Qualified Medicare Beneficiary Program

To be eligible for QMB coverage, a person must:

be entitled to benefits under Medicare Part A and

meet income and resources requirements in 42 U.S.C. §1396d.

A person is not eligible for QMB coverage if the person:

is in the custody of penal authorities as defined in 42 C.F.R. §411.4 or

is over 20 years of age and under 65 years of age and resides in an institution for mental diseases.

A person’s QMB eligibility begins on the first day of the month after the month the person is certified for QMB benefits.

A person with QMB coverage is not eligible for three months prior medical coverage.

Medicare Savings Programs: How It Works

Those with limited income and resources may qualify for premium assistance through Medicare Savings Programs . Each state manages MSP funds and decides who qualifies. Programs can pay for all, or just some, of your Medicare out-of-pocket expenses, which includes premiums. MSPs are primarily designed for Original Medicare plan enrollees, so all states must help eligible citizens with premium payments. However, states can decide whether to help pay Medicare Advantage premiums . When it comes to Medicare Part D, people who qualify for certain MSPs can receive help with premium payments through a separate program called Extra Help.

Where Can Medicare Beneficiaries Get Help In Nebraska

Nebraska State Health and Insurance Assistance Program

Free volunteer Medicare counseling is available by contacting the Nebraska State Health and Insurance Assistance Program at 234-7119.

The SHIP can help beneficiaries enroll in Medicare, compare and change Medicare Advantage and Part D plans, and answer questions about state Medigap protections. SHIP counselors may also be able to offer referrals to local agencies for services like home care and long-term care. The SHIPs website has more information on the services it offers.

Elder Law Attorneys

Elder law attorneys can help individuals plan for Medicaid long-term care benefits. The National Academy of Elder Law Attorneys has a search feature beneficiaries can use to find an elder attorney locally.

Nebraska Area Agencies on Aging

In Nebraska, Area Agencies on Aging can provide information about services to help with aging or living with a disability, and can help with planning for long-term care. This is a list of AAAs in Nebraska.

Also Check: How Much Does Medicare Pay For Hospice

Related Training & Materials

Frequently Asked Questions about Medicare Part A and B “Buy-in” : The main policy questions, & responses, submitted to CMS to date on the updated Manual for State Payment of Medicare Premiums released on September 8, 2020.

Five Key Policy Topics From the Updated Manual on State Payment of Medicare Premiums: CMS designed this webinar for state policy staff to introduce five key policy topics addressed in the updated Manual for State Payment of Medicare Premiums released on September 8, 2020.

Overview of the CMS State Buy-In File Exchange: A webinar, with associated slides, available as a resource to support states moving to daily exchange submission.

Extra Help To Pay For Medicare Prescription Drug Costs

Extra Help is a Medicare program to help people with limited income and resources pay Medicare prescription drug costs. You may qualify for Extra Help if your yearly income and resources are below these limits in 2021:

- Single person – yearly income less than $19,320 and less than $13,290 in other resources per year

You may qualify even if you have a higher income . Resources include money in a checking or savings account, stocks, bonds, mutual funds, and Individual RetirementAccounts . Resources dont include your home, car, household items, burial plot, up to $1,500 for burial expenses , or life insurance policies.

If you qualify for Extra Help and join a Medicare drug plan, you’ll:

- Get help paying your Medicare drug plan’s costs.

- Have no late enrollment penalty.

You automatically qualify and will receive Extra Help if you have Medicare and meet any of these conditions:

- You have full Medicaid coverage.

- You get help from your state Medicaid program paying your Part B premiums .

- You get Supplemental Security Income benefits.

Drug costs in 2021 for people who qualify for Extra Help will be no more than $3.70 for each generic drug and $9.20 for each brand-name drug.

Recommended Reading: Does Medicare Pay For Maintenance Chiropractic Care

Is There Help For Me If I Cant Afford Medicares Premiums

Medicare Savings Programs can pay Medicare Part A and Medicare Part B premiums, deductibles, copays, and coinsurance for enrollees with limited income and limited assets.

Reviewed by our health policy panel.

Q: Is there help for me if I cant afford Medicares premiums?

A: Yes. Medicare Savings Programs can help with premiums and out-of-pocket costs.

Where Can I Apply For Medicaid In Missouri

Medicaid is administered by the Department of Social Services in Missouri. You can use this website to apply for Medicaid ABD or an MSP in Missouri.

Josh Schultz has a strong background in Medicare and the Affordable Care Act. He coordinated a Medicare ombudsman contract at the Medicare Rights Center in New York City, and represented clients in extensive Medicare claims and appeals. In addition to non-profit work, Josh helped implement federal and state health insurance exchanges at the technology firm hCentive. He has also held consulting roles, including at Sachs Policy Group, where he worked on Medicaid and Medicare related client projects.

Also Check: What Is Medicare Part G

What Are The Income And Resources Limits For Medicare Savings Programs

Your income and resources are some of the factors that Medicaid uses to determine if you qualify for help with Medicare premiums. MSPs have different monthly income limits, and most states have the same limits. Alaska and Hawaii are the only two states that have different income limits. Three of the four MSPs have the same resources limits, and these limits are the same for all states, including Alaska and Hawaii. If you earn equal to or less than these limits, then you may qualify for assistance.

| Program Name |

|---|

| Items that cannot be easily converted to cash such as furniture and jewelry | |

| Help from others to pay household expenses | Burial plot and burial funds valued up to $1,500 for individuals and $3,000 for couples |

| Earned income tax credit payments | Life insurance that has less than $1,500 in cash value |

Learn More About Medicare

Join our email series to receive your free Medicare guide and the latest information about Medicare and Medicare Advantage.

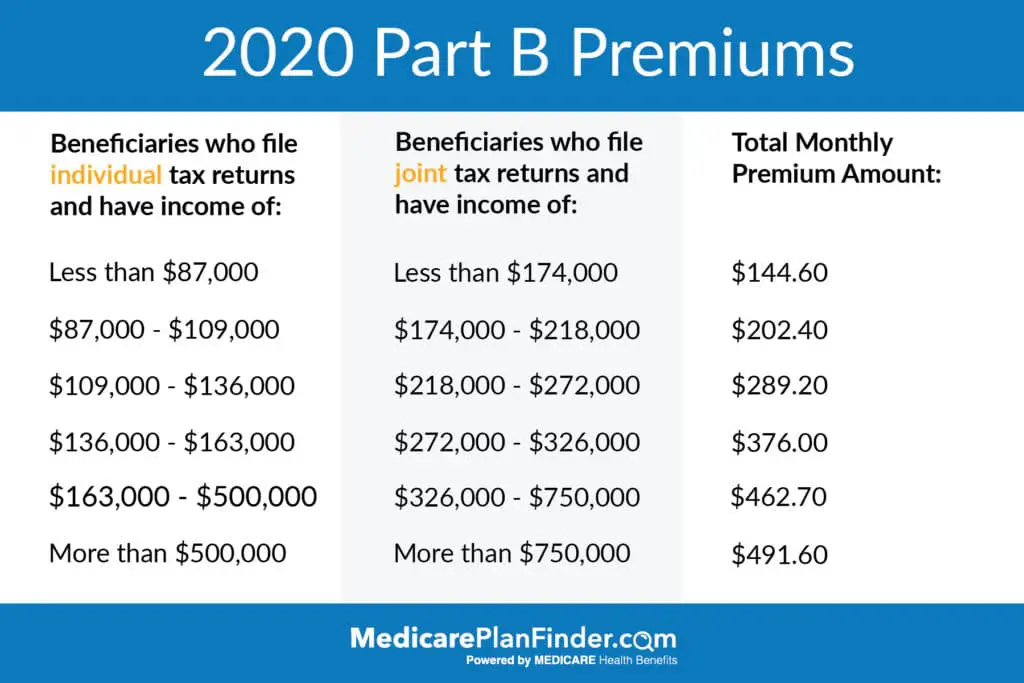

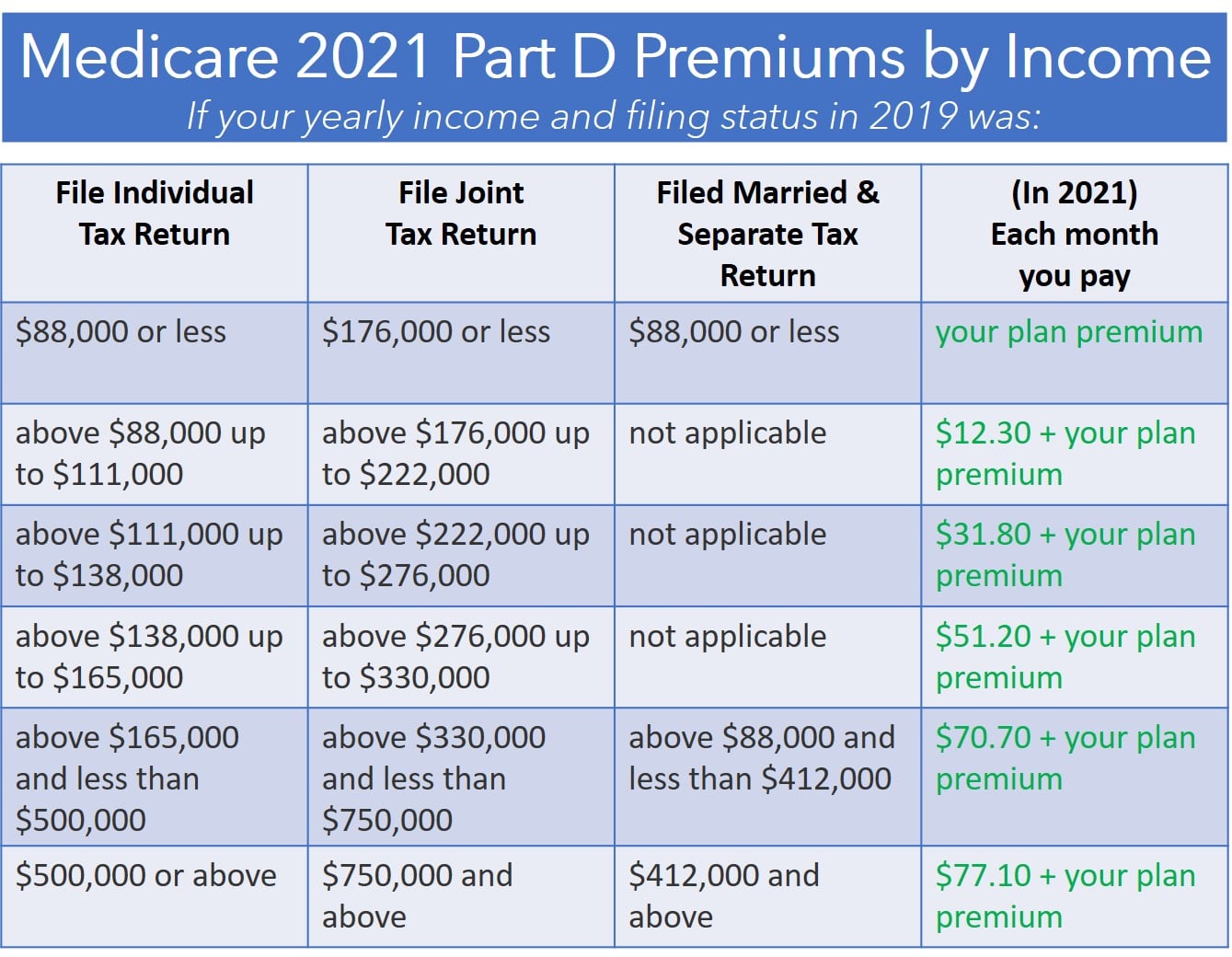

|

More than or equal to $500,000 |

More than or equal to $750,000 |

More than or equal to $412,000 |

$504.90 |

There are several Medicare Savings Programs in place for qualified individuals who may have difficulty paying their Part B premium.

Medicare Part B includes several other costs in addition to monthly premiums. The 2021 Part B deductible is $203 per year.

After you meet your deductible, you typically pay 20 percent of the Medicare-approved amount for qualified Medicare Part B services and devices. Medicare typically pays the other 80 percent of the cost, no matter what your income level may be.

You May Like: What Is The Annual Deductible For Medicare

Contact Your Local State Health Insurance Assistance Program

Based on the information you provided, you do not appear to be eligible for Medicare cost-saving programs.

Each state offers a State Health Insurance Assistance Program , partly funded by the federal government, to give you free counseling and assistance. A SHIP counselor may be available by phone or in person.

Visit www.shiptacenter.org to find your local SHIP office.

Medicare Savings Programs To Help Pay For Medicare Health Care Costs

You can get help from your state paying your Medicare premiums. In some cases, Medicare Savings Programs may also pay Medicare Part A and Medicare Part B deductibles, coinsurance, and copayments if you meet certain conditions. There are four kinds of Medicare Savings Programs:

- Qualified Medicare Beneficiary Program – helps pay for Part A and/or Part B premiums, and in addition Medicare providers aren’t allowed to bill you for services and items Medicare covers like deductibles, coinsurance, and copayments.

- Specified Low-Income Medicare Beneficiary Program – helps pay for Part B premiums.

- Qualified Individual Program – helps pay for Part B premiums and funding for this program is limited.

- Qualified Disabled and Working Individuals Program – helps pay for Part A premiums only.

If you qualify for a QMB, SLMB, or QI program, you automatically qualify to get Extra Help paying for Medicare prescription drug coverage.

Read Also: How Much Can I Make On Medicare

Medicare Premium Assistance Program

This program helps people eligible for Medicare who have limited income and assets get help in paying the cost of one or more of the following:

- Medicare premium

- Medicare copays

To qualify for MPAP, applicants must be eligible for Medicare and meet basic requirements.

When applying for MPAP, proof of income, resources, age or disability, citizenship or non-citizen status, and other health insurance is required.

No face-to-face interview with the local County Department of Job and Family Services is necessary. Applicants can ask an authorized representative to apply on their behalf.

Find A Medicare Advantage Plan That Fits Your Income Level

Did you know that a Medicare Advantage plan covers the same benefits that are covered by Medicare Part A and Part B ? Did you know that some Medicare Advantage plans also offer benefits not covered by Original Medicare?

Some of these additional benefits such as prescription drug coverage or dental benefits can help you save some costs on your health care, no matter what your income level may be.

Some Medicare Advantage plans even feature $0 monthly premiums, though $0 premium plans may not be available in all locations. Find out if a $0 premium plan is available where you live by calling to speak with a licensed insurance agent.

Find $0 premium Medicare Advantage plans in your area

Or call 1-800-557-6059TTY Users: 711 24/7 to speak with a licensed insurance agent.

You May Like: Which Insulin Pumps Are Covered By Medicare

Qualifying Disabled And Working Individuals Program

The QDWI program doesn’t help with Part B premiums, but it will cover your Part A premium if you meet any of the following requirements:

- Are under age 65, have a disability, and work

- Returning to work caused you to lose your Social Security disability benefits and premium-free Part A

- Do not receive state-level medical assistance

- Meet income and resource requirements

Monthly income amounts are higher: $4,379 for singles and $5,892 for married couples. Resource limits, however, are lower: $4,000 or $6,000 .

To apply for one of the Medicare Savings Programs, you can contact your state Medicaid Program. They will help you understand if you meet the guidelines, and will give you instructions about which forms to fill out to apply. You should try to apply for these programs even if your income level is slightly higher than what has been indicated here.

Help Paying Medicare Costs

A Medicare Savings Program can help pay some out-of-pocket costs, including:

- Your monthly Medicare Part B premium

- Prescription drug costs through the Part D Extra Help program, which you automatically qualify for with a Medicare Savings Program

- In certain cases, your out-of-pocket Part A and Part B costs, such as coinsurance and deductibles

- In certain cases, your Part A premium, if you have one

Read Also: Is Unitedhealthcare A Medicare Advantage Plan

Other Things To Know About The Qmb Program:

Medicare providers arent allowed to bill you for services and items Medicare covers, including deductibles, coinsurance, and copayments, except outpatient drugs. Pharmacists may charge you up to a limited amount for prescription drugs covered by Medicare Part D.

- If you get a bill for Medicare charges: Tell your provider or the debt collector that youre in the QMB Program and cant be charged for Medicare deductibles, coinsurance, and copayments.

- If you already made payments on a bill for services and items Medicare covers: You have the right to a refund.

- If you have a Medicare Advantage Plan: Contact the plan to ask them to stop the charges.

In some cases, you may be billed a small copayment through Medicaid, if one applies.

Make sure your provider knows you’re in the QMB program

The SLMB Program is a state program that helps pay Part B premiums for people who have Part A and limited income and resources.

Help Paying For Medicare Premiums

Medicare Savings Programs are programs run by state governments that can payforpremiums, deductibles, copayments and coinsurance associated with Medicare for people with limited income and assets.

To learn more about the costs of Medicare, read the most frequently misunderstood Medicare terms.

Income is the amount of money you earn during the year.

Assets are any money you have in the bank, and the value of any investments . However, the house you live in and up to one car you own are not counted as assets when it comes to qualifying for a Medicare Savings Program.

Also Check: Are Cancer Drugs Covered By Medicare

Medicare Premium: What Is It And How Does It Work

Your Medicare premium is the monthly payment you make to have a Medicare insurance plan. Medicare insurance has four parts:

- Part A ,

- Part C , and

- Part D .

You pay a different premium for each part of Medicare. Medicare Parts A and B are known as Original Medicare because the insurance coverage is provided directly through the Medicare program.

Premiums for Parts A and B are determined by and billed through Medicare. The premium for Part A can be up to $437 a month as of 2019. But you usually dont pay any premiums for Part A insurance . The standard Part B premium as of 2019 is $135.50, but most people with Social Security benefits will pay less .

A Part C plan combines other parts of Medicare and can provide you with a broader range of benefits. These plans are sold through private insurance companies that are approved by Medicare. Premium rates vary depending on the type plan and where you live, but the average premium across all Part C plan types as of 2019 is estimated to be $28, according to My Medicare Matters, a website run by the National Council on Aging.

Medicare Part D plans are also provided through private insurance companies. The national average Part D premium is $33.19, according to My Medicare Matters. But depending on where you live and the type of plan you have, Medicare Part D costs will vary.

Learn More About Medicare Enrollment

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

The purpose of this communication is the solicitation of insurance. Callers will be directed to a licensed insurance agent with TZ Insurance Solutions LLC, TruBridge, Inc. and/or a third-party partner who can provide more information about Medicare Advantage Plans offered by one or several Medicare-contracted carrier. TZ Insurance Solutions LLC, TruBridge, Inc., and the licensed sales agents that may call you are not connected with or endorsed by the U.S. Government or the federal Medicare program.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Medicare has neither reviewed nor endorsed this information.

Don’t Miss: Does Medicare Cover Skin Removal

Changing Addresses: Traditional Medicare Vs Medicare Advantage

Relocation is another area where traditional Medicare and Medicare Advantage are quite different.

Medicare Part A and Part B, for example, are the same regardless where you are in the United States. If you ever change your address, all you typically need to do is notify Social Security either by visiting your local Social Security Administration field office or calling 1-800-772-1213. Traditional Medicare is also more conducive for frequent travelers.

Changing addresses in a Medicare Advantage plan, on the other hand, is a whole different animal.

If you move out of the area served by your Medicare Advantage program, you will need to enroll in a plan in your new area, Bagley said. This isnt just an issue for big, out-of-state moves even moving from one zip code to another can affect your coverage.

If you change addresses, make sure to talk to a Medicare consultant to find out the special enrollment rules and timelines for people who move, Bagley added.

Where Can Medicare Beneficiaries Get Help In Missouri

Missouri State Health Insurance Assistance Program

Free volunteer Medicare counseling is available by contacting the Missouri State Health Insurance Assistance Program at 800-390-3330. The SHIP program in Missouri is called CLAIM.

The SHIP can help beneficiaries enroll in Medicare, compare and change Medicare Advantage and Part D plans, and answer questions about state Medigap protections. SHIP counselors may also be able to offer referrals to local agencies for services like home care and long-term care. The SHIPs website has more information on services it offers.

Elder Law Attorneys

Elder law attorneys can help individuals plan for Medicaid long-term care benefits. You can use this National Academy of Elder Law Attorneys search feature to find an elder attorney locally.

Missouri Area Agencies on Aging

Medicare beneficiaries in Missouri can also receive help from Area Agencies on Aging . These organizations can provide information about services that help with aging or living with a disability, and assist with planning for long-term care needs. Here is a list of AAAs in Missouri.

Don’t Miss: Are Medicare Advantage Plans Hmos