What Is A Medicare Advantage Plan How Does It Differ From Traditional Medicare

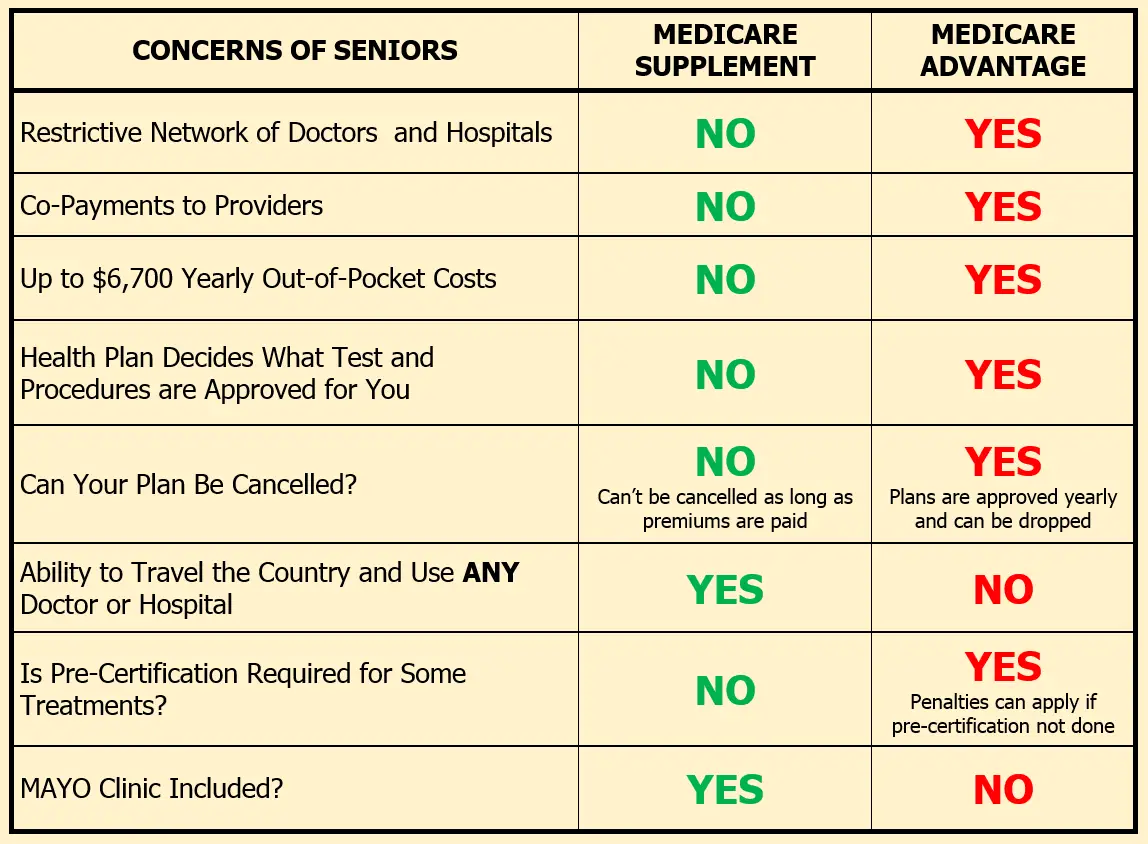

Medicare Advantage plans are private health plans, such as HMOs or PPOs, that are offered by health insurers that have contracts with the Medicare program to offer benefits to people with Medicare. The plans provide all Medicare-covered benefits under Parts A and B, and usually provide Part D prescription drug benefits as well. Some Medicare Advantage plans may also provide benefits that are not covered under traditional Medicare, such as eyeglasses, some dental care, or gym memberships. The plans also have a limit on out-of-pocket spending for services covered under Parts A and B, and may have lower cost-sharing than traditional Medicare for Medicare-covered services. However, Medicare Advantage plans restrict the health care providers that their enrollees can see whereas beneficiaries in traditional Medicare may see any doctor that accepts Medicare, without needing prior authorization or a referral from their primary care doctor.

Choosing A Medicare Advantage Plan

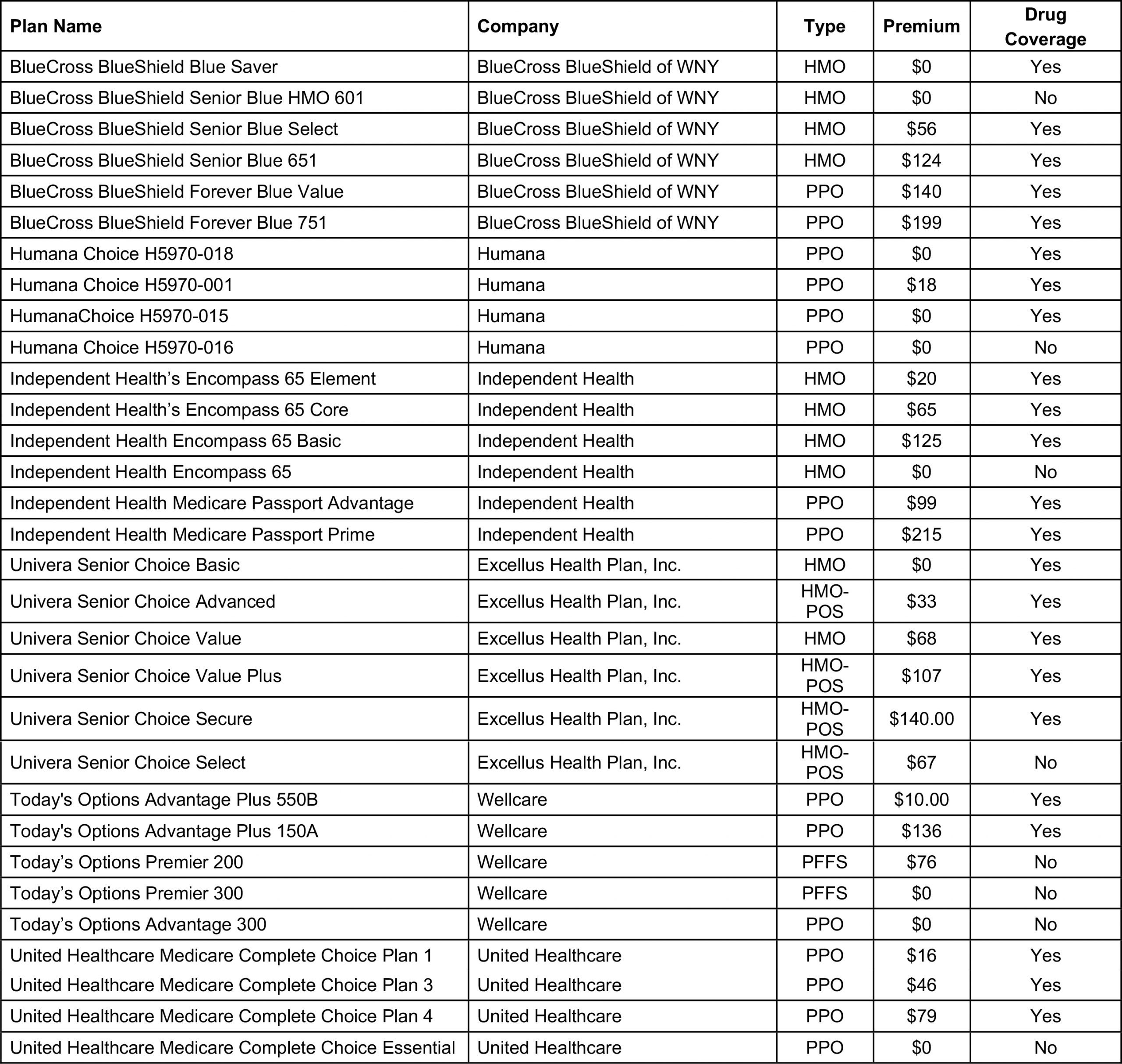

Medicare Advantage Health Plans are similar to private health insurance. Most services, such as office visits, lab work, surgery, and many others, are covered after a small co-pay. Plans might offer an HMO or PPO network and all plans place a yearly limit on total out-of-pocket expenses. Each plan has different benefits and rules. Most provide prescription drug coverage. Some require a referral to see a specialist while others do not. Some may pay a portion of out-of-network care, while others will cover only doctors and facilities that are in the HMO or PPO network. There are also other types of Medicare Advantage plans.

Selecting a plan with a low or no annual premium can be important. But it’s also essential to check on copay and coinsurance costs, especially for expensive hospital stays and procedures, to estimate your possible annual expenses. Since care is often limited to in-network physicians and hospitals, the quality and size of a particular plans network should be an important factor in your choice.

How Much Do Medicare Advantage Plans Cost

Even though Advantage enrollees have rights and protections under Medicare guidelines, the services offered and the fees charged by private insurers vary widely. A thorough understanding of how these plans work is key to the successful management of your personal health.

Advantage plans can charge monthly premiums in addition to the Part B premium, although 59% of 2022 Medicare Advantage plans with integrated Part D coverage are zero premium plans. This means that beneficiaries only pay the Part B premium .

But across all Medicare Advantage plans, the average premium is about $19/month for 2022. This average includes zero-premium plans and Medicare Advantage plans that dont include Part D coverage if we only look at plans that do have premiums and that do include Part D coverage, the average premium is higher.

Some Advantage plans have deductibles, others do not. But all Medicare Advantage plans must currently limit in-network maximum out-of-pocket to no more than $7,550. The out-of-pocket maximum had previously been $6,700 each year from 2011 through 2020, but it increased as of 2021, under new methodology that was finalized in 2018. CMS will continue to gradually change it over time, although its still $7,550 for 2022.

Copayments for doctors visits differ dramatically, as do the actual health care services and how often enrollees receive those services. Close attention to the details is necessary when assessing these plans.

You May Like: Does Medicare Cover Long Term Health Care

How Do Medicare Advantage Plans Work

A Medicare Advantage is another way to get your Medicare Part A and Part B coverage. Medicare Advantage Plans, sometimes called “Part C” or “MA Plans,” are offered by Medicare-approved private companies that must follow rules set by Medicare. If you join a Medicare Advantage Plan, you’ll still have Medicare but you’ll get most of your Part A and Part B coverage from your Medicare Advantage Plan, not Original Medicare.

These “bundled” plans include

, and usually Medicare drug coverage .

What Are The Differences Between Ma Plans And Medigap Plans

|

More out-of-pocket costs, but may have lower premiums |

Fewer out-of-pocket costs, but may have higher premiums |

|

|

Where can I use the plan? |

Works only in your state, by region or county |

Works in any state |

|

Do I have to use the plan’s network of providers? |

Must use a provider network |

No provider network required unless you buy a Medigap Select plan |

|

Does the plan include prescription drug coverage ? |

Most plans cover Medicare Part D |

Medicare Part D not included |

You May Like: Does Medicare Cover Home Sleep Apnea Test

Your Answers Point Toward A Medicare Advantage Plan

The recommended plan is the best fit based on a few questions. There are other personal circumstances that may change this recommendation, including receiving employer sponsored retiree benefits or having specific medical circumstances to consider. Please note that CMS will impose a penalty if you do not have prescription drug coverage . We strongly encourage you review all options with an agent before applying.

Based on your responses, you may want to explore Medicare Advantage, which rolls your Medicare-related coverage into a single plan with lower monthly premiums. Learn more about our partner, NextBlue of North Dakota PPO, and view plan information.

Rather talk to an agent? Call TTY 771.

Why Should I Choose Medicare Advantage

Medicare Advantage covers some of the gaps of Original Medicare and usually offers a $0 premium through a private company. It can be an affordable option for patients who are not currently sick or in need of intense medical care. If a patient’s situation worsens, it might be difficult or expensive to switch plans.

Don’t Miss: Will Medicare Help Pay For Hearing Aids

What Types Of Medicare Advantage Plans Are Available

Medicare Advantage plans can come in a variety of types:

- Private Fee-For-Service

- Medical Savings Accounts

- Special Needs Plans

The available selection of plan types may differ from one county and state to another. The different types of Medicare Advantage plans that are available in your area may include one or more of these plan types.

How To Enroll In A Medicare Advantage Plan

Once youve done your research and found a Medicare Advantage plan that fits your needs, there are various ways to enroll:

-

Use Medicares Plan Finder to find the plan in your area. Click on Enroll.

-

Go to the plans website to see if you can enroll online. Contact the plan to get a paper enrollment form. Fill it out and return it to the plan provider.

You will need your Medicare number and the date your Medicare Part A and/or Part B coverage started. You must be enrolled in Medicare Parts A and B before you can buy a Medicare Advantage plan.

Keep in mind that you can only enroll in a Medicare Advantage plan during your Initial Enrollment Period or during the Open Enrollment Period from Oct. 15 to Dec. 7. Once youre enrolled in a Medicare Advantage plan, you can switch plans during Medicare Advantage Open Enrollment from Jan. 1 to March 31 each year.

Recommended Reading: Can You Get Medicare If You Retire At 62

Best Medicare Advantage Providers Ratings

| Provider |

|---|

- Over-the-counter drug coverage

- Other services that promote health and wellness

You cant be enrolled in a Medicare Advantage plan and Original Medicare at the same time. To obtain Medicare benefits youve earned through payroll deductions before retirement, you must choose one of these plans.

During the open enrollment period, which runs from Oct.15 to Dec. 7 each year, you can join, switch or drop a plan for your coverage to begin on Jan. 1. If youre already enrolled in a Medicare Advantage plan, you can switch to a different Medicare Advantage plan or Original Medicare during the Medicare Advantage open enrollment period, which starts on Jan. 1 and ends on March 31 annually. You can only make one switch during that time period.

If youre already enrolled in Original Medicare , you may be eligible to switch to a Medicare Advantage plan . You must be at least 65 years old or have certain disabilities, such as permanent kidney failure or amyotrophic lateral sclerosis . If the Medicare Advantage plan you choose doesnt already have prescription drug coverage, you will have the option to enroll in Part D.

How To Switch Medicare Advantage Plans

If you want to change Medicare Advantage plans, you can do so once a year, either during Medicare’s fall open enrollment period or the Medicare Advantage open enrollment period .

You also can change to Original Medicare during these periods, but it could be hard to get a Medicare Supplemental Insurance policy if you switch after the first year. In most states, insurers are required to issue you Medigap policies only during your initial Medigap enrollment period , or if you switch out of your Medicare Advantage plan in the first year. After that, insurers may deny you a Medigap policy if you have health problems, or they can require a waiting period before your preexisting conditions are covered.

Recommended Reading: Does Medicare Cover End Of Life Care

Local Health Insurance Resources In California

- Californias Health Insurance Counseling and Advocacy Program provides free education, counseling and outreach for the states Medicare beneficiaries. You may contact Californias HICAP at 800-434-0222 with any questions about Medicare benefits, prescription drug coverage, Medicare Advantage plans, Medicare Supplement Insurance, long-term care insurance and more.

-

You can also explore more information about the insurance industry in California by visiting the states Department of Insurance website.

- California Prescription Drug Assistance ProgramsThe state of California has a number of programs designed to help with the cost of prescription drugs. There are programs for both Medicare beneficiaries and non-Medicare beneficiaries alike that can cover the cost of premiums and cost-sharing or even lower the cost of the drugs themselves.

1 Freed M. et al. . Medicare Advantage 2022 Spotlight: First Look. Kaiser Family Foundation. Retrieved from www.kff.org/issue-brief/medicare-advantage-2022-spotlight-first-look.

3 Medicare evaluates plans based on a 5-star rating system.

Compare plans today.

For California residents, CA-Do Not Sell My Personal Info, .

MedicareAdvantage.com is a website owned and operated by TZ Insurance Solutions LLC. TZ Insurance Solutions LLC and TruBridge, Inc. represent Medicare Advantage Organizations and Prescription Drug Plans having Medicare contracts enrollment in any plan depends upon contract renewal.

What Is Medicare Advantage

Medicare Advantage plans are optional insurance plans you may choose to purchase from a private insurance company. To buy a Part C plan, you must first enroll in original Medicare.

- prescription drug coverage

- vision coverage

- dental coverage

Not all Part C plans are available in every location. Your state, county, and ZIP code determine what plans you are eligible to buy. You can search and review the Part C plans available in your ZIP code using Medicares plan finder tool.

Part C plans typically require that you see providers within their network. If you wish to keep your current doctors who accept Medicare assignment, check to see if theyre listed under the plan youre considering before you sign up.

Also Check: Can I Use Medicare For Dental

Local Medicare Advantage Resources

WestArk Retired and Senior Volunteer Program

Seniors can get personalized Medicare assistance through the WestArk Retired and Senior Volunteer Program. WestArkRSVP volunteers receive intensive annual training through the Arkansas Insurance Departments SHIIP program to provide knowledgeable advice to Medicare beneficiaries through its community outreach program. Trained counselors also conduct orientations for individuals new to Medicare to help them understand their options, including coverage and gaps. Staff members assist Medicare beneficiaries wanting to apply for a federal low-income subsidy, and the Arkansas Medicare Savings program, and help them choose the most appropriate and affordable Medicare Advantage plan and Medicare Part D prescription drug plan. Staff also educates Medicare beneficiaries about free preventative health care services. WestArkRSVP offers all their services free of charge to seniors and those with disabilities in the counties of Benton, Washington, Sebastian, Crawford, Boone, Carroll, Marion and Madison.

Why Medicare Advantage Plans Can Fall Short

For many older Americans, Medicare Advantage plans can work well. A JAMA study found that Advantage enrollees often receive more preventive care than those in traditional Medicare. Advantage plans are competing not just on cost but on delivering quality care, says Kenton Johnston, PhD, associate professor of health management and policy at Saint Louis University, co- author of the study.

But if you have chronic conditions or severe health needs, you may want to think twice about Medicare Advantage because of the requirements for pre-authorization and staying in-network, says Melinda Caughill, co-founder of 65 Incorporated, a firm that provides Medicare enrollment guidance to financial advisers and individuals.

If you need to see multiple specialists, and you have to get referrals for each appointment or fight to overturn denials, it can be really challenging, Caughill says.

Steven Feld, 65, a retiree in South Pasadena, Fla., struggled to get coverage for an injection to treat his arthritic knee. The treatment, a prefilled injection administered in a doctors office, is deemed a medical device by the FDA, so the plan twice denied the coverage. When I was on my employers group plan, there was no problem getting the injection covered, says Feld, who joined his Medicare Advantage plan in May.

Don’t Miss: How To Avoid Medicare Part D Penalty

Medicare Advantage Plans In Arkansas

Medicare Advantage plans present an alternative to Original Medicare and are provided by private insurance companies approved to offer Medicare coverage, instead of the federal government. Original Medicare plans include hospital insurance under Medicare Part A, and medical insurance under Medicare Part B. Medicare Advantage plans, often called Medicare Part C, must include the same type and level of coverage as Original Medicare. These plans often include additional benefits, such as prescription drug coverage under Medicare Part D and services such as dental, vision and hearing care. Since there are several types of plans available and the insurance carriers set the prices for covered services, not the federal government, the cost of Medicare Advantage plans vary.

Seniors in Arkansas interested in enrolling in Medicare Advantage will find numerous insurance providers offering a variety of plans, so they may need help comparing options. This guide provides details on each type of plan available in Arkansas, as well as information about enrollment and eligibility requirements and Medicare Part D prescription drug coverage. Arkansas seniors who cant decide which Medicare Advantage plan is right for them will also find a list of state and local resources that provide information, assistance and counseling to help them better understand the Medicare Advantage program and get the coverage they need.

Medicare Advantage Plans Coverage For Some Services And Procedures May Require Doctors Referral And Plan Authorizations

Medicare Advantage plans try to prevent the misuse or overuse of health care through various means. This might include prior authorization for hospital stays, home health care, medical equipment, and certain complicated procedures. Medicare Advantage plans often also require your primary care doctors referral to see specialists before they will pay for services.

Recommended Reading: Do You Have To Get Medicare At 65

Medicare Advantage Plans Bridge The Gaps

Medicare Advantage plans are offered by private insurance companies, and are designed to address the coverage gaps in Original Medicare. These plans bundle Medicare Part A and Medicare Part B and, in many cases, Medicare prescription drug coverage as well.

Medicare Advantage plans cap healthcare spending so they can offer major benefits for people who want to control costs and enjoy greater peace of mind. Medicare Advantage plans will have a flat cost per month so it provides consistency while also providing simplicity to your healthcare needs.

Pros and Cons of Medicare Advantage Plans:

Pros:

Best For Large Network: Cigna

Cigna-HealthSpring

Why we chose it: Cigna Health-Spring Medicare Advantage was selected because the company is one of the largest networks offering Medicare Advantage plans. Cignas many extra services and benefits, along with low premiums, deductibles, and copays, set it apart from many of its competitors. Cigna was also chosen for its stability, financial soundness , and high CMS rating. Founded in 1792, it is also one of the oldest insurance companies.

-

Gets 4.5 stars

-

Offers Medicare coverage in 23 states

-

Savings on nationwide prescription drug plan

-

24/7 health Information nurse line

-

No cost extras for some extras, such as health coaching and fitness plan

-

Hearing, dental and vision coverage is available

-

Transportation provided for medical appointments and pharmacy visits

-

The website can be difficult to navigate

-

The simplest way to get a quote involves calling

Cigna provides a nationwide prescription drug plan with $0 deductible and $0 copay on many prescriptions.

Cignas unique medical model focuses on customer engagement and holistic care, for example, home-delivered meals after hospitalization, that enhance the patient experience.

Cigna offers many Medicare Advantage plans, most with a $0 premium. In fact, according to Cigna, 50% of its Medical Advantage plans to charge $0 for annual premiums. In addition, 87% of its plans require $0 for copay to visit a primary care doctor. However, the cost of every plan is different, depending on your location.

Also Check: When Does One Qualify For Medicare

Medicare Advantage Plans Have Specific Service Areas

Most Medicare Advantage plans have regional networks of participating providers. To enroll, you must reside in the Medicare Advantage plans service area at least 6 months of the year. If you divide your time between homes located in different areas, this requirement may be difficult to meet.

The bottom line is that Medicare Advantage plans may provide more affordable coverage than you would receive otherwise. The trade-off is that you have to follow the Medicare Advantage plans rules to receive payment for covered services.

Do you have other questions about Medicare Advantage? Call us and speak with a licensed insurance agent about finding Medicare Advantage plans in your area and your Medicare coverage options. Or just enter you zip code on this page.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealths Medicare related content is compliant with CMS regulations, you can rest assured youre getting accurate information so you can make the right decisions for your coverage. Read more to learn about our Compliance Program.

Find Plans in your area instantly!