What You Need To Know About Medicare Supplement Insurance Plans F G And N

Summary:

Medicare Supplement insurance Plans F, G, and N are three of the standardized Medicare Supplement insurance plans offered in most states.

Please note: Medicare Supplement Plan F wonât be sold to people who qualified for Medicare on or after January 1, 2020 . You wonât have to give up your Plan F or Plan C if you already have one.

Medicare Supplement insurance plans are offered by private insurance companies and can help you pay for out-of-pocket costs for services covered under Original Medicare . Theyâre standardized in most states, meaning that different insurance companies must offer the same basic benefits for plans of the same letter. Plans F, G and N are three of the most comprehensive plans.

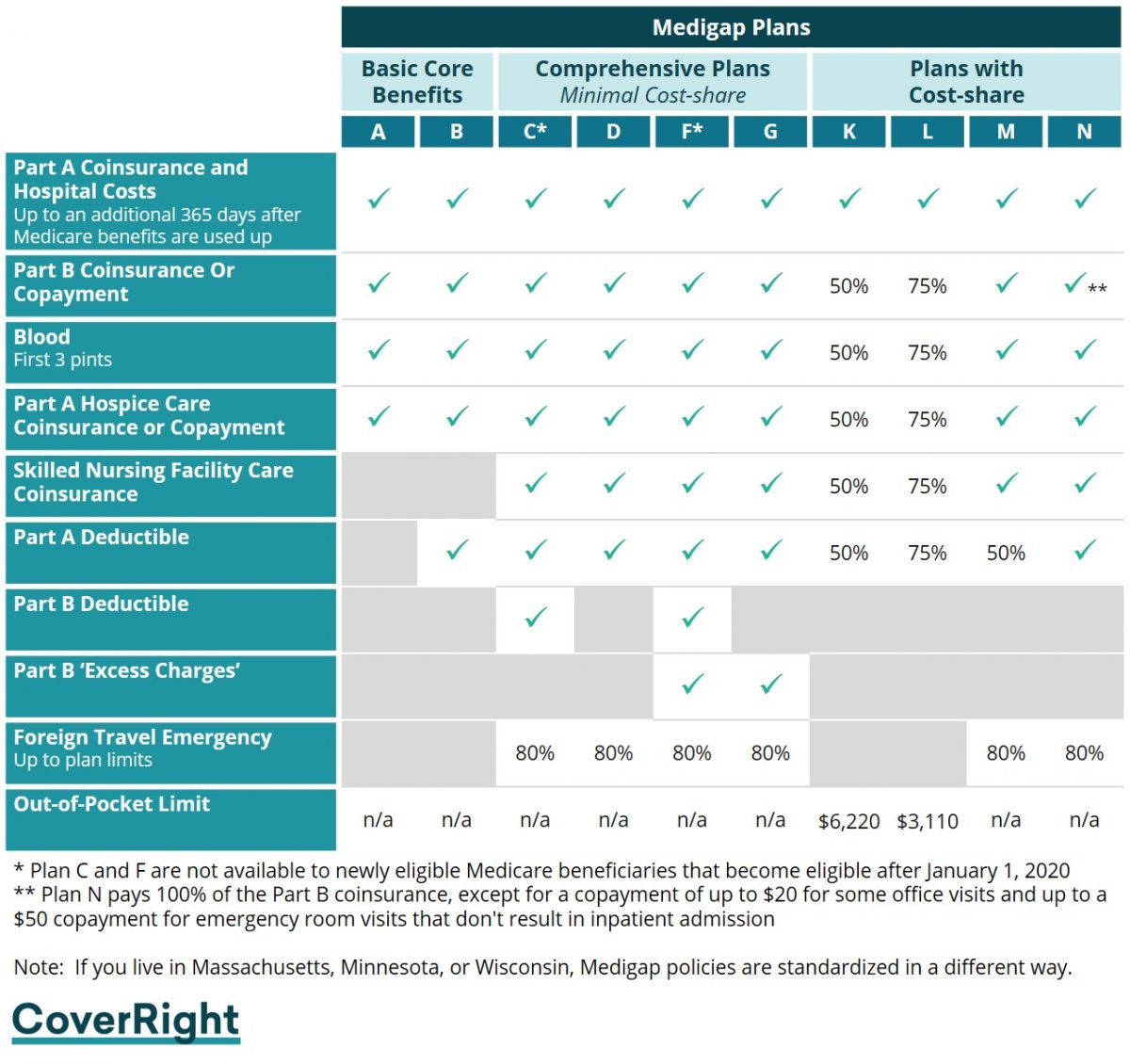

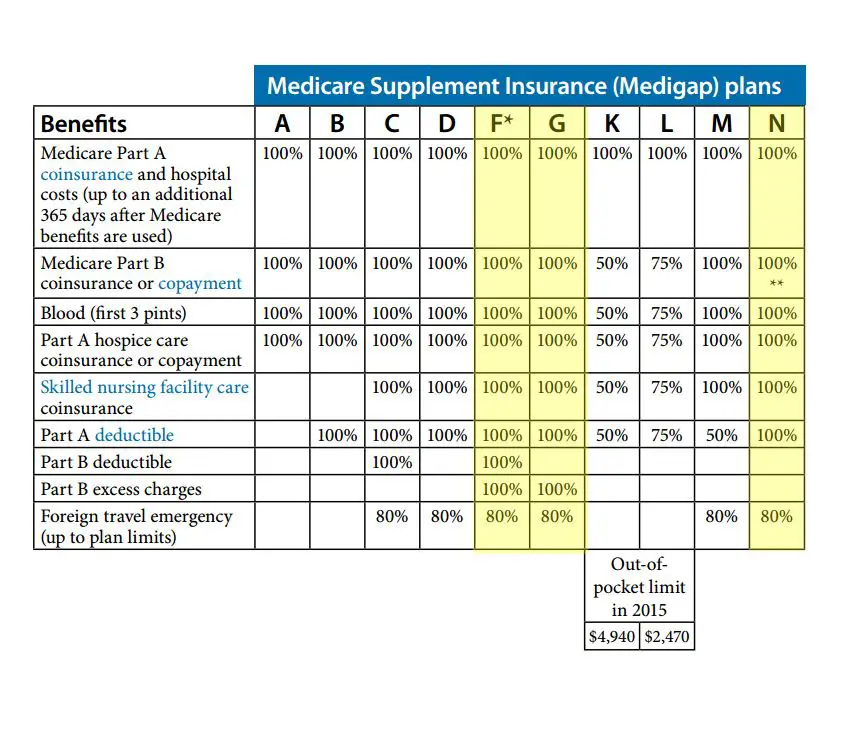

The 10 Standard Medicare Supplement Insurance Plans

There are 10 Medicare supplement insurance plans. Each plan is labeled with a letter of the alphabet and has a different combination of benefits. Plan F has a high-deductible option. Plans K, L, M, and N have a different cost-sharing component.

Every company must offer Plan A. If they offer other plans, they must offer Plan C or Plan F.

What Are The Benefits Of A Medicare Supplement Plan

One of the primary benefits of Medicare Supplement plans is that they help mitigate the costs of health care not covered by Original Medicare, such as copayments, coinsurance and deductibles. Any Medicare beneficiary whos concerned about incurring potentially high out-of-pocket costs should consider Medigap plans and how they can help cover these expenses.

Some Medicare Supplement plans also provide coverage for services that Original Medicare doesnt cover, such as medical care needed during travel outside the U.S. Medicare enrollees who enjoy frequent travel often enjoy the additional layer of protection.

Also Check: How Do I Get A Second Opinion With Medicare

Enrolling In A Medigap Plan

If you enroll in Medigap during your Medigap open enrollment period , insurance companies cannot refuse to sell you a Medigap policy or charge you more for a plan based on your health history.

Some people who are under 65 are also eligible for Medicare and Medigap, such as people with End-Stage Renal Disease or other qualifying disabilities. However, you dont have the same blanket guaranteed-issue rights that pertain to people over 65.

The easiest way to compare Medigap plans and rates in your area is with the help of a licensed insurance agent. Agents can answer questions and help you find the right plan for your needs.

Best In Educational Information: Cigna

Cigna

The best thing about Cigna’s Medicare Supplement Plan F is how it breaks down the costs and benefits of the program. Nothing requires reading multiple pages or an in-depth understanding of health careall the services Medicare and Plan F cover are broken into three categories of cost: what Medicare pays, what Plan F pays, and what you pay.

In most cases, you don’t pay anything. For example, for hospitalization up through the first 60 days, Medicare covers everything except $1,556. Plan F then covers that $1,556, so you pay nothing. Cigna makes it easy to see exactly which gaps Plan F pays for.

-

Easily understandable breakdown of costs

-

Plan information is explained in simple terms

-

Only additional benefit is a 24-hour health hotline staffed by nurses

-

Long process to get estimates, requiring contact information and agreement to be contacted by Cigna representatives

Cigna wants all of its customers to be knowledgeable about and comfortable with what exactly they’re signing up for with a Medicare Plan F plan, whether it’s a regular or a high-deductible option. The differences between the two plansthe deductible costs and the difference in premiumsand what each cover are clearly laid out, so you can make an informed decision.

Recommended Reading: Where Do I Apply For Medicare Card

When And Where To Buy Medicare Plan F

You can buy Medicare Plan F after enrolling in Medicare Part B, assuming you are at least 65 years old. Once you enroll in Part B, you have six months to buy a Medigap policy. That six-month period is known as your Medigap Open Enrollment Period. During that period, you have guaranteed issue rights that ensure the insurance company accepts you into the plan of your choice without medical underwriting.

You will get the lowest Plan F monthly premiums when enrolling during your Open Enrollment Period. Outside of that period, the insurance company will ask questions regarding your health and may deny you coverage.

Medigap plans are sold through private insurance companies. You can work with a licensed insurance agent to consider your options and calculate all possible Medigap Plan F costs.

Best Medicare Supplement Plans In Kentucky

There is no best plan when it comes to Medigap insurance because everyones situation is different. For most people, Medicare Plan G or Plan N will likely suit their needs for relatively low premiums. We can help you decide which plan is best for you.

Medicare Supplement Plan G One low deductible, then 100% coverage. Higher premiums than Plan N

Medicare Supplement Plan N Lower monthly premiums, small out-of-pocket costs such as co-pays, and possibly Medicare Part B excess charges

The difference in monthly premiums between Medicare Plan N and G in Kentucky can often be up to $30 per month!

If you are relatively healthy and dont visit your doctor often, but still want great coverage, Medicare Plan N is a fantastic option.

With our website, you can check the cost between Plan G and Plan N in your area to see how much you can save.

Also Check: Will Medicare Pay For A Hospital Bed At Home

What Is The Best Medicare Supplement Insurance Plan In 2022

There isn’t one best Medigap plan. A specific Medigap plan might work for you if it offers coverage that works for your needs and comes with premiums that fit your budget.

-

Medigap Plan F is the most popular Medicare Supplement Insurance plan. 49 percent of all Medigap beneficiaries are enrolled in Plan F.2

Plan F covers more standardized out-of-pocket Medicare costs than any other Medigap plan. In fact, Plan F covers all 9 of the standardized Medigap benefits a plan may offer.

The average Plan F premium in 2022 is $172.75per month.1

-

Medigap Plan G is the second most popular Medigap plan, and it is quickly growing in popularity. Plan G enrollment spiked 39 percent in recent years.2

Medigap Plan G covers all of the same out-of-pocket Medicare costs than Plan F covers, except for the Medicare Part B deductible. The 2022 Part B deductible is $233 per year .

This means that if you find a Medigap Plan G option that costs only $19.41 more per month than Plan F, it might be a better value over the course of the year than Plan F if you meet the Part B deductible.

The average Medigap Plan G premium in 2022 is $132.83 per month.1

Your unique health coverage needs and budget are important factors to consider as you shop for Medicare Supplement Insurance plans.

The potential cost predictability a Medigap plan can bring may be able to help you better predict your monthly health care spending.

Is A Medicare Supplement Plan Worth It

Yes. A Medicare Supplement plan can help cover what Medicare cantfrom prescription medicine to ER visits to extended stays in the hospital. Some even cover nursing care or facility stays. Depending on the plan you choose, you may have copays, for example, or extremely limited doctor visits. Even getting one ER visit covered can be a huge benefit financially.

Recommended Reading: What Is Medicare Premium Assistance

How Do I Pick A Comprehensive Medicare Supplement Plan

Although at first glance, selecting a Medicare Supplement plan that is right for you may seem daunting. With so many companies and plans to choose from, many seniors feel frustrated trying to find the best plan at affordable prices.

We recommend using this article and the FAQs provided to develop a short list of companies and then call one of our insurance professionals to help you confirm your selection based on your circumstances and budget.

Have Questions?

We can Help!

Talk to one of our licensed Medicare supplement agents about the options available to you in your area.

Medicare Advantage Vs Medicare Supplement

Medicare Advantage plans serve as a substitute for Original Medicare, providing that same coverage plus additional benefits like prescription drugs coverage . Meanwhile, Medicare Supplement plans, or Medigap plans, are sold by private insurance companies to people enrolled in Original Medicare to help fill the gaps of that coverage.

The 10 types of Medigap plans provide standardized coverage to beneficiaries nationwide and help pay for things like deductibles, coinsurance and copays. Because plan coverages are standardized, only monthly premium rates vary from provider to provider. Its also important to note that Medigap policies dont cover prescription drugs. A person enrolled in Original Medicare who wants prescription drug coverage needs to purchase a separate Medicare Part D plan in addition to any Medicare Supplement plan.

Meanwhile, Medicare Advantage policies are only standardized in that they must provide the same benefits of Original Medicare, as the plans serve as a direct substitute. After this threshold is met, private insurance providers can add any number of benefits and services to a planprescription drugs, dental care, vision care and moreto make them more comprehensive . Monthly premium rates for Medicare Advantage plans tend to vary dramatically based on location and the list of benefits provided.

Also Check: How Much Does Medicare Pay For Diabetic Test Strips

Medicare Supplement Plan N Offers Lower Monthly Premiums

Medicare Supplement Plan G and N are nearly identical, except that Plan N doesnt cover Medicare Plan B excess charges. Plan N has $20 copayments for each physician visit and a $50 copay for each emergency room visit that does not result in hospitalization.

Medicare Supplement Plan N covers:

- Medicare Part A deductible.

- Medicare Part A coinsurance and hospital expenses up to an additional 365 days.

- Medicare Part A hospice care copayment and coinsurance.

- Coinsurance for a skilled nursing facility.

- Medicare Part B copayments and coinsurance.

- 80% of foreign travel exchange.

- Three pints of blood.

Plan N doesnt offer a high-deductible plan option. The standard Plan N premium, depending on sex, age, and tobacco use, is between $77 $542, or more, a month in 2022. Plan Ns monthly premium can be lower than Medicare Supplement Plan Gs standard premium , but it will have higher copays.

Below is an example of the monthly premium cost for someone living in the 75001 zip code. Remember, Medicare is local to the county level. Your results may differ based on your zip code/county, sex, age, and tobacco use.

The Plan N Monthly Premium Depending on Age, Sex, and Tobacco Use

| 65-year-old woman, non-smoker |

Source: 2020 Medicare Supplement Loss Ratios, National Association of Insurance Commissioners.

Why Medicare Supplement Sales

There are a ton of prospects in the Medicare market. Ten thousand seniors turn 65 every single day that’s a lot of prospects that need Medicare Supplements.

When we look at a person that is going onto Medicare, it’s pretty confusing and overwhelming. Seniors get a ton of Medicare-related mail. It’s truly information overload.

It’s a serious sense of relief when that senior has someone that can explain how Medicare works.

These prospects are very overwhelmed when they’re trying to figure it out on their own, and you don’t have to come up with some slick sales pitch to get them to buy from you. You’re already a tremendous asset, and your help is truly wanted and appreciated.

A lot of prospects have retired from large companies that no longer pay for their post-65 health insurance. Many companies now offer a reimbursement so that the retirees can go out and buy their own insurance. It works great, but it leaves the retiree with a lot questions, and they need our help.

In sum, there are three great reasons to get into the Medicare Supplement market:

You May Like: Does Medicare Cover Dental Bridges

Best For Extra Benefits: Anthem Medicare Supplement Insurance

Service area: 16 states.

Medigap plans offered: A, F, G and N .

Standout feature: In some locations, Anthem offers the option to add on coverage with cost sharing for services not included in standard Medigap plan types. For example, Anthem Extras packages can cover some costs for dental cleanings, dental procedures and eye exams, plus an allowance for glasses frames or contact lenses.

Anthem is the second-largest health insurer in the U.S. It offers Medicare Supplement Insurance both as part of the Blue Cross Blue Shield collective and on its own. Anthems optional dental and vision coverage add-ons are rare among competitors. It offers only a few Medigap plan types, though, and serves relatively few states.

Pros

-

Anthem offers several tiers of dental and vision coverage to mix and match with Medigap plans.

-

Some members can save on premiums with discounts based on your household and payment methods.

-

Anthem offers extra perks for a variety of fitness, health and wellness products and services.

Cons

-

Only a few Medigap plan types are available, although they are the most popular ones.

-

Medigap policies are available in only about one-third of states.

-

Anthem spends more on overhead and less on member benefits than other major Medigap insurers.

» MORE: Read our review of Anthem Medicare Supplement Insurance

Plan M And Plan N: Best Medicare Supplement Plans For Travelers

One of the health care costs that can be covered by some Medicare Supplement Insurance plans is foreign travel emergency care, or emergency care received outside of the U.S. or U.S. territories.

There are 6 Medigap plans that will pay for 80% of your foreign travel emergency care costs. Two of those plans are Plan M and Plan N, which provide coverage of foreign emergency care while typically offering lower monthly premiums than the other types of Medigap plans that also offer this coverage.

Plus, these plans also offer coverage for Medicare Part B excess charges, which allows members to see a greater variety of health care providers within the U.S. and U.S. territories.

You May Like: Does Medicare Offer Life Insurance

Best Medicare Supplement Plans For 2022

Plan G is the most comprehensive Medigap policy in 2022, but it’s also one of the more expensive Medicare Supplement plans, averaging $190 per month.

Find Cheap Medicare Plans in Your Area

Medicare Supplement policies, also called Medigap, can prevent unexpected medical bills. Without a Medigap plan, Original Medicare policyholders will find tracking deductibles can be cumbersome and paying for regular medical treatment out of pocket can be expensive. The best Medicare Supplement plan for you will depend on your health and budget.

To get a Medicare quote over the phone, call 855-915-0881 TTY 711 to speak with a licensed agent today!

Agents available Monday-Friday 9am-8pm EST

Applying For A Medicare Supplement Insurance Plan

The best time to enroll in a Medicare Supplement plan is during your Medicare Supplement Open Enrollment period because your acceptance is guaranteed. It starts on the first day of the month in which you’re both age 65 or older and enrolled in Medicare Part B. Some states have additional Open Enrollment periods and Guaranteed Issue requirements.

If you apply outside of Open Enrollment or Guaranteed Issue periods, you may be denied coverage or charged more based on your health history. This does not apply to residents of Connecticut and New York where Open Enrollment and Guaranteed Issue is ongoing and Medicare supplement plans are guaranteed available.

Scroll for Important Disclosures

UnitedHealthcare pays royalty fees to AARP for the use of its intellectual property. These fees are used for the general purposes of AARP. AARP and its affiliates are not insurers. AARP does not employ or endorse agents, brokers or producers.

AARP encourages you to consider your needs when selecting products and does not make product recommendations for individuals.

Please note that each insurer has sole financial responsibility for its products.

AARP® Medicare Supplement Insurance Plans

AARP endorses the AARP Medicare Supplement Insurance Plans, insured by UnitedHealthcare.

In some states, plans may be available to persons under age 65 who are eligible for Medicare by reason of disability or End-Stage Renal Disease.

Don’t Miss: Do I Have To Use Medicare When I Turn 65

Medicare Plan N Cost In Kentucky

Medicare Plan N rates in Kentucky range from $72 per month up to around $150, depending on different factors such as age, zip code, tobacco use, gender, and whether any household discounts apply.

Using our FREE quote engine by clicking the orange button below, you can check the rates and compare the cost between Medicare Plan G and N to see how much you can save.

Getting Medicare Supplement Leads

Finally, if you want to sell Medicare Supplements, you obviously need some prospects to sell them to.

Here are the most popular ways to get Medicare Supplement leads:

- Sell to your existing book

Ideally, you would only have to actively prospect for the first few years. Once your established, you’ll hopefully be working solely off of referrals. Which leads us to an important point here always ask for referrals!

No matter how difficult or awkward it feels, ask every single client if they have any family members or friends who would benefit from your services. That’s how you can grow organically and quickly without spending a ton of time and money on lead generation.

Recommended Reading: When You Turn 65 Is Medicare Free

Best For Ease Of Use: Mutual Of Omaha

Mutual of Omaha

Mutual of Omaha is the best company to go with for a quick and painless experience signing up for Medicare Supplement Plan F. It takes hardly any time or effort to get an array of estimates for Plan F and other Medicare Supplement plans.

-

Smooth, clean website with easy-to-follow instructions

-

Detailed information not required to get an estimate

-

Rates increase based on age

Mutual of Omaha gets to the point. All of the different Medicare supplemental insurance coverage options, including Plan F, are listed on the same page when you start your estimate process. All it needs to know is your gender, birth date, and ZIP code before generating an estimate for you.