Reasons To Delay Medicare

If youre thinking about deferring Medicare, discuss the pros and cons with your current insurer, union representative, or employer. Its important to know how or if your current plan will work with Medicare, so you can choose the most comprehensive overage possible.

Some of the common reasons you may want to consider deferring Medicare include:

- You have a plan through an employer that you want to keep.

Do I Need To Notify Medicare If I Am Staying On Group Insurance

No, you do not need to notify Medicare that you are going to stay on your group insurance and will not enroll right now. When you decide to transition to Medicare there are two forms that you will need to complete.

The first form confirms that you have had health insurance and that the prescription portion of that coverage was considered creditable coverage.

The second form states that your group coverage is going to terminate and states the date it will terminate and so you are requesting that your Medicare begin. Note that you can have your Medicare begin on the first of any Month so most people will have their group insurance carry them through the end of the prior month in order to not have any lapse in coverage.

D Late Enrollment Penalty

The Part D late enrollment penalty is similar to the Part B late enrollment penalty, in that you have to keep paying it for as long as you have Part D coverage. But it’s calculated a little differently. For each month that you were eligible but didn’t enroll , you’ll pay an extra 1% of the national base beneficiary amount.

In 2020, the national base beneficiary amount is $32.74/month. Medicare Part D premiums vary significantly from one plan to another, but the penalty amount isn’t based on a percentage of your specific planit’s based instead on a percentage of the national base beneficiary amount. Just as with other parts of Medicare, Part D premiums change from one year to the next, and the national base beneficiary amount generally increases over time.

So a person who delayed Medicare Part D enrollment by 27 months would be paying an extra $8.84/month , on top of their Part D plan’s monthly premium in 2020. A person who had delayed their Part D enrollment by 52 months would be paying an extra $17.02/month. As time goes by, that amount could increase if the national base beneficiary amount increases . People subject to the Part D late enrollment penalty can pick from among several plans, with varying premiums. But the Part D penalty will continue to be added to their premiums for as long as they have Part D coverage.

Recommended Reading: Can I Sign Up For Medicare Before I Turn 65

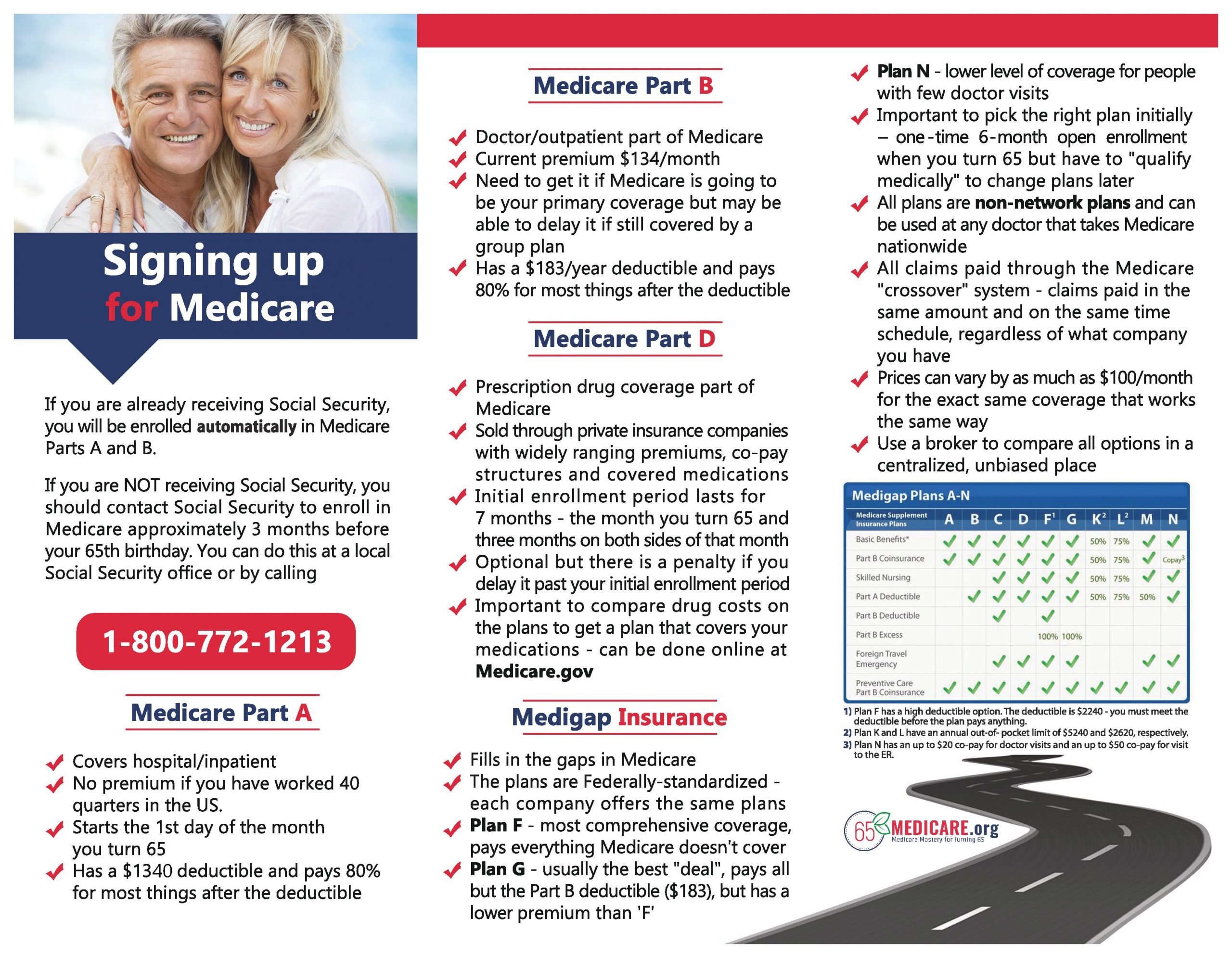

How To Sign Up For Medicare Supplement Insurance Plans: When Can I Enroll

Medicare Supplement insurance plans are voluntary, additional coverage that helps fills the gaps in coverage for Original Medicare. The best time to enroll in a Medicare Supplement insurance plan is during your individual Medigap Open Enrollment Period, which is the six-month period that begins on the first day of the month you turn 65 and have Medicare Part B. If you decide to delay your enrollment in Medicare Part B for certain reasons such as having health coverage based on current employment, your Medigap Open Enrollment Period will not begin until you sign up for Part B.

During your Medigap Open Enrollment Period, you have a âguaranteed-issue rightâ to buy any Medigap plan sold in your state. This means that insurance companies cannot reject your application for a Medicare Supplement insurance plan based on pre-existing health conditions or disabilities. They also cannot charge you a higher premium based on your health status. Outside of this open enrollment period, you may not be able to join any Medigap plan you want, and insurers can require you to undergo medical underwriting. You may have to pay more if you have health problems or disabilities.

Should I Enroll In Medicare Advantage If Im Still Working

Medicare Advantage is a bundle of Medicare products that includes Part A, Part B, and Part D benefits. If you continue working and choose to enroll in Medicare Advantage, keep in mind that it will replace your employers coverage.

Unlike Original Medicare, Medicare Advantage plans come with many additional benefits such as dental and vision benefits. These plans may offer more coverage than your current employer.

To determine which plan you want, identify which plan offers you the best coverage at the best price point. With Medicare Advantage, you cannot dual-enroll in both Medicare and your employers insurance plan as you would be able to with Original Medicare.

Recommended Reading: How Much Is Medicare Cost For 2020

Do You Have To Sign Up For Medicare At Age 65

- Are you required to sign up for Medicare when you turn 65? The answer is more than just a simple yes or no. Be sure to find out when you should sign up so that you dont face a late enrollment penalty or a lapse in coverage.

When you turn 65, you may have the opportunity to enroll in Medicare. But is it mandatory to sign up?

Technically, it is not mandatory to sign up for Medicare at 65 or at any age, for that matter. But its important to consider the situations in which you might decide not to enroll in Medicare at 65 so that you can make sure not to have any lapse in health insurance coverage or face a Medicate late enrollment penalty.

If The Employer Has Fewer Than 20 Employees

The laws that prohibit large insurers from requiring Medicare-eligible employees to drop the employer plan and sign up for Medicare do not apply to companies and organizations that employ fewer than 20 people. In this situation, the employer decides.

If the employer does require you to enroll in Medicare, then Medicare automatically becomes primary and the employer plan provides secondary coverage. In other words, Medicare settles your medical bills first, and the group plan only pays for services that it covers but Medicare doesnt. Therefore, if you fail to sign up for Medicare when required, you will essentially be left with no coverage.

Its therefore extremely important to ask the employer whether you are required to sign up for Medicare when you turn 65 or receive Medicare on the basis of disability. If so, find out exactly how the employer plan will fit in with Medicare. If not, ask for that decision in writing.

Note that in this situation, signing up for Medicare Part B when you also have employer insurance will not jeopardize your chances of buying Medigap supplemental insurance after the employment ends. When Medicare is primary to the employer plan, you have the right to buy Medigap with full federal protections if you do so within 63 days of the employer coverage ending.

You May Like: Where Do I File For Medicare

Eligibility: Medicare Vs Va Health Care

Most people become eligible for Medicare when they turn 65 years old. You can also enroll in Medicare at a younger age if you have a qualifying disability.

People with amyotrophic lateral sclerosis do not have a waiting period, but people on SSDI benefits for other disabilities will need to wait 24 months to get coverage. Medicare for end-stage renal disease has its own set of requirements.

VA Health Care eligibility, on the other hand, is not dependent on age or disability. It is determined based on service.

People who served in the active military, naval, or air service are eligible if:

- They served before September 7, 1980.

- They enlisted after September 7, 1980 and served 24 continuous months or the full period assigned to active duty.

- They were discharged due to a disability that occurred or was aggravated during active duty.

- They were discharged for a hardship or an early out.

People who served in the Reserves or National Guard are eligible if they completed the full period assigned to active duty as long as that assignment was not for training purposes.

VA Health Care benefits are not granted to anyone who was dishonorably discharged.

Why You May Consider Signing Up For Medicare At 65

If youre approaching age 65 and are not going to keep working, you have employer coverage from an employer with fewer than 20 employees, or your spouses employer requires you to get Medicare to stay on their health plan, then you need to enroll during whats known as your Medicare Initial Enrollment Period . If you dont, youll likely face financial premium penalties for enrolling late.

Your IEP is a 7-month window that generally includes the month of your 65th birthday, the 3 months before and the 3 months after For example, if your 65th birthday is on June 20, then your IEP starts on March 1 and ends on September 30.

This is the time to learn about your Medicare coverage options and get what you do or dont need coverage for. Most who have to get Medicare at age 65 will get Part A , Part B and some form of prescription drug coverage through either a stand-alone Part D plan or a Medicare Advantage plan.

Depending on your situation such as if you still have or want to keep employer coverage you may not need every part of Medicare available. But keep in mind here a simple rule: If you are not eligible for a Medicare Special Enrollment Period you need to get Parts A, B and D when youre first eligible to avoid financial penalties. Also, if youre still working, its a good idea to check with your employer plan benefits administrator to see how Medicare might work with that coverage before making any final decisions.

Recommended Reading: Does Medicare Cover Laser Therapy

What Happens If You Dont Sign Up For Medicare At 65

When you near your 65th birthday, you will enter what is called your Initial Enrollment Period . This seven-month period begins three months before you turn 65, includes the month of your birthday and continues for three additional months. This is your first opportunity to sign up for Medicare.

If you choose not to sign up for Medicare during your IEP, there are a few scenarios that might play out depending on your situation.

Medicare Advantage plans do not have a late enrollment penalty. You can sign up for a Medicare Advantage plan at any age, as long as you are already enrolled in Medicare Part A and Part B.

Medicare Supplement Insurance does not technically have a late enrollment penalty. However, if you enroll in a Medigap plan during your Medigap Open Enrollment Period, insurance providers arent allowed to use medical underwriting to determine your plan premiums or deny you coverage. Your Medigap Open Enrollment Period lasts for six months and starts as soon as you are 65 and enrolled in Medicare Part B.

There are also some Medicare Special Enrollment Periods that may apply to a someone who is turning 65. For example, if you are living overseas at the time of your 65th birthday and then later return to the U.S., you may qualify for a Special Enrollment Period for which you can sign up for Medicare with no late enrollment penalty.

Do You Have To Sign Up

If you receive Social Security benefits at least 3 months before you turn 65, in most cases you will automatically receive Medicare Part A and Part B on the first day of the month when you turn 65. If your birthday falls on the first day of the month, your Medicare Part A and Part B coverage will begin on the first day of the previous month.

You will automatically receive Medicare Part A and Part B if you have received Social Security disability benefits for at least 2 years. If you reside in Puerto Rico, you will automatically be enrolled in Medicare Part A, but will have to sign up for Medicare Part B in order to receive it.

If you are not receiving Social Security benefits at least four months before you turn 65, you will have to sign up with Social Security in order to receive Medicare Part A and Part B coverage. To sign up you can apply online at SSA.gov. Additionally, when you receive coverage, you can decide to receive Part C or Part D for additional coverage.

You will receive coverage at different times depending on the exact situation. If you enroll one to three months before you reach 65 years of age, you will receive Medicare benefits the month that you hit 65. If you enroll the month you reach 65, you will receive Medicare one month after. If you enroll one month after you reach 65, you will receive Medicare two months after. If you wait two to three months after you reach 65, then you will have Medicare three months after the month you enrolled.

Also Check: How Much Does The Medicare Coach Cost

Delaying Enrollment Could Result In A Permanent Penalty

As described above, you can’t reject premium-free Medicare Part A without also giving up your Social Security benefits. But since your work history is allowing you access to Medicare Part A without any premiums, few people consider rejecting Part A coverage.

The other parts of Medicare, however, do involve premiums that you have to pay in order to keep the coverage in force. That includes Medicare Part B and Part D , as well as supplemental Medigap plans. Medicare Part C, otherwise known as Medicare Advantage, wraps all of the coverage into one plan and includes premiums for Part B as well as the Medicare Advantage plan itself.

So it’s understandable that some Medicare-eligible people, who are healthy and not using much in the way of medical services, might not want to enroll in Part D and/or Part B. Similarly, people who are eligible for Part A but with premiums might want to avoid enrolling in order to save money on premiums. But before deciding to postpone enrollment in any part of Medicare, it’s important to understand the penalties and the enrollment limitations that will apply if you decide to enroll in the future.

There are penalties associated with delaying your Medicare enrollment unless the reason you’re delaying is that you are still working and you’re covered by the employer’s health plan. If that’s the case, you’ll be eligible for a special enrollment period to sign up for Medicare when you eventually retire.

Can I Decline Medicare Altogether

Medicare isnt exactly mandatory, but it can be complicated to decline. Late enrollment comes with penalties, and some parts of the program are optional to add, like Medicare parts C and D. Medicare parts A and B are the foundation of Medicare, though, and to decline these comes with consequences.

The Social Security Administration oversees the Medicare program and recommends signing up for Medicare when you are initially eligible, even if you dont plan to retire or use your benefits right away. The exception is when you are still participating in an employer-based health plan, in which case you can sign up for Medicare late, usually without penalty.

While you can decline Medicare altogether, Part A at the very least is premium-free for most people, and wont cost you anything if you elect not to use it. Declining your Medicare Part A and Part B benefits completely is possible, but you are required to withdraw from all of your monthly benefits to do so. This means you can no longer receive Social Security or RRB benefits and must repay anything you have already received when you withdraw from the program.

Also Check: How To Work For Medicare

Medicare Part A: If Its Free Why Not Take It

If by the time you reach 65 youve worked a total of approximately 10 years over your career, youre entitled to premium-free Medicare Part A, which pays for in-patient hospital charges and more.

Why sign up for more hospital insurance when an employer plan already provides good coverage at low cost to you? Because in some cases, Medicare Part A may cover what your employer plan does not.

But as with so many aspects of Medicare, there are caveats, exceptions and potential pitfalls.

If the employer has 20 or more employees: If your or your spouse’s employer has 20 or more employees and a group health plan, you don’t have to sign up for Medicare at 65 if it doesn’t make financial sense.

If the employer has fewer than 20 employees: If your or your spouse’s employer has fewer than 20 employees and the health coverage is not part of a multiemployer group plan, at age 65 you must enroll in Medicare Part A, which will be your primary insurance. Primary means that Medicare pays first, and then the employer insurance kicks in to pay whatever might be covered under that policy but was not covered by Part A.

If you have an HSA and want to keep contributing: If you’re saving to a Health Savings Account and wish to keep doing so, you must delay enrollment in Medicare Part A , because Medicare enrollees can’t contribute to an HSA. In fact, to avoid a tax penalty, you should plan to stop making HSA contributions at least six months prior to signing up for Medicare.

How Do I Sign Up For A Medicare Part D Prescription Drug Plan

You can do this in the same way as with a Medicare Advantage plan just enter your zip code in the box on this page to get started. Make sure you click the Medicare Part D plans tab.

Be aware that if you dont sign up for a Medicare prescription drug plan when youre first eligible, you could face a Part D late enrollment penalty if you sign up later. Remember, a Medicare Advantage prescription drug plan can give you this coverage. To avoid the penalty, either:

- Sign up for Medicare prescription drug coverage during your Medicare Initial Enrollment Period

- Make sure you have creditable prescription drug coverage through another source. Creditable coverage means a plan that pays at least as well as Medicares standard prescription drug coverage.

Without creditable coverage, you may pay a late enrollment penalty with your monthly Part D premium. This may occur if you go without coverage for more than 63 days in a row after your Initial Enrollment Period.

Read Also: How Do I Lookup My Medicare Provider Number