Do You Have A Medicare Supplement Plan Heres How To Handle Your Move To Another State

If youre enrolled in a Medicare Supplement plan and move to another state, you may be able to keep the same policy. There are 10 standardized Medigap plans available in 47 states . Because the plans are standardized in most states, you may be able to remain with the same plan. But be aware that you might have to pay more for the Medigap plan in your new state, and you might have to answer some questions about your health history..

Most Medicare Supplement plans let you see any doctor who accepts Medicare assignment, but one type of Medigap plan called Medicare SELECT may require you to use providers within its network. If you have a Medicare SELECT policy and you move out of the plans service area:

- You can sign up for a standardized Medigap policy from your current Medigap policy insurance company that includes the same, or fewer, benefits as your current Medicare SELECT policy.

- Generally, you can sign up to buy any Medigap Plan A, B, C, F, K, or L thats available in the area where you live.

- You wont have to undergo medical underwriting if youve had your Medicare SELECT policy for more than six months. Otherwise, the insurance company may review your health history and may charge you more if you have a health condition.

Coverage Portability: Medicare Supplement Insurance Plans

Medicare Supplement insurance plans are designed to minimize out-of-pocket costs you might pay under Original Medicare. These plans might cover Medicare Part A and Part B coinsurance, copayments, and more. Medicare Supplement insurance plan premiums might depend on a few factors, including:

- The plan type you choose

- The state where the plan is sold

- The private insurance company that offers the plan

- The plan rating, which may be determined in part by your age

Each plan type offers a different set of basic benefits.

In most cases, Medicare Supplement insurance plans let you visit any doctor who takes Medicare. That means if youre visiting another state, your plan will likely help pay for Medicare-covered services.

If you move to another state, you might be able to buy the same plan type in the new state. However, your Medicare plan premium might be different.

If you move to another state, your original Medicare premiums and benefits will remain consistent no matter where you live. Your Medicare Advantage, Medicare Part D plans will likely change to accommodate your new area. The Medicare premiums for these plans may also vary. You will want to shop around to find the best plan and the best rate to accommodate your specific needs and budget.

If you are heading to a new location and wish to compare Medicare plan options for your new area, our online plan comparison tool can help. Enter your zip code and follow the steps to find the right plan for you.

New To Medicare?

Is It Better To Have Medicare Advantage Or Medicare Supplement

Whether you choose to apply for a Medicare Advantage plan vs. a Medicare Supplement insurance plan depends on your needs. Here are a few factors to consider when deciding whether Medicare Advantage or Medicare Supplement is better for you:

- Do you prefer to have all your coverage rolled into one plan? If so, a Medicare Advantage Plan may be the way to go. Many include Part D drug coverage, as well as vision, dental, and hearing, depending on the plan.

- Do you want financial protection from unexpected out-of-pocket costs, such as deductibles, copays, and coinsurance? If yes, Medicare Supplement plans work with Original Medicare and can help cover some of the remaining out-of-pocket expenses that Original Medicare doesnt cover.

- Do you need a plan that provides coverage for disabilities or long term care facilities? If so, Medicare Advantage offers Special Needs Plans that provide this type of coverage.

- Do you want the freedom to see any doctors you choose? If so, Medicare Supplement plans have no required network and you can see any doctor that accepts Medicare, even if youre away from home or traveling. Some Medicare Advantage plans may also allow you to see doctors and hospitals that are not in the plans network, giving you additional freedom to choose your doctors.

Also Check: Do I Need To Pay For Medicare

Medicare Part C Premium

Medicare Part C, also known as Medicare Advantage, is an alternative way to receive your Original Medicare coverage. Private, Medicare-approved health insurance companies offer Medicare Advantage plans. Premiums and other out-of-pocket costs can vary from plan to plan. Some Medicare Advantage plans have monthly premiums as low as $0, but you still need to pay your Medicare Part B premium along with any premium the plan may charge.

Medicare premiums for these plans can also fluctuate between states, depending on the specific plans offered in each state. Since these plans typically have a limited service area, you can also lose your coverage if you move.

If you move out of your Medicare Advantage plans service area, you might qualify for a Special Election Period to enroll in a plan in your new vicinity. eHealths licensed insurance agents can tell you how to go about making the change.

You can start comparing plans right away by entering your new zip code on this page and clicking Medicare Advantage plans.

Medicare Is A Federal Program Why Do Costs Vary So Much Depending On Your Zip Code

If youre over 65, youre probably familiar with Medicare by now. Youve gotten hundreds of letters, youve gotten dozens of calls, and youve seen 1 too many Joe Nameth commercials. But even with an abundance of Medicare information, many are still confused about how the program works.

One of the calls we get all the time is Why does my uncle/cousin/grandma have a Medicare plan that costs less than mine?. People also wonder why some plans have seemingly more benefits and coverage than others. There are many options for Medicare, and the plan you choose as well as your location and prescription drug regimen are the biggest factors in the price you pay per month.

You could also choose a Medicare Advantage Plan. These plans oftentimes have $0 monthly premiums. They also may have free dental, vision, hearing, and gym membership benefits that customers enjoy. The catch is you have to pay for your Medical and Hospital care as it arises, as in, pay as you go. So while youre not paying the same monthly premiums, your costs may come back to bite you later in the form of service copays.

There are many choices you face when deciding what Medicare Plan is right for you and your family. Thats why were always here to answer any questions and add clarity to your decision. Talk to us about what your needs are, and were happy to give you an unbiased Medicare education so you can make your own decision. Contact us at 848-226-6897 to get started.

Don’t Miss: Does Aetna Medicare Advantage Cover Dental

Information For Medicare Patients

Medicare covers both Cooled Thermotherapy and Prostiva RF Therapy. Because Medicare is a national payer, the requirements are the same across every state in the US. You may speak to your urologist or call Medicare directly to learn more about the insurance process.

Medicare Advantage may have separate requirements including a pre-authorization. Please verify coverage requirements with your urologists billing department or Medicare.

Can Medicare Part D Help With Your Chiropractic Care

Medicare Part D, like Part C and Supplement plans, is offered by private insurance companies. This part of Medicare is specifically tailored to cover prescription drug costs.

As many people who seek chiropractic care are suffering from chronic pain issues, chiropractors may partner with local physicians to handle pain management care together.

So, while chiropractors may not be able to prescribe you directly with prescriptions, having your pain management physician be in touch with your chiropractor can make things a lot easier on your end. Part D will most likely cover prescription drugs that are prescribed by your physician to treat your condition.

Read Also: Does Humana Medicare Cover Incontinence Supplies

Do Medicare Benefits Vary By State

There are four main parts to Medicare. These include Part A and B which form Original Medicare. There is also Part C, known as Medicare Advantage, and Medicare Part D, which offers prescription drug coverage.

Original Medicare is provided by the government to those who are age 65 and over, and who have worked in Medicare-covered employment for at least 10 years. Some individuals who are under the age of 65 may also qualify for Medicare benefits, provided that they have received Social Security disability benefits for at least 24 consecutive months.

Coverage that is provided via Medicare Parts A and B is primarily the same from state to state in terms of hospitalization and medical insurance , as well as the required out-of-pocket co-payments and deductibles that are required from enrollees.

However, for those who opt to also include Medicare Part D for prescription drug coverage, benefits can vary from one plan to another, as well as from state to state. In many instances, the benefits can even differ from one region to another.

Likewise, for those who choose to receive their Medicare coverage through a Medicare Advantage plan , both the cost and availability of plans can vary from one state to another, as well as by the private health insurance company that offers them.

Additional Medicare Benefits

State Differences In Medicare Advantage

Medicare Advantage plans are private policies that you can buy to replace Original Medicare coverage.

The federal government requires them to cover everything Original Medicare covers in all 50 states. But Medicare Advantage plans may also offer benefits beyond what Original Medicare covers, such as dental, vision, prescription drug and hearing benefits.

The federal government requires an annual open enrollment for Medicare Advantage in every state that coincides with Original Medicare enrollment. This happens every year from October 15 to December 7.

Since 2019, the federal government has also allowed a second open enrollment period for Medicare Advantage from January 1 through March 31. This period allows people with Medicare Advantage to switch to another Medicare Advantage plan or to switch to Original Medicare.

Read Also: Can You Get Medicare If You Retire At 62

Whats The Difference Between Medicare Advantage And Medicare Supplement

Medicare Advantage combines Medicare Part A and B for comprehensive coverage, all in one plan. It often includes Part D Prescription Drug coverage, too. These are also called Part C plans.

Medicare Supplement insurance policies, also called Medigap, help pay the out-of-pocket expenses not covered by Original Medicare . It is not part of the governments Medicare program, but provides coverage in addition to it.

Where Are You In Your Medicare Journey

1 Original Medicare coverage is required in order to purchase a Medicare Supplement plan.

2These programs are NOT insurance and do not provide reimbursement for financial losses. Some restrictions may apply. Programs and services may be added or discontinued at any time. Customers are required to pay the entire discounted charge for any discounted products or services available through these programs. The Healthy Rewards program is provided by Cigna Health and Life Insurance Company. Programs are provided through third party vendors who are solely responsible for their products and services. Program availability may vary by location, and are not available where prohibited by law.

4 Medicare Supplement plans may be subject to medical underwriting, and coverage may be denied.

Notice for persons eligible for Medicare because of disability:

In the following states, all Medicare Supplement plans are available to persons eligible for Medicare because of disability: California, Colorado, Delaware, Florida, Georgia, Hawaii, Idaho, Illinois, Kansas, Kentucky, Louisiana, Maine, Minnesota, Mississippi, Missouri, Montana, New Hampshire, Oregon, Pennsylvania, South Dakota, Tennessee, Vermont, and Wisconsin.

Tennessee Medicare Supplement Policy Forms

Plan A: CNHIC-MS-AA-A-TN Plan F: CNHIC-MS-AA-F-TN Plan G: CNHIC-MS-AA-G-TN Plan N: CNHIC-MS-AA-N-TN

- Customer Plan Links

Don’t Miss: What Age Do You Register For Medicare

Variation By Type Of Service

Some of the variation in Medicare program expenditures may be explained by differences across States in the use of costlier services, such as inpatient hospital staysâone of the most expensive Medicare services . Although only 20 percent of beneficiaries used hospitals in 1995 , these expenditures accounted for almost one-half of all Medicare spending. More than 90 percent of hospital expenditures were reimbursed under Medicare’s prospective payment system . The remaining hospital expenditures were for rehabilitation hospitals or units , psychiatric hospitals , LTC hospitals , and others, including cancer and children’s hospitals.

Medicare: The Federal Health Insurance In Parts

Medicare began as an amendment to the Social Security Act. The Original Medicare program encompassed the Medical Insurance of Part B and the Hospital coverage of Part A.

Listed below are the major parts of Medicare:

- Original Medicare Part A Inpatient Hospital Insurance.

- Original Medicare Part B Medical Insurance.

- Medicare Part C Medicare Advantage that include at least the coverage of Parts A and B, and many include Part D as well.

- Medicare Part D Prescription Drug coverage.

- Medigap supplemental policies Gap insurance which helps pay out-of-pocket costs for Medicare-covered services.

Also Check: Does Medicare Cover Long Term Health Care

Medicare Coverage By State

It’s painfully obvious: the cost of health care in the US is rising. You feel it every time you visit the doctor, pick up a prescription, and pay your insurance premiums. As your wallet gets lighter, you might be wondering whether Medicare coverage will keep up with these rising costs.

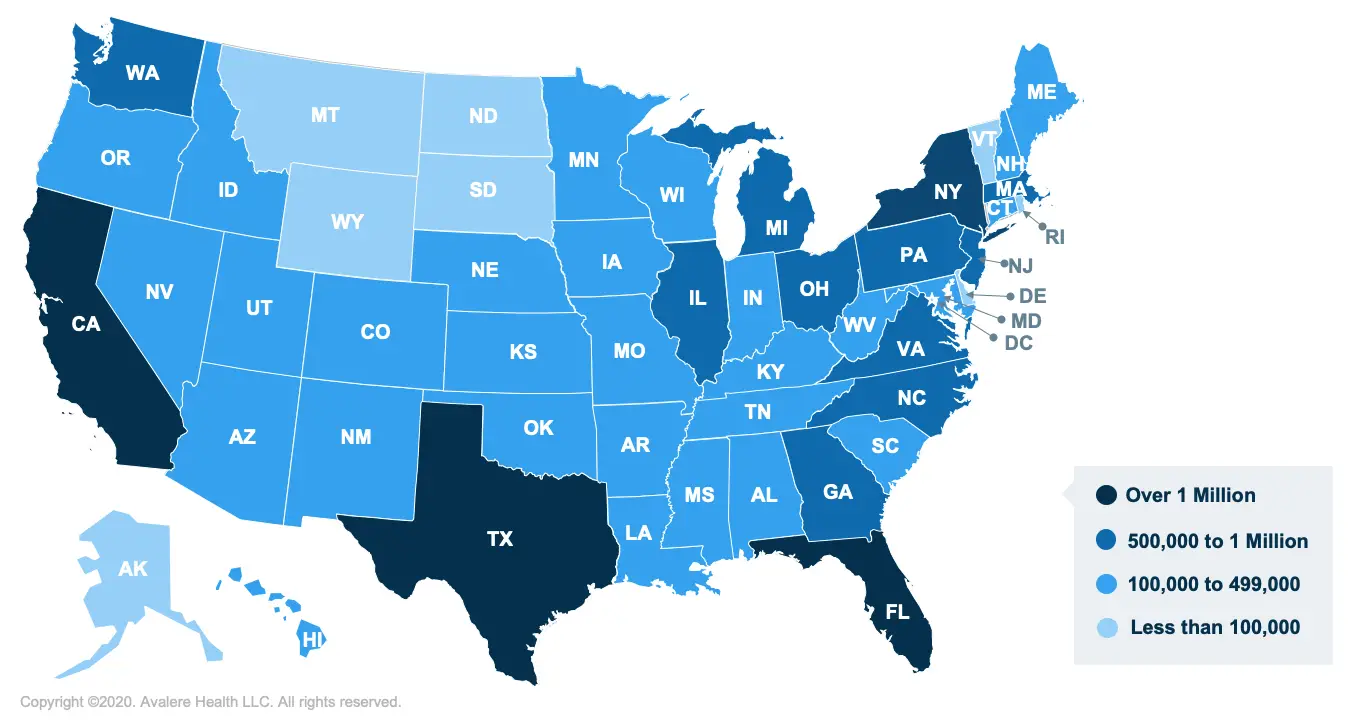

But Medicare recipients in some states may feel these price hikes more than others. Thats right. How much you pay out of pocket varies by where you live. We put together a map of the states that receive the highest and lowest Medicare coverage in the nation.

Medicare Advantage And Cancer

If you have Medicare Advantage , this means that youve purchased your Medicare plan from a private insurance company as opposed to getting it directly from the federal government. These types of plans are required to give you the same basic coverages as Original Medicare, but the CMS warns that they can have different rules and costs. Therefore, its important to go through your individual plan so you understand what it says regarding cancer coverage specifically. And if any portion of that policy is unclear, follow up with your policys administrator so you know what is covered and what isnt.

Recommended Reading: How To Qualify For Medicare In Ga

Medicare Prescription Drug Coverage

Medicare drug coverage helps pay for prescription drugs you need. To get Medicare drug coverage, you must join a Medicare-approved plan that offers drug coverage .

Learn more about how to get Medicare drug coverage.

Each plan can vary in cost and specific drugs covered, but must give at least a standard level of coverage set by Medicare. Medicare drug coverage includes generic and brand-name drugs. Plans can vary the list of prescription drugs they cover and how they place drugs into different “tiers” on their formularies.

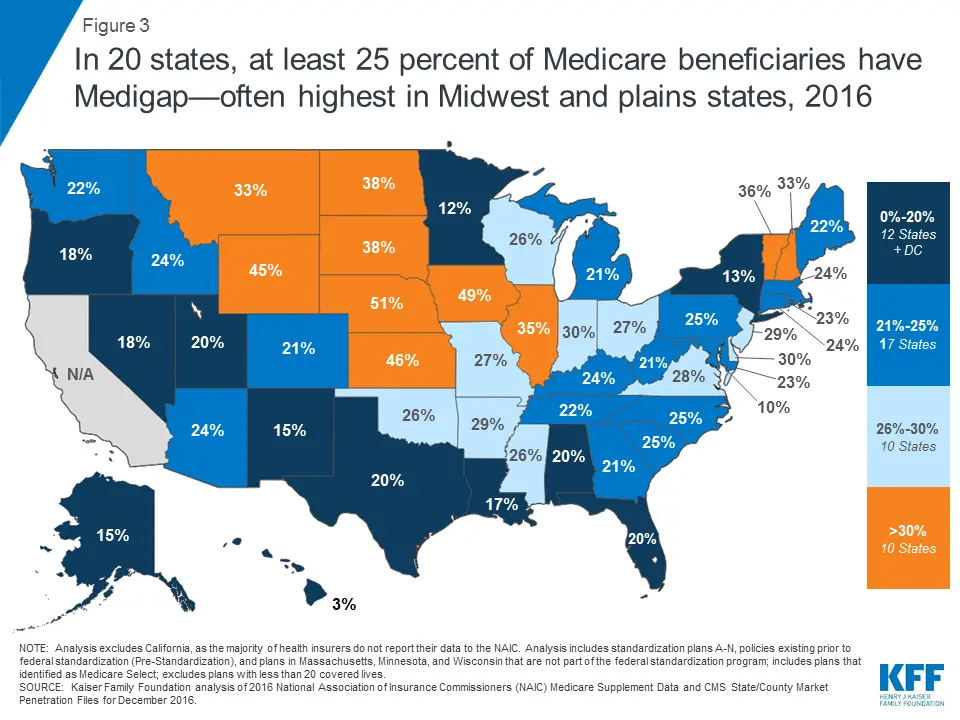

Some States Require Guaranteed Issue And Other Consumer Protections For Medigap Beyond The Federal Minimum Requirements

States have the flexibility to institute Medigap consumer protections that go further than the minimum federal standards. While many states have used this flexibility to expand guarantee issue rights for Medigap under certain circumstances, 15 states and the District of Columbia have not, relying only the minimum guarantee issue requirements under federal law .

Only four states require Medigap insurers to offer policies to Medicare beneficiaries age 65 and older . Three of these states have continuous open enrollment, with guaranteed issue rights throughout the year, and one state requires insurers to issue Medigap Plan A during an annual one-month open enrollment period. Consistent with federal law, Medigap insurers in New York, Connecticut, and Maine may impose up to a six-month waiting period to cover services related to pre-existing conditions if the applicant did not have six months of continuous creditable coverage prior to purchasing a policy during the initial Medigap open enrollment period.8 Massachusetts prohibits pre-existing condition waiting periods for its Medicare supplement policies.

Figure 5: Only 4 states have guaranteed issue protections for Medigap either continuously or annually, for all Medicare beneficiaries ages 65 and older

Some states provide stronger consumer protections for Medigap premiums than others

You May Like: How Old To Get Medicare Part B

Reimbursement For Part A Services

For institutional care, such as hospital and nursing home care, Medicare uses prospective payment systems. In a prospective payment system, the health care institution receives a set amount of money for each episode of care provided to a patient, regardless of the actual amount of care. The actual allotment of funds is based on a list of diagnosis-related groups . The actual amount depends on the primary diagnosis that is actually made at the hospital. There are some issues surrounding Medicare’s use of DRGs because if the patient uses less care, the hospital gets to keep the remainder. This, in theory, should balance the costs for the hospital. However, if the patient uses more care, then the hospital has to cover its own losses. This results in the issue of “upcoding”, when a physician makes a more severe diagnosis to hedge against accidental costs.

Can I Be Covered By Both Medicare And Medicaid

It is possible to be eligible and covered by both Medicare and Medicaid. Within health care, it is known as being “dual eligible.” Typically, these individuals will be enrolled in Original Medicare but receive subsidized Medicaid benefits through Medicare Savings Programs such as the:

- Qualified Medicare Beneficiary Program

- Specified Low-Income Medicare Beneficiary Program

- Qualified Disabled Working Individual Program

All of these programs would provide extra help for covering premiums, deductibles and coinsurance for Medicare.

If you don’t qualify for Medicaid when you are enrolled in Medicare, there are still options to help provide financial aid for Part A, B and D deductibles. This would include enrolling in a supplemental Medigap policy such as Medicare Part F, which is offered by private health insurance companies.

Editorial Note: The content of this article is based on the authors opinions and recommendations alone. It has not been previewed, commissioned or otherwise endorsed by any of our network partners.

You May Like: Will Medicare Help Pay For Hearing Aids