When And How Do I Enroll In Medicare Part D

The first opportunity for Medicare Part D enrollment is when youre initially eligible for Medicare during the seven-month period beginning three months before the month you turn 65.

If you enroll prior to the month you turn 65, your prescription drug coverage will begin the first of the month you turn 65. If you enroll during the month you turn 65 or one of the three following months, your prescription coverage effective date will be delayed it will not be retroactive to the month you turned 65.

If you enrolled in Medicare due to a disability, you may enroll during a seven-month window beginning three months prior to your 25th month of disability. If you enroll in the three months prior to your 25th month of disability, your coverage will begin the first day of the 25th month. If you enroll during the 25th, 26th, 27th, or 28th month of disability, your coverage will begin the first of the month after you enroll .

Heres more information on how to pick a prescription drug plan.

In both of these cases whether youre turning 65 or are eligible for Medicare because of a disability you have the option of selecting a Medicare Advantage plan that includes prescription drug coverage, and using that in place of Medicare A, B, and D. The enrollment periods and rules are the same as those described above for stand-alone Medicare Part D plans.

After youve chosen from the various PDP offerings, you can enroll by:

Also Check: Does Medicare Rated Assisted Living Facilities

How Do Medicare Part D Plans Work

Even if youre a healthy person with a healthy lifestyle, illnesses and accidents are facts of life, and the medications you may need to treat unexpected medical events can be expensive. If youre already covered by Medicare Part A and/or Part B, youre eligible for Medicare Part Da unique and specific, four-stage add-on to your regular Medicare coverage. Also known as prescription drug coverage, Medicare Part D plans require monthly premiums but offer additional coverage not provided by Medicare or supplement plans.

for more information about Part D coverage stages.

Check To Make Sure Your Employer Plan Is Creditable

Now, lets look at something we mentioned above the creditable coverage requirement. What does that mean and why is it important?

Medicare has another rule when it comes to Part D. Lets look at the following situation as an example.

Kate works for an employer with 500 employees. She has health care from her employer including prescription drug coverage. When Kate turns 65, she decides to delay Medicare believing shes qualified to do so because her employer meets the 20 or more employees rule. Kate doesnt ask her employer if her health plans prescription drug coverage is considered creditable.

Fast forward five years. Kate, now 70, retires and enrolls in Medicare Parts A, B and D within 30 days of leaving her job. But, she is soon surprised to learn she must pay the Part D late enrollment penalty. When she asks why, Kate is informed that her employers drug coverage was not considered creditable.

This is where the rule of creditable coverage comes in.

Medicare has a rule that your employer drug coverage must be considered creditable in order to delay Part D enrollment without penalty. This means that the employer drug coverage must be as good as or better than Medicare Part D.

Thus, because Kate did not actually have creditable coverage, even though she had health care through an employer with 20 or more employees, she now has to pay the Part D penalty.

You May Like: When Can You Enroll In Medicare Part D

Do You Need Medicare Part D If You Dont Have Any Prescriptions

Medicare Part D can be considered a safety net for those unforeseen prescriptions you may need in the future. Even if you are currently not taking any medications, you may need them down the road, and having this coverage can help save you money. So, even if you dont currently take prescription medications, signing up for Part D could still be a wise decision.

Medicare Supplement Insurance Plan

To enroll in a Medicare Supplement Insurance plan, please call us at $ $, $.

Aetna is the brand name for insurance products issued by the subsidiary insurance companies controlled by Aetna, Inc. The Medicare Supplement Insurance plans are insured by Aetna Health and Life insurance Company, Aetna Life Insurance Company, American Continental Insurance Company or Continental Life Insurance Company of Brentwood, Tennessee, all Aetna Companies. Not connected with or endorsed by the U.S. Government or the Federal Medicare Program.

Also Check: How Long Does Medicare Open Enrollment Last

When Do I Have To Apply For Medicare If Im Still Working

You dont have to apply for Medicare if youre working and have group medical coverage, but you may want to.

If you are an eligible, employed Medicare beneficiary who has group medical coverage, you may choose to delay Medicare enrollment. But Medicare could offer a cost savings and if your employer has less than 20 employees, youll have no choice but to enroll. Consider these important timelines and regulations when you apply for Medicare while still employed.

The Parts Of Medicare

Social Security enrolls you in Original Medicare .

- Medicare Part A helps pay for inpatient care in a hospital or limited time at a skilled nursing facility . Part A also pays for some home health care and hospice care.

- Medicare Part B helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

Other parts of Medicare are run by private insurance companies that follow rules set by Medicare.

- Supplemental policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses.

- Medicare Advantage Plan includes all benefits and services covered under Part A and Part B prescription drugs and additional benefits such as vision, hearing, and dental bundled together in one plan.

- Medicare Part D helps cover the cost of prescription drugs.

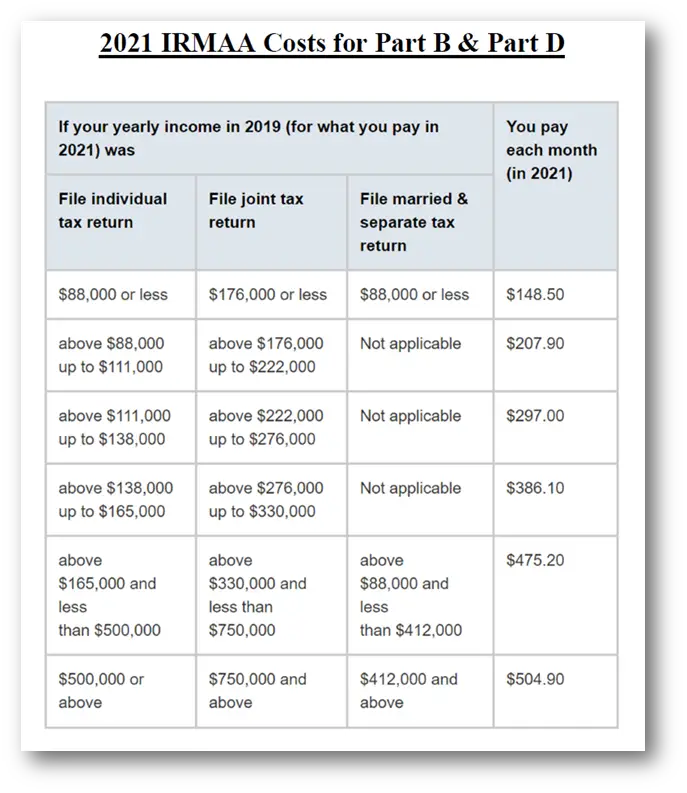

Most people age 65 or older are eligible for free Medicare hospital insurance if they have worked and paid Medicare taxes long enough. You can sign up for Medicare medical insurance by paying a monthly premium. Some beneficiaries with higher incomes will pay a higher monthly Part B premium. To learn more, read .

Read Also: How To Pick A Medicare Plan

How Part D Works

While there are many Part D plans available depending on a persons geographic location, each plan follows the same set of stages listed below, as outlined by the federal government.

Stage 1: Deductible

During this period, you pay the full cost of your medications until you meet your plans deductible. Some plans will offer coverage for certain medications during this stage, says Reese.

Stage 2: Initial Coverage

Once you hit your deductible, the initial coverage stage kicks in. During this stage, you pay your copayment and coinsurance rates, and your plan covers the remaining expenses.

Stage 3: Coverage Gap

If the total amount you and your plan pay for prescription drugs reaches a certain number during the year, you enter the coverage gap. Also known as the donut hole, the coverage gap occurs when theres a temporary limit on what your plan will cover for drugs, requiring you to pay up to 25% of the retail cost of your medications.

Stage 4: Catastrophic

If you reach the catastrophic stage with your medication expenses, Part D will cover most of your prescription drug costs for the rest of the year. You only pay 5% of the cost or $3.95 for generic drugs and 5% of the cost or $9.85 for brand name drugs.

You Automatically Get Medicare When You Turn 65

- Well mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

Sign up for Part B if you live in Puerto Rico or outside the U.S.You get Part A automatically. If you want Part B, you need to sign up for it. If you dont sign up for Part B within 3 months of turning 65, you might have to wait to sign up and pay a monthly late enrollment penalty.

Read Also: Is The Pneumonia Shot Covered By Medicare

How Medicare Prescription Drug Coverage Works With Other Types Of Insurance

You may not need to enroll in a Part D plan if you have creditable prescription drug coverage. Creditable means that the other insurance is expected to pay at least as much as Medicares standard prescription drug coverage.

Coverage from one of the following government-sponsored insurances is worthwhile sticking with.

- Civilian Health and Medical Program of the Department of Veterans Affairs

- Federal Employees Health Benefits Program

- Indian Health Services

When To Sign Up For Medicare And How To Apply

Home / FAQs / General Medicare / When to Sign Up for Medicare and How to Apply

Its not uncommon for new beneficiaries to have questions when signing up for Medicare. It is important to be confident that you enroll correctly to ensure you have the necessary health coverage. Below, we tell you how to effectively apply for Medicare.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Read Also: Does Medicare Cover Bed Rails

Applying For Medicare Part D With Medicares Plan Finder

Before going to Medicares site, be sure youve finished all the prep work described in Enrolling in Medicare Part D: What youll need .

How Do Medicare Enrollees Get Medicare Part D Prescription Drug Coverage

All prescription drug coverage for Medicare beneficiaries is provided by private insurance companies, as Medicare A and B dont cover outpatient prescriptions. Most Medicare Advantage plans do include prescription drug coverage .

If youre enrolled in a Medicare Savings Account plan or Private Fee-for-Service plan that doesnt include Part D coverage, you have the option to enroll in a stand-alone Part D plan to supplement your coverage.

However, a stand-alone Medicare Part D plan cannot be used to supplement a regular Medicare Advantage plan that doesnt include prescription drug benefits. Medicare Advantage enrollees who want prescription drug benefits need to enroll in a Medicare Advantage plan that has integrated Part D coverage.

Also Check: How Long Does Medicare Pay For Home Health Care

When Can I Sign Up For Medicare Part D

There are three times during which you may be able to .

- Initial Enrollment Period Your 7-month Initial Enrollment Period begins 3 months before you turn 65 years old, includes the month of your birthday and continues for 3 more months. During this period, you may sign up for Medicare Part D. If you already have a Part D plan, you also may be able to switch to another Part D plan or drop your Part D plan to switch to a Medicare Advantage plan with prescription drug coverage.

- Annual Enrollment Period Also called the Fall Medicare Open Enrollment Period for Medicare Advantage and Prescription Drug Plans, this period lasts from October 15 to December 7 each year.During Medicare AEP, you may sign up for, disenroll or switch Medicare Part D plans.

- Special Enrollment Period Depending on your circumstances, you may qualify for a Special Enrollment Period at any time during the year. Some of the things that may qualify you for a Special Enrollment Period include moving to a new plan service area or losing creditable drug coverage through no fault of your own. A licensed insurance agent can help determine whether you are eligible for a Medicare Special Enrollment Period.

How To Apply For Medicare

Medicare enrollment is easier than ever. Once you meet eligibility requirements, you are ready to choose from a variety of plans in which to enroll. As we mentioned earlier, some beneficiaries can receive automatic enrollment, and some must apply manually.

There are three ways to apply for Medicare Part A and Part B:

If you have previously been a railroad employee, you can enroll in Medicare by contacting the Railroad Retirement Board, Monday through Friday, from 9:00 AM 3:30 PM at 1-877-772-5772.

Find Medicare Plans in 3 Easy Steps

We can help find the right Medicare plans for you today

Medicare applications generally take between 30-60 days to obtain approval.

Also Check: How To Find Out What My Medicare Number Is

What Medicare Part D Plans Cover

Medicare drug plans cover both generic and brand-name drugs. All plans must meet a standard level of coverage set by Medicare. This means they must all cover the same categories of drugs, such as asthma or high blood pressure medicines, but plans can choose which specific drugs are covered in each drug category.

Each Medicare Part D plan lists the drugs it covers in whats called a formulary. This list will likely include both brand-name and generic drugs and includes at least two drugs in the most commonly prescribed categories. A formulary may not include your specific medication but may include a similar option. Formularies change from year to year and even within the year, so its important to check regularly that the medicines you need are included in your Part D coverage. If they aren’t, check with your physician to see if an alternative drug might work for you.

You may also want to check the insurers you are considering for any restrictions they put on drug coverage. This may include prior authorization before a drug is prescribed, limits on the quantity of certain drugs and step therapy in which generic and lower cost brand-name drugs are required before the most expensive drug is used.

Signing Up For A Medigap Policy

To purchase a Medigap supplement insurance policy, you must first enroll in Medicare Part A and Part B.

Medigap policies are not required but enrolling in one can help you pay out-of-pocket costs, including deductibles, coinsurance and copayments.

The best time to enroll in a Medigap plan is when you are first eligible.

This is a six-month enrollment period that begins the month youre 65 and enrolled in Medicare Part B.

If you apply for Medigap coverage after this six-month window, private insurance companies may not sell you a policy if youre in poor health.

You can find a Medigap policy by using an online tool on the Medicare website, contacting your local SHIP or calling your State Insurance Department.

How to Sign Up for a Medigap Policy Online

Read Also: When Can A Person Born In 1957 Get Medicare

What A Standard Part D Plan Covers

No matter your Medicare Part D provider, the Department of Health and Human Services requires that your plan covers six protected classes of drugs, which include:

- Anticonvulsants. These drugs are commonly used to treat epillectic seizures.

- Antidepressants. These medications help treat depression, some anxiety disorders and some chronic pain conditions, as well as substance use disorders.

- Antineoplastics. These drugs are used to treat cancer.

- Antipsychotics. These medications help treat bipolar disorder, schizophrenia and other mental illnesses.

- Antiretrovirals. These drugs treat human immunodeficiency virus .

- Immunosuppressants. These medications treat a variety of conditions, such as rheumatoid arthritis and Crohns disease, as well as prevent organ rejection in transplant patients.

Medicare Part D plans come with a formulary, which is a list of specific medications that they will cover. Providers maintain the right to add or remove approved medications and change these formularies annually.

The most significant changes for formulariesas well as premiums and copaysare seen each new calendar year, says Reese. Thats why its imperative that you review your Part D plan yearly, especially if your medications have changed.

Compare Top Medicare Plans From Major Carriers

To compare Medicare plans available in your area, click Compare Plans or call 888-349-0361 to speak with a licensed insurance agent.

How To Enroll In The Various Medicare Plans

There are three types of Medicare plans that all have different ways of signing up. Each of these plans also has different enrollment periods. Delaying your Medicare Enrollment could result in various penalties and fees. Its helpful to set reminders for these important dates, especially when signing up for Medicare for the first time.

| Plan | |

|---|---|

|

|

It depends on how long you went without Part D |

You May Like: How Old Do You Have To Be To Have Medicare