B Premiums And Medicare Advantage

You can elect to have Original Medicare or a Medicare Advantage plan . Medicare Advantage plans are offered by private insurance companies and will cover everything that Original Medicare offers and more.

Even if you decide on a Medicare Advantage plan and pay premiums to the insurance company, you still have to pay Part B premiums to the government. You must take that added cost into consideration.

How Does Medicaid Expansion Affect State Budgets

Expansion has produced net savings for many states, according to the Center on Budget and Policy Priorities. Thats because the federal government pays the vast majority of the cost of expansion coverage, while expansion generates offsetting savings and, in many states, raises more revenue from the taxes that some states impose on health plans and providers.

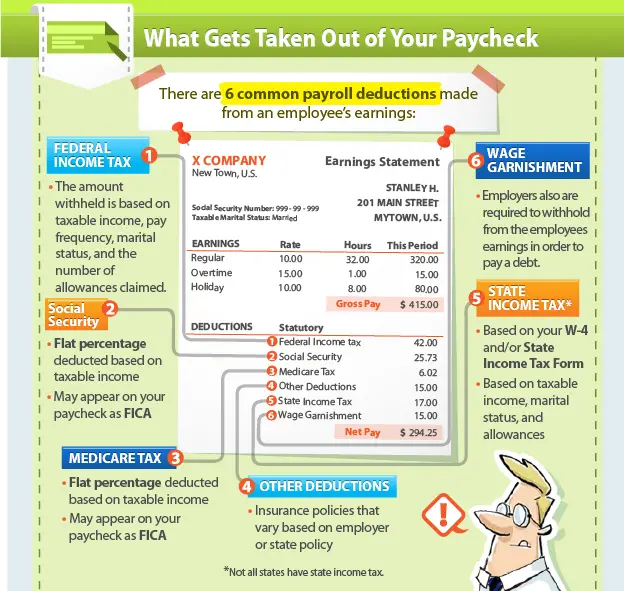

What Is The Medicare Tax Rate

Medicare tax is deducted from each paycheck for Part A of the scheme, which covers the hospital insurance costs for senior citizens and people with disabilities. The sum of this amount is divided among employers and employees who each are required to pay 1.45 percent.

For high-income earners, this amount increases to a larger percentage, while the self-employed pay the tax when submitting their quarterly filings.

Much like other forms of tax, the Medicare tax is an amount set aside from your paycheck if you are in employment, whether it be with a full-time employer or a self-employed individual.

Don’t Miss: Does Medicare Coordinate With Auto Insurance

Who Pays The Premium For Medicare Advantage Plans

You continue to pay premiums for your Medicare Part B benefits when you enroll in a Medicare Advantage plan . Medicare decides the Part B premium rate. The standard 2021 Part B premium is $148.50, but it can be higher depending on your income. On average, those who received Social Security benefits will pay a lesser premium rate.

Usually, you pay a separate monthly premium for a Medicare Part C plan. But not all Part C plans have monthly premiums. In addition to covering medically necessary procedures, Part C plans typically provide prescription drug coverage and other types of benefits such as dental and vision. The premium you may pay is used to cover the wider range of services available with Medicare Part C.

The Medicare-approved private insurance companies that offer Medicare Part C coverage decide what services the plans will cover, so monthly premiums vary from plan to plan and state to state. Insurance companies are only allowed to make changes to the premium rate once a year.

How Do I Know If I Will Have Money Taken Out Of My Social Security Check

If you receive Social Security retirement benefits, your Medicare benefits will be deducted automatically. This means that you do not have to do anything to make this happen it will be automatic when you enroll in Medicare.

If you sign up for Original Medicare during your Initial Enrollment Period and already receive Social Security retirement benefits, you should not expect to receive a bill for your premiums. Instead, your Social Security benefit will be smaller, since the money is taken from there.

If you want to find out for sure whether this applies to you, your best bet is to contact the Social Security Administration . They will look up your current status to determine whether payments will be taken out automatically.

You May Like: Will Medicare Cover Cataract Surgery

What Is The Additional Medicare Tax

The Affordable Care Act expanded the Medicare payroll tax to include the Additional Medicare Tax. This new Medicare tax increase requires higher wage earners to pay an additional tax on earned income.

All types of wages currently subject to the Medicare tax may also be subject to the Additional Medicare Tax. An individual owes Additional Medicare Tax on all cumulative wages, compensation, and self-employment income once the total amount exceeds the threshold for their filing status.

Total 2021 Monthly Medicare Costs

When we total up all of your total monthly Medicare costs, hereâs what you can expect.

If you decide to use Original Medicare with a Medicare Supplement and a drug plan, your monthly costs would be:

- $148.50 for Medicare Part B

- Get a quote for your Medicare Supplement

- An average of $30 for your drug plan

If you decide to use a Medicare Advantage plan that includes a drug plan, your monthly costs would be:

- $148.50 for Medicare Part B

- A very low monthly premium for the MA plan

If you decide to get the Lasso Healthcare MSA and a drug plan, your monthly costs would be:

- $148.50 for Medicare Part B

- $0 premium for the MSA plan

- An average of $30 for your drug plan

For extra help, use the interactive Medicare Cost Worksheet to determine how much you will pay each month for Medicare.

Related Reading

Read Also: When Do Medicare Benefits Kick In

Before You Make Your Decision

There are advantages and disadvantages to taking your benefit before your full retirement age. The advantage is that you collect benefits for a longer period of time. The disadvantage is your benefit will be reduced. Each person’s situation is different. It is important to remember:

- If you delay your benefits until after full retirement age, you will be eligible for delayed retirement credits that would increase your monthly benefit.

- That there are other things to consider when making the decision about when to begin receiving your retirement benefits.

Additional Cares Act Funding

On March 27, 2020, former President Donald Trump signed the CARES Acta $2 trillion coronavirus emergency relief packageinto law. A sizable chunk of those funds$100 billionwas earmarked for healthcare providers and suppliers, including those that are Medicare and Medicaid enrolled for expenses related to COVID-19.

Below are some examples of what the additional funding covers:

- A 20% increase in Medicare payments to hospitals for COVID-19 patients.

- A scheduled payment reduction was eliminated for hospitals treating Medicare patients from May 1, 2020, through Dec. 31, 2020.

- An increase in Medicaid funds for states.

Read Also: Who Must Enroll In Medicare

Medicare Costs At A Glance

Listed below are basic costs for people with Medicare. If you want to see and compare costs for specific health care plans, visit the Medicare Plan Finder.

For specific cost information (like whether you’ve met your

, how much you’ll pay for an item or service you got, or the status of a

| 2021 costs at a glance | |

|---|---|

| Part A premium | Most people don’t pay a monthly premium for Part A . If you buy Part A, you’ll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259. |

| Part A hospital inpatient deductible and coinsurance | You pay:

|

| Part B premium | The standard Part B premium amount is $148.50 . |

| Part B deductible and coinsurance | $203. After your deductible is met, you typically pay 20% of theMedicare-Approved Amountfor most doctor services , outpatient therapy, anddurable medical equipment |

| Part C premium |

How Much Does Medicare Part A Cost In 2021

Premiums for Medicare Part A are $0 if youâre getting or are eligible for federal retirement benefits. Itâs also premium-free if youâre under 65 and receiving Social Security disability benefits for 24 months, or are diagnosed with end-stage kidney disease. If youâre eligible for Medicare, but not other federal benefits, youâll pay a Part A premium of $259 or $471 each month, depending on how long youâve paid Medicare taxes.

The deductible for Medicare Part A is $1,484 per benefit period. A benefit period begins the day youâre admitted to a hospital and ends once you havenât received in-hospital care for 60 days.

The Medicare Part A coinsurance amount varies, depending on how long youâre in the hospital. Coinsurance is typically a percentage of the costs, but Medicare designates the coinsurance as a flat fee.

Hereâs how much youâll pay for inpatient hospital care with Medicare Part A:

-

Days 1-60: $0 per day each benefit period, after paying your deductible.

-

Days 61-90: $371 per day each benefit period.

-

Day 91 and beyond: $742 for each “lifetime reserve day” after benefit period. You get a total of 60 lifetime reserve days until you die.

-

After lifetime reserve days: All costs.

The cost of a stay at a skilled nursing facility is different. This is what a skilled nursing facility costs under Medicare Part A:

Hospice care is free.

Read more about how Medicare Part A covers these costs here.

You May Like: Do I Need Medicare Part C

How Much Does Medicare Part B Cost In 2021

The premium for Medicare Part B in 2021 is $148.50 per month. You may pay less if youâre receiving Social Security benefits. You also may pay more â up to $504.90 â depending on your income. The higher your income, the higher your premium.

The deductible for Medicare Part B is $203 per year.

The Medicare Part B coinsurance amount is 20% for covered supplies and services.

Learn more about Medicare Part B, including Part B premiums prices based on income level.

Example Of How The Additional Medicare Tax Works

Single individuals can have a maximum income of $200,000 before they are subject to the Additional Medicare Tax. Should the cumulative income exceed that amount, they will then be required to pay the Additional Medicare Tax amount .

All wages currently subject to the Medicare Tax are also subject to the Additional Medicare Tax. An individual owes Additional Medicare Tax on all cumulative wages, compensation, and self-employment income that exceeds the threshold for their filing status.

Medicare information is everywhere. What is hard is knowing which information to trust. Because eHealths Medicare related content is compliant with CMS regulations, you can rest assured youre getting accurate information so you can make the right decisions for your coverage. Read more to learn about our Compliance Program.

You May Like: Does Medicare Cover Transportation To Physical Therapy

Adjust Gross Pay For Social Security Wages

Now that you have gross wages, take a closer look. Before you calculate FICA withholding and income tax withholding, you must remove some types of payments to employees.

The types of payments not included from Social Security wages may be different from the types of pay excluded from federal income tax.

For example, if you hire your child to work in your business, you must take out the amount of their pay when you calculate Social Security withholding but don’t take it out when calculating federal income tax withholding.

Here’s another example: Your contributions to a tax-deferred retirement plan plan should not be included in calculations for both federal income tax or Social Security tax.

IRS Publication 15 has a complete list of payments to employees and whether they are included in Social Security wages or subject to federal income tax withholding.

To calculate Federal Income Tax withholding you will need:

- The employee’s adjusted gross pay for the pay period

- The employee’s W-4 form, and

- A copy of the tax tables from the IRS in Publication 15: Employer’s Tax Guide). Make sure you have the table for the correct year.

Starting January 1, 2020, use the new IRS Publication 15-T that includes the tax tables for the new W-4 form. It also includes tables for the old W-4 form for employees who haven’t changed their withholding since January 1, 2020.

Unearned Income Medicare Contribution Tax

There is also an additional tax on unearned income, such as investment income, for those with AGIs higher than the thresholds mentioned above. It is known as the unearned income Medicare contribution tax or the net investment income tax . Taxpayers in this category owe an additional 3.8% Medicare tax on all taxable interest, dividends, capital gains, annuities, royalties, and rental properties that are paid outside of individual retirement accounts or employer-sponsored retirement plans. It also applies to passive income from taxable business activity and to income earned by day traders.

This tax is applied to the lower of the taxpayers net investment income or modified AGIexceeding the listed thresholds. This tax is also levied on income from estates and trusts with income exceeding the AGI threshold limits prescribed for estates and trusts. Deductions that can reduce the amount of taxable net investment income include early withdrawal penalties, investment interest and expenses, and the amount of state tax paid on this income.

When the NIIT legislation was enacted in 2010, the IRS noted in the preamble to its list of regulations that this was a surtax on Medicare. The Joint Committee on Taxation specifically stated: “No provision is made for the transfer of the tax imposed by this provision from the General Fund of the United States Treasury to any Trust Fund.” This means that the funds collected under this tax are left in the federal government’s general fund.

Recommended Reading: Is Sonobello Covered By Medicare

What Is The Part A Late Payment Penalty

If you have to pay Medicare Part A premiums but dont enroll at age 65, your monthly premiums may cost 10% more. And you may be required to pay those higher premiums for twice the number of years you didnt sign up.5

A Word of Advice

While calculating the costs of Medicare can feel overwhelming, figuring out the cost of each part can help you devise a good estimate of your total Medicare costs.

Medicare Part C Costs

If you choose to get Medicare Part C, which is also called Medicare Advantage , you are replacing Medicare Parts A and B. Often times, MA plans also include a drug benefit, so you also replace Part D.

However, you still must pay the $148.50 monthly premium for Medicare Part B.

MA premiums vary, depending on which type of plan you choose, which area youâre in, and other similar factors. In general, MA premiums are quite low, and sometimes, theyâre even $0.â

While the monthly premium is very low or even $0, there are some things to consider before opting an MA plan. You can read about the pros and cons of Medicare Advantage here.

You May Like: Must I Take Medicare At 65

How Your Paycheck Works: Deductions

Federal income tax and FICA tax withholding are mandatory, so theres no way around them unless your earnings are very low. However, theyre not the only factors that count when calculating your paycheck. There are also deductions to consider.

For example, if you pay any amount toward your employer-sponsored health insurance coverage, that amount is deducted from your paycheck. When you enroll in your companys health plan, you can see the amount that is deducted from each paycheck. If you elect to contribute to a Health Savings Account or Flexible Spending Account to help with medical expenses, those contributions are deducted from your paychecks too.

Also deducted from your paychecks are any pre-tax retirement contributions you make. These are contributions that you make before any taxes are withheld from your paycheck. The most common pre-tax contributions are for retirement accounts such as a 401 or 403. So if you elect to save 10% of your income in your companys 401 plan, 10% of your pay will come out of each paycheck. If you increase your contributions, your paychecks will get smaller. However, making pre-tax contributions will also decrease the amount of your pay that is subject to income tax. The money also grows tax-free so that you only pay income tax when you withdraw it, at which point it has grown substantially.

How Can I Lower Medicare Costs

The Medicare Savings Program helps low-income beneficiaries pay Original Medicare premiums, copays, and deductibles. The Medicare Extra Help program assists low-income beneficiaries with prescription drug coverage.

Some Medicare beneficiaries are also eligible for Medicaid, the federal-and-state-funded health insurance program for low-income Americans. Eligibility varies by state â you can see our state-by-state guide to Medicaid here to find out if youâre eligible, and read more about Medicare vs Medicaid.

Beyond that, cost-saving comes down to finding the best plan and program structure for you. Some people may be looking for different Medicare benefits and more robust coverage than others. As weâve discussed, these elections and their costs will vary, depending on whatâs offered by your state and your income level.

Don’t Miss: Is Silver Sneakers Part Of Medicare

So Much For That Generous Social Security Raise

In 2022, seniors on Social Security are in line for a 5.9% cost-of-living adjustment , their largest in decades. All told, the average benefit will rise from $1,565 a month to $1,657 a month, representing a $92 increase.

But now, about one-third of that raise will be wiped out by the higher cost of Medicare Part B. And while it’s easy to argue that seniors will still come out ahead financially, let’s also remember that the whole reason Social Security benefits are rising so much in 2022 is that inflation has driven the cost of living up substantially. And so while Medicare Part B hikes won’t take seniors’ entire Social Security raise, the remainder of that increase will no doubt be eaten up by higher gas, grocery, and utility costs.

For years, Medicare premiums costs have risen at a much faster rate than Social Security COLAs, leaving seniors struggling to keep up. In addition to higher monthly premiums, seniors on Medicare will face an annual Part B deductible of $233 in 2022. That’s a $30 increase from 2021, and while it may not seem like a huge jump on its own, combined with premium increases, it certainly leaves many beneficiaries in a tough spot.