|

428.60 |

Notes: Each member of a couple pays the applicable premium. Lower thresholds are rounded up to the nearest dollar and upper thresholds are rounded down to the nearest dollar.

Medicare Coverage Start Date

|

The month you turn 65 |

1 month after you register |

|

1 month after you turn 65 |

2 months after you register |

|

2 months after you turn 65 |

3 months after you register |

|

3 months after you turn 55 |

3 months after you register |

|

During the General Enrollment Period |

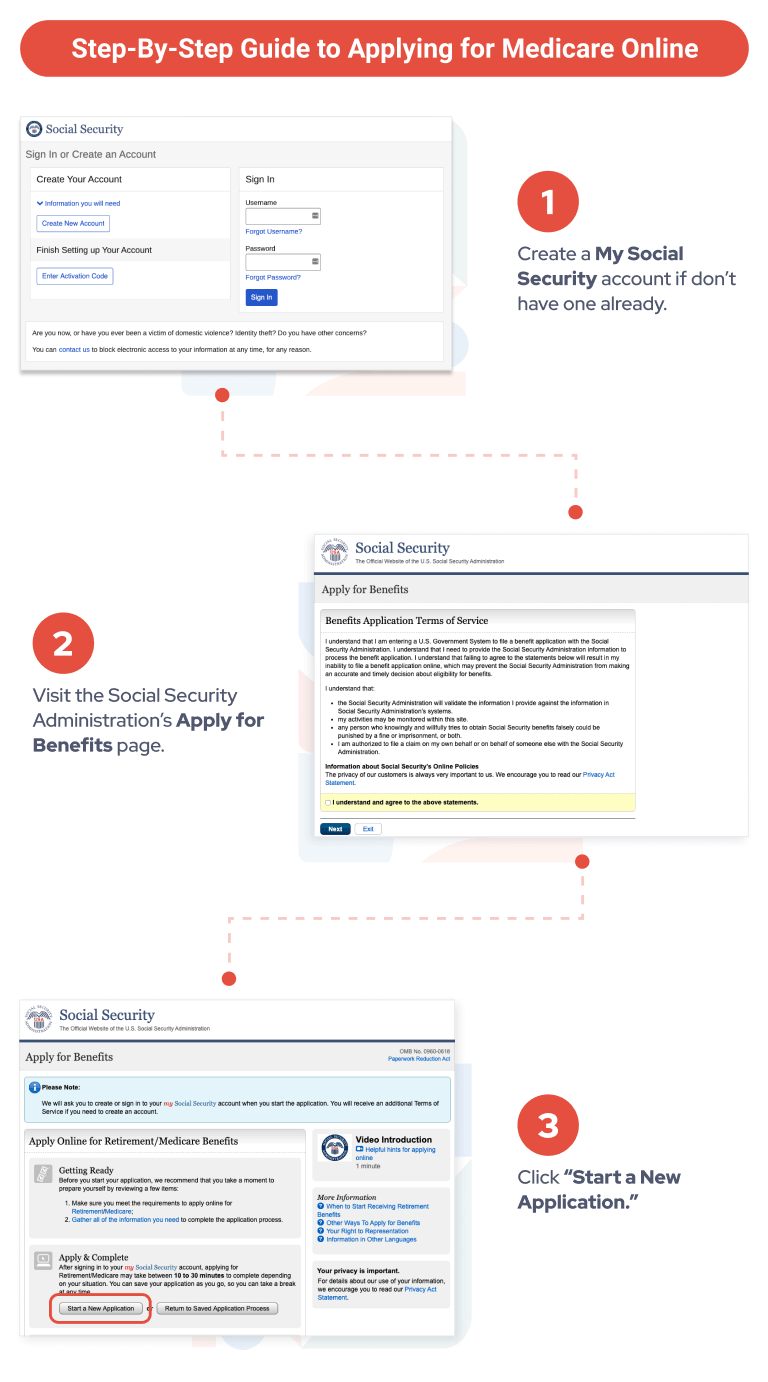

How to Appy for Medicare Online

Many Medicare users like to apply online without having to leave their home. If youre one of these people, just visit the Social Security website and follow the links to apply for Medicare. Its a quick application. Remember, you dont have to be getting income benefits to sign up for Medicare!

- To apply for SS retirement benefits and Medicare at the same time, click here:

- To apply for Medicare only, click here:

While waiting for your Medicare card to show up, we can help you understand your supplemental insurance options. Then youll be ready to arrange the rest of your coverage as soon as you get your card.

Applying for Medicare online is the easiest way to do it. On rare occasions, people have problems due to incorrect info in Social Securitys system. If this happens, you can consider applying by phone.

How to Apply for Medicare by Phone

If the representative sends you forms to fill out, these are usually pretty simple. Be aware that phone applications for Medicare can take many weeks. We suggest only using this option if you have one or two months before your planned Medicare effective date.

Recommended Reading: How Do I Find My Medicare Card Number Online

When Is The Medicare Advantage Plan Annual Election Period:

You can also add, drop, or change your Medicare Advantage plan during the Annual Election Period, which occurs from October 15 to December 7 of every year. During this period, you may:

- Switch from Original Medicare to a Medicare Advantage plan, and vice versa.

- Switch from one Medicare Advantage plan to a different one.

- Switch from a Medicare Advantage plan without prescription drug coverage to a Medicare Advantage plan that covers prescription drugs, and vice versa.