If You Disagree With Our Decision

If you disagree with the decision we made about your income-related monthly adjustment amounts, you have the right to appeal. The fastest and easiest way to file an appeal of your decision is online. You can file online and provide documents electronically to support your appeal. You can file an appeal online even if you live outside of the United States.

You may also request an appeal in writing by completing a Request for Reconsideration , or contact your local Social Security office. You can use the appeal form online, or request a copy through our toll-free number at 1-800-772-1213 . You dont need to file an appeal if youre requesting a new decision because you experienced one of the events listed and, it made your income go down, or if youve shown us the information we used is wrong.

If you disagree with the MAGI amount we received from the IRS, you must correct the information with the IRS. If we determine you must pay a higher amount for Medicare prescription drug coverage, and you dont have this coverage, you must call the Centers for Medicare & Medicaid Services to make a correction at 1-800-MEDICARE . We receive the information about your prescription drug coverage from CMS.

Who Is Eligible For Part B Give Back Benefit

To qualify to receive the benefits of the giveback plan, policies need certain criteria. You have to first enroll into Medicare and pay their own premiums. This does not make the premiums eligible for the program.

In addition, it’s essential you live in service areas with plans that offer premium-reduced rates. There are now 48 countries providing these benefits. Get a free quote Find the best Medicare Plan for you.

Medicare Advantage Msa: A Special Type Of $0 Premium Plan

Other types of Medicare Advantage plans are available called medical savings accounts and SSMAs. This plan is different because of its lack of Medicare Advantage insurance benefits. It’s no accident the insurer passed out money to its members as if it wasn’t for the benefit of the customer.

Part B premiums are also paid if you enroll in MSA plans as with most Medicare Advantage plans. There is a tradeoff with no monthly premium because MSAs have higher deductibles. Typically, deductibles are what your health insurance plan pays out in cash before the plan pays for covered services.

You May Like: How Much Medicare Pays For Home Health Care

Ways To Find Out If Medicare Covers What You Need

Who Pays More For Medicare Part B

Each year the government crunches the numbers to determine total costs for providing Medicare Part B coverage. For most enrollees, the government agrees to cover 75% of the cost and charges enrollees the Medicare Part B premium to cover the other 25%.

In 2021, a single taxpayer whose 2019 return reported MAGI of no more than $88,000 and married couples with MAGI up to $176,000 paid the lowest base Medicare Part B monthly premium of $148.50 per person.

If your income is above those levels, the government shifts more of the premium cost to your personal balance sheet. Instead of covering 75% of the premium cost, the government pays anywhere from 65% to as little as 15% of the premium, based on your IRMAA.

The annual Medicare report estimates that about 5 million beneficiaries currently pay a higher premium, and by 2029 more than 10 million enrollees will pay an IRMAA surcharge.

You May Like: What Is A Medicare Wellness Visit

What Is The Monthly Premium For Medicare Part B

The standard Medicare Part B premium for medical insurance in 2021 is $148.50.Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less. This is because their Part B premium increased more than the cost-of-living increase for 2021 Social Security benefits. Social Security will send a letter to all people who collect Social Security benefits that states each persons exact Part B premium amount for 2021. Since 2007, higher-income beneficiaries have paid a larger percentage of their Medicare Part B premium than most. Depending on their income, these higher-income beneficiaries will pay premiums that amount to 35, 50, 65, or 80 percent of the total cost of coverage. You can get details at Medicare.gov or by calling 1-800-MEDICARE .

More Information

B Premium Can Be Limited By Social Security Cola But That Hasnt Been An Issue For Most Beneficiaries Since 2019

In 2022, most enrollees will pay $171.10/month for their Part B coverage, which is the standard amount. Most enrollees were also paying the standard amount in 2021 , in 2020 , and in 2019 . Some enrollees pay more than the standard premium, if theyre subject to a high-income surcharge .

But thats in contrast with 2017 and 2018, when most enrollees paid a premium that was lower than the standard premium. The standard premium in 2018 was actually $134/month, but the cost of living adjustment for Social Security wasnt quite large enough to cover all of the increase from 2017s premium for most enrollees. Thats why most people paid about $130/month.

The standard Part B premium increased by about $9/month in 2020. But the 1.6% Social Security COLA for 2020 increased the average beneficiarys Social Security benefit . Since the COLA for most beneficiaries exceeded the premium increase for Part B, most Part B enrollees paid the standard premium in 2020. And for 2021, the 1.3% COLA was adequate to cover the increase to the new standard premium for virtually all enrollees. The COLA for 2022 was the largest it had been in 30 years, and more than adequate to cover even the substantial increase in Part B premiums.

Don’t Miss: Where Can I Go To Sign Up For Medicare

How Do Medicare Part B Give Back Plans Work

Part B giveback programs are private health plans that are provided instead of Medicare. Medicare Advantage plan beneficiaries can get original Medicare Part A or Part B insurance benefits along with some additional benefits.

This package of coverage provides complete coverage and helps reduce the out-of-pocket cost of hospital services. Other features include prescription coverage. GivingBack initiatives are a further additional benefit which separate the plans from others.

How Social Security Determines You Have A Higher Premium

We use the most recent federal tax return the IRS provides to us. If you must pay higher premiums, we use a sliding scale to calculate the adjustments, based on your modified adjusted gross income . Your MAGI is your total adjusted gross income and tax-exempt interest income.

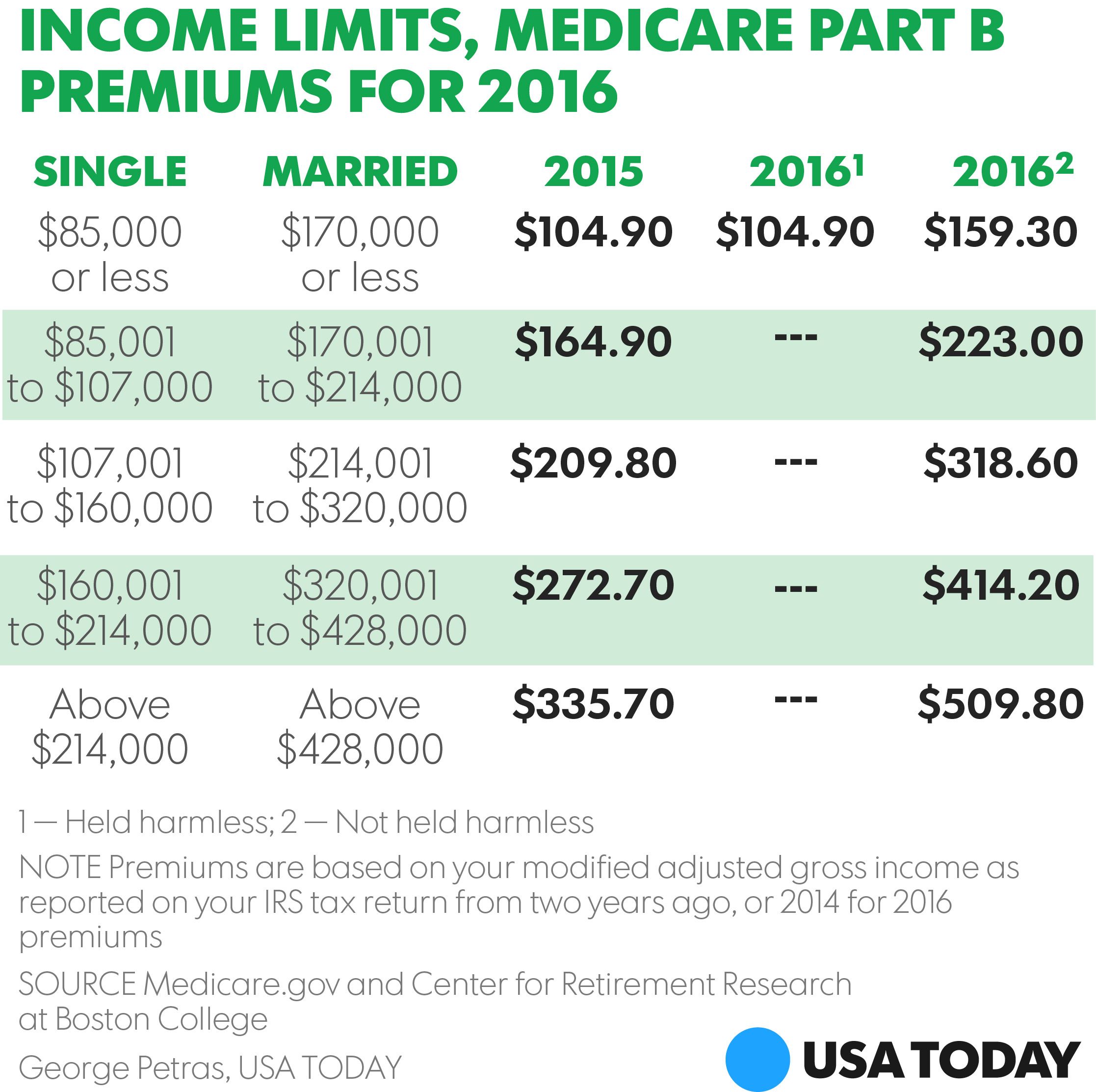

If you file your taxes as married, filing jointly and your MAGI is greater than $182,000, youll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $91,000, youll pay higher premiums. See the chart below, Modified Adjusted Gross Income , for an idea of what you can expect to pay.

If you must pay higher premiums, well send you a letter with your premium amount and the reason for our determination. If you have both Medicare Part B and Medicare prescription drug coverage, youll pay higher premiums for each. If you have only one Medicare Part B or Medicare prescription drug coverage youll pay an income-related monthly adjustment amount only on the benefit you have. If you decide to enroll in the other program later in the same year, well apply an adjustment automatically to the other program when you enroll. You must already be paying an income-related monthly adjustment amount. In this case, we wont send you another letter explaining how we made this determination.

Remember, if your income isnt greater than the limits described above, this law does not apply to you.

You May Like: Does Medicare Pay For Glucometer

Officials Say Substantial Social Security Cola Will More Than Offset The Monthly Hike

by Dena Bunis, AARP, Updated November 15, 2021

designer491 / Alamy Stock Photo

Medicare’s Part B monthly premium for 2022 will increase by $21.60, the largest dollar increase in the health insurance program’s history, the Centers for Medicare & Medicaid Services announced on Nov. 12. Standard monthly premiums for Part B will cost $170.10 in 2022, up from $148.50 in 2021.

Medicare Part B covers doctor visits, and other outpatient services, such as lab tests and diagnostic screenings. CMS officials gave three reasons for the historically high premium increase:

CMS officials stressed that while the 14.5 percent Part B premium increase is a stiff one, the Social Security cost-of-living adjustment at 5.9 percent, the largest in 30 years – is estimated to average $92 per recipient. So even after the increase in the Medicare Part B premium, most Social Security recipients, whose Part B premiums are typically deducted from their Social Security benefits, will still see a net increase in their monthly check. The COLA goes into effect in January.

AARP Membership -Join AARP for just $9 per year when you sign up for a 5-year term

Join today and save 43% off the standard annual rate. Get instant access to discounts, programs, services, and the information you need to benefit every area of your life.

Need Help With Medicare?

What Is The Medicare Part B Premium

The Medicare Part B premium is a monthly fee that Medicare beneficiaries pay if they choose to enroll in it to supplement the services available to most seniors for free with Medicare Part A.

- Medicare Part A is hospital insurance. It is available primarily to U.S. citizens and permanent residents age 65 and older. Most pay no premium for it.

- Medicare Part B covers other medically necessary services and preventative care like doctor’s services, lab tests, and outpatient care. Most pay a flat monthly premium for it, which is adjusted annually.

There is also a Medicare Part D, which covers prescription costs. It is available from insurance companies that are approved to offer it.

Read Also: How Does Medicare Plan G Work

Are Medicare Part B Give Back Plans Cheaper Than Other Medicare Plans

Providers that waive Part B may have lower premiums than other Medicare Advantage programs, as compared to the other. In some situations, Medicare Part B grant back plan costs may differ from Original Medicare combined with Medicare Supplement plans.

Costs of doctor appointments or medical services are typically far higher for patients out-of-network. Consider the high deductible plans, which offer lower costs than the standard Medicare Advantage plans, and are less costly than Medicare Part D Giveback plans if you’ve made no claim.

Why Did I Get A Refund Of My Medicare Premium

If there is a premium overpayment, such as when a person changes to a lower premium plan and the premium change doesn’t immediately go into effect, Social Security will automatically refund the premium overpayment. The person will get a refund check separate from his or her regular monthly Social Security benefit.

Don’t Miss: What Is A Medicare Ppo Plan

How To Apply For Medicare Part B

If you are already receiving Social Security benefits when you turn 65, you will automatically be signed up for Medicare Part A and Medicare Part B by the Social Security program. Your Part B premium will be deducted from your retirement benefit each month.

If you are not yet collecting Social Security at age 65, you can apply for Medicare coverage online at the Social Security website. You will be billed for your Medicare Part B premium quarterly. You can pay for this with a credit card, debit card or a bank transfer.

To avoid any potential missed payments, you might want to consider enrolling in Medicare Easy Pay, which will automatically deduct your premiums from a bank checking or savings accounts.

If you are still working at age 65 and continue to have coverage through your workplace plan, you may want to delay starting your Medicare Part B coverage. Joanne Giardini-Russell, whose insurance firm specializes in helping people navigate Medicare choices, notes that even if you automatically signed up at 65 because you were already receiving Social Security benefits, you could then opt out, if that made sense.

I often see people who just accept enrollment and start paying the premium, even though they dont need to just yet, says Giardini-Russell.

Before making that choice, be sure to consult a Medicare insurance pro to make sure you are in fact eligible to delay, or you could be slapped with a permanent penalty premium when you do eventually sign up for Part B.

What Are The 4 Parts Of Medicare

The four parts of Medicare include the following:

- Part A is insurance for the costs of hospitalization and hospital treatment. Most eligible seniors get this for free.

- Part B is optional and covers medically necessary outpatient services and care. This has a monthly premium of $170.10 for most individuals as of 2022.

- Part C is also called a Medicare Advantage Plan. This is for people who want a private insurance company to administer all of their Medicare services. You can choose your own provider, and you have the option to pay for services above and beyond Medicare coverage.

- Part D is optional coverage for prescription medicine and is available from private insurance companies. If you have a Medicare Advantage Plan you can add Part D coverage to it. Or, you can buy it separately.

The Medicare site has a search function to help people find a Part C or a Part D plan.

Also Check: What Is The Medicare Supplement Plan

Monthly Medicare Part B Premiums Will Fall To $16490 In 2023 Marking A $520 Decrease From This Year While Part A Premiums Are Set To Increase By $4 To $7

September 27, 2022 – Medicare Part B premiums and deductibles will decrease in 2023, while Part A costs will rise, according to a fact sheet released by CMS.

Medicare Part B offers coverage for physician services, outpatient hospital services, certain home healthcare services, durable medical equipment , and other medical services not covered by Medicare Part A.

The standard monthly premium for Part B enrollees will be $164.90 compared to $170.10 in 2022. The annual deductible will be $226, decreasing $7 from $233 in 2022.

Dig Deeper

The 2022 premiums included a contingency margin for projected Part B spending on the Alzheimers disease drug Aduhelm. However, 2022 saw lower-than-expected spending on Aduhelm and other Part B services, leading to larger reserves in the Part B account of the Supplementary Medical Insurance Trust Fund. This trust fund helps limit Part B premium increases, resulting in lower premiums for 2023.

Individuals with Medicare who take insulin through a pump supplied through the Part B DME benefit will not have to pay a deductible starting on July 1, 2023. In addition, cost-sharing will be capped at $35 for a one-month supply of covered insulin.

While Part B costs will decrease in 2023, Part A costs are set to increase.

Medicare Part A offers coverage for inpatient hospital services, skilled nursing facility care, hospice care, inpatient rehab, and home healthcare services.

What Is The Medicare Part B Late Enrollment Penalty

If you dont sign up for Part B when youre first eligible, you may be required to pay a late enrollment penalty when you do choose to enroll. Additionally, youll need to wait until the general enrollment period .

With the late enrollment penalty, your monthly premium may go up 10 percent of the standard premium for each 12-month period that you were eligible but didnt enroll. Youll continue to pay this penalty for as long as youre enrolled in Part B.

For example, lets say that you waited 2 years to enroll in Part B. In this case, youd pay your monthly premium plus 20 percent of the standard premium.

Recommended Reading: How To Get Medicare For Free

Deadlines For Enrolling In Medicare Part B

Here are some important dates to keep in mind for enrolling in Part B:

- Your 65th birthday. The initial enrollment period is a 7-month time span. It includes the month of your 65th birthday and the 3 months before and after. You can enroll in parts A and B at any point during this time.

- This is general enrollment. If you didnt enroll in Part B during Initial Enrollment, you can do so at this time. You may need to pay a late enrollment penalty.

- If you chose to enroll in Part B during general enrollment, you may add a Part D plan during this period.

- This is the open enrollment period. If you want to switch from original Medicare to a Part C plan, you can do so. You may also switch, add, or remove a Part D plan.

- Special enrollment. You may have employer-provided coverage in a group health plan. If so, you can sign up for parts A and B at any time during plan coverage or in the 8-month special enrollment period after leaving employment or the group health plan.

What Do I Do If My Medicare Is Cancelled

If you’ve disenrolled from or cancelled your Medicare Part B coverage, you may have to pay a costly late enrollment penalty to reenroll. This is especially true if you have a gap in coverage. If you’re looking to reenroll in Medicare Part B, follow these steps: Go to the Social Security Administration website.

Read Also: Do I Have To Apply For Medicare At Age 65