What Does Medicare Part B Cover

Part B provides coverage for a mixture of outpatient medical services. This includes coverage for preventive vaccines, cancer screenings, annual lab work, and much more.

It will cover preventive services in addition to specialist services. Part B even covers services for mental healthcare, durable medical equipment that your doctor finds medically necessary.

Also, Part B will cover some services you receive while in the hospital. This includes surgeries, diagnostic imaging, chemotherapy, and dialysis if you obtain drugs while at the hospital, it will also provide coverage for those.

Retiree Health Plan Part B Reimbursement Options

If you’re retired and have Medicare and retiree group health plan coverage from a former employer, Medicare typically pays first for your medical bills and your retiree plan would pay the remaining amount.

Some of these retiree plans offer a Part B reimbursement to eligible enrollees. Each retiree plan has different eligibility requirements, so check with your plan to understand your options. However, for most plans you must be a retired employee or already enrolled in the health plan and be enrolled in Medicare Part B.

You may be reimbursed the full premium amount, or it may only be a partial amount. In most cases, you must complete a Part B reimbursement program application and include a copy of your Medicare card or Part B premium information.

Defer Income To Avoid A Premium Surcharge

The standard premium for Medicare Part B is $148.50 per month in 2021 but that assumes youre not a higher earner. Those with higher income levels are subject to higher premium costs. For 2021 heres what youre looking at:

| 2021 Medicare Part B premium costs by income level | ||

|---|---|---|

| Income level: individual tax filer | Income level: joint tax filer | Total monthly premium |

| $750,000 and above | $504.90 |

If youre able to defer income strategically to future tax years so that you can report a lower total on your tax return, you might save yourself a higher premium charge for at least a year, since those surcharges are based on previous tax returns. For example, your 2019 tax return will determine whether you pay a surcharge in 2021 .

Don’t Miss: How Long Do You Have To Sign Up For Medicare

Cdc Shingles Vaccine Recommendations

The Centers for Disease Control and Prevention recommends Shingrix vaccination for anyone 50 years and older, even if you have already had shingles, if you had another type of shingles vaccine, and if you dont know whether or not youve had chickenpox in the past.

You should not get the vaccine if you are allergic to any of the components, are pregnant or breastfeeding, currently have shingles, or you have lab tests that definitively show that you do not have antibodies against the varicella-zoster virus. In that case, you may be better off getting the varicella vaccine instead.

Are Medicare Deductibles Based On Calendar Year

The concept of a benefit period is important because the Medicare Part A deductible is based on the benefit period, rather than a calendar year. Once you meet it, your plan will pay all or part of your costs for the remainder of the year, but then your deductible resets on January 1.

Don’t Miss: Does Medicare Cover Me Overseas

Should I Sign Up For Medical Insurance

With our online application, you can sign up for Medicare Part A and Part B . Because you must pay a premium for Part B coverage, you can turn it down.

If youre eligible at age 65, your initial enrollment period begins three months before your 65th birthday, includes the month you turn age 65, and ends three months after that birthday.

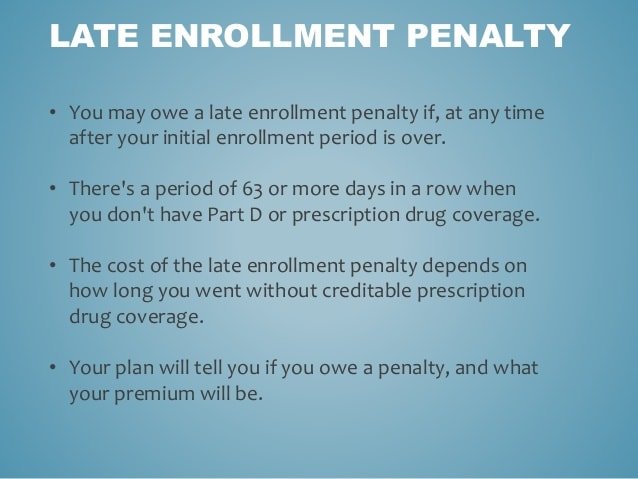

If you choose not to enroll in Medicare Part B and then decide to do so later, your coverage could be delayed and you may have to pay a higher monthly premium for as long as you have Part B. Your monthly premium will go up 10 percent for each 12-month period you were eligible for Part B, but didnt sign up for it, unless you qualify for a “” .

If you dont enroll in Medicare Part B during your initial enrollment period, you have another chance each year to sign up during a general enrollment period from January 1 through March 31. Your coverage begins on July 1 of the year you enroll. Read our publication for more information.

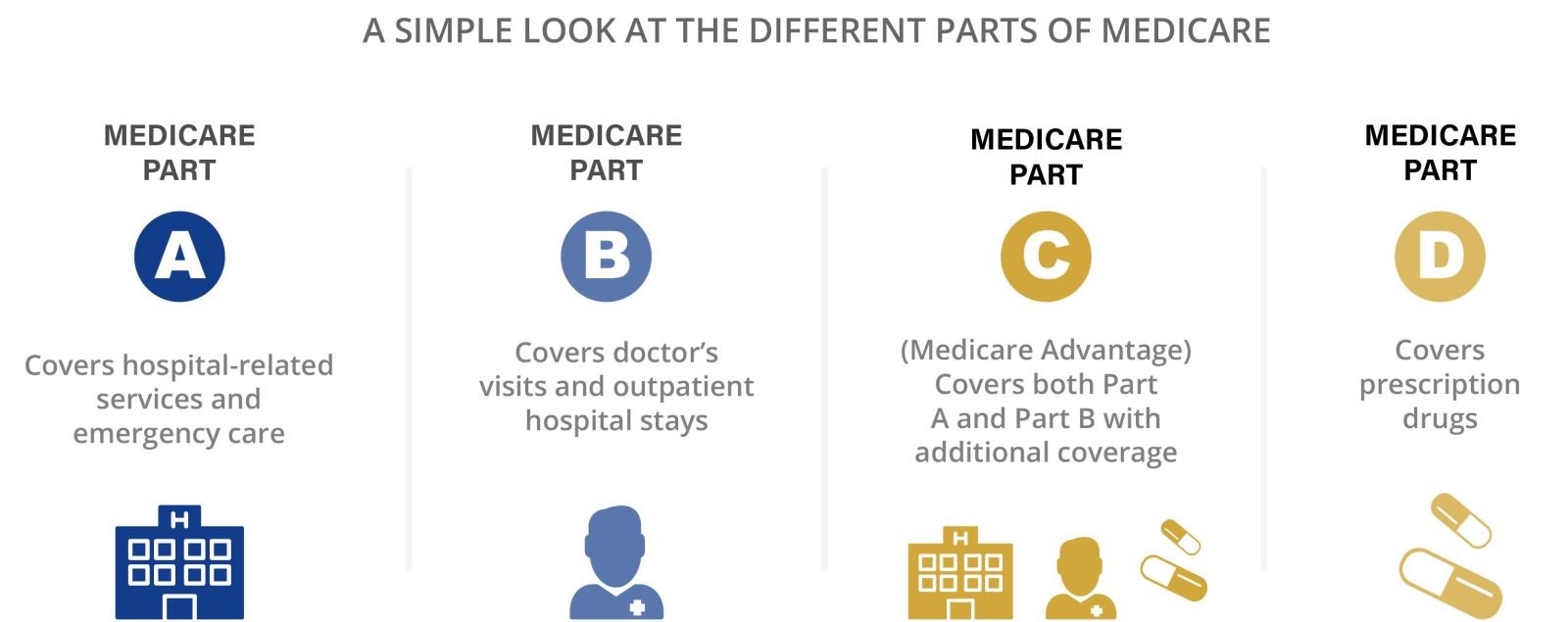

What You Need To Know About Medicare Parts A B C And D

Our editors independently research and recommend the best products and services. You can learn more about our independent review process and partners in ouradvertiser disclosure. We may receive commissions on purchases made from our chosen links.

There are four parts of Medicare: Part A, Part B, Part C, and Part D. In general, the four Medicare parts cover different services, so it’s essential that you understand the options so you can pick your Medicare coverage carefully.

Read Also: Does Medicare Pay For Custom Foot Orthotics

Medicare Part B Special Circumstances

Some people dont need Medicare Part B coverage right away, because they have medical insurance through their employers or meet other special conditions. And some people choose not to enroll in Medicare Part B, because they dont want to pay for medical coverage they feel they dont need. There are a variety of reasons why you might hesitate to pay for medical insurance. Likewise, you may be concerned about how the new healthcare laws affect Medicare Part B coverage. In this section, well discuss a few reasons to hold off on Medicare Part B, as well as how Obamacare affects Medicare Part B coverage.

For starters, people who are still working when they qualify for Medicare may not need to get Part B coverage right away. If you have insurance through your employer, then you most likely already have medical coverage. However, you should still meet with your plan administrator to find out how your current insurance works with Medicare, because some policies change once youre eligible for Medicare. Other special situations include the following:

Once you stop working or lose your work-based coverage, you have an eight-month period to enroll in Medicare Part B. If you dont enroll during this time, you may have to pay the late enrollment penalty every month that you have Part B coverage sometimes indefinitely. Also, you may face a serious coverage gap if you wait to enroll.

How Much Does Medicare Cost If You Have Never Worked

If you never worked, then your Part A premium for 2021 will be $471. But if you spent at least 30 to 39 quarters in the workforce and paid Medicare taxes, your premium could be reduced to $259. Medicare Part B, which covers outpatient care, comes with a monthly premium that is not affected by your work history.

Don’t Miss: Will Medicare Pay For A Bedside Commode

I Have Cobra Coverage

COBRA lets you keep your employer health coverage for a limited time after your employment ends. There are two situations that can happen with COBRA and Medicare, and it depends on which you get first.

Situation 1: If you get COBRA first.

Usually you cant keep COBRA once you become eligible for Medicare. Youll want to sign up for Medicare Part A and Part B when you turn 65, unless you have access to other creditable coverage. However, you may be able to keep parts of COBRA that cover services Medicare doesnt, such as dental care.

Your spouse and dependents may be able to continue COBRA coverage after you enroll in Medicare. Talk with your plan benefits administrator about your needs and options.

Situation 2: If you get Medicare first.

In this case, you are allowed to enroll in COBRA as well. Its not required, and COBRA would act as your secondary insurance.

I am receiving Social Security disability benefits

You will be enrolled in Original Medicare automatically when you become eligible for Medicare due to disability. Youll get your Medicare card in the mail. Coverage usually starts the first day of the 25th month you receive disability benefits.

You may delay Part B and postpone paying the premium if you have other creditable coverage. Youll be able to sign up for Part B later without penalty, as long as you do it within eight months after your other coverage ends.

How To Find Plans That Offer The Giveback Benefit

Not all MA plans offer this benefit, so you must find a plan that does in order to take advantage of the opportunity. In 2021, these plans are offered in nearly all states, so you may find one close to you.

If you enroll in a plan that offers a giveback benefit, you’ll find a section in the plan’s summary of benefits or evidence of coverage that outlines the Part B premium buy-down. Here, you’ll see how much of a reduction you’ll get. You can also call us toll-free at 1-855-537-2378 and one of our knowledgeable, licensed agents will answer your questions and explain your options.

Don’t Miss: Does Medicare Part B Cover Home Health Care Services

What Does Part B Cost

With Medicare Part B, you pay a standard monthly premium thats based on your income. In some cases, your monthly premium may be higher if you didnt sign up for Part B when you became eligible.

You may also need to meet an annual deductible before Medicare kicks in and starts paying. Once youve met your deductible, you will pay a 20 percent copay for approved Medicare Part B services.

You can always buy a Medicare Supplement Plan that pays your Part B deductible, as well as other out-of-pocket costs such as copays and coinsurance.

Benefits Of Medicare Part B

Medicare Part B covers a variety of routine healthcare visits and treatments. If you can afford the premiums, then you may want to take advantage of this program, as it could help offset the cost of ongoing medical care. Depending on your eligibility, you may not have a choice when it comes to Medicare Part B.

However, financial need could help you pay for a portion or all of your monthly premiums. Dont hesitate to contact a representative from your local Social Security office to find out more about your unique situation. Just remember to conduct your own research well ahead of time, so that you dont incur unnecessary late fees in the future.

You May Like: Does Medicare Coverage Vary By State

Is There Help For Me If I Cant Afford Medicares Premiums

Medicare Savings Programs can pay Medicare Part A and Medicare Part B premiums, deductibles, copays, and coinsurance for enrollees with limited income and limited assets.

Reviewed by our health policy panel.

Q: Is there help for me if I cant afford Medicares premiums?

A: Yes. Medicare Savings Programs can help with premiums and out-of-pocket costs.

How Much Does It Cost

The standard premium amount for Medicare Part B is $144.60. You may pay a higher premium amount if your income is higher than $85,000 as an individual and $170,000 as a couple. Your premium may also be different if youre enrolling in Medicare Part B for the first time, you do not get Social Security benefits, or you are billed directly for your premium.

Be sure to enter your zip code below and compare Medicare costs to ensure you have the best and most affordable coverage.

Don’t Miss: How Do I Qualify For Medicare Low Income Subsidy

Enrolling In Medicare Part B If You Are 65 Or Older Still Working And Have Insurance From That Job

You are not required to take Part B during your Initial Enrollment Period if you are still working or your spouse is still working and one of you has coverage as a result of that current work. You should only delay Part B if this current employer insurance is the primary payer on your health care expenses . You should talk to your employer when you become eligible for Medicare to see how employer insurance will work with Medicare. Generally, if you are eligible for Medicare because you are over 65, the employer must have more than 20 employees to be the primary payer. If you are eligible for Medicare because you get SSDI, the employer must have more than 100 employees to be the primary payer.

If there are fewer than 20 employees at the company where you currently work or your spouse currently works, Medicare is your primary coverage. In this case, you should not delay enrollment into Part B. If you decline Part B, you will have noprimary insurance, which is usually like having no insurance at all.

In either case, if you have insurance from a current employer, you qualify for aSpecial Enrollment Period . During this period, you can enroll in Part B without penalty at any time while you or your spouse is still working and for up to eight months after you lose employer coverage, switch to retiree coverage, or stop working.

What Is Medicare Part B

Medicare Part B helps cover medical services like doctors’ services, outpatient care, and other medical services that Part A doesn’t cover. Part B is optional. Part B helps pay for covered medical services and items when they are medically necessary. Part B also covers some preventive services like exams, lab tests, and screening shots to help prevent, find, or manage a medical problem.

Cost: If you have Part B, you pay a Part B premium each month. Most people will pay the standard premium amount. Social Security will contact some people who have to pay more depending on their income. If you don’t sign up for Part B when you are first eligible, you may have to pay a late enrollment penalty.

For more information about enrolling in Medicare, look in your copy of the “Medicare & You” handbook, call Social Security at 1-800-772-1213, or visit your local Social Security office. If you get benefits from the Railroad Retirement Board , call your local RRB office or 1-800-808-0772.Learn More:

Recommended Reading: Does Kaiser Permanente Take Medicare

Please Answer A Few Questions To Help Us Determine Your Eligibility

Thecategories of medical treatment and services listed below are not covered byMedicare. However, the non-covered services listed below do not necessarilyapply to HMO or other Medicare Advantage plan coverage. Many Medicare Advantageplans include some coverage for these medical services even though Medicareitself does not cover them.

Does My Income Affect My Monthly Premiums For Medicare

If you are what Social Security considers a higher-income beneficiary, you pay more for Medicare Part B, the health-insurance portion of Medicare.

Medicare premiums are based on your modified adjusted gross income, or MAGI. Thats your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS. To set your Medicare cost for 2021, Social Security likely relied on the tax return you filed in 2020 that details your 2019 earnings.

If your MAGI for 2019 was less than or equal to the higher-income threshold $88,000 for an individual taxpayer, $176,000 for a married couple filing jointly you pay the standard Medicare Part B rate for 2021, which is $148.50 a month. At higher incomes, premiums rise, to a maximum of $504.90 a month if your MAGI exceeded $500,000 for an individual, $750,000 for a couple.

You can ask Social Security to adjust your premium if a life-changing event caused significant income reduction or financial disruption in the intervening tax year for example, if your marital status changed, or you lost a job, pension or income-producing property.

Youll find detailed information on the Social Security web page Medicare Premiums: Rules for Higher-Income Beneficiaries.

Also Check: What Age Does A Person Qualify For Medicare

What Is The Medicare Part B Premium

The Medicare Part B premium is a monthly fee that Medicare beneficiaries pay if they choose to enroll in it to supplement the services available to most seniors for free with Medicare Part A.

- Medicare Part A is hospital insurance. It is available primarily to U.S. citizens and permanent residents age 65 and older. Most pay no premium for it.

- Medicare Part B covers other medically necessary services and preventative care like doctor’s services, lab tests, and outpatient care. Most pay a flat monthly premium for it, which is adjusted annually.

There is also a Medicare Part D, which covers prescription costs. It is available from insurance companies that are approved to offer it.

Do You Automatically Get A Medicare Card When You Turn 65

Medicare will enroll you in Part B automatically. Your Medicare card will be mailed to you about 3 months before your 65th birthday. If youre not getting disability benefits and Medicare when you turn 65, youll need to call or visit your local Social Security office, or call Social Security at 1-800-772-1213.

Don’t Miss: When Can You Collect Medicare Benefits

What Does Part A Cost

With Medicare Part A, you may have to pay copays and deductibles for hospital stays, but may not have to pay a monthly premium. Copays and deductibles apply to hospital benefit periods, which start when you enter a hospital or skilled nursing facility, and end 60 days after youve left the facility . Its important to note that:

- For each hospital benefit period, you pay a deductible.

- You pay a copay if youve stayed in a hospital for more than 60 days.

- Theres no deductible or copayment for home health care or hospice care.

For many people, Part A comes without a monthly premium. You may have no monthly premium if you paid a certain amount toward Medicare taxes while working. In this case, you are often automatically enrolled in premium-free Part A.

If you dont automatically get premium-free Part A, you may be able to buy it if you :

- Are age 65 or older and allowed to Part B to meet the citizenship and residency requirements.

- Are under age 65 and are disabled but no longer get premium-free Part A because you returned to work.