What Are The Medicare Supplement Plan Rate Increases For Humana

The cost of your Supplement is subject to increase every year. Usually, the rate increase is about 3% each year.

Also, insurance companies increase the rate for entire states all at once. These increases are plan-specific so, Humana could increase Plan F by 5%, Plan G by 4%, and Plan N by 3%.

Sometimes, the rate will only go up a couple of dollars and other times the rates increase more. Working with an agent ensures you have access to different options when you need them.

Are There Any Costs Or Services Humana Medicare Supplement Insurance Doesnt Cover

Medicare supplement plans dont provide prescription drug coverage. To obtain prescription drug coverage, youll need to enroll in a Medicare Part D prescription drug plan.

As of January 1, 2020, plans that cover Part B deductibles can no longer be offered. This means you can enroll in plans C, F, and high-deductible F only if you were eligible for Medicare before 2020.

Most Humana plans dont cover excess charges on Part B healthcare services. That means if your physician or healthcare facility charges more than Medicare allows for a service, youll have to pay the excess charges on your own.

Do Humana Medigap Plans Include A Medicare Part D Plan

Humana Medicare Supplement plans do not include Medicare Part D prescription drug plans. This is true of all of the Supplement plans from the best Medicare Supplement insurance companies. If you want prescription drug coverage, you are going to need to buy a Medicare Part D drug plan separately. You can purchase your plan from Humana or any other company that offers them you do not have to buy your Supplement plan from the same company that you purchase your prescription drug plan from.

Additionally, be prepared that some other basic benefits such as hearing aids, vision care and more are not included. This is because these things are not covered by Original Medicare, and Medicare Supplements are designed to fill in the gaps. Many Medicare Advantage plans do have this type of coverage, though.

You May Like: Is Mutual Of Omaha A Good Medicare Supplement Company

How Do Plans Differ

Each lettered plan is standardized by the federal government to provide the exact same benefits. This means that one companys Plan F will provide the same benefits as another companys Plan F.

The main difference between two plans with the same lettered name is price.

Each insurance company charges different premiums for each plan.

Humana Part D Preferred Pharmacy

The well-known Humana Walmart Value Rx plan requires lower costs for prescriptions at Walmart pharmacies or the mail order program.

There are three basic Part D plans with Humana:

- Humana Basic Rx Plan has a $435 deductible on brand-name drugs. This plan would be great for someone with a few generic scripts.

- Humana Walmart Rx Plan offers a low monthly premium and low copays if you fill your prescriptions at Walmart or Sams Club.

- The Humana Preferred Rx Plan has a low copay amount for prescriptions filled at Walmart or Sams Club and slightly higher copays for prescriptions filled at other network pharmacies.

Read Also: What Does My Medicare Cover

Enrollment For Medigap Plan N

Enrollment begins the first day of the month you turn 65 and are covered under Medicare Part B and ends six months after your birthday month. Applying for benefits during this time is the most beneficial, as insurance companies are not permitted to use medical underwriting. That means you could get the lowest prices available.

Applying for benefits outside of the six-month time window could mean higher premiums or a denial of coverage due to your health.

What To Know Before Enrolling In Medicare Supplement Plan N

If you are interested in enrolling in Medicare Supplement Plan N, or any Medigap plan, there are five things you should know beforehand:

47333-HM-1121

Also Check: Does Medicare Coordinate With Auto Insurance

What Does Medicare Supplement Plan N Not Cover

Medigap Plan N does not cover the Medicare Part B deductible or excess charges, which are the difference in cost between what a health provider charges for a medical service and the Medicare-approved amount. Medicare Plan N will not cover the copay or coinsurance for doctors office and emergency room visits.

Human Medicare Supplement Coverage

If you are enrolled in Original Medicare , then you are likely aware that this program can come with a fair amount of out-of-pocket charges, such as copayments, coinsurance, and deductibles.

One of the best ways to help reign in these expenses is to own a Medicare Supplement insurance policy. This coverage also referred to simply as Medigap, helps to fill in Medicares coverage gaps.

Before moving forward with the purchase of a Medigap plan, though, it is recommended that you have a good understanding of the different coverage options that are available to you, as well as the history and financial strength of the underlying carrier.

Bluewave Insurance works with Humana and many other reputable companies like United American Medicare Supplement insurance company. We are independent and charge nothing for our services. Contact us at for a free quote comparison.

Recommended Reading: When Do Medicare Benefits Kick In

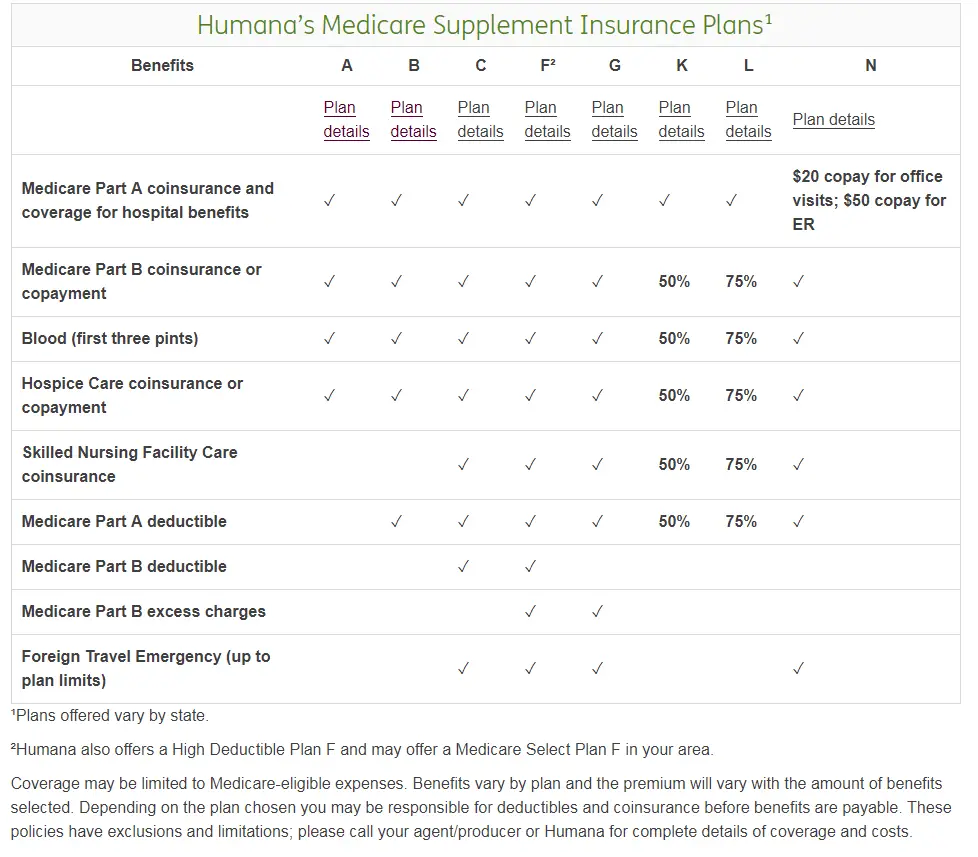

Humanas Medicare Supplement Benefits

When you purchase a Medicare Supplement insurance plan through Humana, you are allowed to choose any doctor, hospital, or clinic that accepts Medicare as payment for services. You can also get the following benefits:

- Portable Coverage The Medigap plans from Humana are portable, meaning that the coverage will follow you anywhere in the U.S. , and they are accepted anywhere that also accepts Medicare.

- Guaranteed Renewable Once you have qualified for a Humana Medicare Supplement plan, your insurability is guaranteed, even if you become ill or injured in the future.

- 30-Day Free Look Period If, after purchasing a Humana Medigap plan, you decide that you do not want the coverage, you will have 30 days to receive a full premium refund.

- Household Discount If another person who lives in your household also applies for a Humana Medigap plan, you can both save 5% on your monthly premium.

- Electronic Claims Handling Humana makes it easy for Medicare Supplement plan enrollees to file claims, as this can be done electronically through the companys website.

- ACH Discount As a Humana Medicare Supplement Insurance policyholder, you can save on your monthly premium by electing to make your future payments electronically through monthly bank drafts, or via a credit card.

If you have any questions or would like a free quote comparison, contact us at today!

What Does A Humana Medicare Supplement Plan Really Cost

Overall, the cost of Humana Medigap plans can range from $50 to $300 a month depending on the coverage you choose. The cost of Medigap varies more by the state than by carrier. Most top carriers have similar prices.

Further, you may pay more if you sign up outside your Medigap Open Enrollment Period. Also, Medigap can charge higher premiums to those with pre-existing conditions if they dont use their Open Enrollment window.

The best way to obtain an accurate quote is by using a professional insurance agent who specializes in Medicare.

You May Like: How To Find Out If I Have Medicare

Competition: Humana Vs Unitedhealthcare

Humana and UnitedHealthcare are the Medicare Advantage plans with the broadest geographical coverage 84% of counties have Humana options, 66% have UnitedHealthcare, and 60% have both. UnitedHealthcare is the nations largest health insurer, with more than 14% market share.

UnitedHealthcare also has an exclusive partnership with AARP, giving it a unique advantage in a trusted brand affiliation. UnitedHealthcare has slightly higher average Star Ratings, but both companies offer online tools or apps and multiple channels for customer support. UnitedHealthcare helps members choose a plan with customized recommendations and cost estimators.

In a head-to-head comparison, the difference may come down to specific quality ratings in your local area and cost, which vary depending on where you are.

| 3.50 |

Humana has deep roots in care for older Americans. They offer a wide range of Medicare plans in the broadest geography of any insurer. Not only one of the biggest Medicare plans, Humana is one of the highest-rated overall. Not all their subsidiaries score as well for quality or customer satisfaction, so verifying the ratings of your specific options is important.

They also offer a range of ways to sign up and interact with the plan. Humana offers many extra benefits along with health and wellness programs.

What Do I Need To Know When Comparing Plans

First, there are no provider networks with Medicare Supplement insurance plans. Plans can be used with any doctor or hospital that accepts Medicare. Second, the basic benefits offered by Plans A, B, C, F, G, K, L and N are the same from every insurance company. However, some companieslike Humanaalso offer additional benefits. Take some time to consider the differences is in the companies, the quality of service and the price.

Also Check: Should I Enroll In Medicare If I Have Employer Insurance

Humana Medicare Supplement Value Plans

Humana offers two versions of their Medicare supplement plans. The most popular is the Value Plan. Plans F, G, and N are all offered as Value Plans in most states. There is no difference in coverage between a Humana Value Plan and a Medigap plan with another company.

Humana is using the name Value to differentiate from the other Medigap product they offer referred to as Humana Healthy Living .

Humana Medicare Advantage Plans

Humana is one of the leaders in the Medicare Advantage market. In some areas, Part C plans have options that lower Part B premium costs.

Many of these plans have a $0 premium. Additionally, Humana offers Special Needs Plans to cater to those with chronic conditions.

Many Humana plans offer fitness programs such as SilverSneakers. Also, plans can include prescription drug coverage, as well as coverage for dental, vision, and hearing. Some plans with such benefits charge slightly higher premiums. Plan availability varies by location.

The maximum out-of-pocket amounts for Humana Advantage plans range depending on the policy you choose. Your deductibles and copays go toward this amount before the plan starts paying 100%, so keep this in mind when evaluating your options.

Don’t Miss: Does Medicare Cover New Patient Visit

Humana Group Medicare Advantage Base Plan

State Health Plan Medicare retirees have several options for health plan coverage. One of these options is the Humana Group Medicare Advantage PPO Base Plan *, which includes Medicare prescription drug coverage.

* The Humana Group Medicare Advantage Plans have a benefit value equivalent to a 90/10 plan.

Below are resources for members enrolled in the Humana Base Plan.

Humana Medigap Plan K

Medigap Plans K, L and N cover many of the same benefits as the plans outlined above but with cost-sharing included. This means that instead of 100 percent coverage for the Part A deductible, for instance, you might be responsible for half of the cost. The tradeoff is a lower premium and an out-of-pocket cap . Medigap Plan K covers:

- Medicare Part A coinsurance and coverage for hospital benefits

- 50% of Medicare Part B coinsurance or copayments

- 50% of coinsurance or copayments for hospice care

- 50% of the first three pints of blood in a medical procedure

- 50% of Medicare Part A deductible

- 50% of coinsurance for skilled nursing facility care

Plan K offers the same peace of mind that many supplemental plans afford, letting you off the hook for a portion of your out-of-pocket expenses but without the higher price tag of more comprehensive plans. Under Plan K, youll also have an out-of-pocket cap that keeps costs in check. In 2022, the out-of-pocket cap for a Humana Medigap Plan K policy is $6,620. This cap increases each year based on inflation. The 65-year-old woman in Lexington County would have paid about $69 a month for this coverage in 2018. Humana also offers a Plan K with dental and vision, which cost about $80 a month in 2018.

Don’t Miss: Is A Walk In Tub Covered By Medicare

About Medicare Supplement Plans

Medigap plans are standardized by the federal government. This means that plans of the same letter offer the same benefits, no matter who you buy it from. But keep in mind that insurance companies are allowed to offer additional benefits, so compare plans carefully before you purchase a policy. You are eligible to purchase a Medicare supplement insurance plan if you are 65 years old or older and enrolled in Medicare Part B. If you are under 65 and disabled, you will likely be limited as to which Medigap plan you can purchase.

There are 10 Medigap plan options in total. But we are going to focus on Medicare Supplement Plan N.

Humana Medigap Plan G

Medigap Plan G covers everything that Medigap Plan F covers, minus the Medicare Part B deductible. Other than this exception, Plan G mirrors Plan F, making it a good choice for people who will need a lot of care but dont mind paying the Part B deductible. Medigap Plan G covers:

- Medicare Part A coinsurance and coverage for hospital benefits

- Medicare Part B coinsurance or copayments

- Coinsurance or copayments for hospice care

- The first three pints of blood in a medical procedure

- Medicare Part A deductible

- Coinsurance for skilled nursing facility care

- Foreign travel emergencies up to plan limits

- Medicare Part B excess charges

You might wonder why someone would choose Plan G over Plan F since theyre almost the same, but cost can be a factor. The price of any Medigap plan will vary based on where you live, and some people may not have access to all or any supplemental policies from a specific company. But using the plan options for our 65-year-old South Carolina woman, Plan G cost about $25 less per month than Plan F in 2018 depending on the plan she chose. For her, a Medigap Plan G policy from Humana would have run about $123 a month.

Don’t Miss: What Is The Average Cost Of Medicare Supplement Plan F

Medicare Supplement Plans Must Adhere To State And Federal Laws

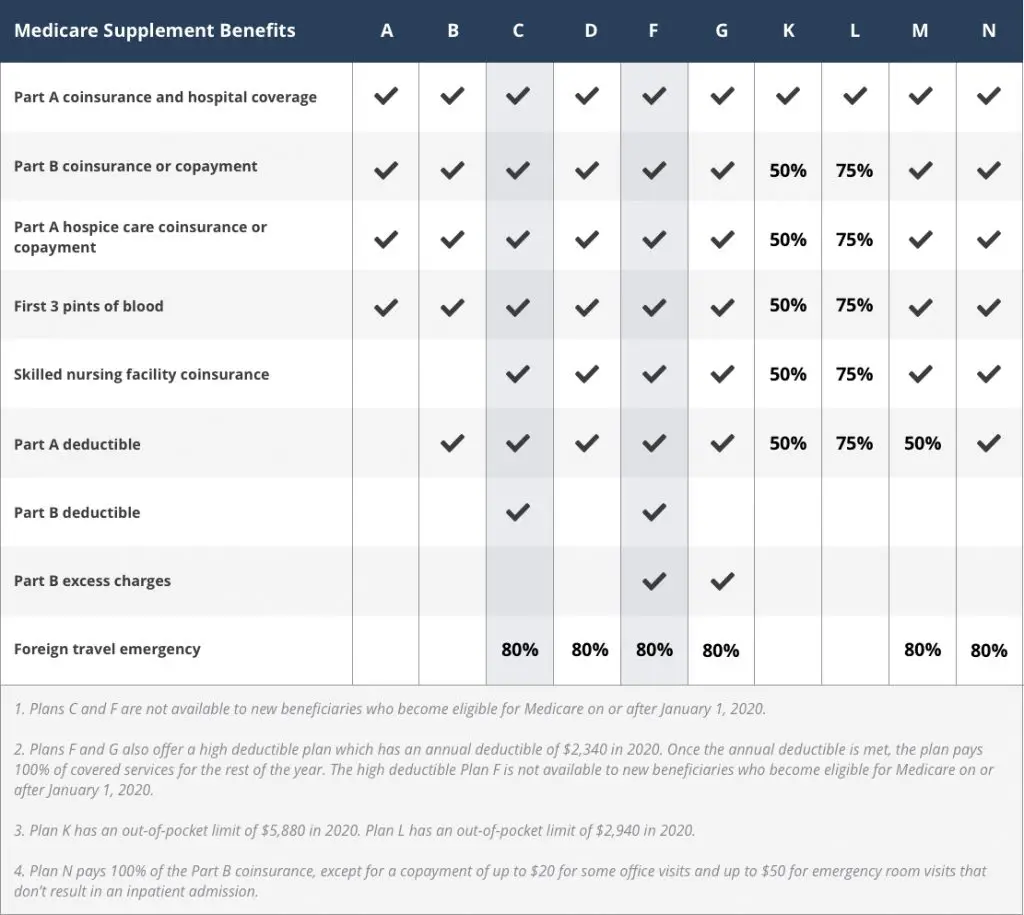

Every Medicare Supplement plan must follow strict federal and state laws. The federal government has 10 standardized Medicare Supplement plans. Below is a chart from the Centers for Medicare and Medicaid Services describing what these plans might cover:

nsurance companies can only sell you a standardized Medicare policy. These policies must be clearly identified as Medicare Supplement insurance.

These standardized policies offer the same primary benefits, along with additional benefits to help you meet your particular health care requirements.

What Do Humana Medicare Advantage Plans Offer

Humana Medicare Advantage Plans offer private insurance to Medicare beneficiaries. As with all Medicare Advantage plans, these plans offer the same coverage that Original Medicare Parts A and B provide, but may also come with additional benefits, like dental and vision care as well as a variety of non-medical perks. Read on for more about Humana’s Medicare Advantage offerings.

Also Check: When Can You Have Medicare

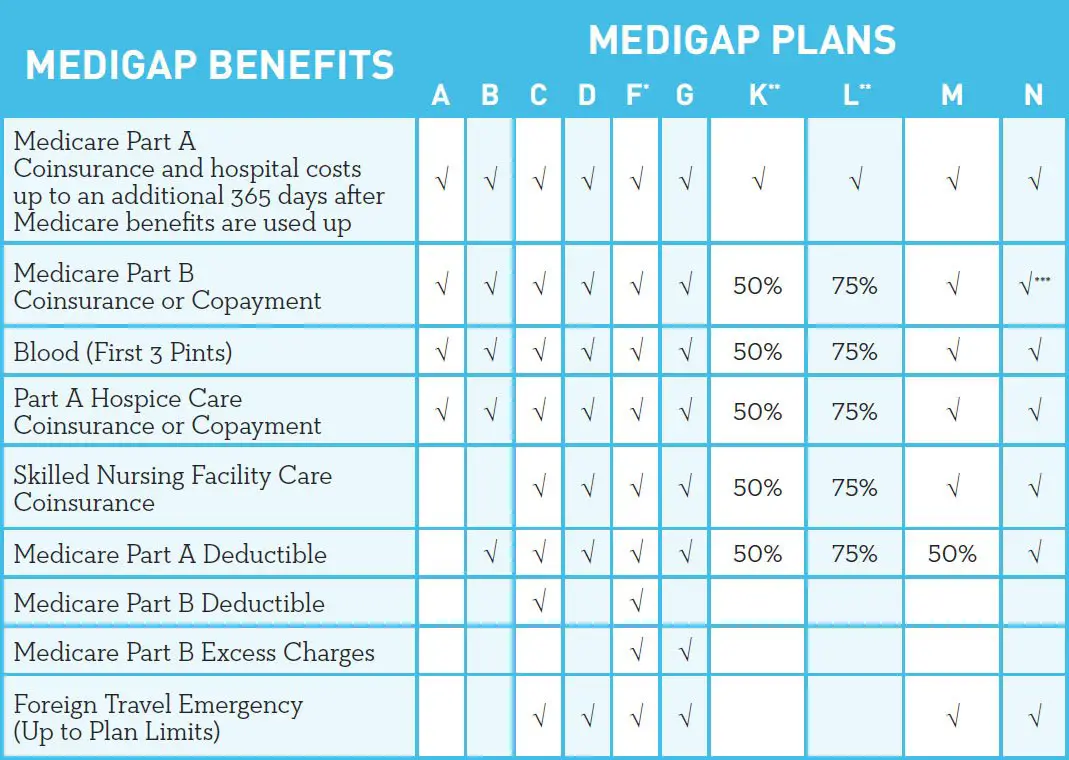

How Does Medicare Supplement Plan N Compare To Other Medigap Plans

Medicare Supplement Plan N provides more coverage than Plans K and L. For example, it covers 100% of the Medicare Part B coinsurance and copayments, whereas K and L only pay 50% and 75%, respectively. The same is true with the Medicare Part A deductible.

Additionally, the only out-of-pocket expenses beyond the monthly premium are a $20 copay for office visits and a $50 copay for a trip to the ER.

The chart below will help you make comparisons.

What Does Medicare Supplement Plan N Cover

Medigap Plan N has coverage for four basic areas:

Additionally, Medicare Supplement Plan N pays for skilled nursing facility care and the Medicare Part A deductible for hospitalization.

Also Check: Does Medicare Cover Any Dental Surgery

Humana Medicare Supplement Plan G

Medicare Supplement Plan G is currently the most popular Medigap plan because it gives you the best overall deal. It is common for eligible beneficiaries to save at least $250 per year by selecting Plan G instead of Plan F.

For instance, if a 70-year-old man in Arizona doesnt use tobacco and chooses to go with Plan F from Humana, hell be paying about $182 in premiums each month. Yet, the same beneficiarys monthly premium for Humanas Medicare Supplement Plan G in Arizona would be around $154 per month.

In most cases including this one, where the annual difference is to the tune of $336 the savings surpass the cost of the Part B deductible, which is the only cost Plan F covers that Plan G doesnt. Meaning, it could be more financially responsible to choose Plan G over Plan F.