Will Inheritance Affect My Medicare Benefits

4.1/5inheritancebenefits willwillMedicare

Also to know is, will inheritance affect my Medicaid benefits?

An inheritance may also affect your income, which in turn affects Medicaid eligibility. If you inherit an annuity and it pays out a monthly benefit, if it puts you over the SSI monthly limit, you will no longer qualify for SSI or for Medicaid. Income limits vary by program and by state.

Likewise, does inheritance affect disability benefits? If you are a Social Security Disability Insurance recipient and receive an inheritance, it will not affect your benefits. SSDI is not a needs-based program and is not contingent upon your unearned incomeincluding inheritance. Any income, earned or unearned, can affect your benefits.

In this manner, do you have to pay back Medicaid if you inherit money?

If you inherit money, you are legally obligated to report it to Medicaid. Depending on the amount of the inheritance and your current level of income and assets, an inheritance can cause you to lose your Medicaid coverage.

What happens if someone on benefits inherits money?

Since the Social Security Administration considers inherited money as income, your inheritance could make you ineligible for SSI benefits during the month in which you receive the inheritance. But, it is considered income only in the month you receive it after that, it is considered part of your resources.

How Do I Get Full Medicare Benefits

If youve worked at least 10 years while paying Medicare taxes, there is no monthly premium for your Medicare Part A benefits. But if you havent worked, or worked less than 10 years, you may qualify for premium-free Part A when your spouse turns 62, if she or he has worked at least 10 years while paying Medicare taxes. However, to be eligible for Medicare, you need to be 65 years old. You also need to be an American citizen or legal permanent resident of at least five continuous years.

So, to summarize with an example:

- Bob is 65 years old. Hes on Medicare, but he pays a monthly premium for his Medicare Part A benefits. He only worked for seven years and no longer works.

- His wife, Mary, has worked for over 30 years.

Requirements To Purchase Part B

Medicare Part B is also known as medical insurance. Part B helps to pay for the basic medical costs you have, such as doctor visits, preventive care and basic medical treatments. If you are a non-citizen, you can purchase Medicare Part B under specific conditions. You are required to be 65 years of age or older. You also are required to prove that you were legally admitted to the United States and that your status is still legal at the moment of applying for Part B. Along with that, you must have lived in the United States for at least five consecutive years.

Read Also: Can You Have Private Health Insurance And Medicare

Medical Conditions And Disabilities

If you have certain disabilities, you may be eligible for premium-free Medicare Part A benefits even if youre under 65 years old.

Social Security Disability Insurance recipients

If you have a disability and have been receiving SSDI benefits for at least 24 months , you will automatically be enrolled in premium-free Medicare at the beginning of the 25th month.

ESRD

If your doctor has diagnosed you with ESRD and youve received a kidney transplant or youre on dialysis, you qualify for Medicare benefits if one of the following criteria applies:

- you qualify for Social Security retirement benefits

- you qualify for Railroad Retirement Board benefits

- your spouse or parent worked long enough to be eligible for Social Security retirement benefits

When you become eligible for Medicare benefits depends on whether you receive dialysis at home or in a treatment facility:

- If youre receiving dialysis in your home, you can apply for Medicare the first day you begin your dialysis program. You need to be sure to apply before the third month of treatment.

- If you receive dialysis in a treatment facility, you can apply for Medicare on the first day of the fourth month of your treatment.

If youre scheduled to receive a kidney transplant, you can apply for Medicare on the first day of the month youre admitted to the hospital to start preparing for the transplant. But if your transplant is delayed, your Medicare benefits wont start until 2 months before the month your transplant takes place.

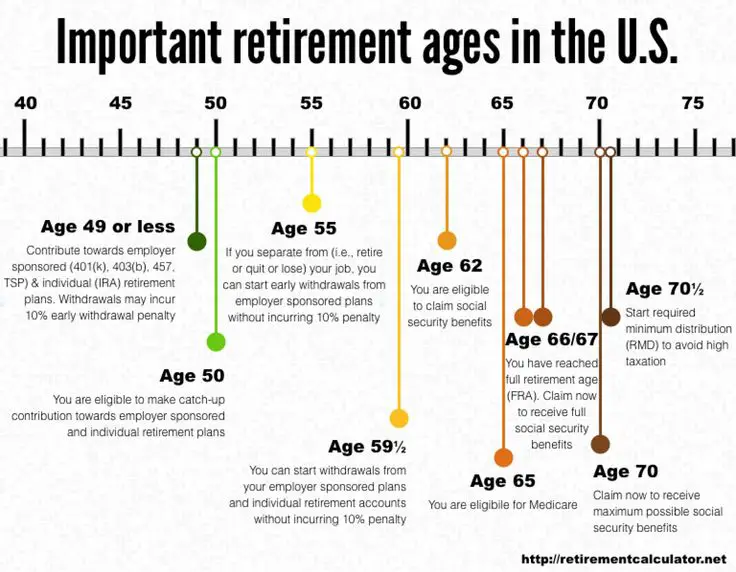

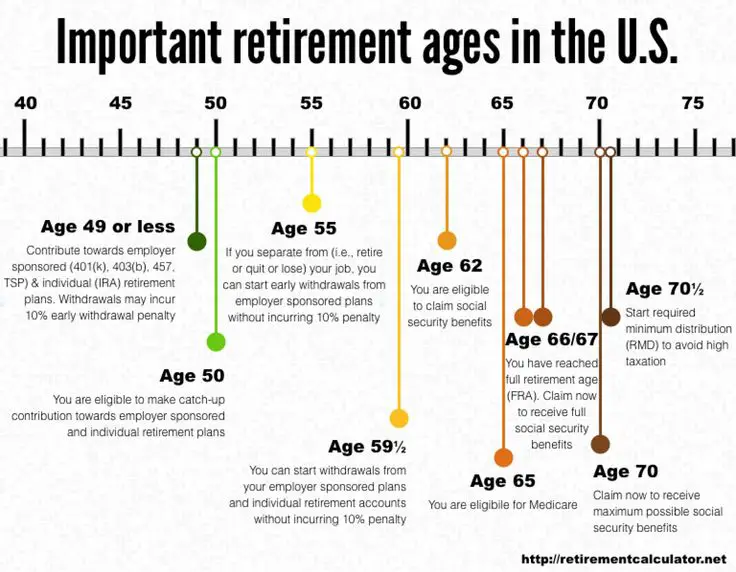

When You’re Eligible For Social Security

Today, older adults become eligible for full Social Security retirement benefits at age 66 or 67 depending on their birth year and whether they or their spouse have met the work credit requirement.

For anyone born in 1929 or later, the minimum work credit requirement for Social Security benefits is 40 credits or 10 years of work. The year you can start taking full Social Security benefits is known as your full retirement age or normal retirement age. If you were born on January 1 of any year, refer to the previous year when calculating your full retirement age.

| Age for Receiving Full Social Security Benefits | |

|---|---|

| Birth Year | |

| 1960 and later | 67 |

Unlike Medicare, older people can opt to start taking their benefits before their full retirement age. The earliest you can begin taking Social Security benefits is age 62. However, if you begin taking Social Security payments before your full retirement age, you will receive a reduced monthly benefit for the remainder of your life.

If you are a widow or widower, you can start claiming your spouse’s reduced Social Security benefits when you are age 60, or 50 if you are disabled. You can then switch to taking your own full benefit at your full retirement age.

You can also choose to delay your Social Security benefit past full retirement age until age 70. This will often make you eligible for delayed retirement credits, which increase your monthly benefit for the remainder of your life.

Also Check: How Many Parts Does Medicare Have

What If I Have Non

If you have non-retiree health insurance through your or your spouseâs employer when you become eligible, youâll have to choose if you want to enroll in Medicare Parts A, B, and/or D. Ultimately, this decision depends on the type of health coverage you or your spouse currently have and the size of your or your spouseâs employer.

Generally speaking, you should probably enroll in Part A after qualifying for Medicare.

If the employer has fewer than 20 employees, youâll probably want to enroll in Parts A, B, and D upon becoming eligible for them. In this situation, Medicare usually becomes your primary coverage. If the employer has 20 employees or more, you may want to delay Parts A, B, and/or D if you have sufficient group coverage and know you wonât incur late enrollment penalties. Medicare usually pays second to group coverage from larger employers.

If you have any questions, you can always reach out to a licensed agent.

Generally speaking, you should probably enroll in Part A after qualifying for Medicare. For many seniors, Part A is premium-free and acts as great supplementary coverage. In some cases, it may not make sense to enroll in and pay the monthly premiums that come with Parts B and D right away. Before making the decision to delay any part of Medicare, compare the coverage to see if enrolling in it while covered by your current health plan makes sense. If you have any questions, you can always reach out to a licensed agent.

When Can Veterans Enroll In Medicare

Like other Americans, veterans become eligible for Medicare at age 65. The best time to sign up is during your initial enrollment period. That begins 3 months before the first day of your birthday month and lasts for 7 months.

If you already receive Social Security benefits, your enrollment in Medicare Parts A and B will happen automatically. Keep in mind that having VA healthcare doesnt mean that you can delay starting Medicare Part B and dodge a late enrollment penalty. But the VA program does provide , so you can delay enrolling in Medicare Part D without facing a penalty.

After your initial Medicare enrollment, you must re-register every year during the open enrollment period . Thats your opportunity to make any changes for the plan that starts on the following January 1.

Recommended Reading: How Do I Become A Medicare Provider

Do I Need Medicare Part B

We always advise our clients to contact their employer or union benefits administrator before delaying Part A and Part B to learn more about how their insurance works with Medicare. Employer coverage may require that you enroll in both Part A and Part B to receive full coverage.

Common reasons beneficiaries delay Part B include:

Understanding Social Security And Medicare

Home / FAQs / General Medicare / Understanding Social Security and Medicare

Social Security and Medicare are both federal programs. Together, these programs help those no longer working due to retirement or disability. There are similarities and differences between these two programs. In some ways they work together and yet, they are two separate programs. Just because you qualify for one doesnt mean youll immediately qualify for the other.

Recommended Reading: Do Husband And Wife Pay Separate Medicare Premiums

Medicare Other Insurance And How We Can Help

Did you know you can enroll in Medicare even if you have other kinds of insurance such as Medicaid, VA benefits, and employer-sponsored health insurance? That said, some of these types of insurance work better with Medicare than others. In some cases, they may affect your ability to enroll in Medicare.

To find out how to choose the right Medicare coverage and understand how it will interact with health insurance you may already have, call the number below. A licensed Medicare expert can answer your Medicare eligibility questionsand help you enroll.

Am I Eligible For Medicare

To receive Medicare, you must be eligible for Social Security benefits.

Part A Eligibility

Most people age 65 or older are eligible for Medicare Part A based on their own employment, or their spouse’s employment. Most people have enough Social Security credits to get Part A for free. Others must purchase it.

You are eligible for Medicare Part A if you meet one of the following criteria:

- You are eligible for Social Security or Railroad Retirement benefits, even if you do not receive those benefits.

- You are entitled to Social Security benefits based on a spouse’s, or divorced spouse’s work record, and that spouse is at least 62 years old.

- You have worked long enough in a federal, state, or local government job to be eligible for Medicare.

If you are under 65, you are eligible for Medicare Part A if you meet one of the following criteria:

- You have received Social Security disability benefits for 24 months.

- You have received Social Security benefits as a disabled widow, divorced disabled widow, or a disabled child for 24 months.

- You have worked long enough in a federal, state, or local government job and meet the requirements of the Social Security disability program.

- You have permanent kidney failure that requires maintenance dialysis or a kidney transplant.

- You are diagnosed with ALS or Lou Gehrig’s disease.

Part B Eligibility

If you are eligible for Part A, you can enroll in Medicare Part B which has a monthly premium.

Will I Need To Prove My Age?

Automatic Enrollment

Also Check: Is It Mandatory To Take Medicare At 65

When Do I Have To Sign Up For Medicare

If youre collecting Social Security, youll automatically be enrolled in both Part A and Part B. If youre not receiving Social Security, then youll want to sign up manually during your Initial Enrollment Period.

Three months before your 65th birthday, your Initial Enrollment Period window will start. Your IEP is a once-in-a-lifetime enrollment window that you dont want to miss.

If you do happen to miss it, youll have another opportunity to enroll during another enrollment period. However, you could get a penalty for not signing up when you first become eligible. The only way around the penalty is if you have creditable coverage.

Is It Mandatory To Sign Up For Medicare After Age 65

No, it isnt mandatory to join Medicare. People can opt to sign up, or not.

If you don’t qualify for Social Security retirement benefits yet, you may need to manually enroll in Medicare at your local Social Security office, online or over the phone when you turn 65. You can also apply online for your Medicare coverage at www.medicare.gov.

Enrolling in Medicare as soon as youre eligible ensures you get the subsidized health care you deserve without waiting periods or financial penalties.

If you continue to work for a company employing 20 or more people after you turn 65, you could delay your Medicare enrollment. Your employee group plan provides enough medical coverage while youre working, meaning you may be able to wait to sign up for Medicare once you retire without incurring any late penalties.

Don’t Miss: Does Medicare Require A Referral For A Colonoscopy

But You Don’t Have To Sign Up For Medicare

Just because you’re turning 65 this year doesn’t mean you’re giving up your job. And if you plan to keep working, you may continue to have access to a group health insurance policy through your employer.

If you’re happy with that coverage and want to keep it, you can delay your Medicare enrollment and avoid a late signup penalty. But if you’re not happy with that group plan, know that you’re allowed to work and get health coverage through Medicare at the same time.

Furthermore, if you’re keeping your group health coverage through your job, you may want to sign up for Medicare Part A regardless. Though you’ll pay a premium for Parts B and D, Part A is generally free for enrollees. Signing up could give you access to secondary insurance that may pick up the tab for hospital care your primary insurance doesn’t cover.

That said, once you enroll in Medicare, you won’t be eligible to contribute to a health savings account. And so if you’re currently taking advantage of that option, you may want to forgo that free Part A coverage if you’re keeping your group plan through work.

Find A $0 Premium Medicare Advantage Plan Today

For California residents, CA-Do Not Sell My Personal Info, .

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

The purpose of this communication is the solicitation of insurance. Callers will be directed to a licensed insurance agent with TZ Insurance Solutions LLC, TruBridge, Inc. and/or a third-party partner who can provide more information about Medicare Advantage Plans offered by one or several Medicare-contracted carrier. TZ Insurance Solutions LLC, TruBridge, Inc., and the licensed sales agents that may call you are not connected with or endorsed by the U.S. Government or the federal Medicare program.

Plan availability varies by region and state. For a complete list of available plans, please contact 1-800-MEDICARE , 24 hours a day/7 days a week or consult www.medicare.gov.

Medicare has neither reviewed nor endorsed this information.

Recommended Reading: Are Hospital Beds Covered By Medicare

When Should I Apply

Typically, if you are receiving benefits either from Social Security, disability or Railroad, you should receive information in the mail three months prior to turning 65. In fact, enrollment in Medicare Parts A and B is automatic if you live in one of the fifty states or Washington D.C. However, because the premium for Part B is deducted from your Social Security benefits, you have the right to refuse. Keep in mind you are automatically signed up for Part A, but not for Part B. You have a 7-month period your initial enrollment period to sign up for Medicare Part B, and this period begins three months before the month of your 65th birthday. If you are not receiving benefits currently, it is your responsibility to contact Social Security three months prior to turning 65. Even if you do not plan on retiring at age 65, you can still sign up.

Medicare is available to everyone over the age of 65 and those under 65 with a disability or kidney failure. You will automatically be enrolled in Medicare Part A but you must take steps to enroll in Part B as this is not automatic.

Darryl was faithful in calling me back. He didnt pressure me. He was the real reason I picked Blue Cross.L. Rippe, Downers Grove

Debbie was so polite. She didnt make me feel incompetent when I didnt understand something.S. Scheibly, Decatur

Kathleen was helpful and provided me with information quickly!M. Greaney, Oak Lawn

Will I Get Medicare At 62 If I Retire Then

If you retire before the age of 65, you may be able to continue to get medical insurance coverage through your employer, or you can purchase coverage from a private insurance company until you turn 65. While waiting for Medicare enrollment eligibility, you may contact your State Health Insurance Assistance Program to discuss your options.

Here are some ways you may be eligible for Medicare at age 62:

- You may qualify for Medicare due to a disability if you have been receiving SSDI checks for more than 24 months.

- You have been diagnosed with End-Stage Renal Disease .

- You are getting dialysis treatments or have had a kidney transplant.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealths Medicare related content is compliant with CMS regulations, you can rest assured youre getting accurate information so you can make the right decisions for your coverage. Read more to learn about our Compliance Program.

Find Plans in your area instantly!

You May Like: What Is Medicare Advantage Part C